As

filed with the Securities and Exchange Commission on November 8, 2023.

Registration

Statement No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ADIAL

PHARMACEUTICALS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

8071 |

|

82-3074668 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification No.) |

Adial

Pharmaceuticals, Inc.

1180

Seminole Trail, Suite 495

Charlottesville,

Virginia 22901

(434)

422-9800

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive office)

Cary

Claiborne

President

and Chief Executive Officer

Adial

Pharmaceuticals, Inc.

1180

Seminole Trail, Suite 495

Charlottesville,

Virginia 22901

(434)

422-9800

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Leslie

Marlow, Esq.

Hank

Gracin, Esq.

Patrick

J. Egan, Esq.

Blank

Rome LLP

1271

Avenue of the Americas

New

York, New York 10020

Telephone:

(212) 885-5000

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If

any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, as amended, check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same

offering: ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list

the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

Growth Company ☒ |

If

an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

NOVEMBER 8, 2023 |

4,340,426

Shares

Common

Stock

This

prospectus relates to the resale from time to time of up to 4,340,426 shares of Common Stock, par value $0.001 per share (the “Common

Stock”), of Adial Pharmaceuticals, Inc. by the selling stockholders identified in this prospectus (the “Selling Stockholders”),

including their pledgees, assignees, donees, transferees or their respective successors-in-interest consisting of (i) 1,418,440 shares

of Common Stock issuable upon the exercise of outstanding pre-funded warrants (the “Pre-Funded Warrants”) to purchase shares

of Common Stock purchased by a Selling Stockholder (the “Investor Selling Stockholder”) in a private placement transaction

that closed on October 24, 2023 (the “Private Placement”); (ii) 1,418,440 shares of Common Stock issuable upon the exercise

of outstanding Series A warrants to purchase shares of Common Stock purchased by the Investor Selling Stockholder in the Private Placement

(the “Series A Common Warrants”); (iii) 1,418,440 shares of Common Stock issuable upon the exercise of outstanding Series

B warrants to purchase shares of Common Stock purchased by the Investor Selling Stockholder in the Private Placement (the “Series

B Common Warrants” and together with the Series A Common Warrants, the “Common Warrants”); and (iv) 85,106 shares of

Common Stock issuable upon the exercise of outstanding warrants (the “Placement Agent Warrants”) issued to designees of H.C.

Wainwright & Co., LLC (“H.C.W.” or the “Placement Agent”) as partial compensation for H.C.W. acting as placement

agent in connection with the Private Placement. The shares of Common Stock issuable upon exercise of the Common Warrants are referred

to as the “Common Warrant Shares,” the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants are referred

to as the “Pre-Funded Warrant Shares” and the shares of Common Stock issuable upon exercise of the Placement Agent Warrants

are referred to as the “Placement Agent Warrant Shares.”

We

are filing the registration statement on Form S-1, of which this prospectus forms a part, to fulfill our contractual obligations with

the Selling Stockholders to provide for the resale by the Selling Stockholders of the shares of Common Stock offered hereby. See “Selling

Stockholders” beginning on page 15 of this prospectus for more information about the Selling Stockholders. The registration

of the shares of Common Stock to which this prospectus relates does not require the Selling Stockholders to sell any of their shares

of our Common Stock.

We

are not offering any shares of Common Stock under this prospectus and will not receive any proceeds from the sale or other disposition

of the shares of our Common Stock covered hereby. See “Use of Proceeds” beginning on page 9 of this prospectus.

The

Selling Stockholders identified in this prospectus, or their pledgees, assignees, donees, transferees or their respective successors-in-interest,

from time to time may offer and sell through public or private transactions at prevailing market prices, at prices related to prevailing

market prices or at privately negotiated prices the shares held by them directly or through underwriters, agents or broker-dealers on

terms to be determined at the time of sale, as described in more detail in this prospectus. See “Plan of Distribution” beginning

on page 17 of this prospectus for more information about how the Selling Stockholders may sell their respective shares of Common

Stock. The Selling Stockholders may be deemed “underwriters” within the meaning of Section 2(a)(11) of the Securities Act

of 1933, as amended.

In

connection with the Private Placement, we have agreed, pursuant to a registration rights agreement that we have entered into with the

Investor Selling Stockholder, to bear all of the expenses in connection with the registration of the Common Warrant Shares, the Pre-Funded

Warrant Shares and the Placement Agent Warrant Shares pursuant to this prospectus. The Selling Stockholders will pay or assume all commissions,

discounts, fees of underwriters, agents, selling brokers or dealer managers and similar expenses, if any, attributable to their respective

sales of the shares of Common Stock.

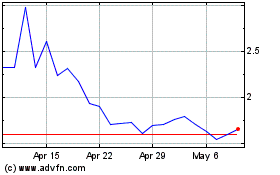

Our

Common Stock is listed on the Nasdaq Capital Market under the symbol “ADIL”. On November 3, 2023, the closing price

of our Common Stock on the Nasdaq Capital Market was $2.26 per share.

We

are an “emerging growth company” under the federal securities laws and, as such, are subject to reduced public company reporting

requirements.

Investing

in our securities involves risks. You should review carefully the risks and uncertainties described under the heading “Risk

Factors” contained in this prospectus and under similar headings in the other documents that are incorporated by reference

into this prospectus, as described beginning on page 6 of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. The securities are not being

offered in any jurisdiction where the offer is not permitted.

The

date of this prospectus is , 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information we have provided or incorporated by reference into this prospectus and any related free writing prospectus.

We have not authorized anyone to provide you with information different from that contained in this prospectus, any applicable prospectus

supplement or any related free writing prospectus. No dealer, salesperson or other person is authorized to give any information or to

represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. You

must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the shares of Common Stock

offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information

in this prospectus or any related free writing prospectus is accurate only as of the date on the front of the document and that any information

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of

delivery of this prospectus or any sale of a security.

This

prospectus and the documents incorporated by reference into this prospectus include statistical and other industry and market data that

we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party

research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although

they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications

and third-party research, surveys and studies are reliable. We are ultimately responsible for all disclosure included in this prospectus.

