Appian Announces Fourth Quarter and Full Year 2017 Financial Results

February 22 2018 - 4:12PM

Fourth quarter subscription revenue increased 42%

year-over-year to $23.5 millionFourth quarter total revenue

increased 50% year-over-year to $50.6 million

Appian (NASDAQ:APPN) today announced financial results for the

fourth quarter and full year ended December 31, 2017.

"Companies everywhere want a better way to make unique software.

Appian is emerging as a good platform for doing that, as you

can see in our recent results," said Matt Calkins, Founder and CEO,

Appian.

Fourth Quarter 2017 Financial

Highlights:

- Revenue: Subscription revenue was $23.5

million for the fourth quarter of 2017, up 42% compared to the

fourth quarter of 2016. Total subscriptions, software and support

revenue was $25.4 million for the fourth quarter of 2017, an

increase of 31% year over year. Professional services revenue

was $25.2 million for the fourth quarter of 2017, an increase of

75% year over year. Total revenue was $50.6 million for the fourth

quarter of 2017, up 50% compared to the fourth quarter of 2016.

Appian's subscription revenue retention rate was 122% as of

December 31, 2017.

- Operating loss and non-GAAP operating loss:

GAAP operating loss was $(7.0) million for the fourth quarter of

2017, compared to $(1.8) million for the fourth quarter of

2016. Non-GAAP operating loss was $(4.9) million for the

fourth quarter of 2017, compared to $(1.8) million for the fourth

quarter of 2016.

- Net loss and non-GAAP net loss: GAAP net loss

was $(6.9) million for the fourth quarter of 2017, compared to

$(4.2) million for the fourth quarter of 2016. GAAP net loss

per basic and diluted share attributable to common stockholders was

$(0.11) for the fourth quarter of 2017 based on 60.4 million

weighted average shares outstanding, compared to $(0.13) per basic

and diluted share for the fourth quarter of 2016 based on 34.3

million weighted average shares outstanding. Non-GAAP net

loss was $(4.8) million for the fourth quarter of 2017, compared to

$(4.2) million for the fourth quarter of 2016. Non-GAAP net

loss per basic and diluted share was $(0.08) for the fourth quarter

of 2017, based on 60.4 million weighted average shares outstanding,

compared to $(0.08) basic and diluted share for the fourth quarter

of 2016, based on 52.4 million weighted average shares

outstanding.

Full Year 2017 Financial

Highlights:

- Revenue: Subscription revenue was $82.8

million for the full year of 2017, up 38% compared to the full year

2016. Total subscriptions, software and support revenue was $91.5

million for the full year 2017, an increase of 31% from the prior

year. Professional services revenue was $85.2 million for the full

year 2017, an increase of 35% from the prior year. Total revenue

was $176.7 million for the full year 2017, up 33% compared to the

full year 2016.

- Operating loss and non-GAAP operating loss:

GAAP operating loss was $(31.8) million for the full year 2017,

compared to $(11.4) million for the full year 2016. Non-GAAP

operating loss was $(18.8) million for the year 2017, compared to

$(11.4) million for the full year 2016.

- Net loss and non-GAAP net loss: GAAP net loss

was $(31.0) million for the full year 2017, compared to $(12.5)

million for the full year 2016. GAAP net loss per basic and

diluted share attributable to common stockholders was $(0.63) for

the year 2017 based on 49.5 million weighted average shares

outstanding, compared to $(0.39) per basic and diluted share for

the full year 2016 based on 34.3 million weighted average shares

outstanding. Non-GAAP net loss was $(17.3) million for the

full year 2017, compared to $(12.3) million for the full year

2016. Non-GAAP net loss per basic and diluted share was

$(0.30) for the full year 2017, based on 57.0 million weighted

average shares outstanding, compared to $(0.23) basic and diluted

share for the full year 2016, based on 52.4 million weighted

average shares outstanding.

- Balance sheet and cash flows: As of December

31, 2017, Appian had cash and cash equivalents of $73.8 million.

