FALSE000180770700018077072023-07-242023-07-240001807707us-gaap:CommonStockMember2023-07-242023-07-240001807707us-gaap:WarrantMember2023-07-242023-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2023

AppHarvest, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39288 | 84-5042965 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

500 Appalachian Way Morehead, KY | 40351 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (606) 653-6100

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

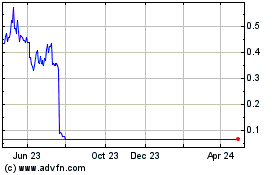

| Common Stock, $0.0001 par value per share | | APPH | | The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | APPHW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Restructuring Support Agreement

On July 24, 2023, AppHarvest, Inc., (the “Company”) entered into a Restructuring Support Agreement (including all exhibits thereto, collectively, the “RSA”) with (i) each of its affiliates (as set forth in the RSA, and together with the Company, the “Debtors”), (ii) CEFF II AppHarvest Holdings, LLC (“Equilibrium”); (iii) Mastronardi Produce Limited (“Mastronardi”); and (iv) Mastronardi Berea LLC (“Mastronardi Berea”, and together with Equilibrium and Mastronardi, the “Non-Company Parties”).

The transactions contemplated by the RSA include, among other things, (i) procurement of debtor-in-possession financing; (ii) a stalking horse asset purchase agreement (the “Stalking Horse APA”) and related sales under 11 U.S.C. § 363; (iii) a transition of AppHarvest Berea Farm, LLC’s (“AppHarvest Berea”) facility in Berea, Kentucky to Mastronardi Berea; and (iv) a chapter 11 plan (the “Plan”).

On or around the Agreement Effective Date (as defined in the RSA), the Company expects to enter into the transactions described in this paragraph pursuant to the RSA. The Debtors’ chapter 11 cases (the “Chapter 11 Cases”) shall be financed by a $29.6 million DIP Facility (as defined below), to be provided by Equilibrium. Additionally, the Debtors and Equilibrium or its designee shall enter into the Stalking Horse APA providing for the purchase and sale of certain of the Debtors’ facilities. AppHarvest Berea will also assign its assets, properties, and business in connection with the AppHarvest Berea facility to Mastronardi Berea in exchange for $3.75 million, among other consideration. The RSA may be mutually terminated by the Debtors and the Non-Company Parties by mutual written agreement. The RSA will automatically terminate after the Plan Effective Date (as defined in the RSA). Moreover, the Company and the Non-Company Parties each have termination rights if certain conditions, including milestones set forth in the RSA, are not met.

The foregoing description of the RSA and the transactions and documents contemplated thereby does not purport to be complete and is qualified in its entirety by reference to the RSA filed as Exhibit 10.1 hereto and incorporated herein by reference.

Certain of the transactions described in the foregoing shall be subject to approval by the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”).

DIP Credit Agreement

On July 25, 2023, the Company, as borrower, and its Debtor affiliates, as guarantors, entered into that certain Senior Secured Super-Priority Debtor-In-Possession Credit Agreement (the “DIP Credit Agreement”) with Equilibrium, as lender (the “Lender”, and together with the Company and its Debtor affiliates, the “DIP Parties”), pursuant to which the Lender agreed to provide the Company with a debtor-in-possession, super-priority, senior secured loan credit facility (the “DIP Facility”) which consists of (i) a new money multiple-draw delayed draw term loan (“New Money Facility”) in the initial aggregate principal amount of up to approximately $24.3 million and (ii) a loan in an amount equal to the Roll-Up Loan Amount (as defined in the DIP Credit Agreement). Interest under the DIP Facility shall accrue at a rate per annum equal to 12.0% and the DIP Facility contains additional terms with respect to interest and fees as set forth in the DIP Credit Agreement. The DIP Facility has a maturity date of the earlier of (i) seventy-five (75) days after the initiation of the Chapter 11 Cases; (ii) the effective date of the Plan; and (iii) the date of delivery of a Termination Notice (as defined in the DIP Credit Agreement).

Proceeds from the DIP Facility may be used for, among other things, (i) post-bankruptcy petition working capital purposes of the Debtors; (ii) for payment of current interest, fees, and expenses under the DIP Facility; (iii) for payment of allowed administrative costs and expenses of the Chapter 11 Cases (including professional fees and expenses), (iv) for payment of prepetition claims authorized by the Bankruptcy Court, (v) for any other forecasted cash outlays included in the Approved Budget (as defined in the DIP Credit Agreement); and (vi) as otherwise agreed by the Lender and the Company.

The obligations under the DIP Facility shall be secured by (i) senior, first-priority liens and security interests on all unencumbered assets of the Debtors; (ii) senior, first-priority priming liens and security interests on certain prepetition collateral of the Debtors; and (iii) junior liens and security interests on all other assets of the Debtors, in each case subject to certain limitations as set forth in the DIP Credit Agreement.

The foregoing description of the DIP Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the DIP Credit Agreement, a copy of which is filed as Exhibit 10.2 hereto and incorporated by reference herein.

First Amendment to Credit Agreement

On July 26, 2023, the DIP Parties entered into that certain First Amendment to Credit Agreement (the “DIP Amendment”, and together with the DIP Credit Agreement, the “Amended DIP Credit Agreement”). Pursuant to the Amended DIP Credit Agreement, the New Money Loan Commitment (as defined in the Amended DIP Credit Agreement) shall be made available in multiple draws over the term of the DIP Facility. Pursuant to the terms and conditions of the Amended DIP Credit Agreement, the Lender advanced $2,000,000 to the Company on July 26, 2023 and shall advance an additional $6,000,000 upon the satisfaction of certain terms in the Amended DIP Credit Agreement (such advances, collectively, the “Interim Advance”). Subject

to the terms and conditions of any applicable Bankruptcy Court order and the Amended DIP Credit Agreement, the balance of the DIP Facility shall be available in two subsequent draws, the first of which shall be equal to $4 million (the “Second Advance”) and the last of which shall be equal to the New Money Loan Commitment, minus the sum of the Interim Advance and the Second Advance (the “Final Advance”).

The foregoing description of the DIP Amendment does not purport to be complete and is qualified in its entirety by reference to the DIP Amendment, a copy of which is filed as Exhibit 10.3 hereto and incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a

Registrant.

The information set forth above in Item 1.01 of this Current Report on Form 8-K regarding the RSA, DIP Credit Agreement, and DIP Amendment is incorporated by reference herein.

Cautionary Statements Regarding Trading in the Company’s Securities

The Company’s securityholders are cautioned that trading in the Company’s securities during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders thereof in the Company’s Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to expectations concerning matters that are not historical facts. Words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,”, “could” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “can,” “goal,” “target” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, without limitation, the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to raise additional funds during the Chapter 11 Cases; and risks associated with the Company’s business prospects, financial results and business operations. These and other factors that may affect the Company’s future business prospects, results and operations are identified and described in more detail in the Company’s filings with the SEC, including the Company’s most recent Annual Report filed on Form 10-K and the subsequently filed Quarterly Report(s) on Form 10-Q. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 8-K. Except as required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| 10.1 | | | |

| 10.2 | | | |

| 10.3 | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| AppHarvest, Inc. |

| |

| Dated: July 28, 2023 | |

| By: | /s/ Loren Eggleton |

| | Loren Eggleton |

| | Chief Financial Officer |

| | (Principal Financial Officer and Principal Accounting Officer) |

Exhibit 10.1

Execution Version

THIS RESTRUCTURING SUPPORT AGREEMENT IS NOT AN OFFER OR ACCEPTANCE WITH RESPECT TO ANY SECURITIES OR A SOLICITATION OF ACCEPTANCES OF A CHAPTER 11 PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE. NOTHING CONTAINED IN THIS RESTRUCTURING SUPPORT AGREEMENT SHALL BE AN ADMISSION OF FACT OR LIABILITY OR, UNTIL THE OCCURRENCE OF THE AGREEMENT EFFECTIVE DATE ON THE TERMS DESCRIBED HEREIN, DEEMED BINDING ON ANY OF THE PARTIES HERETO.

