false--12-31000160397800016039782023-10-122023-10-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 12, 2023

AquaBounty Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | |

Delaware | 001-36426 | 04-3156167 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

2 Mill & Main Place, Suite 395, Maynard, Massachusetts

(Address of principal executive offices)

01754

(Zip Code)

978-648-6000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Title of each class | Trading Symbol(s) | Name of exchange on which registered |

Common Stock, par value $0.001 per share | AQB | The NASDAQ Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On October 12, 2023, AquaBounty Technologies, Inc. (the “Company”) filed a Certificate of Amendment (the “Certificate of Amendment”) to its Third Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware to effect a 1-for-20 reverse stock split (the “Reverse Split”) of the Company’s shares of common stock, par value $0.001 per share (the “Common Stock”), as of 12:01 a.m. Eastern Time on October 16, 2023 (the “Effective Time”), and an associated reduction in the number of shares of Common Stock the Company is authorized to issue from 150,000,000 to 75,000,000 (the “Authorized Capital Change”). Beginning with the commencement of trading on October 16, 2023, the Common Stock is expected to trade on the Nasdaq Capital Market on a split-adjusted basis under a new CUSIP number 03842K309. The Common Stock will continue to trade under the symbol “AQB.”

At the special meeting of stockholders held on October 12, 2023 (the “Special Meeting”), the Company’s stockholders granted the Company’s Board of Directors (the “Board”) the discretion to effect (i) a reverse stock split at a ratio ranging from 1-for-15 to 1-for-20, inclusive, with such ratio and the timing of the reverse stock split to be determined by the Board in its sole discretion (but in no event later than December 31, 2023) and (ii) the Authorized Capital Change. Subsequently, the Board approved the Reverse Split and the Authorized Capital Change.

As a result of the Reverse Split, every twenty (20) shares of the Common Stock as of the Effective Time will automatically be converted into one (1) share of Common Stock, but without any change in the par value per share. Proportional adjustments will be made to the exercise price and the number of shares issuable upon the exercise or conversion of the Company’s outstanding stock options, restricted stock units, and other equity securities under the Company’s equity incentive plans. Pursuant to the Authorized Capital Change, the number of shares of Common Stock the Company is authorized to issue will be reduced from 150,000,000 to 75,000,000. Immediately after the Effective Time, the Company will have approximately 3.57 million shares of Common Stock issued and outstanding.

Computershare Trust Company, N.A. (“Computershare”), the Company’s transfer agent, is acting as the exchange agent for the Reverse Split. The Reverse Split will affect all stockholders uniformly, except that no fractional shares will be issued in connection with the Reverse Split, and stockholders who would otherwise be entitled to a fractional share will receive a full share. Stockholders of record holding all of their shares of Common Stock electronically in book-entry form under the direct registration system for securities will be exchanged by the exchange agent and will receive a transaction statement at their address of record indicating the number of new post-split shares of Common Stock they hold after the Reverse Split. Non-registered stockholders holding Common Stock through a broker and/or other nominee should note that such brokers and/or other nominees may have different procedures for processing the Reverse Split than those that would be put in place for registered stockholders. If a stockholder holds shares of Common Stock with a broker and/or other nominee and has any questions in this regard, stockholders are encouraged to contact the broker and/or other nominee holding their shares for more information. Stockholders of record holding some or all of their shares in certificate form will receive a letter of transmittal from the exchange agent, as soon as reasonably practicable after the effective date of the Reverse Split. Holders of pre-Reverse Split shares will be asked to surrender to the exchange agent certificates representing pre-Reverse Split shares in exchange for post-Reverse Split shares in accordance with the procedures to be set forth in the letter of transmittal. No new post- Reverse Split shares will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent.

The foregoing description of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On October 12, 2023, the Company held the Special Meeting to consider and vote on the proposals set forth below, each of which is described in greater detail in the Company’s definitive proxy statement filed with the U.S. Securities and Exchange Commission on September 1, 2023. A total of 39,762,694 shares of the Common Stock were present or represented by proxy at the Special Meeting, representing approximately 55.7% of the Company’s outstanding Common Stock as of the August 21, 2023 record date. The final voting results are set forth below.

Proposal 1. To approve an amendment to the Company’s Third Amended and Restated Certificate of Incorporation, as amended, to approve a reverse stock split of the Common Stock and an associated reduction in the number of shares of Common Stock the Company is authorized to issue from 150,000,000 to 75,000,000 (the “Reverse Split Proposal”).

Votes For | Votes Against | Abstentions | Broker Non-Votes |

35,869,970 | 3,203,492 | 689,232 | 0 |

Proposal 2. To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Reverse Split Proposal.

Votes For | Votes Against | Abstentions | Broker Non-Votes |

36,239,980 | 2,692,261 | 830,453 | 0 |

Based on the foregoing votes, each proposal was approved.

Item 7.01 Regulation FD Disclosure.

