Arqit Quantum Inc. Announces Closing of $16.2 Million Registered Direct Offering

September 12 2023 - 4:05PM

Arqit Quantum Inc. (Nasdaq: ARQQ, ARQQW) (“Arqit” or the

“Company”), a global leader in quantum encryption technology, today

announced the closing of its previously announced registered direct

offering (the “Offering”), pursuant to which it sold 12,820,513 of

the Company’s ordinary shares, $0.0001 par value per share (the

“Ordinary Shares”), together with warrants (the “Warrants”) to

purchase up to 12,820,513 Ordinary Shares at a combined offering

price of $0.78 per Ordinary Share and accompanying Warrant. The

Warrants have an exercise price of $0.78 per Ordinary Share, are

immediately exercisable and will expire five years from the initial

exercise date.

In addition, existing shareholders Heritage

Assets SCSP, Ropemaker Nominees Limited and Carlo Calabria

purchased 7,935,164 Ordinary Shares, together with Warrants to

purchase up to 7,935,164 Ordinary Shares at a combined offering

price of $0.78 per Ordinary Share and accompanying Warrant. Arqit

director Manfredi Lefebvre d’Ovidio has sole investment and voting

power over the shares held by Heritage Assets SCSP, long-time Arqit

shareholder Notion Capital is the beneficial owner of the Arqit

shares held by Ropemaker Nominees Limited and Carlo Calabria is an

Arqit director.

H.C. Wainwright & Co. acted as the sole

placement agent for the Offering.

The gross proceeds of the Offering were

approximately $16.2 million, before deducting the placement agent's

fees and other Offering expenses. Arqit intends to use the net

proceeds from this Offering to support the growth of its channel

partnerships and for general corporate purposes.

Commenting, Arqit Chairman and CEO David

Williams said, “We are seeing traction in onboarding major global

technology vendors as channel partners. Our adjusted cash and

cash equivalents as of August 31, 2023, after taking into account

the net proceeds of the offering following the deduction estimated

offering expenses, is $46.3 million. Combined with our reduced

monthly operating costs of approximately $3.2 million, the proceeds

from this offering are expected to allow us to present a strong

channel partnership proposition.”

A “shelf” registration statement on Form F-3, as

amended (File Number 333-268786), relating to the offered

securities was initially filed with the Securities and Exchange

Commission (“SEC”) on 14 December 2022 and was declared effective

on 30 December 2022. The Offering is being made only by means of a

prospectus, including a prospectus supplement, forming a part of an

effective registration statement. A prospectus supplement and

accompanying prospectus relating to the Offering was filed with the

SEC on September 11, 2023. Electronic copies of the prospectus

supplement and accompanying prospectus may be obtained on the SEC’s

website at www.sec.gov or by contacting H.C. Wainwright & Co.,

LLC at 430 Park Avenue, 3rd Floor, New York, NY 10022, by phone at

(212) 856-5711 or e-mail at placements@hcwco.com.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of these Company

securities, nor shall there be any sale of these Company securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.

About Arqit

Arqit supplies a unique Symmetric Key Agreement

Platform-as-a-Service which makes the communications links of any

networked device, cloud machine or data at rest secure against both

current and future forms of attack on encryption – even from a

quantum computer. Arqit’s Symmetric Key Agreement Platform delivers

a lightweight software agent that allows devices to create

encryption keys locally in partnership with any number of other

devices. The keys are computationally secure and operate over zero

trust networks. It can create limitless volumes of keys with any

group size and refresh rate and can regulate the secure entrance

and exit of a device in a group. The agent is lightweight and will

thus run on the smallest of end point devices. The Product sits

within a growing portfolio of granted patents but also works in a

standards compliant manner which does not oblige customers to make

a disruptive rip and replace of their technology. Arqit was

recently awarded the Innovation in Cyber award at the UK National

Cyber Awards and Cyber Security Software Company of the Year Award

at the UK Cyber Security Awards. www.arqit.uk

Media relations enquiries:

Arqit: pr@arqit.uk

Gateway: arqit@gateway-grp.com

Investor relations

enquiries:

Arqit:

investorrelations@arqit.ukGateway:

arqit@gateway-grp.com

Caution About Forward-Looking

Statements

This communication includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements, other than statements of

historical facts, may be forward-looking statements. These

forward-looking statements are based on Arqit’s expectations and

beliefs concerning future events and involve risks and

uncertainties that may cause actual results to differ materially

from current expectations. These factors are difficult to predict

accurately and may be beyond Arqit’s control. Forward-looking

statements in this communication or elsewhere speak only as of the

date made. New uncertainties and risks arise from time to time, and

it is impossible for Arqit to predict these events or how they may

affect it. Except as required by law, Arqit does not have any duty

to, and does not intend to, update or revise the forward-looking

statements in this communication or elsewhere after the date this

communication is issued. In light of these risks and uncertainties,

investors should keep in mind that results, events or developments

discussed in any forward-looking statement made in this

communication may not occur. Uncertainties and risk factors that

could affect Arqit’s future performance and cause results to differ

from the forward-looking statements in this release include, but

are not limited to: (i) the outcome of any legal proceedings that

may be instituted against Arqit related to the business

combination, (ii) the ability to maintain the listing of Arqit’s

securities on a national securities exchange, (iii) changes in the

competitive and regulated industries in which Arqit operates,

variations in operating performance across competitors and changes

in laws and regulations affecting Arqit’s business, (iv) the

ability to implement business plans, forecasts, and other

expectations, and identify and realise additional opportunities,

(v) the potential inability of Arqit to convert its pipeline into

contracts or orders in backlog into revenue, (vi) the potential

inability of Arqit to successfully deliver its operational

technology, (vii) the risk of interruption or failure of Arqit’s

information technology and communications system, (viii) the

enforceability of Arqit’s intellectual property, (ix) the

anticipated use of proceeds from the Offering, (x) market and other

conditions, and (xi) other risks and uncertainties set forth in the

sections entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in Arqit’s annual report on Form 20-F

(the “Form 20-F”), filed with the U.S. Securities and Exchange

Commission (the “SEC”) on 14 December 2022 and in subsequent

filings with the SEC. While the list of factors discussed above and

in the Form 20-F and other SEC filings are considered

representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the

realisation of forward-looking statements.

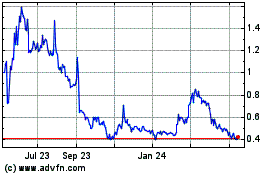

Arqit Quantum (NASDAQ:ARQQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

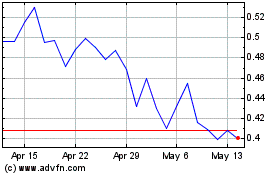

Arqit Quantum (NASDAQ:ARQQ)

Historical Stock Chart

From Dec 2023 to Dec 2024