false

--12-31

0001068875

0001068875

2023-11-27

2023-11-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): November 27, 2023

AVANTAX, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

000-25131 |

|

91-1718107 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

3200 Olympus Blvd, Suite 100

Dallas, Texas 75019

(Address of principal executive offices, including zip code)

(972) 870-6400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

AVTA |

|

NASDAQ Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

This

Current Report on Form 8-K is being filed in connection with the completion of the previously announced Merger (as defined below) pursuant

to the Agreement and Plan of Merger, dated as of September 9, 2023 (the “Merger Agreement”), by and among Avantax,

Inc., a Delaware corporation (the “Company”), Aretec Group, Inc., a Delaware corporation (“Parent”),

and C2023 Sub Corp., a Delaware corporation and a wholly-owned subsidiary of Parent (“Acquisition Sub”).

On November

27, 2023, pursuant to the terms of the Merger Agreement, Acquisition Sub merged with and into the Company (the “Merger”),

with the Company continuing as the surviving corporation of the Merger and a wholly-owned subsidiary of Parent.

| Item 1.01. | Entry into a Material Definitive Agreement. |

The information set forth

in the Introductory Note of this Current Report on Form 8-K is incorporated by reference into this Item 1.01.

Credit Agreement

On

November 27, 2023, Parent and certain other entities party thereto entered into an amendment (the “Amendment”)

to that certain First Lien Credit Agreement, dated as of October 1, 2018 (as amended, amended and restated, supplemented or otherwise

modified prior to November 27, 2023, the “Existing Credit Agreement” and, as amended by the Amendment, the “Credit

Agreement”), by and among Parent, as the borrower, UBS AG, Stamford Branch, as administrative agent and collateral agent,

the other entities party thereto as guarantors, and the lenders party thereto from time to time, pursuant to which, among other things,

(i) the initial term loans and revolving credit commitments outstanding under the Existing Credit Agreement were refinanced and (ii) additional

term loans and revolving credit commitments were incurred. After giving effect to the Amendment, the Credit Agreement will provide for

(i) a term loan facility in an aggregate principal amount of approximately $2,439.0

million and (ii) a revolving credit facility with aggregate commitments equal to $300.0 million.

The

obligations under the Credit Agreement are guaranteed by the direct parent of Parent and certain material domestic restricted subsidiaries

of Parent (the “Credit Agreement Guarantors”), including, following the consummation of the Merger, the Company

and certain of its material domestic restricted subsidiaries (in each case, subject to certain exclusions and exceptions). The obligations

under the Credit Agreement are secured on a first priority basis, equally and ratably with the obligations evidenced by the Secured Notes

(as defined below), by substantially all of the assets of Parent and the Credit Agreement Guarantors (subject to certain exclusions and

exceptions).

The

Credit Agreement includes representations and warranties, covenants, events of default and other provisions that are customary for facilities

of this type.

10.000% Senior

Secured Notes due 2030

On

November 2, 2023, a newly formed subsidiary of Parent (the “Escrow Issuer”) closed an offering into escrow (the

“Notes Offering”) of $700.0 million aggregate principal amount of 10.000% Senior Secured Notes due 2030 (the

“Secured Notes”). Net proceeds from the Notes Offering, together with borrowings under the Credit Agreement

and cash on hand at Parent and its subsidiaries, were used to finance and consummate the Merger, and to pay transaction fees, costs and

expenses incurred in connection with the Merger and the other transactions contemplated by the Merger Agreement.

The

Secured Notes were issued pursuant to an Indenture, dated as of November 2, 2023 (the “Base Indenture”), by

and among the Escrow Issuer, as issuer, and The Bank of New York Mellon Trust Company, N.A., as trustee (in such capacity, the “Trustee”)

and as notes collateral agent (in such capacity, the “Notes Collateral Agent”). In connection with the consummation

of the Merger, on November 27, 2023, Parent, the Credit Agreement Guarantors, the Trustee and the Notes Collateral Agent entered into

a supplemental indenture (the “Supplemental Indenture” and, together with the Base Indenture, the “Indenture”),

whereby Parent agreed to assume the Escrow Issuer’s obligations under the Indenture and the Secured Notes, and the Credit Agreement

Guarantors agreed to guarantee, on a joint and several basis, Parent’s obligations under the Indenture and the Secured Notes. The

Secured Notes and the related guarantees are secured on a first priority basis, equally and ratably with the obligations outstanding under

the Credit Agreement, by substantially all of the assets of Parent and the Credit Agreement Guarantors (subject to certain exclusions

and exceptions).

The

Indenture and the Secured Notes include covenants, events of default and other provisions that are customary for obligations of this type.

| Item 1.02. | Termination of a Material Definitive Agreement. |

The

information set forth in the Introductory Note of this Current Report on Form 8-K is incorporated by reference into this Item 1.02.

On

November 27, 2023, the Company paid all outstanding obligations under that certain Amended and Restated Credit Agreement, dated as of

January 24, 2023, by and among the Company, each of the subsidiary guarantors thereto, the lender parties thereto and JPMorgan Chase Bank,

N.A., as administrative agent and as collateral agent (as amended by the Amendment No. 1, dated as of February 2, 2023, the “Restatement

Agreement”), and the Company terminated the Restatement Agreement and all credit commitments under the Restatement Agreement.

| Item 2.01. | Completion of Acquisition or Disposition of Assets. |

The

information set forth in the Introductory Note of this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

Pursuant

to the Merger Agreement, at the effective time of the Merger (the “Effective Time”):

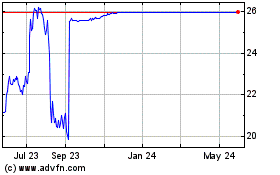

| ● | each share of Company common stock, par value $0.0001 per share (“Company Common Stock”),

issued and outstanding immediately prior to the Effective Time (other than any Excluded Shares and any Dissenting Shares (each, as defined

in the Merger Agreement)) was canceled and converted into the right to receive $26.00 per share in cash (the “Merger Consideration”),

without interest thereon and less any required tax withholdings; |

| ● | each option to purchase shares of Company Common Stock issued under any Company Equity Plan (as defined

in the Merger Agreement) (each, a “Company Option”) outstanding immediately prior to the Effective Time, whether

or not vested, was cancelled and converted into the right to receive an amount in cash, without interest, equal to the product of (i)

the excess, if any, of (A) the Merger Consideration over (B) the per-share exercise price for such Company Option multiplied by (ii) the

total number of shares of Company Common Stock underlying such Company Option; provided that, if the per-share exercise price for such

Company Option was equal to or greater than the Merger Consideration, such Company Option was cancelled without any cash payment or other

consideration; |

| ● | each restricted stock unit granted pursuant to a Company Equity Plan that vested solely on the basis of

time and pursuant to which the holder had a right to receive shares of Company Common Stock or a cash amount equal to the fair market

value of the applicable number of shares of Company Common Stock following the vesting or lapse of restrictions applicable to such restricted

stock unit (each, a “Company RSU”) outstanding immediately prior to the Effective Time was cancelled and converted

into the right to receive an amount in cash, without interest, equal to the product of (i) the total number of shares of Company Common

Stock underlying such Company RSU multiplied by (ii) the Merger Consideration; and |

| ● | each performance stock unit granted pursuant to a Company Equity Plan that vested on the basis of time

and the achievement of performance targets and pursuant to which the holder had a right to receive shares of Company Common Stock following

the vesting or lapse of restrictions applicable to such performance stock unit (each, a “Company PSU”) outstanding

immediately prior to the Effective Time was cancelled and converted into the right to receive an amount in cash, without interest, equal

to the product of (i) the number of shares of Company Common Stock underlying such Company PSU multiplied by (ii) the Merger Consideration;

provided that the number of shares of Company Common Stock underlying a Company PSU for this purpose was (x) for Company PSUs (or portions

thereof) for which the performance period was completed prior to the Effective Time, based on the actual level of performance (as determined

by the board of directors of the Company (the “Board”) prior to the Effective Time in good faith consistent

with past practices) through the end of such performance period and (y) for Company PSUs (or portions thereof) for which the performance

period had not expired as of the Effective Time, based on the greater of (i) the target level of performance, (ii) if the vesting of which

was measured by reference to total shareholder return, based on the total shareholder return reflected by the Merger Consideration (and,

as applicable, the total shareholder return of the comparator group as of a date within 10 business days prior to the Effective Time)

and (iii) if the vesting of which was measured by reference to EBITDA, based on the EBITDA measured as of the Effective Time (as determined

by the Board), in each case determined by assuming shortened performance periods that end as of the Effective Time and otherwise in good

faith consistent with past practices, and provided further that any Company PSU that did not vest as described in this paragraph was cancelled

and terminated without consideration immediately prior to the Effective Time. |

The

foregoing description of the Merger and the Merger Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the Merger Agreement, which was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with

the U.S. Securities and Exchange Commission on September 11, 2023, and which is incorporated herein by reference.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under

an Off-Balance Sheet Arrangement of a Registrant. |

The

information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

| Item 3.01. | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

The

information set forth in the Introductory Note and under Item 2.01 of this Current Report on Form 8-K is incorporated by reference into

this Item 3.01.

On

November 27, 2023, the Company notified The Nasdaq Stock Market LLC (“Nasdaq”) of the completion of the Merger,

and the Company requested that Nasdaq (i) suspend trading of Company Common Stock, (ii) remove Company Common Stock from listing on Nasdaq

prior to the opening of trading on November 28, 2023 and (iii) file with the SEC a notification of delisting of Company Common Stock under

Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result, Company

Common Stock will no longer be listed on Nasdaq.

Additionally,

after the Form 25 is effective, the Company intends to file with the SEC a certification and notice on Form 15 to terminate the registration

of Company Common Stock under the Exchange Act and suspend the Company’s reporting obligations under Section 13 and Section 15(d)

of the Exchange Act.

| Item 3.03. | Material Modification to Rights of Security Holders. |

The

information set forth in the Introductory Note and under Items 2.01, 3.01, 5.01 and 5.03 of this Current Report on Form 8-K is incorporated

by reference into this Item 3.03.

At

the Effective Time, the holders of shares of Company Common Stock as of immediately prior to the Effective Time ceased to have any rights

as stockholders of the Company, other than the right to receive the Merger Consideration pursuant to the Merger Agreement.

| Item 5.01. | Change in Control of Registrant. |

The

information set forth in the Introductory Note and under Items 2.01, 3.01 and 5.02 of this Current Report on Form 8-K is incorporated

by reference into this Item 5.01.

As

a result of the Merger, a change in control of the Company occurred, and the Company became a wholly-owned subsidiary of Parent. The total

amount of consideration payable in connection with the Merger was approximately $1.3 billion, including the repayment of indebtedness

outstanding under the Restatement Agreement. The funds used by Parent to complete the Merger and the related transactions came from proceeds

received in connection with the debt financing arrangements described in Item 1.01 of this Current Report on Form 8-K as well as cash

on hand at Parent and its subsidiaries.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

Effective

as of the Effective Time and as a result of the completion of the Merger, the directors of Acquisition Sub became the sole directors of

the Company. Accordingly, effective as of the Effective Time, Georganne Proctor, Christopher W. Walters, Mark A. Ernst, E. Carol Hayles,

Kanayalal A. Kotecha, J. Richard Leaman III, Tina Perry, Karthik Rao and Jana R. Schreuder, constituting all of the directors of

the Company prior to the Effective Time (collectively, the “Existing Directors”), ceased to be directors of

the Company. Each of the Existing Directors also tendered his or her resignation effective as of the Effective Time.

Additionally,

effective as of the Effective Time and as a result of the completion of the Merger, the officers of Acquisition Sub became the sole officers

of the Company. Accordingly, effective as of the Effective Time, each of Christopher W. Walters, the Company’s President and Chief

Executive Officer (and the Company’s principal executive officer), Marc Mehlman, the Company’s Chief Financial Officer and

Treasurer (and the Company’s principal financial officer), Todd Mackay, the President of Avantax Wealth Management (and a named

executive officer), and Stacy Murray, the Company’s Chief Accounting Officer (and the Company’s principal accounting officer)

(collectively, the “Existing Officers”) ceased to be officers of the Company. Each of the Existing Officers

also tendered his or her resignation from his or her position as an officer of the Company (but not as an employee of the Company) effective

as of the Effective Time, provided that such resignation would not affect his or her duties, authority, responsibilities or reporting

relationship for purposes of any Company Benefit Plan (as defined in the Merger Agreement) in which he or she participated immediately

prior to the Effective Time. None of the Existing Officers entered into any other agreements or understandings with the Company, Parent

or any of Parent’s affiliates in connection with such resignations.