The

Selling Stockholders are offering the shares of Common Stock only in jurisdictions where such issuances are permitted. The distribution

of this prospectus and the issuance of the shares of Common Stock in certain jurisdictions may be restricted by law. Persons outside

the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to,

the issuance of the shares and the distribution of this prospectus outside the United States. This prospectus does not constitute, and

may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the shares of Common Stock offered by this

prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This

prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”),

under which the Selling Stockholders may offer from time-to-time securities described herein in one or more offerings. If required, each

time a Selling Stockholder offers shares, we will provide you with, in addition to this prospectus, a prospectus supplement that will

contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided

to you that may contain material information relating to that offering. We may also use a prospectus supplement and any related free

writing prospectus to add, update or change any of the information contained in this prospectus or in documents we have incorporated

by reference. This prospectus, together with any related free writing prospectuses and the documents incorporated by reference into this

prospectus, includes all material information relating to this offering. To the extent that any statement that we make in a prospectus

supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or

superseded by those made in a prospectus supplement. Please carefully read both this prospectus and any prospectus supplement before

buying any of the securities offered.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the sections entitled

“Where You Can Find More Information” and “Incorporation of Certain Information By Reference.”

This

prospectus provides you with a general description of the shares of Common Stock the Selling Stockholders may offer. To the extent that

any statement made in an accompanying prospectus supplement is inconsistent with statements made in this prospectus, the statements made

in this prospectus will be deemed modified or superseded by those made in the accompanying prospectus supplement. You should read both

this prospectus and any accompanying prospectus supplement together with the additional information described under the section “Where

You Can Find More Information” included elsewhere in this prospectus.

Neither

we nor any Selling Stockholder has authorized anyone to provide you with information different from that contained in this prospectus,

any accompanying prospectus supplement or in any related free-writing prospectus filed by us with the SEC. Neither we nor any Selling

Stockholder takes any responsibility for, or provides any assurance as to the reliability of, any information other than the information

in this prospectus, any accompanying prospectus supplement or in any related free-writing prospectus filed by us with the SEC. This prospectus

and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other

than the securities described in this prospectus or any accompanying prospectus supplement or an offer to sell or the solicitation of

an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information

appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free-writing prospectus

is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed

materially since those dates.

Except

as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Adial,” “the

Company,” “we,” “us,” “our” and similar references refer to Adial Pharmaceuticals, Inc., an

entity incorporated under the laws of the State of Delaware.

Smaller

Reporting Company – Scaled Disclosure

Pursuant

to Item 10(f) of Regulation S-K promulgated under the Securities Act of 1933, as amended, as indicated herein, we have elected to comply

with the scaled disclosure requirements applicable to “smaller reporting companies,” including providing two years of audited

financial statements.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains predictive or “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995. All statements other than statements of current or historical fact contained in this prospectus, including statements that

express our intentions, plans, objectives, beliefs, expectations, strategies, predictions or any other statements relating to our future

activities or other future events or conditions are forward-looking statements. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“predict,” “project,” “will,” “should,” “would” and similar expressions,

as they relate to us, are intended to identify forward-looking statements.

These

statements are based on current expectations, estimates and projections made by management about our business, our industry and other

conditions affecting our financial condition, results of operations or business prospects. These statements are not guarantees of future

performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may

differ materially from what is expressed or forecasted in, or implied by, the forward-looking statements due to numerous risks and uncertainties.

Factors that could cause such outcomes and results to differ include, but are not limited to, risks and uncertainties arising from:

| |

● |

our

projected financial position and estimated cash burn rate; |

| |

● |

our

estimates regarding expenses, future revenues and capital requirements; |

| |

● |

our

need to raise substantial additional capital to fund our operations; |

| |

● |

the

success, cost and timing of our clinical trials; |

| |

● |

our

dependence on third parties in the conduct of our clinical trials; |

| |

● |

our

ability to obtain the necessary regulatory approvals to market and commercialize our product candidates; |

| |

● |

the

potential that results of preclinical and clinical trials indicate our current product candidates or any future product candidates

we may seek to develop are unsafe or ineffective; |

| |

● |

the

results of market research conducted by us or others; |

| |

● |

our

ability to obtain and maintain intellectual property protection for our current product candidates; |

| |

● |

our

ability to protect our intellectual property rights and the potential for us to incur substantial costs from lawsuits to enforce

or protect our intellectual property rights; |

| |

● |

the

possibility that a third party may claim we have infringed, misappropriated or otherwise violated their intellectual property rights

and that we may incur substantial costs and be required to devote substantial time defending against these claims; |

| |

● |

our

reliance on third-party suppliers and manufacturers; |

| |

● |

the

success of competing therapies and products that are or become available; |

| |

● |

our

ability to expand our organization to accommodate potential growth and our ability to retain and attract key personnel; |

| |

● |

the

potential for us to incur substantial costs resulting from product liability lawsuits against us and the potential for these product

liability lawsuits to cause us to limit our commercialization of our product candidates; |

| |

● |

market

acceptance of our product candidates, the size and growth of the potential markets for our current product candidates and any future

product candidates we may seek to develop, and our ability to serve those markets; and |

| |

● |

the

successful development of our commercialization capabilities, including sales and marketing capabilities. |

Our

current product candidate is undergoing clinical development and has not been approved by the Food and Drug Administration (“FDA”)

or the European Commission. This product candidate has not been, nor may it ever be, approved by any regulatory agency or competent authorities

nor marketed anywhere in the world.

We

may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place

undue reliance on our forward-looking statements. Forward-looking statements should be regarded solely as our current plans, estimates

and beliefs. We have included important factors in the cautionary statements included in this document and the documents incorporated

by reference in this prospectus, particularly in the section entitled “Risk Factors” that we believe could cause actual results

or events to differ materially from the forward-looking statements that we make. Moreover, we operate in a very competitive and rapidly

changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess

the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements we may make. Given these risks and uncertainties, readers are cautioned

not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this

cautionary statement. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions,

joint ventures or investments we may make. You should read this prospectus and the documents that we have filed as exhibits to this prospectus

and incorporated by reference herein completely and with the understanding that our actual future results may be materially different

from the plans, intentions and expectations disclosed in the forward-looking statements we make. The forward-looking statements contained

in this prospectus and the documents incorporated by reference in this prospectus are made as of the date of this prospectus and the

dates of the documents incorporated by reference in this prospectus and we do not assume any obligation to update any forward-looking

statements, whether as a result of new information, future events or otherwise, except as required by applicable law.. Investors should

evaluate any statements made by us in light of these important factors.

