As filed

with the Securities and Exchange Commission on October 24, 2023.

Registration No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Canoo Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

83-1476189 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

19951 Mariner Avenue

Torrance, California |

|

90503 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Canoo Inc. 2020 Equity Incentive Plan

Canoo Inc. 2020 Employee Stock Purchase Plan

(Full title of the plan)

Hector Ruiz

General Counsel and Corporate Secretary

Canoo Inc.

19951 Mariner Avenue

Torrance,

California 90503

(Name and address of agent for service)

Tel:

(424) 271-2144

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

|

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

|

Smaller reporting company |

x |

| |

|

|

Emerging growth company |

¨ |

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) or the Securities Act. ¨

EXPLANATORY NOTE

Canoo Inc. (the “Registrant”)

is filing this Registration Statement on Form S-8 with the Securities and Exchange Commission (the “Commission”)

to register (i) 17,766,551 additional shares of the Registrant’s common stock, par value $0.0001 per share (the “Common

Stock”), reserved for issuance under the Canoo Inc. 2020 Equity Incentive Plan (the “2020 Plan”), and (ii) 3,553,310

additional shares of Common Stock reserved for issuance under the Canoo Inc. 2020 Employee Stock Purchase Plan (the “2020 ESPP”

and, together with the 2020 Plan, the “Plans”), in each case as a result of the annual evergreen increase under each

Plan. In accordance with General Instruction E of Form S-8, and only with respect to the Common Stock being registered under the

Plans, this Registration Statement hereby incorporates by reference the contents of the Registration Statement on Form S-8 (File No. 333-253463), filed by the Registrant with the Commission on February 24, 2021, except to the extent superseded hereby.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 8. Exhibits.

| Exhibit No. |

|

Description |

| 4.1 |

|

Second Amended and Restated Certificate of Incorporation of the Registrant, dated December 21, 2020 (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed with the Commission on December 22, 2020). |

| |

|

|

| 4.2 |

|

Amended and Restated Bylaws of the Registrant, dated December 21, 2020 (incorporated by reference to Exhibit 3.2 to the Registrant’s Current Report on Form 8-K filed with the Commission on December 22, 2020). |

| |

|

|

| 4.3 |

|

Certificate of Amendment, dated January 25, 2023, to the Second Amended and Restated Certificate of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed with the Commission on January 25, 2023). |

| |

|

|

| 4.4 |

|

Certificate of Amendment, dated October 6, 2023, to the Second Amended and Restated Certificate of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed with the Commission on October 6, 2023). |

| |

|

|

| 5.1* |

|

Opinion of Kirkland & Ellis LLP, counsel to the Registrant. |

| |

|

|

| 10.1 |

|

Canoo Inc. 2020 Equity Incentive Plan (incorporated by reference to Exhibit 10.4 to the Registrant’s Registration Statement on Form S-4 filed with the Commission on November 25, 2020). |

| |

|

|

| 10.2 |

|

Canoo Inc. 2020 Employee Stock Purchase Plan (incorporated by reference to Exhibit 10.5 to the Registrant’s Registration Statement on Form S-4 filed with the Commission on November 25, 2020). |

| |

|

|

| 23.1* |

|

Consent of Deloitte & Touche LLP, independent registered public accounting firm of the Registrant. |

| |

|

|

| 23.2* |

|

Consent of Kirkland & Ellis LLP (included in Exhibit 5.1). |

| |

|

|

| 24.1* |

|

Power of Attorney (contained on the signature page hereto). |

| |

|

|

| 107* |

|

Filing Fee Table. |

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8,

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Torrance, State of California, on October 24, 2023.

| |

CANOO INC. |

| |

|

|

| |

By: |

/s/ Tony Aquila |

| |

Name: |

Tony Aquila |

| |

Title: |

Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each

person whose signature appears below hereby constitutes and appoints Tony Aquila, Greg Ethridge and Hector Ruiz, and each of them, his

true and lawful attorneys-in-fact and agents, each with full power of substitution and resubstitution, for him and in his name, place

and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this registration statement,

and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing

requisite and necessary to be done, as fully for all intents and purposes as he might or could do in person, hereby ratifying and confirming

all that each of said attorneys-in-fact and agents, or his substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed below by the following persons in the capacities indicated on October 24,

2023.