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

Effective

as of the Effective Time and as a result of the completion of the Merger, the certificate of incorporation and the bylaws of the Company,

as in effect immediately prior to the Effective Time, were amended and restated in their entirety. Copies of the Amended and Restated

Certificate of Incorporation of the Company and the Amended and Restated Bylaws of the Company that are effective as of the Effective

Time are attached hereto as Exhibits 3.1 and 3.2, respectively, and are incorporated herein by reference.

| Item 7.01. | Regulation FD Disclosure. |

On November 27, 2023, the

Company and Parent issued a joint press release announcing the completion of the Merger. A copy of the joint press release is furnished

as Exhibit 99.1 hereto and is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description |

| 2.1* |

Agreement and Plan of Merger, dated as of September 9, 2023, by and among Avantax, Inc., Aretec Group, Inc. and C2023 Sub Corp. (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed on September 11, 2023) |

| 3.1 |

Amended and Restated Certificate of Incorporation of Avantax, Inc. |

| 3.2 |

Amended and Restated Bylaws of Avantax, Inc. |

| 99.1 |

Joint Press Release, dated as of November 27, 2023 |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Schedules and exhibits have been omitted

pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby undertakes to furnish copies of any of the omitted schedules or exhibits

to the SEC upon request by the SEC; provided that the Company may request confidential treatment pursuant to Rule 24b-2 of the Securities

Exchange Act of 1934, as amended, for any schedules or exhibits so furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

AVANTAX, INC. |

|

| |

|

(Registrant) |

|

| |

|

|

|

| Date: November 27, 2023 |

By: |

/s/ Keith Shores |

|

| |

|

Name: Keith Shores

Title: Treasurer |

|

AVANTAX, INC. 8-K

Exhibit 3.1

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

AVANTAX, INC.

* * * * * * * *

ARTICLE I.

The name of the corporation

is Avantax, Inc. (the “Corporation”).

ARTICLE II.

The address of the registered

office of the Corporation in the State of Delaware is Corporation Service Company, 251 Little Falls Drive, Wilmington, county of New Castle,

Delaware, 19808. The name of the registered agent of the Corporation at such address is Corporation Service Company.

ARTICLE III.

The nature of the business

or purposes to be conducted or promoted by the Corporation is to engage in any lawful act or activity for which corporations may be organized

under the General Corporation Law of the State of Delaware (as amended, the “DGCL”).

ARTICLE IV.

The total number of shares

of stock which the Corporation shall have authority to issue is 1,000 shares, which shall be shares of common stock with a par value of

$0.01 per share.

ARTICLE V.

In furtherance and not in

limitation of the powers conferred by statute, the board of directors of the Corporation (the “Board”) is expressly

authorized to adopt, amend or repeal the bylaws of the Corporation (the “Bylaws”) to the fullest extent permitted by

the DGCL.

ARTICLE VI.

The election of directors

need not be conducted by written ballot except and to the extent provided in the Bylaws.

ARTICLE VII.

(a)

Each person who was or is made a party or is threatened to be made a party to or is otherwise involved (including, without limitation,

as a witness) in any actual or threatened action, suit or proceeding, whether civil, criminal, administrative or investigative (hereinafter

a “proceeding”), by reason of the fact that he or she is or was a director or officer of the Corporation or that, being

or having been such a director or officer of the Corporation, he or she is or was serving at the request of the Corporation as a director,

officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with

respect to an employee benefit plan (hereinafter an “indemnitee”), whether the basis of such proceeding is alleged

action in an official capacity as such a director or officer or in any other capacity while serving as such a director or officer, shall

be indemnified and held harmless by the Corporation to the full extent permitted by the DGCL, as the same exists or may hereafter be amended

(but, in the case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader indemnification

rights than permitted prior thereto), or by other applicable law as then in effect, against all expense, liability and, loss (including

attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) actually and reasonably incurred

or suffered by such indemnitee in connection therewith and such indemnification shall continue as to an indemnitee who has ceased to be

a director or officer and shall inure to the benefit of the indemnitee’s heirs, executors and administrators; provided, however,

that except as provided in paragraph (b) of this Article VII with respect to proceedings seeking to enforce rights to indemnification,

the Corporation shall indemnify any such indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only

if such proceeding (or part thereof) was authorized or ratified by the Board. The right to indemnification conferred in this paragraph

(a) of Article VII shall be a contract right and shall include the right to be paid by the Corporation the expenses incurred

in defending any such proceeding in advance of its final disposition (hereinafter an “advancement of expenses”); provided,

however, that if the DGCL requires, an advancement of expenses incurred by an indemnitee in his or her capacity as a director or

officer (and not in any other capacity in which service was or is rendered by such indemnitee, including, without limitation, service

to an employee benefit plan) shall be made only upon delivery to the Corporation of an undertaking (hereinafter an “undertaking”),

by or on behalf of such indemnitee, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from

which there is no further right to appeal that such indemnitee is not entitled to be indemnified for such expenses under this paragraph

(a) of Article VII or otherwise.

(b)

If a claim under paragraph (a) of this Article VII is not paid in full by the Corporation within sixty (60) days

after a written claim has been received by the Corporation, except in the case of a claim for an advancement of expenses, in which case

the applicable period shall be twenty (20) days, the indemnitee may at any time thereafter bring suit against the Corporation to recover

the unpaid amount of the claim. If successful in whole or in part in any such suit, or in a suit brought by the Corporation to recover

an advancement of expenses pursuant to the terms of an undertaking, the indemnitee shall be entitled to be paid also the expense of prosecuting

or defending such suit. The indemnitee shall be presumed to be entitled to indemnification under this Article VII upon submission

of a written claim (and, in an action brought to enforce a claim for an advancement of expenses, where the required undertaking, if any

is required, has been tendered to the Corporation), and thereafter the Corporation shall have the burden of proof to overcome the presumption

that the indemnitee is not so entitled. Neither the failure of the Corporation (including the Board, independent legal counsel or the

stockholders of the Corporation) to have made a determination prior to the commencement of such suit that indemnification of the indemnitee

is proper in the circumstances nor an actual determination by the Corporation (including the Board, independent legal counsel or the stockholders

of the Corporation) that the indemnitee is not entitled to indemnification shall be a defense to the suit or create a presumption that

the indemnitee is not so entitled.

(c)

The rights to indemnification and to the advancement of expenses conferred in this Article VII shall not be exclusive of

any other right that any person may have or hereafter acquire under any statute, agreement, vote of stockholders or disinterested directors,

provisions of this Amended and Restated Certificate of Incorporation of the Corporation (this “Certificate of Incorporation”)

or the Bylaws or otherwise. Notwithstanding any amendment to or repeal of this Article VII, any indemnitee shall be entitled to

indemnification and expense reimbursement in accordance with the provisions hereof with respect to any acts or omissions of such indemnitee

occurring prior to such amendment or repeal.

(d)

The Corporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the Corporation

or another corporation, partnership, joint venture, trust or other enterprise against any expense, liability or loss, whether or not the

Corporation would have the power to indemnify such person against such expense, liability or loss under the DGCL. The Corporation, without

further stockholder approval, may enter into contracts with any director, officer, employee or agent in furtherance of the provisions

of this Article VII and may create a trust fund, grant a security interest or use other means (including, without limitation, a

letter of credit) to ensure the payment of such amounts as may be necessary to effect indemnification as provided in this Article VII.

(e)

The Corporation may, by action of the Board, grant rights to indemnification and advancement of expenses to employees or agents

or groups of employees or agents of the Corporation with the same scope and effect as the provisions of this Article VII with respect

to the indemnification and advancement of expenses of directors and officers of the Corporation; provided, however, that

an undertaking shall be made by an employee or agent only if required by the Board.