PROSPECTUS

SUMMARY

This

summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain

all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before

making an investment in our securities. You should carefully consider, among other things, our financial statements and the related notes

and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” included elsewhere in, or incorporated by reference into, this prospectus.

In

this prospectus, unless the context otherwise requires, the terms “we,” “us,” “our,” “Adial”

and the “Company” refer to Adial Pharmaceuticals, Inc.

Overview

We

are a clinical-stage biopharmaceutical company focused on the development of therapeutics for the treatment or prevention of addiction

and related disorders. Our lead investigational new drug product, AD04, is a genetically targeted therapeutic agent being developed for

the treatment of alcohol use disorder (“AUD”). AD04 was recently investigated in a Phase 3 clinical trial, designated the

ONWARD trial, for the potential treatment of AUD in subjects with certain target genotypes, which were identified using our companion

diagnostic genetic test. Based on our analysis of the subgroup data from the ONWARD trial, we are now focused on commercializing AD04

in the U.S. and Europe.

We

continue to explore opportunities to expand our portfolio in the field of addiction and related disorders such as pain reduction, both

through internal development and through acquisitions. Our vision is to create the world’s leading addiction focused pharmaceutical

company.

In

January 2021, we expanded our portfolio in the field of addiction with the acquisition of Purnovate, LLC via a merger into our wholly

owned subsidiary, Purnovate, Inc., (“Purnovate”) and in January 2023, we entered into an option agreement with Adovate LLC

(“Adovate”), pursuant to which we granted to Adovate an exclusive option for a period of one hundred twenty (120) days from

the effective date of the Option Agreement for Adovate or its designated affiliate to acquire all of the assets of Purnovate and to assume

related liabilities and expenses. On May 8, 2023, Adovate sent a letter exercising its option effective May 16, 2023 and made payment

of the $450,000 in fees due on exercise. On August 17, 2023, a Bill of Sale, Assignment and Assumption Agreement (“Bill of Sale”)

was executed between Purnovate and Adovate, transferring the Purnovate assets to Adovate, effective as of June 30, 2023. On August 17,

2023, Purnovate and Adovate also entered into a Letter Agreement which stated that Adovate acquired the assets of Purnovate effective

as of June 30, 2023, pursuant to the Bill of Sale. On September 18, 2023, the parties executed a final acquisition agreement which memorialized

the terms of the sale of the Purnovate assets to Adovate pursuant to the Option Agreement and Bill of Sale.

We

have devoted the vast majority of our resources to development efforts relating to AD04, including preparation for conducting clinical

trials, providing general and administrative support for these operations and protecting our intellectual property.

We

currently do not have any products approved for sale and we have not generated any significant revenue since our inception. From our

inception through the date of this prospectus, we have funded our operations primarily through the private and public placements of debt

and equity securities and equity lines.

We

have incurred net losses in each year since our inception, including net losses of approximately $1.8 million and $6.8 million for the

six months ended June 30, 2023 and 2022, respectively. We had accumulated deficits of approximately $65.4 and $63.7 million as of June

30, 2023 and December 31, 2022, respectively. Substantially all our operating losses resulted from costs incurred in connection with

our research and development programs, from general and administrative costs associated with our operations, and from financing costs.

We

will not generate revenue from product sales unless and until we successfully complete development and obtain marketing approval for

AD04, which we expect will take a number of years and is subject to significant uncertainty. Based our current projections, we do not

believe our current cash and cash equivalents will be sufficient to fund our operations for the next twelve months from the date of this

prospectus.

Until

such time, if ever, as we can generate substantial revenue from product sales, we expect to finance our operating activities through

a combination of equity offerings, debt financings, government or other third-party funding, commercialization, marketing and distribution

arrangements and other collaborations, strategic alliances and licensing arrangements. However, we may be unable to raise additional

funds or enter into such other arrangements when needed on favorable terms or at all. Our failure to raise capital or enter into such

other arrangements as and when needed would have a negative impact on our financial condition and our ability to develop AD04.

Corporate

Information

Adial

Pharmaceuticals, L.L.C. was formed as a Virginia limited liability company in November 2010. Adial Pharmaceuticals, L.L.C. converted

from a Virginia limited liability company into a Virginia corporation on October 3, 2017, and then reincorporated in Delaware on October

11, 2017 by merging the Virginia corporation with and into Adial Pharmaceuticals, Inc., a Delaware corporation that was incorporated

on October 5, 2017 as a wholly owned subsidiary of the Virginia corporation. We refer to this as the corporate conversion/reincorporation.

In connection with the corporate conversion/reincorporation, each unit of Adial Pharmaceuticals, L.L.C. was converted into shares of

common stock of the Virginia corporation and then into shares of common stock of Adial Pharmaceuticals, Inc., the members of Adial Pharmaceuticals,

L.L.C. became stockholders of Adial Pharmaceuticals, Inc. and Adial Pharmaceuticals, Inc. succeeded to the business of Adial Pharmaceuticals,

L.L.C.

Our

principal executive offices are located at 1180 Seminole Trail, Suite 495, Charlottesville, Virginia 22901, and our telephone number

is (434) 422-9800. Our website address is www.adial.com. Information contained on our website is intended for informational purposes

only and is not incorporated by reference into this prospectus, and it should not be considered to be part of this prospectus or the

registration statement of which this prospectus forms a part. The SEC maintains an internet site that contains reports, proxy and information

statements, and other information regarding issuers like us that file documents electronically with the SEC. The address of the SEC website

is www.sec.gov.

Recent

Developments

October

2023 Private Placement

On

October 19, 2023, we entered into a securities purchase agreement (the “Purchase Agreement”) with the Investor Selling Stockholder

pursuant to which we sold to the Investor Selling Stockholder in the Private Placement priced at-the-market consistent with the rules

of the Nasdaq Stock Market LLC, (i) the Pre-Funded Warrants to purchase up to an aggregate of 1,418,440 shares of Common Stock, (ii)

Series A Common Warrants to purchase up to an aggregate of 1,418,440 shares of Common Stock, and (iii) Series B Common Warrants to purchase

up to an aggregate of 1,418,440 shares of Common Stock. The combined purchase price of each Pre-Funded Warrant and accompanying Series

A Common Warrant and Series B Common Warrant was $2.819.

