false00000035452023FYhttp://fasb.org/us-gaap/2023#GainsLossesOnSalesOfInvestmentRealEstatehttp://fasb.org/us-gaap/2023#GainsLossesOnSalesOfInvestmentRealEstateP1Yhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent00000035452022-10-012023-09-3000000035452023-03-31iso4217:USD00000035452023-12-04xbrli:shares00000035452023-09-3000000035452022-09-30iso4217:USDxbrli:shares0000003545alco:AlicoCitrusMember2022-10-012023-09-300000003545alco:AlicoCitrusMember2021-10-012022-09-300000003545alco:AlicoCitrusMember2020-10-012021-09-300000003545alco:LandManagementAndOtherOperationsMember2022-10-012023-09-300000003545alco:LandManagementAndOtherOperationsMember2021-10-012022-09-300000003545alco:LandManagementAndOtherOperationsMember2020-10-012021-09-3000000035452021-10-012022-09-3000000035452020-10-012021-09-300000003545us-gaap:CommonStockMember2020-09-300000003545us-gaap:AdditionalPaidInCapitalMember2020-09-300000003545us-gaap:TreasuryStockCommonMember2020-09-300000003545us-gaap:RetainedEarningsMember2020-09-300000003545us-gaap:ParentMember2020-09-300000003545us-gaap:NoncontrollingInterestMember2020-09-3000000035452020-09-300000003545us-gaap:RetainedEarningsMember2020-10-012021-09-300000003545us-gaap:ParentMember2020-10-012021-09-300000003545us-gaap:NoncontrollingInterestMember2020-10-012021-09-300000003545us-gaap:AdditionalPaidInCapitalMember2020-10-012021-09-300000003545us-gaap:TreasuryStockCommonMember2020-10-012021-09-300000003545us-gaap:CommonStockMember2021-09-300000003545us-gaap:AdditionalPaidInCapitalMember2021-09-300000003545us-gaap:TreasuryStockCommonMember2021-09-300000003545us-gaap:RetainedEarningsMember2021-09-300000003545us-gaap:ParentMember2021-09-300000003545us-gaap:NoncontrollingInterestMember2021-09-3000000035452021-09-300000003545us-gaap:RetainedEarningsMember2021-10-012022-09-300000003545us-gaap:ParentMember2021-10-012022-09-300000003545us-gaap:NoncontrollingInterestMember2021-10-012022-09-300000003545us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-300000003545us-gaap:TreasuryStockCommonMember2021-10-012022-09-300000003545us-gaap:CommonStockMember2022-09-300000003545us-gaap:AdditionalPaidInCapitalMember2022-09-300000003545us-gaap:TreasuryStockCommonMember2022-09-300000003545us-gaap:RetainedEarningsMember2022-09-300000003545us-gaap:ParentMember2022-09-300000003545us-gaap:NoncontrollingInterestMember2022-09-300000003545us-gaap:RetainedEarningsMember2022-10-012023-09-300000003545us-gaap:ParentMember2022-10-012023-09-300000003545us-gaap:NoncontrollingInterestMember2022-10-012023-09-300000003545us-gaap:NoncontrollingInterestMember2023-06-222023-06-220000003545us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300000003545us-gaap:TreasuryStockCommonMember2022-10-012023-09-300000003545us-gaap:CommonStockMember2023-09-300000003545us-gaap:AdditionalPaidInCapitalMember2023-09-300000003545us-gaap:TreasuryStockCommonMember2023-09-300000003545us-gaap:RetainedEarningsMember2023-09-300000003545us-gaap:ParentMember2023-09-300000003545us-gaap:NoncontrollingInterestMember2023-09-300000003545us-gaap:LandMember2023-09-30utr:acrealco:classificationalco:Segment0000003545alco:CitreeHoldingsILLCMember2022-10-012023-09-300000003545alco:CitreeHoldingsILLCMember2021-10-012022-09-300000003545alco:CitreeHoldingsILLCMember2020-10-012021-09-300000003545alco:CitrusTreesMember2023-09-300000003545alco:CitrusTreesMember2022-09-300000003545alco:GroveManagementServicesMember2022-10-012023-09-300000003545alco:GroveManagementServicesMember2021-10-012022-09-300000003545alco:GroveManagementServicesMember2020-10-012021-09-300000003545alco:AlicoCitrusMemberalco:EarlyAndMidSeasonMember2022-10-012023-09-300000003545alco:AlicoCitrusMemberalco:EarlyAndMidSeasonMember2021-10-012022-09-300000003545alco:AlicoCitrusMemberalco:EarlyAndMidSeasonMember2020-10-012021-09-300000003545alco:AlicoCitrusMemberalco:ValenciasMember2022-10-012023-09-300000003545alco:AlicoCitrusMemberalco:ValenciasMember2021-10-012022-09-300000003545alco:AlicoCitrusMemberalco:ValenciasMember2020-10-012021-09-300000003545alco:AlicoCitrusMemberalco:FreshFruitMember2022-10-012023-09-300000003545alco:AlicoCitrusMemberalco:FreshFruitMember2021-10-012022-09-300000003545alco:AlicoCitrusMemberalco:FreshFruitMember2020-10-012021-09-300000003545alco:AlicoCitrusMemberalco:GroveManagementServicesMember2022-10-012023-09-300000003545alco:AlicoCitrusMemberalco:GroveManagementServicesMember2021-10-012022-09-300000003545alco:AlicoCitrusMemberalco:GroveManagementServicesMember2020-10-012021-09-300000003545alco:LandAndOtherLeasingMemberalco:LandManagementAndOtherOperationsMember2022-10-012023-09-300000003545alco:LandAndOtherLeasingMemberalco:LandManagementAndOtherOperationsMember2021-10-012022-09-300000003545alco:LandAndOtherLeasingMemberalco:LandManagementAndOtherOperationsMember2020-10-012021-09-300000003545alco:OtherMemberalco:LandManagementAndOtherOperationsMember2022-10-012023-09-300000003545alco:OtherMemberalco:LandManagementAndOtherOperationsMember2021-10-012022-09-300000003545alco:OtherMemberalco:LandManagementAndOtherOperationsMember2020-10-012021-09-300000003545us-gaap:FairValueInputsLevel2Member2023-09-300000003545us-gaap:FairValueInputsLevel2Member2022-09-300000003545alco:TropicanaMember2023-09-300000003545alco:TropicanaMember2022-09-300000003545alco:TropicanaMember2022-10-012023-09-300000003545alco:TropicanaMember2021-10-012022-09-300000003545alco:TropicanaMember2020-10-012021-09-300000003545us-gaap:SalesRevenueNetMemberalco:TropicanaMemberus-gaap:CustomerConcentrationRiskMember2022-10-012023-09-30xbrli:pure0000003545us-gaap:SalesRevenueNetMemberalco:TropicanaMemberus-gaap:CustomerConcentrationRiskMember2021-10-012022-09-300000003545us-gaap:SalesRevenueNetMemberalco:TropicanaMemberus-gaap:CustomerConcentrationRiskMember2020-10-012021-09-300000003545alco:CitrusTreesMember2022-10-012023-09-300000003545us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2023-09-300000003545us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2023-09-300000003545us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2023-09-300000003545us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2023-09-300000003545alco:RanchMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-09-300000003545alco:RanchMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2022-09-300000003545us-gaap:DiscontinuedOperationsHeldforsaleMember2023-09-300000003545us-gaap:DiscontinuedOperationsHeldforsaleMember2022-09-300000003545us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-09-180000003545us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-09-212023-09-210000003545us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-09-300000003545us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-10-012023-09-3000000035452022-10-2000000035452022-10-202022-10-200000003545us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-09-300000003545us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2021-10-012022-09-300000003545us-gaap:MachineryAndEquipmentMember2023-09-300000003545us-gaap:MachineryAndEquipmentMember2022-09-300000003545us-gaap:BuildingAndBuildingImprovementsMember2023-09-300000003545us-gaap:BuildingAndBuildingImprovementsMember2022-09-300000003545alco:DepreciablePropertyPlantAndEquipmentMember2023-09-300000003545alco:DepreciablePropertyPlantAndEquipmentMember2022-09-300000003545us-gaap:LandAndLandImprovementsMember2023-09-300000003545us-gaap:LandAndLandImprovementsMember2022-09-300000003545us-gaap:HurricaneMember2021-10-012022-09-300000003545us-gaap:HurricaneMemberalco:CitrusTreesMember2021-10-012022-09-300000003545us-gaap:BuildingMemberus-gaap:HurricaneMember2021-10-012022-09-300000003545alco:PortionOfCitrusGrovesMember2022-10-012023-09-300000003545alco:FixedRateTermLoanMember2023-09-300000003545alco:FixedRateTermLoanMember2022-09-300000003545alco:VariableRateTermLoanMember2023-09-300000003545alco:VariableRateTermLoanMember2022-09-300000003545alco:CitreeTermLoanMember2023-09-300000003545alco:CitreeTermLoanMember2022-09-300000003545alco:PruLoansABMember2023-09-300000003545alco:PruLoansABMember2022-09-300000003545alco:TermLoansandPRULoansMember2023-09-300000003545alco:TermLoansandPRULoansMember2022-09-300000003545us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-09-300000003545us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-09-300000003545alco:WorkingCapitalLineOfCreditMemberus-gaap:LineOfCreditMember2023-09-300000003545alco:WorkingCapitalLineOfCreditMemberus-gaap:LineOfCreditMember2022-09-300000003545us-gaap:LineOfCreditMember2023-09-300000003545us-gaap:LineOfCreditMember2022-09-300000003545us-gaap:RevolvingCreditFacilityMemberalco:FixedRateTermLoanMember2023-09-300000003545alco:VariableRateTermLoanMemberus-gaap:RevolvingCreditFacilityMember2023-09-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMember2023-09-300000003545alco:WorkingCapitalLineOfCreditMember2023-09-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMember2022-09-300000003545alco:WorkingCapitalLineOfCreditMember2022-09-300000003545alco:CitrusGrovesMember2023-09-300000003545alco:FarmandRanchLandMember2023-09-300000003545alco:FarmandRanchLandMember2021-04-300000003545alco:CitrusGrovesMember2021-04-300000003545alco:FixedRateTermLoanMember2022-10-012023-09-300000003545alco:FixedRateTermLoanMember2021-04-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMember2022-10-012023-09-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMemberalco:LondonInterbankOfferedRateLIBOR1Member2022-10-012023-09-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2021-10-012022-09-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-10-012023-09-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-09-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-09-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMemberalco:VariableRateTermLoanMember2023-09-300000003545alco:MetropolitanLifeInsuranceCompanyAndNewEnglandLifeInsuranceCompanyRevolvingLineOfCreditMemberalco:VariableRateTermLoanMember2022-09-300000003545alco:WorkingCapitalLineOfCreditMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-10-272022-10-270000003545alco:WorkingCapitalLineOfCreditMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-10-272022-10-270000003545alco:WorkingCapitalLineOfCreditMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-10-012023-09-300000003545alco:WorkingCapitalLineOfCreditMemberus-gaap:LetterOfCreditMember2023-09-300000003545us-gaap:FinancialStandbyLetterOfCreditMember2023-09-300000003545alco:WorkingCapitalLineOfCreditMembersrt:MinimumMember2022-10-012023-09-300000003545alco:WorkingCapitalLineOfCreditMembersrt:MaximumMember2022-10-012023-09-300000003545alco:WorkingCapitalLineOfCreditMember2022-10-012023-09-300000003545alco:MetlifeTermLoanMemberalco:CitreeHoldingsILLCMember2023-09-300000003545alco:FixedRateTermLoanMemberalco:SilverNipCitrusMember2023-09-30alco:Loan0000003545alco:FixedRateTermLoanMemberalco:SilverNipCitrusMember2022-10-012023-09-300000003545alco:FixedRateTermLoanMemberalco:SilverNipCitrusMember2015-02-150000003545alco:FixedRateTermLoanMemberalco:SilverNipCitrusMember2018-03-310000003545alco:SilverNipCitrusMember2023-09-300000003545alco:TwoThousandAndFifteenPlanMember2015-01-270000003545srt:MinimumMemberalco:TwoThousandAndFifteenPlanMember2015-01-272015-01-270000003545srt:MaximumMemberalco:TwoThousandAndFifteenPlanMember2015-01-272015-01-270000003545alco:BoardOfDirectorsFeesMember2022-10-012023-09-300000003545alco:BoardOfDirectorsFeesMember2021-10-012022-09-300000003545alco:BoardOfDirectorsFeesMember2020-10-012021-09-300000003545us-gaap:RestrictedStockMember2022-09-300000003545us-gaap:RestrictedStockMember2022-10-012023-09-300000003545us-gaap:RestrictedStockMember2023-09-300000003545us-gaap:RestrictedStockMember2021-10-012022-09-300000003545us-gaap:RestrictedStockMember2020-10-012021-09-300000003545us-gaap:ShareBasedCompensationAwardTrancheOneMember2022-09-300000003545us-gaap:ShareBasedCompensationAwardTrancheTwoMember2022-09-300000003545us-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-09-300000003545us-gaap:EmployeeStockOptionMember2022-10-012023-09-300000003545us-gaap:EmployeeStockOptionMember2021-10-012022-09-300000003545us-gaap:EmployeeStockOptionMember2020-10-012021-09-300000003545us-gaap:EmployeeStockOptionMember2023-09-300000003545us-gaap:EmployeeStockOptionMember2022-09-300000003545us-gaap:DomesticCountryMember2023-09-300000003545us-gaap:StateAndLocalJurisdictionMember2023-09-300000003545alco:AlicoCitrusMemberus-gaap:OperatingSegmentsMember2022-10-012023-09-300000003545alco:AlicoCitrusMemberus-gaap:OperatingSegmentsMember2021-10-012022-09-300000003545alco:AlicoCitrusMemberus-gaap:OperatingSegmentsMember2020-10-012021-09-300000003545us-gaap:OperatingSegmentsMemberalco:LandManagementAndOtherOperationsMember2022-10-012023-09-300000003545us-gaap:OperatingSegmentsMemberalco:LandManagementAndOtherOperationsMember2021-10-012022-09-300000003545us-gaap:OperatingSegmentsMemberalco:LandManagementAndOtherOperationsMember2020-10-012021-09-300000003545us-gaap:MaterialReconcilingItemsMember2022-10-012023-09-300000003545us-gaap:MaterialReconcilingItemsMember2021-10-012022-09-300000003545us-gaap:MaterialReconcilingItemsMember2020-10-012021-09-300000003545alco:AlicoCitrusMemberus-gaap:OperatingSegmentsMember2023-09-300000003545alco:AlicoCitrusMemberus-gaap:OperatingSegmentsMember2022-09-300000003545us-gaap:OperatingSegmentsMemberalco:LandManagementAndOtherOperationsMember2023-09-300000003545us-gaap:OperatingSegmentsMemberalco:LandManagementAndOtherOperationsMember2022-09-300000003545us-gaap:CorporateNonSegmentMember2023-09-300000003545us-gaap:CorporateNonSegmentMember2022-09-300000003545alco:CitreeHoldingsILLCMemberus-gaap:RelatedPartyMember2023-06-060000003545alco:CitreeHoldingsILLCMemberus-gaap:RelatedPartyMember2023-06-222023-06-220000003545alco:CitreeHoldingsILLCMemberus-gaap:RelatedPartyMember2022-09-060000003545alco:CitreeHoldingsILLCMemberus-gaap:RelatedPartyMember2022-09-222022-09-220000003545srt:ChiefExecutiveOfficerMember2022-01-010000003545srt:ChiefExecutiveOfficerMember2022-01-012022-01-010000003545srt:ChiefExecutiveOfficerMember2022-10-200000003545srt:ChiefExecutiveOfficerMember2022-10-202022-10-200000003545us-gaap:FinancialStandbyLetterOfCreditMember2022-09-300000003545us-gaap:SubsequentEventMember2023-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| þ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended September 30, 2023

