false2023Q3000160062012-3100016006202023-01-012023-09-3000016006202023-11-01xbrli:shares00016006202023-09-30iso4217:USD00016006202022-12-31iso4217:USDxbrli:shares0001600620us-gaap:ProductMember2023-07-012023-09-300001600620us-gaap:ProductMember2022-07-012022-09-300001600620us-gaap:ProductMember2023-01-012023-09-300001600620us-gaap:ProductMember2022-01-012022-09-300001600620auph:LicenseRoyaltyAndCollaborationRevenueMember2023-07-012023-09-300001600620auph:LicenseRoyaltyAndCollaborationRevenueMember2022-07-012022-09-300001600620auph:LicenseRoyaltyAndCollaborationRevenueMember2023-01-012023-09-300001600620auph:LicenseRoyaltyAndCollaborationRevenueMember2022-01-012022-09-3000016006202023-07-012023-09-3000016006202022-07-012022-09-3000016006202022-01-012022-09-300001600620us-gaap:CommonStockMember2023-06-300001600620us-gaap:AdditionalPaidInCapitalMember2023-06-300001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001600620us-gaap:RetainedEarningsMember2023-06-3000016006202023-06-300001600620us-gaap:CommonStockMember2023-07-012023-09-300001600620us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001600620us-gaap:RetainedEarningsMember2023-07-012023-09-300001600620us-gaap:CommonStockMember2023-09-300001600620us-gaap:AdditionalPaidInCapitalMember2023-09-300001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001600620us-gaap:RetainedEarningsMember2023-09-300001600620us-gaap:CommonStockMember2022-06-300001600620us-gaap:AdditionalPaidInCapitalMember2022-06-300001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001600620us-gaap:RetainedEarningsMember2022-06-3000016006202022-06-300001600620us-gaap:CommonStockMember2022-07-012022-09-300001600620us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001600620us-gaap:RetainedEarningsMember2022-07-012022-09-300001600620us-gaap:CommonStockMember2022-09-300001600620us-gaap:AdditionalPaidInCapitalMember2022-09-300001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001600620us-gaap:RetainedEarningsMember2022-09-3000016006202022-09-300001600620us-gaap:CommonStockMember2022-12-310001600620us-gaap:AdditionalPaidInCapitalMember2022-12-310001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001600620us-gaap:RetainedEarningsMember2022-12-310001600620us-gaap:CommonStockMember2023-01-012023-09-300001600620us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001600620us-gaap:RetainedEarningsMember2023-01-012023-09-300001600620us-gaap:CommonStockMember2021-12-310001600620us-gaap:AdditionalPaidInCapitalMember2021-12-310001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001600620us-gaap:RetainedEarningsMember2021-12-3100016006202021-12-310001600620us-gaap:CommonStockMember2022-01-012022-09-300001600620us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001600620us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001600620us-gaap:RetainedEarningsMember2022-01-012022-09-3000016006202021-08-17auph:novelAssetauph:segment0001600620us-gaap:SalesRevenueNetMemberus-gaap:ProductMemberauph:TwoSpecialtyPharmacyMemberus-gaap:CustomerConcentrationRiskMember2023-07-012023-09-30xbrli:pure0001600620us-gaap:SalesRevenueNetMemberus-gaap:ProductMemberauph:TwoSpecialtyPharmacyMemberus-gaap:CustomerConcentrationRiskMember2022-07-012022-09-300001600620us-gaap:SalesRevenueNetMemberus-gaap:ProductMemberauph:TwoSpecialtyPharmacyMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-09-300001600620us-gaap:SalesRevenueNetMemberus-gaap:ProductMemberauph:TwoSpecialtyPharmacyMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-09-300001600620us-gaap:SalesRevenueNetMemberauph:TwoSpecialtyPharmacyMemberauph:LicenseRoyaltyAndCollaborationRevenueMemberus-gaap:CustomerConcentrationRiskMember2023-07-012023-09-300001600620us-gaap:SalesRevenueNetMemberauph:TwoSpecialtyPharmacyMemberauph:LicenseRoyaltyAndCollaborationRevenueMemberus-gaap:CustomerConcentrationRiskMember2022-07-012022-09-300001600620us-gaap:SalesRevenueNetMemberauph:TwoSpecialtyPharmacyMemberauph:LicenseRoyaltyAndCollaborationRevenueMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-09-300001600620us-gaap:SalesRevenueNetMemberauph:TwoSpecialtyPharmacyMemberauph:LicenseRoyaltyAndCollaborationRevenueMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-09-300001600620srt:MinimumMember2023-01-012023-09-300001600620srt:MaximumMember2023-01-012023-09-300001600620us-gaap:FairValueInputsLevel1Memberauph:CashCashEquivalentsAndRestrictedCashMember2023-09-300001600620us-gaap:FairValueInputsLevel2Memberauph:CashCashEquivalentsAndRestrictedCashMember2023-09-300001600620us-gaap:FairValueInputsLevel3Memberauph:CashCashEquivalentsAndRestrictedCashMember2023-09-300001600620auph:CashCashEquivalentsAndRestrictedCashMember2023-09-300001600620us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2023-09-300001600620us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2023-09-300001600620us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateBondSecuritiesMember2023-09-300001600620us-gaap:CorporateBondSecuritiesMember2023-09-300001600620us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2023-09-300001600620us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Member2023-09-300001600620us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel3Member2023-09-300001600620us-gaap:CommercialPaperMember2023-09-300001600620us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryBillSecuritiesMember2023-09-300001600620us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBillSecuritiesMember2023-09-300001600620us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryBillSecuritiesMember2023-09-300001600620us-gaap:USTreasuryBillSecuritiesMember2023-09-300001600620us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryBondSecuritiesMember2023-09-300001600620us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBondSecuritiesMember2023-09-300001600620us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryBondSecuritiesMember2023-09-300001600620us-gaap:USTreasuryBondSecuritiesMember2023-09-300001600620us-gaap:FairValueInputsLevel1Memberauph:YankeeBondMember2023-09-300001600620us-gaap:FairValueInputsLevel2Memberauph:YankeeBondMember2023-09-300001600620us-gaap:FairValueInputsLevel3Memberauph:YankeeBondMember2023-09-300001600620auph:YankeeBondMember2023-09-300001600620us-gaap:FairValueInputsLevel1Member2023-09-300001600620us-gaap:FairValueInputsLevel2Member2023-09-300001600620us-gaap:FairValueInputsLevel3Member2023-09-300001600620us-gaap:FairValueInputsLevel1Memberauph:CashCashEquivalentsAndRestrictedCashMember2022-12-310001600620us-gaap:FairValueInputsLevel2Memberauph:CashCashEquivalentsAndRestrictedCashMember2022-12-310001600620us-gaap:FairValueInputsLevel3Memberauph:CashCashEquivalentsAndRestrictedCashMember2022-12-310001600620auph:CashCashEquivalentsAndRestrictedCashMember2022-12-310001600620us-gaap:FairValueInputsLevel1Memberauph:USAgencySecurityMember2022-12-310001600620us-gaap:FairValueInputsLevel2Memberauph:USAgencySecurityMember2022-12-310001600620us-gaap:FairValueInputsLevel3Memberauph:USAgencySecurityMember2022-12-310001600620auph:USAgencySecurityMember2022-12-310001600620us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2022-12-310001600620us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2022-12-310001600620us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateBondSecuritiesMember2022-12-310001600620us-gaap:CorporateBondSecuritiesMember2022-12-310001600620us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2022-12-310001600620us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Member2022-12-310001600620us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel3Member2022-12-310001600620us-gaap:CommercialPaperMember2022-12-310001600620us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryBillSecuritiesMember2022-12-310001600620us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBillSecuritiesMember2022-12-310001600620us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryBillSecuritiesMember2022-12-310001600620us-gaap:USTreasuryBillSecuritiesMember2022-12-310001600620us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryBondSecuritiesMember2022-12-310001600620us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBondSecuritiesMember2022-12-310001600620us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryBondSecuritiesMember2022-12-310001600620us-gaap:USTreasuryBondSecuritiesMember2022-12-310001600620us-gaap:FairValueInputsLevel1Memberauph:YankeeBondMember2022-12-310001600620us-gaap:FairValueInputsLevel2Memberauph:YankeeBondMember2022-12-310001600620us-gaap:FairValueInputsLevel3Memberauph:YankeeBondMember2022-12-310001600620auph:YankeeBondMember2022-12-310001600620us-gaap:FairValueInputsLevel1Member2022-12-310001600620us-gaap:FairValueInputsLevel2Member2022-12-310001600620us-gaap:FairValueInputsLevel3Member2022-12-310001600620us-gaap:FairValueInputsLevel2Member2023-01-012023-09-300001600620us-gaap:FairValueInputsLevel2Member2022-01-012022-12-310001600620auph:ShortTermCorporateDebtSecuritiesMember2023-09-300001600620auph:LongTermCorporateDebtSecuritiesMember2023-09-300001600620us-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001600620auph:ShortTermCorporateDebtSecuritiesMember2022-12-310001600620us-gaap:PatentsMember2023-09-300001600620us-gaap:IntellectualPropertyMember2023-09-300001600620us-gaap:ComputerSoftwareIntangibleAssetMember2023-09-300001600620us-gaap:PatentsMember2022-12-310001600620us-gaap:IntellectualPropertyMember2022-12-310001600620us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310001600620us-gaap:ConstructionInProgressMember2023-09-300001600620us-gaap:ConstructionInProgressMember2022-12-310001600620us-gaap:LeaseholdImprovementsMember2023-09-300001600620us-gaap:LeaseholdImprovementsMember2022-12-310001600620us-gaap:OfficeEquipmentMember2023-09-300001600620us-gaap:OfficeEquipmentMember2022-12-310001600620us-gaap:FurnitureAndFixturesMember2023-09-300001600620us-gaap:FurnitureAndFixturesMember2022-12-310001600620us-gaap:ComputerEquipmentMember2023-09-300001600620us-gaap:ComputerEquipmentMember2022-12-310001600620auph:RockvilleMarylandMember2020-03-31utr:sqftauph:extension_option0001600620auph:RockvilleMarylandMember2020-03-012020-03-310001600620auph:RockvilleMarylandMember2023-09-300001600620auph:RockvilleMarylandMember2022-12-310001600620auph:RockvilleMarylandMember2022-01-012022-12-310001600620auph:RockvilleMarylandMember2020-03-120001600620auph:EdmontonAlbertaMember2022-10-310001600620auph:VispSwitzerlandMember2021-01-012021-01-31iso4217:CHF0001600620auph:VispSwitzerlandMember2021-02-012021-02-280001600620auph:VispSwitzerlandMember2023-04-012023-06-300001600620auph:VispSwitzerlandMember2023-07-310001600620auph:VispSwitzerlandMember2023-09-300001600620auph:VispSwitzerlandMember2023-07-012023-09-300001600620auph:VispSwitzerlandMember2023-01-012023-09-300001600620auph:BeinheimFranceMember2023-09-300001600620auph:OtuskaPharmaceuticalCoLtdMemberus-gaap:LicenseAgreementTermsMember2020-01-012020-12-310001600620auph:OtuskaPharmaceuticalCoLtdMemberus-gaap:LicenseAgreementTermsMember2020-12-310001600620auph:OtuskaPharmaceuticalCoLtdMembersrt:MinimumMemberus-gaap:LicenseAgreementTermsMember2020-12-310001600620auph:OtuskaPharmaceuticalCoLtdMemberus-gaap:LicenseAgreementTermsMembersrt:MaximumMember2020-12-310001600620auph:OtuskaPharmaceuticalCoLtdMemberus-gaap:LicenseAgreementTermsMember2022-09-150001600620auph:OtuskaPharmaceuticalCoLtdMemberus-gaap:LicenseAgreementTermsMember2023-07-012023-09-300001600620auph:OtuskaPharmaceuticalCoLtdMemberus-gaap:ServiceMemberus-gaap:LicenseAgreementTermsMember2023-07-012023-09-300001600620auph:OtuskaPharmaceuticalCoLtdMemberus-gaap:ServiceMemberus-gaap:LicenseAgreementTermsMember2023-01-012023-09-300001600620auph:OtuskaPharmaceuticalCoLtdMemberus-gaap:ServiceMemberus-gaap:LicenseAgreementTermsMember2022-07-012022-09-300001600620auph:OtuskaPharmaceuticalCoLtdMemberus-gaap:ServiceMemberus-gaap:LicenseAgreementTermsMember2022-01-012022-09-300001600620auph:RiptideBioscienceIncMemberus-gaap:LicenseAgreementTermsMember2021-08-172021-08-170001600620auph:RiptideBioscienceIncMemberus-gaap:LicenseAgreementTermsMember2022-01-012022-03-310001600620us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001600620us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001600620us-gaap:PerformanceSharesMember2023-01-012023-09-300001600620us-gaap:PerformanceSharesMember2022-01-012022-09-300001600620us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001600620us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-300001600620auph:AmendedAndRestatedEquityIncentivePlanMember2021-06-012021-06-300001600620us-gaap:EmployeeStockMember2021-06-300001600620us-gaap:EmployeeStockMember2022-01-012022-03-31auph:purchase_period0001600620us-gaap:EmployeeStockMember2023-01-012023-03-310001600620srt:OfficerMemberauph:PerformanceShareSandRestrictedStockUnitsRSUsMember2022-12-310001600620srt:OfficerMemberauph:PerformanceShareSandRestrictedStockUnitsRSUsMember2023-01-012023-09-300001600620srt:OfficerMemberauph:PerformanceShareSandRestrictedStockUnitsRSUsMember2023-09-300001600620us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300001600620us-gaap:ResearchAndDevelopmentExpenseMember2022-07-012022-09-300001600620us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001600620us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-09-300001600620us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001600620us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012022-09-300001600620us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001600620us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-09-300001600620us-gaap:InventoriesMember2023-07-012023-09-300001600620us-gaap:InventoriesMember2022-07-012022-09-300001600620us-gaap:InventoriesMember2023-01-012023-09-300001600620us-gaap:InventoriesMember2022-01-012022-09-300001600620auph:ILJINMemberauph:MilestoneAchievedMemberus-gaap:RelatedPartyMember2023-09-300001600620auph:MilestoneAchievedMemberauph:ILJINMember2023-09-300001600620auph:EmployeeBenefitObligationsMemberauph:DrRobertTFosterMember2023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_____________________________________________