The

Private Placement closed on October 24, 2023. We received aggregate gross proceeds from the Private Placement of approximately $4.0 million,

before deducting the placement agent commissions and estimated offering expenses payable by us. We intend to use the net proceeds from

the Private Placement for working capital purposes. H.C.W. acted as the placement agent in the Private Placement and as part of its compensation

we issued to designees of H.C.W. Placement Agent Warrants to purchase up to 85,106 shares of Common Stock.

See

the section of this prospectus entitled “Description of the Private Placement” for a more detailed description of the Private

Placement.

Implications

of Being an Emerging Growth Company and a Smaller Reporting Company

We

qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS

Act”). As an “emerging growth company,” we may take advantage of specified reduced disclosure and other requirements

that are otherwise applicable generally to public companies. These provisions include, but are not limited to:

| |

● |

requiring

only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly

reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Securities

Act of 1933, as amended (the “Securities Act”), filings; |

| |

● |

reduced

disclosure about our executive compensation arrangements; |

| |

● |

no

non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| |

● |

exemption

from compliance with the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant

to Section 404(b) of the Sarbanes Oxley Act of 2002 (“SOX”). |

We

may take advantage of these exemptions for up to five years or such earlier time that we are no longer an “emerging growth company.”

We will continue to remain an “emerging growth company” until the earliest of the following: (i) the last day of the fiscal

year following the fifth anniversary of the date of the completion of our initial public offering; (ii) the last day of the fiscal year

in which our total annual gross revenue is equal to or more than $1.235 billion; (iii) the date on which we have issued more than $1

billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer

under the rules of the SEC.

We

are also a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. To the

extent that we continue to qualify as a “smaller reporting company” as such term is defined in Rule 12b-2 under the Exchange

Act, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an “emerging growth

company” may continue to be available to us as a “smaller reporting company,” including exemption from compliance with

the auditor attestation requirements pursuant to SOX and reduced disclosure about our executive compensation arrangements. We will continue

to be a “smaller reporting company” until we have $250 million or more in public float (based on our common stock) measured

as of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float (based on our

common stock) or a public float (based on our common stock) that is less than $700 million and annual revenues of $100 million or more

during the most recently completed fiscal year.

We

may choose to take advantage of some, but not all, of these exemptions. We have taken advantage of reduced reporting requirements in

this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies

in which you hold stock. In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition

period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply

to private companies. We have elected to avail ourselves of the extended transition period for complying with new or revised financial

accounting standards. As a result of the accounting standards election, we will not be subject to the same implementation timing for

new or revised accounting standards as other public companies that are not emerging growth companies which may make comparison of our

financials to those of other public companies more difficult.

Additional

Information

For

additional information related to our business and operations, please refer to the reports incorporated herein by reference, including

our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K as filed with the

SEC, as described in the section entitled “Incorporation of Certain Information by Reference” included elsewhere in this

prospectus.

THE

OFFERING

All

share number and exercise price information presented in this prospectus reflects a 1-for-25 reverse stock split of our common stock,

which was effected on August 4, 2023.

Shares

of Common Stock offered by the Selling Stockholders |

|

4,340,426

shares (consisting of: (i) 1,418,440 shares of our Common Stock issuable upon the exercise of the Pre-Funded Warrants, (ii) 1,418,440

shares of our Common Stock issuable upon the exercise of the Series A Common Warrants, (iii) 1,418,440 shares of Common Stock issuable

upon exercise of the Series B Common Warrants; (iv) 85,106 shares of Common Stock issuable upon the exercise of the Placement Agent

Warrants). |

| |

|

|

Common

Stock to be outstanding after this offering(1) |

|

5,558,407

shares of Common Stock, assuming the exercise of all of the Pre-Funded Warrants, the Common

Warrants and the Placement Agent Warrants

|

| Registration

Rights |

|

Under

the terms of the Registration Rights Agreement, we agreed to file this registration statement

with respect to the registration of the resale by the Investor Selling Stockholder of the

Pre-Funded Warrant Shares and the Common Warrant Shares by the 20th calendar

day following the date of the Registration Rights Agreement, and to use commercially reasonable

efforts to have the registration statement declared effective as promptly as practical, and

in any event, no later than the 45th calendar day following the date of the Registration

Rights Agreement or, in the event of a full review by the SEC, 75 days. In addition, we agreed

that, upon the registration statement being declared effective under the Securities Act,

we will use commercially reasonable efforts to maintain the effectiveness of the registration

statement until the date that (i) the Investor Selling Stockholder has sold all of the shares

of Common Stock issuable under the Registration Rights Agreement or (ii) such shares may

be resold by the Investor Selling Stockholder pursuant to Rule 144 of the Securities Act,

without the requirement for us to be in compliance with the current public information required

under such rule and without volume or manner-of-sale restriction.

|

| Use

of Proceeds |

|

The

Selling Stockholders will receive all of the proceeds of the sale of shares of Common Stock

offered from time to time pursuant to this prospectus. Accordingly, we will not receive any

proceeds from the sale of shares of Common Stock that may be sold from time to time pursuant

to this prospectus; however, we will receive proceeds from the any cash exercise of the Pre-Funded

Warrants, the Common Warrants and the Placement Agent Warrants. See “Use of Proceeds.”

We intend to use the proceeds from the any cash exercise of the Pre-Funded Warrants, the

Common Warrants and the Placement Agent Warrants for working capital purposes.

|

| Plan

of Distribution |

|

The

Selling Stockholders named in this prospectus, or their pledgees, donees, transferees, distributees, beneficiaries or other successors-in-interest,

may offer or sell the shares of Common Stock offered hereby from time to time through public or private transactions at prevailing

market prices, at prices related to prevailing market prices or at privately negotiated prices. The Selling Stockholders may also

resell the shares of Common Stock to or through underwriters, broker-dealers or agents, who may receive compensation in the form

of discounts, concessions or commissions. |

| Risk

Factors |

|

See

“Risk Factors” beginning on page 6 of this prospectus and in the documents incorporated by reference in this

prospectus and the other information included in this prospectus for a discussion of factors you should carefully consider before

investing in our securities. |

| |

|

|

| Nasdaq

Capital Market trading symbol |

|

Our

Common Stock is listed on the Nasdaq Capital Market under the symbol “ADIL.” |

| (1) | The

number of shares of Common Stock to be outstanding after this offering is based on 1,217,981 shares of our Common Stock outstanding as

of November 3, 2023, and excludes: |

| ● | 329,022

shares of Common Stock issuable as of the date hereof upon the exercise of Common Stock warrants outstanding at a weighted average exercise

price of $74.44 per share; |

| ● | 204,059

shares of Common Stock issuable upon the exercise of stock options outstanding at a weighted-average exercise price of $52.49 per share;

and |

| ● | 162,994

shares of Common Stock available for future issuance under the 2017 Equity Incentive Plan. |

RISK

FACTORS

Our

business, results of operations and financial condition and the industry in which we operate are subject to various risks. Accordingly,

investing in our securities involves a high degree of risk. This prospectus does not describe all of those risks. You should consider

the risk factors described in this prospectus below, as well as those described under the caption “Risk Factors” in the documents

incorporated by reference herein, including our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, together

with the other information contained or incorporated by reference in this prospectus.

