Advanced Energy Industries, Inc. (Nasdaq GM: AEIS) today

announced financial results for the fourth quarter ended December

31, 2010. Reporting record revenue, the company posted fourth

quarter sales of $148.7 million and earnings of $0.45 per diluted

share from continuing operations.

“2010 was a year of significant accomplishments for Advanced

Energy. We responded with speed and flexibility to meet the needs

of our customers during this high growth period in the thin film

and renewable markets,” said Dr. Hans Betz, chief executive

officer. “Advanced Energy has become a clear leader in solar

inverter solutions. Coupled with our industry-leading thin film

products, our expansion into renewables led to our record revenue

quarter, as we further penetrated the inverter market.”

Sales to the renewable inverter market surged ahead in the

fourth quarter, reflecting the wide-ranging applicability of our

extended product portfolio. Inverter sales grew substantially to

$51.7 million, or 34.8% of total sales this quarter, compared to

$37.4 million, or 27% of total sales in the third quarter of 2010.

Sales to the non-semiconductor thin film markets were also

extremely strong at $43.3 million, or 29.1% of total sales,

compared to $41.1 million last quarter. Sales to the semiconductor

market were $40.2 million, or 27.0% of sales compared to $49.4

million last quarter. During a seasonally soft quarter, service

revenue performed well, roughly flat sequentially at $13.4 million,

or 9.0% of total sales, compared to $13.2 million last quarter.

Bookings for the fourth quarter were $113.3 million, compared to

$160.3 million in the third quarter of 2010. We entered the fourth

quarter with record bookings as inverter customers placed orders

for delivery prior to year-end in order to satisfy funding

requirements for various federal incentives and grant programs in

the U.S. and Europe, many of which were expected to be reduced or

ended in 2010, but have since been extended.

Gross margin for the fourth quarter improved sequentially at

43.6% compared to 43.1% in the third quarter of 2010. This was due

in large part to the continued decline in warranty costs,

reflecting continuous improvement in our product quality. Operating

expenses for the fourth quarter increased to $40.8 million compared

to $38.4 million in the third quarter in order to support higher

sales volumes. Net income from continuing operations for the fourth

quarter was $19.7 million or $0.45 per diluted share, compared to

net income from continuing operations of $17.6 million or $0.40 per

diluted share in the third quarter of 2010.

Cash and investments were $140.6 million at the end of the

fourth quarter, compared to $112.4 million in the third quarter of

2010. We generated $34.9 million in cash from operations during the

fourth quarter of 2010.

For the full year 2010, sales nearly tripled to $459.4 million,

compared to $161.8 million in 2009. Net income from continuing

operations for 2010 was $53.6 million or earnings per share of

$1.23, compared to a net loss from continuing operations of $101.8

million, or a loss per share of $2.43 in 2009.

First Quarter 2011 Guidance

The Company anticipates first quarter 2011 results from

continuing operations, to be within the following ranges:

- Sales of $132 million to $142

million

- Gross margin of 41% to 43%

- Earnings per share of $0.32 to

$0.38

Fourth Quarter 2010 Conference Call

Management will host a conference call tomorrow, Tuesday,

February 15, 2011, at 8:30 a.m. Eastern Standard Time to discuss

Advanced Energy's financial results. Domestic callers may access

this conference call by dialing (866) 783-2137. International

callers may access the call by dialing (857) 350-1596. Participants

will need to provide a conference pass code 67334137. For a replay

of this teleconference, please call (888) 286-8010 or (617)

801-6888, and enter the pass code 61436573. The replay will be

available for two weeks following the conference call. A webcast

will also be available on the Investor Relations web page at

http://ir.advanced-energy.com.

About Advanced Energy

Advanced Energy (NASDAQ: AEIS - News) is a global leader in

innovative power and control technologies for thin-film

manufacturing and high-growth solar-power generation. Advanced

Energy is headquartered in Fort Collins, Colorado, with dedicated

support and service locations around the world. For more

information, go to www.advanced-energy.com.

Forward-Looking Language

The Company’s expectations with respect to guidance to financial

results for the first quarter ending March 31, 2011 and statements

that are not historical information are forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements are subject to known and unknown risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such statements. Such risks and

uncertainties include, but are not limited to: the effects of

global macroeconomic conditions upon demand for our products, the

volatility and cyclicality of the industries the company serves,

particularly the semiconductor industry, the continuation of RPS

(renewable portfolio standards), the timing and availability of

incentives and grant programs in the U.S. and Europe related to the

renewable energy market, the timing of orders received from

customers, the company's ability to realize benefits from cost

improvement efforts, the ability to source materials and

manufacture products, and unanticipated changes to management's

estimates, reserves or allowances. These and other risks are

described in Advanced Energy's Form 10-K, Forms 10-Q and other

reports and statements filed with the Securities and Exchange

Commission. These reports and statements are available on the SEC's

website at www.sec.gov. Copies may also be obtained from Advanced

Energy's website at www.advancedenergy.com or by contacting

Advanced Energy's investor relations at 970-407-6555.

