0000811240false00008112402023-08-102023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 10, 2023 |

BIOLASE, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36385 |

87-0442441 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

27042 Towne Centre Drive, Suite 270 |

|

Lake Forest, California |

|

92610 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (949) 361-1200 |

Not Applicable |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

BIOL |

|

The NASDAQ Stock Market LLC (NASDAQ Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 10, 2023, BIOLASE, Inc. issued a press release announcing its financial results for the second quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

BIOLASE, INC. |

|

|

|

|

|

Date: August 10, 2023 |

|

By |

|

/s/ JENNIFER BRIGHT |

|

|

|

|

Name: Jennifer Bright |

|

|

|

|

Title: Chief Financial Officer |

Exhibit 99.1

BIOLASE REPORTS RECORD CONSUMABLE SALES AS TOTAL SECOND QUARTER REVENUE INCREASES 17% YEAR OVER YEAR

Continues to Experience Positive Momentum and Expects to Achieve Improved Net Income and Positive Adjusted EBITDA for the Second Half of 2023

LAKE FOREST, Calif., August 10, 2023 – BIOLASE, Inc. (NASDAQ: BIOL), the global leader in dental lasers, today announced its financial results for the second quarter ended June 30, 2023.

Second Quarter Financial Highlights

•Total revenue was $14.3 million, up 17% year over year, and the highest quarterly revenue since the fourth quarter of 2015

•Consumable sales reached a record $4.1 million, increasing 36% year over year, driven by rising utilization of BIOLASE laser systems

•Generated increased adoption of its industry-leading laser, with approximately 69% of U.S. Waterlase sales coming from new customers and approximately one-third from dental specialists

•Gross margin improved 100 basis points to 43%

•Waterlase Trial Program's ("WTP") year-to-date sales conversion success rate of approximately 56% surpassed the 2022 full year success rate by 10%

“Although we faced some macroeconomic hurdles during the quarter, we have made many improvements in the business that has led to improved financial performance as we continue to show sustainable growth and progress toward positive EBITDA performance," commented John Beaver, President and Chief Executive Officer of BIOLASE. “Our second quarter performance represents our tenth consecutive quarter of year-over-year revenue growth and demonstrates that our efforts to raise awareness of our industry-leading dental lasers continue to gain traction. Furthermore, we reported record consumable revenue, growing an impressive 36% increase from our previous record last quarter and from the second quarter of 2022, and we are hopeful that the trends in consumable usage will continue and are reflective of the improved training of our new dentists, the awareness of the value in all specialties and in particular endodontics. We continue to be subject to market dynamics that include pressure on the finances of dentists, continuing migration to dental service organizations and still a challenging environment in our international markets.

“Operationally, we achieved a WTP conversion success rate of approximately 56%, making WTP one of the most successful programs we have ever implemented. Moreover, new customers accounted for approximately 69% of our sales in the second quarter, with almost a third of the sales being generated by dental specialists. We believe that the combination of all of these positive indicators confirms the market's growing acceptance of our industry-leading lasers and inspires confidence in our growth strategy. We are also excited about the collaboration with the American Academy of Facial Aesthetics as we continue the rollout of our new fractional handpiece. I look forward to realizing the potential that Waterlase technology has for aesthetics, both for dentists and physicians.

“Concurrent with our revenue growth, we demonstrated continued improvement of our bottom line, and we believe the cost-saving initiatives we implemented during the quarter will result in additional annualized savings of $5 to $6 million beginning in the third quarter. These initiatives, along with our improving gross margins and continued revenue growth, put us on track to achieve positive adjusted EBITDA for the second half of 2023.”

Second Quarter Financial Results

Net revenue for the quarter ended June 30, 2023 was $14.3 million, an increase of 17% compared to net revenue of $12.2 million for the quarter ended June 30, 2022. U.S. laser revenue was $6.3 million for the quarter ended June 30, 2023, an increase of 14% compared to U.S. laser revenue of $5.5 million for the quarter ended June 30, 2022. U.S. consumables and other revenue for the quarter ended June 30, 2023, which consists of revenue from consumable products such as disposable tips, increased 40% year over year. International laser revenue was $2.5 million for the quarter ended June 30, 2023, essentially the same as for the quarter ended June 30, 2022. International consumables and other revenue for the quarter ended June 30, 2023, which consists of revenue from consumable products such as disposable tips, increased 24% year over year.