We

have described below and, in the documents incorporated by reference herein, the most significant risk factors applicable to us, but

they do not constitute all of the risks that may be applicable to us. New risks may emerge from time to time, and it is not possible

for us to predict all potential risks or to assess the likely impact of all risks. Before making an investment decision, you should carefully

consider these risks as well as other information we include or incorporate by reference in this prospectus and any amendment to this

prospectus or any prospectus supplement. This prospectus also contains forward-looking statements that involve risks and uncertainties.

Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors,

including the risks described below. See the section titled “Cautionary Note Regarding Forward-Looking Statements.”

Risks

Related to Our Financial Position and Need for Capital

We

must raise additional capital to fund our operations in order to continue as a going concern.

Although

we raised net proceeds of approximately $3.5 million in the Private Placement and we believe that, with together with a $350 thousand

in expected expense reimbursements due, we will have sufficient cash and cash equivalents to fund our ongoing operations for a period

of a least 12 months subsequent to the date of this prospectus, we will need to raise additional capital through the sale of additional

equity or debt securities or other debt instruments, strategic relationships or grants, or other arrangements to support our future operations.

Our current business plan includes expansion for our commercialization efforts, which will require additional funding. If we are unable

to improve our liquidity position, we may not be able to continue as a going concern. Our ability to continue as a going concern is dependent

upon our ability to generate revenue and raise capital from financing transactions. Our future is dependent upon its ability to obtain

financing and upon future profitable operations from the development of its new business opportunities. There can be no assurance that

we will be successful in accomplishing these objectives. Without such additional capital, we may be required to curtail or cease operations

and be required to realize our assets and discharge our liabilities other than in the normal course of business which could cause investors

to suffer the loss of all or a substantial portion of their investment. Marcum LLP, our independent registered public accounting firm

for the fiscal year ended December 31, 2022, has included an explanatory paragraph in its opinion that accompanies our audited consolidated

financial statements as of and for the year ended December 31, 2022, indicating that our current liquidity position raises substantial

doubt about our ability to continue as a going concern.

We

have incurred losses from our continuing operations every year and quarter since our inception and anticipate that we will continue to

incur losses from our continuing operations in the future. We anticipate that we will need to raise additional funds even if we sell

the maximum number of securities offered in this offering.

We

are a clinical stage biotechnology pharmaceutical company that is focused on the discovery and development of medications for the treatment

of addictions and related disorders of AUD in patients with certain targeted genotypes. We have a limited operating history. Investment

in biopharmaceutical product development is highly speculative because it entails substantial upfront capital expenditures and significant

risk that any potential product candidate will fail to demonstrate adequate effect or an acceptable safety profile, gain regulatory approval

and become commercially viable. We have no products approved for commercial sale and have not generated any revenue from product sales

to date, and we continue to incur significant research and development and other expenses related to our ongoing operations. To date,

we have not generated positive cash flow from operations, revenues, or profitable operations, nor do we expect to in the foreseeable

future. As of June 30, 2023, we had an accumulated deficit of approximately $65.5 million and as of December 31, 2022, we had an accumulated

deficit of approximately $63.7 million. Even though we raised net proceeds of approximately $3.5 million in the Private Placement and

these proceeds, together with receipt of an additional $350 thousand in expense reimbursements due, are expected to fund our ongoing

operations for at least 12 months from the date of this prospectus, we will need to raise additional funds as our current cash and cash

equivalents to fund operation beyond that point or to fund any additional projects or expenses. We believe that additional equity financings

are the most likely source of capital going forward. There can be no assurance that we will be able to complete any such financing transaction

on acceptable terms or otherwise.

Even

if we succeed in commercializing our product candidate or any future product candidates, we expect that the commercialization of our

product will not begin until 2026 or later, we will continue to incur substantial research and development and other expenditures to

develop and market additional product candidates and will continue to incur substantial losses and negative operating cash flow. We may

encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business.

The size of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenue.

Our prior losses and expected future losses have had and will continue to have an adverse effect on our shareholders’ equity and

working capital.

Even

if we can raise additional funding, we may be required to do so on terms that are dilutive to you.

The

capital markets have been unpredictable in the past for unprofitable companies such as ours. In addition, it is generally difficult for

development stage companies to raise capital under current market conditions. The amount of capital that a company such as ours is able

to raise often depends on variables that are beyond our control. As a result, we may not be able to secure financing on terms attractive

to us, or at all. If we can consummate a financing arrangement, the amount raised may not be sufficient to meet our future needs. If

adequate funds are not available on acceptable terms, or at all, our business, including our results of operations, financial condition

and our continued viability will be materially adversely affected.

Risks

Related to the Private Placement and Ownership of the Warrants

Our

management will have broad discretion over the use of the net proceeds from the Private Placement and may apply it to uses that do not

improve our operating results or the value of our securities.

Our

management will have broad discretion over the use of proceeds from the Private Placement. We intend to use the net proceeds from the

Private Placement for working capital and other general corporate purposes. Our management will have considerable discretion in the application

of the net proceeds, and shareholders will not have the opportunity, as part of their investment decision, to assess whether the proceeds

are being used appropriately. The net proceeds, if any, may be used for corporate purposes that do not improve our operating results

or enhance the value of our Common Stock. The failure of our management to use these funds effectively could have a material adverse

effect on our business, cause the market price of our Common Stock to decline and impair the commercialization of our products and/or

delay the development of our product candidates. Pending their use, we may invest the net proceeds from this offering in short-term,

investment-grade, interest-bearing instruments and U.S. government securities. These investments may not yield a favorable return to

our stockholders.