(f)

Any person who is or was a director or officer of the Corporation who is or was serving (i) as a director or officer of another

corporation of which a majority of the shares entitled to vote in the election of its directors is held by the Corporation or (ii) in

an executive or management capacity in a partnership, joint venture, trust or other enterprise of which the Corporation or a wholly owned

subsidiary of the Corporation is a general partner or has a majority ownership shall be deemed to be so serving at the request of the

Corporation and entitled to indemnification and advancement of expenses under paragraph (a) of this Article VII.

(g)

The Board may establish reasonable procedures for the submission of claims for indemnification pursuant to this Article VII,

determination of the entitlement of any person thereto and review of any such determination.

ARTICLE VIII.

Unless the Corporation consents

in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum

for (a) any derivative action or proceeding brought on behalf of the Corporation, (b) any action asserting a claim for breach of a fiduciary

duty owed by any director, officer, employee or agent of the Corporation to the Corporation or the Corporation’s stockholders, (c)

any action asserting a claim arising pursuant to any provision of the DGCL, this Certificate of Incorporation or the Bylaws or (d) any

action asserting a claim governed by the internal affairs doctrine, in each case subject to said Court of Chancery having personal jurisdiction

over the indispensable parties named as defendants therein.

ARTICLE IX.

To the full extent that the

DGCL, as it exists on the date hereof or may hereafter be amended, permits the limitation or elimination of the liability of directors

and officers, no director or officer of the Corporation shall be liable to the Corporation or its stockholders for monetary damages for

breach of fiduciary duty as a director or officer. Any amendment or repeal of this Article IX shall not adversely affect any limitation

or elimination of liability as relates to any acts or omissions of any director or officer of the Corporation occurring prior to such

amendment or repeal.

AVANTAX, INC. 8-K

Exhibit

3.2

AMENDED

AND RESTATED BYLAWS

OF

AVANTAX,

INC.

(a

Delaware corporation)

ARTICLE

I

Stockholders

SECTION

1. Annual Meetings. The annual meeting of stockholders for the election of directors and for the

transaction of such other business as may properly come before the meeting shall be held each year at such date and time, within or without

the State of Delaware, as the board of directors (the “Board”) of Avantax, Inc. (the “Corporation”)

shall determine.

SECTION

2. Special Meetings. Special meetings of stockholders for the transaction of such business as may

properly come before the meeting may be called by order of the Board or by stockholders holding together at least a majority of all the

shares of the Corporation entitled to vote at the meeting, and shall be held at such date and time, within or without the State of Delaware,

as may be specified by such order. Whenever the directors shall fail to fix such place, the meeting shall be held at the principal executive

office of the Corporation.

SECTION

3. Notice of Meetings. Written notice of all meetings of the stockholders, stating the place, date

and hour of the meeting and the place within the city or other municipality or community at which the list of stockholders may be examined,

shall be mailed or delivered to each stockholder not less than ten (10) nor more than sixty (60) days prior to the meeting. Notice of

any special meeting shall state in general terms the purpose or purposes for which the meeting is to be held.

SECTION

4. Stockholder Lists. The officer who has charge of the stock ledger of the Corporation shall prepare

and make, at least ten (10) days before every meeting of stockholders, a complete list of the stockholders entitled to vote at the meeting,

arranged in alphabetical order, and showing the address of each stockholder and the number of shares registered in the name of each stockholder.

Such list shall be open to the examination of any stockholder, for any purpose germane to the meeting, either at a place within the city

where the meeting is to be held, which place shall be specified in the notice of the meeting, or, if not so specified, at the place where

the meeting is to be held. The list shall also be produced and kept at the time and place of the meeting during the whole time thereof,

and may be inspected by any stockholder who is present. The stock ledger shall be the only evidence as to who are the stockholders entitled

to examine the stock ledger, the list required by this section or the books of the Corporation, or to vote in person or by proxy at any

meeting of stockholders.

SECTION

5. Quorum. Except as otherwise provided by law or the Corporation’s certificate of incorporation

(as amended, amended and restated, supplemented or otherwise modified from time to time, the “Certificate of Incorporation”),

a quorum for the transaction of business at any meeting of stockholders shall consist of the holders of record of a majority of the issued

and outstanding shares of the capital stock of the Corporation entitled to vote at the meeting, present in person or by proxy. At all

meetings of the stockholders at which a quorum is present, all matters, except as otherwise provided by law or the Certificate of Incorporation,

shall be decided by the vote of the holders of a majority of the shares entitled to vote thereat present in person or by proxy. If there

be no such quorum, the holders of a majority of such shares so present or represented may adjourn the meeting from time to time, without

further notice, until a quorum shall have been obtained. When a quorum is once present it is not broken by the subsequent withdrawal

of any stockholder.

Exhibit

3.2

SECTION

6. Organization. Meetings of stockholders shall be presided over by the Chairman, if any, or if

none or in the Chairman’s absence the Vice-Chairman, if any, or if none or in the Vice-Chairman’s absence the President,

if any, or if none or in the President’s absence a Vice President, or, if none of the foregoing is present, by a chairman to be

chosen by the stockholders entitled to vote who are present in person or by proxy at the meeting. The Secretary of the Corporation, or

in the Secretary’s absence an Assistant Secretary, shall act as secretary of every meeting, but if neither the Secretary nor an

Assistant Secretary is present, the presiding officer of the meeting shall appoint any person present to act as secretary of the meeting.

SECTION

7. Voting; Proxies; Required Vote.

(a) At each meeting of stockholders, every stockholder shall be entitled to vote in person or by proxy appointed by instrument in writing,

subscribed by such stockholder or by such stockholder’s duly authorized attorney-in-fact, and, unless the Certificate of Incorporation

provides otherwise, shall have one vote for each share of stock entitled to vote registered in the name of such stockholder on the books

of the Corporation on the applicable record date fixed pursuant to these bylaws of the Corporation (these “Bylaws”).

At all elections of directors the voting may but need not be by ballot and a plurality of the votes cast there shall elect. Except as

otherwise required by law or the Certificate of Incorporation, any other action shall be authorized by a majority of the votes cast.

(b) Any action required or permitted to be taken at any meeting of stockholders may, except as otherwise required by law or the Certificate

of Incorporation, be taken without a meeting, without prior notice and without a vote, if a consent in writing, setting forth the action

so taken, shall be signed by the holders of record of a number of the issued and outstanding shares of capital stock of the Corporation

representing the number of votes necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon

were present and voted. Prompt notice of the taking of corporate action without a meeting by less than unanimous written consent shall

be given to those stockholders who have not consented in writing.

