false

0001019034

0001019034

2023-10-25

2023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

|

BIO-key International, Inc.

(Exact name of registrant as specified in its charter)

|

| |

|

|

|

Delaware

(State or other jurisdiction of incorporation)

|

1-13463

(Commission File Number)

|

41-1741861

(I.R.S. Employer Identification No.)

|

| |

|

|

|

101 Crawfords Corner Road

Suite 4116

Holmdel, NJ 07733

(Address of principal executive offices)

|

| |

|

(732) 359-1100

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

BKYI |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On October 25, 2023, BIO-key International, Inc. (the “Company”) issued a press release announcing its preliminary financial results for the three and nine months ended September 30, 2023. A copy of the press release issued by the Company on October 25, 2023 is attached as Exhibit 99.

The information, including the exhibit attached hereto, in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as otherwise expressly stated in such filing.

|

Item 9.01.

|

Financial Statements, Pro Forma Financial Information and Exhibit.

|

|

(d)

|

Exhibits. The following exhibit is furnished herewith:

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BIO-KEY INTERNATIONAL, INC.

|

|

|

Date: October 25, 2023

|

|

|

|

|

|

By:

|

/s/ Cecilia C. Welch

|

|

|

|

|

Cecilia C. Welch

|

|

|

|

|

Chief Financial Officer

|

|

EXHIBIT INDEX

| Exhibit No. |

Description |

| |

|

| 99.1 |

Press Release, dated October 25, 2023 issued by the Company. |

Exhibit 99.1

Digital Authentication and Identity Provider BIO-key Sees Q3 Revenues Rising over 30% to $1.8M on Strength in Software License Fees, Services and Hardware Sales

Holmdel, NJ – October 25, 2023 - BIO-key® International, Inc. (Nasdaq: BKYI), an innovative provider of workforce and customer Identity and Access Management (IAM) featuring passwordless, phoneless and token-less Identity-Bound Biometric (IBB) authentication solutions, announced results for its preliminary third quarter ended September 30, 2023 (Q3’23).

Highlights:

|

●

|

Revenue rose over 30% to $1.8M vs. $1.4M in Q3’22

|

|

●

|

Gross profit improved more than 40% to $1.4M vs. $1.0M in Q3’22

|

|

●

|

Q3’23 operating loss improved to approximately ($750,000) vs. an operating loss of ($2.4M) in Q3’22.

|

|

●

|

Q3’23 net loss per share reduced approximately 72% to ($0.08) vs. ($0.29) in Q3’22.

|

CEO Commentary

BIO-key CEO, Mike DePasquale commented, “Our Q3 performance reflects continued progress driving revenue growth and reducing expenses to move our business toward sustained profitability. These trends are also reflected in our nine-month results, with revenues up approximately 30% to $6.8M and our operating loss reduced by over 50%.

“We are pleased to report that our sales team has developed a significant pipeline of larger customer opportunities interested in the savings and superior user experience of our phoneless, tokenless, passwordless authentication. Our team is focused on those opportunities with the greatest potential for generating meaningful Annual Recurring Revenue (ARR). Our Channel Alliance Partner (CAP) program continues to build both its geographic scope and its sales productivity. These channels have enabled us to build our ARR to approximately $7M per year, providing a solid base on which to layer new SaaS deployments around the globe, through new customer wins and the expanded penetration of existing customer accounts.

Outlook

“We believe BIO-key is well positioned to deliver solid top-line and bottom-line improvements going forward. This view is based on the very attractive value proposition of our secure, convenient, scalable and cost-efficient solutions incorporating the industry’s widest array of multi-factor authentication methods, including our identity-bound biometric solutions. With greater cyber-insurer scrutiny and the recent SEC regulation requiring companies to report on their cybersecurity measures beginning in mid-December, we expect that most sizeable companies will be implementing multi-factor authentication throughout their workforce. We believe the market is ripe for a phoneless, tokenless passwordless FIDO passkey authentication option for manufacturing, retail, call center, and other roving workforces. Historically, Q4 tends to be one of our strongest quarters each year in terms of business volume, and we are confident about our prospects for continued growth and improved bottom line performance in 2024.

“Supporting our near-term outlook is a significant recent commitment from a long-standing international defense ministry customer, for additional software and hardware to support their expanded rollout of our biometric authentication solution. To support our working capital requirements, we are working to convert certain inventories into cash while also pursuing operating expense reduction opportunities, including relocating our headquarters, to accelerate our path to cash flow breakeven.”

