UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

BLUE

STAR FOODS CORP.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

82-4270040 |

(State

or other jurisdiction

of incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| |

|

|

3000

NW 109th Avenue

Miami,

Florida |

|

33172 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Consulting

Agreement

(Full

title of the plan)

_____________________

(Name

and address of agent for service)

(860)

633-5565

(Telephone

number, including area code, of agent for service)

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company.

☐

Large accelerated filer ☐ Accelerated filer

☒

Non-accelerated filer ☒ Smaller reporting company

☒

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

PART

I

INFORMATION

REQUIRED IN SECTION 10(a) PROSPECTUS

| Item 1. |

Plan Information.* |

| Item 2. |

Registrant Information and Employee Plan Annual Information.* |

| * |

Information

required by Part I to be contained in Section 10(a) prospectus is omitted from the Registration Statement in accordance with Rule

428 under the Securities Act of 1933, and Note to Part I of Form S-8. |

PART

II

| Item 3. |

Incorporation of Documents by Reference. |

The

following documents filed by the Company with the Securities and Exchange Commission are incorporated by reference into this Registration

Statement:

| |

1. |

Annual

Report on Form

10-K for the period ended December 31, 2022, filed with the Commission on April 17, 2023. |

| |

|

|

| |

2. |

Quarterly

Report on Form

10-Q for the period ended March 31, 2023, filed with the Commission on May 22, 2023. |

| |

|

|

| |

3. |

Current

Report on Form

8-K filed with the Commission on May 22, 2023. |

| |

|

|

| |

4. |

Current

Report on Form

8-K filed with the Commission on May 23, 2023 |

| |

|

|

| |

5. |

Current

Report on Form

8-K filed with the Commission on May 31, 2023. |

| |

|

|

| |

6. |

Current

Report on Form

8-K filed with the Commission on May 31, 2023. |

| |

|

|

| |

7. |

Current

Report on Form

8-K filed with the Commission on June 20, 2023. |

| |

|

|

| |

8. |

Current

Report on Form

8-K filed with the Commission on July 11, 2023. |

All

reports and other documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior

to the filing of a post-effective amendment which indicates that all securities offered have been sold or which de-registers all securities

then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part of this Registration Statement from the

date of the filing of such reports and documents.

Any

statement contained in an Incorporated Document shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein or in any other subsequently filed Incorporated Document modifies or supersedes such

statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part

of this Registration Statement.

| Item 4. |

Description of Securities. |

Not

Applicable

| Item 5. |

Interests of Named Experts and Counsel. |

No

expert or counsel named in this prospectus as having prepared or certified any part of it or as having given an opinion upon the validity

of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was

employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect,

in the Company or any of its parents or subsidiaries. Nor was any such person connected with the Company or any of its parents or subsidiaries

as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

| Item 6. |

Indemnification of Directors

and Officers. |

Our

officers and directors are indemnified as provided by the Delaware General Corporation Law and our Certificate of Incorporation and our

Bylaws.

Pursuant

to our Certificate of Incorporation and our Bylaws, we may indemnify any person who was or is a party or is threatened to be made a party

to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, (other

than an action by or in the right of us) by reason of the fact that he is or was a director, officer, employee, fiduciary or agent of

the Company or is or was serving at the request of us as a director, officer, employee, fiduciary or agent of another corporation, partnership,

joint venture, trust, or other enterprise, against expenses (including attorney fees), judgments, fines, and amounts paid in settlement

actually and reasonably believed to be in our best interests and, with respect to any criminal action or proceeding, had no reasonable

cause to believe his conduct was unlawful. The termination of any action, suit, or proceeding by judgment, order, settlement, or conviction

or upon pleas of nolo contenders or its equivalent shall not of itself create a presumption that the person did not act in good faith

and in a manner which he reasonably believed to be in our best interests and, with respect to any criminal action or proceeding, had

reasonable cause to believe his conduct was unlawful.

