By Tripp Mickle

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 11, 2019).

CUPERTINO, Calif. -- Apple Inc. revealed a trio of upgraded

iPhones, including a lower-priced model, and detailed its plans to

enter the increasingly competitive video-streaming market with an

offering that is cheaper than rivals.

The announcements came Tuesday at Apple's marquee product

showcase, where this year the tech giant sought to balance its

penchant for premium products with an emphasis on value. Apple is

looking to offset slowing hardware sales by selling newer services,

such as TV streaming, videogames and news -- and it is being

aggressive on pricing to gain a foothold in those cutthroat

industries.

Apple set monthly prices for its TV+ video-streaming service and

Arcade videogame-streaming service at $4.99, largely undercutting

rivals. TV+ comes free for a year with the purchase of a new

iPhone, iPad or Mac, a perk that could get more people to buy a new

device or upgrade. Apple can afford to discount the services

because of the profits it earns on hardware and its distribution

edge over competitors, with more than 1.4 billion devices in use

world-wide.

The company is making just a handful of shows available for the

TV+ debut in November, so the service will be a tough sell against

the deeper programming catalogs offered by streaming rivals Netflix

Inc. and Walt Disney Co. But at $4.99 a month, TV+ is much cheaper

than Netflix's $12.99 monthly standard option and Disney's $6.99

monthly fee for a service expected to arrive in November.

"Clearly, they want their customers to use it and not feel

forced to choose between it and Netflix or Hulu," said Carolina

Milanesi, an analyst with Creative Strategies. She added that Apple

could offer lower prices on services without affecting its

historical brand position in hardware as a luxury-device maker.

Netflix doesn't see the low prices as a threat, because they

make it more likely Netflix customers won't be forced into a choice

if they want to add another streaming service, an executive

familiar with the company's strategy said.

At Tuesday's event -- held in the Steve Jobs Theater, the

on-campus auditorium named after Apple's co-founder -- Apple

lavished much of its time on the flagship device that Mr. Jobs

helped create a dozen years ago. The new but familiar-looking

iPhones, now under the iPhone 11 brand, blended standard updates

such as longer-lasting batteries and new colors with more

innovative features such as a night mode for low-light photos and

the ability to shoot video by holding down the camera button.

Apple lowered the price of its most popular model by $50,

countering three consecutive years of price increases. The iPhone

11, a 6.1-inch device that updates last year's XR model, will start

at $699 and include a dual-rear camera. The iPhone 11 Pro and 11

Pro Max, with triple-rear cameras, play to the premium market with

prices of $999 and $1,099.

Apple also introduced an updated smartwatch with improved power

that allows it to display time throughout the day, and cut the

price of an earlier model to its lowest point yet.

The company didn't reveal any surprise new devices, delivering

instead the type of incremental hardware improvements that have

defined its events in recent years and stirred up questions about

Apple's innovation prowess under Chief Executive Tim Cook. Mr.

Jobs's successor has transformed Apple into one of the world's most

profitable companies but hasn't delivered a megahit product on par

with the iPhone, which arrived in 2007, or the iPad, first released

in 2010, the year before Mr. Cook took over.

The Apple Watch made its debut five years ago and has largely

been a success, as have the more recent AirPods wireless earbuds,

but not enough to shore up falling iPhone sales. Mr. Cook has since

pushed Apple to leverage its hardware success to sell more software

and services.

TV+ will make its debut Nov. 1 with shows such as "The Morning

Show," a drama about a morning talk show starring Reese Witherspoon

and Jennifer Aniston. Other shows will be added in the months

afterward, Mr. Cook said.

The watch and new subscription services are central to Apple's

efforts to diversify its business as the iPhone falters. Its

customers are holding on to current iPhones longer and bristling at

prices of new models that average nearly $1,000. Those struggles

are particularly acute in China, where Apple is battling increased

competition, trade tensions and a decelerating economy.

Apple also made the Apple Watch a better value, reducing the

price of the Series 3 model about 30% to $199 and maintaining a

price of $399 on its newest model, the Series 5.

The smartwatch prices showed Apple is willing to eat the cost of

tariffs rather than pass them on to consumers. The Apple Watch was

among its first products subjected to the 15% tariffs the Trump

administration introduced on $111 billion in Chinese-made goods

this month.

Apple can absorb the extra costs of tariffs without it affecting

margins because memory prices have fallen in recent years,

providing a cushion, analysts said.

To sustain growth, Apple must squeeze more money out of existing

customers by leveraging past hardware success to sell newer

products and services. It has over 900 million iPhone users

world-wide, but only a fraction own an Apple Watch or pay for the

company's streaming-music service. It has rolled out several new

accessories and services to deepen its reach into users' wallets,

including its AirPods, a credit card and a videogame service called

Arcade.

The emphasis on services and newer products has coincided with

several high-profile executive departures, including design chief

Jony Ive, who will leave this year to start his own design firm. It

has also revived questions about the company's ability to offer the

type of hardware innovations that turned the iPhone into one of the

world's best-selling products.

"Apple isn't growing like they were before," said Mike Frazier,

president of Bedell Frazier Investment Counselling, a Walnut Creek,

Calif.-based firm with about $500 million under management that

counted Apple as its largest holding before scaling back its

investment this year. "They're a victim of their own success."

Apple needs to encourage enough iPhone upgrades to avoid

repeating the smartphone sales slump that dogged the company last

year, forcing it to slash its revenue forecast in January for the

first time in more than 15 years. World-wide sales of the company's

smartphones fell 15% to $109.02 billion for the three quarters

ended in June. Shipments have declined an estimated 17% over that

period, according to analysts, outpacing the smartphone industry's

projected decline of 2% this year.

Wall Street has already begun to look ahead to next year's

models that are expected to feature 5G, a faster fifth generation

of wireless technology that will result in speedier smartphones.

Apple will be lagging behind rivals such as Huawei Technologies Co.

and Samsung Electronics Co. in bringing that technology to

market.

"They will lose market share in China in the premium space

without 5G because the country is going to ensure 5G is relevant,"

said Patrick Moorhead, principal analyst at Moor Insights &

Strategy. "That will trigger adoption of Huawei, Xiaomi and others

and hurt Apple."

Dow Jones & Co., publisher of The Wall Street Journal, has a

commercial agreement to supply news through Apple services.

--Amol Sharma contributed to this article.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

September 11, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

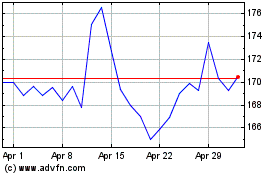

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Aug 2024 to Sep 2024

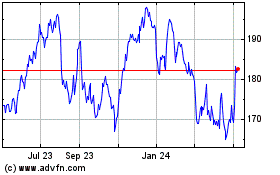

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Sep 2023 to Sep 2024