or

| | | | | |

| o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period

from ____________________to_________________________

Commission File Number: 0-261

| | |

| ALICO, INC. |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Florida | | 59-0906081 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

10070 Daniels Interstate Court, Suite 200, Fort Myers, FL | | 33913 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

(239) 226-2000 |

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

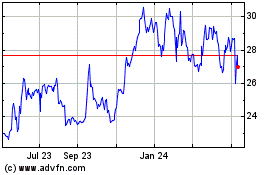

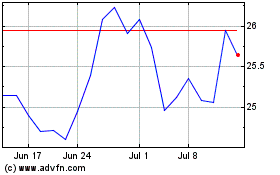

| Common Stock | ALCO | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

oYes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

oYes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þYes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). þYes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | o | Emerging Growth Company | o | Accelerated Filer | þ |

| Non-accelerated filer | o | | | Smaller Reporting Company | þ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. þ

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting and nonvoting common equity held by non-affiliates based on the closing price, as quoted on the Nasdaq Global Select Market as of March 31, 2023 (the last business day of Alico’s most recently completed second fiscal quarter) was $183,907,706.

As of December 4, 2023, there were 7,616,081 shares of common stock, $1.00 par value per share outstanding.

Documents Incorporated by Reference:

Portions of the registrant’s definitive Proxy Statement relating to its 2024 Annual Meeting of Stockholders, to be filed with the SEC under Regulation 14A within 120 days after the end of the Registrant’s fiscal year ended September 30, 2023, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

ALICO, INC.

FORM 10-K

For the year ended September 30, 2023

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (the “Annual Report”) contains certain forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact contained in this Annual Report are forward-looking statements, including without limitation, statements regarding future actions, business plans and prospects, prospective products, trends, future performance or results of current and anticipated products, sales efforts, expenses, interest rates, the outcome of contingencies, such as legal proceedings, plans relating to dividends, government regulations, the adequacy of our liquidity to meet our needs for the foreseeable future and our expectations regarding market conditions. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as such as “may,” “will,” “could,” “should,” “would,” “believes,” “expects,” “anticipates”, “estimates”, “projects,” “intends,” “plans” or the negative of these terms or other similar expressions. The forward-looking statements in this Annual Report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the factors described under the sections in this Annual Report titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

You should read this Annual Report and the documents that we reference in this Annual Report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. As used in this Annual Report, unless otherwise specified or the context otherwise requires, references to “we,” “us,” “our,” the “Company” and “Alico” refer to the operations of Alico, Inc. and its consolidated subsidiaries.

SUMMARY RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those described in Part I, Item 1A, “Risk Factors” in this Annual Report. You should carefully consider these risks and uncertainties, together with all of the other information contained in this Annual Report, when investing in our common stock. The principal risks and uncertainties affecting our business include the following:

•Adverse weather conditions, natural disasters and other natural conditions, including the effects of climate change and hurricanes and tropical storms, particularly because our citrus groves are geographically concentrated in Florida, could impose significant costs and losses on our business and adversely affect our results of operations, financial position and cash flows.

•Our citrus groves are subject to damage and loss from disease including, but not limited to, citrus greening and citrus canker, which could negatively impact our business, financial condition, results of operations and cash flows.

•A significant portion of our revenues are derived from our citrus business and any adverse event affecting such business could disproportionately harm our business.

•Our failure to effectively perform grove management services, or to effectively manage an expanded portfolio of groves, could materially and adversely affect our business, financial condition, and results of operations.

•We depend on our relationship with Tropicana and Tropicana’s relationship with certain third parties for a significant portion of our business. Any disruption in these relationships could harm our revenue. Additionally, if certain criteria are not met under one of our contracts with Tropicana, we could experience a significant reduction in revenues and cash flows.

•If we are unable to successfully develop and execute our strategic growth initiatives, or if they do not adequately address the challenges or opportunities we face, our business, financial condition and prospects may be adversely affected.

•We are subject to the risk of product contamination and product liability claims.

•Our agricultural operations are subject to water use regulations restricting our access to water.

•Changes in immigration laws could impact our ability to harvest our crops.

•Harm to our reputation could have an adverse effect on our business, financial condition and results of operations.

•If a transaction intended to qualify as a Section 1031 Exchange is later determined to be taxable, we may face adverse consequences, and if the laws applicable to such transactions are amended or repealed, we may not be able to dispose of properties in the future on a tax deferred basis.

•We may undertake one or more significant corporate transactions that may not achieve their intended results, may adversely affect our financial condition and our results of operations, or result in unforeseeable risks to our business.

•Our citrus business is seasonal.

•Our earnings are sensitive to fluctuations in market supply and prices and demand for our products.

•Climate change, or legal, regulatory, or market measures to address climate change, may negatively affect our business and operations.

•ESG issues, including those related to climate change and sustainability, may have an adverse effect on our business, financial condition, results of operations, and cash flows and damage our reputation.

•Increases in labor, personnel and benefits costs could adversely affect our operating results.

•Increases in commodity or raw product costs, such as fuel and chemical costs, could adversely affect our operating results.

•We are subject to transportation risks.

•We benefit from reduced real estate taxes due to the agricultural classification of a majority of our land. Changes in the classification or valuation methods employed by county property appraisers could cause significant changes in our real estate property tax liabilities.

•Liability for the use of fertilizers, pesticides, herbicides and other potentially hazardous substances could increase our costs.

•Compliance with applicable environmental laws may substantially increase our costs of doing business, which could reduce our profits.

•Our business may be adversely affected if we lose key employees.

•Material weaknesses and other control deficiencies relating to our internal control over financial reporting could result in errors in our reported results and could have a material adverse effect on our operations, investor confidence in our business and the trading price of our securities.

•Macroeconomic conditions, such as rising inflation, the deadly conflicts in Ukraine and Israel, and the COVID-19 pandemic could adversely affect our business, financial condition, results of operations and cash flows.

•System security risks, data protection breaches, cyber-attacks and systems integration issues could disrupt our internal operations or services provided to customers, and any such disruption could reduce our expected revenues, increase our expenses, damage our reputation and adversely affect our stock price.