On October 13, 2023, the Company issued a press release announcing the anticipated completion of the reverse stock split. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information included in this Current Report on Form 8-K pursuant to Item 7.01, including Exhibit 99.1 attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| | AquaBounty Technologies, Inc. |

| | (Registrant) |

| | |

October 13, 2023 | | /s/ David A. Frank |

| | David A. Frank |

| | Chief Financial Officer |

CERTIFICATE OF AMENDMENT

TO THE

THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

AQUABOUNTY TECHNOLOGIES, INC.

AquaBounty Technologies, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify:

1. Pursuant to Section 242 of the DGCL, this Certificate of Amendment to the Third Amended and Restated Certificate of Incorporation (this “Certificate of Amendment”) amends the provisions of the Third Amended and Restated Certificate of Incorporation of the Corporation, as amended (the “Charter”).

2. This Certificate of Amendment has been approved and duly adopted by the Corporation’s Board of Directors and stockholders in accordance with the provisions of Section 242 of the DGCL.

3. Upon this Certificate of Amendment becoming effective, the Charter is hereby amended as follows:

Subsection 4(a) of the Charter is hereby amended and restated in its entirety to read as follows:

“4. (a) The Corporation is authorized to issue two classes of stock to be designated Common Stock and Preferred Stock. The Corporation is authorized to issue 75,000,000 shares of Common Stock, with a par value of $0.001 per share, and 5,000,000 shares of Preferred Stock, with a par value of $0.01 per share.

Upon the effectiveness of the filing of this Certificate of Amendment (the “2023 Split Effective Time”), every fifteen (15) to twenty (20) shares of Common Stock issued and outstanding or held by the Corporation as treasury shares as of the 2023 Split Effective Time (with the exact number within such range being determined by the Board of Directors prior to the filing of this Certificate of Amendment and set forth in a public announcement issued by the Corporation prior to the date of the 2023 Split Effective Time) shall automatically, and without any further action on the part of the stockholders, be reclassified as one (1) validly issued, fully paid and non-assessable share of Common Stock, without effecting a change to the par value per share of Common Stock (the “2023 Reverse Split”). If, as a result of the 2023 Reverse Split, any stockholder would receive a fraction of a share of Common Stock, the Board of Directors shall cause to be issued to such stockholder an additional fraction of a share of Common Stock that, together with the fraction resulting from the 2023 Reverse Split, would result in such stockholder having a whole share of Common Stock rather than the fraction otherwise resulting from the 2023 Reverse Split. As of the 2023 Split Effective Time, a certificate(s) representing shares of Common Stock prior to the 2023 Reverse Split shall be deemed to represent the number of post-2023 Reverse Split shares into which the pre-2023 Reverse Split shares were reclassified and combined, together with the additional fraction, if any, issued to result in each holder having a whole number of shares, until surrendered to the Corporation for transfer or exchange. The 2023 Reverse Split shall also apply to any outstanding securities or rights convertible into, or exchangeable or exercisable for, Common Stock of the Corporation and all references to such Common Stock in agreements, arrangements, documents and plans relating thereto or any option or right to purchase or acquire shares of Common Stock shall be deemed to be references to the Common Stock or options or rights to purchase or acquire shares of Common Stock, as the case may be, after giving effect to the 2023 Reverse Split.”

4. This Certificate of Amendment shall become effective at 12:01 a.m., Eastern Time, on October 16, 2023.

* * * *

IN WITNESS WHEREOF, the undersigned authorized officer of the Corporation has executed this Certificate of Amendment to the Third Amended and Restated Certificate of Incorporation as of October 12, 2023.

|

AQUABOUNTY TECHNOLOGIES, INC.

|

|

|

|

|

BY:

|

|

/s/ Sylvia Wulf

|

|

Name: Sylvia Wulf

|

|

Title: Chief Executive Officer

|

AquaBounty Technologies Announces Reverse Stock Split

MAYNARD, Mass., October 13, 2023 -- AquaBounty Technologies, Inc. (NASDAQ: AQB) (“AquaBounty” or the “Company”), a land-based aquaculture company utilizing technology to enhance productivity and sustainability, today announced that its Board of Directors has approved a 1-for-20 reverse stock split of its common stock to be effective 12:01 a.m., Eastern Time, on October 16, 2023 and an associated reduction in the number of shares of Common Stock the Company is authorized to issue. AquaBounty expects its common stock to begin trading on a split-adjusted basis on the Nasdaq Capital Market as of the commencement of trading on October 16, 2023.

On October 12, 2023, the Company’s stockholders approved a reverse stock split of the Company’s common stock at a ratio in the range of 1-for-15 to 1-for-20, inclusive, with such ratio to be determined at the discretion of the Company's Board of Directors and with such reverse stock split to be effected at such time and date as determined by the Board of Directors in its sole discretion (but in no event later than December 31, 2023). The reverse stock split is intended to bring the Company into compliance with the minimum bid price requirement for continued listing on the Nasdaq Capital Market.

