Zevra Therapeutics, Inc. (NasdaqGS: ZVRA) (“Zevra”), a rare disease

company melding science, data and patient need to create

transformational therapies for diseases with limited or no

treatment options, and Acer Therapeutics Inc. (Nasdaq: ACER)

(“Acer”), a pharmaceutical company focused on development and

commercialization of therapies for rare and life-threatening

diseases, today announced the companies have entered into a

definitive agreement pursuant to which Zevra would acquire Acer in

a merger transaction having a total potential value for Acer

stockholders of up to $91 million, consisting of (i) approximately

2.96 million shares of Zevra common stock valued at $15 million, or

0.121 shares of Zevra’s common stock per share of Acer common stock

based on the volume weighted average trading price (VWAP) of shares

of Zevra’s common stock during the 20 consecutive trading days

ending on the trading date prior to today, and (ii) up to an

additional $76 million in a series of potential cash payments

pursuant to non-transferable Contingent Value Rights (CVRs) upon

achievement of certain commercial and regulatory milestones for

Acer’s OLPRUVA (sodium phenylbutyrate) and Acer’s EDSIVO (celiprol)

within specified time periods. Certain additional cash payments are

also possible pursuant to the CVRs with respect to milestones

involving Acer’s early-stage program ACER-2820 (emetine), as

described further below. Zevra has also purchased Acer’s secured

debt at a discount from Nantahala Capital (Nantahala) through a

series of transactions in capital efficient structure. In addition,

Zevra has agreed to provide Acer with a bridge loan facility for up

to $16.5 million, subject to certain terms and conditions. Both

companies are deeply committed to developing and commercializing

treatments for rare diseases with a strong focus on patients and

remain dedicated to supporting communities with little or no

existing therapeutic options. The merger is expected to expand

Zevra's rare disease portfolio, as well as increase and diversify

its revenues with the addition of a U.S. commercial asset,

OLPRUVA, indicated for the treatment of UCDs. The transaction is

subject to certain customary closing conditions, including, but not

limited to, approval by Acer’s stockholders.

“We believe that Acer’s portfolio of rare

disease programs, including the recent U.S. commercial approval

of OLPRUVA for UCDs, is a perfect strategic fit for Zevra and

creates significant opportunity for us to positively impact patient

lives while creating shareholder value,” said Joshua Schafer, Chief

Commercialization Officer and Executive Vice President of Business

Development of Zevra Therapeutics. “We are excited about

Acer’s clinical programs and are confident in the potential

of OLPRUVA to bring UCD patients a more convenient and

cost-effective treatment option over current therapies. Acer would

bring unique rare disease operations and capabilities that would

serve as a foundation to support the commercialization

of Zevra’s pipeline as it advances.”

Chris Schelling, Acer Therapeutics’ Chief

Executive Officer and Founder, added, “Following years of product

development and commitment to rare disease communities, culminating

in the FDA approval of OLPRUVA, we are pleased to see our assets,

pipeline and team positioned to unite under the Zevra umbrella. We

look forward to working with the Zevra team to ensure a smooth

transition as we work together on behalf of patients.”

“This merger would support Zevra's vision of

becoming a leading rare disease company bringing life-changing

therapies to patients with a significant unmet need,” said Christal

Mickle, Zevra’s interim Chief Executive Officer and Chief

Development Officer. “The commercial launch of OLPRUVA in the U.S.

requires a small, highly-focused commercial team, which is

complementary to what we intend to build for arimoclomol, our

product candidate for the treatment of Niemann-Pick disease Type C

(NPC). We believe there is potential to realize significant

synergies across our commercial organizations as both UCDs and NPC

are metabolic related conditions and there is overlap among those

physicians that treat both disorders.”

Financial Details and Terms of the

Transactions:The transactions, which have been approved by

the Boards of Directors of both companies, are currently

anticipated to close in the fourth quarter of 2023, subject to Acer

stockholder approval, as well as other customary closing

conditions. The merger is expected to accelerate Zevra’s pathway to

becoming a commercial-stage company by adding OLPRUVA, an

FDA-approved asset, which is expected to add to Zevra’s revenue.

There are potential synergies to be realized by combining Acer’s

operations with Zevra’s capabilities in preparation for the

potential launch of arimoclomol. In addition, Zevra expects to

acquire significant net operating loss (NOL) tax assets as part of

this merger, providing potential tax savings against future

earnings.

