Atlantic American Corporation Reports Second Quarter Results for 2020

August 11 2020 - 1:07PM

Atlantic American Corporation (Nasdaq- AAME) today reported net

income for the three month period ended June 30, 2020 of $6.5

million, or $0.30 per diluted share, as compared to net loss of

$4.4 million, or $0.22 per diluted share, for the comparable period

in 2019. For the six month period ended June 30, 2020, the

Company reported net loss of $1.6 million, or $0.09 per diluted

share, as compared to net loss of $0.3 million, or $0.02 per

diluted share, for the comparable period in 2019. The

increase in net income during the second quarter of 2020 was

primarily due to a $7.3 million decrease in total benefits and

expenses coupled with an increase in unrealized gains on equity

securities of $6.7 million for the second quarter of 2020 as

compared to the second quarter of 2019. The net loss for the

six month period ended June 30, 2020 was primarily due to $7.1

million of net unrealized losses on equity securities during the

six month period ended June 30, 2020 as compared to $1.2 million of

unrealized gains on equity securities during the comparable period

in 2019. Changes in unrealized gains and losses on equity

securities for the applicable periods are primarily the result of

fluctuations in the market values of the Company’s equity

investments.

Excluding the effects of realized or unrealized

gains or losses and taxes, operating income (as defined below)

increased $7.8 million in the three month period ended June 30,

2020 from the three month period ended June 30, 2019. For the

six month period ended June 30, 2020, operating income increased

$8.4 million over the comparable period in 2019. The increase

in operating income was primarily due to favorable loss experience

in the Company’s life and health operations, resulting from a

significant decrease in the number of incurred claims within the

Medicare supplement line of business. This decrease in the

number of incurred claims was primarily attributable to the

Company’s individual policy holders being subject to varying

degrees of shelter in place orders instituted throughout the United

States during the second quarter of 2020 as a result of

COVID-19.

Commenting on the results, Hilton H. Howell,

Jr., chairman, president and chief executive officer, stated, “I am

delighted with the performance of each of our operating segments

and proud to report the return to operating income for the

year. Our BankersWorksite® division is on track for a record

year of new sales which will further promote our diversification

efforts. Additionally, our property and casualty operations

continue to perform well and had one of the best quarters on

record. Our Company remains strong and firmly committed to

delivering our superior service to policyholders, employers, and

agents in these unprecedented times.”

Atlantic American Corporation is an insurance

holding company involved through its subsidiary companies in

specialty markets of the life, health, and property and casualty

insurance industries. Its principal insurance subsidiaries

are American Southern Insurance Company, American Safety Insurance

Company, Bankers Fidelity Life Insurance Company and Bankers

Fidelity Assurance Company.

Note regarding non-GAAP financial measure:

Atlantic American Corporation presents its consolidated financial

statements in accordance with U.S. generally accepted accounting

principles (GAAP). However, from time to time, the Company

may present, in its public statements, press releases and filings

with the Securities and Exchange Commission, non-GAAP financial

measures such as operating income (loss). Management believes

operating income (loss) is a useful metric for investors, potential

investors, securities analysts and others because it isolates the

“core” operating results of the Company before considering certain

items that are either beyond the control of management (such as

income tax expense, which is subject to timing, regulatory and rate

changes depending on the timing of the associated revenues and

expenses) or are not expected to regularly impact the Company’s

operating results (such as any realized and unrealized investment

gains (losses), which are not a part of the Company’s primary

operations and are, to a limited extent, subject to discretion in

terms of timing of realization). The financial data attached

includes a reconciliation of operating income (loss) to net income

(loss), the most comparable GAAP financial measure. The

Company’s definition of operating income (loss) may differ from

similarly titled financial measures used by others. This

non-GAAP financial measure should be considered supplemental to,

and not a substitute for, financial information prepared in

accordance with GAAP.

Note regarding Private Securities Litigation

Reform Act: Except for historical information contained herein,

this press release contains forward-looking statements that involve

a number of risks and uncertainties. Actual results could

differ materially from those indicated by such forward-looking

statements due to a number of factors and risks detailed from time

to time in statements and reports that Atlantic American

Corporation files with the Securities and Exchange Commission.