RESTRUCTURING SUPPORT AGREEMENT

This RESTRUCTURING SUPPORT AGREEMENT (including all exhibits, annexes, and schedules hereto in accordance with Section 14.02, this “Agreement”) is made and entered into as of July 24, 2023 (the “Execution Date”), by and among the following parties (each of the following described in sub-clauses (i) through (iii) of this preamble, collectively, the “Parties”):1

i.AppHarvest, Inc., a public benefit company incorporated under the Laws of Delaware (“AppHarvest”), and each of its affiliates listed on Exhibit A to this Agreement that have executed and delivered counterpart signature pages to this Agreement to counsel to the Consenting Stakeholders (the Entities in this clause (i), collectively, the “Company Parties”);

ii.CEFF II AppHarvest Holdings, LLC (“Equilibrium”);

iii.Mastronardi Produce Limited (“MPL”);

iv.Mastronardi Berea LLC (“Mastronardi Berea,” and together with MPL, the “Mastronardi Parties”); and

v.Undersigned holders of any Claims/Interests that have executed and delivered counterpart signature pages to this Agreement, a Joinder, or a Transfer Agreement to counsel to the Company Parties (together with Equilibrium, the “Consenting Stakeholders”).

RECITALS

WHEREAS, the Parties have in good faith and at arms’ length negotiated or been apprised of certain restructuring and recapitalization transactions with respect to the Company Parties’ capital structure on the terms set forth in this Agreement and as specified in the term sheet attached as Exhibit B hereto (the “Restructuring Term Sheet”) and the term sheet attached as Annex B to the Restructuring Term Sheet (the “Berea Term Sheet”) and such transactions as described in this Agreement (collectively, the “Restructuring Transactions”);

1 Capitalized terms used but not defined in the preamble and recitals to this Agreement have the meanings ascribed to them in Section 1.

WHEREAS, the Company Parties intend to implement the Restructuring Transactions, including through the commencement by the Debtors of voluntary cases under chapter 11 of the Bankruptcy Code in the Bankruptcy Court (the cases commenced, the “Chapter 11 Cases”); and

WHEREAS, the Parties have agreed to take certain actions in support of the Restructuring Transactions on the terms and conditions set forth in this Agreement and the Restructuring Term Sheet;

NOW, THEREFORE, in consideration of the covenants and agreements contained herein, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each Party, intending to be legally bound hereby, agrees as follows:

AGREEMENT

Section 1. Definitions and Interpretation. Definitions. The following terms shall have the following definitions:

“9019 Motion” means that certain motion seeking interim and final orders approving the Berea Term Sheet and the transactions contemplated thereby, which orders for the avoidance of doubt shall, as applicable, provide for the acknowledgment of lease termination and release of claims with respect to the Berea Lease, AppHarvest’s acknowledgment that the Berea Lease has been terminated and AppHarvest’s irrevocably release and waiver of any and all claims, demands, causes of action and damages of any kind whatsoever, whether known or unknown against Mastronardi Berea with its affiliates related in any way to the Berea Lease.

“Affiliate” has the meaning set forth in section 101(2) of the Bankruptcy Code as if such Entity was a debtor in a case under the Bankruptcy Code.

“Agreement” has the meaning set forth in the preamble to this Agreement and, for the avoidance of doubt, includes all the exhibits, annexes, and schedules hereto in accordance with Section 14.02 (including the Restructuring Term Sheet and the Berea Term Sheet).

“Agreement Effective Date” means the date on which the conditions set forth in Section 2 have been satisfied or waived by the appropriate Party or Parties in accordance with this Agreement.

“Agreement Effective Period” means, with respect to a Party, the period from the Agreement Effective Date to the Termination Date applicable to that Party.

“Alternative Restructuring Proposal” means any inquiry, proposal, offer, bid, term sheet, discussion, or agreement with respect to a sale, disposition, new-money investment, restructuring, reorganization, merger, amalgamation, acquisition, consolidation, dissolution, debt investment, equity investment, liquidation, tender offer, recapitalization, plan of reorganization, share exchange, business combination, or similar transaction involving any one or more Company Parties or the debt, equity, or other interests in any one or more Company Parties that is an alternative to one or more of the Restructuring Transactions.

“Bankruptcy Code” means title 11 of the United States Code, 11 U.S.C. §§ 101–1532, as amended.

“Bankruptcy Court” means the United States Bankruptcy Court for the Southern District of Texas.

“Berea Lease” means that certain Lease Agreement, dated December 27, 2022, between Mastronardi Berea as landlord, and AppHarvest Berea Farm, LLC, as tenant, as may be amended, supplemented or otherwise modified.

“Berea Term Sheet” has the meaning set forth in the recitals to this Agreement. “Business Day” means any day other than a Saturday, Sunday, or other day on which

commercial banks are authorized to close under the Laws of, or are in fact closed in, the state of New York.

“Causes of Action” means any claims, interests, damages, remedies, causes of action, demands, rights, actions, controversies, proceedings, agreements, suits, obligations, liabilities, accounts, defenses, offsets, powers, privileges, licenses, Liens, indemnities, guaranties, and franchises of any kind or character whatsoever, whether known or unknown, foreseen or unforeseen, existing or hereinafter arising, contingent or non-contingent, liquidated or unliquidated, secured or unsecured, assertable, directly or derivatively, matured or unmatured, suspected or unsuspected, whether arising before, on, or after the Petition Date, in contract, tort, law, equity, or otherwise. Causes of Action also include: (a) all rights of setoff, counterclaim, or recoupment and claims under contracts or for breaches of duties imposed by law or in equity;

(b) the right to object to or otherwise contest Claims or Interests; (c) claims pursuant to section 362 or chapter 5 of the Bankruptcy Code; (d) such claims and defenses as fraud, mistake, duress, and usury, and any other defenses set forth in section 558 of the Bankruptcy Code; and (e) any avoidance actions arising under chapter 5 of the Bankruptcy Code or under similar local, state, federal, or foreign statutes and common law, including fraudulent transfer laws.

“Chapter 11 Cases” has the meaning set forth in the recitals to this Agreement. “Claim” has the meaning ascribed to it in section 101(5) of the Bankruptcy Code.

“COFRA” means COFRA Holding AG, together with any of COFRA Holding AG’s direct and indirect affiliates other than Mastronardi Berea and Berea Farm Joint Venture LLC.

“Company Claims/Interests” means any Claim against, or Interest in, a Company Party. “Company Parties” has the meaning set forth in the recitals to this Agreement. “Confidentiality Agreement” means an executed confidentiality agreement, including

with respect to the issuance of a “cleansing letter” or other public disclosure of material non-public information agreement, in connection with any proposed Restructuring Transactions.

“Confirmation Order” means the confirmation order with respect to the Plan.

“Consenting Stakeholders” has the meaning set forth in the preamble to this Agreement; provided that COFRA shall not become an additional Consenting Stakeholder or party to this Agreement without the prior written consent of the Required Consenting Stakeholder.

“Credit Bidding and Sale Provisions” means, subject to section 363(k) of the Bankruptcy Code, the rights of the DIP Lender and the Prepetition Lenders to credit bid (either directly or through one or more acquisition vehicles), up to the full amount of the Prepetition Lenders’ respective claims, as set forth in the DIP Documents.

“Debtors” means the Company Parties that commence Chapter 11 Cases. “Definitive Documents” means the documents listed in Section 3.01.

“DIP Documents” means the DIP Orders, the DIP Credit Agreement, the Restructuring Term Sheet, and any ancillary documents related thereto.

“DIP Credit Agreement” means the credit agreement evidencing the DIP Facility.