Gross margin for the quarter ended June 30, 2023 was 43% compared to 42% for the quarter ended June 30, 2022. The increase in gross profit as a percentage of revenue reflects improvement from changing to new suppliers, which resulted in lower warranty expenses. Total operating expenses were $10.0 million for the quarter ended June 30, 2023, compared to $10.2 million for the quarter ended June 30, 2022, a 2% decrease year over year. Operating loss for the quarter ended June 30, 2023 was $3.9 million, compared to an operating loss of $5.1 million for the quarter ended June 30, 2022, an improvement of 23% year over year.

The Company had cash and cash equivalents of approximately $6.9 million on June 30, 2023.

Net Loss and Adjusted EBITDA

The Non-GAAP Financial Measures at the end of this news release provide the details of the Company's non-GAAP disclosures and the reconciliation of GAAP net loss and net loss per share to the Company's adjusted EBITDA and adjusted EBITDA per share.

Net loss attributable to common stockholders for the quarter ended June 30, 2023 was $4.9 million, or $8.93 per share (as adjusted for the reverse stock split), compared to a net loss of $5.6 million, or $91.98 per share (as adjusted for the reverse stock split), for the quarter ended June 30, 2022. Adjusted EBITDA for the quarter ended June 30, 2023 was a loss of $2.3 million, or $4.24 per share (as adjusted for the reverse stock split), compared with an adjusted EBITDA loss of $4.1 million, or $66.87 per share (as adjusted for the reverse stock split), for the quarter ended June 30, 2022.

2023 Full Year Financial Guidance

BIOLASE is updating its guidance and now expects revenue for the second half of the year to be 15-20% higher than the comparable period a year ago. BIOLASE expects to achieve positive adjusted EBITDA results for the second half of 2023 (adjusted EBITDA is defined as net loss before interest, taxes, depreciation and amortization, stock-based and other non-cash compensation, severance expense, and the change in allowance for doubtful accounts).

Conference Call Information

BIOLASE, Inc. will host a conference call today at 4:30 p.m. Eastern Time to discuss its operating results for the second quarter ended June 30, 2023, and to answer questions. To access the live call, dial 1-888-506-0062 (U.S.) or +1 973-528-0011 (International) and provide the following code: 679201.

A live and archived webcast of the conference call will be accessible on the BIOLASE Investor Relations page. In addition, a phone replay will be available approximately two hours following the end of the call, and it will remain available for one week. To access the call replay, dial 1-877-481-4010 or +1 919-882-2331 (International) and enter replay passcode: 48764.

About BIOLASE

BIOLASE is a medical device company that develops, manufactures, markets, and sells laser systems in dentistry and medicine. BIOLASE's products advance the practice of dentistry and medicine for patients and healthcare professionals. BIOLASE's proprietary laser products incorporate approximately 259 active patents and 24 patent-pending technologies designed to provide biologically and clinically superior performance with less pain and faster recovery times as of December 31, 2022. BIOLASE's innovative products provide cutting-edge technology at competitive prices to deliver superior results for dentists and patients. BIOLASE's principal products are dental laser systems that perform a broad range of dental procedures, including cosmetic and complex surgical applications. From 1998 through December 31, 2022, BIOLASE has sold over 45,500 laser systems in over 80 countries around the world. Laser products under development address BIOLASE's core dental market and other adjacent medical and consumer applications.

For updates and information on Waterlase iPlus®, Waterlase Express™, and laser dentistry, find BIOLASE online at www.biolase.com, Facebook at www.facebook.com/biolase, Twitter at www.twitter.com/biolaseinc, Instagram at www.instagram.com/waterlase_laserdentistry, and LinkedIn at www.linkedin.com/company/biolase.