Under the terms of the definitive agreement, at

closing, Zevra would issue 0.121 of a share of Zevra’s common stock

in respect of each share of Acer’s common stock. In addition, Acer

stockholders of record as of immediately prior to the effective

time of the merger would receive non-transferable CVRs entitling

the holders to receive up to $34 million in cash upon the

achievement of certain commercial milestones for OLPRUVA, and up to

an additional $42 million in cash upon the achievement of certain

regulatory milestones for OLPRUVA and EDSIVO.

Approximately 2.96 million shares of Zevra

common stock to be issued in the merger is calculated by dividing

$15.0 million by the VWAP of Zevra’s shares of common stock during

the 20 consecutive trading days through yesterday, which was

$5.0667. The 20-day trailing VWAP value represents a discount of

approximately 2% to yesterday’s closing share price for Acer.

The non-transferable CVRs will entitle the Acer

stockholders of record to receive up to $34 million in cash upon

the achievement of certain commercial milestones for OLPRUVA, and

an additional $42 million in cash upon the achievement of certain

regulatory milestones for other development programs. The proposed

transactions also include non-transferable CVRs for ACER-2820,

Acer's early phase emetine program.

Based on the number of Zevra shares issued and

outstanding as of June 30, 2023, together with the equity issued to

Nantahala as part of the debt acquisition as described below, the

aggregate number of shares issuable to Acer stockholders in the

merger is expected to represent approximately 7.6% of the issued

and outstanding common stock of Zevra following the merger.

To provide for a smooth transition and

uninterrupted operations, and subject to certain conditions, Zevra

has extended a bridge loan facility to Acer of up to $16.5 million

to provide additional working capital to, among other things,

support the commercial launch of OLPRUVA until the expected closing

of the merger transaction, and to provide the $10 million payment

to Acer's termination of the 2021 collaboration and license

agreement by and between Acer and Relief Therapeutics, and Acer’s

related entry into an exclusive license agreement with Relief for

the development and commercialization rights for OLPRUVA in

geographical Europe.

Additionally, Zevra has purchased Acer's secured

debt from Nantahala representing an aggregate of principal, accrued

interest other fees and premiums of approximately $35.3 million,

for a total of $28.5 million to be paid using a combination of $12

million in cash financed from Zevra’s existing margin line of

credit facility, $5 million in a new promissory note held by

Nantahala, with a three-year maturity and bearing interest

initially at 9% per annum (increasing to 12% per annum if the note

remains outstanding six months after issuance), and $11.5 million

in Zevra’s common stock based on the 20-day trailing VWAP

calculation described above, or approximately 2.27 million shares,

or approximately 5.8% of the issued and outstanding common stock of

Zevra following the merger.

Bryan Cave Leighton Paisner LLP served as legal

advisor to Zevra and Canaccord Genuity LLC served as exclusive

financial advisor to Zevra for the transactions. Pillsbury Winthrop

Shaw Pittman LLP served as legal advisor to Acer, and William Blair

& Company, LLC served as exclusive financial advisor to

Acer.

Conference Call

Information:Zevra will host a conference call and live

audio webcast with a slide presentation today, August 31, 2023, at

8:30 a.m. ET, to discuss details of the acquisition agreement with

Acer.

The audio webcast with a slide presentation will

be accessible via the Investor Relations section of the Company’s

website, http://investors.zevra.com/. An archive of the webcast and

presentation will be available for 90 days beginning at

approximately 9:30 a.m. ET, on August 31, 2023.

Additionally, interested participants and

investors may access the conference call by dialing

either:

- (800) 245-3047

(U.S.)

- +1 (203) 518-9765

(International)

- Conference ID:

ZevraUpdate

About Urea Cycle Disorders:UCDs

are a group of rare, genetic disorders that can cause harmful

ammonia to build up in the blood, potentially resulting in brain

damage and neurocognitive impairments, if ammonia levels are not

controlled.i Any increase in ammonia over time is serious.

Therefore, it is important to adhere to any dietary protein

restrictions and have alternative medication options to help

control ammonia levels.