|

For further information contact: |

|

|

|

J. Ross Franklin |

|

Hilton H. Howell, Jr. |

|

Chief Financial Officer |

|

Chairman, President & CEO |

|

Atlantic American Corporation |

|

Atlantic American Corporation |

|

404-266-5580 |

|

404-266-5505 |

Atlantic American

CorporationFinancial Data

| |

Three Months

Ended |

|

Six Months

Ended |

| |

June 30, |

|

June 30, |

|

(Unaudited; In thousands, except per share data) |

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

| Insurance

premiums |

|

|

|

|

|

|

|

|

Life and health |

$ |

30,675 |

|

|

$ |

30,715 |

|

|

$ |

61,303 |

|

|

$ |

61,691 |

|

|

Property and casualty |

|

15,824 |

|

|

|

14,754 |

|

|

|

30,746 |

|

|

|

28,560 |

|

|

Insurance premiums, net |

|

46,499 |

|

|

|

45,469 |

|

|

|

92,049 |

|

|

|

90,251 |

|

| |

|

|

|

|

|

|

|

| Net

investment income |

|

1,850 |

|

|

|

2,313 |

|

|

|

3,889 |

|

|

|

4,647 |

|

| Realized

investment gains, net |

|

- |

|

|

|

610 |

|

|

|

249 |

|

|

|

1,995 |

|

| Unrealized

gains (losses) on equity securities, net |

|

1,355 |

|

|

|

(5,337 |

) |

|

|

(7,100 |

) |

|

|

1,152 |

|

| Other

income |

|

33 |

|

|

|

72 |

|

|

|

60 |

|

|

|

100 |

|

| |

|

|

|

|

|

|

|

|

Total revenue |

|

49,737 |

|

|

|

43,127 |

|

|

|

89,147 |

|

|

|

98,145 |

|

| |

|

|

|

|

|

|

|

| Insurance

benefits and losses incurred |

|

|

|

|

|

|

|

|

Life and health |

|

17,055 |

|

|

|

24,288 |

|

|

|

41,104 |

|

|

|

50,552 |

|

|

Property and casualty |

|

10,021 |

|

|

|

9,863 |

|

|

|

19,555 |

|

|

|

18,906 |

|

| Commissions

and underwriting expenses |

|

10,854 |

|

|

|

11,509 |

|

|

|

23,480 |

|

|

|

22,524 |

|

| Interest

expense |

|

414 |

|

|

|

545 |

|

|

|

890 |

|

|

|

1,091 |

|

| Other

expense |

|

3,112 |

|

|

|

2,511 |

|

|

|

6,064 |

|

|

|

5,376 |

|

| |

|

|

|

|

|

|

|

|

Total benefits and expenses |

|

41,456 |

|

|

|

48,716 |

|

|

|

91,093 |

|

|

|

98,449 |

|

| |

|

|

|

|

|

|

|

| Income

(loss) before income taxes |

|

8,281 |

|

|

|

(5,589 |

) |

|

|

(1,946 |

) |

|

|

(304 |

) |

| Income tax

expense (benefit) |

|

1,749 |

|

|

|

(1,163 |

) |

|

|

(391 |

) |

|

|

(40 |

) |

| |

|

|

|

|

|

|

|

| Net

income (loss) |

$ |

6,532 |

|

|

$ |

(4,426 |

) |

|

$ |

(1,555 |

) |

|

$ |

(264 |

) |

| |

|

|

|

|

|

|

|

|

Earnings (loss) per common share (basic) |

$ |

0.31 |

|

|

$ |

(0.22 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.02 |

) |

|

Earnings (loss) per common share (diluted) |

$ |

0.30 |

|

|

$ |

(0.22 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.02 |

) |

| |

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measure |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net income

(loss) |

$ |

6,532 |

|

|

$ |

(4,426 |

) |

|

$ |

(1,555 |

) |

|

$ |

(264 |

) |

| Income tax

expense (benefit) |

|

1,749 |

|

|

|

(1,163 |

) |

|

|

(391 |

) |

|

|

(40 |

) |

| Realized

investment gains, net |

|

- |

|

|

|

(610 |

) |

|

|

(249 |

) |

|

|

(1,995 |

) |

| Unrealized

(gains) losses on equity securities, net |

|

(1,355 |

) |

|

|

5,337 |

|

|

|

7,100 |

|

|

|

(1,152 |

) |

| |

|

|

|

|

|

|

|

|

Non-GAAP Operating income (loss) |

$ |

6,926 |

|

|

$ |

(862 |

) |

|

$ |

4,905 |

|

|

$ |

(3,451 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

|

Selected Balance Sheet Data |

|

2020 |

|

|

|

2019 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Total cash

and investments |

$ |

283,254 |

|

|

$ |

281,530 |

|

|

|

|

|

|

Insurance subsidiaries |

|

276,585 |

|

|

|

274,730 |

|

|

|

|

|

|

Parent and other |

|

6,669 |

|

|

|

6,800 |

|

|

|

|

|

| Total

assets |

|

385,737 |

|

|

|

377,626 |

|

|

|

|

|

| Insurance

reserves and policyholder funds |

|

204,711 |

|

|

|

201,906 |

|

|

|

|

|

| Debt |

|

33,738 |

|

|

|

33,738 |

|

|

|

|

|

| Total

shareholders' equity |

|

123,894 |

|

|

|

118,394 |

|

|

|

|

|

| Book value

per common share |

|

5.79 |

|

|

|

5.51 |

|

|

|

|

|

| Statutory

capital and surplus |

|

|

|

|

|

|

|

|

Life and health |

|

34,735 |

|

|

|

35,546 |

|

|

|

|

|

|

Property and casualty |

|

45,927 |

|

|

|

45,827 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

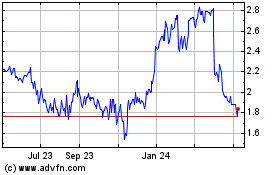

Atlantic American (NASDAQ:AAME)

Historical Stock Chart

From Jan 2025 to Feb 2025

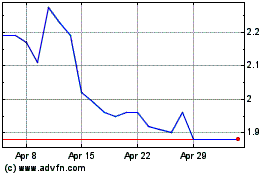

Atlantic American (NASDAQ:AAME)

Historical Stock Chart

From Feb 2024 to Feb 2025