|

Signature |

|

Title |

| |

|

Chief Executive Officer (Principal Executive Officer) and Executive Chair of the Board |

| /s/ Tony Aquila |

|

| Tony Aquila |

|

| |

|

Chief Financial Officer (Principal Financial Officer) and Director |

| /s/ Greg Ethridge |

|

| Greg Ethridge |

|

| |

|

Senior Vice President, Chief Accounting Officer (Principal Accounting Officer) |

| /s/ Ramesh Murthy |

|

| Ramesh Murthy |

|

| |

|

Director |

| /s/ Foster Chiang |

|

| Foster Chiang |

|

| |

|

Director |

| /s/ Thomas Datillo |

|

| Thomas Dattilo |

|

| |

|

Director |

| /s/ Arthur Kingsbury |

|

| Arthur Kingsbury |

|

| |

|

Director |

| /s/ Claudia Romo Edelman |

|

| Claudia Romo Edelman |

|

| |

|

Director |

| /s/ Rainer Schmueckle |

|

| Rainer Schmueckle |

|

| |

|

Director |

| /s/ Josette Sheeran |

|

| Josette Sheeran |

|

| |

|

Director |

| /s/ Debra von Storch |

|

| Debra von Storch |

|

Exhibit 5.1

|

| |

|

|

300 North LaSalle

Chicago, IL 60654

United States

+1 312 862 2000

www.kirkland.com |

Facsimile:

+1 312 862 2200 |

October 24, 2023

Canoo Inc.

19951 Mariner Avenue

Torrance, California

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We are providing this

letter in our capacity as special counsel to Canoo Inc., a Delaware corporation (the “Company”), in connection with the preparation

and filing by the Company of a Registration Statement on Form S-8 (the “Registration Statement”) under the Securities

Act of 1933, as amended (the “Securities Act”), with the Securities and Exchange Commission (the “Commission”)

covering the offering of up to (i) 17,766,551 additional shares of common stock of the Company, par value $0.0001 per share (the “EIP

Shares”), pursuant to the Canoo Inc. 2020 Equity Incentive Plan (the “Equity Incentive Plan”), including shares that

may again become available for delivery with respect to awards under the Equity Incentive Plan pursuant to the share counting, share recycling

and other terms and conditions of the Equity Incentive Plan, and (ii) 3,553,310 additional shares of common stock of the Company, par

value $0.0001 per share (the “ESPP Shares” and, together with the EIP Shares, the “Plan Shares”) pursuant to the

Canoo Inc. 2020 Employee Stock Purchase Plan (the “ESPP”, together with the Equity Incentive Plan, the “Plans”).

For purposes of this

letter, we have examined such documents, records, certificates, resolutions and other instruments deemed necessary as a basis for this

opinion, and we have assumed the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents

submitted to us as copies and the authenticity of the originals of all documents submitted to us as copies. We have also assumed the legal

capacity of all natural persons, the genuineness of the signatures of persons signing all documents in connection with which this opinion

is rendered, the authority of such persons signing on behalf of the parties thereto other than the Company, the due authorization, execution

and delivery of all documents by the parties thereto other than the Company and that the Plan Shares will be issued in accordance with

the terms of the Plans. As to any facts material to the opinion expressed herein that we have not independently established or verified,

we have relied upon statements and representations of officers and other representatives of the Company.

Austin

Bay Area Beijing Boston Brussels Chicago Dallas Hong Kong Houston London Los Angeles Miami Munich New York Paris Salt Lake City Shanghai

Washington, D.C.

Canoo Inc.

October 24, 2023

Page 2

Based upon and subject

to the qualifications, assumptions and limitations stated in this letter, we advise you that that the Plan Shares are duly authorized

and, when (i) the Registration Statement related to the Plan Shares becomes effective under the Securities Act, and (ii) the

Plan Shares have been duly issued pursuant to and in accordance with the terms and conditions of the Plans and the Company’s Second

Amended & Restated Certificate of Incorporation (as amended from time to time) (the “Certificate of Incorporation”) and

the Company’s Amended & Restated Bylaws (as amended), the Plan Shares will be validly issued, fully paid and non-assessable.

Our opinion expressed

above is subject to the qualification that we express no opinion as to the applicability of, compliance with, or effect of any laws except

the General Corporation Law of the State of Delaware.

We have relied without

independent investigation upon, among other things, an assurance from the Company that the number of shares which the Company is authorized

to issue in its Certificate of Incorporation exceeds the number of shares outstanding and the number of shares which the Company is obligated

to issue (or has otherwise reserved for issuance) for any purposes other than issuances in connection with the Plans by at least the number

of Plan Shares which may be issued in connection with the Plans and we have assumed that such condition will remain true at all future

times relevant to this opinion. We have assumed that the Company will cause certificates, if any, representing the Plan Shares issued

in the future to be properly executed and delivered and will take all other actions appropriate for the issuances of such Plan Shares.