BIOLASE®, Waterlase® and Waterlase iPlus® are registered trademarks of BIOLASE, Inc.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, that involve significant risks and uncertainties, including statements, regarding BIOLASE’s expected revenue and revenue growth. Forward-looking statements can be identified through the use of words such as “may,” “might,” “will,” “intend,” “should,” “could,” “can,” “would,” “continue,” “expect,” “believe,” “anticipate,” “estimate,” “predict,” “outlook,” “potential,” “plan,” “seek,” and similar expressions and variations or the negatives of these terms or other comparable terminology. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect BIOLASE’s current expectations and speak only as of the date of this release. Actual results may differ materially from BIOLASE’s current expectations depending upon a number of factors. These factors include, among others, adverse changes in general economic and market conditions, competitive factors including, but not limited to, pricing pressures and new product introductions, uncertainty of customer acceptance of new product offerings and market changes, risks associated with managing the growth of the business, substantial doubt regarding BIOLASE's ability to continue as a going concern, inability to raise additional capital on terms acceptable to BIOLASE and those other risks and uncertainties that are described in the "Risk Factors" section of BIOLASE's most recent annual report on Form 10-K and quarterly report on Form 10-Q filed with the Securities and Exchange Commission. Except as required by law, BIOLASE does not undertake any responsibility to revise or update any forward-looking statements.

For further information, please contact:

EVC Group LLC

Michael Polyviou / Todd Kehrli

(732) 933-2754

mpolyviou@evcgroup.com / tkehrli@evcgroup.com

Tables to Follow

BIOLASE, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

June 30, |

|

|

June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net revenue |

|

$ |

14,286 |

|

|

$ |

12,235 |

|

|

$ |

24,753 |

|

|

$ |

22,401 |

|

Cost of revenue |

|

|

8,168 |

|

|

|

7,094 |

|

|

|

15,299 |

|

|

|

12,531 |

|

Gross profit |

|

|

6,118 |

|

|

|

5,141 |

|

|

|

9,454 |

|

|

|

9,870 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

6,189 |

|

|

|

5,402 |

|

|

|

10,812 |

|

|

|

10,216 |

|

General and administrative |

|

|

2,357 |

|

|

|

3,141 |

|

|

|

4,815 |

|

|

|

5,717 |

|

Engineering and development |

|

|

1,444 |

|

|

|

1,653 |

|

|

|

2,991 |

|

|

|

3,197 |

|

Total operating expenses |

|

|

9,990 |

|

|

|

10,196 |

|

|

|

18,618 |

|

|

|

19,130 |

|

Loss from operations |

|

|

(3,872 |

) |

|

|

(5,055 |

) |

|

|

(9,164 |

) |

|

|

(9,260 |

) |

Loss on foreign currency transactions |

|

|

(235 |

) |

|

|

(103 |

) |

|

|

(215 |

) |

|

|

(223 |

) |

Interest expense, net |

|

|

(583 |

) |

|

|

(430 |

) |

|

|

(1,160 |

) |

|

|

(863 |

) |

Other income (expenses), net |

|

|

(147 |

) |

|

|

— |

|

|

|

(147 |

) |

|

|

— |

|

Non-operating loss, net |

|

|

(965 |

) |

|

|

(533 |

) |

|

|

(1,522 |

) |

|

|

(1,086 |

) |

Loss before income tax provision |

|

|

(4,837 |

) |

|

|

(5,588 |

) |

|

|

(10,686 |

) |

|

|

(10,346 |

) |

Income tax provision |

|

|

(31 |

) |

|

|

(23 |

) |

|

|

(31 |

) |

|

|

(40 |

) |

Net loss |

|

|

(4,868 |

) |

|

|

(5,611 |

) |

|

|

(10,717 |

) |

|

|

(10,386 |

) |

Other comprehensive loss items: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

39 |

|

|

|

(222 |

) |

|

|

119 |

|

|

|

(263 |

) |

Comprehensive loss |

|

$ |

(4,829 |

) |

|

$ |

(5,833 |

) |

|

$ |

(10,598 |

) |

|

$ |

(10,649 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(4,868 |

) |

|

$ |

(5,611 |

) |

|

$ |

(10,717 |

) |

|

$ |

(10,386 |

) |

Deemed dividend on convertible preferred stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(217 |