There

is no public market for the Pre-Funded Warrants, Common Warrants or Placement Agent Warrants.

There

is no established public trading market for the Pre-Funded Warrants, Common Warrants or Placement Agent Warrants, and we do not expect

a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants, Common Warrants or Placement Agent Warrants

on the Nasdaq Capital Market or any national securities exchange or other nationally recognized trading system. Without an active market,

the liquidity of the Pre-Funded Warrants, Common Warrants and Placement Agent Warrants will be limited.

We

may not receive any additional funds upon the exercise of the Pre-Funded Warrants, Common Warrants or Placement Agent Warrants.

Each

Pre-Funded Warrant, Common Warrant and Placement Agent Warrant may be exercised by way of a cashless exercise, meaning that the holder

may not pay a cash purchase price upon exercise under certain circumstances, but instead would receive upon such exercise the net number

of shares of our Common Stock determined according to the formula set forth in the Pre-Funded Warrants, Common Warrants or Placement

Agent Warrants. Accordingly, we may not receive any additional funds upon the exercise of the Pre-Funded Warrants, Common Warrants or

Placement Agent Warrants.

The

Pre-Funded Warrants, Common Warrants and Placement Agent Warrants are speculative in nature.

The

Pre-Funded Warrants, Common Warrants and Placement Agent Warrants do not confer any rights of Common Stock ownership on their holders,

such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of Common Stock at a

fixed price for a limited period of time. Specifically, commencing on the earlier of (i) if permissible by the applicable rules and regulations

of the Nasdaq Stock Market LLC (“Nasdaq”), payment by the holder of $0.125 per Common Warrant Share and (ii) the date of

which approval (as may be required by the applicable rules and regulations of Nasdaq (or any successor entity) from our stockholders

with respect to issuance of all of the Common Warrants and the Common Warrant Shares upon the exercise thereof is obtained, holders of

the Common Warrants may exercise their right to acquire shares of our Common Stock and pay an exercise price of $2.82 per share, subject

to certain adjustments, prior to five and one-half years from the issuance date for the Series A Common Warrant and 18 months from the

issuance date for the Series B Common Warrant, after which date any unexercised Common Warrants will expire and have no further value.

Holders of Placement Agent Warrants may exercise their right to acquire our Common Stock and pay an exercise price of $3.525 per share,

subject to certain adjustments, prior to five and one-half years from the date on which such Placement Agent Warrants were issued, after

which date any unexercised Placement Agent Warrants will expire and have no further value. Holders of Pre-Funded Warrants have identical

rights, except that the Pre-Funded Warrants have an exercise price of $0.001 and do not expire until exercised in full. The market value

of the Pre-Funded Warrants, Common Warrants and Placement Agent Warrants, if any, is uncertain and there can be no assurance that the

market value of the Pre-Funded Warrants, Common Warrants and Placement Agent Warrants will equal or exceed their imputed offering price.

The Pre-Funded Warrants, Common Warrants and Placement Agent Warrants will not be listed or quoted for trading on any market or exchange.

There can be no assurance that the market price of the Common Stock will ever equal or exceed the exercise price of the Common Warrants

or Placement Agent Warrants and consequently, whether it will ever be profitable for holders of the Common Warrants or Placement Agent

Warrants to exercise the warrants.

Holders

of the Common Warrants, Pre-Funded Warrants and Placement Agent Warrants will have no rights as common stockholders with respect to the

shares our Common Stock underlying the warrants until such holders exercise their warrants and acquire our Common Stock, except as otherwise

provided in the Common Warrants, and Pre-Funded Warrants and Placement Agent Warrants.

Until

holders of the Common Warrants, Pre-Funded Warrants and/or and Placement Agent Warrants acquire shares of our Common Stock upon exercise

thereof, such holders will have no rights with respect to the shares of our Common Stock underlying such warrants, except to the extent

that holders of such Common Warrants, Pre-Funded Warrants and Placement Agent Warrants will have certain rights to participate in distributions

or dividends paid on our Common Stock as set forth in such warrants. Upon exercise of the Common Warrants, Pre-Funded Warrants and Placement

Agent Warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date

occurs after the exercise date.

We

do not intend to pay dividends on our Common Stock, so any returns will be limited to increases, if any, in our Common Stock’s

value. Your ability to achieve a return on your investment will depend on appreciation, if any, in the price of our Common Stock.

We

currently anticipate that we will retain future earnings for the development, operation and expansion of our business and do not anticipate

declaring or paying any cash dividends for the foreseeable future. Any future determination to declare dividends will be made at the

discretion of our board of directors and will depend on, among other factors, our financial condition, operating results, capital requirements,

general business conditions and other factors that our board of directors may deem relevant. Any return to stockholders will therefore

be limited to the appreciation in the value of their stock, if any.

USE

OF PROCEEDS

The

Selling Stockholders will receive all of the proceeds of the sale of shares of Common Stock offered from time to time pursuant to this

prospectus. Accordingly, we will not receive any proceeds from the sale of shares of Common Stock that may be sold from time to time

pursuant to this prospectus; however, we will receive proceeds from the cash exercise of the Pre-Funded Warrants, Common Warrants and

Placement Agent Warrants.

We

will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of shares of our Common Stock to be

sold by the Selling Stockholders pursuant to this prospectus. Other than registration expenses, the Selling Stockholders will bear any

underwriting discounts, commissions, placement agent fees or other similar expenses payable with respect to sales of shares of our Common

Stock.

DIVIDEND

POLICY

We

currently intend to retain all available funds and any future earnings to fund the growth and development of our business. We have never

declared or paid any cash dividends on our capital stock. We do not intend to pay cash dividends on our Common Stock in the foreseeable

future. Investors should not purchase our Common Stock with the expectation of receiving cash dividends.

Any

future determination to declare dividends will be made at the discretion of our board of directors and will depend on our financial condition,

operating results, capital requirements, general business conditions, and other factors that our board of directors may deem relevant.

DETERMINATION

OF THE OFFERING PRICE

The

prices at which the shares of Common Stock covered by this prospectus may actually be sold will be determined by the prevailing public

market price for shares of our Common Stock or by negotiations between the Selling Stockholders and buyers of our Common Stock in private

transactions or as otherwise described in “Plan of Distribution.”