For the fourth quarter of 2017, cash flow generated from operations

was $1.0 million, compared with $0.1 million in the fourth quarter

of 2016. Cash used in operating activities was $(9.2) million

for the twelve months ended December 31, 2017, compared to $(7.8)

million for the same period in 2016.

A reconciliation of GAAP to non-GAAP financial

measures has been provided in the tables following the financial

statements in this press release. An explanation of these

measures is also included below under the heading “Non-GAAP

Financial Measures.”

Recent Business Highlights:

- Appian announced that it has been positioned by Gartner, Inc.

in the "Leaders" quadrant in the new "Magic Quadrant for

Intelligent Business Process Management Suites." For the

third year in a row, Appian has been positioned as a "leader" in

this evaluation.

- Appian and Luxoft announced a global partnership to deliver

end-to-end, low-code solutions to Life Sciences companies around

the world. Luxoft will leverage its IT integration expertise,

experience of providing IT services to major pharmaceutical

companies and 42 global delivery centers to help companies

implement the Appian platform.

- Appian announced that Aviva is leveraging Appian to deliver on

Digital Transformation Initiatives. With the Appian platform, Aviva

is anchoring around the customer, removing complexities and

streamlining operations.

- Appian announced that SDL selected Appian to automate and

digitize its core language services business in support of the

company’s digital transformation strategy. Using Appian’s low-code

development platform in the cloud enables SDL to rapidly unify data

from across systems and processes, and present them through a

single intuitive interface, resulting in significant improvements

in customer experience.

- Appian extended its market leading Low-Code design experience

in the latest version of the Appian platform with patent pending

intelligent and automatic parallelization for multi-core

processing.

Financial Outlook:

As of February 22, 2018, guidance for the first

quarter 2018 and full year 2018 is as follows:

First Quarter 2018

Guidance:

- Subscription revenue is expected to be in the range of $24.4

million and $24.6 million, representing year-over-year growth of

between 30% and 31%.

- Total revenue is expected to be in the range of $46.0 million

and $46.2 million, representing year-over-year growth of between

20% and 21%.

- Non-GAAP operating loss is expected to be in the range of

$(10.9) million and $(10.5) million.

- Non-GAAP net loss per basic and diluted share is expected to be

in the range of $(0.18) and $(0.17). This assumes 60.6 million

weighted average common shares outstanding.

Full Year 2018 Guidance:

- Subscription revenue is expected to be in the range of $106.5

million and $107.5 million, representing year-over-year growth of

between 29% and 30%.

- Total revenue is expected to be in the range of $198.1 million

and $201.1 million, representing year-over-year growth of between

12% and 14%.

- Non-GAAP operating loss is expected to be in the range of

$(39.9) million and $(37.9) million.

- Non-GAAP net loss per basic and diluted share is expected to be

in the range of $(0.54) and $(0.53). This assumes 61.1

million non-GAAP weighted average common shares outstanding.

Conference Call Details:

Appian will host a conference call today,

February 22, 2018, at 5:00 p.m. ET to discuss the Company’s

financial results for the fourth quarter and full year ended

December 31, 2017 and business outlook.

The live webcast of the conference call can be

accessed on the Investor Relations page of the Company’s website at

http://investors.appian.com. To access the call, please dial (877)

407-0792 in the U.S. or (201) 689-8263 internationally.

Following the call, an archived webcast will be available at the

same location on the Investor Relations page. A telephone

replay will be available for one week at (844) 512-2921 in the U.S.

or (412) 317-6671 internationally with recording access code

13675183.

About Appian

Appian provides a leading low-code software

development and business process management (BPM) platform

that enables organizations to rapidly develop powerful and unique

applications. The applications created on Appian’s platform help

companies drive digital transformation and competitive

differentiation. For more information, visit www.appian.com.

Non-GAAP Financial Measures

To supplement its consolidated financial

statements, which are prepared and presented in accordance with

GAAP, Appian provides investors with certain non-GAAP financial

measures, including non-GAAP operating loss, non-GAAP net loss,

non-GAAP net loss per share and non-GAAP weighted average shares

outstanding. The presentation of these non-GAAP financial measures

is not intended to be considered in isolation or as a substitute

for, or superior to, the financial information prepared and

presented in accordance with GAAP, and Appian’s non-GAAP measures

may be different from non-GAAP measures used by other companies.