SECTION

8. Inspectors. The Board, in advance of any meeting, may, but need not, appoint one or more inspectors

of election to act at the meeting or any adjournment thereof. If an inspector or inspectors are not so appointed, the person presiding

at the meeting may, but need not, appoint one or more inspectors. In case any person who may be appointed as an inspector fails to appear

or act, the vacancy may be filled by appointment made by the directors in advance of the meeting or at the meeting by the person presiding

thereat. Each inspector, if any, before entering upon the discharge of his or her duties, shall take and sign an oath faithfully to execute

the duties of inspector at such meeting with strict impartiality and according to the best of his ability. The inspectors, if any, shall

determine the number of shares of stock outstanding and the voting power of each, the shares of stock represented at the meeting, the

existence of a quorum, and the validity and effect of proxies, and shall receive votes, ballots or consents, hear and determine all challenges

and questions arising in connection with the right to vote, count and tabulate all votes, ballots or consents, determine the result,

and do such acts as are proper to conduct the election or vote with fairness to all stockholders. On request of the person presiding

at the meeting, the inspector or inspectors, if any, shall make a report in writing of any challenge, question or matter determined by

such inspector or inspectors and execute a certificate of any fact found by such inspector or inspectors.

Exhibit

3.2

ARTICLE

II

Board of Directors

SECTION

1. General Powers. The business, property and affairs of the Corporation shall be managed by, or

under the direction of, the Board.

SECTION

2. Qualification; Number; Term; Remuneration.

(a) Each director shall be at least 18 years of age. A director need not be a stockholder, a citizen of the United States, or a resident

of the State of Delaware. Except as otherwise provided by law or the Certificate of Incorporation, the number of directors constituting

the entire Board shall be the number fixed from time to time by affirmative vote of a majority of the votes to which all of the Directors

then in office are entitled pursuant to the Certificate of Incorporation. The use of the phrase “entire Board” herein refers

to the total number of directors the Corporation has at any point in time.

(b) Directors who are elected at an annual meeting of stockholders, and directors who are elected in the interim to fill vacancies and newly

created directorships, shall hold office until the next annual meeting of stockholders and until their successors are elected and qualified

or until their earlier resignation or removal.

(c) Directors may be paid their expenses, if any, of attendance at each meeting of the Board and may be paid a fixed sum for attendance at

each meeting of the Board or a stated salary as director. No such payment shall preclude any director from serving the Corporation in

any other capacity and receiving compensation therefor. Members of special or standing committees may be allowed like compensation for

attending committee meetings.

SECTION

3. Quorum and Manner of Voting. Except as otherwise provided by law, a majority of the votes to

which the entire Board is entitled shall constitute a quorum. A majority of the directors present, whether or not a quorum is present,

may adjourn a meeting from time to time to another time and place without notice. With respect to any matter submitted to a vote of the

Board, directors shall each be entitled to the number of votes set forth in the Certificate of Incorporation. The vote of the majority

of the votes held by the directors present at a meeting at which a quorum is present shall be the act of the Board.

Exhibit

3.2

SECTION

4. Places of Meetings. Meetings of the Board may be held at any place within or without the State

of Delaware, as may from time to time be fixed by resolution of the Board, or as may be specified in the notice of meeting.

SECTION

5. Action by Communications Equipment. Members of the Board or any committee thereof may participate

in a meeting of such Board or committee by means of conference telephone or similar communications equipment by means of which all persons

participating in the meeting can hear each other, and such participation shall constitute presence in person at such meeting.

SECTION

6. Annual Meeting. Following the annual meeting of stockholders, the newly elected Board shall meet

for the purpose of the election of officers and the transaction of such other business as may properly come before the meeting. Such

meeting may be held without notice immediately after the annual meeting of stockholders at the same place at which such stockholders’

meeting is held.

SECTION

7. Regular Meetings. Regular meetings of the Board shall be held at such times and places as the

Board shall from time to time by resolution determine. Notice need not be given of regular meetings of the Board held at times and places

fixed by resolution of the Board.

SECTION

8. Special Meetings. Special meetings of the Board shall be held whenever called by the Chairman

of the Board, President or by a majority of the votes held by directors then in office.

SECTION

9. Notice of Meetings. A notice of the place, date and time and the purpose or purposes of each

meeting of the Board shall be given to each director by mailing the same at least two (2) days before the special meeting, or by telegraphing

or telephoning the same or by delivering the same personally not later than the day before the day of the meeting. Notice of any meeting

of the Board need not be given to any director, however, if waived by him in writing whether before or after such meeting be held, or

if he shall be present at such meeting, and any meeting of the Board shall be a legal meeting without any notice thereof having been

given, if all the directors then in office shall be present thereat.

SECTION

10. Organization. At all meetings of the Board, the Chairman, if any, or if none or in the Chairman’s absence or inability

to act the President, or in the President’s absence or inability to act any Vice President who is a member of the Board, or in

such Vice President’s absence or inability to act a chairman chosen by the directors, shall preside. The Secretary of the Corporation

shall act as secretary at all meetings of the Board when present, and, in the Secretary’s absence, the presiding officer may appoint

any person to act as secretary.

SECTION

11. Resignation. Any director may resign at any time upon written notice to the Corporation and such resignation shall take

effect upon receipt thereof by the President or Secretary, unless otherwise specified in the resignation. Any or all of the directors

may be removed, with or without cause, by the holders of a majority of the shares of stock outstanding and entitled to vote for the election

of directors.

Exhibit

3.2

SECTION

12. Vacancies. Unless otherwise provided in these Bylaws, vacancies on the Board, whether caused by resignation, death,

disqualification, removal, an increase in the authorized number of directors or otherwise, may be filled by the affirmative vote of a

majority of the remaining directors, although less than a quorum, or by a sole remaining director, or at a special meeting of the stockholders,

by the holders of shares entitled to vote for the election of directors.

SECTION

13. Action by Written Consent. Any action required or permitted to be taken at any meeting of the Board may be taken without

a meeting if all the directors consent thereto in writing, and the writing or writings are filed with the minutes of proceedings of the

Board.

ARTICLE

III

Committees

SECTION

1. Appointment. From time to time the Board by a resolution adopted by a majority of the votes to

which the entire Board is entitled may appoint any committee or committees for any purpose or purposes, to the extent lawful, which shall

have powers as shall be determined and specified by the Board in the resolution of appointment.

SECTION

2. Procedures, Quorum and Manner of Acting. Each committee shall fix its own rules of procedure,

and shall meet where and as provided by such rules or by resolution of the Board. Except as otherwise provided by law, the presence of

a majority of the then appointed members of a committee shall constitute a quorum for the transaction of business by that committee,

and in every case where a quorum is present the affirmative vote of a majority of the members of the committee present shall be the act

of the committee. Each committee shall keep minutes of its proceedings, and actions taken by a committee shall be reported to the Board.

