BT Brands, Inc. (Nasdaq: BTBD and BTBDW), today reported its

financial results for the first quarter, the thirteen weeks ending

April 2, 2023.

Together with the three 2022 restaurant acquisitions, and

including our 41.2% ownership of Bagger Dave’s Burger Tavern with

six locations (OTCMarkets: BDVB), BT Brands operates a total of

eighteen restaurants comprising the following:

- Eight Burger Time fast-food restaurants and one Dairy Queen

franchise; located in the North Central region of the United

States, collectively (“BTND”);

- Bagger Dave’s Burger Tavern, Inc., a 41.2% owned affiliate,

operates six Bagger Dave’s restaurants in Michigan, Ohio, and

Indiana (“Bagger Dave’s”);

- Keegan’s Seafood Grille in Indian Rocks Beach, Florida

(“Keegan’s”);

- Pie In The Sky Coffee and Bakery in Woods Hole, Massachusetts

(“PIE”).

- Village Bier Garten, a German-themed restaurant, bar, and

entertainment venue in Cocoa, Florida (“VBG”).

Highlights and recent activities include:

- Total revenues for the 2023 period increased 48% over 2022 to

$3.1 million;

- Operating income for the quarter declined to a loss of $250,758

from an operating profit of $88,921 in 2022;

- Net loss attributable to common shareholders was $141,786, or

$.02 per share for the first quarter;

- Restaurant-level adjusted EBITDA (a non-GAAP measure) for the

quarter declined to $338,644 in 2023 from $449,398 in the same

period in 2022;

- Our equity in the first quarter loss of Bagger Dave’s was

$54,399;

- During the first quarter of 2023, the Company repurchased

150,000 shares of common stock for $250,225, approximately $1.67

per share.

- We ended the quarter with $6.9 million in total cash and

short-term investments;

- First quarter results include the gain on the sale of a former

Burger Time property in West St. Paul for a pre-tax gain of

approximately $313,000;

- The disposition of our St. Louis property was recently

finalized and will result in recording a $180,000 gain in the

second quarter of 2023.

Gary Copperud, the Company’s Chief Executive Officer, said, “The

first quarter has always been seasonally slower for our Burger Time

business, and harsher than normal winter weather in the

north-central region contributed to a challenging sales

environment. Our Pie in The Sky business follows a similar seasonal

sales pattern. The first quarter of the year is considered an

off-season period on Cape Cod. As a public company, we face

significantly higher general and administrative expenses. Overall,

we continue to see inflationary pressure on our cost of sales

inputs, and there are persistent challenges with staffing which

recently appear to be lessening as labor markets are slightly more

favorable. Also, the pace of increases in hourly labor rates is

moderating. As we look toward the balance of 2023, we remain

focused on achieving profitability consistent with our

expectations.”

Fiscal 2023 Outlook: Because of the uncertain nature of

the performance of recent acquisitions and the evolving character

of our Company and because of continuing uncertainty surrounding

public health concerns, impacts of supply chain constraints, and

the current inflationary environment, the Company is not at this

point, providing a financial forecast for fiscal 2023.

Conference Call: Management will host a conference call

to discuss its first quarter ending April 2, 2023, financial

results on Thursday, May 18, 2023, at 4:00 p.m. ET. Hosting the

call will be Kenneth Brimmer, Chief Financial Officer and Gary

Copperud, Chief Executive Officer. Dial: 877-344-8082

Secondary, international dial-in: +1-213-992-4618 The

conference call can be accessed live over the phone by dialing the

access code. In addition, an archive of the call will be available

on the Company’s corporate website page after the call has

concluded. Website www.itsburgertime.com.

About BT Brands Inc.: BT Brands, Inc. (BTBD and BTBDW)

owns and operates a fast-food restaurant chain called Burger Time

with locations in North and South Dakota and Minnesota. In

addition, the Company owns the Pie In The Sky Coffee and Bakery in

Woods Hole, Massachusetts, the Village Bier Garten in Cocoa,

Florida, and Keegan’s Seafood Grille near Clearwater, Florida. BT

Brands is seeking acquisitions within the restaurant industry.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as: "anticipate,"

"intend," "plan," "goal," "seek," "believe," "project," "estimate,"

"expect," "strategy," "future," "likely," "may," "should," "will"

and similar references to future periods. Examples of

forward-looking statements include, among others, statements we

make regarding guidance relating to net income and net income per

share, expected operating results, such as revenue growth and

earnings, anticipated levels of capital expenditures for the 2023

fiscal year, current or future volatility in the credit markets and

future market conditions, our belief that we have sufficient

liquidity to fund our business operations during the next fiscal

year, market position, financial results and reserves, and strategy

for risk management.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding the

future of our business, future plans and strategies, projections,

anticipated events and trends, the economy and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the

forward-looking statements. Therefore, you should not rely on any

of these forward-looking statements. Important factors that could

cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the following: the disruption to our

business from public health emergencies, the impact on our results

of operations, and our financial condition; the uncertain nature of

the restaurant industry; our ability to integrate acquired

restaurants, delays in developing and opening new restaurants

because of weather, local permitting or other reasons, increased

competition, cost increases or shortages in raw food products,

staffing shortages and the effect of inflation on key supplies and

inputs.