Forward-looking statements are made and based on information

available to the company on the date of this press release. The

company assumes no obligation to update the information in this

press release.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (in thousands, except per share data)

Three Months Ended

Twelve Months Ended December 31,

September 30, December 31, 2010

2009 2010 2010

2009 SALES $ 148,653 $ 58,081 $ 140,966 $ 459,414 $

161,846 COST OF SALES 83,910 34,812

80,276 260,215 112,056

GROSS PROFIT 64,743 23,269 60,690 199,199 49,790 43.6 % 40.1 % 43.1

% 43.4 % 30.8 % OPERATING EXPENSES: Research and development 15,275

10,720 16,672 56,604 41,132

Selling, general and administrative

24,586 10,316 20,545 74,543 38,041 Impairment of goodwill - - - -

63,260 Amortization of intangible assets 920 20 1,177 2,864 121

Restructuring charges

- 6 - -

4,376 Total operating expenses 40,781

21,062 38,394 134,011

146,930 INCOME (LOSS) FROM OPERATIONS 23,962

2,207 22,296 65,188 (97,140 )

Other income, net

392 494 1,224

2,221 1,910 Income (loss) from continuing

operations before income taxes 24,354 2,701 23,520 67,409 (95,230 )

Provision for income taxes 4,624 1,025

5,964 13,816 6,582 INCOME

(LOSS) FROM CONTINUING OPERATIONS 19,730 1,676 17,556 53,593

(101,812 ) Gain on sale of discontinued operations, net of

tax 12,531 - - 12,531 - Results from discontinued operations, net

of tax (853 ) (153 ) 2,392 5,068

(893 ) INCOME (LOSS) FROM DISCONTINUED

OPERATIONS, NET OF INCOME TAXES 11,678 (153 )

2,392 17,599 (893 )

NET INCOME (LOSS) $ 31,408 $ 1,523 $ 19,948

$ 71,192 $ (102,705 ) Basic weighted-average

common shares outstanding 43,315 42,032 43,254 42,862 41,966

Diluted weighted-average common shares outstanding 43,796 42,464

43,849 43,419 41,966

EARNINGS PER SHARE: CONTINUING

OPERATIONS: BASIC EARNINGS (LOSS) PER SHARE $ 0.46 $ 0.04 $ 0.41 $

1.25 $ (2.43 ) DILUTED EARNINGS (LOSS) PER SHARE $ 0.45 $ 0.04 $

0.40 $ 1.23 $ (2.43 ) DISCONTINUED OPERATIONS BASIC EARNINGS

(LOSS) PER SHARE $ 0.27 $ (0.00 ) $ 0.06 $ 0.41 $ (0.02 ) DILUTED

EARNINGS (LOSS) PER SHARE $ 0.27 $ (0.00 ) $ 0.05 $ 0.41 $ (0.02 )

NET INCOME (LOSS):

BASIC EARNINGS (LOSS) PER SHARE $ 0.73

$ 0.04 $ 0.46 $ 1.66

$ (2.45 ) DILUTED EARNINGS (LOSS) PER

SHARE $ 0.72 $ 0.04 $

0.45 $ 1.64 $ (2.45 )

CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands)

December 31, 2010 2009 ASSETS Current assets: Cash

and cash equivalents $ 130,914 $ 133,106 Marketable securities

9,640 44,401 Accounts receivable, net 119,893 50,267 Inventories,

net 77,593 28,567 Deferred income taxes 9,303 9,222 Income taxes

receivable 6,061 - Assets held for sale - 26,460 Other current

assets 10,157 5,641 Total current assets 363,561

297,664 Property and equipment, net 34,569 18,687

Deposits and other 8,874 9,295 Goodwill and intangibles, net 96,781

- Deferred income tax assets, net 1,373 19,479 Total

assets $ 505,158 $ 345,125 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities: Accounts payable $

56,185 $ 23,802 Other accrued expenses 46,141 24,055 Liabilities of

business held for sale - 1,477 Total current

liabilities 102,326 49,334 Long-term liabilities

28,863 17,457 Total liabilities 131,189 66,791

Stockholders' equity 373,969 278,334 Total

liabilities and stockholders' equity $ 505,158 $ 345,125

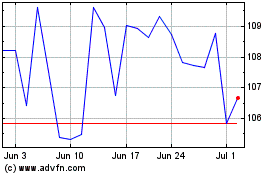

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

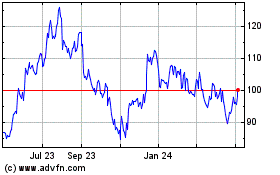

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024