FORM 10-Q

_____________________________________________

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____________ to ________________

Commission file number: 001-36421

__________________________________________

Aurinia Pharmaceuticals Inc.

(Exact Name of Registrant as Specified in its Charter)

__________________________________________

| | | | | |

Alberta, Canada | |

(State or other jurisdiction of

incorporation or organization) | |

#140, 14315 - 118 Avenue Edmonton, Alberta T5L 4S6 | 98-1231763 |

| (Address of principal executive offices) | (I.R.S. Employer

Identification Number) |

(250) 744-2487

Registrant’s telephone number, including area code

_____________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | |

| Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the registrant's classes of common shares, as of the latest predictable date. As of November 1, 2023, the registrant had 143,608,164 of common shares outstanding.

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common shares, no par value | AUPH | The Nasdaq Global Market LLC |

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

TABLE OF CONTENTS

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands) | | | | | | | | | | | | | | |

| (unaudited) | | September 30, 2023 | | December 31, 2022 |

| | | | |

| ASSETS | | | | |

| Current assets | | | | |

| Cash, cash equivalents and restricted cash | | $ | 46,397 | | | $ | 94,172 | |

| Short-term investments | | 291,503 | | | 295,218 | |

| Accounts receivable, net | | 37,946 | | | 13,483 | |

| Inventories, net | | 32,820 | | | 24,752 | |

| Prepaid expenses | | 16,158 | | | 13,580 | |

| Other current assets | | 1,645 | | | 1,334 | |

| Total current assets | | 426,469 | | | 442,539 | |

| | | | |

| Non-current assets | | | | |

| Long-term investments | | 591 | | | — | |

| Other non-current assets | | 1,518 | | | 13,339 | |

| Property and equipment, net | | 3,496 | | | 3,650 | |

| Acquired intellectual property and other intangible assets, net | | 5,261 | | | 6,425 | |

| Finance right-of-use asset, net | | 113,069 | | | — | |

| Operating right-of-use assets, net | | 4,609 | | | 4,907 | |

| Total assets | | $ | 555,013 | | | $ | 470,860 | |

| | | | |

| LIABILITIES | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued liabilities | | 52,309 | | | 39,990 | |