About OLPRUVA:ACER-001 (sodium

phenylbutyrate) was approved for the treatment of certain UCDs in

December 2022 and has recently been marketed under the brand name,

OLPRUVA. OLPRUVA (sodium phenylbutyrate) for oral suspension is a

prescription medicine used along with certain therapy, including

changes in diet, for the long-term management of adults and

children weighing 44 pounds (20 kg) or greater and with a body

surface area (BSA) of 1.2 m2 or greater, with urea cycle disorders

(UCDs), involving deficiencies of carbamylphosphate synthetase

(CPS), ornithine transcarbamylase (OTC), or argininosuccinic acid

synthetase (AS). Please see Important Safety Information and full

Prescribing Information, including Patient Information.

Important Safety Information:

Certain medicines may increase the level of

ammonia in your blood or cause serious side effects when taken

during treatment with OLPRUVA. Tell your doctor about all the

medicines you or your child takes especially if you or your child

takes corticosteroids, valproic acid, haloperidol, and/or

probenecid.

OLPRUVA can cause serious side effects,

including: 1) nervous system problems (neurotoxicity). Symptoms

include sleepiness, tiredness, lightheadedness, vomiting, nausea,

headache, confusion, 2) low potassium levels in your blood

(hypokalemia) and 3) conditions related to swelling (edema).

OLPRUVA contains salt (sodium), which can cause swelling from salt

and water retention. Tell your doctor right away if you or your

child get any of these symptoms. Your doctor may do certain blood

tests to check for side effects during treatment with OLPRUVA. If

you have certain medical conditions such as heart, liver or kidney

problems, are pregnant/planning to get pregnant or breast-feeding,

your doctor will decide if OLPRUVA is right for you.

The most common side effects of OLPRUVA include

absent or irregular menstrual periods, decreased appetite, body

odor, bad taste or avoiding foods you ate prior to getting sick

(taste aversion). These are not all of the possible side effects of

OLPRUVA. Call your doctor for medical advice about side effects.

You may report side effects to FDA at 1-800-FDA-1088.

For additional information, please see Important

Safety Information and full Prescribing Information, including

Patient Information and discuss with your doctor.

About Niemann-Pick disease type C

(NPC):Niemann-Pick disease type C (NPC) is an ultra-rare

and progressive, neurodegenerative lysosomal storage disorder

characterized by an inability of the body to transport cholesterol

and other lipids within the cell, leading to an accumulation of

these substances in various tissue areas, including brain tissue.

The disease is caused by mutations in the NPC1 or NPC2 genes which

are responsible for making lysosomal proteins and is an autosomal

recessive trait. Both children and adults can be affected by NPC

with varying clinical presentations. Those living with NPC lose

independence due to physical and cognitive limitations, with key

neurological impairments presenting in speech, cognition,

swallowing, ambulation, and fine motor skills. Disease progression

is irreversible and can be fatal within months or take years to be

diagnosed and advance in severity.

About Arimoclomol:Arimoclomol,

Zevra’s orally-delivered, first-in-class investigational product

candidate for the treatment of NPC, has been granted orphan drug

designation, Fast Track designation, Breakthrough Therapy

designation and rare pediatric disease designation for NPC by the

FDA, and orphan medicinal product designation for the treatment of

NPC by the European Medicines Agency (EMA). The

arimoclomol NDA is currently being prepared for resubmission to the

FDA.

About Zevra Therapeutics:Zevra

Therapeutics is a rare disease company melding science, data, and

patient need to create transformational therapies for diseases with

limited or no treatment options. With unique, data-driven clinical,

regulatory, and commercialization strategies, the Company is

overcoming complex drug development challenges to bring much-needed

therapies to patients. With both regulatory and clinical stage

product candidates, the Company is building its commercial

capability to make new therapies available to the rare disease

community.

Early access programs are made available by

Zevra Therapeutics and its affiliates and are subject to the

Company's Early Access Program (EAP) policy as published on its

website at zevra.com. Participation in these programs is

subject to the laws and regulations of each jurisdiction under

which each respective program is operated. Eligibility for

participation in any such program is at the treating physician's

discretion.

About Acer Therapeutics:Acer is

a pharmaceutical company focused on the acquisition, development

and commercialization of therapies for serious rare and

life-threatening diseases with significant unmet medical needs. In

the U.S., OLPRUVA (sodium phenylbutyrate) is approved for the

treatment of urea cycle disorders (UCDs) involving deficiencies of

carbamylphosphate synthetase (CPS), ornithine transcarbamylase

(OTC), or argininosuccinic acid synthetase (AS). Acer is also

advancing a pipeline of investigational product candidates for rare

and life-threatening diseases, including: OLPRUVA (sodium

phenylbutyrate) for treatment of various disorders, including Maple

Syrup Urine Disease (MSUD); and EDSIVO (celiprolol) for treatment

of vascular Ehlers-Danlos syndrome (vEDS) in patients with a

confirmed type III collagen (COL3A1) mutation. For more

information, visit www.acertx.com.