For more information on these non-GAAP financial measures, please

see the reconciliation of these non-GAAP financial measures to

their nearest comparable GAAP measures at the end of this press

release.

Appian uses these non-GAAP financial measures

for financial and operational decision-making and as a means to

evaluate period-to-period comparisons. Appian’s management believes

that these non-GAAP financial measures provide meaningful

supplemental information regarding Appian’s performance by

excluding certain expenses that may not be indicative of its

recurring core business operating results. Appian believes that

both management and investors benefit from referring to these

non-GAAP financial measures in assessing Appian’s performance and

when planning, forecasting, and analyzing future periods. These

non-GAAP financial measures also facilitate management’s internal

comparisons to historical performance as well as comparisons to

competitors’ operating results. Appian believes these non-GAAP

financial measures are useful to investors both because (1) they

allow for greater transparency with respect to measures used by

management in its financial and operational decision-making and (2)

they are used by Appian’s institutional investors and the analyst

community to help them analyze the health of Appian’s business.

Forward-Looking Statements

This press release includes forward-looking

statements. All statements contained in this press release other

than statements of historical facts, including statements regarding

Appian’s future financial and business performance for the first

quarter and full-year 2018, future investment by Appian in its

go-to-market initiatives, increased demand for the Appian platform,

market opportunity and plans and objectives for future operations,

including Appian’s ability to drive continued subscription revenue

and total revenue growth, are forward-looking statements. The words

"anticipate," believe," "continue," "estimate," "expect," "intend,"

"may," "will" and similar expressions are intended to identify

forward-looking statements. Appian has based these forward-looking

statements on its current expectations and projections about future

events and financial trends that Appian believes may affect its

financial condition, results of operations, business strategy,

short-term and long-term business operations and objectives and

financial needs. These forward-looking statements are subject to a

number of risks and uncertainties, including the risks and

uncertainties associated with Appian’s ability to grow its business

and manage its growth, Appian’s ability to sustain its revenue

growth rate, continued market acceptance of Appian’s platform and

adoption of low-code solutions to drive digital transformation, the

fluctuation of Appian’s operating results due to the length and

variability of its sales cycle, competition in the markets in which

Appian operates, risks and uncertainties associated with the

composition and concentration of Appian’s customer base and their

demand for its platform and satisfaction with the services provided

by Appian, the potential fluctuation of Appian’s future quarterly

results of operations, Appian’s ability to shift its revenue

towards subscriptions and away from professional services, Appian’s

ability to operate in compliance with applicable laws and

regulations, Appian’s strategic relationships with third parties

and use of third-party licensed software and its platform’s

compatibility with third-party applications, and the timing of

Appian’s recognition of subscription revenue which may delay the

effect of near term changes in sales on its operating results, and

the additional risks and uncertainties set forth in the "Risk

Factors" section of Appian’s Quarterly Report on Form 10-Q for the

quarter ended September 30, 2017 filed with the Securities and

Exchange Commission on November 2, 2017 and other reports that

Appian has filed with the Securities and Exchange Commission.

Moreover, Appian operates in a very competitive and rapidly

changing environment. New risks emerge from time to time. It is not

possible for Appian’s management to predict all risks, nor can

Appian assess the impact of all factors on its business or the

extent to which any factor, or combination of factors, may cause

actual results to differ materially from those contained in any

forward-looking statements Appian may make. In light of these

risks, uncertainties and assumptions, Appian cannot guarantee

future results, levels of activity, performance, achievements or

events and circumstances reflected in the forward-looking

statements will occur. Appian is under no duty to update any of

these forward-looking statements after the date of this press

release to conform these statements to actual results or revised

expectations, except as required by law.