| Deferred revenue | | 4,662 | | | 3,148 | |

| Other current liabilities | | 2,611 | | | 2,033 | |

| Finance lease liability | | 13,328 | | | — | |

| Operating lease liabilities | | 980 | | | 936 | |

| Total current liabilities | | 73,890 | | | 46,107 | |

| | | | |

| Non-current liabilities | | | | |

| Finance lease liability | | 72,193 | | | — | |

| Operating lease liabilities | | 6,713 | | | 7,152 | |

| Deferred compensation and other non-current liabilities | | 10,340 | | | 12,166 | |

| Total liabilities | | 163,136 | | | 65,425 | |

| Commitments and contingencies (Note 17) | | | | |

| SHAREHOLDER’S EQUITY | | | | |

Common shares - no par value, unlimited shares authorized, 143,605 and 142,268 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | | 1,198,560 | | | 1,185,309 | |

| Additional paid-in capital | | 109,711 | | | 85,489 | |

| Accumulated other comprehensive loss | | (947) | | | (1,061) | |

| Accumulated deficit | | (915,447) | | | (864,302) | |

| Total shareholders' equity | | 391,877 | | | 405,435 | |

| Total liabilities and shareholders' equity | | $ | 555,013 | | | $ | 470,860 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 30, | | September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (unaudited) |

| Revenue | | | | | | | | |

| Product revenue, net | | $ | 40,781 | | | $ | 25,502 | | | $ | 116,218 | | | $ | 75,142 | |

| License, royalty and collaboration revenue | | 13,734 | | | 30,277 | | | 14,200 | | | 30,453 | |

| Total revenue, net | | 54,515 | | | 55,779 | | | 130,418 | | | 105,595 | |

| Operating expenses | | | | | | | | |

| Cost of sales | | 6,769 | | | 2,447 | | | 8,753 | | | 4,302 | |

| Selling, general and administrative | | 47,759 | | | 52,169 | | | 144,964 | | | 148,898 | |

| Research and development | | 13,605 | | | 10,973 | | | 39,413 | | | 35,118 | |

| Other (income) expense, net | | 2,645 | | | (311) | | | (695) | | | 647 | |

| Total cost of sales and operating expenses | | 70,778 | | | 65,278 | | | 192,435 | | | 188,965 | |

| Loss from operations | | (16,263) | | | (9,499) | | | (62,017) | | | (83,370) | |

| Interest expense | | (1,400) | | | — | | | (1,465) | | | — | |

| Interest income | | 4,514 | | | 1,464 | | | 12,429 | | | 2,209 | |

| Net loss before income taxes | | (13,149) | | | (8,035) | | | (51,053) | | | (81,161) | |

| Income tax expense | | 298 | | | 954 | | | 92 | | | 973 | |

| Net loss | | $ | (13,447) | | | $ | (8,989) | | | $ | (51,145) | | | $ | (82,134) | |

| Other comprehensive loss: | | | | | | | | |

Unrealized gain (loss) on available-for-sale securities, net of tax of nil | | 73 | | | 326 | | | 114 | | | (675) | |

| | | | | | | | |

| Comprehensive loss | | $ | (13,374) | | | $ | (8,663) | | | $ | (51,031) | | | $ | (82,809) | |

| Basic and diluted loss per share | | $ | (0.09) | | | $ | (0.06) | | | $ | (0.36) | | | $ | (0.58) | |

| Weighted-average common shares outstanding used in computation of basic and diluted loss per share | | 142,847 | | | 141,856 | | | 143,085 | | | 141,831 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Shares | | | | | | | | |

| Three Months Ended September 30, 2023 | | Shares | | Amount | | Additional

paid in

capital | | Accumulated

Other

Comprehensive

(Loss) Income | | Accumulated

Deficit | | Total

Shareholders'

Equity |

| Balance at June 30, 2023 | | 143,369 | | | $ | 1,196,480 | | | $ | 98,832 | | | $ | (1,020) | | | $ | (902,000) | | | $ | 392,292 | |

| Shares issued on exercise of stock options and vesting of restricted stock units | | 236 | | | 2,080 | | | (929) | | | — | | | — | | | 1,151 | |

| | | | | | | | | | | | |

| Share-based compensation | | — | | | — | | | 11,808 | | | — | | | — | | | 11,808 | |

| Unrealized gain on available-sale-securities, net | | — | | | — | | | — | | | 73 | | | — | | | 73 | |

| Net loss | | — | | | — | | | — | | | — | | | (13,447) | | | (13,447) | |

| Balance at September 30, 2023 | | 143,605 | | | $ | 1,198,560 | | | $ | 109,711 | | | $ | (947) | | | $ | (915,447) | | | $ | 391,877 | |

| | | | | | | | | | | | |

| | Common Shares | | | | | | | | |

| Three Months Ended September 30, 2022 | | Shares | | Amount | | Additional

paid in

capital | | Accumulated

Other

Comprehensive

(Loss) Income | | Accumulated

Deficit | | Total

Shareholders'

Equity |

| Balance at June 30, 2022 | | 141,892 | | | $ | 1,180,884 | | | $ | 74,004 | | | $ | (1,853) | | | $ | (829,267) | | | $ | 423,768 | |

| Shares issued on exercise of stock options and vesting of performance awards and restricted stock units | | 218 | | | 3,136 | | | (3,136) | | | — | | | — | | | — | |

| | | | | | | | | | | | |

| Shared-based compensation | | — | | | — | | | 8,320 | | | — | | | — | | | 8,320 | |

| Unrealized gain on available-for-sale securities, net | | — | | | — | | | — | | | 326 | | | — | | | 326 | |

| Net loss | | — | | | — | | | — | | | — | | | (8,989) | | | (8,989) | |

| Balance at September 30, 2022 | | 142,110 | | | $ | 1,184,020 | | | $ | 79,188 | | | $ | (1,527) | | | $ | (838,256) | | | $ | 423,425 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Common Shares | | | | | | | | |

| Nine Months Ended September 30, 2023 | | Shares | | Amount | | Additional

paid in

capital | | Accumulated

Other

Comprehensive

(Loss) Income | | Accumulated

Deficit | | Total

Shareholders'

Equity |

| Balance at December 31, 2022 | | 142,268 | | | $ | 1,185,309 | | | $ | 85,489 | | | $ | (1,061) | | | $ | (864,302) | | | $ | 405,435 | |

| Shares issued on exercise of stock options and vesting of restricted stock units | | 1,127 | | | 11,141 | | | (8,117) | | | — | | | — | | | 3,024 | |

| Issuance of common shares in conjunction with ESPP program | | 210 | | | 2,110 | | | (1,204) | | | — | | | — | | | 906 | |

| Share-based compensation | | — | | | — | | | 33,543 | | | — | | | — | | | 33,543 | |

| Unrealized gain on available-for-sale securities, net | | — | | | — | | | — | | | 114 | | | — | | | 114 | |

| Net loss | | — | | | — | | | — | | | — | | | (51,145) | | | (51,145) | |

| Balance at September 30, 2023 | | 143,605 | | | $ | 1,198,560 | | | $ | 109,711 | | | $ | (947) | | | $ | (915,447) | | | $ | 391,877 | |

| | | | | | | | | | | | |

| | Common Shares | | | | | | | | |

| Nine Months Ended September 30, 2022 | | Shares | | Amount | | Additional

paid in

capital | | Accumulated

Other

Comprehensive

(Loss) Income | | Accumulated

Deficit | | Total

Shareholders'