•We maintain a significant amount of indebtedness, which could adversely affect our financial condition, results of operations or cash flows, and may limit our operational and financing flexibility and negatively impact our business.

•We may be unable to generate sufficient cash flow to service our debt obligations.

•Some of our debt is based on variable rates of interest, which could result in higher interest expenses in the event of an increase in the interest rates.

•We may not be able to continue to pay or maintain our cash dividends on our common stock and the failure to do so may negatively affect our share price.

PART I

Item 1. Business

Overview

Alico was incorporated under the laws of the State of Florida in 1960. Alico is an agribusiness with a legacy of achievement and innovation in citrus and conservation. We own approximately 72,000 acres of land in eight Florida counties (Charlotte, Collier, DeSoto, Glades, Hardee, Hendry, Highlands and Polk), and also mineral rights throughout Florida. We hold these mineral rights on substantially all our owned acres, with additional mineral rights on other leased acres. Our principal lines of business are citrus groves and land management.

We are one of the largest citrus producers in the United States of America.

We operate two divisions: Alico Citrus, a citrus producer on its own land and as a manager of citrus groves for third parties, and Land Management and Other Operations, which includes land conservation, encompassing environmental services, land leasing and related support operations.

We manage our land based upon its primary usage and review its performance based upon two primary classifications - Alico Citrus and Land Management and Other Operations. The Alico Citrus division includes the production, cultivation and sale of citrus on our owned lands and as a manager of citrus groves for third parties. Land Management and Other Operations include leases for grazing rights, hunting leases, a farm lease, a lease to a third party of an aggregate mine, leases of oil extraction rights to third parties, and other miscellaneous operations generating income. We present our financial results and the related discussion based upon our two business segments: (i) Alico Citrus and (ii) Land Management and Other Operations.

Recent Developments

Florida Forever Program Land Sale

On September 18, 2023, we signed an Option Agreement for Sale and Purchase (“Option Agreement”) with the Board of Trustees of the Internal Improvement Trust Fund of the State of Florida for the sale of 17,229 acres of the Alico Ranch. On September 21, 2023, Florida Governor Ron DeSantis and the Florida Cabinet approved the purchase of this land from Alico, under the Florida Forever Program, for approximately $77,600 thousand. The sale is expected to close between December 2023 and February 2024, and we intend to use the proceeds from this sale to repay variable rate debt and for general corporate purposes.

Hurricane Ian

On September 28, 2022, Hurricane Ian made landfall on the southwest coast of Florida and a majority of our groves were adversely impacted by the storm. The impact of Hurricane Ian has affected our year ended September 30, 2023 fruit production as we accelerated the harvest to maximize box production for both our Early and Mid-Season and Valencia harvest, which was completed earlier than the prior year harvest. Approximately 48,900 gross acres of our citrus groves, which are in Charlotte, Collier, DeSoto, Hardee, Hendry, Highlands and Polk Counties, sustained hurricane or tropical storm force winds for varying durations of time. While we lost a small percentage of trees, the force and duration of the storm impacted the majority of the groves. Based upon prior experience with serious storms of this nature, we expect it may take up to two full seasons or more for the groves to recover to pre-hurricane production levels.

We maintain crop insurance and property and casualty insurance and have received, as of September 30, 2023, $27,389 thousand in proceeds for crop claims and $839 thousand relating to property and casualty damage claims. These insurance proceeds are included as a reduction to operating expenses in the Consolidated Statements of Operations.

Federal Relief Program – Hurricane Ian

In December 2022, the Consolidated Appropriations Act was signed into law by the federal government; however, the details of the mechanism and funding of any Hurricane Ian relief still remains unclear and, if available, the extent to which we will be eligible. We intend to take advantage of any such available programs as and when they become available. We are currently working with Florida Citrus Mutual, the industry trade group, and government agencies on the federal relief programs available as part of the Consolidated Appropriations Act.

Citrus Greening Treatment

In 2022, we began testing a new application of the citrus greening therapy Oxytetracycline (“OTC”), which is used in citrus and other crops. Although not a cure for citrus greening, this OTC application is expected to mitigate some of the impacts of citrus greening and is expected to decrease the rate of fruit drop and improve fruit quality. After a review of the new application method by the U.S. Environmental Protection Agency, the Florida Department of Agriculture and Consumer Services (“FDACS”) granted a special local-need registration (24c) on October 28, 2022. We began treating our trees on

January 16, 2023, as the product and application devices became available, and as of September 30, 2023, had treated over 35% of our trees. The extent of any benefit of the OTC application will not be measurable until the completion of the harvest for the year ended September 30, 2024.

Sales of Land

During the year ended September 30, 2023, we sold approximately 2,255 acres to third parties for approximately $12,000 thousand and recognized a gain of $11,432 thousand.

Federal Relief Program – Hurricane Irma

We were eligible for Hurricane Irma federal relief programs for block grants that were being administered through the State of Florida. We have received a total of $26,963 thousand in Hurricane Irma federal relief through the year ended September 30, 2023. As of September 30, 2023, we have received all funds due under the Florida Citrus Recovery Block Grant (“CRBG”) program. These federal relief proceeds are included as a reduction to operating expenses in the Consolidated Statements of Operations. During the years ended September 30, 2023, 2022 and 2021 we received Hurricane Irma federal relief proceeds of $1,315 thousand, $1,123 thousand and $4,299 thousand, respectively.

The Land We Manage

We regularly review our land-holdings to determine the best use of each parcel based upon our management expertise. Our total return profile is a combination of operating income potential and long-term appreciation. Land holdings not meeting our total return criteria are considered surplus to our operations and efforts are being made to sell such land holdings or to exchange such land holdings for land considered to be more compatible with our business objectives and total return profile, or to lease such land holdings.

Our land holdings and the operating activities in which we engage are categorized in the following table:

| | | | | | | | | | | |

| Gross Acreage | | Operating Activities |

| Alico Citrus | | | |

| Citrus Groves | 48,927 | | Citrus Cultivation |

| Citrus Nursery | 22 | | Citrus Tree Development |

| 48,949 | | |

| Land Management and Other Operations | | | |

| Ranch | 22,328 | | Leasing and Conservation |

| Other Land | 526 | | Mining Lease and Office |

| 22,854 | | |

| Total | 71,803 | | |

Alico Citrus

We own and manage citrus land in DeSoto, Polk, Collier, Hendry, Charlotte, Highlands, and Hardee Counties in the state of Florida and engage in the cultivation of citrus trees to produce citrus for delivery to the fresh and processed citrus markets. Alico citrus groves total 48,949 gross acres or 68.2% of our land holdings.

Citrus Land Lease

On June 29, 2022, we signed three agreements to lease approximately 2,100 citrus acres from the grove owners and thus had the rights to citrus production on such leased acreage for a one-year term at a cost of $157 thousand. On June 26, 2023, we extended the lease representing approximately 1,115 acres for one-year through June 30, 2024. Additionally, on the same terms and conditions, we have the right to extend this lease representing 1,115 acres for two one-year periods. This lease expands our current citrus production acreage by approximately 3%, over our owned land production, to approximately 36,000 net citrus acres.