Investor ContactStaci

MortensonICR for Appian703-442-1091investors@appian.com

Media ContactNicole

GreggsDirector, Media

Relations703-260-7868nicole.greggs@appian.com

| |

|

|

|

| |

|

|

|

| |

|

|

|

| APPIAN CORPORATION AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(in thousands, except share and per share data) |

| |

As ofDecember 31,2017 |

|

As of December 31,2016 |

| |

(unaudited) |

|

|

|

Assets |

|

|

|

| Current

assets |

|

|

|

| Cash and

cash equivalents |

$ |

73,758 |

|

|

$ |

31,143 |

|

| Accounts

receivable, net of allowance of $400 |

55,315 |

|

|

46,814 |

|

| Deferred

commissions, current |

9,117 |

|

|

7,146 |

|

|

Prepaid expenses and other current assets |

7,032 |

|

|

3,281 |

|

|

Total current assets |

145,222 |

|

|

88,384 |

|

| Property and equipment,

net |

2,663 |

|

|

3,101 |

|

| Deferred commissions,

net of current portion |

12,376 |

|

|

10,860 |

|

| Deferred tax

assets |

281 |

|

|

12 |

|

| Other assets |

510 |

|

|

381 |

|

| Total

assets |

$ |

161,052 |

|

|

$ |

102,738 |

|

| Liabilities,

Convertible Preferred Stock and Stockholders’ Equity

(Deficit) |

|

|

|

| Current

liabilities |

|

|

|

| Accounts

payable |

$ |

5,226 |

|

|

$ |

5,057 |

|

| Accrued

expenses |

6,467 |

|

|

2,860 |

|

| Accrued

compensation and related benefits |

12,075 |

|

|

9,554 |

|

| Deferred

revenue, current |

70,165 |

|

|

52,000 |

|

| Current

portion of long-term debt |

— |

|

|

6,111 |

|

| Other

current liabilities |

1,182 |

|

|

437 |

|

|

Total current liabilities |

95,115 |

|

|

76,019 |

|

| Long-term debt, net of

current portion |

— |

|

|

13,889 |

|

| Deferred tax

liabilities |

87 |

|

|

32 |

|

| Deferred revenue, net

of current portion |

18,922 |

|

|

18,108 |

|

| Preferred stock warrant

liability |

— |

|

|

850 |

|

| Other long-term

liabilities |

1,404 |

|

|

1,917 |

|

| Total

liabilities |

115,528 |

|

|

110,815 |

|

| Convertible

preferred stock |

|

|

|

| Series A convertible

preferred stock—par value $0.0001; no shares authorized, issued or

outstanding as of December 31, 2017; 12,127,468 shares authorized

and 12,043,108 shares issued and outstanding as of December 31,

2016 |

— |

|

|

17,915 |

|

| Series B convertible

preferred stock—par value $0.0001; no shares authorized, issued or

outstanding as of December 31, 2017; 6,120,050 shares authorized,

issued and outstanding as of December 31, 2016 |

— |

|

|

37,500 |

|

| Stockholders’

equity (deficit) |

|

|

|

| Common stock—par value

$0.0001; no shares authorized, issued or outstanding as of December

31, 2017; 61,462,320 shares authorized and 34,274,718 shares issued

and outstanding as of December 31, 2016 |

— |

|

|

3 |

|

| Class A common

stock—par value $0.0001; 500,000,000 shares authorized and

13,030,081 shares issued and outstanding as of December 31, 2017;

no shares authorized, issued or outstanding as of December 31,

2016 |

1 |

|

|

— |

|

| Class B common

stock—par value $0.0001; 100,000,000 shares authorized and

47,569,796 shares issued and outstanding as of December 31, 2017;