Equity |

| Balance at December 31, 2021 | | 141,600 | | | $ | 1,177,051 | | | $ | 59,014 | | | $ | (852) | | | $ | (756,122) | | | $ | 479,091 | |

| Shares issued on exercise of stock options and vesting of performance awards and restricted stock units | | 383 | | | 5,064 | | | (4,542) | | | — | | | — | | | 522 | |

| Issuance of common shares in conjunction with ESPP program | | 127 | | | 1,905 | | | (682) | | | — | | | — | | | 1,223 | |

| Shared-based compensation | | — | | | — | | | 25,398 | | | — | | | — | | | 25,398 | |

| Unrealized loss on available-for-sale securities, net | | — | | | — | | | — | | | (675) | | | — | | | (675) | |

| Net loss | | — | | | — | | | — | | | — | | | (82,134) | | | (82,134) | |

| Balance at September 30, 2022 | | 142,110 | | | $ | 1,184,020 | | | $ | 79,188 | | | $ | (1,527) | | | $ | (838,256) | | | $ | 423,425 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2023 | | 2022 |

| (in thousands) | | (unaudited) |

| Cash flows used in operating activities: | | | | |

| Net loss | | $ | (51,145) | | | $ | (82,134) | |

| Adjustments to reconcile net loss to net cash used in operating activities | | | | |

| Depreciation and amortization | | 6,698 | | | 2,487 | |

| | | | |

| Net amortization of premiums and discounts on short-term investments | | (8,836) | | | (14) | |

| Share-based compensation expense | | 33,543 | | | 25,398 | |

| Write-down of inventory | | 916 | | | 2,464 | |

| | | | |

| Other, net | | (3,910) | | | 601 | |

| Net changes in operating assets and liabilities | | | | |

| Accounts receivable, net | | (24,463) | | | (26,356) | |

| Inventories, net | | (8,984) | | | (8,458) | |

| Prepaid expenses and other current assets | | (2,889) | | | (3,461) | |

| | | | |

| Non-current operating assets | | (16) | | | (830) | |

| Accounts payable, accrued and other liabilities | | 11,812 | | | 875 | |

| | | | |

| Operating lease liabilities | | (499) | | | (551) | |

| Net cash used in operating activities | | (47,773) | | | (89,979) | |

| Cash flows used in investing activities: | | | | |

| Purchase of investments | | (379,213) | | | (403,184) | |

| Proceeds from investments | | 391,287 | | | 346,109 | |

| Upfront lease payment | | (11,864) | | | (381) | |

| | | | |

| Purchase of long-lived assets | | (419) | | | (158) | |

| | | | |

| Capitalized patent costs | | (240) | | | — | |

| Net cash provided by (used in) investing activities | | (449) | | | (57,614) | |

| Cash flows from financing activities | | | | |

| Proceeds from exercise of stock options and employee share purchase plan | | 3,929 | | | 1,745 | |

| Finance lease payment | | (3,482) | | | — | |

| Cash provided by financing activities | | 447 | | | 1,745 | |

| | | | |

| Net decrease in cash, cash equivalents and restricted cash | | (47,775) | | | (145,848) | |

| Cash, cash equivalents and restricted cash, beginning of period | | 94,172 | | | 231,900 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 46,397 | | | $ | 86,052 | |

| | | | |

| Supplemental cash flow information | | | | |

| Cash received for interest | | $ | 3,559 | | | $ | 1,705 | |

| Cash paid for income taxes | | $ | (339) | | | $ | (779) | |

| | | | |

| Reconciliation of cash, cash equivalents and restricted cash to the condensed consolidated balance sheets | | | | |

| Cash, cash equivalents | | $ | 45,557 | | | $ | 85,341 | |

| Restricted cash | | 840 | | | 711 | |

| Total cash, cash equivalents and restricted cash | | $ | 46,397 | | | $ | 86,052 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

AURINIA PHARMACEUTICALS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1.Organization and Description of Business

Aurinia Pharmaceuticals Inc. (Aurinia or the Company) is a fully integrated biopharmaceutical company focused on delivering therapies to treat targeted patient populations with a high unmet medical need that are impacted by autoimmune, kidney and rare diseases. In January 2021, the Company introduced LUPKYNIS® (voclosporin), the first U.S. Food and Drug Administration (FDA) approved oral therapy for the treatment of adult patients with active lupus nephritis (LN) and continues to conduct pre-clinical, clinical, and regulatory activities to support the voclosporin development program as well as other assets. Aurinia engaged with Otsuka Pharmaceutical Co., Ltd. (Otsuka) as a collaboration partner for development and commercialization of LUPKYNIS in the European Union (EU), Japan, as well as the United Kingdom, Russia, Switzerland, Norway, Belarus, Iceland, Liechtenstein and Ukraine (collectively, the Otsuka Territories).

On August 17, 2021, the Company announced the addition of two novel assets AUR200 and AUR300. AUR200 and AUR300 are currently undergoing pre-clinical development with projected submission to the FDA (or their equivalent) for AUR200 in 2023 and for AUR300 in 2024.

On September 15, 2022, the European Commission (EC) granted marketing authorization of LUPKYNIS to Otsuka. The centralized marketing authorization is valid in all EU member states as well as in Iceland, Liechtenstein, Norway and Northern Ireland.

As of April 1, 2023, Aurinia's head office and registered office is located at #140, 14315-118 Avenue, Edmonton, Alberta, Canada T5L 4S6. Aurinia also has a U.S. commercial office located at 77 Upper Rock Circle Suite 700, Rockville, Maryland, 20850 United States.

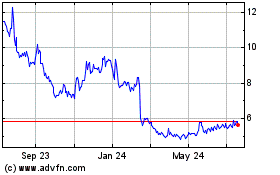

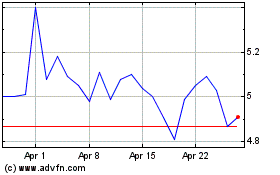

Aurinia is incorporated pursuant to the Business Corporations Act (Alberta). The Company’s common shares are traded on the Nasdaq Global Market (Nasdaq) under the symbol AUPH.

2.Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (U.S. GAAP) for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments considered necessary for fair presentation in accordance with U.S. GAAP. The condensed consolidated balance sheet as of September 30, 2023 was derived from audited annual consolidated financial statements but does not include all annual disclosures required by U.S. GAAP. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2022. The results of operations for the three and nine months ended September 30, 2023 are not necessarily indicative of the results to be expected for the full year or any other future periods.

These unaudited condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, Aurinia Pharma U.S., Inc. (Delaware incorporated) and Aurinia Pharma Limited (UK incorporated). All intercompany balances and transactions have been eliminated in consolidation and operate in one segment.

These unaudited condensed consolidated financial statements are presented in U.S. dollars, which is the Company's and all of its foreign subsidiaries' functional currency. Therefore, there is no currency translation adjustment upon consolidation as the remeasurement of gains or losses are recorded in the condensed consolidated statements of operations. All monetary assets and liabilities denominated in a foreign currency are remeasured into U.S. dollars at the exchange rate on the balance sheet date. Non-monetary assets and liabilities (along with their related expenses) are translated at the rate of exchange in effect on the date assets were acquired. Monetary income and expense items are translated at the average foreign currency period. Foreign exchange gains and losses arising on translation or settlement of a foreign currency denominated monetary item are included in the consolidated statements of operations and recorded in other (income) expense, net.

The Company is devoting the majority of its operational efforts and financial resources towards the commercialization and post approval commitments of the approved drug, LUPKYNIS. The Company is also expending efforts towards its pipeline assets AUR200 and AUR300. Taking into consideration the Company's cash, cash equivalents, restricted cash and investments of $338.5 million as of September 30, 2023, the Company believes that it has sufficient resources to fund its operations for at least the next few years beyond the date that the unaudited condensed consolidated financial statements are issued.

Major Customers: The Company currently has two main customers for U.S. commercial sales of LUPKYNIS and a collaboration partnership with Otsuka for sales of semi-finished product and license, royalty, and collaboration revenue in the Otsuka Territories.

The percentage of total revenues, net from our main customers were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

September 30, | | Nine months ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Product revenue, net | | 77% | | 48% | | 90% | | 74% |

License, royalty and collaboration revenue | | 21% | | 52% | | 9% | | 26% |

In late March 2022, the Company provided a nominal additional discount to both of its two main U.S. customers, applicable for the 2022 calendar year, in connection with holding additional amounts of LUPKYNIS on hand due to supply chain concerns. In December 2022, the Company extended the nominal discount to the end of 2023. Such discounts, or any future discounts, may result in reduced sales to these customers in subsequent periods and substantial fluctuations in revenues from period to period. The Company monitors economic conditions, the creditworthiness of customers and government regulations and funding, both domestically and abroad. The Company regularly communicates with its customers regarding the status of receivable balances. Global economic conditions and customer specific factors may require the Company to periodically reevaluate the collectability of its receivables and based on this evaluation the Company could potentially incur credit losses. The Company has had no historical write-offs related to customers or receivables.

Significant Accounting Policies

The Company's significant accounting policies have not changed from those previously described in the Company's Annual Report on Form 10-K for the year ended December 31, 2022.