The 1-for-20 reverse stock split will automatically convert 20 current shares of the Company’s common stock into one new share of common stock. AquaBounty’s common stock will continue to trade on the Nasdaq Capital Market under the symbol “AQB” following the reverse stock split, with a new CUSIP number of 03842K309. After the effectiveness of the reverse stock split, the number of outstanding shares of common stock will be reduced from approximately 71.36 million to approximately 3.57 million, subject to adjustment to give effect to the treatment of any fractional shares that stockholders would have received in the reverse stock split. No fractional shares will be issued in connection with the reverse stock split, and stockholders who would otherwise be entitled to a fractional share will receive a full share. Proportional adjustments will be made to the exercise price and the number of shares issuable upon the exercise or conversion of the Company’s outstanding stock options, restricted stock units, and other equity securities under the Company’s equity incentive plans. In conjunction with the reverse stock split, the number of shares of common stock authorized to be issued will be reduced from 150 million to 75 million.

Computershare Trust Company, N.A. (“Computershare”), AquaBounty’s transfer agent, is acting as the exchange agent for the reverse stock split. Stockholders of record holding certificates representing pre-split shares of the Company’s common stock will receive a letter of transmittal from Computershare with instructions on how to surrender certificates representing pre-split shares. Stockholders should not send in their pre-split certificates until they receive a letter of transmittal from Computershare. Stockholders with book-entry shares or who hold their shares through a broker and/or other nominee will not need to take any action. Stockholders of record who held pre-split certificates will receive their post-split shares in book-entry form and will be receiving a transaction statement from Computershare regarding their common stock ownership post-reverse stock split.

Additional information about the reverse stock split can be found in the Company’s definitive proxy statement (the “Proxy Statement”) filed with the Securities and Exchange Commission (the “SEC”) on September 1, 2023, which is available at the SEC’s website, www.sec.gov, and on the Company’s website at www.aquabounty.com.

About AquaBounty

At AquaBounty Technologies, Inc. (NASDAQ: AQB), we believe we are a leader in land-based sustainable aquaculture from start to finish. As a vertically integrated Company from broodstock to grow out, we are leveraging decades of expertise in fish breeding, genetics, and health & nutrition to deliver disruptive solutions that address food insecurity and climate change issues. We are committed to feeding the world efficiently, sustainably, and profitably. AquaBounty provides fresh Atlantic salmon to nearby markets by raising its fish in carefully monitored land-based fish farms through a safe, secure, and sustainable process. The Company’s land-based Recirculating Aquaculture System farms, including a grow-out farm located in Indiana, United States and a broodstock and egg production farm located on Prince Edward Island, Canada, are close to key consumption markets and are designed to prevent disease and to include multiple levels of fish containment to protect wild fish populations. AquaBounty is raising nutritious salmon that is free of antibiotics and contaminants and provides a solution resulting in a reduced carbon footprint and no risk of pollution to marine ecosystems as compared to traditional sea-cage farming. For more information on AquaBounty, please visit www.aquabounty.com or follow us on Facebook, Twitter, LinkedIn and Instagram.

Forward-Looking Statements

This press release contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, as amended, including regarding the timing of and consummation of the reverse stock split, the effect of the reverse stock split on the Company’s compliance with the minimum bid price requirement for continued listing on the Nasdaq Capital Market and the actions of third parties, including Computershare, with respect to the reverse stock split. The forward-looking statements in this press release are neither promises nor guarantees, and you should not place undue reliance on these statements because they involve significant risks and uncertainties about AquaBounty. AquaBounty may use words such as “expect,” “continue,” “plan,” “moving forward,” “believe,” “will,” “may,” the negative forms of these words and similar expressions to identify such forward-looking statements. Forward-looking statements speak only as of the date hereof, and, except as required by law, AquaBounty undertakes no obligation to update or revise these forward-looking statements. Risks and uncertainties that contribute to the uncertain nature of the forward-looking statements include, but are not limited to: market conditions and their impact on the trading price of AquaBounty’s common stock on the Nasdaq Capital Market; other factors discussed in the Proxy Statement; and other risks and uncertainties described in filings by AquaBounty with the Securities and Exchange Commission (“SEC”), available on the Investors section of AquaBounty’s website at www.aquabounty.com and on the SEC’s website at www.sec.gov.

Company & Investor Contact:

AquaBounty Technologies

Dave Conley

Corporate Communications

(613) 294-3078

dconley@aquabounty.com

Media Contact:

Vince McMorrow

Fahlgren Mortine

(614) 906-1671

vince.mcmorrow@Fahlgren.com

v3.23.3

Document and Entity Information

|

Oct. 12, 2023 |

| Document and Entity Information [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 12, 2023

|

| Entity Registrant Name |

AquaBounty Technologies, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36426

|

| Entity Tax Identification Number |

04-3156167

|

| Entity Address, Address Line One |

2 Mill & Main Place

|

| Entity Address, Address Line Two |

Suite 395

|

| Entity Address, City or Town |

Maynard

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01754

|

| City Area Code |

978

|

| Local Phone Number |

648-6000

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

AQB

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001603978

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

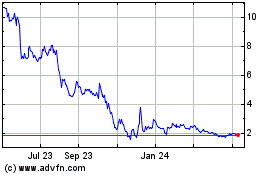

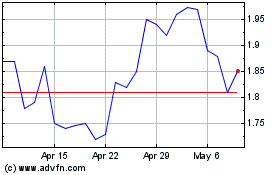

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Oct 2024 to Nov 2024

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Nov 2023 to Nov 2024