Our

Certificate of Incorporation and Bylaws also provide that we may indemnify any person who was or is a party or is threatened to be made

a party to any threatened, pending, or completed action or suit by or in the right of our company or procure a judgment in its favor

by reason of the fact that he is or was a director, officer, employee, or agent of our company or is or was serving at our request as

a director, officer, employee, fiduciary or agent of another corporation, partnership, joint venture, trust or other enterprise against

expenses (including attorney fees) actually and reasonably incurred by him in connection with the defense or settlement of such action

or suit if he acted in good faith and in a manner he reasonably believed to be in our best interests: but no indemnification shall be

made in respect to any claim, issue, or matter as to which such person has been adjudged to be liable for negligence or misconduct in

the performance of his duty to us unless and only to the extent that the court in which such action or suit was brought determines upon

application that, despite the adjudication of liability, but in view of all circumstances of the case, such person is fairly and reasonably

entitled to indemnification for such expenses which such court deems proper.

To

the extent that a director, officer, employee, fiduciary or agent of a corporation has been successful on the merits in defense of any

action, suit, or proceeding referred to in the preceding two paragraphs or in defense of any claim, issue, or matter therein, he shall

be indemnified against expenses (including attorney fees) actually and reasonably incurred by him in connection therewith.

The

indemnification provided by the provisions described in this section shall not be deemed exclusive of any other rights to which those

seeking indemnification may be entitled under our Certificate of Incorporation, the Bylaws, agreements, vote of the shareholders or disinterested

directors, or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office, and

shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the heirs

and personal representatives of such a person.

| Item 7. |

Exemption from Registration

Claimed. |

Not

applicable.

A.

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) of the Securities Act if, in the aggregate,

the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement; or

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

provided,

however, that paragraphs (i) and (ii) of this section do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section

15(d) of the Exchange Act that are incorporated by reference in the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

B.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of

the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable,

each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that

is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the Delaware General Corporation Law, the Certificate of Incorporation of the registrant, the Bylaws of

the registrant, indemnification agreements entered into between the registrant and its officers and directors or otherwise, the registrant

has been advised that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed

in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other

than the payment by the registrant in successful defense of any action, suit or proceeding) is asserted by such director, officer or

controlling person in connection with the securities being registered hereunder, the registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

In

accordance with the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-8 and authorized this registration statement to be signed on its behalf by the

undersigned, in Miami, Florida, on August 14, 2023.

| Blue

Star Foods Corp. |

|

| |

|

|

| By: |

/s/

John Keeler |

|

| |

John

Keeler |

|

| |

Chief

Executive Officer, Chief Financial Officer |

|

| |

(Principal

Executive Officer, Principal Financial Officer, and Principal Accounting Officer) and Director |

|

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints John Keeler as his true and lawful

attorney-in-fact and agent, with full power of substitution and re-substitution, for him and in his name, place and stead, in any and

all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and to file the

same, with all exhibits thereto, and other documents in connection therewith, with the U.S. Securities and Exchange Commission, granting

unto said attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite and necessary

to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming

all that said attorney-in-fact and agent or any of them, or of their substitute or substitutes, may lawfully do or cause to be done by

virtue hereof.

Pursuant

to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and

on the dates stated.

| By: |

/s/

John Keeler |

|

| |

John

Keeler |

|

| |

Chief

Executive Officer, Chief Financial Officer |

|

| |

(Principal

Executive Officer, Principal Financial Officer, and Principal Accounting Officer) and Director |

|

| By: |

/s/

Nubar Herian |

|

By: |

/s/

Trond Ringstad |

| |

Nubar Herian |

|

|

Trond

Ringstad |

| |

|

|

|

|

| By: |

/s/

Jeffrey J. Guzy |

|

By: |

/s/

Silvia Alana |

| |

Jeffrey J. Guzy |

|

|

Silvia

Alana |

| |

|

|

|

|

| By: |

/s/

Timothy McLellan |

|

By: |

/s/

Juan Carlos Dalto |

| |

Timothy McLellan |

|

|

Juan

Carlos Dalto |

Exhibit

5.1

MCMURDO

LAW GROUP, LLC

Matthew C. McMurdo | 917 318 2865 | matt@nannaronelaw.com |

1185 Avenue of the Americas

3rd Floor New York,

NY 10036 |

Date:

August 14, 2023

VIA

ELECTRONIC TRANSMISSION

Blue

Star Foods Corp.