) |

Net loss attributable to common stockholders |

|

$ |

(4,868 |

) |

|

$ |

(5,611 |

) |

|

$ |

(10,717 |

) |

|

$ |

(10,603 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(8.93 |

) |

|

$ |

(91.98 |

) |

|

$ |

(24.52 |

) |

|

$ |

(173.82 |

) |

Shares used in the calculation of net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

545 |

|

|

|

61 |

|

|

|

437 |

|

|

|

61 |

|

BIOLASE, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,930 |

|

|

$ |

4,181 |

|

Accounts receivable, less allowance of $2,183 and $2,164 as of June 30, 2023 and December 31, 2022, respectively |

|

|

5,717 |

|

|

|

5,841 |

|

Inventory |

|

|

13,330 |

|

|

|

15,884 |

|

Prepaid expenses and other current assets |

|

|

2,170 |

|

|

|

3,053 |

|

Total current assets |

|

|

28,147 |

|

|

|

28,959 |

|

Property, plant, and equipment, net |

|

|

6,371 |

|

|

|

4,278 |

|

Goodwill |

|

|

2,926 |

|

|

|

2,926 |

|

Right-of-use assets, leases |

|

|

1,910 |

|

|

|

1,768 |

|

Other assets |

|

|

279 |

|

|

|

255 |

|

Total assets |

|

$ |

39,633 |

|

|

$ |

38,186 |

|

LIABILITIES, CONVERTIBLE REDEEMABLE PREFERRED STOCK AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

6,314 |

|

|

$ |

5,786 |

|

Accrued liabilities |

|

|

7,734 |

|

|

|

9,210 |

|

Deferred revenue, current portion |

|

|

2,236 |

|

|

|

2,111 |

|

Current portion of term loans, net of discount |

|

|

2,100 |

|

|

|

700 |

|

Total current liabilities |

|

|

18,384 |

|

|

|

17,807 |

|

Deferred revenue |

|

|

311 |

|

|

|

418 |

|

Warranty accrual |

|

|

397 |

|

|

|

360 |

|

Non-current term loans, net of discount |

|

|

11,902 |

|

|

|

13,091 |

|

Non-current operating lease liability |

|

|

1,219 |

|

|

|

1,259 |

|

Other liabilities |

|

|

79 |

|

|

|

362 |

|

Total liabilities |

|

|

32,292 |

|

|

|

33,297 |

|

Mezzanine Equity |

|

|

|

|

|

|

Series I Preferred stock, par value $0.001 per share |

|

|

— |

|

|

|

— |

|

Series H Convertible Preferred stock, par value $0.001 per share |

|

|

720 |

|

|

|

— |

|

Total mezzanine equity |

|

|

720 |

|

|

|

— |

|

Stockholders' equity: |

|

|

|

|

|

|

Common stock, par value $0.001 per share |

|

|

1 |

|

|

|

— |

|

Additional paid-in capital |

|

|

314,119 |

|

|

|

301,790 |

|

Accumulated other comprehensive loss |

|

|

(614 |

) |

|

|

(733 |

) |

Accumulated deficit |

|

|

(306,885 |

) |

|

|

(296,168 |

) |

Total stockholders' equity |

|

|

6,621 |

|

|

|

4,889 |

|

Total liabilities, convertible redeemable preferred stock and

stockholders' equity |

|

$ |

39,633 |

|

|

$ |

38,186 |

|

BIOLASE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

|

June 30, |

|

|

|

2023 |

|

|

2022 |

|

Cash Flows from Operating Activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(10,717 |

) |

|

$ |

(10,386 |

) |

Adjustments to reconcile net loss to net cash and cash equivalents used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,573 |

