Activision Blizzard Shares Rise After Record-Setting Year and Strong Forecast

February 05 2021 - 2:32PM

Dow Jones News

By Maria Armental

Activision Blizzard Inc. was among the best performers on the

S&P 500 Friday with a 9.4% gain to $101.39, following record

results in 2020 with more than $8 billion in revenue and $2 billion

in profit and company executives' bullish tone for 2021 and

beyond.

The last time the company's stock traded at those levels was in

early 1984, according to FactSet.

"We are entering 2021 with momentum across our largest

franchises," Chief Operating Officer Daniel Alegre said in a

conference call with analysts.

"We are only at the beginning of unlocking the full potential of

our portfolio and expect another step change in financial

performance in 2022 as we execute against our pipeline," he

said.

The company behind gaming franchises such as Call of Duty, Candy

Crush, and World of Warcraft, has seen higher engagement as people

stayed home during the coronavirus pandemic.

"But two things that we saw, one is that on our more social

titles, engagement remained at an elevated level," Mr. Alegre said.

"Second, and I think more importantly, we see that for the

franchises where we're executing on our new franchise strategy,

especially Call of Duty and World of Warcraft, we see engagement

substantially higher than we had even as regions reopen."

This year, Activision said it expects profit to reach $2.83 a

share, or $3.34 a share on an adjusted basis, on $8.23 billion in

revenue.

That may be a conservative outlook, MKM Partners analyst Eric

Handler said.

"With little, if anything being accounted for in the numbers for

Crash Bandicoot on the Run and Diablo: Immortal, plus, an

expectation for [Call of Duty] premium revenue to be down y/y,

guidance will likely be seen once again as being conservative," Mr.

Handler wrote Friday. "Adding even more fuel to the fire,

management sounded very confident about growth prospects in 2022 as

well as for 2023 while providing a little color on incremental

content drivers."

He raised the price target to $115 from $105.

Raymond James' Andrew Marok and Crystal Liu raised their price

target to $120 from $109, pointing to "plenty of runway to reach

new players through mobile and free-to-play offerings and

capitalize on strong demand for planned new titles in existing

franchises."

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 05, 2021 14:17 ET (19:17 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

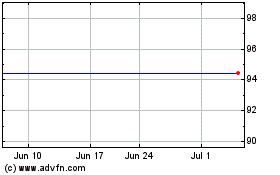

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Aug 2024 to Sep 2024

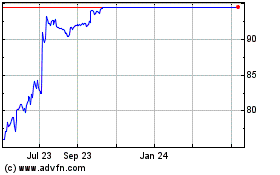

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Sep 2023 to Sep 2024