“DIP Facility” means the delayed draw term loan credit facility to be provided in accordance with the terms and conditions set forth in the Restructuring Term Sheet.

“Disclosure Statement” means the related disclosure statement with respect to the Plan. “Entity” shall have the meaning set forth in section 101(15) of the Bankruptcy Code. “EQ Term Sheet” means that certain Binding Term Sheet Agreement among Mastronardi

Produce-USA and Equilibrium, dated as of July 24, 2023.

“Equilibrium” shall have the meaning set forth in the preamble to this Agreement. “Exculpation” means the exculpations set forth in Annex A of the Restructuring Term

Sheet.

“Execution Date” has the meaning set forth in the preamble to this Agreement.

“First Day Pleadings” means the first-day pleadings that the Company Parties determine

are necessary or desirable to file, each of which shall be in form and substance reasonably acceptable to the Required Consenting Stakeholder.

“Interests” means, collectively, the shares (or any class thereof), common stock, preferred stock, limited liability company interests, and any other equity, ownership, or profits interests of any Company Party, and options, warrants, rights, or other securities or agreements to acquire or subscribe for, or which are convertible into the shares (or any class thereof) of, common stock, preferred stock, limited liability company interests, or other equity, ownership, or profits interests of any Company Party (in each case whether or not arising under or in connection with any employment agreement).

“Joinder” means a joinder to this Agreement substantially in the form attached hereto as

Exhibit D.

“Law” means any federal, state, local, or foreign law (including common law), statute, code, ordinance, rule, regulation, order, ruling, or judgment, in each case, that is validly adopted, promulgated, issued, or entered by a governmental authority of competent jurisdiction (including the Bankruptcy Court).

“Mastronardi” has the meaning set forth in the preamble to this Agreement. “Mastronardi Berea” has the meaning set forth in the preamble to this Agreement. “Mastronardi Produce-USA” means Mastronardi Produce-USA, Inc.

“MPL” has the meaning set forth in the preamble to this Agreement.

“Non-Company Parties” means, collectively, the Mastronardi Parties, Equilibrium, and the other Consenting Stakeholders.

“Parties” has the meaning set forth in the preamble to this Agreement.

“Permitted Transferee” means each transferee of any Company Claims/Interests who meets the requirements of Section 8.01.

“Petition Date” means the first date any of the Company Parties commences a Chapter 11

Case.

“Plan” means the plan of liquidation to be proposed by the Debtors in the Chapter 11 Cases

in order to effectuate the Restructuring Transactions, which shall be in form and substance acceptable to the Required Consenting Stakeholder.

“Plan Effective Date” means the occurrence of the Effective Date of the Plan according to its terms.

“Plan Supplement” means the compilation of documents and forms of documents, schedules, and exhibits to the Plan that will be filed by the Debtors with the Bankruptcy Court, each of which shall be in form and substance acceptable to the Required Consenting Stakeholder.

“Qualified Marketmaker” means an entity that (a) holds itself out to the public or the applicable private markets as standing ready in the ordinary course of business to purchase from customers and sell to customers Company Claims/Interests (or enter with customers into long and short positions in Company Claims/Interests), in its capacity as a dealer or market maker in Company Claims/Interests and (b) is, in fact, regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt).

“Releases” means the releases set forth in Annex A of the Restructuring Term Sheet. “Released Claim” means any Claim or Cause of Action released pursuant to the Releases.

“Releasing Parties” means, collectively, (a) each of the Company Parties, and, to the maximum extent permitted by law, each of the Company Parties, on behalf of their respective Affiliates and Related Parties, (b) each of, and in each case in its capacity as such, the Consenting Stakeholders, and, to the maximum extent permitted by law, each current and former Affiliate and Related Party of each Entity, and (c) the Mastronardi Parties.

“Required Consenting Stakeholder” means, as of the relevant date, Equilibrium. “Restructuring Term Sheet” has the meaning set forth in the recitals to this Agreement. “Restructuring Transactions” has the meaning set forth in the recitals to this Agreement. “Rules” means Rule 501(a)(l), (2), (3), and (7) of the Securities Act.

“Securities Act” means the Securities Act of 1933, as amended.

“Solicitation Materials” means any of the materials to be provided to in connection with the solicitation of votes on the Plan, including, but not limited to, any notice of voting status, notice of non-voting status, ballots, and confirmation hearing notice.

“Stalking Horse Purchase Agreement” means that certain stalking horse purchase agreement by and between the Debtors and Equilibrium providing for the purchase and sale of the Richmond Assets and Morehead Assets, solely to the extent and in such form as such purchase agreement is approved by the Bankruptcy Court pursuant to a Sale Order.

“Termination Date” means the date on which termination of this Agreement as to a Party is effective in accordance with Sections 11.01, 11.02, 11.03, 11.04 or 11.05.

“Transfer” means to sell, resell, reallocate, use, pledge, assign, transfer, hypothecate, participate, donate or otherwise encumber or dispose of, directly or indirectly (including through derivatives, options, swaps, pledges, forward sales or other transactions).

“Transfer Agreement” means an executed form of the transfer agreement providing, among other things, that a transferee is bound by the terms of this Agreement and substantially in the form attached hereto as Exhibit C.

1.02. Interpretation. For purposes of this Agreement:

(a)in the appropriate context, each term, whether stated in the singular or the plural, shall include both the singular and the plural, and pronouns stated in the masculine, feminine, or neuter gender shall include the masculine, feminine, and the neuter gender;

(b)capitalized terms defined only in the plural or singular form shall nonetheless have their defined meanings when used in the opposite form;

(c)unless otherwise specified, any reference herein to a contract, lease, instrument, release, indenture, or other agreement or document being in a particular form or on particular terms

and conditions means that such document shall be substantially in such form or substantially on such terms and conditions;

(d)unless otherwise specified, any reference herein to an existing document, schedule, or exhibit shall mean such document, schedule, or exhibit, as it may have been or may be amended, restated, supplemented, or otherwise modified from time to time; provided that any capitalized terms herein which are defined with reference to another agreement, are defined with reference to such other agreement as of the date of this Agreement, without giving effect to any termination of such other agreement or amendments to such capitalized terms in any such other agreement following the date hereof;

(e)unless otherwise specified, all references herein to “Sections” are references to Sections of this Agreement;

(f)the words “herein,” “hereof,” and “hereto” refer to this Agreement in its entirety rather than to any particular portion of this Agreement;

(g)captions and headings to Sections are inserted for convenience of reference only and are not intended to be a part of or to affect the interpretation of this Agreement;

(h)references to “shareholders,” “directors,” and/or “officers” shall also include “members” and/or “managers,” as applicable, as such terms are defined under the applicable limited liability company Laws;

(i)the use of “include” or “including” is without limitation, whether stated or not;

(j)the phrase “counsel to the Consenting Stakeholders” refers in this Agreement to each counsel specified in Section 14.10 other than counsel to the Company Parties; and

(k)capitalized terms used but not defined in this Agreement shall have the meanings ascribed to such terms in the Restructuring Term Sheet.

Section 2. Effectiveness of this Agreement. This Agreement shall become effective and binding as to each of the Parties independently at 12:00 a.m., prevailing Eastern Standard Time, on the Agreement Effective Date, which is the date on which all of the following conditions have been satisfied or waived in accordance with this Agreement:

(a)each of the Company Parties shall have executed, delivered, and released counterpart signature pages of this Agreement to counsel to each of the Parties;

(b)each Mastronardi Party shall have executed, delivered, and released counterpart signatures pages of this Agreement; and

(c)the relevant Consenting Stakeholder shall have executed, delivered, and released counterpart signature pages of this Agreement.

Section 3. Definitive Documents.