no shares authorized, issued or outstanding as of December 31,

2016 |

5 |

|

|

— |

|

| Additional paid-in

capital |

141,268 |

|

|

— |

|

| Accumulated other

comprehensive income |

439 |

|

|

1,330 |

|

| Accumulated

deficit |

(96,189 |

) |

|

(64,825 |

) |

| Total

stockholders’ equity (deficit) |

45,524 |

|

|

(63,492 |

) |

| Total

liabilities, convertible preferred stock and stockholders’ equity

(deficit) |

$ |

161,052 |

|

|

$ |

102,738 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

| APPIAN CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF OPERATIONS(in

thousands, except share and per share data) |

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

(unaudited) |

|

(unaudited) |

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

Subscriptions, software and support |

$ |

25,398 |

|

|

$ |

19,365 |

|

|

$ |

91,514 |

|

|

$ |

69,972 |

|

|

Professional services |

25,164 |

|

|

14,382 |

|

|

85,223 |

|

|

62,951 |

|

| Total revenue |

50,562 |

|

|

33,747 |

|

|

176,737 |

|

|

132,923 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscriptions, software and support |

2,488 |

|

|

1,929 |

|

|

9,379 |

|

|

7,437 |

|

|

Professional services |

16,169 |

|

|

8,670 |

|

|

55,218 |

|

|

42,686 |

|

| Total cost of

revenue |

18,657 |

|

|

10,599 |

|

|

64,597 |

|

|

50,123 |

|

| Gross profit |

31,905 |

|

|

23,148 |

|

|

112,140 |

|

|

82,800 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Sales and

marketing |

22,463 |

|

|

14,660 |

|

|

81,966 |

|

|

54,137 |

|

| Research

and development |

8,968 |

|

|

6,069 |

|

|

34,835 |

|

|

22,994 |

|

| General

and administrative |

7,429 |

|

|

4,260 |

|

|

27,150 |

|

|

17,039 |

|

| Total operating

expenses |

38,860 |

|

|

24,989 |

|

|

143,951 |

|

|

94,170 |

|

| Operating loss |

(6,955 |

) |

|

(1,841 |

) |

|

(31,811 |

) |

|

(11,370 |

) |

| Other (income)

expense: |

|

|

|

|

|

|

|

| Other

(income) expense, net |

(380 |

) |

|

1,663 |

|

|

(2,038 |

) |

|

1,792 |

|

| Interest

expense |

22 |

|

|

256 |

|

|

473 |

|

|

982 |

|

| Total other (income)

expense |

(358 |

) |

|

1,919 |

|

|

(1,565 |

) |

|

2,774 |

|

| Net loss before income

taxes |

(6,597 |

) |

|

(3,760 |

) |

|

(30,246 |

) |

|

(14,144 |

) |

| Income tax expense

(benefit) |

272 |

|

|

423 |

|

|

761 |

|

|

(1,683 |

) |

| Net loss |

(6,869 |

) |

|

(4,183 |

) |

|

(31,007 |

) |

|

(12,461 |

) |

| Accretion of dividends

on convertible preferred stock |

— |

|

|

214 |

|

|

357 |

|

|

857 |

|

| Net loss attributable

to common stockholders |

$ |

(6,969 |

) |

|

$ |

(4,953 |

) |

|

$ |

(31,364 |

) |

|

$ |

(13,318 |

) |

| Net loss per share

attributable to common stockholders: |

|

|

|

|

|

|

|

| Basic and

diluted |

$ |

(0.11 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.63 |

) |

|

$ |

(0.39 |

) |

| Weighted average common

shares outstanding: |

|

|

|

|

|

|

|

| Basic and

diluted |

60,434,368 |

|

|

34,274,718 |

|

|

49,529,833 |

|

|

34,274,718 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

| APPIAN CORPORATION AND

SUBSIDIARIESSTOCK-BASED COMPENSATION

EXPENSE(in thousands) |

| |

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

(unaudited) |

|

(unaudited) |

|

|

|

|

| Cost of revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscriptions, software and support |