Product Revenues

In the United States (and territories), the Company sells LUPKYNIS primarily to specialty pharmacies and specialty distributors. These customers subsequently distribute the Company's products to patients and healthcare providers. Revenues from product sales are recognized when the customer obtains control of the Company's product, which typically occurs upon delivery to the customer.

Reserves for discounts and allowances: Product sales are recorded at the net sales price, which includes estimates of variable consideration for which reserves are established. These reserves are based on estimates of the amounts earned or to be claimed on the related sales and are classified as reductions of accounts receivable (if the amount is payable to the customer) or a liability (if the amount is payable to a party other than the customer).

The Company's estimates of reserves established for variable consideration are calculated based upon utilizing the expected value method. The transaction price, which includes variable consideration reflecting the impact of discounts and allowances, may be subject to constraint and is included in the net sales price only to the extent that it is probable that a significant reversal of the amount of the cumulative revenues recognized will not occur in a future period. Amounts related to such items are estimated at contract inception and updated at the end of each reporting period as additional information becomes available.

Significant judgment is required in estimating variable consideration. In making these estimates, the Company considers historical data, including patient mix and inventory sold to customers that has not yet been dispensed. The Company uses a data aggregator and historical claims to estimate variable consideration for inventory sold to customers, including specialty pharmacies and specialty distributors, that has not yet been dispensed. Actual amounts may ultimately differ from the Company's estimates. If actual results vary, the Company adjusts these estimates, which could have an effect on earnings in the period of adjustment. As of September 30, 2023, the Company did not have any material adjustments to variable consideration

estimates based on actual results. These specific adjustments are detailed further in the Company's Annual Report on Form 10-K for the year ended December 31, 2022.

Accounts Receivable, Net: Accounts receivable are stated at their net realizable value. The Company's accounts receivable primarily represent amounts due to the Company from product sales and from its Otsuka collaboration agreement (Note 12). As of September 30, 2023 and December 31, 2022, accounts receivable, net are $37.9 million and $13.5 million, respectively. The Company's standard credit terms range from 30 to 45 days and does not assess whether a contract has a significant financing component if the expectation at contract inception is such that the period between the transfer of the promised good to the customer and receipt of payment will be one year or less. The Company estimates the allowance for doubtful accounts using the current expected credit loss, or CECL, model. Under the CECL model, the allowance for doubtful accounts reflects the net amount expected to be collected from the account receivables. Aurinia evaluates the collectability of these cash flows based on the asset’s amortized cost, the risk of loss even when that risk is remote, losses over an asset’s contractual life, and other relevant information available to the Company. Accounts receivable balances are written off against the allowance when it is probable that the receivable will not be collected. The allowance for doubtful accounts was nil as of September 30, 2023 and December 31, 2022.

Share-Based Compensation: The Company follows ASC Topic 718, Compensation - Stock Compensation (ASC 718), which requires the measurement and recognition of compensation expense, based on estimated fair values, for all share-based awards made to employees and directors. The Company records compensation expense based on the fair value on the grant date using the graded accelerated vesting method for all share-based payments related to stock options, performance awards (PAs), restricted stock units (RSUs) and purchases under the Company's 2021 Employee Share Purchase Plan (ESPP). The estimated fair value of performance-based awards is measured on the grant date and is recognized when it is determined that it is probable that the performance condition will be achieved. The Company has elected a policy for all share-based awards to estimate forfeitures based on historical forfeiture experience at the time of grant and revise in subsequent periods if actual forfeitures differ from those estimates.

Recently Adopted Accounting Pronouncements

In November 2021, the FASB issued ASU No. 2021-10, Government Assistance (Topic 832): Disclosures by Business Entities about Government Assistance, which requires business entities to make annual disclosures about transactions with a government (including government assistance) by analogizing to a grant or contribution accounting model. The required disclosures include the nature of the transaction, the entity's related accounting policy, the financial statement line items affected and the amounts reflected in the current period financial statements, as well as any significant terms and conditions. The guidance is effective for financial statements issued for annual periods beginning after December 15, 2021. The Company adopted the ASU effective January 1, 2022, with no material impact on the condensed consolidated financial statements as of September 30, 2023.

3. Fair Value Measurements

The Company's financial instruments consist primarily of cash and cash equivalents, investments, accounts receivable, accounts payable and accrued liabilities. The carrying value of accounts receivable, accounts payable and accrued liabilities approximate their fair value because of their short-term nature. Estimated fair value of available-for-sale debt securities are generally based on prices obtained from commercial pricing services.

In connection with measuring the fair value of its assets and liabilities, the Company seeks to maximize the use of observable inputs (market data obtained from sources independent from the Company) and to minimize the use of unobservable inputs (the Company’s assumptions about how market participants would price assets and liabilities). As a basis for considering such assumptions, a three-tier fair value hierarchy has been established, which prioritizes the inputs used in measuring fair value as follows:

•Level 1 - Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities.

•Level 2 - Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active.

•Level 3 - Unobservable inputs that reflect the reporting entity’s own assumptions.

The following table summarizes the financial assets (cash, cash equivalents, restricted cash and investments) measured at fair value on a recurring basis:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 |

| (in thousands) | | Level 1 | | Level 2 | | Level 3 | | Total |

| Financial assets: | | | | | | | | |

| Cash, cash equivalents and restricted cash | | $ | 46,397 | | | $ | — | | | $ | — | | | $ | 46,397 | |

| | | | | | | | |

| Corporate bonds | | — | | | 32,396 | | | — | | | 32,396 | |

| Commercial paper | | — | | | 93,916 | | | — | | | 93,916 | |

| Treasury bills | | — | | | 80,213 | | | — | | | 80,213 | |

| Treasury bonds | | — | | | 85,569 | | | — | | | 85,569 | |

| Yankee bonds | | — | | | — | | | — | | | — | |

| Total financial assets | | $ | 46,397 | | | $ | 292,094 | | | $ | — | | | $ | 338,491 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2022 |

| (in thousands) | | Level 1 | | Level 2 | | Level 3 | | Total |

| Financial assets: | | | | | | | | |

| Cash, cash equivalents and restricted cash | | $ | 94,172 | | | $ | — | | | $ | — | | | $ | 94,172 | |

| U.S. agency securities | | — | | | 4,948 | | | — | | | 4,948 | |

| Corporate bonds | | — | | | 104,080 | | | — | | | 104,080 | |

| Commercial paper | | — | | | 125,187 | | | — | | | 125,187 | |

| Treasury bills | | — | | | 12,282 | | | — | | | 12,282 | |

| Treasury bonds | | — | | | 42,220 | | | — | | | 42,220 | |

| Yankee bonds | | — | | | 6,501 | | | — | | | 6,501 | |

| Total financial assets | | $ | 94,172 | | | $ | 295,218 | | | $ | — | | | $ | 389,390 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

The Company's Level 1 instruments include cash, cash equivalents and restricted cash that are valued using quoted market prices. Aurinia estimates the fair values of investments in corporate debt securities, government and government related securities and certificates of deposits by taking into consideration valuations obtained from third-party pricing services. The fair value of the Company's investments classified within Level 2 is based upon observable inputs that may include benchmark yield curves, reported trades, issuer spreads, benchmark securities and reference data including market research publications. At September 30, 2023 and December 31, 2022, the weighted average remaining contractual maturities of Aurinia's Level 2 investments were approximately 7 months. It is the Company's intent for these investments to have an overall rating of A-1, or higher, by Moody’s, Standard & Poor’s and Fitch.

No credit loss allowance was recorded as of September 30, 2023 and December 31, 2022, as the Company does not believe the unrealized loss is a result of a credit loss due to the nature of the investments. Aurinia also considered the current and expected future economic and market conditions and determined that the estimate of credit losses was not significantly impacted.

Refer to Note 4, “Cash, Cash Equivalents, Restricted Cash and Investments,” for the carrying amount and related unrealized gains (losses) by type of investment.