Our citrus acreage is further detailed in the following table:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Plantable | | | | | | |

| Producing | | Developing | | Fallow | | Total Net

Plantable | | Support

& Other | | Gross |

| DeSoto County | 17,569 | | — | | — | | 17,569 | | 4,043 | | 21,612 |

| Polk County | 4,907 | | — | | — | | 4,907 | | 2,147 | | 7,054 |

| Collier County | 3,869 | | — | | — | | 3,869 | | 3,187 | | 7,056 |

| Hendry County | 5,758 | | — | | 311 | | 6,069 | | 2,831 | | 8,900 |

| Charlotte County | 976 | | — | | 136 | | 1,112 | | 1,409 | | 2,521 |

| Highlands County | 1,049 | | — | | — | | 1,049 | | 175 | | 1,224 |

| Hardee County | 410 | | — | | — | | 410 | | 172 | | 582 |

| Total | 34,538 | | — | | 447 | | 34,985 | | 13,964 | | 48,949 |

Of the 48,949 gross acres of citrus land we own and manage, 13,964 acres are classified as support and other acreage. Support and other acreage include acres used for roads, barns, water detention, water retention and drainage ditches integral to the cultivation of citrus trees, but which are not capable of directly producing fruit. In addition, we own a small citrus tree nursery consisting of approximately 22 acres and utilize the trees produced in this nursery in our own operations. The 34,985 remaining acres are classified as net plantable acres. Net plantable acres are those that are capable of directly producing fruit. These include acres that are currently producing, acres that are developing (i.e., acres that are planted with trees too young to commercially produce fruit) and acres that are fallow.

In an effort to increase the density of our citrus groves, we have planted approximately 2,200,000 new trees since 2017. This level of planting has been substantially higher than the normal level of tree attrition. We will continue to evaluate the density throughout our groves and determine the appropriate tree plantings moving forward. Typically, citrus trees become fruit-bearing four to five years after planting and peak around seven to eight years after planting.

Our Alico Citrus business segment cultivates citrus trees to produce citrus for delivery to the processed and fresh citrus markets. Our sales to the processed market were 94.0%, 84.5%, and 82.7% of Alico Citrus revenues for the years ended September 30, 2023, 2022 and 2021, respectively. The overall increase in the sales to the processed markets as a percentage of citrus revenues during the year ended September 30, 2023, as compared to the years ended September 30, 2022 and 2021, is due to the termination of an agreement to provide grove management services to third-party grove owners, discussed further below.

The average pound solids per box was 5.02, 5.28, and 5.66 for the years ended September 30, 2023, 2022 and 2021, respectively.

We generally use multi-year contracts with citrus processors that include pricing structures based on a floor and ceiling price. Therefore, if pricing in the market is favorable, relative to our floor price, we benefit from the incremental difference between the floor and the final market price to the extent it does not exceed the ceiling price.

Our citrus produced for the processed citrus market during the year ended September 30, 2023, under our largest agreement, was subject to floor prices and ceiling prices. Under this agreement, if the market price was below the floor prices or exceeded the ceiling prices, then 50% of the shortfall or excess was deducted from the floor price or added to the ceiling price. Under our next largest agreement, our citrus produced is subject to a minimum floor price and maximum ceiling price and is based on a cost-plus structure.

In May, 2020, we entered into two agreements to supply Tropicana, our largest customer, with citrus fruit. These new agreements were effective October 1, 2020, expire on July 31, 2024, and succeeded our existing largest agreement with this customer which expired at the end of September 2020. On June 26, 2023 we renewed another agreement to supply Tropicana with citrus fruit, which expired after the fiscal year 2023 harvest season. This new agreement was effective August 31, 2023 and expires on August 31, 2025. Our sales to the fresh citrus market constituted 1.5%, 1.4%, and 0.6% of our Alico Citrus revenues for the years ended September 30, 2023, 2022 and 2021, respectively.

In June 2022, a group of third-party grove owners, who are affiliated with each other (collectively, the “Grove Owners”), for which we were managing groves under a Property Management Agreement executed on July 16, 2020 with the Grove Owners, under which we performed grove management services, terminated the management relationship under the Property Management Agreement with us as the Grove Owners decided to exit the citrus business. As a result, all grove management services relating to the Property Management Agreement and the accompanying management fee and reimbursed costs associated with performing grove management services ceased on June 10, 2022. The management fee was paid through June 30, 2022. We continue to provide grove management services to several small third-party grove-

owners on acres within our groves. Revenues generated from our grove management services were 3.2%, 13.3%, and 16.1% of our total citrus revenues for the years ended September 30, 2023, 2022 and 2021, respectively.

On October 30, 2020, we purchased approximately 3,280 gross acres located in Hendry County for a purchase price of $18,230 thousand. This acquisition allowed us to add additional scale to our then approximately 46,000 gross acres of citrus properties. Strategically, with these acquired groves neighboring existing Alico groves, we believe that this acquisition will help us with our operation designed to be a low-cost, high-producing citrus grower.

Revenues from our Alico Citrus operations were 95.7%, 97.5%, and 97.5% of our total operating revenues for the years ended September 30, 2023, 2022 and 2021, respectively.

Land Management and Other Operations

We own and manage land in Collier, Glades, and Hendry Counties and lease land for recreational and grazing purposes, conservation, and mining activities. Our Land Management and Other Operations land holdings total 22,854 gross acres, or 31.8% of our total acreage.

Our Land Management and Other Operations acreage is detailed in the following table as of September 30, 2023:

| | | | | |

| Acreage |

| Hendry County | 18,722 |

| Collier County | 3,606 |

| Glades County | 526 |

| Total | 22,854 |

During the year ended September 30, 2023, we sold approximately 2,255 acres for $12,000 thousand and recognized a gain of $11,432 thousand (including approximately 85 acres for $439 thousand to Mr. John E. Kiernan, our President and CEO).

During the year ended September 30, 2022, we sold approximately 9,414 acres for $41,421 thousand and recognized a gain of $39,124 thousand.

During the year ended September 30, 2021, we sold approximately 17,434 acres for $26,664 thousand and recognized a gain of $25,272 thousand (including approximately 7,372 acres for $20,120 thousand to the State of Florida, under the Florida Forever program, for a gain of $5,570 thousand). See Note 4. Assets Held for Sale to the Consolidated Financial Statements included in this Annual Report for further information on ranch land sales. Revenues from Land Management and Other Operations were 4.3%, 2.5%, and 2.5% of total operating revenues for the years ended September 30, 2023, 2022 and 2021, respectively.

Our Strategy

Our core business strategy is to maximize stockholder value through continuously improving the return on our invested capital, either by holding and managing our existing land through skilled agricultural production, leasing, or other opportunistic means of monetization, disposing of under productive land or business units and acquiring new land or operations with appreciation potential.

Our objectives are to produce the highest quality agricultural products, create innovative land uses, opportunistically acquire and convert undervalued assets, sell under-productive land and other assets not meeting our total return profile, generate recurring and sustainable profit with the appropriate balance of risk and reward, and exceed the expectations of stockholder, customers, clients and partners.

Our strategy is based on what we believe are best-management practices of our agricultural operations and the environmental and conservation stewardship of our land and natural resources. We try to manage our land in a sustainable manner to maximize value creation and to evaluate the effect of changing land uses while considering new opportunities. We believe that our commitment to environmental stewardship is fundamental to our core beliefs.

Intellectual Property

While we consider our various intellectual property to be valued assets, we do not believe that our competitive position or our operations are dependent upon or would be materially impacted by any single piece of intellectual property or group of related intellectual property registrations or rights.