Any forward-looking statement made by us in this press release

is based only on information currently available to us and speaks

only as of the date on which it is made. We undertake no obligation

to publicly update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

Financial Results Follow:

BT BRANDS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

13 Weeks Ended,

13 Weeks Ended,

April 2, 2023

April 3, 2022

SALES

$

3,070,798

$

2,073,195

COSTS AND EXPENSES

Restaurant operating expenses

Food and paper costs

1,290,323

721,583

Labor costs

1,202,760

607,710

Occupancy costs

357,125

174,638

Other operating expenses

195,614

119,867

Depreciation and amortization expenses

163,507

69,415

General and administrative expenses

425,915

291062

Gain on sale of assets held for sale

(313,688

)

-

Total costs and expenses

3,321,556

1,984,274

Income (loss) from operations

(250,758

)

88,921

UNREALIZED GAIN ON MARKETABLE

SECURITIES

69,856

-

INTEREST EXPENSE

(25,533

)

(28,271

)

INTEREST AND DIVIDEND INCOME

89,048

-

EQUITY IN LOSS OF AFFILIATE

(54,399

)

-

INCOME (LOSS) BEFORE TAXES

(171,786

)

60,650

INCOME TAX (EXPENSE) BENEFIT

30,000

(18,000

)

NET INCOME (LOSS)

$

(141,786

)

$

42,650

NET INCOME (LOSS) PER COMMON SHARE - Basic

and Diluted

$

(0.02

)

$

0.01

WEIGHTED AVERAGE SHARES USED IN COMPUTING

PER COMMON SHARE AMOUNTS - Basic and Diluted

6,280,729

6,455,434

BT BRANDS, INC., AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

Unaudited

April 2, 2023

January 1, 2023

ASSETS

CURRENT ASSETS

Cash

$

5,494,401

$

2,150,578

Marketable securities

1,378,337

5,994,295

Receivables

14,596

76,948

Inventory

173,007

158,351

Prepaid expenses and other current

assets

64,424

37,397

Assets held for sale

258,751

446,524

Total current assets

7,383,516

8,864,093

PROPERTY, EQUIPMENT AND LEASEHOLD

IMPROVEMENTS, NET

3,258,759

3,294,644

OPERATING LEASES RIGHT-OF-USE ASSETS

1,946,394

2,004,673

INVESTMENTS

1,314,787

1,369,186

DEFERRED INCOME TAXES

91,000

61,000

GOODWILL

671,220

671,220

INTANGIBLE ASSETS, NET

439,260

453,978

OTHER ASSETS, NET

50,477

50,903

Total assets

$

15,155,413

$

16,769,697

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES

Accounts payable

$

400,711

$

448,605

Broker margin loan

-

791,370

Current maturities of long-term debt

166,241

167,616

Current operating lease obligations

193,430

193,430

Accrued expenses

410,101

532,520

Total current liabilities

1,170,483

2,133,541

LONG-TERM DEBT, LESS CURRENT PORTION

2,416,905

2,658,477

NONCURRENT LEASE OBLIGATIONS

1,771,514

1,825,057

Total liabilities

5,358,902

6,617,075

COMMITMENTS AND CONTINGENCIES

SHAREHOLDERS' EQUITY

Preferred stock, $.001 par value,

2,000,000 shares authorized, no shares outstanding at April 2, 2023

and January 1, 2023

-

-

Common stock, $.002 par value, 50,000,000

authorized, 6,461,118 issued and 6,246,118 shares outstanding at

April 2, 2023 and 6,461,118 shares issued and 6,396,118 shares

outstanding at January 1, 2023

12,492

12,792

Less cost of 215,000 and 65,000 common

shares held in Treasury at April 2, 2023 and January 1, 2023,

respectively.

(356,807

)

(106,882

)

Additional paid-in capital

11,445,135

11,409,235

Accumulated deficit

$

(1,304,309

)

(1,162,523

)

Total shareholders' equity

9,796,511

10,152,622

Total liabilities and shareholders'

equity

$

15,155,413

$

16,769,697

Category: Financial Category

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230516005861/en/

KENNETH BRIMMER 612-229-8811

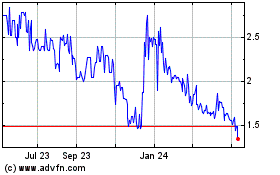

BT Brands (NASDAQ:BTBD)

Historical Stock Chart

From Nov 2024 to Dec 2024

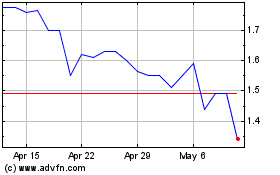

BT Brands (NASDAQ:BTBD)

Historical Stock Chart

From Dec 2023 to Dec 2024