3000

NW 109th Avenue

Miami,

Florida 33172

Re:

Blue Star Foods Corp. Form S-8 Registration Statement

Ladies

and Gentlemen:

We

refer to the above-captioned registration statement on Form S-8 (the “Registration Statement”) under the Securities Act of

1933, as amended (the “Act”), to be filed by Blue Star Foods Corp., a Delaware corporation (the “Company”), with

the Securities and Exchange Commission on or about August 14, 2023, in connection with the registration under the Securities Act

of 1933, as amended (the “Securities Act”), of 200,000 shares of the Company’s common stock, $0.0001 par value per

share, that are subject to issuance by the Company under the Company’s 2018 Equity Incentive Plan (the “Plan”).

We

have examined the originals, photocopies, certified copies or other evidence of such records of the Company, certificates of officers

of the Company and public officials, and other documents as we have deemed relevant and necessary as a basis for the opinion hereinafter

expressed. In such examination, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us

as certified copies or photocopies and the authenticity of the originals of such latter documents.

Based

on our examination mentioned above, we are of the opinion that the securities being issued pursuant to the Registration Statement are

duly authorized and will be, when issued, legally and validly issued, and fully paid and non-assessable.

McMurdo

Law Group, LLC

NEW

YORK

We

hereby consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement. In giving the foregoing consent, we do not

hereby admit that we are in the category of persons whose consent is required under Section 7 of the Act, or the rules and regulations

of the Securities and Exchange Commission.

| |

MCMURDO

LAW GROUP, LLC |

| |

|

| |

/s/

Matthew McMurdo, Esq. |

| |

Matthew

McMurdo, Esq. |

McMurdo

Law Group, LLC

NEW

YORK

Exhibit 10.1

Consulting Agreement

THIS

CONSULTING AGREEMENT (this “Agreement”), dated as of July 28, 2023, by and between Blue Star Foods Corp., a Delaware

corporation (the “Company”), and Mark Crone (the “Consultant”).

W I T N E S S E T H:

WHEREAS,

the Company desires to retain the Consultant and the Consultant desires to be retained by the Company pursuant to the terms and conditions

hereinafter set forth.

NOW,

THEREFORE, in consideration of the foregoing and the mutual promises and covenants herein contained, it is hereby agreed as follows:

Section 1. RETENTION.

| |

(a) |

The Company engages retains the Consultant to perform the services set forth in Section 1(b) and the Consultant hereby accepts such retention and shall perform for the Company the duties described herein, faithfully and to the best of the Consultant’s ability. |

| |

(b) |

The Consultant shall serve as a corporate legal advisor to the Company and render such advice and professional services to the Company as may be reasonably requested by the Company. In his role as a legal advisor, the Consultant shall not solicit investments, make any recommendations regarding investments, or provide any analysis or advice regarding investments. Consultant’s services rendered under this Agreement shall not include any services in connection with the offer or sale of securities in a capital-raising transaction by the Company, or services which directly or indirectly promote or maintain a market for the Company’s securities. |

Section 2. COMPENSATION.

In consideration for the Consultant providing the services described above, the Company shall compensate Consultant by the issuance of

200,000 shares of common stock in the Company, to be registered via an S-8 registration statement, in exchange for Consultant’s

services (the “Shares”). The Shares shall be deemed earned and irrevocable. The Shares shall be non-cancellable and

free and clear of any and all encumbrances and restrictions, and shall be duly issued, fully paid and non-assessable.

Section 3. TERMINATION.

Either party may terminate this Agreement at any time for any reason or on reason; however, such termination shall not remove the Company’s

nor the Consultant’s obligations that survive per the terms of this Agreement, including, but not limited to, the Company’s

obligation to pay the Shares already earned by the Consultant.