Seasonal Nature of Business

As with any agribusiness enterprise, our agribusiness operations and revenues are predominantly seasonal in nature. The following table illustrates the seasonality of our agribusiness revenues:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended September 30 |

| Q1 | Q2 | Q3 | Q4 |

| Ending 12/31 | Ending 3/31 | Ending 6/30 | Ending 9/30 |

| Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sept |

| Harvest Fresh and Early/Mid Varieties of Oranges | | X | X | X | X | | | | | | | |

| Harvest Valencia Oranges | | | | | | X | X | X | X | | | |

Significant Customer

Revenue from Tropicana represented 81.3%, 79.7%, and 77.5% of our consolidated revenue for the years ended September 30, 2023, 2022 and 2021, respectively. Revenue in the years ended September 30, 2023 and 2022, from Tropicana, was generated primarily from two separate contracts. This revenue was generated from the sale of our citrus product in the processed market. No other single customer provided more than 10% of our consolidated revenue in the years ended September 30, 2023, 2022 or 2021.

The slight increase in Tropicana revenue, as a percentage of sales, for the years ended September 30, 2023 and 2022 is primarily due to the Grove Owners terminating the Property Management Agreement in June 2022.

Competition

The orange and specialty citrus markets are intensely competitive, but no single producer has any significant market power over any market segments, as is consistent with the production of most agricultural commodities. Citrus is grown domestically in several states including Florida, California, Arizona, and Texas, as well as foreign countries, most notably Brazil and Mexico. Competition is impacted by several factors including quality, production, demand, brand recognition, market prices, weather, disease, export/import restrictions and foreign currency exchange rates.

Environmental, Social and Governance (“ESG”)

We are an agricultural company which, based upon its rich heritage and traditions, seeks to maximize value for its customers and stockholders in the long term, which we believe includes employing sustainable practices in all aspects of operations including stewardship of both its natural and human resources. We recognize the increased emphasis by stockholders, business partners and other key constituents in recent years on ESG programs that are embedded into day-to-day business policies and practices. We are proud of our focus on the impacts of our business on our communities, the environment, and employees.

Governmental Regulations

Our operations are subject to various federal, state and local laws regulating the discharge of materials into the environment. Management believes we are in material compliance with all such rules including permitting and reporting requirements. Historically, compliance with environmental regulations has not had a material impact on our financial position, results of operations or cash flows.

Management monitors environmental legislation and requirements and makes every reasonable effort to remain in compliance with such regulations. In addition, we require in our leases that lessees of our property comply with environmental regulations as a condition of leasing.

We are subject to other laws of the United States and the rules and regulations of various governing bodies within the United States, which may differ among jurisdictions. Compliance with these laws, rules and regulations has not had, and is not expected to have, a material effect on our capital expenditures, results of operations and competitive position as compared to prior periods.

Human Capital Management

Purpose and Company Values

Supporting our people is a fundamental value for Alico. We believe our success depends on our ability to attract, develop and retain key personnel. The skills, experience and industry knowledge of our employees and the employees of our

independent contractors significantly benefit our operations and performance. Our management oversees various employee initiatives and also monitors the effectiveness of the personnel provided by independent contractors with which we contract for certain harvesting and hauling services.

Employees

We believe in a culture of equity, diversity and inclusion. We are also committed to advancing safe and respectful work environments where our employees are invited to bring their talents, backgrounds and expertise to bear on the success of our business and where every person has the opportunity to thrive personally and professionally.

Hiring, Development and Retention

Employee levels are managed to align with the pace of business and consider the services that are provided for us by our independent contractors. We rely on our independent contractors to manage their respective employee levels so that the harvesting and hauling services they are obligated to perform for us are consistent with the contractual obligations of these independent contractors and enable us to satisfy our harvesting and hauling needs. Management believes that through our own employees, coupled with the human capital supplied by our independent contractors, we have sufficient human capital to operate our business successfully. Management believes that our employee relations are favorable, that our relations with our independent contractors is favorable, and that the relations that the independent contractors and we have with the employees of the independent contractors is favorable.

Employee Safety and Well-Being

Protecting the health and safety in the workplace for our employees and personnel provided by independent contractors with which we contract is one of our core values. Hazards in the workplace are actively identified and management tracks incidents so remedial actions can be taken to improve workplace safety. In order to support and enhance health and safety practices, we routinely conduct safety training with employees to emphasize safety when conducting grove caretaking, general employee health, proper equipment operating techniques, office ergonomics and other important safety topics. The COVID-19 pandemic underscored for us the importance of keeping our employees and the personnel provided by independent contractors safe and healthy. In response to the pandemic, we have taken actions aligned with the Centers for Disease Control and Prevention to protect our workforce so that our workforce can more safely and effectively perform their work.

Inclusion and Diversity

People are critical to our efforts to drive growth and deliver value for stockholders. One of the ways we have put people at the center is by continuing to work toward a more inclusive and diverse workplace where each person feels respected, valued and seen and can be the best version of themselves – from women and ethnically diverse employees to veterans, among others. With employees, management and directors from diverse backgrounds, we can access stronger insights into different cultures and backgrounds, which ultimately helps us to better operate the business.

Based on our Inclusion and Diversity strategy, we seek to promote a greater sense of inclusion through a variety of initiatives, which includes a Company-wide women’s group to promote mentoring, career advancement, training, comradery, and empowerment.

Compensation and Benefits

Our compensation and benefits are designed to support the financial, mental, and physical well-being of our employees. We are committed to equal pay for equal work, regardless of gender, race, ethnicity, or other personal characteristics. We believe our base wages and salaries, which we review annually, are fair and competitive with the external labor markets in which our employees work. We also regularly review our compensation practices to promote fair and equitable pay. We also offer competitive benefit programs, in line with local practices and with the flexibility to accommodate the needs of a diverse workforce. The benefit programs include, among others, paid holidays, family leave, disability insurance, life insurance, healthcare, and a 401(k) plan with a company match. As of September 30, 2023, we had 194 full-time employees and no part-time employees. We do not include our independent contractors in our number of employees because they are not employees.

Our employees work in the following divisions:

| | | | | |

| Alico Citrus | 168 |

Land Management and Other Operations (1) | 0 |

| Corporate, General, Administrative and Other | 26 |

| Total employees | 194 |

(1)There is one employee who is included in Corporate, General, Administrative and Other who oversees the Land Management and Other Operations.

None of our employees are subject to a collective bargaining agreement. We believe that our relations with our employees are good.

Workforce Housing

We own and maintain 38 residential housing units located in various counties in Florida that we offer to employees. Our residential units provide affordable housing to many of our employees, including our agribusiness employees. Employees live close to their work, which reduces traffic and commuting times. This unique employment benefit helps us maintain a dependable, long-term employee base.

Raw Materials

Raw materials needed to cultivate the various crops grown by us consist primarily of fertilizers, herbicides, insecticides and fuel and are readily available from local suppliers. These raw materials are purchased on an order basis without long-term commitments. Our key suppliers for fertilizer, herbicides and insecticides include Howard Fertilizer, Wedgeworth’s, Nutrien AG Solutions and Helena Agri-Enterprises.

Societal Well-Being

We remain committed to a healthy and equitable society to ensure our collective well-being for future generations. In the past year, we provided cash grants and supporting donations to support our communities and promote health, safety and education.