Financial Results

Please note that the review of our Q3 FY2023 financial statements has not been completed by our independent registered public accounting firm as of the date of this press release and are therefore subject to change.

Q3’23 revenues rose 33% to $1.8M, reflecting increased services, software license and hardware revenue versus Q3’22. Q3’23 service revenue was driven by custom service installations for new and existing customer deployments and upgrades, and hardware revenue reflected new contact activity as well as progress in reducing hardware inventories. For the first nine months of 2023, total revenues rose 30% to $6.8M compared to $5.3M for the first nine months of 2022, reflecting growth in service and license revenue and a decline in hardware revenue.

Gross profit grew 43% to $1.4M in Q3’23 from $1.0M in Q3’22, reflecting an increase in gross margin to 77% from 71% in Q3’22. Gross profit and gross margin benefitted from a year-over-year increase in higher margin services and software license revenue and a decrease in third-party software costs, principally due to the seasonal, vacation-related slowdown in Q3 business activity in Europe.

Q3’23 operating expenses decreased 36% to $2.2 million from $3.3 million in Q3’22, due primarily to lower selling, general and administrative expenses reflecting progress in BIO-key’s expense reduction initiatives as well as lower research and development investments. BIO-key continues to seek expense reduction opportunities to further benefit its operating results.

Reflecting higher gross profit and lower operating costs, BIO-key trimmed its Q3’23 net loss to $749,000, as compared to $2.4M in Q3’22. Similarly, for the first nine months of 2023 compared to 2022, the Company reduced its year-to-date 2023 net loss to $2.5M from a net loss of $5.1M.

At September 30, 2023, BIO-key had current assets of $7.9M, including $0.3M of cash and cash equivalents, $2.9M of accounts receivable, and $4.3M of inventory.

About BIO-key International, Inc. (www.BIO-key.com)

BIO-key is revolutionizing authentication and cybersecurity with biometric-centric, multi-factor identity and access management (IAM) software managing millions of users. Its cloud-based PortalGuard IAM solution provides cost-effective, easy-to-deploy, convenient, and secure access to devices, information, applications, and high-value transactions. With industry-leading Identity-Bound Biometric (IBB) capabilities, BIO-key's patented software and hardware solutions enable large-scale Identity-as-a-Service (IDaaS) solutions and customized on-premises solutions.

BIO-key Safe Harbor Statement

All statements contained in this press release other than statements of historical facts are "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 (the "Act"). The words "estimate," "project," "intends," "expects," "anticipates," "believes" and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are made based on management's beliefs, as well as assumptions made by, and information currently available to, management pursuant to the "safe-harbor" provisions of the Act. These statements are not guarantees of future performance or events and are subject to risks and uncertainties that may cause actual results to differ materially from those included within or implied by such forward-looking statements. These risks and uncertainties include, without limitation, our history of losses and limited revenue; our ability to raise additional capital to satisfy debt repayment obligations and working capital needs; our ability to continue as a going concern; our ability to protect our intellectual property; changes in business conditions; changes in our sales strategy and product development plans; changes in the marketplace; continued services of our executive management team; security breaches; competition in the biometric technology industry; market acceptance of biometric products generally and our products under development; our ability to convert sales opportunities to customer contracts; our ability to expand into Asia, Africa and other foreign markets; our ability to integrate the operations and personnel of Swivel Secure into our business; fluctuations in foreign currency exchange rates; delays in the development of products and statements of assumption underlying any of the foregoing as well as other factors set forth under the caption "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2022 and other filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. Except as required by law, we undertake no obligation to disclose any revision to these forward-looking statements whether as a result of new information, future events, or otherwise.

Engage with BIO-key

|

Facebook – Corporate:

|

https://www.facebook.com/BIOkeyInternational/

|

|

LinkedIn – Corporate:

|

https://www.linkedin.com/company/bio-key-international

|

|

Twitter – Corporate:

|

@BIOkeyIntl

|

|

Twitter – Investors:

|

@BIO_keyIR

|

|

StockTwits:

|

BIO_keyIR

|

Investor Contacts

William Jones, David Collins

Catalyst IR

BKYI@catalyst-ir.com or 212-924-9800

|

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

|

|

Preliminary Condensed Consolidated Statements of Operations and Comprehensive Loss

|

|

(Unaudited and Unreviewed)