Section 4. CONFIDENTIAL INFORMATION.

The Consultant agrees that during and after the term of this Agreement, he shall keep in strictest confidence, and shall not disclose

or make accessible to any other person without the written consent of the Company, the Company’s products, services and technology,

both current and under development, promotion and marketing programs, lists, trades secrets and other confidential and proprietary business

information of the Company of or any of its clients and third parties including, without limitation, Proprietary Information (as defined

in Section 6) (all of the foregoing is referred to herein as the “Confidential Information”). The Consultant agrees

(a) not to use any such Confidential Information for himself or others; and (b) not to take any such material or reproductions thereof

from the Company’s facilities at any time except, in each case, as required in connection with the Consultant’s duties hereunder.

Notwithstanding the foregoing, the parties 3agree the Consultant is free to use (a) information in the public domain not as a result of

a breach of this Agreement, (b) information lawfully received form a third party who had the right to disclose such information and (c)

the Consultant’s own independent skill, knowledge, know-how and experience to whatever extent and in whatever way it wishes, in

each case consistent with his obligations as the Consultant and that, at all times, the Consultant is free to conduct any research relating

to the Company’s business.

Section 5. OWNERSHIP OF PROPRIETARY

INFORMATION. The Consultant agrees that all information that has been created, discovered of developed by the Company, its subsidiaries,

affiliates, licensors, licensees, successors or assigns (collectively, the “Affiliates”) (including, without limitation,

information relating to the development of the Company’s business created, discovered, developed by the Company any of its affiliates

during the term of this Agreement, and information relating to the Company’s customers, suppliers, advisors, and licensees) and/or

in which property rights have been assigned or otherwise conveyed to the Company or the Affiliates, shall be the sole property of the

Company or the Affiliates, as applicable, and the Company or the Affiliates, as the case may be, shall be the sole owner of all patents,

copyrights and other rights in connection therewith, including, without limitation, the right to make application for statutory protection.

All the aforementioned information is hereinafter called “Proprietary Information.” By way of illustration, but not

limitation, Proprietary Information includes trade secrets, processes, discoveries, structures, inventions, designs, ideas, works of authorship,

copyrightable works, trademarks, copyrights, formulas, improvements, inventions, product concepts, techniques, marketing plans, merger

and acquisition targets, strategies, forecasts, blueprints, sketches, records, notes, devices, drawings, customer lists, patent applications,

continuation applications, continuation-in-part applications, file wrapper continuation applications and divisional applications and information

about the Company’s Affiliates, its employees and/or advisors (including, without limitation, the compensation, job responsibility

and job performance of such employees and/or advisors). All original content, proprietary information, trademarks, copyrights, patents

or other intellectual property created by the Consultant that does not include any specific information relative to the patents or other

intellectual property created by the Consultant that does not include any specific information relative to the Company’s proprietary

information, shall be the sole and exclusive property of the Consultant.

Section 6. NOTICES. Any

notice or other communication under this Agreement shall be in writing and shall be deemed to have been duly given: (a) upon facsimile

transmission (with written transmission confirmation report) at the number designated below; (b) when delivered personally against receipt

therefore; (c) one day after being sent by Federal Express or similar overnight delivery; or (d) five (5) business days after being mailed

registered or certified mail, postage prepaid.

Section 7. STATUS OF CONSULTANT.

The Consultant shall be deemed to be an independent contractor and, except as expressly provided or authorized in the Agreement, shall

have no authority to act for on behalf of or represent the Company. This Agreement does not create a partnership or joint venture.

Section 8. OTHER ACTIVITIES

OF CONSULTANT. The Company recognizes that the Consultant now renders and may continue to render consulting and other services to

other companies that may or may not conduct business and activities similar to those of the Company. The Consultant shall not be required

to devote his full time and attention to the performance of his duties under this Agreement, but shall devote only so much of his time

and attention as it deems reasonable or necessary for such purposes.