SECTION

3. Action by Written Consent. Any action required or permitted to be taken at any meeting of any

committee of the Board may be taken without a meeting if all the members of the committee consent thereto in writing, and the writing

or writings are filed with the minutes of proceedings of the committee.

SECTION

4. Term; Termination. In the event any person shall cease to be a director of the Corporation, such

person shall simultaneously therewith cease to be a member of any committee appointed by the Board.

ARTICLE

IV

Officers

SECTION

1. Election and Qualifications. The Board shall elect the officers of the Corporation, which shall

include a President and a Secretary, and may include, by election or appointment, one or more Vice Presidents (any one or more of whom

may be given an additional designation of rank or function), a Treasurer and such Assistant Secretaries, such Assistant Treasurers and

such other officers as the Board may from time to time deem proper. Each officer shall have such powers and duties as may be prescribed

by these Bylaws and as may be assigned by the Board or the President.

Exhibit

3.2

SECTION

2. Term of Office and Remuneration. The term of office of all officers shall be one year and until

their respective successors have been elected and qualified, but any officer may be removed from office, either with or without cause,

at any time by the Board. Any vacancy in any office arising from any cause may be filled for the unexpired portion of the term by the

Board. The remuneration of all officers of the Corporation may be fixed by the Board or in such manner as the Board shall provide.

SECTION

3. Resignation; Removal. Any officer may resign at any time upon written notice to the Corporation

and such resignation shall take effect upon receipt thereof by the President or Secretary, unless otherwise specified in the resignation.

Any officer shall be subject to removal, with or without cause, at any time by vote of a majority of the entire Board.

SECTION

4. Compensation. The compensation of the officers shall be fixed by the Board, or by a committee

of the Board upon whom power in that regard may be conferred by the Board.

SECTION

5. Chairman of the Board. The Chairman of the Board, if there be one, shall preside at all meetings

of the Board and shall have such other powers and duties as may from time to time be assigned by the Board.

SECTION

6. President and Chief Executive Officer. The President shall be the chief executive officer of

the Corporation, and shall have such duties as customarily pertain to that office. The President shall have general management and supervision

of the property, business and affairs of the Corporation and over its other officers; may appoint and remove assistant officers and other

agents and employees; and may execute and deliver in the name of the Corporation powers of attorney, contracts, bonds and other obligations

and instruments.

SECTION

7. Vice President. A Vice President may execute and deliver in the name of the Corporation contracts

and other obligations and instruments pertaining to the regular course of the duties of said office, and shall have such other authority

as from time to time may be assigned by the Board or the President.

SECTION

8. Treasurer. The Treasurer shall in general have all duties incident to the position of Treasurer

and such other duties as may be assigned by the Board or the President.

SECTION

9. Secretary. The Secretary shall in general have all the duties incident to the office of Secretary

and such other duties as may be assigned by the Board or the President.

SECTION

10. Assistant Officers. Any assistant officer shall have such powers and duties of the officer such assistant officer assists

as such officer or the Board shall from time to time prescribe.

ARTICLE

V

Books and Records

SECTION

1. Location. The books and records of the Corporation may be kept at such place or places within

or outside the State of Delaware as the Board or the respective officers in charge thereof may from time to time determine. The record

books containing the names and addresses of all stockholders, the number and class of shares of stock held by each and the dates when

they respectively became the owners of record thereof shall be kept by the Secretary as prescribed in the Bylaws and by such officer

or agent as shall be designated by the Board.

Exhibit

3.2

SECTION

2. Addresses of Stockholders. Notices of meetings and all other corporate notices may be delivered

personally or mailed to each stockholder at the stockholder’s address as it appears on the records of the Corporation.

SECTION

3. Fixing Date for Determination of Stockholders of Record.

(a) In order that the Corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment

thereof, the Board may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date

is adopted by the Board, and which record date shall not be more than sixty (60) nor less than ten (10) days before the date of such

meeting. If no record date is fixed by the Board, the record date for determining stockholders entitled to notice of or to vote at a

meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is given, or, if notice is

waived, at the close of business on the day next preceding the day on which the meeting is held. A determination of stockholders of record

entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting; provided, however, that

the Board may fix a new record date for the adjourned meeting.

(b) In order that the Corporation may determine the stockholders entitled to consent to corporate action in writing without a meeting, the

Board may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted

by the Board, and which date shall not be more than ten (10) days after the date upon which the resolution fixing the record date is

adopted by the Board. If no record date has been fixed by the Board, the record date for determining stockholders entitled to consent

to corporate action in writing without a meeting, when no prior action by the Board is required, shall be the first date on which a signed

written consent setting forth the action taken or proposed to be taken is delivered to the Corporation by delivery to its registered

office in this State, its principal place of business, or an officer or agent of the Corporation having custody of the book in which

proceedings of meetings of stockholders are recorded. Delivery made to the Corporation’s registered office shall be by hand or

by certified or registered mail, return receipt requested. If no record date has been fixed by the Board and prior action by the Board

is required by this chapter, the record date for determining stockholders entitled to consent to corporate action in writing without

a meeting shall be at the close of business on the day on which the Board adopts the resolution taking such prior action.

(c) In order that the Corporation may determine the stockholders entitled to receive payment of any dividend or other distribution or allotment

of any rights or the stockholders entitled to exercise any rights in respect of any change, conversion or exchange of stock, or for the

purpose of any other lawful action, the Board may fix a record date, which record date shall not precede the date upon which the resolution

fixing the record date is adopted, and which record date shall be not more than sixty (60) days prior to such action. If no record date

is fixed, the record date for determining stockholders for any such purpose shall be at the close of business on the day on which the

Board adopts the resolution relating thereto.

Exhibit

3.2

ARTICLE

VI

Certificates Representing Stock

SECTION

1. Certificates; Signatures. The shares of the Corporation shall be represented by certificates

or shall be uncertificated. Every holder of stock represented by certificates and upon request every holder of uncertificated shares

shall be entitled to have a certificate, signed by or in the name of the Corporation by the Chairman or Vice-Chairman of the Board, or

the President or Vice President, and by the Treasurer or an Assistant Treasurer, or the Secretary or an Assistant Secretary of the Corporation,

representing the number of shares registered in certificate form. Any and all signatures on any such certificate may be facsimiles. In

case any officer, transfer agent or registrar who has signed or whose facsimile signature has been placed upon a certificate shall have

ceased to be such officer, transfer agent or registrar before such certificate is issued, it may be issued by the Corporation with the

same effect as if he were such officer, transfer agent or registrar at the date of issue. The name of the holder of record of the shares

represented thereby, with the number of such shares and the date of issue, shall be entered on the books of the Corporation.