|

|

|

247 |

|

Provision for bad debts |

|

|

42 |

|

|

|

143 |

|

Inventory write-offs and disposals |

|

|

— |

|

|

|

(42 |

) |

Amortization of debt issuance costs |

|

|

214 |

|

|

|

131 |

|

Change in fair value of warrants |

|

|

(78 |

) |

|

|

— |

|

Issuance costs for warrants |

|

|

224 |

|

|

|

— |

|

Stock-based compensation |

|

|

775 |

|

|

|

1,100 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

82 |

|

|

|

(1,986 |

) |

Inventory |

|

|

(163 |

) |

|

|

(3,602 |

) |

Prepaid expenses and other current assets |

|

|

713 |

|

|

|

(236 |

) |

Accounts payable and accrued liabilities |

|

|

(1,903 |

) |

|

|

(232 |

) |

Deferred revenue |

|

|

18 |

|

|

|

230 |

|

Net cash and cash equivalents used in operating activities |

|

|

(9,220 |

) |

|

|

(14,633 |

) |

Cash Flows from Investing Activities: |

|

|

|

|

|

|

Purchases of property, plant, and equipment |

|

|

(944 |

) |

|

|

(578 |

) |

Net cash and cash equivalents used in investing activities |

|

|

(944 |

) |

|

|

(578 |

) |

Cash Flows from Financing Activities: |

|

|

|

|

|

|

Proceeds from the sale of common stock and pre-funded warrants, net of fees |

|

|

8,502 |

|

|

|

5,849 |

|

Proceeds from the sale of Series H Convertible Preferred Stock, net of fees |

|

|

2,738 |

|

|

|

— |

|

Proceeds from the sale of Series H warrants, net of fees |

|

|

918 |

|

|

|

— |

|

Principal payment on loan |

|

|

— |

|

|

|

(1,000 |

) |

Proceeds from the exercise of warrants |

|

|

635 |

|

|

|

— |

|

Net cash and cash equivalents provided by financing activities |

|

|

12,793 |

|

|

|

4,849 |

|

Effect of exchange rate changes |

|

|

120 |

|

|

|

(264 |

) |

Increase (decrease) in cash, cash equivalents and restricted cash |

|

|

2,749 |

|

|

|

(10,626 |

) |

Cash, cash equivalents and restricted cash, beginning of period |

|

|

4,181 |

|

|

|

30,175 |

|

Cash and cash equivalents, end of period |

|

$ |

6,930 |

|

|

$ |

19,549 |

|

Supplemental cash flow disclosure: |

|

|

|

|

|

|

Cash paid for interest |

|

$ |

930 |

|

|

$ |

743 |

|

Cash received for interest |

|

$ |

5 |

|

|

$ |

17 |

|

Cash paid for income taxes |

|

$ |

12 |

|

|

$ |

46 |

|

Cash paid for operating leases |

|

$ |

159 |

|

|

$ |

135 |

|

Non-cash right-of-use assets obtained in exchange for lease obligation |

|

$ |

483 |

|

|

$ |

532 |

|

Deemed dividend on preferred stock |

|

$ |

— |

|

|

$ |

217 |

|

Common stock issued upon exercise of preferred stock |

|

$ |

10,980 |

|

|

$ |

— |

|

Non-GAAP Financial Measures

In addition to the financial information prepared in conformity with generally accepted accounting principles in the U.S. (“GAAP”), this press release includes certain historical non-GAAP financial information. Management believes that these non-GAAP financial measures assist investors in making comparisons of period-to-period operating results and that, in some respects, these non-GAAP financial measures are more indicative of the Company’s ongoing core operating performance than their GAAP equivalents.

Adjusted EBITDA is defined as net loss before interest, taxes, depreciation and amortization, stock-based and other non-cash compensation, severance expense, and the change in allowance for doubtful accounts. Management uses adjusted EBITDA in its evaluation of the Company’s core results of operations and trends between fiscal periods and believes that these measures are important components of its internal performance measurement process. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. Further, the non-GAAP financial measures presented by the Company may be different from similarly named non-GAAP financial measures used by other companies.

BIOLASE, INC.

Reconciliation of GAAP Net Loss to Adjusted EBITDA and

GAAP Net Loss Per Share to Adjusted EBITDA Per Share

(Unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

June 30, |

|

|

June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

GAAP net loss attributable to common stockholders |

|

$ |

(4,868 |

) |

|

$ |

(5,611 |

) |

|

$ |

(10,717 |

) |

|

$ |

(10,603 |

) |

Deemed dividend on convertible preferred stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