3.01.The Definitive Documents governing the Restructuring Transactions shall include the following: (A) the Plan; (B) the Confirmation Order; (C) the Disclosure Statement; (D) the order of the Bankruptcy Court approving the Disclosure Statement and the other Solicitation Materials; (E) the First Day Pleadings and all orders sought pursuant thereto; (F) the DIP Documents; and (G) the Plan Supplement.

3.02.The Definitive Documents not executed or in a form attached to this Agreement as of the Execution Date remain subject to negotiation and completion. Upon completion, the Definitive Documents and every other document, deed, agreement, filing, notification, letter or instrument related to the Restructuring Transactions shall contain terms, conditions, representations, warranties, and covenants consistent with the terms of this Agreement, as they may be modified, amended, or supplemented in accordance with Section 12. Further, the Definitive Documents not executed or in a form attached to this Agreement as of the Execution Date shall otherwise be in form and substance acceptable to the Company Parties and the Required Consenting Stakeholder and, solely to the extent impacting their rights hereunder, the Mastronardi Parties.

Section 4. Commitments of the Non-Company Parties.

4.01.General Commitments, Forbearances, and Waivers.

(a)During the Agreement Effective Period, each Consenting Stakeholder agrees, in respect of all of its Company Claims/Interests, to:

(i)support the Restructuring Transactions and vote and exercise any necessary corporate powers or rights available to it (including in any board, shareholders’, or creditors’ meeting or in any process requiring voting or approval to which they are legally entitled to participate) in each case in favor of any matter requiring approval to the extent necessary to implement the Restructuring Transactions;

(ii)use commercially reasonable efforts to cooperate with and assist the Company Parties in obtaining additional support for the Restructuring Transactions from the Company Parties’ other stakeholders;

(iii)use commercially reasonable efforts to oppose any party or person from taking any actions contemplated in Section 4.03(b);

(iv)negotiate in good faith any additional or alternative provisions or agreements to address any legal, financial, or structural impediment that may arise that would reasonably be expected to prevent, hinder, impede, delay, or are necessary to effectuate the consummation of the Restructuring Transactions;

(v)negotiate in good faith and use commercially reasonable efforts to execute and implement the Definitive Documents that are consistent with this Agreement and the Restructuring Term Sheet to which it is required to be a party; and

(vi)support, and not oppose, entry of the DIP Orders, to the extent consistent with the terms of this Agreement and the Restructuring Term Sheet.

(b)During the Agreement Effective Period, each Consenting Stakeholder agrees, in respect of all of its Company Claims/Interests, that it shall not directly or indirectly:

(i)subject to Section 5.02, object to, delay, impede, or take any other action to interfere with acceptance, implementation, or consummation of the Restructuring Transactions;

(ii)propose, file, support, or vote for any Alternative Restructuring Proposal;

(iii)file any motion, pleading, or other document with the Bankruptcy Court or any other court (including any modifications or amendments thereof) that, in whole or in part, is not materially consistent with this Agreement or the Plan, including any DIP Order other than as contemplated in the Restructuring Term Sheet;

(iv)subject to section 5.02, initiate, or have initiated on its behalf, any litigation or proceeding of any kind with respect to the Chapter 11 Cases, this Agreement, or the other Restructuring Transactions contemplated herein against the Company Parties or the other Parties other than to enforce this Agreement or any Definitive Document or as otherwise permitted under this Agreement;

(v)subject to Section 5.02, exercise, or direct any other person to exercise, any right or remedy for the enforcement, collection, or recovery of any of Claims against or Interests in the Company Parties; or

(vi)subject to Section 5.02, object to, delay, impede, or take any other action to interfere with the Company Parties’ ownership and possession of their assets, wherever located, or interfere with the automatic stay arising under section 362 of the Bankruptcy Code; or

(vii)subject to Section 5.02, object to or commence any legal proceeding challenging the liens, claims, or adequate protection granted or proposed to be granted to the holders of Claims under the DIP Orders or the prepetition liens and claims of any Consenting Stakeholder.

(c)During the Agreement Effective Period, each Mastronardi Party agrees, in respect of all of its Company Claims/Interests, to:

(i)support the Restructuring Transactions and vote and exercise any necessary corporate powers or rights available to it (including in any board, shareholders’, or creditors’ meeting or in any process requiring voting or approval to which they are legally entitled to participate) in each case in favor of any matter requiring approval to the extent necessary to implement the Restructuring Transactions;

(ii)with respect to Mastronardi Berea, negotiate in good faith and use commercially reasonable efforts to execute and implement the Berea Term Sheet; and

(iii)support, and not oppose, entry of the DIP Orders, to the extent consistent with the terms of this Agreement and the Restructuring Term Sheet.

(d)During the Agreement Effective Period, each Mastronardi Party agrees, in respect of all of its Company Claims/Interests, that it shall not directly or indirectly:

(i)subject to Section 5.02, object to, delay, impede, or take any other action to interfere with acceptance, implementation, or consummation of the Restructuring Transactions;

(ii)propose, file, support, or vote for any Alternative Restructuring Proposal;

(iii)file any motion, pleading, or other document with the Bankruptcy Court or any other court (including any modifications or amendments thereof) that, in whole or in part, is not materially consistent with this Agreement or the Plan, including any DIP Order other than as contemplated in the Restructuring Term Sheet;

(iv)subject to section 5.02, initiate, or have initiated on its behalf, any litigation or proceeding of any kind with respect to the Chapter 11 Cases, this Agreement, or the other Restructuring Transactions contemplated herein against the Company Parties or the other Parties that is not materially consistent with this Agreement;

(v)subject to Section 5.02, exercise, or direct any other person to exercise, any right or remedy for the enforcement, collection, or recovery of any of Claims against or Interests in the Company Parties, other than is contemplated by the Berea Term Sheet;

(vi)subject to Section 5.02, object to, delay, impede, or take any other action to interfere with the Company Parties’ ownership and possession of their assets, wherever located, or interfere with the automatic stay arising under section 362 of the Bankruptcy Code, other than is contemplated by the Berea Term Sheet; or

(vii)subject to Section 5.02, object to or commence any legal proceeding challenging the liens, claims, or adequate protection granted or proposed to be granted to the holders of Claims under the DIP Orders or the prepetition liens and claims of any Consenting Stakeholder, other than is contemplated by the Berea Term Sheet.

4.01.Commitments with Respect to the DIP Facility.

(a)Subject to the conditions set forth in the Restructuring Term Sheet, Equilibrium agrees to provide (or cause any of its designees, including any joint venture, to provide) its respective share of the DIP Facility on the terms and conditions set forth in the Restructuring Term Sheet and the DIP Loan Documents; provided, that upon the termination or expiration of this Agreement in accordance with its terms prior to the closing of the DIP Loan Documents, the commitments of Equilibrium made pursuant to this section 4.02(a) with respect to the DIP Facility shall terminate.

4.01.Commitments with Respect to Chapter 11 Cases.

(a)During the Agreement Effective Period, each Non-Company Party that is entitled to vote to accept or reject the Plan pursuant to its terms agrees that it shall, subject to receipt by such Non-Company Party, whether before or after the commencement of the Chapter 11 Cases, of the Solicitation Materials:

(i)vote each of its Company Claims/Interests to accept the Plan by delivering its duly executed and completed ballot accepting the Plan on a timely basis following the commencement of the solicitation of the Plan and its actual receipt of the Solicitation Materials and the ballot;

(ii)to the extent it is permitted to elect whether to opt out of the releases set forth in the Plan, elect not to opt out of the releases set forth in the Plan by timely delivering its duly executed and completed ballot(s) indicating such election; and

(iii)not change, withdraw, amend, or revoke (or cause to be changed, withdrawn, amended, or revoked) any vote or election referred to in clauses (i) and (ii) above.

