Beam Global, (Nasdaq: BEEM, BEEMW), (the “Company”), the leading

provider of innovative sustainable products and technologies for

electric vehicle (EV) charging, energy storage, energy security and

outdoor media, today announced the financial results for the first

fiscal quarter ended March 31, 2022.

Fiscal Q1 2022 and Recent Company

Highlights

- Generated the highest quarterly revenues in the company’s

history of $3.8 million, a 175% increase over Q1 2021

- Q1 22 system deliveries 250% higher than Q1 21

- Grew pipeline to a new record of over $100M

- Reduced the gross loss in Q1 2022 by 3 percentage points,

compared to Q1 2021, in spite of inflationary pressures

- Closed the strategic acquisition of All Cell Technologies, LLC

(All Cell), an energy storage leader, which is expected to secure

vital battery supply, reduce battery costs for Beam, and increase

Company revenues

- Received a $2.4 million order from mobile EV charging company

SparkCharge for Beam AllCell™ battery products

- Received a follow-on order from the California Department of

General Services for 23 EV ARC™ systems to charge fleet EVs for

government agencies

- Awarded Federal Blanket Purchase Agreement for electric vehicle

charging infrastructure to provide a streamlined procurement

process

- Beam Global products featured on the front cover of the FHA

NEVI Program Guidance document

- Selected for autonomous wildfire fighting exercise, Project

Vesta, to charge electric vehicles that were used to provide

autonomous wildfire fighting experiment

- Award winner for Achievement in Product Innovation in 2022

American Business Awards®

“We continue to make advances across all areas of our business

with new records in revenues, product deliveries and, perhaps most

importantly, pipeline,” said Desmond Wheatley, CEO of Beam.

“Deliveries and new opportunities in the quarter came from

government and commercial sectors and we anticipate strong

continued growth from both. Operationally we are more efficient and

producing product at a faster rate than at any time in our history.

Our acquisition of a battery technology company makes us unique in

the industry and will, I believe, further improve our efficiency

and profitability. Improving our gross margins at a time of

historically high inflation is a powerful testament that our cost

management efforts are paying off. The combination of all these

factors bodes well for an excellent 2022 for Beam Global.”

First Fiscal Quarter 2022 Financial Summary

RevenuesBeam Global reported record quarterly

revenues in the first fiscal quarter of 2022 of $3.8 million,

compared to $1.4 million in the same period in the prior year, an

increase of 175%. Revenues included $0.4 million for battery

storage devices as a result of closing the acquisition of All Cell

in early May. Shortly following the closing, Beam received a $2.4

million order for Beam AllCell™ battery products.

Gross LossGross loss in the quarter ended March

31, 2022 was $0.3 million compared to $0.1 million for the same

period in the prior year. As a percentage of sales, the gross loss

improved by three percentage points reflecting favorable fixed

overhead absorption and improved labor efficiency due to the

increase in production levels. This was partially offset by an

increase in material costs for steel and other components due to

supply chain shortages and other inflationary pressures.

Operating ExpensesOperating Expenses were $2.0

million for the first quarter of 2022, compared to $1.1 million for

the same period in the prior year. The increases were primarily due

to the addition of All Cell expenses, increased sales and marketing

expense to support revenue growth, increased legal and accounting

services partially due to the acquisition, and other increases.

Cash and Working CapitalAt March 31, 2022, we

had cash of $19.2 million, compared to $21.9 million at December

31, 2021. The cash decrease was primarily from operating activities

and the purchase of working capital from All Cell. Our working

capital decreased from $24.6 million to $21.8 million from December

31, 2021 to March 31, 2022.

Conference Call Tomorrow at 4:30 PM ET

Management will host a conference call on Wednesday at 4:30 PM

ET to review financial results and provide an update on corporate

developments. Following management’s formal remarks, there will be

a question-and-answer session.

Participants can register for the conference through the

following

link: https://dpregister.com/sreg/10167545/f2f356d8cbPlease

note that registered participants will receive their dial in number

upon registration.

| Those without

internet access or unable to pre-register may dial in by

calling: |

|

PARTICIPANT DIAL IN (TOLL FREE): |

1-844-739-3880 |

| PARTICIPANT INTERNATIONAL DIAL

IN: |

1-412-317-5716 |

| Please ask to be

joined into the Beam Global call. |

| |

|

A webcast archive is available for 3 months following the call

at the following

URL: https://event.choruscall.com/mediaframe/webcast.html?webcastid=8DDPhg12

About Beam Global

Beam Global is a clean technology leader providing innovative,

sustainable products and technologies for electric vehicle (EV)

charging, energy storage, energy security and outdoor media. Core

platforms include Beam EV ARC™ and Solar Tree® sustainable EV

charging systems, Beam AllCell™ high-performance energy storage

solutions, energy resiliency and disaster preparedness products and

a deep patent library.