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Services

|

|

$ |

599,156 |

|

|

$ |

371,956 |

|

|

$ |

1,752,143 |

|

|

$ |

1,202,866 |

|

|

License fees

|

|

|

950,015 |

|

|

|

918,260 |

|

|

|

4,664,341 |

|

|

|

3,540,592 |

|

|

Hardware

|

|

|

279,200 |

|

|

|

83,333 |

|

|

|

424,583 |

|

|

|

518,377 |

|

|

Total revenues

|

|

|

1,828,371 |

|

|

|

1,373,549 |

|

|

|

6,841,067 |

|

|

|

5,261,835 |

|

|

Costs and other expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services

|

|

|

125,039 |

|

|

|

162,632 |

|

|

|

639,996 |

|

|

|

554,222 |

|

|

Cost of license fees

|

|

|

203,891 |

|

|

|

173,310 |

|

|

|

1,022,919 |

|

|

|

604,677 |

|

|

Cost of hardware

|

|

|

97,674 |

|

|

|

57,841 |

|

|

|

190,074 |

|

|

|

296,278 |

|

|

Total costs and other expenses

|

|

|

426,604 |

|

|

|

393,783 |

|

|

|

1,852,989 |

|

|

|

1,455,177 |

|

|

Gross profit

|

|

|

1,401,767 |

|

|

|

979,766 |

|

|

|

4,988,078 |

|

|

|

3,806,658 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

1,592,410 |

|

|

|

2,510,706 |

|

|

|

5,467,306 |

|

|

|

6,315,277 |

|

|

Research, development and engineering

|

|

|

558,686 |

|

|

|

829,506 |

|

|

|

1,807,026 |

|

|

|

2,418,855 |

|

|

Total Operating Expenses

|

|

|

2,151,096 |

|

|

|

3,340,212 |

|

|

|

7,274,332 |

|

|

|

8,734,132 |

|

|

Operating loss

|

|

|

(749,329 |

) |

|

|

(2,360,446 |

) |

|

|

(2,286,254 |

) |

|

|

(4,927,474 |

) |

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

3 |

|

|

|

8 |

|

|

|

29 |

|

|

|

216 |

|

|

Loss on foreign currency transactions

|

|

|

- |

|

|

|

- |

|

|

|

(15,000 |

) |

|

|

- |

|

|

Investment-debt security reserve

|

|

|

- |

|

|

|

(40,000 |

) |

|

|

- |

|

|

|

(190,000 |

) |

|

Change in fair value of convertible note

|

|

|

85,890 |

|

|

|

- |

|

|

|

183,313 |

|

|

|

- |

|

|

Interest expense

|

|

|

(23,655 |

) |

|

|

(2,071 |

) |

|

|

(137,379 |

) |

|

|

(3,611 |

) |

|

Total other income (expense), net

|

|

|

62,238 |

|

|

|

(42,063 |

) |

|

|

30,963 |

|

|

|

(193,395 |

) |

|

Loss before provision for income tax

|

|

|

(687,091 |

) |

|

|

(2,402,509 |

) |

|

|

(2,255,291 |

) |

|

|

(5,120,869 |

) |

|

Provision for income tax

|

|

|

(62,000 |

) |

|

|

- |

|

|

|

(205,000 |

) |

|

|

- |

|

|

Net loss

|

|

$ |

(749,091 |

) |

|

$ |

(2,402,509 |

) |

|

$ |

(2,460,291 |

) |

|

$ |

(5,120,869 |

) |

|

Comprehensive loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(749,091 |

) |

|

$ |

(2,402,509 |

) |

|

$ |

(2,460,291 |

) |

|

$ |

(5,120,869 |

) |

|

Other comprehensive income (loss) – Foreign currency translation adjustment

|

|

|

35,363 |

|

|

|

(119,269 |

) |

|

|

127,393 |

|

|

|

(229,350 |

) |

|

Comprehensive loss

|

|

$ |

(713,728 |

) |

|

$ |

(2,521,778 |

) |

|

$ |

(2,332,898 |

) |

|

$ |

(5,350,219 |

) |

|

Basic and Diluted Loss per Common Share

|

|

$ |

(0.08 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.64 |

) |

|

Weighted Average Common Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

9,130,899 |

|

|

|

8,148,848 |

|

|

|

9,049,835 |

|

|

|

8,054,207 |

|

Please note that the review of our Q3 FY2023 financial statements has not been completed by our independent registered public accounting firm as of the date of this press release and are therefore subject to change.

|

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

|

|

Preliminary Consolidated Balance Sheets

|

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited and Unreviewed)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