(b)Subject to Section 5.02, during the Agreement Effective Period, each Consenting Stakeholder, in respect of each of its Company Claims/Interests, will support, and will not directly or indirectly object to, delay, impede, or take any other action to interfere with any motion or other pleading or document filed by a Company Party in the Bankruptcy Court that is consistent with this Agreement.

(c)MPL expressly waives and relinquishes any and all rights to any recovery or distribution on account of any Company Claim/Interest held by MPL, subject to the occurrence of the Effective Date.

(d)Mastronardi Berea expressly waives and relinquishes any and all rights to any recovery or distribution on account of any Company Claim/Interest arising out of the Berea Lease held by Mastronardi Berea, subject to entry of the Final Berea Order and the consummation of the Berea Transfer (each as defined in the Restructuring Term Sheet).

Section 5. Additional Provisions Regarding the Parties’ Commitments.

5.01.Notwithstanding anything contained in this Agreement, nothing in this Agreement shall: (a) affect the ability of any Non-Company Party to consult with any other Non-Company Party, the Company Parties, or any other party in interest in the Chapter 11 Cases (including any official committee and the United States Trustee); (b) impair or waive the rights of any Non- Company Party to assert or raise any objection permitted under this Agreement in connection with the Restructuring Transactions; and (c) prevent any Non-Company Party from enforcing this Agreement or contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement.

5.02.For the avoidance of doubt, nothing in this Agreement shall affect or impair the Parties’ claims, liens, security interests, rights or remedies under (a) the DIP Loan Documents, including the DIP Credit Agreement or applicable DIP Order (including its right to declare an

event of default, accelerate, terminate commitments, foreclose, or otherwise exercise any right or remedy provided for therein) or (b) the Stalking Horse Purchase Agreement.

Section 6. Commitments of the Company Parties.

6.01.Affirmative Commitments. Except as set forth in Section 7, during the Agreement Effective Period, the Company Parties agree to:

(a)support and take all steps reasonably necessary and desirable to consummate the Restructuring Transactions in accordance with this Agreement;

(b)to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Restructuring Transactions contemplated herein, take all steps reasonably necessary and desirable to address any such impediment;

(c)use commercially reasonable efforts to obtain any and all required regulatory and/or third-party approvals for the Restructuring Transactions;

(d)negotiate in good faith and use commercially reasonable efforts to execute and deliver the Definitive Documents, the Berea Term Sheet and any other required agreements to effectuate and consummate the Restructuring Transactions as contemplated by this Agreement;

(e)use commercially reasonable efforts to seek additional support for the Restructuring Transactions from their other material stakeholders to the extent reasonably prudent;

(f)(i) provide counsel for the Non-Company Parties a reasonable opportunity to review draft copies of all First Day Pleadings and, (ii) to the extent reasonably practicable, provide a reasonable opportunity to counsel to any Non-Company Parties materially affected by such filing to review draft copies of other documents that the Company Parties intend to file with Bankruptcy Court, as applicable;

(g)initiate the Chapter 11 Cases in the Bankruptcy Court for the Southern District of Texas by no later than 11:59 p.m. prevailing Central Time on July 24, 2023, subject to the approval of the board of directors, board of managers, or similar governing body of the Company Parties in the exercise of their fiduciary duty and reasonable discretion;

(h)take all steps reasonably necessary or desirable to continue operations in the ordinary course of business at the Berea, Richmond, Morehead and Pulaski greenhouse facilities until such time as the operations and/or ownership for each applicable facility is transferred to a Non-Company Party or other third-party buyer pursuant to the 363 Sale or otherwise;

(i)take all steps reasonably necessary or desirable to deliver to Mastronardi Berea

(i) an executed counterpart to the Berea Term Sheet and (ii) the 9019 Motion prior to the Petition Date or the date of commencement of any other insolvency proceedings with respect thereto;

(j)use commercially reasonable efforts to obtain approval of the 9019 Motion (and related release of claims) by the Bankruptcy Court on an interim basis within five (5) calendar days following the Petition Date;

(k)use commercially reasonable efforts to obtain approval of the 9019 Motion (and related release of claims) by the Bankruptcy Court on a final basis within thirty-five (35) calendar days following the Petition Date; and

(l)take all steps reasonably necessary or desirable to transfer to Mastronardi Berea or its designee, free and clear of all liens or other encumbrances of any kind or nature, all right, title and interest of AppHarvest in, to and under the assets, properties and business, of every kind and description, wherever located, real, personal or mixed, tangible or intangible, known or unknown, owned, held or used in or primarily related to the Berea Lease and/or the use and operation thereof, within sixty (60) days following the Petition Date.

6.02.Negative Commitments. Except as set forth in Section 7, during the Agreement Effective Period, each of the Company Parties shall not directly or indirectly:

(a)object to, delay, impede, or take any other action to interfere with acceptance, implementation, or consummation of the Restructuring Transactions;

(b)take any action that is inconsistent in any material respect with, or is intended to frustrate or impede approval, implementation and consummation of the Restructuring Transactions described in, this Agreement or the Plan;

(c)object to, or solicit, support, or encourage any objection to any Credit Bidding and Sale Provisions rights set forth in the DIP Documents;

(d)modify the Definitive Documents, in whole or in part, in a manner that is not consistent with this Agreement, the Restructuring Term Sheet and the Berea Term Sheet in all material respects; and

(e)file any motion, pleading, or Definitive Documents with the Bankruptcy Court or any other court (including any modifications or amendments thereof) that, in whole or in part, is not materially consistent with this Agreement, the Restructuring Term Sheet, or the Berea Term Sheet.

Section 7. Additional Provisions Regarding Company Parties’ Commitments.

7.01.Notwithstanding anything to the contrary in this Agreement, nothing in this Agreement shall require a Company Party or the board of directors, board of managers, or similar governing body of a Company Party, after consulting with counsel, to take any action or to refrain from taking any action with respect to the Restructuring Transactions to the extent taking or failing to take such action would be inconsistent with applicable Law or its fiduciary obligations under applicable Law, and any such action or inaction pursuant to this Section 7.01 shall not be deemed to constitute a breach of this Agreement.

7.02.Notwithstanding anything to the contrary in this Agreement (but subject to Section 7.01), each Company Party and its respective directors, officers, employees, investment bankers, attorneys, accountants, consultants, and other advisors or representatives shall have the rights to: (a) consider, respond to, and facilitate unsolicited Alternative Restructuring Proposals;

(f)provide access to non-public information concerning any Company Party to any Entity that

enters into a reasonable and customary Confidentiality Agreements or nondisclosure agreement with any Company Party; (c) maintain or continue discussions or negotiations with respect to Alternative Restructuring Proposals; (d) otherwise cooperate with, assist, participate in, or facilitate any inquiries, proposals, discussions, or negotiation of Alternative Restructuring Proposals; and (e) enter into or continue discussions or negotiations with holders of Claims against or Interests in a Company Party (including any Consenting Stakeholder), any other party in interest in the Chapter 11 Cases (including any official committee and the United States Trustee), or any other Entity regarding the Restructuring Transactions or Alternative Restructuring Proposals; provided that the Company Parties shall provide counsel to the Required Consenting Stakeholder and the Mastronardi Parties reasonable updates on the status of discussions regarding any unsolicited Alternative Restructuring Proposal (subject to any applicable confidentiality restrictions) within five (5) Business Days of the Company Parties’ receipt of any such unsolicited Alternative Restructuring Proposal; provided further that, for the avoidance of doubt, nothing in this section 7.02 shall prevent the Company Parties from continuing the marketing process and/or otherwise seeking the highest and best price with respect to the 363 Sale or other transaction providing for the sale or disposition of the Richmond Assets, the Morehead Assets, the Pulaski Assets, or the Other Assets.

7.03.Nothing in this Agreement shall: (a) impair or waive the rights of any Company Party to assert or raise any objection permitted under this Agreement in connection with the Restructuring Transactions; or (b) prevent any Company Party from enforcing this Agreement or contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement.