4. Cash, Cash Equivalents, Restricted Cash and Investments

As of September 30, 2023 and December 31, 2022, the Company had $338.5 million and $389.4 million, respectively of cash, cash equivalents, restricted cash and investments summarized below. As of September 30, 2023 and December 31, 2022, $292.1 million and $295.2 million were available-for-sale debt securities which are carried at fair market value.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 |

| (in thousands) | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Estimated Fair Value |

| Cash, cash equivalents and restricted cash | | $ | 46,397 | | | $ | — | | | $ | — | | | $ | 46,397 | |

| | | | | | | | |

| Corporate bonds | | 31,820 | | | — | | | (15) | | | 31,805 | |

| Commercial paper | | 93,960 | | | — | | | (44) | | | 93,916 | |

| Treasury bills | | 80,210 | | | 3 | | | — | | | 80,213 | |

| Treasury bonds | | 85,654 | | | — | | | (85) | | | 85,569 | |

| Yankee bonds | | — | | | — | | | — | | | — | |

| Total cash, cash equivalents, restricted cash and short-term investments | | $ | 338,041 | | | $ | 3 | | | $ | (144) | | | $ | 337,900 | |

| Total long-term investment corporate bond | | 592 | | | — | | | (1) | | | 591 | |

| Total cash, cash equivalents, restricted cash and investments | | | | | | | | $ | 338,491 | |

| | | | | | | | |

| | December 31, 2022 |

| (in thousands) | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Estimated Fair Value |

| Cash, cash equivalents and restricted cash | | $ | 94,172 | | | $ | — | | | $ | — | | | $ | 94,172 | |

| U.S. agency securities | | 4,951 | | | — | | | (3) | | | 4,948 | |

| Corporate bonds | | 104,174 | | | — | | | (94) | | | 104,080 | |

| Commercial paper | | 125,255 | | | — | | | (68) | | | 125,187 | |

| Treasury bills | | 12,290 | | | — | | | (8) | | | 12,282 | |

| Treasury bonds | | 42,301 | | | — | | | (81) | | | 42,220 | |

| Yankee bonds | | 6,503 | | | — | | | (2) | | | 6,501 | |

| | | | | | | | |

| | | | | | | | |

| Total cash, cash equivalents, restricted cash and short-term investments | | $ | 389,646 | | | $ | — | | | $ | (256) | | | $ | 389,390 | |

As of September 30, 2023 and December 31, 2022, accrued interest receivable from investments were $0.7 million and $1.1 million, respectively. During the three and nine months ended September 30, 2023, the Company had $73 thousand and $114 thousand unrealized gains on available-for-sale securities, net of tax, respectively, which are included as a component of comprehensive loss on the consolidated statements of operations. During the three and nine months ended September 30, 2022, the Company had $0.3 million and $0.7 million unrealized gains and losses on available-for-sale securities, net of tax, respectively, which are included as a component of comprehensive loss on the consolidated statements of operations. Currently, the Company does not intend to sell investments that are in an unrealized loss position, and it is unlikely the Company will be required to sell the investments before recovery of their amortized cost basis, which may be at maturity. The Company has determined that the gross unrealized losses on investments at September 30, 2023, were temporary in nature. Realized gains or losses were immaterial during the three and nine months ended September 30, 2023 and 2022.

The Company's investments as of September 30, 2023 mature at various dates through August 2025.

5. Inventories, net

Inventories are valued under a standard costing methodology on a first-in, first-out basis and are stated at the lower of cost or net realizable value. The Company capitalizes inventory costs related to products to be sold in the ordinary course of business.

The Company makes a determination of capitalizing inventory costs for a product based on, among other factors, status of regulatory approval, information regarding safety, efficacy and expectations relating to commercial sales and recoverability of costs. Capitalized costs of inventories for LUPKYNIS mainly include third party manufacturing costs, transportation, storage, insurance, and allocated internal labor. Due to the nature of the Company's supply chain process, inventory that is owned by the Company, is physically stored at third-party warehouses, logistics providers, and contract manufacturers.

The Company assesses recoverability of inventory each reporting period to determine any write-down to net realizable value resulting from excess or obsolete inventories. As of September 30, 2023 and December 31, 2022, Aurinia recorded reserves of finished goods inventories of approximately $1.1 million and $3.9 million, respectively, which were primarily related to potential inventory obsolescence.

The components of inventory, net are as follows:

| | | | | | | | | | | | | | |

| (in thousands) | | September 30, 2023 | | December 31, 2022 |

| Raw materials | | $ | 1,985 | | | $ | 2,217 | |

| Work in process | | 29,639 | | | 21,059 | |

| Finished goods, net of reserve | | 1,196 | | | 1,476 | |

| Total inventories, net | | $ | 32,820 | | | $ | 24,752 | |

6.Prepaid Expenses

Prepaid expenses are as follows:

| | | | | | | | | | | | | | |

| (in thousands) | | September 30, 2023 | | December 31, 2022 |

| | | | |

| Prepaid assets | | $ | 7,288 | | | $ | 5,451 | |

| Prepaid deposits | | 6,922 | | | 6,330 | |

| Prepaid insurance | | 1,948 | | | 1,799 | |

| Total prepaid expenses | | $ | 16,158 | | | $ | 13,580 | |

7.Intangible Assets

The following table summarizes the carrying amount of intangible assets, net of accumulated amortization.

| | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 |

| (in thousands) | | Gross Carrying

Value | | Accumulated

Amortization | | Net Carrying

Amount |

| Patents | | $ | 1,802 | | | $ | (1,287) | | | $ | 515 | |

| Acquired intellectual property and reacquired rights | | 15,126 | | | (10,538) | | | 4,588 | |

| Internal-use software implementation costs | | 2,873 | | | (2,715) | | | 158 | |

| | $ | 19,801 | | | $ | (14,540) | | | $ | 5,261 | |

| | | | | | | | | | | | | | | | | | | | |

| | December 31, 2022 |

| (in thousands) | | Gross Carrying

Value | | Accumulated

Amortization | | Net Carrying

Amount |

| Patents | | $ | 1,569 | | | $ | (1,262) | | | $ | 307 | |

| Acquired intellectual property and reacquired rights | | 15,126 | | | (9,838) | | | 5,288 | |

| Internal-use software implementation costs | | 2,873 | | | (2,043) | | | 830 | |

| | $ | 19,568 | | | $ | (13,143) | | | $ | 6,425 | |

Amortization expense for the three months ended September 30, 2023 and 2022 was approximately $0.5 million for both periods and for the nine months ended September 30, 2023 and 2022 was approximately $1.4 million and $1.6 million, respectively.

8. Property and Equipment, net

Property and equipment, net are as follows:

| | | | | | | | | | | | | | |

| (in thousands) | | September 30, 2023 | | December 31, 2022 |

| Construction in progress | | $ | — | | | $ | 255 | |

| Leasehold improvements | | 3,243 | | | 2,978 | |

| Office equipment | | 631 | | | 645 | |

| Furniture | | 1,141 | | | 976 | |

| Computer equipment | | 235 | | | 251 | |

| | 5,250 | | 5,105 |

| Less accumulated depreciation | | (1,754) | | | (1,455) | |

| Property and equipment, net | | $ | 3,496 | | | $ | 3,650 | |

9. Lease Obligations

The Company has the following lease obligations:

Victoria, British Columbia

In December 2020, Aurinia entered into a lease for office space in Victoria, British Columbia. During September 2022, the fixed lease term ended on the Victoria lease and the Company exercised its right to enter into a short-term month to month lease, of which expenses are incurred in SG&A. On March 31, 2023, the Company terminated the Victoria lease.

Rockville, Maryland

During March 2020, the Company entered into a lease for its U.S. commercial office in Rockville, Maryland for a total of 30,531 square feet of office space. The lease has a remaining term of approximately eight years and has an option to extend for two five-year periods after the initial term of 11 years has elapsed and has an option to terminate after seven years. As of September 30, 2023, the Company had a right-of-use (ROU) asset of $4.6 million and lease liability of $7.5 million included in the condensed consolidated balance sheets. As of December 31, 2022, the Company had a right of use asset of $4.9 million and lease liability of $8.0 million included in the condensed consolidated balance sheets. The Company recorded leasehold improvement incentives in the amount of $2.3 million as additions to the lease liability. The lease term commenced on March 12, 2020. When measuring the lease liability, the Company discounted lease payments using its incremental borrowing rate at March 12, 2020. The incremental borrowing rate applied to the lease liability on March 12, 2020 was 5.2% based on the financial position of the Company, geographical region and term of lease.

Edmonton, Alberta

During October 2022, the Company entered into a long term lease in Edmonton for a total of 4,375 square feet of office space. The lease is a six year lease and has an option to renew after five years at prevailing market rates. The lease commenced on November 1, 2022 and the Company recorded the lease as an operating lease. The lease is not material to the Company's financial position.