Cautionary Note Concerning Forward

Looking Statements:This press release may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that do not relate solely to

historical or current facts, and which can be identified by the use

of words such as "may," "will," "expect," "project," "estimate,"

"anticipate," "plan," "believe," "potential," "should," "continue,"

"could," "intend," "target," "predict," or the negative versions of

those words or other comparable words or expressions, although not

all forward-looking statements contain these identifying words or

expressions. Forward-looking statements are not guarantees of

future actions or performance. These forward-looking statements

include without limitation statements regarding the proposed merger

transaction, its timing and its consummation, the anticipated

financial performance of Zevra and Acer related thereto, including

the anticipated closing of, benefits of, and synergies related to

the proposed merger transaction, potential strategic implications

as a result of the proposed merger transaction, Zevra’s intention

to provide bridge financing to Acer and the availability of such

financing to Acer, Zevra’s path to profitability, Zevra’s strategic

and product development objectives, including with respect to

becoming a leading, commercially-focused rare disease company,

Zevra’s plans to build out commercial teams for products or product

candidates, Zevra’s commercial infrastructure investments and the

impact of the proposed transactions on them, Zevra’s industry,

plans, goals and expectations concerning market position, future

operations and other financial and operating information, and the

potential for achievement of the milestones that would trigger cash

payments pursuant to the CVRs that would be issued to the Acer

stockholders in the merger. Forward-looking statements are based on

information currently available to Zevra and Acer and their

respective current plans or expectations, and are subject to

several known and unknown uncertainties, risks, and other important

factors that may cause actual results, performance, or achievements

to be materially different from any future results, performance, or

achievements expressed or implied by the forward-looking

statements, including, but not limited to, uncertainties involving

the following: the potential timing of the consummation of the

proposed merger transaction and the ability of the parties to

consummate the proposed merger; the satisfaction of the conditions

precedent to consummation of the proposed merger, including the

approval of Acer’s stockholders; the ability to obtain required

regulatory approvals at all or in a timely manner; any litigation

related to the proposed transactions; disruption of Acer’s or

Zevra’s current plans and operations as a result of the proposed

transactions; the ability of Acer or Zevra to retain and hire key

personnel; competitive responses to the proposed transactions;

unexpected costs, charges or expenses resulting from the proposed

transactions; the ability of Zevra to successfully integrate Acer’s

operations, products, product candidates and technology; the

ability of Zevra to implement its plans, forecasts and other

expectations with respect to Acer’s business after the completion

of the proposed transactions and realize additional opportunities

for growth and innovation; the ability of Zevra to realize the

anticipated synergies and related benefits from the proposed

transactions in the anticipated amounts or within the anticipated

timeframes or at all; and the ability to maintain relationships

with Zevra’s and Acer’s respective employees, customers, other

business partners and governmental authorities. These and other

important factors are described in detail in the “Risk Factors”

section of Zevra’s and Acer’s Annual Reports on Form 10-K for the

year ended December 31, 2022, as updated in Zevra’s and Acer’s

Quarterly Reports on Form 10-Q for the quarter ended June 30,

2023, and Zevra’s and Acer’s other filings with the Securities

and Exchange Commission. While either Zevra or Acer may elect to

update such forward-looking statements at some point in the future,

each party disclaims any obligation to do so, except as required by

law, even if subsequent events cause their respective views to

change. Although each party believes the expectations reflected in

such forward-looking statements are reasonable, neither party can

assure that such expectations will prove correct. These

forward-looking statements should not be relied upon as

representing the views of either Acer as of any date after the date

of this press release.