SECTION

2. Transfers of Stock. The shares of stock of the Corporation shall be transferable on the books

of the Corporation by the holders thereof in person, or by their duly authorized attorneys or legal representatives, on delivery of an

assignment or power of transfer. A record shall be made of each transfer.

SECTION

3. Lost, Stolen or Destroyed Certificates. The Corporation may issue a new certificate of stock

in place of any certificate, theretofore issued by it, alleged to have been lost, stolen or destroyed, and the Board may require the

owner of any lost, stolen or destroyed certificate, or his legal representative, to give the Corporation a bond sufficient to indemnify

the Corporation against any claim that may be made against it on account of the alleged loss, theft or destruction of any such certificate

or the issuance of any such new certificate.

ARTICLE

VII

Dividends

Subject

always to the provisions of law and the Certificate of Incorporation, the Board shall have full power to determine whether any, and,

if any, what part of any, funds legally available for the payment of dividends shall be declared as dividends and paid to stockholders;

the division of the whole or any part of such funds of the Corporation shall rest wholly within the lawful discretion of the Board, and

it shall not be required at any time, against such discretion, to divide or pay any part of such funds among or to the stockholders as

dividends or otherwise; and before payment of any dividend, there may be set aside out of any funds of the Corporation available for

dividends such sum or sums as the Board from time to time, in its absolute discretion, thinks proper as a reserve or reserves to meet

contingencies, or for equalizing dividends, or for repairing or maintaining any property of the Corporation, or for such other purpose

as the Board shall think conducive to the interest of the Corporation, and the Board may modify or abolish any such reserve in the manner

in which it was created.

Exhibit

3.2

ARTICLE

VIII

Ratification

Any

transaction, questioned in any law suit on the ground of lack of authority, defective or irregular execution, adverse interest of director,

officer or stockholder, non-disclosure, miscomputation, or the application of improper principles or practices of accounting, may be

ratified before or after judgment, by the Board or by the stockholders, and if so ratified shall have the same force and effect as if

the questioned transaction had been originally duly authorized. Such ratification shall be binding upon the Corporation and its stockholders

and shall constitute a bar to any claim or execution of any judgment in respect of such questioned transaction.

ARTICLE

IX

Corporate Seal

The

Corporation shall have no corporate seal.

ARTICLE

X

Fiscal Year

The

fiscal year of the Corporation shall be fixed, and shall be subject to change, by the Board. Unless otherwise fixed by the Board, the

fiscal year of the Corporation shall be the calendar year.

ARTICLE

XI

Waiver of Notice

Whenever

notice is required to be given by these Bylaws or by the Certificate of Incorporation or by law, a written waiver thereof, signed by

the person or persons entitled to said notice, whether before or after the time stated therein, shall be deemed equivalent to notice.

ARTICLE

XII

Bank Accounts, Drafts, Contracts, Etc.

SECTION

1. Bank Accounts and Drafts. In addition to such bank accounts as may be authorized by the Board,

the primary financial officer or any person designated by said primary financial officer, whether or not an employee of the Corporation,

may authorize such bank accounts to be opened or maintained in the name and on behalf of the Corporation as he may deem necessary or

appropriate, payments from such bank accounts to be made upon and according to the check of the Corporation in accordance with the written

instructions of said primary financial officer, or other person so designated by the Treasurer.

Exhibit

3.2

SECTION

2. Contracts. The Board may authorize any person or persons, in the name and on behalf of the Corporation,

to enter into or execute and deliver any and all deeds, bonds, mortgages, contracts and other obligations or instruments, and such authority

may be general or confined to specific instances.

SECTION

3. Proxies; Powers of Attorney; Other Instruments. The Chairman, the President or any other person

designated by either of them shall have the power and authority to execute and deliver proxies, powers of attorney and other instruments

on behalf of the Corporation in connection with the rights and powers incident to the ownership of stock by the Corporation. The Chairman,

the President or any other person authorized by proxy or power of attorney executed and delivered by either of them on behalf of the

Corporation may attend and vote at any meeting of stockholders of any company in which the Corporation may hold stock, and may exercise

on behalf of the Corporation any and all of the rights and powers incident to the ownership of such stock at any such meeting, or otherwise

as specified in the proxy or power of attorney so authorizing any such person. The Board, from time to time, may confer like powers upon

any other person.

SECTION

4. Financial Reports. The Board may appoint the primary financial officer or other fiscal officer

or any other officer to cause to be prepared and furnished to stockholders entitled thereto any special financial notice and/or financial

statement, as the case may be, which may be required by any provision of law.

ARTICLE

XIII

Electronic Transmission

The

Corporation is authorized to use “electronic transmissions” as defined in the General Corporation Law of the State of Delaware

(as amended, the “DGCL”) to the full extent allowed by the DGCL, including, but not limited to the purposes of notices,

proxies, waivers, resignations, and any other purpose for which electronic transmissions are permitted. Any reference in these Bylaws

to the delivery of consents, approvals or waivers or to the taking of any other actions by a writing, shall be satisfied

by use of an electronic transmission. An electronic transmission by a stockholder consenting to an action to be taken is considered to

be written, signed, and dated for the purposes of this article if the transmission sets forth or is delivered with information from which

the Corporation can determine that the transmission was transmitted by the stockholder and the date on which the stockholder transmitted

the transmission. The date of transmission is the date on which the consent was signed. Consent given by electronic transmission

may not be considered delivered until the consent is reproduced in paper form and the paper form is delivered to the Corporation at its

registered office in this state or its principal place of business, or to an officer or agent of the Corporation having custody of the

book in which proceedings of stockholder meetings are recorded. Notwithstanding the foregoing limitations on delivery, consent

given by electronic transmission may be delivered to the principal place of business of the Corporation or to an officer or agent of

the Corporation having custody of the book in which proceedings of stockholder meetings are recorded to the extent and in the manner

provided by resolution of the Board.

Exhibit

3.2

ARTICLE

XIV

Amendments

The

Board shall have power to adopt, amend or repeal these Bylaws. Bylaws adopted by the Board may be repealed or changed, and new Bylaws

made, by the stockholders, and the stockholders may prescribe that any Bylaw made by them shall not be altered, amended or repealed by

the Board.

ARTICLE

XV

Conflicts

These

Bylaws are adopted subject to any applicable law and the Certificate of Incorporation. Whenever these Bylaws may conflict with any applicable

law or the Certificate of Incorporation, such conflict shall be resolved in favor of such law or the Certificate of Incorporation.

[Remainder

of page intentionally left blank.]