Section 8. Transfer of Interests and Securities; Joinder.During the Agreement Effective Period, no Consenting Stakeholder shall Transfer any ownership (including any beneficial ownership as defined in the Rule 13d-3 under the Securities Exchange Act of 1934, as amended) in any Company Claims/Interests to any affiliated or unaffiliated party, including any party in which it may hold a direct or indirect beneficial interest, unless:

(a)in the case of any Company Claims/Interests, the authorized transferee is either

(1) a qualified institutional buyer as defined in Rule 144A of the Securities Act, (2) a non-U.S. person in an offshore transaction as defined under Regulation S under the Securities Act, (3) an institutional accredited investor (as defined in the Rules), or (4) a Consenting Stakeholder; and

(b)either (i) the transferee executes and delivers to counsel to the Company Parties, at or before the time of the proposed Transfer, a Transfer Agreement or (ii) the transferee is a. Consenting Stakeholder and the transferee provides notice of such Transfer (including the amount and type of Company Claim Transferred) to counsel to the Company Parties at or before the time of the proposed Transfer; and

(c)such Transfer shall not violate the terms of any order entered by the Bankruptcy Court with respect to preservation of net operating losses; provided that, this Section 8.01 shall not apply to the Required Consenting Stakeholder or any of its affiliates or designees in connection with any transfers related to structuring or closing the Restructuring Transactions, including the 363 Sale governed by the Stalking Horse Purchase Agreement and related credit bid.

8.02.Upon compliance with the requirements of Section 8.01, the transferor shall be deemed to relinquish its rights (and be released from its obligations) under this Agreement to the extent of the rights and obligations in respect of such transferred Company Claims/Interests. Any Transfer in violation of Section 8.01 shall be void ab initio.

8.03.This Agreement shall in no way be construed to preclude the Consenting Stakeholders from acquiring additional Company Claims/Interests; provided, however, that

(a) such additional Company Claims/Interests shall automatically and immediately upon acquisition by a Consenting Stakeholder be deemed subject to the terms of this Agreement (regardless of when or whether notice of such acquisition is given to counsel to the Company Parties or counsel to the Consenting Stakeholders) and (b) such Consenting Stakeholder must provide notice of such acquisition (including the amount and type of Company Claim/Interest acquired) to counsel to the Company Parties within five (5) Business Days of such acquisition.

8.04.This Section 8 shall not impose any obligation on any Company Party to issue any “cleansing letter” or otherwise publicly disclose information for the purpose of enabling a Consenting Stakeholder to Transfer any of its Company Claims/Interests. Notwithstanding anything to the contrary herein, to the extent a Company Party and another Party have entered into a Confidentiality Agreement, the terms of such Confidentiality Agreement shall continue to apply and remain in full force and effect according to its terms, and this Agreement does not supersede any rights or obligations otherwise arising under such Confidentiality Agreements.

8.05.Notwithstanding Section 8.01, a Qualified Marketmaker that acquires any Company Claims/Interests with the purpose and intent of acting as a Qualified Marketmaker for such Company Claims/Interests shall not be required to execute and deliver a Transfer Agreement in respect of such Company Claims/Interests if (i) such Qualified Marketmaker subsequently transfers such Company Claims/Interests (by purchase, sale assignment, participation, or otherwise) within five (5) Business Days of its acquisition to a transferee that is an entity that is not an affiliate, affiliated fund, or affiliated entity with a common investment advisor; (ii) the transferee otherwise is a Permitted Transferee under Section 8.01; and (iii) the Transfer otherwise is a Permitted Transfer under Section 8.01. To the extent that a Consenting Stakeholder is acting in its capacity as a Qualified Marketmaker, it may Transfer (by purchase, sale, assignment, participation, or otherwise) any right, title or interests in Company Claims/Interests that the Qualified Marketmaker acquires from a holder of the Company Claims/Interests who is not a Consenting Stakeholder without the requirement that the transferee be a Permitted Transferee.

8.06.Notwithstanding anything to the contrary in this Section 8, the restrictions on Transfer set forth in this Section 8 shall not apply to the grant of any liens or encumbrances on any claims and interests in favor of a bank or broker-dealer holding custody of such claims and interests in the ordinary course of business and which lien or encumbrance is released upon the Transfer of such claims and interests.

8.07.Additional Consenting Stakeholders. Any holder of Company Claims/Interests that is not a party to this Agreement as of the Agreement Effective Date may, at any time after the Agreement Effective Date, become a Consenting Stakeholder by executing and delivering a Joinder to Counsel to the Company Parties and Counsel to the Required Consenting Stakeholder, pursuant to which such Entity shall be bound by the terms of this Agreement.

Section 9. Representations and Warranties of Consenting Stakeholders. Each Consenting Stakeholder severally, and not jointly, represents and warrants that, as of the date such Consenting Stakeholder executes and delivers this Agreement and as of the Plan Effective Date:

(a)it is the beneficial or record owner of the face amount of the Company Claims/Interests or is the nominee, investment manager, or advisor for beneficial holders of the Company Claims/Interests reflected in, and, having made reasonable inquiry, is not the beneficial or record owner of any Company Claims/Interests other than those reflected in, such Consenting Stakeholder’s signature page to this Agreement or a Transfer Agreement, as applicable (as may be updated pursuant to Section 8);

(b)it has the full power and authority to act on behalf of, vote and consent to matters concerning, such Company Claims/Interests;

(c)such Company Claims/Interests are free and clear of any pledge, lien, security interest, charge, claim, equity, option, proxy, voting restriction, right of first refusal, or other limitation on disposition, transfer, or encumbrances of any kind, that would adversely affect in any way such Consenting Stakeholder’s ability to perform any of its obligations under this Agreement at the time such obligations are required to be performed;

(d)it has the full power to vote, approve changes to, and transfer all of its Company Claims/Interests referable to it as contemplated by this Agreement subject to applicable Law; and

(e)solely with respect to holders of Company Claims/Interests, (i) it is either (A) a qualified institutional buyer as defined in Rule 144A of the Securities Act, (B) not a U.S. person (as defined in Regulation S of the Securities Act), or (C) an institutional accredited investor (as defined in the Rules), and (ii) any securities acquired by the Consenting Stakeholder in connection with the Restructuring Transactions will have been acquired for investment and not with a view to distribution or resale in violation of the Securities Act.

Section 10. Mutual Representations, Warranties, and Covenants. Each of the Parties represents, warrants, and covenants to each other Party, as of the date such Party executed and delivers this Agreement, on the Plan Effective Date:

(a)it is validly existing and in good standing under the Laws of the state of its organization, and this Agreement is a legal, valid, and binding obligation of such Party, enforceable against it in accordance with its terms, except as enforcement may be limited by applicable Laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability;

(b)except as expressly provided in this Agreement, the Plan, and the Bankruptcy Code, no consent or approval is required by any other person or Entity in order for it to effectuate the Restructuring Transactions contemplated by, and perform its respective obligations under, this Agreement;

(c)the entry into and performance by it of, and the transactions contemplated by, this Agreement do not, and will not, conflict in any material respect with any Law or regulation

applicable to it or with any of its articles of association, memorandum of association or other constitutional documents;

(d)except as expressly provided in this Agreement, it has (or will have, at the relevant time) all requisite corporate or other power and authority to enter into, execute, and deliver this Agreement and to effectuate the Restructuring Transactions contemplated by, and perform its respective obligations under, this Agreement; and

(e)except as expressly provided by this Agreement, it is not party to any restructuring or similar agreements or arrangements with the other Parties to this Agreement that have not been disclosed to all Parties to this Agreement.

Section 11. Termination Events.