Beam EV ARC™ EV charging infrastructure systems support any

quality brand EV charging service equipment, and Beam AllCell™

battery solutions power micro-mobility, terrestrial EVs, aviation,

maritime and recreational vehicles as well as stationery and

energy-security platforms.

Beam develops, patents, designs, engineers and manufactures

unique and advanced clean mobility solutions that protect the

environment, save customers time and money, empower communities and

keep people moving. Based in San Diego and Chicago, the company

produces Made-in-America products with the mission to Lead the

World to Clean Mobility. Beam Global is listed on Nasdaq under the

symbols BEEM and BEEMW. For more information visit BeamForAll.com,

LinkedIn, YouTube and Twitter.

Forward-Looking Statements

This Beam Global Press Release may contain forward-looking

statements. All statements in this Press Release other than

statements of historical facts are forward-looking statements.

Forward-looking statements are generally accompanied by terms or

phrases such as “estimate,” “project,” “predict,” “believe,”

“expect,” “anticipate,” “target,” “plan,” “intend,” “seek,” “goal,”

“will,” “should,” “may,” or other words and similar expressions

that convey the uncertainty of future events or results. These

statements relate to future events or future results of operations,

including, but not limited to the following statements: statements

regarding the acquisition, its expected benefits and the

anticipated future financial performance as a result of the

acquisition. These statements are only predictions and involve

known and unknown risks, uncertainties and other factors, which may

cause Beam Global's actual results to be materially different from

these forward-looking statements. Except to the extent required by

law, Beam Global expressly disclaims any obligation to update any

forward-looking statements.

Investor Relations:Kathy

McDermottIR@BeamForAll.com+1 858-799-4583

Media Contact:Next PR+1

813-526-1195Press@BeamForAll.com

|

|

|

Beam Global |

|

Condensed Balance Sheets |

|

(000's omitted) |

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

2022 |

|

2021 |

|

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash |

|

$ |

19,176 |

|

|

$ |

21,949 |

|

|

Accounts receivable |

|

2,634 |

|

|

3,827 |

|

|

Prepaid and other current assets |

|

1,755 |

|

|

180 |

|

|

Inventory, net |

|

4,403 |

|

|

1,611 |

|

|

Total current assets |

|

27,968 |

|

|

27,567 |

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

1,107 |

|

|

650 |

|

|

Operating lease right of use asset |

|

2,097 |

|

|

2,030 |

|

|

Goodwill |

|

4,600 |

|

|

- |

|

|

Intangible assets, net |

|

10,676 |

|

|

359 |

|

|

Deposits |

|

62 |

|

|

52 |

|

|

Total assets |

|

$ |

46,510 |

|

|

$ |

30,658 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,036 |

|

|

$ |

1,567 |

|

|

Accrued expenses |

|

1,113 |

|

|

727 |

|

|

Sales tax payable |

|

67 |

|

|

57 |

|

|

Deferred revenue |

|

1,425 |

|

|

136 |

|

|

Contingent consideration, current |

|

876 |

|

|

- |

|

|

Operating lease liabilities, current |

|

611 |

|

|

468 |

|

|

Total current liabilities |

|

6,128 |

|

|

2,955 |

|

|

|

|

|

|

|

|

|

|

Deferred revenue, noncurrent |

|

122 |

|

|

118 |

|

|

Contingent consideration, noncurrent |

|

375 |

|

|

- |

|

|

Operating lease liabilities, noncurrent |

|

1,537 |

|

|

1,607 |

|

|

Total liabilities |

|

8,162 |

|

|

4,680 |

|

|

|

|

|

|

|

|

|

|

Total stockholders' equity |

|

38,348 |

|

|

25,978 |

|

|

Total liabilities and stockholders' equity |

|

$ |

46,510 |

|

|

$ |

30,658 |

|

|

Beam Global |

|

Condensed Statements of Operations |

|

(000's omitted except share and per share

amounts) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

3,770 |

|

|

$ |

1,372 |

|

|

Cost of revenues |

|

4,075 |

|

|

1,521 |

|

|

Gross loss |

|

(305 |

) |

|

(149 |

) |

|

|

|

|

|

|

|

|

|

Operating expenses |

|

1,975 |

|

|

1,103 |

|

|

Loss from operations |

|

(2,280 |

) |

|

(1,252 |

) |

|

|

|

|

|

|

|

|

|

Interest income |

|

2 |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,278 |

) |

|

$ |

(1,251 |

) |

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted |

|

$ |

(0.24 |

) |

|

$ |

(0.14 |

) |

|

Weighted average shares outstanding - basic and diluted |

|

9,309 |

|

|

8,765 |

|

|

|

|

|

|

|

|

|

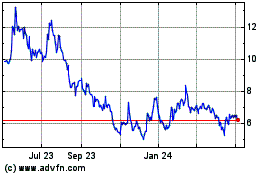

Beam Global (NASDAQ:BEEM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Beam Global (NASDAQ:BEEM)

Historical Stock Chart

From Sep 2023 to Sep 2024