Section 9. SUCCESSORS AND

ASSIGNS. This Agreement and all of the provisions hereof shall be binding upon and inure to benefit of the parties hereto and their

respective successors and permitted assigns. This Agreement and any of the rights, interest or obligations hereunder may be assigned by

the Consultant without the prior written consent of the Company. This Agreement and any of the rights, interests or obligations hereunder

may not be assigned by the Company without the prior written consent of the Consultant, which consent shall not be unreasonably withheld.

Section 10. SEVERABILITY

OF PROVISIONS. If any provision of this Agreement shall be declared by a court of competent jurisdiction to be invalid, illegal or

incapable of being enforced in whole or in part, the remaining conditions and provisions or portions thereof shall nevertheless remain

in full force and effect and enforceable to the extent they are valid, legal and enforceable, and no provision shall be deemed dependent

upon any other covenant or provision unless so expressed herein.

Section 11. MODIFICATION.

No amendment or modification of this Agreement shall be valid unless made in writing and signed by each of the parties hereto.

Section 12. NON-WAIVER. The

failure of any party to insist upon the strict performance of any of the term, conditions and provisions of this Agreement shall not be

construed as a waiver or relinquishment of future compliance therewith; and the said terms, conditions and provisions shall remain in

full force and effect. No waiver of any term or condition of the Agreement on the party of any party shall be effective for any purpose

whatsoever unless such waiver is in writing and signed by such party.

Section 13. REMEDIES FOR

BREACH. The Consultant and the Company mutually agree that any breach of Sections 2, 4, and 5 of this Agreement by the Consultant

or the Company may cause irreparable damage to the other party and/or their affiliates, and that monetary damages alone would not be adequate

and, in the event of such breach or threat of breach, the damaged parry shall have, in addition to any and all remedies at law and without

the posting of a bond or other security, the right to an injunction, specific performance or other equitable relief necessary to prevent

or redress the violation of either party’s obligations under such Sections. In the event that an actual proceeding is brought in

equity to enforce such Sections, the offending party shall not urge as a defense that there is an adequate remedy at law nor shall the

damaged party be prevented from seeking any other remedies that may be available to it. The defaulting party shall pay all attorneys’

fees and costs incurred by the other party in enforcing this Agreement.

Section 14. GOVERNING LAW.

The parties hereto acknowledge that the transactions contemplated by this Agreement bear a reasonable relation to the State of New York.

This Agreement shall be governed by, and construed and interpreted in accordance with, the internal laws of the State of New York without

regard to such state’s principles of conflicts of laws. The parties irrevocable and unconditionally agree that the exclusive place

of jurisdiction for any action, suit or proceeding (“Actions”) relating to this Agreement shall be in the state and/or

federal courts situate in the county of New York and State of New York. Each party irrevocable and unconditionally waives any objection

it may have to the venue of any Action brought in such courts or to the convenience of the forum. Final judgment in any such Action shall

be conclusive and may be enforced in other jurisdictions by suit on the judgment, a certified or true copy of which shall be conclusive

evidence of the fact and the amount of any indebtedness or liability of any party therein described. Service of the process in any Action

by any party may be made by serving a copy of the summons and complaint, in addition to any other relevant documents, by commercial overnight

courier to any other party at their address set forth in this Agreement.

Section 15. HEADINGS. The

headings of the Sections are inserted for convenience of reference only and shall not affect any interpretation of this Agreement.

Section 16. COUNTERPARTS.

This Agreement may be executed in counterpart signatures, each of which shall be deemed an original, but all of which, when taken together,

shall constitute one and the same instrument, it being understood that both parties need not sign the same counterpart. In the event that

any signature is delivered by facsimile transmission, such signature shall create a valid and binding obligation of the party executing

(or on whose behalf such signature is executed) the same with the same force and effect as if such facsimile signature page were an original

thereof.