DESCRIPTION

OF CAPITAL STOCK

The

following description of the material terms of our capital stock and the provisions of our certificate of incorporation (“Certificate

of Incorporation”) and our amended and restated bylaws (“Bylaws”) are summaries and are qualified by reference to copies

of the Certificate of Incorporation and Bylaws, which are filed with the SEC as exhibits to our registration statement of which this

prospectus forms a part.

Authorized

Capital Stock

Our

authorized capital stock consists of 50,000,000 shares of Common Stock, with a par value of $0.001 per share, and 5,000,000 shares of

preferred stock, with a par value of $0.001 per share.

As

of November 3, 2023, there were 1,217,981 shares of our Common Stock outstanding held by 101 record stockholders and no shares

of preferred stock were issued and outstanding.

Common

Stock

Authorized

Shares of Common Stock. We currently have authorized 50,000,000 shares of Common Stock.

Voting

Rights. The holders of Common Stock are entitled to one vote per share on all matters to be voted upon by the stockholders, except

on matters relating solely to terms of preferred stock.

Dividend

Rights. Subject to preferences that may be applicable to any outstanding preferred stock, the holders of Common Stock are entitled

to receive ratably such dividends, if any, as may be declared from time to time by the board of directors out of funds legally available

therefor.

Liquidation

Rights. In the event of our liquidation, dissolution or winding up, the holders of Common Stock are entitled to share ratably in

all assets remaining after payment of liabilities, subject to prior distribution rights of preferred stock, if any, then outstanding.

Other

Rights and Preferences. The holders of our Common Stock have no preemptive or conversion rights or other subscription rights. There

are no redemption or sinking fund provisions applicable to our Common Stock.

Listing.

Our Common Stock is listed for trading on the Nasdaq Capital Market under the symbol “ADIL.”

Transfer

Agent and Registrar. The transfer agent and registrar for our Common Stock is VStock Transfer, LLC.

Anti-Takeover

Effects of Delaware Law

The

provisions of Delaware law, our Certificate of Incorporation and our Bylaws described below may have the effect of delaying, deferring

or discouraging another party from acquiring control of us.

Section

203 of the Delaware General Corporation Law

We

are subject to Section 203 of the Delaware General Corporation Law, which prohibits a Delaware corporation from engaging in any business

combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder,

with the following exceptions:

| |

● |

before

such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in

the stockholder becoming an interested stockholder; |

| |

● |

upon

completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned

at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining

the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (i) by

persons who are directors and also officers and (ii) employee stock plans in which employee participants do not have the right to

determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| |

● |

on

or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of

the stockholders, and not by written consent, by the affirmative vote of at least sixty-six and two-thirds percent (66 2/3%) of the outstanding

voting stock that is not owned by the interested stockholder. |

In

general, Section 203 defines business combination to include the following:

| ● | any

merger or consolidation involving the corporation and the interested stockholder; |

| ● | any

sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder; |

| ● | subject

to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to

the interested stockholder; |

| ● | any

transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of

the corporation beneficially owned by the interested stockholder; or |

| ● | the

receipt by the interested stockholder of the benefit of any loss, advances, guarantees, pledges or other financial benefits by or through

the corporation. |

Certificate

of Incorporation and Bylaws

Our

Certificate of Incorporation and Bylaws provide that:

| ● | our

board of directors is divided into three classes, one class of which is elected each year by our stockholders with the directors in each

class to serve for a three-year term; |

| ● | the

authorized number of directors can be changed only by resolution of our board of directors; |

| ● | directors

may be removed only by the affirmative vote of the holders of at least 60% of our voting stock, whether for cause or without cause; |

| |

● |

our Bylaws may be amended or repealed by our board of directors or by the affirmative vote of sixty-six and two-thirds percent (66 2/3%) of our stockholders; |

| ● | stockholders

may not call special meetings of the stockholders or fill vacancies on the board of directors; |

| ● | our

board of directors will be authorized to issue, without stockholder approval, preferred stock, the rights of which will be determined

at the discretion of the board of directors and that, if issued, could operate as a “poison pill” to dilute the stock ownership

of a potential hostile acquirer to prevent an acquisition that our board of directors does not approve; |

| ● | our

stockholders do not have cumulative voting rights, and therefore our stockholders holding a majority of the shares of Common Stock outstanding

will be able to elect all of our directors; and |

| ● | our

stockholders must comply with advance notice provisions to bring business before or nominate directors for election at a stockholder

meeting. |

Limitations

of Director Liability and Indemnification of Directors, Officers and Employees

Our

Certificate of Incorporation limits the liability of directors to the maximum extent permitted by Delaware law. Delaware law provides

that directors of a corporation will not be personally liable for monetary damages for breach of their fiduciary duties as directors,

except for liability for any:

| |

● |

breach

of their duty of loyalty to us or our stockholders; |

| |

● |

act

or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| |

● |

unlawful

payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General Corporation

Law; or |

| |

● |

transaction

from which the directors derived an improper personal benefit. |

These

limitations of liability do not apply to liabilities arising under the federal or state securities laws and do not affect the availability

of equitable remedies such as injunctive relief or rescission.

Our

Bylaws provide that we will indemnify our directors and officers to the fullest extent permitted by law and may indemnify employees and

other agents. Our Bylaws also provide that we are obligated to advance expenses incurred by a director or officer in advance of the final

disposition of any action or proceeding.

We

have obtained a policy of directors’ and officers’ liability insurance.

We

have entered into separate indemnification agreements with our directors and officers. These agreements, among other things, require

us to indemnify our directors and officers for any and all expenses (including reasonable attorneys’ fees, retainers, court costs,

transcript costs, fees of experts, witness fees, travel expenses, duplicating costs, printing and binding costs, telephone charges, postage,

delivery service fees) judgments, fines and amounts paid in settlement actually and reasonably incurred by such directors or officers

or on his or her behalf in connection with any action or proceeding arising out of their services as one of our directors or officers,

or any of our subsidiaries or any other company or enterprise to which the person provides services at our request provided that such

person follows the procedures for determining entitlement to indemnification and advancement of expenses set forth in the indemnification

agreement. We believe that these bylaw provisions and indemnification agreements are necessary to attract and retain qualified persons

as directors and officers.