217 |

|

GAAP net loss |

|

$ |

(4,868 |

) |

|

$ |

(5,611 |

) |

|

$ |

(10,717 |

) |

|

$ |

(10,386 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

583 |

|

|

|

430 |

|

|

|

1,160 |

|

|

|

863 |

|

Income tax provision |

|

|

31 |

|

|

|

23 |

|

|

|

31 |

|

|

|

40 |

|

Depreciation and amortization |

|

|

1,424 |

|

|

|

130 |

|

|

|

1,573 |

|

|

|

247 |

|

Severance expense |

|

|

229 |

|

|

|

— |

|

|

|

229 |

|

|

|

— |

|

Change in allowance for doubtful accounts |

|

|

59 |

|

|

|

59 |

|

|

|

42 |

|

|

|

143 |

|

Stock-based and other non-cash compensation |

|

|

84 |

|

|

|

890 |

|

|

|

775 |

|

|

|

1,100 |

|

Other (income) expense, net |

|

|

147 |

|

|

|

— |

|

|

|

147 |

|

|

|

— |

|

Adjusted EBITDA |

|

$ |

(2,311 |

) |

|

$ |

(4,079 |

) |

|

$ |

(6,760 |

) |

|

$ |

(7,993 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss attributable to common stockholders

per share, basic and diluted |

|

$ |

(8.93 |

) |

|

$ |

(91.98 |

) |

|

$ |

(24.52 |

) |

|

$ |

(173.82 |

) |

Deemed dividend on convertible preferred stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.56 |

|

GAAP net loss per share, basic and diluted |

|

$ |

(8.93 |

) |

|

$ |

(91.98 |

) |

|

$ |

(24.52 |

) |

|

$ |

(170.26 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

1.07 |

|

|

|

7.05 |

|

|

|

2.66 |

|

|

|

14.15 |

|

Income tax provision |

|

|

0.06 |

|

|

|

0.38 |

|

|

|

0.07 |

|

|

|

0.66 |

|

Depreciation and amortization |

|

|

2.61 |

|

|

|

2.13 |

|

|

|

3.59 |

|

|

|

4.05 |

|

Severance expense |

|

|

0.42 |

|

|

|

— |

|

|

|

0.52 |

|

|

|

— |

|

Change in allowance for doubtful accounts |

|

|

0.11 |

|

|

|

0.97 |

|

|

|

0.10 |

|

|

|

2.34 |

|

Stock-based and other non-cash compensation |

|

|

0.15 |

|

|

|

14.58 |

|

|

|

1.77 |

|

|

|

18.03 |

|

Other (income) expense, net |

|

|

0.27 |

|

|

|

— |

|

|

|

0.34 |

|

|

|

— |

|

Adjusted EBITDA per share, basic and diluted |

|

$ |

(4.24 |

) |

|

$ |

(66.87 |

) |

|

$ |

(15.47 |

) |

|

$ |

(131.03 |

) |

Other (income) expense, net for the three and six months ended June 30, 2023 relates to issuance costs from the May 2023 public offering that were allocated to the Series H warrants and immediately expensed due to the liability classification of the awards. These expenses were partially offset by gains recorded on the revaluation of these awards during the period.

v3.23.2

Document and Entity Information

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 10, 2023

|

| Trading Symbol |

BIOL

|

| Entity Registrant Name |

BIOLASE, INC

|

| Entity Central Index Key |

0000811240

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Security Exchange Name |

NASDAQ

|

| Entity File Number |

001-36385

|

| Entity Tax Identification Number |

87-0442441

|

| Entity Address, Address Line One |

27042 Towne Centre Drive

|

| Entity Address, Address Line Two |

Suite 270

|

| Entity Address, City or Town |

Lake Forest

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92610

|

| City Area Code |

(949)

|

| Local Phone Number |

361-1200

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

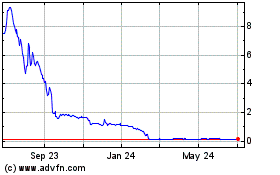

Biolase (NASDAQ:BIOL)

Historical Stock Chart

From Oct 2024 to Nov 2024

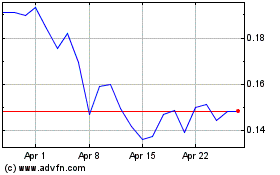

Biolase (NASDAQ:BIOL)

Historical Stock Chart

From Nov 2023 to Nov 2024