Remainder of Page Intentionally

Omitted; Signature Pages to Follow

IN WITNESS

WHEREOF, the parties hereto have executed this Agreement as of the day and year first written above.

| BLUE STAR FOODS CORP. |

|

| |

|

|

| |

|

|

| By: |

/s/ John Keeler |

|

| |

John Keeler, CEO |

|

| |

|

|

| |

|

|

| Consultant |

|

| |

|

|

| |

|

|

| /s/ Mark Crone |

|

| Mark Crone |

|

Exhibit 23.1

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated April 27, 2023 with respect

to the audited consolidated financial statements of Blue Star Foods Corp. for the years ended December 31, 2022 and 2021. Our report

contains an explanatory paragraph regarding the Company’s ability to continue as a going concern.

/s/

MaloneBailey, LLP

www.malonebailey.com

Houston,

Texas

August

14, 2023

Exhibit 107

Calculation of Filing Fee

Tables

S-8

(Form Type)

BLUE STAR FOODS CORP.

(Exact Name of Registrant as

Specified in its Charter)

Table 1: Newly Registered

and Carry Forward Securities

| | |

Security Type | |

Security

Class

Title | |

Fee

Calculation

or Carry

Forward Rule | |

Amount

Registered(2) | |

Proposed

Maximum

Offering Price

Per Unit(3) |

Maximum

Aggregate

Offering Price(3) | |

Fee

Rate | |

Amount

of

Registration Fee | |

Carry

Forward

Form Type | |

Carry

Forward

File Number | |

Carry

Forward

Initial

effective date | |

Filing

Fee

Previously Paid

In Connection

with Unsold

Securities

to be Carried

Forward |

| | |

Newly

Registered Securities | |

|

| Fees

to Be Paid | |

Equity(1) | |

| Common

Stock, $0.0001

par value per share(1) | | |

| 457 | (c) | |

| 200,000 | | |

$ | 1.02 |

| |

$ | 204,000 | | |

| 0.00011020 | | |

$ | 22.48 | | |

| — | | |

| — | | |

| — | | |

— |

| | |

| |

| | | |

| | | |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| Fees

Previously Paid | |

— | |

| — | | |

| — | | |

| — | | |

| — |

| |

| — | | |

| — | | |

$ | — | | |

| — | | |

| — | | |

| — | | |

— |

| | |

| |

| | | |

| | | |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| | |

Total

Offering Amounts | |

| |

$ | [*] | | |

| 0.00011020 | | |

$ | 22.48 | | |

| | | |

| | | |

| | | |

|

| | |

Total

Fees Previously Paid | | |

| |

| |

| | | |

| | | |

$ | — | | |

| | | |

| | | |

| | | |

|

| | |

Total

Fee Offsets | | |

| |

| |

| | | |

| | | |

| — | | |

| | | |

| | | |

| | | |

|

| | |

Net

Fee Due | | |

| |

| |

| | | |

| | | |

$ | 22.48 | | |

| | | |

| | | |

| | | |

|

| |

(1) |

This registration statement covers the ordinary shares issuable pursuant to the Consulting Agreement dated July 28, 2023. |

| |

|

|

| |

(2) |

Pursuant to Rule 416(a) under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of ordinary shares as may be issued after the date hereof as a result of stock splits, stock dividends, or similar transactions. |

| |

|

|

| |

(3) |

Estimated solely for the purpose of calculating the registration fee. Pursuant to Rule 457(c) under the Securities Act, the proposed maximum offering price per share and the proposed maximum aggregate offering price has been determined on the basis of the average of the bid and asked price as of a specified date within five business days prior to the date of filing the registration statement. |

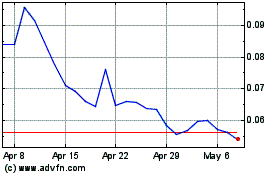

Blue Star Foods (NASDAQ:BSFC)

Historical Stock Chart

From Apr 2024 to May 2024

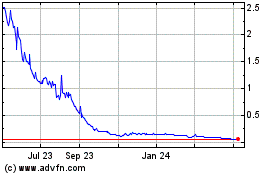

Blue Star Foods (NASDAQ:BSFC)

Historical Stock Chart

From May 2023 to May 2024