Statement of Changes in Beneficial Ownership (4)

April 06 2023 - 6:42PM

Edgar (US Regulatory)

FORM 4

☐

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

FARKAS MICHAEL D |

2. Issuer Name and Ticker or Trading Symbol

Blink Charging Co.

[

BLNK

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chairman & CEO |

|

(Last)

(First)

(Middle)

C/O BLINK CHARGING CO., 605 LINCOLN ROAD, 5TH FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

4/4/2023 |

|

(Street)

MIAMI BEACH, FL 33139 |

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

|

(City)

(State)

(Zip)

|

Rule 10b5-1(c) Transaction Indication

☐

Check this box to indicate that a transaction was made pursuant to a contract, instruction or written plan that is intended to

satisfy the affirmative defense conditions of Rule 10b5-1(c). See Instruction 10.

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, par value $0.001 per share ("Common Stock") | 4/4/2023 | | X(1) | | 780432 | A | $4.25 | 2922929 | D | |

| Common Stock | 4/4/2023 | | S(1) | | 396998 | D | $8.3548 | 2525931 | D | |

| Common Stock | 4/5/2023 | | G | | 50000 (2) | D | $0 | 2475931 | D | |

| Common Stock | | | | | | | | 4072616 | I | Farkas Group, Inc. (3) |

| Common Stock | | | | | | | | 81441 | I | Balance Group LLC (3) |

| Common Stock | | | | | | | | 15000 | I | See note (4) |

| Common Stock | | | | | | | | 7200 | I | Farkas Charitable Foundation (5) |

| Common Stock | | | | | | | | 80 | I | Farkas Family Trust (6) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Warrants to purchase shares of Common Stock | $4.25 | 4/4/2023 | | X | | | 780432 | 4/9/2018 | 4/9/2023 | Common Stock | 780432 | $0 | 0 | D | |

| Warrants to purchase shares of Common Stock | $8.82 | 4/4/2023 | | A (7) | | 780432 | | 4/4/2023 | 4/4/2028 | Common Stock | 780432 | $0 | 780432 | D | |

| Explanation of Responses: |

| (1) | On April 4, 2023, Mr. Farkas exercised a warrant to purchase 780,432 shares of the issuer's Common Stock for $4.25 per share. Mr. Farkas paid the exercise price on a cashless basis, resulting in the issuer's withholding of 396,998 of the warrant shares to pay the exercise price and issuing to Mr. Farkas the remaining 383,434 shares. |

| (2) | Mr. Farkas disposed of 50,000 shares of Common Stock as a bona fide gift to the Sammy Farkas Foundation Inc. (the "Foundation"). Mr. Farkas does not have voting or investment power with respect to the shares held by the Foundation. |

| (3) | Mr. Farkas has voting and investment power with respect to these shares. |

| (4) | Mr. Farkas has voting and investment power and serves as custodian for shares held by his children. |

| (5) | Mr. Farkas has voting and investment power as trustee with respect to these shares. |

| (6) | Mr. Farkas is a beneficiary of these shares. |

| (7) | Reflects the one-time "evergreen" grant to Mr. Farkas of warrants to purchase 780,432 shares of the issuer's Common Stock at an exercise price of $8.82 per share, in replacement of the exercised warrants referenced in footnote 1 above. These warrants were granted pursuant to Rule 16b-3(d). |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

FARKAS MICHAEL D

C/O BLINK CHARGING CO.

605 LINCOLN ROAD, 5TH FLOOR

MIAMI BEACH, FL 33139 | X | X | Chairman & CEO |

|

Signatures

|

| /s/ Michael D. Farkas | | 4/6/2023 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

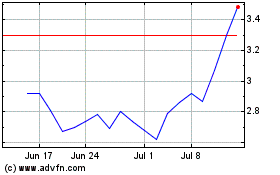

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Jun 2024 to Jul 2024

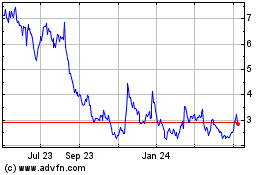

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Jul 2023 to Jul 2024