Byrna Technologies Announces $10 Million Stock Repurchase Program

August 05 2024 - 8:00AM

Byrna Technologies Inc. (“Byrna” or the

“Company”) (Nasdaq: BYRN), a technology company,

specializing in the development, manufacture, and sale of

innovative less-lethal personal security solutions, today announced

that its Board of Directors has approved a $10 million stock

repurchase program. This program authorizes the Company to

repurchase up to $10 million of its common stock over a twenty-four

month period.

“Based on our continuing strong operating

performance, primarily driven by our successful marketing

strategies, we believe Byrna’s shares present a compelling

investment opportunity at their current valuation,” said Byrna CEO

Bryan Ganz. “We believe that our shares are currently undervalued

by the market, and this repurchase program demonstrates our

confidence in the long-term sustainability of our marketing

strategies and business model. As we have done with previous

repurchase programs, we aim to enhance shareholder value and

demonstrate our commitment to delivering consistent returns by

taking advantage of the current market conditions.”

Byrna has achieved impressive sequential revenue

growth over the past several quarters, with Q2 2024 marking a

company record for revenue, surpassing the previous record set in

Q1 2024, all while improving profitability. This consistent growth

reinforces management’s confidence in the Company’s long-term

prospects. The stock repurchase program reflects management’s

belief in the intrinsic value of Byrna and the Company’s dedication

to utilizing its robust cash position to benefit shareholders.

Management remains committed to driving returns for Byrna’s

shareholders through strong operational performance and in the

capital markets.

Under the stock repurchase program, the Company

may buy back its common stock in the open market from time to time,

in amounts, at prices, and at such times as the Company deems

appropriate, subject to market conditions, pursuant to Rule 10b5-1

of the Securities Exchange Act of 1934, and federal and state laws

governing such transactions. Byrna intends to fund the repurchases

with its existing cash balance, including cash generated from

operations, ensuring that the program does not impact operational

capabilities or growth initiatives. There can be no assurances as

to the exact number or aggregate value of shares that will be

repurchased by Byrna.

During the Company’s previous stock repurchase

programs, Byrna has repurchased $17.5 million of stock. The Company

most recently had a stock repurchase program in place in 2022.

About Byrna Technologies

Inc.Byrna is a technology company specializing in the

development, manufacture, and sale of innovative less-lethal

personal security solutions. For more information on the Company,

please visit the corporate website here or the Company's

investor relations site here. The Company is the manufacturer

of the Byrna® SD personal security device, a state-of-the-art

handheld CO2 powered launcher designed to provide a less-lethal

alternative to a firearm for the consumer, private security, and

law enforcement markets. To purchase Byrna products, visit the

Company's e-commerce store.

Forward-Looking StatementsThis

news release contains “forward-looking statements” within the

meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. All statements contained

in this news release, other than statements of current and

historical fact, are forward-looking statements. Often, but not

always, forward-looking statements can be identified by the use of

words such as: “may,” “aim,” “will,” “plan,” “expect,” “intend,”

“anticipate,” and “believe,” “could,” “should,” “might,” “occur,”

“achieved” and similar references to future periods.

Forward-looking statements include descriptions of currently

occurring matters which may continue in the future. Forward-looking

statements in this news release include, but are not limited to,

our statements related to the approval and implementation of the

$10 million stock repurchase program, the potential repurchases of

the Company’s common stock, the anticipated benefits of the stock

repurchase program, the expected funding of the repurchase program

with existing cash balance and cash generated from operations, and

the continue strong performance and long-term growth opportunities

of the Company. Forward-looking statements are based on, among

other things, our opinions, assumptions, estimates, and analyses

that, while considered reasonable by the Company at the date the

forward-looking information is provided, inherently are subject to

significant risks, uncertainties, contingencies, and other factors

that may cause actual results and events to be materially different

from those expressed or implied. Any number of risk factors could

affect our actual results and cause them to differ materially from

those expressed or implied by the forward-looking statements in

this news release, including, but not limited to, the risk that the

stock repurchase program may not achieve the intended benefits, the

risk that the market conditions may not be favorable for

repurchases, fluctuations in stock price, liquidity, capital

position, market disruptions, alternative opportunities or needs

for use of surplus cash and the risk that the Company’s financial

performance may not continue as anticipated. The order in which

these factors appear should not be construed to indicate their

relative importance or priority. We caution that these factors may

not be exhaustive; accordingly, any forward-looking statements

contained herein should not be relied upon as a prediction of

actual results. Investors should carefully consider these and other

relevant factors, including those risk factors in Part I, Item 1A,

(“Risk Factors”) in the Company's most

recent Form 10-K, should understand it is impossible

to predict or identify all such factors or risks, should not

consider the foregoing list, or the risks identified in the

Company's SEC filings, to be a complete discussion of all potential

risks or uncertainties, and should not place undue reliance on

forward-looking information. The Company assumes no obligation to

update or revise any forward-looking information, except as

required by applicable law.

Investor Contact:Tom Colton and

Alec WilsonGateway Group, Inc. 949-574-3860BYRN@gateway-grp.com

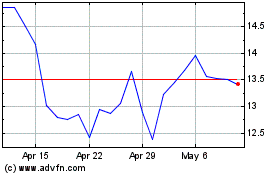

Byrna Technologies (NASDAQ:BYRN)

Historical Stock Chart

From Oct 2024 to Nov 2024

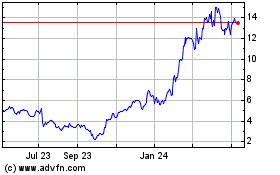

Byrna Technologies (NASDAQ:BYRN)

Historical Stock Chart

From Nov 2023 to Nov 2024