For all leases, the Company incurs variable lease costs. These costs include operation and maintenance costs included in SG&A and are expensed as incurred. The variable lease costs are not material to the Company's financial position.

The operating lease costs for all leases for the three and nine months ended September 30, 2023 were $0.2 million and $0.6 million, respectively. Operating lease costs for the three and nine months ended September 30, 2022 were $0.2 million and $0.8 million, respectively.

Monoplant

On December 15, 2020, the Company entered into a collaborative agreement with Lonza to build a dedicated manufacturing facility within Lonza’s existing small molecule facility in Visp, Switzerland. The dedicated facility (also referred to as "monoplant") is equipped with state-of-the-art manufacturing equipment to provide cost and production efficiency for the manufacturing of voclosporin, while expanding existing capacity and providing supply security to meet future commercial demand.

Following U.S. regulatory approval of LUPKYNIS in January 2021, the construction of the monoplant began. The Company has completed a capital expenditure payment program for the monoplant totaling approximately CHF 21.0 million. The first capital expenditure payment was made in February 2021 of $11.8 million (CHF 10.5 million) and was treated as an upfront lease payment and recorded under other non-current assets on the condensed consolidated balance sheets. The second payment of $11.9 million (CHF 10.5 million) became due when the facility fulfilled the required operational qualifications, which occurred during the second quarter of 2023. The Company now has the exclusive right to use the monoplant by paying a quarterly fixed facility fee.

The Company has determined that the arrangement will be accounted for as a finance lease under ASC 842. Under ASC 842, the lease term begins at the commencement date and is based on the noncancellable period for which a lessee has the right to use an underlying asset. Aurinia determined that the lease commencement occurred at the point when the FDA manufacturing validation process began, which occurred during the three months ended June 30, 2023.

The Company, at lease inception, recorded an ROU asset of approximately $117.6 million and a corresponding lease liability of $94.1 million, which is the present value of the minimum lease payments beginning July 2023 and expiring in 2030. The incremental borrowing rate applied to value the lease liability at inception is 6.19%, which was based on the financial position of the Company, geographical region and term of lease.

As of September 30, 2023 the ROU asset, net and corresponding lease liability balance were $113.1 million and $85.5 million, respectively. For the three and nine months ended September 30, 2023, related to the lease, ROU amortization was $4.4 million and $4.6 million respectively, and interest expense was $1.4 million and $1.5 million, respectively.

The following table represents the weighted-average remaining lease terms and discount rates as of September 30, 2023:

| | | | | | | | | | | | | | |

| | As of September 30, 2023 |

| | Weighted Average Remaining Lease Term (years) | | Weighted Average Discount Rate |

| Operating leases | | 7.9 | | 5.28% |

Finance lease | | 6.5 | | 6.19% |

Supplemental cash flow information related to the leases are as follows:

| | | | | | | | | | | | | | |

| | Nine months ended

September 30, |

| | 2023 | | 2022 |

| | (in thousands) |

Cash paid for amounts included in the measurement of lease liabilities | | | | |

Financing cash flows from finance lease | | $ | (3,482) | | | $ | — | |

Operating cash flows from finance lease | | $ | (718) | | | $ | — | |

Operating cash flows from operating leases | | $ | (805) | | | $ | (897) | |

The following table provides a summary of lease liabilities payments for the next five years and thereafter:

| | | | | | | | | | | | | | |

| (in thousands) | | Finance Lease Payments | | Operating Lease Payments |

| Remainder of 2023 | | $ | 3,963 | | | $ | 276 | |

| 2024 | | 15,851 | | | 1,113 | |

| 2025 | | 15,851 | | | 1,141 | |

| 2026 | | 15,851 | | | 1,169 | |

| 2027 | | 15,851 | | | 1,198 | |

| Thereafter | | 35,663 | | | 4,533 | |

| Total future minimum lease payments | | 103,030 | | | 9,430 | |

| Less: lease imputed interest | | (17,509) | | | (1,737) | |

| Total future minimum lease payments | | $ | 85,521 | | | $ | 7,693 | |

Beinheim

The Company has entered into an equipment and facility finance lease for a backup manufacturing encapsulation site in Beinheim, France that has not yet commenced operations and is therefore, not included in the above table. As part of the agreement, the Company expects to make payments of approximately $1.0 million prior to lease commencement and the present value of minimum lease payments will total approximately $0.1 million.

10.Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities are as follows:

| | | | | | | | | | | | | | |

| (in thousands) | | September 30, 2023 | | December 31, 2022 |

| | | | |

| Employee accruals | | $ | 18,177 | | | $ | 20,214 | |

| Commercial accruals | | 13,437 | | | 8,620 | |

| Accrued R&D projects | | 5,678 | | | 5,350 | |

| Trade payables | | 8,854 | | | 3,087 | |

| Other accrued liabilities | | 5,938 | | | 2,094 | |

| Income taxes payable | | 225 | | | 625 | |

| Total accounts payable and accrued liabilities | | $ | 52,309 | | | $ | 39,990 | |

11.Deferred Compensation and Other Non-current Liabilities

The Company recorded other non-current liabilities of $10.3 million and $12.2 million as of September 30, 2023 and December 31, 2022, respectively. The balance as of September 30, 2023 and December 31, 2022 primarily included deferred compensation arrangements whereby certain former executive officers as of March 8, 2012 were provided with future potential employee benefit obligations for remaining with the Company for a certain period of time. These obligations are also contingent on the occurrence of uncertain future events. For further discussion, refer to Note 16, “Related Party”.

12.License and Collaboration Agreements

Otsuka Contract

On December 17, 2020, the Company entered into a collaboration and license agreement with Otsuka for the development and commercialization of oral LUPKYNIS in the Otsuka Territories.

As part of the agreement, the Company received an upfront cash payment of $50.0 million in 2020 for the license agreement and has the potential to receive up to $50.0 million in regulatory and pricing approval related milestones. The Company provides semi-finished product of LUPKYNIS to Otsuka on a cost-plus basis, and receives tiered royalties ranging from 10 to

20 percent (dependent on territory and achievement of sale thresholds) on net product sales by Otsuka, along with additional milestone payments based on the attainment of certain annual sales. In addition, certain collaboration services are to be provided to Otsuka on agreed upon rates.

In furtherance of the collaboration and license agreement with Otsuka mentioned above, on August 1, 2022, the Company entered into a commercial supply agreement with Otsuka, formalizing the terms to supply semi-finished goods of LUPKYNIS to Otsuka in the Otsuka Territories, including sharing production capacity of the monoplant.

On September 15, 2022, the European Commission (EC) granted marketing authorization of LUPKYNIS. The centralized marketing authorization is valid in all EU member states as well as in Iceland, Liechtenstein, Norway and Northern Ireland. The approval triggered a $30.0 million milestone to the Company, which was recognized as collaboration revenue for the year ended December 31, 2022. On November 29, 2022 Aurinia announced that the MHRA had granted marketing authorization of LUPKYNIS in Great Britain. On April 24, 2023, LUPKYNIS received regulatory approval in Switzerland. The Company continues to progress with regulatory approval with Otsuka in the other Otsuka Territories.

During the three months ended September 30, 2023, the Company received notification that the pricing and reimbursement milestone was secured. As a result, this triggered a $10.0 million milestone which was recognized as collaboration revenue in the quarter.

For the three and nine months ended September 30, 2023, the Company recognized $12.7 million and $13.2 million, respectively of license, royalty and collaboration revenue from services provided under the Otsuka agreement. For the three and nine months ended September 30, 2022, the Company recognized $30.2 million and $30.4 million, respectively.

Riptide License

On August 17, 2021, AUR300 (M2 macrophage modulation via CD206 binding) was secured through a global licensing and research agreement with Riptide Bioscience, Inc. (Riptide), a private company. As part of the agreement, in 2021 the Company paid Riptide an upfront license fee of $6.0 million which was expensed as research and development on the condensed consolidated statements of operations. During the first quarter of 2022, Aurinia paid $4.0 million for the achievement of a one-time milestone. Additional payments are due upon certain development, clinical and regulatory milestones, and royalties will be payable upon commercialization.