The

limitation of liability and indemnification provisions in our Certificate of Incorporation and Bylaws may discourage stockholders from

bringing a lawsuit against directors for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation

against directors and officers, even though an action, if successful, might provide a benefit to us and our stockholders. Our results

of operations and financial condition may be harmed to the extent we pay the costs of settlement and damage awards against directors

and officers pursuant to these indemnification provisions.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us,

we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act

and is therefore unenforceable.

Common

Warrants, Pre-Funded Warrants and Placement Agent Warrants Issued in the Private Placement

See

“Description of the Private Placement” for a description of the Common Warrants, the Pre-Funded Warrants and the Placement

Agent Warrants issued in connection with the Private Placement.

DESCRIPTION

OF THE PRIVATE PLACEMENT

On

October 19, 2023, we entered into the Purchase Agreement with the Investor Selling Stockholder pursuant to which we agreed to issue and

sell to the Investor Selling Stockholder in the Private Placement priced at-the-market consistent with the rules of Nasdaq, securities

consisting of: (i) Pre-Funded Warrants to purchase up to an aggregate of 1,418,440 shares of our Common Stock, (ii) Series A Common Warrants

to purchase up to 1,418,440 shares of Common Stock, and (iii) Series B Common Warrants to purchase up to 1,418,440 shares of Common Stock.

The combined purchase price of each Pre-Funded Warrant and accompanying Common Warrants was $2.819.

The

Private Placement closed on October 24, 2023. We received aggregate gross proceeds from the Private Placement of approximately $4.0 million,

before deducting the Placement Agent commissions and estimated offering expenses payable by us. We intend to use the net proceeds from

the Private Placement for working capital purposes.

Each

Pre-Funded Warrant has an exercise price equal to $0.001 per share. The Pre-Funded Warrants are exercisable at any time after their original

issuance and will not expire until exercised in full. Each Common Warrant has an exercise price equal to $2.82 per share. The Series

A Common Warrants and Series B Common Warrants are exercisable at any time after the earlier of (i) if permissible by the applicable

rules and regulations of Nasdaq, payment by the holder of $0.125 per Common Warrant Share and (ii) the date of which approval as may

be required by the applicable rules and regulations of the Nasdaq (or any successor entity) from our stockholders with respect to

issuance of all of the Common Warrants and the Common Warrant Shares upon the exercise thereof. The Series A Common Warrants will expire

on the five and one-half (5.5) year anniversary of their issuance and the Series B Common Warrants will expire on the 18 month anniversary

of their issuance. The exercise price and number of shares of Common Stock issuable upon exercise of the Common Warrant and Pre-Funded

Warrant are subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events.

The

Pre-Funded Warrants and the Common Warrants issued in the Private Placement provide that a holder of Pre-Funded Warrants or Common Warrants,

as applicable, will not have the right to exercise any portion of its Pre-Funded Warrants or Warrants if such holder, together with its

affiliates, and any other party whose holdings would be aggregated with those of the holder for purposes of Section 13(d) or Section

16 of the Exchange Act would beneficially own in excess of 9.99% for the Pre-Funded Warrants and 4.99% for the Common Warrants of the

number of shares of Common Stock outstanding immediately after giving effect to such exercise (the “Beneficial Ownership Limitation”);

provided, however, that the holder may increase or decrease the Beneficial Ownership Limitation by giving notice to the Company,

with any such increase not taking effect until the sixty-first day after such notice is delivered to the Company but not to any percentage

in excess of 9.99%. The Common Warrants may be exercised on a cashless basis if a registration statement registering Common Warrant Shares

is not effective. The Pre-Funded Warrants may be exercised on a cashless basis.

Subject

to applicable laws, a Common Warrant and Pre-Funded Warrant may be transferred at the option of the holder upon surrender of the applicable

warrant to us together with the appropriate instruments of transfer.

There

is no trading market available for the Common Warrants or the Pre-Funded Warrants on any securities exchange or nationally recognized

trading system. We do not intend to list the Common Warrants or the Pre-Funded Warrants on any securities exchange or nationally recognized

trading system.

In

the event of a fundamental transaction, as described in the Common Warrants and Pre-Funded Warrants and generally including any reorganization,

recapitalization or reclassification of our Common Stock, the sale, transfer or other disposition of all or substantially all of our

properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding Common

Stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding Common Stock, the

holders of the Common Warrants and Pre-Funded Warrants will be entitled to receive upon exercise of the Common Warrants and Pre-Funded

Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the Common

Warrants and Pre-Funded Warrants immediately prior to such fundamental transaction. In addition, in certain circumstances, upon a fundamental

transaction, the holder will have the right to require us to repurchase its Common Warrants at the Black Scholes Value; provided, however,

that, if the fundamental transaction is not within our control, including not approved by our board of directors, then the holder shall

only be entitled to receive the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised

portion of the Common Warrant, that is being offered and paid to the holders of Common Stock in connection with the fundamental transaction.

Pursuant

to the terms of the Purchase Agreement, the Company is prohibited from entering into any agreement to issue or announcing the issuance

or proposed issuance of any shares of Common Stock or securities convertible or exercisable into Common Stock for a period commencing

on October 19, 2023 and expiring 60 days from the Effective Date (as defined in the Purchase Agreement). Furthermore, the Company is

also prohibited from entering into any agreement to issue Common Stock or Common Stock Equivalents (as defined in the Purchase Agreement)

involving a Variable Rate Transaction (as defined in the Purchase Agreement), subject to certain exceptions, for a period commencing

on October 19, 2023 and expiring one year from such Effective Date. The Effective Date is defined in the Purchase Agreement as the earliest

of the date that (a) the initial registration statement contemplated by the Registration Rights Agreement (described below) has been

declared effective by the SEC, (b) all of the Common Warrant Shares and Pre-Funded Warrant Shares have been sold pursuant to Rule 144

or may be sold pursuant to Rule 144 without the requirement for the Company to be in compliance with the current public information required

under Rule 144 and without volume or manner-of-sale restrictions, (c) following the one year anniversary of the closing of the Private

Placement provided that the holder of the Common Warrant Shares and the Pre-Funded Warrant Shares is not an affiliate of the Company,

or (d) all of the Common Warrant Shares and Pre-Funded Warrant Shares may be sold pursuant to an exemption from registration under Section