Available Information

Our reports filed with or furnished to the SEC pursuant to Sections 13(a) and 15(d) of the Exchange Act, are available, free of charge, on our investor relations website at ir.alicoinc.com as soon as reasonably practicable after we electronically file or furnish such information with the Securities and Exchange Commission (the “SEC”). Any information posted on, or that can be accessed through our website, is not incorporated by reference in this Annual Report. The SEC also maintains a website at http://www.sec.gov, which contains annual, quarterly and current reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors

Our business and results of operations are subject to numerous risks and uncertainties, many of which are beyond our control. The following is a description of key known factors that we believe may materially affect our business, financial condition, results of operations or cash flows. They should be considered carefully, together with the information set forth elsewhere in this Annual Report, and with our other filings with the SEC. The realization of any of these risks and uncertainties could have a material adverse effect on our reputation, business, financial condition, results of operations, growth and future prospects, as well as our ability to accomplish our strategic objectives.

Risks Related to our Business

Adverse weather conditions, natural disasters and other natural conditions, including the effects of climate change and hurricanes and tropical storms, particularly because our citrus groves are geographically concentrated in Florida, could impose significant costs and losses on our business and adversely affect our results of operations, financial position and cash flows.

Fresh produce is vulnerable to adverse weather conditions, including windstorms, floods, drought and temperature extremes, which are quite common and may occur with higher frequency or be less predictable in the future due to the effects of climate change. Unfavorable growing conditions can reduce both crop size and crop quality. In extreme cases, entire harvests may be lost in some geographic areas. Citrus groves are subject to damage from frost and freezes, and this has happened periodically in the recent past, including the freeze in the last week of January 2022. In some cases, the fruit is damaged or ruined; in the case of extended periods of cold, the trees can also be damaged or killed. These factors can

increase costs, decrease revenues and lead to additional charges to earnings, which may have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our citrus operations are concentrated in central and south Florida, with our groves located in parcels in DeSoto, Polk, Collier, Hendry, Charlotte, Highlands, and Hardee Counties. Because our groves are located in close proximity to each other, the impact of adverse weather conditions may be material to our results of operations, financial position and cash flows. Florida is particularly susceptible to the occurrence of hurricanes and tropical storms. Depending on where any particular hurricane or tropical storm makes landfall, our properties could experience significant, if not catastrophic damage. Hurricanes and tropical storms have the potential to destroy crops and impact citrus production through the loss of fruit and destruction of trees and/or plants either as a result of high winds or through the spread of windblown disease. Such damage could materially affect our citrus operations and could result in a loss of operating revenues from those products for a multi-year period. For instance, recent Hurricane Ian had a material adverse effect on the fruit production from our trees for the 2023 harvest season and, potentially to a lesser extent, the next season and future seasons. We seek to minimize hurricane risk by the purchase of insurance contracts, but a significant portion of our crops remain uninsured. In addition to hurricanes and tropical storms, the occurrence of other natural disasters and climate conditions in Florida, such as tornadoes, floods, freezes (such as the freeze in the last week of January 2022), unusually heavy or prolonged rain, droughts and heat waves, could have a material adverse effect on our operations and our ability to realize income from our crops or properties.

Our citrus groves are subject to damage and loss from disease including, but not limited to, citrus greening and citrus canker, which could negatively impact our business, financial condition, results of operations and cash flows.

Our citrus groves are subject to damage and loss from diseases such as citrus greening and citrus canker. Each of these diseases is widespread in Florida and exists in our citrus groves and in the areas where our citrus groves are located. The success of our citrus business is directly related to the viability and health of our citrus groves.

Citrus greening is one of the most serious citrus plant diseases in the world. Once a tree is infected, its productivity generally decreases. While the disease poses no threat to humans or animals, it has devastated citrus crops throughout the United States and abroad. Named for its green, misshapen fruit, citrus greening disease has now killed millions of citrus plants in the southeastern United States and has spread across the entire country. Infected trees produce fruits that are green, misshapen and bitter, unsuitable for sale as fresh fruit or for juice. Infected trees can die within a few years. At the present time, there is no known cure for citrus greening once trees have become infected. Primarily, as a result of citrus greening, orange production in the state of Florida has continued to drop.

Citrus canker is a disease affecting citrus species and is caused by a bacterium which is spread by contact with infected trees or by windblown transmission. There is no known cure for citrus canker at present, although some management practices, including the use of copper-based bactericides, can mitigate its spread and lessen its effect on infected trees; however, there is no assurance that currently available technologies will control such disease effectively.

Both of these diseases pose a significant threat to the Florida citrus industry and to our citrus groves. While we try to use best management practices to attempt to control diseases and their spread, there can be no assurance that our mitigation efforts will be successful. These diseases can significantly increase our costs, which could materially adversely affect our business, financial condition, results of operations and cash flows. Our citrus groves produce the significant majority of our annual operating revenues. A significant reduction in available citrus from our citrus groves could decrease our operating revenues and materially adversely affect our business, financial condition, results of operations and cash flows.

A significant portion of our revenues are derived from our citrus business and any adverse event affecting such business could disproportionately harm our business.

Our revenues from our citrus business were 95.7%, 97.5%, and 97.5% of our operating revenues in the years ended September 30, 2023, 2022 and 2021, respectively. Our citrus division is one of the largest citrus producers in the United States, and because of the significance of the revenues derived from this business, we are vulnerable to adverse events or market conditions affecting our citrus business, in particular, or the citrus business, generally, which could have a significant adversely impact on our overall results of operations, financial condition and cash flows.

Our failure to effectively perform grove management services, or to effectively manage an expanded portfolio of groves, could materially and adversely affect our business, financial condition, and results of operations.

If we are unable to effectively perform grove management services for both our own groves and the groves owned by third parties at the level and/or the cost that we expect, or if we were to fail to allocate sufficient resources to meet the grove management of our own groves and the groves owned by these third parties, it could adversely affect our performance and reputation. Our ability to perform the grove management services has in the past and will continue to be affected by various factors, including, among other things, our ability to maintain sufficient personnel and retain key personnel, the ability of the independent contractors whom we engage to assist in providing these services to maintain sufficient personnel and retain key personnel, and the number of acres and groves that we will manage. No assurance can be made that we will continue to be successful in attracting and retaining skilled personnel or in integrating any new personnel into our organization or that the independent contractors whom we engage to assist in providing these services will continue to be

successful in attracting and retaining skilled personnel or in integrating any new personnel into their respective organizations.

Our business is highly competitive, and we cannot assure you that we will maintain our current market share.

Many companies compete in our different businesses and offer products that are similar to our products or are direct competitors to our products. We face strong competition from these and other companies engaged in the agricultural product business.

Important factors with respect to our competitors include the following:

•Some of our competitors may have greater operating flexibility and, in certain cases, this may permit them to respond better or more quickly to changes in the industry.

•We cannot predict the pricing or promotional actions of our competitors or whether those actions will have a negative effect on us.

•Our competitors may have access to substantially greater financial resources, deeper management and agricultural resources, regional, national or global areas that offer agricultural advantages, and enhanced public visibility or reputations.

There can be no assurance that we will continue to compete effectively with our present and future competitors, and our ability to compete could be materially adversely affected by our debt levels and debt service requirements.

We depend on our relationship with Tropicana and Tropicana’s relationship with certain third parties for a significant portion of our business. Any disruption in these relationships could harm our revenue. Additionally, if certain criteria are not met under one of our contracts with Tropicana, we could experience a significant reduction in revenues and cash flows.