Our opinion assumes that the Registration Statement related to the Plan Shares will become effective under the Securities Act before any

Plan Shares covered by such Registration Statement are sold.

We hereby consent to

the filing of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. In giving this consent, we do

not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and

regulations of the Commission.

We do not find it necessary

for the purposes of this opinion, and accordingly we do not purport to cover herein, the application of the securities or “Blue

Sky” laws of the various states to the issuance and sale of the Plan Shares.

This opinion is limited

to the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein. We assume no obligation

to revise or supplement this opinion should the present laws of the State of Delaware be changed by legislative action, judicial decision

or otherwise.

This opinion is furnished

to you in connection with the filing of the Registration Statement in accordance with the requirements of Item 601(b)(5) of Regulation

S-K under the Securities Act, and is not to be used, circulated, quoted or otherwise relied upon for any other purpose.

| |

Yours very truly, |

| |

/s/ Kirkland & Ellis LLP |

| |

KIRKLAND & ELLIS LLP |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

We consent to the incorporation

by reference in this Registration Statement on Form S-8 of our report dated March 30, 2023 relating to the financial statements

of Canoo Inc. appearing in the Annual Report on Form 10-K of Canoo Inc. for the year ended December 31, 2022.

/s/ Deloitte & Touche

LLP

Austin, Texas

October 24, 2023

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

CANOO INC.

(Exact Name of Registrant as Specified in its

Charter)

Newly Registered Securities

Security

Type |

|

Security Class Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

|

Proposed

Maximum

Offering

Price Per

Unit |

|

|

Maximum

Aggregate

Offering Price |

|

|

Fee

Rate |

|

|

Amount of

Registration

Fee |

|

| Equity |

|

Common Stock, par value

$0.0001 per share |

|

Rule 457(c)

and (h) |

|

|

17,766,551 |

(2) |

|

$ |

0.2711 |

(4) |

|

$ |

4,816,511.98 |

|

|

|

0.00014760 |

|

|

$ |

710.92 |

(5) |

| Equity |

|

Common Stock, par value

$0.0001 per share |

|

Rule 457(c)

and (h) |

|

|

3,553,310 |

(3) |

|

$ |

0.2711 |

(4) |

|

$ |

963,302.34 |

|

|

|

0.00014760 |

|

|

$ |

142.18 |

(5) |

| Total Offering Amounts |

|

|

|

|

|

|

$ |

5,779,814.32 |

|

|

|

|

|

|

$ |

853.11 |

|

| Total Fee Offsets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/A |

|

| Net Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

853.11 |

|

| (1) |

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of common stock which become issuable under the Canoo Inc. 2020 Equity Incentive Plan and the Canoo Inc. 2020 Employee Stock Incentive Plan (together, the “Plans”) by reason of any stock dividend, stock split, recapitalization or any other similar transaction effected without the receipt of consideration which results in an increase in the number of shares of outstanding common stock. |

| (2) |

Represents shares of common stock issuable pursuant to the Canoo Inc. 2020 Equity Incentive Plan being registered herein, which shares consist of additional shares of common stock reserved and available for delivery with respect to awards issued thereunder pursuant to the “evergreen” provision under such plan, shares of common stock that may again become available for delivery with respect to awards under such plan pursuant to the share counting, share recycling and other terms and conditions of the plan. |

| |

|

| (3) |

Represents shares of common stock issuable pursuant to the Canoo Inc. 2020 Employee Stock Purchase Plan being registered herein, which shares consist of additional shares of common stock reserved and available for delivery under the Canoo Inc. 2020 Employee Stock Purchase Plan pursuant to the “evergreen” provision under such plan. |

| (4) |

Estimated pursuant to Rules 457(c) and 457(h) under the Securities Act solely for the purpose of calculating the registration fee. The price of $0.2711 per share represents the average of the high and low sales prices of the common stock as reported on The Nasdaq Capital Market on October 20, 2023. |

| |

|

| (5) |

Pursuant to General Instruction E to Form S-8, a filing fee is only being paid with respect to the registration of additional shares of common stock being registered pursuant to the Plans. Registration Statements on Form S-8 have been filed previously on February 24, 2021 (File No. 333-253463) and May 20, 2022 (File No. 333-265106) covering an aggregate of 45,078,740 and 14,314,701 shares of common stock, respectively, reserved for issuance pursuant to the Plans. |

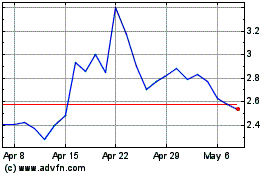

Canoo (NASDAQ:GOEV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Canoo (NASDAQ:GOEV)

Historical Stock Chart

From Jul 2023 to Jul 2024