11.01.Non-Company Party Termination Events. This Agreement may be terminated by each of the Non-Company Parties with respect to themselves (but not with respect to the other Non-Company Parties) by the delivery to the Company Parties of a written notice in accordance with Section 14.10 hereof upon the occurrence of the following events:

(a)the breach in any material respect by a Company Party of any of the representations, warranties, or covenants of the Company Parties set forth in this Agreement that (i) is adverse to the Non-Company Parties seeking termination pursuant to this provision and (ii) remains uncured for five (5) Business Days after such terminating Non-Company Parties transmit a written notice in accordance with Section 14.10 hereof detailing any such breach;

(b)with respect to the Required Consenting Stakeholder and the Mastronardi Parties, any Milestone (as defined in the Restructuring Term Sheet) shall fail to occur by the date set forth in the Restructuring Term Sheet, unless such failure is due to delay in obtaining a hearing before the Bankruptcy Court;

(c)with respect to the Required Consenting Stakeholder and the Mastronardi Parties, the occurrence of any event of default under any of the DIP Loan Documents, including, without limitation, the DIP Credit Agreement or applicable DIP Order or the acceleration or maturity of the obligations or termination of commitments under the DIP Facility;

(d)with respect to the Required Consenting Stakeholder and the Mastronardi Parties, any Company Party’s entry into any new financing arrangement or arrangement or contract with respect to debtor-in-possession financing or cash collateral use other than the DIP Facility without the consent of the Required Consenting Stakeholder to the extent such new financing arrangement or arrangement or contract is adverse to the Required Consenting Stakeholder;

(e)the Bankruptcy Court grants relief that (i) is materially inconsistent with this Agreement or (ii) would materially frustrate the purposes of this Agreement, including by preventing the consummation of the Restructuring Transactions;

(f)the issuance by any governmental authority, including any regulatory authority or court of competent jurisdiction, of any final, non-appealable ruling or order that (i) enjoins the consummation of a material portion of the Restructuring Transactions and (ii) remains in effect for

fifteen (15) Business Days after such terminating Non-Company Parties transmit a written notice in accordance with Section 14.10 hereof detailing any such issuance; provided, that this termination right may not be exercised by any Party that sought or requested such ruling or order in contravention of any obligation set out in this Agreement;

(g)the Bankruptcy Court enters an order denying confirmation of the Plan; or

(h)the entry of an order by the Bankruptcy Court, or the filing of a motion or application by any Company Party seeking an order (without the prior written consent of the Required Consenting Stakeholder, not to be unreasonably withheld), (i) converting one or more of the Chapter 11 Cases of a Company Party to a case under chapter 7 of the Bankruptcy Code or dismissing such cases, (ii) appointing an examiner with expanded powers beyond those set forth in sections 1106(a)(3) and (4) of the Bankruptcy Code or a trustee in one or more of the Chapter 11 Cases of a Company Party, or (iii) rejecting this Agreement.

11.02.EQ Term Sheet Termination Events. In addition to the Termination Events applicable to the Mastronardi Parties set forth in Section 11.01, this Agreement shall terminate automatically as to the Mastronardi Parties and Equilibrium with respect to themselves upon the termination of the EQ Term Sheet.

11.03.Company Party Termination Events. Any Company Party may terminate this Agreement as to all Parties upon prior written notice to all Parties in accordance with Section 14.10 hereof upon the occurrence of any of the following events:

(a)the breach in any material respect by one or more of the Consenting Stakeholders of any provision set forth in this Agreement that remains uncured for a period of fifteen (15) Business Days after the receipt by the Consenting Stakeholders of notice of such breach;

(b)the board of directors, board of managers, or such similar governing body of any Company Party determines, after consulting with counsel, (i) that proceeding with any of the Restructuring Transactions would be inconsistent with the exercise of its fiduciary duties or applicable Law or (ii) in the exercise of its fiduciary duties, to pursue an Alternative Restructuring Proposal;

(c)the issuance by any governmental authority, including any regulatory authority or court of competent jurisdiction, of any final, non-appealable ruling or order that (i) enjoins the consummation of a material portion of the Restructuring Transactions and (ii) remains in effect for thirty (30) Business Days after such terminating Company Party transmits a written notice in accordance with Section 14.10 hereof detailing any such issuance; provided, that this termination right shall not apply to or be exercised by any Company Party that sought or requested such ruling or order in contravention of any obligation or restriction set out in this Agreement; or

(d)the Bankruptcy Court enters an order denying confirmation of the Plan that remains uncured for a period of fourteen (14) Business Days.

11.04.Mutual Termination. This Agreement, and the obligations of all Parties hereunder, may be terminated by mutual written agreement among all of the following: (a) the Required Consenting Stakeholder; (b) the Mastronardi Parties, and (c) each Company Party.

11.05.Automatic Termination. This Agreement shall terminate automatically without any further required action or notice immediately after the Plan Effective Date.

11.06.Effect of Termination. Upon the occurrence of a Termination Date as to a Party, this Agreement shall be of no further force and effect as to such Party and each Party subject to such termination shall be released from its commitments, undertakings, and agreements under or related to this Agreement and shall have the rights and remedies that it would have had, had it not entered into this Agreement, and shall be entitled to take all actions, whether with respect to the. Restructuring Transactions or otherwise, that it would have been entitled to take had it not entered into this Agreement, including with respect to any and all Claims or causes of action. Upon the occurrence of a Termination Date prior to the Confirmation Order being entered by a Bankruptcy Court, any and all consents or ballots tendered by the Parties subject to such termination before a Termination Date shall be deemed, for all purposes, to be null and void from the first instance and shall not be considered or otherwise used in any manner by the Parties in connection with the Restructuring Transactions and this Agreement or otherwise; provided, however, any Consenting Stakeholder withdrawing or changing its vote pursuant to this Section 11.05 shall promptly provide written notice of such withdrawal or change to each other Party to this Agreement and, if such withdrawal or change occurs on or after the Petition Date, file notice of such withdrawal or change with the Bankruptcy Court. Nothing in this Agreement shall be construed as prohibiting a Company Party or any of the Non-Company Parties from contesting whether any such termination is in accordance with its terms or to seek enforcement of any rights under this Agreement that arose or existed before a Termination Date. Except as expressly provided in this Agreement, nothing herein is intended to, or does, in any manner waive, limit, impair, or restrict (a) any right of any Company Party or the ability of any Company Party to protect and reserve its rights (including rights under this Agreement), remedies, and interests, including its claims against any Consenting Stakeholder, and (b) any right of any Non-Company Party, or the ability of any Non- Company Party, to protect and preserve its rights (including rights under this Agreement), remedies, and interests, including its claims against any Company Party or Non-Company Party. No purported termination of this Agreement shall be effective under this Section 11.05 or otherwise if the Party seeking to terminate this Agreement is in material breach of this Agreement, except a termination pursuant to Section 11.02(b) or Section 11.02(d). Nothing in this Section 11.05 shall restrict any Company Party’s right to terminate this Agreement in accordance with Section l 1.02(b).

Section 12. Amendments and Waivers.

(a)This Agreement may not be modified, amended, or supplemented, and no condition or requirement of this Agreement may be waived, in any manner except in accordance with this Section 12. This Section 12 may not be modified, amended, or supplemented without the consent of (i) each Company Party and (ii) each Non-Company Party.

(b)This Agreement may be modified, amended, or supplemented, or a condition or requirement of this Agreement may be waived, in a writing signed by: (i) each Company Party and

(ii) the following Parties, solely with respect to any modification, amendment, waiver or supplement that adversely affects the rights of such Parties and unless otherwise specified in this Agreement: (A) Equilibrium, (B) the Mastronardi Parties and (C) any other Consenting Stakeholder; provided, however, that if the proposed modification, amendment, waiver, or

supplement has a material, disproportionate, and adverse effect on any of the Company Claims/Interests held by a Non-Company Party, then the consent of each such affected Non- Company Party shall also be required to effectuate such modification, amendment, waiver or supplement; provided further that, for the avoidance of doubt, as to Equilibrium, a modification, amendment, waiver, or supplement to sections 4.01(a) and (b) (with respect to the Required Consenting Stakeholder); 4.02(a); 5.01; 5.02; 6.02(c)–(e); 7.01–7.02; 11.01 (with respect to the Required Consenting Stakeholder); or 11.04 hereto shall constitute an adverse effect such that the written consent of Equilibrium shall be required to effectuate such modification, amendment, waiver, or supplement.