Our contracts with Tropicana accounted for 81.3%, 79.7%, and 77.5% of our revenues in the years ended September 30, 2023, 2022 and 2021, respectively. The revenue for Tropicana is primarily generated from two contracts. Should there be any change in our current relationship structure, whereby they do not buy our oranges, we would need to find replacement buyers to purchase our remaining crop, which could take time and expense and may result in less favorable terms of sale. The loss of Tropicana as a customer or significant reduction in business with Tropicana may cause a material adverse impact to our financial position, results of operations and cash flows.

In addition, with the sale of a majority ownership of Tropicana by PepsiCo to a French private equity firm (the “Firm”), there is some heightened risk and uncertainty in our current relationship with Tropicana, which potentially could result in a significant reduction in revenues and cash flows if that relationship were to be changed. We currently have citrus supply contracts with Tropicana that expire in both 2024 and 2025, with the majority expiring in 2024. If Tropicana were to reduce the volume of oranges purchased from us and/or purchased from owners of groves that we manage, we would need to find, and/or the owners of groves that we manage would need to find or work with us to find, replacement buyers to purchase any remaining crop of our and/or of the owners of the groves we manage, which could take time and expense and may result in less favorable terms of sale. The loss of Tropicana as a customer or significant reduction in business with Tropicana for us and/or for the owners of the groves we manage may cause a material adverse impact to our financial position, results of operations and cash flows.

Our agricultural products are subject to supply and demand pricing which is not predictable.

Agricultural operations traditionally provide almost all of our operating revenues, with citrus being the largest portion and subject to supply and demand pricing. Prior to the COVID-19 pandemic, according to Nielsen data, consumer demand for orange juice had decreased significantly to its lowest level in almost a decade; however, we have been able to offset the impact of such decline with higher prices based on a lower supply of available oranges. In addition, there is currently a shortage of orange juice worldwide that is forecasted to continue for the foreseeable future. Although the demand for orange juice has increased during the COVID-19 pandemic, it is uncertain as to whether such increased demand can be maintained, whether we will see a return to a decline in the future and whether, if there were to be such a decline, the impact could be again offset by higher prices. Although our processed citrus is subject to minimum pricing, we are unable to predict with certainty the final price we will receive for our products. In some instances, the harvest and growth cycle will dictate when such products must be marketed which may or may not be advantageous in obtaining the best price. Excessive supplies tend to cause severe price competition and lower prices for the commodity affected. Limited supply of certain agricultural commodities due to world and domestic market conditions can cause commodity prices to rise in certain situations.

If we are unable to successfully develop and execute our strategic growth initiatives, or if they do not adequately address the challenges or opportunities we face, our business, financial condition and prospects may be adversely affected.

Our success is dependent, in part, on our ability to identify, develop and execute appropriate strategic growth initiatives that will enable us to achieve sustainable growth in the long term. The implementation of our strategic initiatives is subject to both the risks affecting our business generally and the inherent risks associated with implementing new strategies. These

strategic initiatives may not be successful in generating revenues or improving operating profit and, if they are, it may take longer than anticipated. As a result, and depending on evolving conditions and opportunities, we may need to adjust our strategic initiatives and such changes could be substantial, including modifying or terminating one or more of such initiatives. Termination of such initiatives may require us to write down or write off the value of our investments in them. Transition and changes in our strategic initiatives may also create uncertainty in our employees, customers and partners that could adversely affect our business and revenues. In addition, we may incur higher than expected or unanticipated costs in implementing our strategic initiatives, attempting to attract revenue opportunities or changing our strategies. There can be no assurance that the implementation of any strategic growth initiative will be successful, and we may not realize anticipated benefits at levels we project or at all, which would adversely affect our business, financial condition and prospects.

We are subject to the risk of product contamination and product liability claims.

The sale of agricultural products for human consumption involves the risk of injury to consumers. Such injuries may result from tampering by unauthorized third parties, product contamination or spoilage, including the presence of foreign objects, substances, chemicals, other agents, or residues introduced during the growing, storage, handling or transportation phases. We are subject to governmental inspection and regulations and we cannot be sure that our agricultural products will not cause a health-related illness in the future or that we will not be subject to claims or lawsuits relating to such matters. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertion that our products caused illness or injury could adversely affect our reputation with existing and potential customers and our corporate and brand image. Moreover, claims or liabilities of this sort might not be covered or fully covered by our insurance or by any rights of indemnity or contribution that we may have against others. We cannot be sure that we will not incur claims or liabilities for which we are not insured or that exceed the amount of our product liability insurance coverage.

Our agricultural operations are subject to water use regulations restricting our access to water.

Our operations are dependent upon the availability of adequate surface and underground water. The availability of water is regulated by the state of Florida through water management districts which have jurisdiction over various geographic regions in which our lands are located. Currently, we have permits in place for the next 15 to 20 years for the use of underground and surface water which are believed to be adequate for our agricultural needs.

Surface water in Hendry County, where much of our agricultural land is located, comes from Lake Okeechobee via the Caloosahatchee River and a system of canals used to irrigate such land. The Army Corps of Engineers controls the level of Lake Okeechobee and ultimately determines the availability of surface water, even though the use of water has been permitted by the State of Florida through the water management district. The Army Corps of Engineers decided in 2010 to lower the permissible level of Lake Okeechobee in response to concerns about the ability of the levee surrounding the lake to restrain rising waters which could result from hurricanes. Changes in availability of surface water use may result during times of drought, because of lower lake levels and could materially adversely affect our agricultural operations, financial condition, results of operations and cash flows.

Changes in immigration laws could impact our ability to harvest our crops.

We engage third parties to provide personnel for our harvesting operations. The availability and number of such workers is subject to decrease if there are changes in the U.S. immigration laws. Immigration reform and enforcement has been attracting significant attention from the U.S. Government, with enforcement operations taking place across the country, resulting in arrests and detentions of unauthorized workers. It remains unclear how the U.S. administration and U.S. Congress will approach immigration reform and enforcement. If new immigration legislation is enacted in the U.S. and/or if enforcement actions are taken against available personnel, such legislation and/or enforcement activities may contain provisions that could significantly reduce the number and availability of workers. Termination of a significant number of personnel who might be found to be unauthorized workers, or the scarcity of other available personnel to harvest our agricultural products, could cause harvesting costs to increase, or could lead to the loss of product that is not timely harvested, which could have a material adverse effect to our citrus grove business, financial condition, results of operations and cash flows.

Harm to our reputation could have an adverse effect on our business, financial condition and results of operations.

Maintaining a strong reputation with fruit processors and third-party partners is critical to the success of our business. We devote significant time and resources to training programs, relating to, among other things, ethics, compliance and product safety and quality, as well as sustainability goals, and have published ESG goals (i.e., environmental, social and governance), including relating to environmental impact and sustainability and inclusion and diversity, as part of our ESG strategy. Despite these efforts, we may not be successful in achieving our goals, might provide materially inaccurate information, or might receive negative publicity about the Company, including relating to product safety, quality, efficacy, ESG or similar issues, whether real or perceived, and reputational damage could occur. In addition, our products could face withdrawal, recall or other quality issues, which could lead to decreased demand for our products or services and reputational damage.

Widespread use of social media and networking sites by consumers has greatly increased the accessibility and speed of dissemination of information. Negative publicity, posts or comments about the Company, whether accurate or inaccurate, or disclosure of non-public sensitive information about the Company, could be widely disseminated through the use of social media or in other formats.

If a transaction intended to qualify as a Section 1031 Exchange is later determined to be taxable, we may face adverse consequences, and if the laws applicable to such transactions are amended or repealed, we may not be able to dispose of properties in the future on a tax deferred basis.