13.Net Loss per Common Share

Basic and diluted net loss per common share is computed by dividing net loss by the weighted average number of common shares outstanding. Since the Company was in a loss position for all periods presented, diluted net loss per share is the same as basic net loss per share. The numerator and denominator used in the calculation of basic and diluted net loss per common share are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

September 30, | | Nine months ended

September 30, |

| (in thousands, except per share data) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | | $ | (13,447) | | | $ | (8,989) | | | $ | (51,145) | | | $ | (82,134) | |

| Weighted average common shares outstanding | | 142,847 | | | 141,856 | | | 143,085 | | | 141,831 | |

| Net loss per common share (expressed in $ per share) | | $ | (0.09) | | | $ | (0.06) | | | $ | (0.36) | | | $ | (0.58) | |

The Company did not include the securities in the following table in the computation of the net loss per common share because the effect would have been anti-dilutive during each period:

| | | | | | | | | | | | | | |

| | Nine months ended

September 30, |

| (in thousands) | | 2023 | | 2022 |

| Stock options | | 12,400 | | | 14,299 | |

| Unvested performance awards | | 921 | | | — | |

| Unvested restricted stock units | | 6,968 | | | 2,098 | |

| | 20,289 | | | 16,397 | |

14.Share-based Compensation

The Company's Amended and Restated Equity Incentive Plan (the Plan), which was adopted and approved by the Company's shareholders in June 2021, allows for an issuance of up to an aggregate of 23.8 million shares and provides for grants of stock options, performance awards (PAs), and restricted stock units (RSUs) that may be settled in cash and common shares. Also in June 2021, the Company's shareholders adopted and approved the Company's 2021 ESPP, which allows for the issuance of up to 2.5 million shares. The 2021 ESPP is intended to qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue Code but also permits the Company to include the employees, including non-United States employees, in offerings not intended to qualify under Section 423. The purpose of the 2021 ESPP is to provide eligible employees with opportunities to purchase the Company’s common shares at a discounted price.

During 2022, the Company modified the 2021 ESPP for the current and future offerings. The new ESPP terms shortened the plan from four purchases over a 24-month offering period to two purchases over a 12-month offering period. Additionally, the ESPP now contains a rollover mechanism; that is, if the stock price on the purchase date is less than the offering price (as that is determined under the 2021 ESPP), that offering is then canceled and any participants are rolled into a new 12-month offering period at the lower price.

In addition to stock options, PAs and RSUs granted under the Plan, the Company has granted certain stock options and RSUs as inducements material to new employees entering employment in accordance with Nasdaq Listing Rule 5635(c)(4). The inducements were granted outside of the Plan.

Stock Options

The Plan requires the exercise price of each option not to be less than the closing market price of the Company’s common shares on the business day immediately prior to the date of grant. The Board of Directors approves the vesting criteria and periods at its discretion. The options issued under the Plan are accounted for as equity-settled share-based payments.

The Company used the Black-Scholes option pricing model to estimate the fair value of the options granted. The assumptions used for the annual volatility and expected life of the options are reviewed and updated annually. The Company considers historical volatility of its common shares in estimating its future stock price volatility. The risk-free interest rate for the expected life of the options was based on the yield available on government benchmark bonds with an approximate equivalent

remaining term at the time of the grant. The expected life is based upon the contractual term, taking into account expected employee exercise and expected post-vesting employment termination behavior.

The following weighted average assumptions were used to estimate the fair value of the options granted during the nine months ended September 30, 2023 and September 30, 2022:

| | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| Annualized volatility | | 71 | % | | 70 | % |

| Risk-free interest rate | | 3.92 | % | | 2.01 | % |

| Expected life of options in years | | 5.0 years | | 5.0 years |

| Estimated forfeiture rate | | 12.7 | % | | 12.1 | % |

| Dividend rate | | 0.0 | % | | 0.0% |

| Fair value per common share option | | $ | 5.94 | | | $ | 6.60 | |

The increase of the risk-free interest rate during the nine months ended September 30, 2023 was due to the increase of higher yields on government benchmark bonds.

The following table summarizes the option award activity for the nine months ended September 30, 2023:

| | | | | | | | | | | | | | |

| | September 30, 2023 |

| | Number of shares (in thousands) | | Weighted average exercise price $ |

| Outstanding - December 31, 2022 | | 13,295 | | | $ | 12.09 | |

| Granted | | 675 | | | 9.68 | |

| Exercised | | (558) | | | 5.27 | |

| Forfeited | | (1,012) | | | 14.11 | |

| Outstanding - September 30, 2023 | | 12,400 | | | $ | 12.10 | |

| | | | |

Restricted Stock Units and Performance Awards

The Company has granted RSUs and PAs under the Plan, as well as inducements for certain new hires as discussed above. The RSUs and PAs are fair valued based on the previous business days' market price of common shares on the date of the grant.

The following table summarizes the RSU and PA activity for the nine months ended September 30, 2023:

| | | | | | | | | | | | | | |

| | September 30, 2023 |

| | Number of shares (in thousands) | | Weighted average fair value price $ |

| Outstanding - December 31, 2022 | | 1,980 | | | $ | 10.84 | |

| Granted | | 6,775 | | | 9.04 | |

| Vested | | (569) | | | 11.71 | |

| Forfeited | | (297) | | | 9.31 | |

| Outstanding - September 30, 2023 | | 7,889 | | | $ | 9.29 | |

Compensation Expense

The Company recognized share-based compensation expense for the three and nine months ended September 30, 2023 and September 30, 2022 as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

September 30, | | Nine months ended

September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Research and development | | $ | 1,975 | | | $ | 1,489 | | | $ | 5,679 | | | $ | 3,531 | |

| Selling, general and administrative | | 9,560 | | | 6,625 | | | 26,969 | | | 21,480 | |

| Capitalized under inventories | | 273 | | | 206 | | | 895 | | | 387 | |

| Share-based compensation expense | | $ | 11,808 | | | $ | 8,320 | | | $ | 33,543 | | | $ | 25,398 | |

As of September 30, 2023, there was $39.2 million of unrecognized share-based compensation expense related to unvested awards granted which is expected to be recognized over a weighted-average period of approximately 1.4 years.

15.Income Taxes

The effective tax rates for the three and nine months ended September 30, 2023 and September 30, 2022 differed from the federal statutory rate applied to losses before income taxes primarily as a result of the mix of income, losses and valuation allowances.

The Company recognized an income tax expense of approximately $298 thousand and $92 thousand for the three and nine months ended September 30, 2023 respectively. The Company recognized an income tax expense of approximately $954 thousand and $973 thousand for the three and nine months ended September 30, 2022. The 2023 quarter to date income tax expense recognized for 2023 relates to a current period tax expense that is not offset by a tax benefit as the Company had losses which were fully offset by a valuation allowance in its significant jurisdictions and withholding taxes on foreign income. The 2023 year to date tax expense is partially offset by a prior period favorable adjustment in U.S. income taxes. The income tax expense recognized for 2022 was a result of income in certain jurisdictions. The tax expense was not offset by a tax benefit as the Company had losses which were fully offset by a valuation allowance in its significant jurisdictions.

16.Related Party Transactions

ILJIN is considered to be a related party due to their equity ownership of over 5%. The outstanding related party amount payable to ILJIN is the result of a milestone achieved as of September 30, 2023. The amount payable to ILJIN of $0.5 million as of September 30, 2023 was recorded in other current liabilities.

On September 21, 2023, the Company appointed Dr. Robert T. Foster to the Board of Directors. Dr. Foster is considered a related party since he is one of the former executive officers of the Company who, as of March 8, 2012 was provided with future potential employee benefit obligations for remaining with the Company for a certain period of time. These obligations are contingent on the occurrence of uncertain future events. As of September 30, 2023, the Company had $0.5 million and $6.4 million of current and non-current liabilities related to Dr. Foster, respectively. From the time that Dr. Foster became a related party, the Company has not made any payments to him for the former employee benefit obligations.

17.Commitments and Contingencies

The Company may, from time to time, be subject to claims and legal proceedings brought against it in the normal course of business. Such matters are subject to many uncertainties. Management believes the ultimate resolution of such contingencies will not have a material adverse effect on the consolidated financial position of the Company. The Company's material commitments and contingencies have not changed in any material manner from those previously described in the Company's Annual Report on Form 10-K for the year ended December 31, 2022 and the quarterly report for the quarter ended June 30, 2023.

Other Funding Commitments

In the normal course of business, the Company enters into agreements with contract research organizations, contract manufacturing organizations and other third parties for services to be provided to the Company. Generally, these agreements