$ |

91 |

|

|

$ |

— |

|

|

$ |

575 |

|

|

$ |

— |

|

|

Professional services |

169 |

|

|

— |

|

|

1,295 |

|

|

— |

|

| Operating expenses |

|

|

|

|

|

|

|

| Sales and

marketing |

451 |

|

|

— |

|

|

3,233 |

|

|

— |

|

| Research

and development |

364 |

|

|

— |

|

|

2,822 |

|

|

— |

|

| General

and administrative |

982 |

|

|

— |

|

|

5,051 |

|

|

— |

|

| Total

stock-based compensation expense |

$ |

2,057 |

|

|

$ |

— |

|

|

$ |

12,976 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| APPIAN CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(in thousands) |

| |

|

|

Year Ended December 31, |

| |

2017 |

|

2016 |

| |

(unaudited) |

|

|

| Cash flows from

operating activities: |

|

|

|

| Net

loss |

$ |

(31,007 |

) |

|

$ |

(12,461 |

) |

|

Adjustments to reconcile net loss to net cash used in

operating activities: |

|

|

|

|

Depreciation and amortization |

886 |

|

|

764 |

|

| Bad debt

expense |

62 |

|

|

7 |

|

| Deferred

income taxes |

(251 |

) |

|

(1,122 |

) |

|

Stock-based compensation |

12,976 |

|

|

— |

|

| Fair

value adjustment for warrant liability |

341 |

|

|

200 |

|

| Loss on

extinguishment of debt |

384 |

|

|

— |

|

|

Changes in assets and liabilities: |

|

|

|

| Accounts

receivable |

(9,716 |

) |

|

(11,154 |

) |

| Prepaid

expenses and other assets |

(4,162 |

) |

|

(1,665 |

) |

| Deferred

commissions |

(3,487 |

) |

|

(5,335 |

) |

| Accounts

payable and accrued expenses |

4,128 |

|

|

1,287 |

|

| Accrued

compensation and related benefits |

2,365 |

|

|

3,717 |

|

| Other

current liabilities |

383 |

|

|

19 |

|

| Deferred

revenue |

18,344 |

|

|

17,410 |

|

| Other

long-term liabilities |

(374 |

) |

|

577 |

|

|

Net cash used in operating activities |

(9,128 |

) |

|

(7,756 |

) |

| Cash flows from

investing activities: |

|

|

|

| Purchases

of property and equipment |

(433 |

) |

|

(984 |

) |

|

Net cash used in investing activities |

(433 |

) |

|

(984 |

) |

| Cash flows from

financing activities: |

|

|

|

| Proceeds

from initial public offering, net of underwriting discounts |

80,213 |

|

|

— |

|

| Payment

of initial public offering costs |

(2,424 |

) |

|

— |

|

| Payment

of dividend to Series A preferred stockholders |

(7,565 |

) |

|

— |

|

| Proceeds

from exercise of common stock options |

1,108 |

|

|

— |

|

| Proceeds

from issuance of long-term debt, net of debt issuance costs |

19,616 |

|

|

20,000 |

|

| Repayment

of long-term debt |

(40,000 |

) |

|

(10,000 |

) |

|

Net cash provided by financing activities |

50,948 |

|

|

10,000 |

|

| Effect of

foreign exchange rate changes on cash and cash

equivalents |

1,228 |

|

|

(1,510 |

) |

| Net increase

(decrease) in cash and cash equivalents |

42,615 |

|

|

(250 |

) |

| Cash and cash

equivalents, beginning of period |

31,143 |

|

|

31,393 |

|

| Cash and cash

equivalents, end of period |

$ |

73,758 |

|

|

$ |

31,143 |

|

| Supplemental

disclosure of cash flow information: |

|

|

|

| Cash paid

for interest |

$ |

515 |

|

|

$ |

895 |

|

| Cash paid

for income taxes |

$ |

615 |

|

|

$ |

610 |

|

| Supplemental

disclosure of non-cash financing activities: |

|

|

|

|

Conversion of convertible preferred stock to common stock |

$ |

48,207 |

|

|

$ |

— |

|

|