307,086 |

|

|

$ |

2,635,522 |

|

|

Accounts receivable, net

|

|

|

2,899,218 |

|

|

|

1,522,784 |

|

|

Due from factor

|

|

|

62,572 |

|

|

|

49,500 |

|

|

Inventory

|

|

|

4,289,213 |

|

|

|

4,434,369 |

|

|

Prepaid expenses and other

|

|

|

362,250 |

|

|

|

342,706 |

|

|

Total current assets

|

|

|

7,920,339 |

|

|

|

8,984,881 |

|

|

Equipment and leasehold improvements, net

|

|

|

69,202 |

|

|

|

107,413 |

|

|

Capitalized contract costs, net

|

|

|

264,349 |

|

|

|

283,069 |

|

|

Deposits and other assets

|

|

|

8,712 |

|

|

|

8,712 |

|

|

Operating lease right-of-use assets

|

|

|

50,464 |

|

|

|

197,355 |

|

|

Intangible assets, net

|

|

|

1,519,592 |

|

|

|

1,762,825 |

|

|

Total non-current assets

|

|

|

1,912,319 |

|

|

|

2,359,374 |

|

|

TOTAL ASSETS

|

|

$ |

9,832,658 |

|

|

$ |

11,344,255 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

1,644,100 |

|

|

$ |

1,108,279 |

|

|

Accrued liabilities

|

|

|

1,030,033 |

|

|

|

1,009,123 |

|

|

Income taxes payable

|

|

|

231,000 |

|

|

|

- |

|

|

Convertible note payable

|

|

|

2,412,890 |

|

|

|

2,596,203 |

|

|

Government loan – BBVA Bank, current portion

|

|

|

135,308 |

|

|

|

120,000 |

|

|

Deferred revenue, current

|

|

|

594,262 |

|

|

|

462,418 |

|

|

Operating lease liabilities, current portion

|

|

|

42,176 |

|

|

|

159,665 |

|

|

Total current liabilities

|

|

|

6,089,769 |

|

|

|

5,455,688 |

|

|

Deferred revenue, long term

|

|

|

37,280 |

|

|

|

52,134 |

|

|

Deferred tax liability

|

|

|

146,997 |

|

|

|

170,281 |

|

|

Government loan – BBVA Bank – net of current portion

|

|

|

221,625 |

|

|

|

326,767 |

|

|

Operating lease liabilities, net of current portion

|

|

|

9,570 |

|

|

|

37,829 |

|

|

Total non-current liabilities

|

|

|

415,472 |

|

|

|

587,011 |

|

|

TOTAL LIABILITIES

|

|

|

6,505,241 |

|

|

|

6,042,699 |

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Common stock — authorized, 170,000,000 shares; issued and outstanding; 9,438,894 and 9,190,504 of $.0001 par value at Sept 30, 2023 and Dec. 31, 2022, respectively

|

|

|

946 |

|

|

|

919 |

|

|

Additional paid-in capital

|

|

|

122,362,110 |

|

|

|

122,028,612 |

|

|

Accumulated other comprehensive loss

|

|

|

(115,208 |

) |

|

|

(242,602 |

) |

|

Accumulated deficit

|

|

|

(118,920,431 |

) |

|

|

(116,485,373 |

) |

|

TOTAL STOCKHOLDERS’ EQUITY

|

|

|

3,327,417 |

|

|

|

5,301,556 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$ |

9,832,658 |

|

|

$ |

11,344,255 |

|

Please note that the review of our Q3 FY2023 financial statements has not been completed by our independent registered public accounting firm as of the date of this press release and are therefore subject to change.

v3.23.3

Document And Entity Information

|

Oct. 25, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BIO-key International, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 25, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

1-13463

|

| Entity, Tax Identification Number |

41-1741861

|

| Entity, Address, Address Line One |

101 Crawfords Corner Road

Suite 4116

|

| Entity, Address, City or Town |

Holmdel

|

| Entity, Address, State or Province |

NJ

|

| Entity, Address, Postal Zip Code |

07733

|

| City Area Code |

732

|

| Local Phone Number |

359-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BKYI

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001019034

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

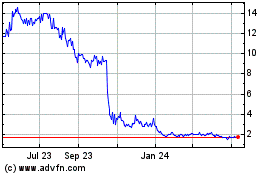

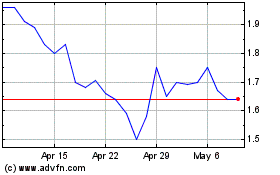

BIO key (NASDAQ:BKYI)

Historical Stock Chart

From Apr 2024 to May 2024

BIO key (NASDAQ:BKYI)

Historical Stock Chart

From May 2023 to May 2024