Important Additional Information

Regarding the Transactions Will Be Filed With the SECIn

connection with the proposed transactions, Zevra and Acer will file

relevant materials with the SEC, including a Zevra registration

statement on Form S-4 that will include a proxy statement of Acer

and will also constitute a prospectus of Zevra, and a definitive

proxy statement will be mailed to stockholders of Acer. INVESTORS

AND SECURITY HOLDERS OF ZEVRA AND ACER ARE URGED TO READ THE PROXY

STATEMENT/PROSPECTUS THAT WILL BE INCLUDED IN THE REGISTRATION

STATEMENT ON FORM S-4, AND OTHER RELEVANT DOCUMENTS FILED OR TO BE

FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTIONS OR

INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS (IF

ANY) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTIONS, THE PARTIES TO THE PROPOSED TRANSACTIONS AND THE

RISKS ASSOCIATED WITH THE PROPOSED TRANSACTIONS. Investors and

security holders will be able to obtain, without charge, a copy of

the registration statement, the proxy statement/prospectus and

other relevant documents filed with the SEC (when available) from

the SEC’s website at www.sec.gov. Copies of the documents filed

with the SEC by Zevra will be available free of charge on Zevra’s

investor relations website at investors.zevra.com under the tab

“SEC Filings.” Copies of the documents filed with the SEC by Acer

will be available free of charge on Acer’s investor relations

website at www.acertx.com/investor-relations under the tab “SEC

Filings.”

Participants in the

SolicitationZevra, Acer and certain of their directors,

executive officers and other members of management may be deemed to

be participants in the solicitation of proxies with respect to the

proposed transactions. Information regarding the persons who may,

under the rules of the SEC, be deemed participants in the

solicitation of the stockholders of Acer in connection with the

proposed transactions, including a description of their direct or

indirect interests, by security holdings or otherwise, will be set

forth in the proxy statement/prospectus when it is filed with the

SEC. Information regarding Zevra’s directors and executive officers

is contained in Zevra’s definitive proxy statement, which was filed

with the SEC on March 15, 2023, the definitive proxy statement

filed by Daniel J. Mangless, together with the other participants

named therein, which was filed with the SEC on March 17, 2023, and

Zevra’s Current Reports on Form 8-K, filed with the SEC on March

30, 2023, May 8, 2023, May 15, 2023, and August 7, 2023.

Information regarding Acer’s directors and executive officers is

contained in Acer’s definitive proxy statement, which was filed

with the SEC on April 14, 2023. Security holders and investors may

obtain additional information regarding the interests of such

persons, which may be different than those of Zevra’s security

holders generally, by reading the proxy statement/prospectus and

other relevant documents regarding the transactions, which will be

filed with the SEC. You may obtain these documents (when they

become available) free of charge through the website maintained by

the SEC at www.sec.gov and Zevra’s or Acer’s investor relations

websites as described above.

No Offer or SolicitationThis

communication is not intended to and does not constitute an offer

to sell or the solicitation of an offer to subscribe for or buy or

an invitation to purchase or subscribe for any securities or the

solicitation of any vote or approval in any jurisdiction pursuant

to the proposed transactions or otherwise, nor shall there be any

sale, issuance or transfer of securities in any jurisdiction in

contravention of applicable law. This communication does not

constitute a prospectus or prospectus equivalent document. No

offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act. In connection with the proposed transactions, Zevra will file

a registration statement on Form S-4 that will include a proxy

statement of Acer and will also constitute a prospectus of Zevra.

INVESTORS AND SECURITY HOLDERS OF ZEVRA AND ACER ARE URGED TO READ

THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE

FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Zevra Contacts:

Nichol Ochsner +1 (732)

754-2545 nochsner@zevra.com

Janine Bogris+1 (201) 245-6838Janine.bogris@canalecomm.com

Acer Contacts:

Harry Palmin+1 (844) 902-6100investors@acertx.com

Nick Colangelo+1 (332) 895-3226nick@gilmartinIR.com

i Ah Mew N, et al. Urea cycle disorders overview [updated June

22, 2017]. In: Adam MP, Ardinger HH, Pagon RA, et al, eds.

GeneReviews® [Internet]. University of Washington; 1993-2022.

Accessed March 20, 2022.

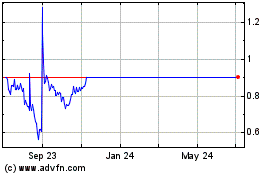

Acer Therapeutics (NASDAQ:ACER)

Historical Stock Chart

From Nov 2024 to Dec 2024

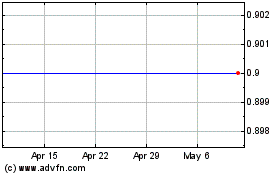

Acer Therapeutics (NASDAQ:ACER)

Historical Stock Chart

From Dec 2023 to Dec 2024