Conversion of convertible preferred stock warrant to common stock

warrant |

$ |

1,191 |

|

|

$ |

— |

|

| Accretion

of dividends on convertible preferred stock |

$ |

357 |

|

|

$ |

857 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

| APPIAN CORPORATION AND

SUBSIDIARIESRECONCILIATION OF GAAP MEASURES TO

NON-GAAP MEASURES(in thousands, except share and per share

data)(unaudited) |

| |

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Reconciliation of

non-GAAP operating loss: |

|

|

|

|

|

|

|

| GAAP

operating loss |

$ |

(6,955 |

) |

|

$ |

(1,841 |

) |

|

$ |

(31,811 |

) |

|

$ |

(11,370 |

) |

| Add

back: |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

2,057 |

|

|

— |

|

|

12,976 |

|

|

— |

|

| Non-GAAP

operating loss |

$ |

(4,898 |

) |

|

$ |

(1,841 |

) |

|

$ |

(18,835 |

) |

|

$ |

(11,370 |

) |

| |

|

|

|

|

|

|

|

| Reconciliation of

non-GAAP net loss: |

|

|

|

|

|

|

|

| GAAP net

loss |

$ |

(6,869 |

) |

|

$ |

(4,183 |

) |

|

$ |

(31,007 |

) |

|

$ |

(12,461 |

) |

| Add

back: |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

2,057 |

|

|

— |

|

|

12,976 |

|

|

— |

|

| Change in

fair value of warrant liability |

— |

|

|

— |

|

|

341 |

|

|

200 |

|

| Loss on

extinguishment of debt |

— |

|

|

— |

|

|

384 |

|

|

— |

|

| Non-GAAP

net loss |

$ |

(4,812 |

) |

|

$ |

(4,183 |

) |

|

$ |

(17,306 |

) |

|

$ |

(12,261 |

) |

| |

|

|

|

|

|

|

|

| Non-GAAP earnings per

share: |

|

|

|

|

|

|

|

| Non-GAAP

net loss |

$ |

(4,812 |

) |

|

$ |

(4,183 |

) |

|

$ |

(17,306 |

) |

|

$ |

(12,261 |

) |

| Non-GAAP

weighted average shares used to compute net loss per share

attributable to common stockholders, basic and diluted |

60,434,368 |

|

|

52,437,876 |

|

|

57,043,906 |

|

|

52,437,876 |

|

| Non-GAAP

net loss per share, basic and diluted |

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.23 |

) |

| |

|

|

|

|

|

|

|

| Reconciliation of

non-GAAP net loss per share, basic and diluted: |

|

|

|

|

|

|

|

| GAAP net

loss per share attributable to common stockholders, basic and

diluted |

$ |

(0.11 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.63 |

) |

|

$ |

(0.39 |

) |

| Add

back: |

|

|

|

|

|

|

|

| Non-GAAP

adjustments to net loss per share |

0.03 |

|

|

0.05 |

|

|

0.33 |

|

|

0.16 |

|

| Non-GAAP

net loss per share, basic and diluted |

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.23 |

) |

| |

|

|

|

|

|

|

|

| Reconciliation of

non-GAAP weighted average shares outstanding, basic and

diluted: |

|

|

|

|

|

|

|

| GAAP

weighted average shares used to compute net loss per share

attributable to common stockholders, basic and diluted |

60,434,368 |

|

|

34,274,718 |

|

|

49,529,833 |

|

|

34,274,718 |

|

| Add

back: |

|

|

|

|

|

|

|

|

Additional weighted average shares giving effect to conversion of

preferred stock at the beginning of the period |

— |

|

|

18,163,158 |

|

|

7,514,073 |

|

|

18,163,158 |

|

| Non-GAAP

weighted average shares used to compute net loss per share, basic

and diluted |

60,434,368 |

|

|

52,437,876 |

|

|

57,043,906 |

|

|

52,437,876 |

|

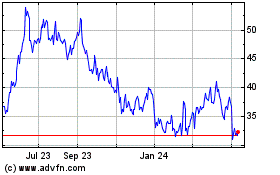

Appian (NASDAQ:APPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

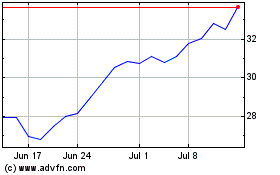

Appian (NASDAQ:APPN)

Historical Stock Chart

From Nov 2023 to Nov 2024