(c)Any proposed modification, amendment, waiver or supplement that does not comply with this Section 12 shall be ineffective and void ab initio.

(d)The waiver by any Party of a breach of any provision of this Agreement shall not operate or be construed as a further or continuing waiver of such breach or as a waiver of any other or subsequent breach. No failure on the part of any Party to exercise, and no delay in exercising, any right, power or remedy under this Agreement shall operate as a waiver of any such right, power or remedy or any provision of this Agreement, nor shall any single or partial exercise of such right, power or remedy by such Party preclude any other or further exercise of such right, power or remedy or the exercise of any other right, power or remedy. All remedies under this Agreement are cumulative and are not exclusive of any other remedies provided by Law.

Section 13. Mutual Releases and Exculpations.

13.01.Releases and Exculpations. The Consenting Stakeholders, the Mastronardi Parties, and the Company Parties agree to support inclusion of the Releases and Exculpations as set forth in Annex A of the Restructuring Term Sheet and the DIP Loan Documents in the Plan.

13.02.No Additional Representations and Warranties. Each of the Parties agrees and acknowledges that, except as expressly provided in this Agreement and the Definitive Documents, no other Party, in any capacity, has warranted or otherwise made any representations concerning any Released Claim (including any representation or warranty concerning the existence, nonexistence, validity, or invalidity of any Released Claim). Notwithstanding the foregoing, nothing contained in this Agreement is intended to impair or otherwise derogate from any of the representations, warranties, or covenants expressly set forth in this Agreement or any of the Definitive Documents.

13.03.Releases of Unknown Claims. Each of the Releasing Parties in each of the Releases contemplated to be included in the Plan pursuant to this Agreement expressly acknowledges that although ordinarily a general release may not extend to Released Claims which the Releasing Party does not know or suspect to exist in its favor, which if known by it may have materially affected its settlement with the party released, they have carefully considered and taken into account in determining to enter into the above Releases the possible existence of such unknown losses or claims. Without limiting the generality of the foregoing, each Releasing Party expressly waives and relinquishes any and all rights such Party may have or conferred upon it under any federal, state, or local statute, rule, regulation, or principle of common law or equity which provides that a release does not extend to claims which the claimant does not know or suspect to exist in its favor

at the time of providing the Release or which may in any way limit the effect or scope of the Releases with respect to Released Claims which such Party did not know or suspect to exist in such Party’s favor at the time of providing the Release, which in each case if known by it may have materially affected its settlement with any Released Party. Each of the Releasing Parties expressly acknowledges that the Releases and covenants not to sue contemplated to be included in the Plan are to be effective regardless of whether those released matters or Released Claims are presently known or unknown, suspected or unsuspected, or foreseen or unforeseen.

13.04.Turnover of Subsequently Recovered Assets. Subject to the effectiveness of the Plan providing for the Releases, in the event that any Releasing Party (including any successor or assignee thereof and including through any third party, trustee, debtor in possession, creditor, estate, creditors’ committee, or similar Entity) is successful in pursuing or receives, directly or indirectly, any funds, property, or other value on account of any Claim, Cause of Action, or litigation against any Released Party that was released pursuant to the Release (or would have been released pursuant to the Release if the party bringing such claim were a Releasing Party), such Releasing Party (i) shall not commingle any such recovery with any of its other assets and (ii) agrees that it shall promptly turnover and assign any such recoveries to, and hold them in trust for, such Released Party.

13.05.Certain Limitations on Releases. For the avoidance of doubt, nothing in this Agreement and the Releases contemplated to be included in the Plan pursuant to this Section 13 shall or shall be deemed to result in the waiving or limiting by (a) the Company Parties, or any officer, director, member of any governing body, or employee thereof, of (i) any indemnification against any Company Party, any of their insurance carriers, or any other Entity, (ii) any rights as beneficiaries of any insurance policies, (iii) wages, salaries, compensation, or benefits, (iv) intercompany claims, or (v) any Interest held by a Company Party; (b) the Consenting Stakeholders or any administrative agent appointed under any financing document (except as may be expressly amended or modified by the Plan, or any other financing document under and as defined therein);

(c) the Mastronardi Parties or (d) any Party or other Entity of any post-Agreement Effective Date obligations under this Agreement or post-Plan Effective Date obligations under the Plan, the Confirmation Order, the Restructuring Transaction, or any document, instrument, or agreement (including those set forth in the Plan Supplement) executed to implement the Plan, or any Claim or obligation arising under the Plan.

13.06.Covenant Not to Sue. Subject to effectiveness of the Plan providing for the Releases, each of the Releasing Parties hereby further agrees and covenants not to, and shall not, commence or prosecute, or assist or otherwise aid any other Entity in the commencement or prosecution of, whether directly, derivatively or otherwise, any Released Claims.

Section 14. Miscellaneous.

14.01.Acknowledgement. Notwithstanding any other provision herein, this Agreement is not and shall not be deemed to be an offer with respect to any securities or solicitation of votes for the acceptance of a plan of reorganization for purposes of sections 1125 and 1126 of the Bankruptcy Code or otherwise. Any such offer or solicitation will be made only in compliance with all applicable securities Laws, provisions of the Bankruptcy Code, and/or other applicable Law.

14.02.Exhibits Incorporated by Reference; Conflicts. Each of the exhibits, annexes, signatures pages, and schedules attached hereto, including the Restructuring Term Sheet and the Berea Term Sheet, is expressly incorporated herein and made a part of this Agreement, and all references to this Agreement shall include such exhibits, annexes, and schedules. In the event of any inconsistency between this Agreement (without reference to the exhibits, annexes, and schedules hereto) and (a) the Restructuring Term Sheet, the Restructuring Term Sheet shall govern, (b) any DIP Loan Document, such DIP Loan Document shall govern, or (c) the Stalking Horse Purchase Agreement, the Stalking Horse Purchase Agreement shall govern.

14.03.Further Assurances. In accordance with the other terms of this Agreement, the Parties agree to execute and deliver such other instruments and perform such acts, in addition to the matters herein specified, as may be reasonably appropriate or necessary, or as may be required by order of the Bankruptcy Court, from time to time, to effectuate the Restructuring Transactions, as applicable.

14.04.Complete Agreement. Except as otherwise explicitly provided herein, this Agreement, including the Restructuring Term Sheet, constitutes the entire agreement among the Parties with respect to the subject matter hereof and supersedes all prior agreements, oral or written, among the Parties with respect thereto, other than any Confidentiality Agreement, the Berea Term Sheet and the EQ Term Sheet.

14.05.GOVERNING LAW; SUBMISSION TO JURISDICTION: SELECTION OF FORUM. THIS AGREEMENT IS TO BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS MADE AND TO BE PERFORMED IN SUCH STATE, WITHOUT GIVING EFFECT TO THE CONFLICT OF LAWS PRINCIPLES THEREOF. Each Party hereto agrees

that it shall bring any action or proceeding in respect of any claim arising out of or related to this Agreement, to the extent possible, in the Bankruptcy Court, and solely in connection with claims arising under this Agreement: (a) irrevocably submits to the exclusive jurisdiction of the Bankruptcy Court; (b) waives any objection to laying venue in any such action or proceeding in the Bankruptcy Court; and (c) waives any objection that the Bankruptcy Court is an inconvenient forum or does not have jurisdiction over any Party hereto.