UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16

or 15d-16 of the Securities Exchange Act of 1934

| For

the month of |

July

2023 |

| |

|

| Commission

File Number |

001-41460 |

Bruush

Oral Care Inc.

(Translation

of registrant’s name into English)

128

West Hastings Street, Unit 210

Vancouver,

British Columbia V6B 1G8

Canada

(844)

427-8774

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

On

July 31, 2023, Bruush Oral Care Inc. (the “Company”) announced that it will effect a one-for-twenty five (1-for-25)

reverse split of its common shares (the “Consolidation”).

Upon

the opening of the market on August 1, 2023, the Company’s common shares and warrants will trade on the Nasdaq

Capital Market (“Nasdaq”) on a post-Consolidation basis under the current symbols “BRSH” and “BRSHW”,

respectively.

The

Consolidation is primarily intended for the Company to regain compliance with a minimum bid price of $1.00 per share for continued

listing on Nasdaq, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Requirement”). Nasdaq previously

provided the Company until July 19, 2023 to regain compliance. On July 20, 2023, Nasdaq notified the Company that Nasdaq has

determined that the Company’s securities will be delisted from Nasdaq in accordance with Listing Rules Listing Rule

5450(a)(1), 5810(c)(3)(A) and 5550(b)(1) unless the Company appeals the delisting determination. On July 27, 2023, the Company

appealed such determination and requested a hearing. The hearing has been scheduled for September 21, 2023. To regain

compliance, the closing bid price of the Company’s common shares must meet or exceed $1.00 per share for a minimum of ten

consecutive trading days during this period. There can be no assurance that the Company will be able to regain compliance

with the Minimum Bid Requirement.

The

Consolidation will reduce the number of issued and outstanding common shares of the Company from 12,784,209 to 511,368 and will

affect all outstanding common shares. Every twenty five (25) outstanding common shares will be combined into and automatically

become one post-Consolidation common share. If any fractional common shares are created as a result of the Consolidation,

any fractional common share less than 0.50 will be cancelled and any fractional common share greater than 0.50 will be rounded up

to the nearest whole common share.

Additionally, the exercise price per common

share attributable to the warrants will be proportionately increased, such that the exercise price immediately following the Consolidation

will equal the product of twenty five (25) multiplied by the exercise price per share immediately prior to the Consolidation. The number

of shares immediately subject to the warrants, will equal after the Consolidation, 1/25th (0.04 or 4%) of the number of shares

immediately prior to the Consolidation.

Attached

to this Report as Exhibit 99.1 is a copy of the press release (furnished and not filed) dated July 31, 2023 titled “Brüush

Oral Care Inc. Announces 1-for-25 Reverse Stock Split Effective Pre-Market Opening on August 1, 2023”.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

|

|

|

Bruush

Oral Care Inc. |

| |

|

|

|

(Registrant) |

| |

|

|

|

|

| Date: |

July

31, 2023 |

|

By: |

/s/

Aneil Singh Manhas |

| |

|

|

Name: |

Aneil

Singh Manhas |

| |

|

|

Title: |

Chief

Executive Officer |

Exhibit

99.1

Brüush

Oral Care Inc. Announces 1-for-25 Reverse Stock Split Effective Pre-Market Opening on August 1, 2023

VANCOUVER,

BC / ACCESSWIRE / July 31, 2023 / Bruush Oral Care Inc. (NASDAQ: BRSH) (the “Company”), a direct-to-consumer leader

in the oral care category, announced today that its Board of Directors has approved a 1-for-25 reverse split of its common shares

(“Consolidation”) primarily to comply with the Nasdaq’s minimum bid price requirement. The Consolidation is effective

as of the close of business on July 31, 2023 and the Company’s common shares and warrants will trade on a post-split

basis under the same symbols, BRSH and BRSHW, respectively, commencing with the opening of trading on the Nasdaq on August

1, 2023.

Following

the effectiveness of the Consolidation, the CUSIP number for the Company’s common shares will be 11750K401. As a result of the

Consolidation, every 25 common shares issued and outstanding will be exchanged for one common share. If any fractional common

shares are created as a result of the Consolidation, any fractional common share less than 0.50 will be cancelled and any fractional

common share greater than 0.50 will be rounded up to the nearest whole common share. Immediately after the Consolidation becomes

effective, the Company will have approximately 511,368 common shares issued and outstanding. Additionally, the exercise price

per common share attributable to the warrants will be proportionately increased, such that the exercise price immediately following the

Consolidation will equal the product of twenty five (25) multiplied by the exercise price per share immediately prior to the Consolidation.

The number of shares immediately subject to the warrants , will equal after the Consolidation, 1/25th (0.04 or 4%) of the

number of shares immediately prior to the Consolidation.

About

Bruush Oral Care Inc.

Bruush

Oral Care Inc. is on a mission to inspire confidence through brighter smiles and better oral health. Founded in 2018, we are an oral

care company that is disrupting the space by reducing the barriers between consumers and access to premium oral care products. We are

an e-commerce business with a product portfolio that currently consists of a sonic-powered electric toothbrush kit and brush head refills.

We developed the product to make upgrading to an electric brush appealing with three core priorities in mind: (i) a high-quality electric

toothbrush at a more affordable price than a comparable electric toothbrush from the competition; (ii) a sleek, countertop-friendly design;

and (iii) a convenient brush head refill subscription program that eliminates the frustrating experience of purchasing replacement brush

heads at the grocery/drug store. Later this year, we plan to expand our portfolio with the launch of several new subscription-based

consumable oral care products, including toothpaste, mouthwash, dental floss, a whitening pen, as well as an electric toothbrush designed

for kids. We are rooted in building a brand that creates relevant experiences and content, with the goal of becoming the go-to oral care

brand for millennials and Generation Z.

For

more information on Brüush visit: https://bruush.com

Follow

Brüush on LinkedIn: Bruush

Follow

Brüush on Instagram: @bruush

Safe

Harbor Forward-Looking Statements

This

press release of Bruush Oral Care Inc. contains “forward-looking statements”. Words such as “may”, “will”,

“could”, “should”, “expects”, “anticipates”, “intends”, “plans”,

“believes”, “seeks”, “estimates” and other comparable terminology are intended to identify forward-looking

statements. For example, the Company is using forward-looking statements when it discusses its vision, its strategy, and its products.

Forward-looking statements are not historical facts, and are based upon management’s current expectations, beliefs and projections,

many of which, by their nature are inherently uncertain. Such expectations, beliefs and projections are expressed in good faith. However,

there could be no assurance that management’s expectations, beliefs and projections will be achieved, and actual results may differ

materially from what is expressed or indicated by the forward-looking statements. Forward-looking statements are subject to risks and

uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements.

Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking

statements to reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting

forward-looking statements except to the extent required by applicable securities laws. If the Company does update one or more forward-looking

statement, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking

statements.

Investor

Relations Contact:

Colette

Eymontt

colette@tradigitalir.com

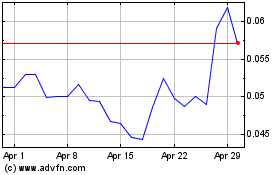

Bruush Oral Care (NASDAQ:BRSH)

Historical Stock Chart

From Apr 2024 to May 2024

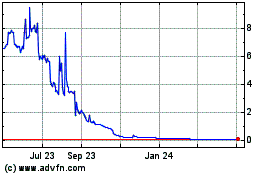

Bruush Oral Care (NASDAQ:BRSH)

Historical Stock Chart

From May 2023 to May 2024