AVANTAX, INC. 8-K

Exhibit 99.1

Cetera Holdings Announces Close

of Avantax Acquisition

Avantax to operate as a unique community within

Cetera Holdings, bringing more than 3,100 financial professionals and over $82 billion in assets to Cetera

Acquisition further expands Cetera’s tax

and wealth management offerings and represents core component of Cetera’s growth strategy

Dallas and Los Angeles – November 27, 2023 – Avantax,

Inc. (NASDAQ: AVTA) and Cetera Holdings, the holding company of Cetera Financial Group, announced

today the successful completion of Cetera’s acquisition of Avantax. Avantax is now a unique community within the Cetera family

with 3,111 financial professionals, representing $82.3 billion in assets under administration and $42.0 billion in assets under management,

as of September 30, 2023. Cetera retained Avantax’s legal entities, brand, core technology, product offerings and existing clearing

and custody relationships. The addition of Avantax Planning Partners, an employee-based RIA with over $7.8 billion in assets under management

as of September 30, 2023, strengthens Cetera’s established succession solution and delivers a powerful combined offering for Cetera’s

advisor communities.

“This transaction represents the beginning of a promising new

chapter together for two industry-leading firms, and we are pleased to welcome the Avantax team to Cetera,” said Mike Durbin, CEO

of Cetera Holdings. “Partnering with Avantax is core to our growth strategy and capitalizes on Avantax’s many capabilities

that benefit financial professionals, affiliates and their clients. The Avantax Community immediately builds upon Cetera’s tax and

wealth management capabilities and expertise, complementing our established tax-centric Cetera Financial Specialist team, and provides

financial professionals another avenue for affiliation with Cetera. In addition, this acquisition establishes a strategic relationship

between Cetera and Fidelity, as Cetera expands further into a multi-custodial platform, enhancing our capabilities to deliver the latest

tools and resources to affiliated advisors.”

Durbin continued, “We will continue to prioritize a thoughtful

and collaborative approach to integration efforts to ensure a smooth onboarding process for Avantax. We are confident Avantax financial

professionals, affiliates and staff will thrive at Cetera, and we look forward to serving clients together for years to come.”

“I’d like to share my sincere gratitude

to our Board of Directors, our leadership team and the entire Avantax Community for making Avantax the strong company it is today. We

believe the partnership with Cetera will expand Avantax’s unique tax-intelligent offering and position our financial professionals

and affiliates for continued growth and success,” said Chris Walters, Chief Executive Officer of Avantax.

Click here to learn more about

Cetera Holdings and click here to learn more about Avantax.

Transaction Details

Avantax’s Board of Directors unanimously approved the transaction,

and holders of approximately 81% of the outstanding shares of Avantax common stock entitled to vote thereon approved the transaction.

Avantax is now a privately held company, and its common stock will no longer be traded on Nasdaq. Holders of shares of Avantax common

stock are entitled to receive $26.00 in cash per share, without interest and subject to required withholding taxes.

Advisors

PJT Partners acted as financial advisor to Avantax, and Sidley Austin

LLP and Haynes and Boone, LLP served as legal counsel to Avantax. Morgan Stanley & Co. served as financial advisor to Cetera. UBS

Investment Bank and BMO Capital Markets served as co-advisors to Cetera. Willkie Farr & Gallagher LLP served as legal counsel to Cetera.

About Cetera Financial Group®

Cetera Financial Group, which is owned by Cetera Holdings (collectively,

Cetera), is the premier financial advisor Wealth Hub where financial advisors and institutions optimize their control and value creation.

Breaking away from a commoditized and homogenous IBD model, Cetera offers financial professionals and institutions the latest solutions,

support, and services to grow, scale, or transition with a merger, sale, investment, or succession plan. Cetera proudly serves independent

financial advisors, tax professionals, licensed administrators, large enterprises, as well as institutions, such as banks and credit unions,

providing an established and repeatable blueprint for scalable growth.

Home to more than 9,000 financial professionals and their teams, Cetera

oversees approximately $374 billion in assets under administration and $145 billion in assets under management, as of September 25, 2023.

In a recent advisor satisfaction survey of more than 21,000 reviews, Cetera's Voice of Customer (VoC) program vigorously measures advisor

experience and satisfaction 24/7. Currently, it's ranked 4.8 out of 5 stars.

Visit www.cetera.com,

and follow Cetera on LinkedIn, YouTube, Twitter and Facebook.

“Cetera Financial Group” refers to the network of independent

retail firms encompassing, among others, Cetera Advisors LLC, Cetera Advisor Networks LLC, Cetera Investment Services LLC (marketed as

Cetera Financial Institutions or Cetera Investors), and Cetera Financial Specialists LLC. All firms are FINRA/SIPC members. Located at:

655 W. Broadway, 11th Floor, San Diego, CA 92101.

Individuals affiliated with Cetera firms are either Registered Representatives

who offer only brokerage services and receive transaction-based compensation (commissions), Investment Adviser Representatives who offer

only investment advisory services and receive fees based on assets, or both Registered Representatives and Investment Adviser Representatives,

who can offer both types of services.

About Avantax®

Avantax, Inc. delivers tax-focused financial planning and wealth management

solutions for financial professionals, tax professionals and CPA firms, supporting its goal of minimizing clients’ tax burdens

through comprehensive tax-focused financial planning. Avantax has two distinct, but related, models within its business: the independent

Financial Professional model and the employee-based model. Avantax refers to its independent Financial Professional model as Avantax

Wealth Management®. Avantax Wealth Management offers services through its registered broker-dealer, registered investment

advisor (RIA) and insurance agency subsidiaries and is a leading U.S. tax-focused independent broker-dealer that works with a nationwide

network of financial professionals operating as independent contractors. Avantax refers to its employee-based model as Avantax Planning

Partners℠. Avantax Planning Partners offers services through its RIA and insurance agency by partnering with CPA firms to provide

their consumer and small-business clients with holistic financial planning and advisory services. Collectively, Avantax had $82.3 billion

in total client assets as of September 30, 2023. For additional information, please visit www.avantax.com.

Cautionary Statement Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including

without limitation, statements regarding Cetera’s integration plans, the effects of the acquisition on Avantax’s offerings

and financial professionals. Forward-looking statements provide current expectations of future events based on certain assumptions and

include any statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified

by words such as “anticipates,” “believes,” “plans,” “expects,” “future,”

“intends,” “may,” “will,” “would,” “could,” “should,” “estimates,”

“predicts,” “potential,” “continues,” “target,” “outlook,” and similar terms

and expressions, but the absence of these words does not mean that the statement is not forward-looking. Actual results may differ significantly

from expectations due to various risks and uncertainties including, but not limited to those described in the Company’s most recent

Annual Report on Form 10-K and most recent Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission. Readers

are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes

no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as may be required

by law.

v3.23.3

Cover

|

Nov. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 27, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

000-25131

|

| Entity Registrant Name |

AVANTAX, INC.

|

| Entity Central Index Key |

0001068875

|

| Entity Tax Identification Number |

91-1718107

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3200 Olympus Blvd

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75019

|

| City Area Code |

(972)

|

| Local Phone Number |

870-6400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

AVTA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |