0001888654false00018886542023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 09, 2023 |

5E ADVANCED MATERIALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41279 |

87-3426517 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

9329 Mariposa Road, Suite 210 |

|

Hesperia, California |

|

92344 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (442) 221-0225 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

FEAM |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into a Material Definitive Agreement.

On November 9, 2023, 5E Advanced Materials, Inc. (the "Company") entered into a standstill agreement (the "Agreement") with BEP Special Situations IV LLC (“Bluescape”), Alter Domus (US) LLC (“Collateral Agent”), Ascend Global Investment Fund SPC – Strategic SP (“Ascend”), and Mayfair Ventures Pte Ltd (“Mayfair”) (collectively, the "Parties") in connection with the Company’s senior secured convertible notes.

Pursuant to the Agreement, (a) Bluescape and Collateral Agent shall not exercise their respective rights, remedies, powers, privileges and defenses under the convertible notes agreement with respect to the occurrence of any default or event of default, and (b) each Party shall forbear from instituting or pursuing legal action with respect to the convertible notes agreement. The foregoing includes temporarily allowing the Company to go below its current cash covenant of $10 million. The Agreement will remain in effect until December 1, 2023, unless another material creditor initiates or exercises any remedy or an insolvency proceeding is begun by the Company or another creditor.

As part of the Agreement, the Company agreed to appoint Peter Kravitz as Chief Restructuring Officer effective the date of the Agreement and to maintain a Chief Restructuring Officer until such time the Lender determines it is no longer needed.

The foregoing summary of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, 5E Advanced Materials, Inc. (the “Company”) issued a press release related to the aforementioned Agreement which also discloses the Company's cash balance as of September 30, 2023. A copy of the press release issued by the Company is attached as Exhibit 99.1 and is incorporated herein by reference.

The information in this current report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such Section nor shall it be incorporated by reference into a filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

5E Advanced Materials, Inc. |

|

|

|

|

Date: |

November 9, 2023 |

By: |

/s/ Paul Weibel |

|

|

|

Paul Weibel, Chief Financial Officer |

STANDSTILL AGREEMENT

This STANDSTILL AGREEMENT (this “Agreement”) is entered into as of November 9, 2023 (the “Standstill Effective Date”), by and among 5E Advanced Materials, Inc., a Delaware corporation (the “Issuer”), BEP Special Situations IV LLC (“Bluescape”), Alter Domus (US) LLC (“Collateral Agent”), Ascend Global Investment Fund SPC – Strategic SP (“Ascend”), and Mayfair Ventures Pte Ltd (“Mayfair”) in connection with that certain Note Purchase Agreement dated as of August 11, 2022, among the Issuer, certain subsidiaries of the Issuer as guarantors, Bluescape as Purchaser, and the Collateral Agent (as amended, modified and supplemented from time to time, the “Note Purchase Agreement”). The Issuer, Bluescape, the Collateral Agent, Ascend and Mayfair collectively with their respective successors and assigns, are collectively referred to herein as the “Parties”, and each individually, collectively with their respective successors and assigns, a “Party”.

WHEREAS, the Issuer, Bluescape, and Ascend are working to document a recapitalization transaction contemplated among Issuer, Bluescape, and Ascend (the “Transaction”).

NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties hereby agree as follows:

Section 1. Definitions. Except as otherwise defined in this Agreement, terms defined in the Note Purchase Agreement are used herein as defined therein. For purposes of this Agreement, the following terms shall have the following meanings:

“Standstill Termination Date” means the earliest to occur of (a) December 1, 2023, (b) the initiation or other exercise of any remedy by any creditor (other than any Purchaser or the Collateral Agent) holding Indebtedness of the Issuer or any guarantor in an amount greater than US$750,000.00, and (c) the date on which Issuer begins an Insolvency Proceeding, or an Insolvency Proceeding is begun against Issuer (other than by any Purchaser or the Collateral Agent).

Section 2. Standstill. Until the occurrence of the Standstill Termination Date, (i) Issuer, Bluescape, and the Collateral Agent hereby covenant and agree that any Purchaser and the Collateral Agent shall not exercise their rights, remedies, powers, privileges and defenses under the Note Documents with respect to the occurrence of any Default or Event of Default (other than with respect to the charging of any default interest, as may be applicable, in accordance with the terms of the Note Purchase Agreement), nor shall any Purchaser direct the Collateral Agent to do the same, and (ii) each Party hereby covenants and agrees that it shall forbear from instituting or pursuing as against any other Party any suit or proceeding in any court, or taking any other formal action, or sending any legal notice, concerning, or in connection with, the Note Documents or matters arising therefrom or related thereto, and the Parties further agree that any such suit or proceeding or formal action or legal notice shall be null and void and without force or effect.

Section 3. Conditions Precedent. The effectiveness of this Agreement and the obligations of Parties hereunder are subject to the satisfaction of the following conditions:

3.01.Counterparts. Each Party to this Agreement shall have received a fully executed counterpart to this Agreement duly executed by the Parties hereto.

3.02.Chief Restructuring Officer. Issuer shall have appointed Peter Kravitz as Chief Restructuring Officer who shall report directly to the Issuer’s board of directors and whose scope

1

of authority shall be acceptable to Bluescape in its sole discretion. At all times during the Standstill Period and thereafter until Bluescape in its sole discretion agrees that the Chief Restructuring Officer role is no longer needed, the Issuer shall maintain the appointment of the Chief Restructuring Officer as provided for in the immediately preceding sentence. If the Chief Restructuring Officer resigns for any reason, Issuer shall appoint a replacement Chief Restructuring Officer acceptable to Bluescape, in its sole discretion, within five (5) Business Days.

3.03.Fees. Issuer shall have paid all outstanding legal fees of counsel to the Purchaser, Kirkland & Ellis LLP and Clifford Chance LLP, and counsel to the Collateral Agent, Holland & Knight LLP, in each case, as accrued and invoiced in connection with the Note Documents.

Section 4. No Waiver; Reservation of Rights.

4.01.The Purchaser have not waived, and are not waiving, by the execution of this Agreement or the acceptance of any payments hereunder or under the Note Purchase Agreement any Default or Event of Default whether now existing or hereafter arising under the Note Purchase Agreement or any of the other Note Documents, or its respective rights, remedies, powers, privileges and defenses arising as a result thereof or otherwise, and no failure on the part of the Purchasers to exercise and no delay in exercising, including without limitation the right to take any enforcement actions, and no course of dealing with respect to, any right, remedy, power, privilege or defense hereunder, under the Note Purchase Agreement or any other Note Document, at law or in equity or otherwise, arising as the result of any Default or Event of Default whether now existing or hereafter arising under the Note Purchase Agreement or any of the other Note Documents or the occurrence thereof or any other action by Note Parties and no acceptance of partial performance or partial payment by the Purchasers shall operate as a waiver thereof, nor shall any single or partial exercise of any right, remedy, power, privilege or defense hereunder, under the Note Purchase Agreement or under any other Note Document, at law, in equity or otherwise, preclude any other or further exercise thereof or the exercise of any other right, remedy, power, privilege or defense nor shall any failure to specify any Default or Event of Default in this Agreement constitute any waiver of such Default or Event of Default.

4.02.The Parties agree that this Agreement is not intended as and shall not be construed or deemed an admission adverse to any Party hereto of (i) liability to any person and/or entity, (ii) the commission of any act or wrong which was or could have been alleged in any action, or (iii) the violation of any law or regulation. No Party has waived, or has intended to waive, any of its rights with respect to any actions, except as expressly provided in this Agreement.

Section 5. Representations and Warranties. Each Party hereto represents and warrants to each other Party hereto that it has the requisite power and authority to enter into this Agreement and to undertake its respective obligations contemplated hereby. The Issuer hereby represents and warrants to the other Parties party hereto that its Board of Directors has approved moving forward to document the Transaction.

Section 6. Amendments. No amendment, modification, termination or waiver of any provision of this Agreement shall in any event be effective without the written concurrence of each Party hereto (which may be provided by e-mail).

Section 7. Miscellaneous. This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one and the same amendatory instrument and any of the parties hereto may execute this Agreement by signing any such counterpart. Delivery of an executed counterpart of a signature page to this Agreement by electronic transmission shall be effective as delivery of a manually executed counterpart of this Agreement. This Agreement and any agreements referred to herein constitute the entire contract among the parties hereto relating to the subject matter hereof and supersede any and all previous agreements and understandings, oral or written, relating to the subject matter hereof. This

2

Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns. Wherever possible, each provision of this Agreement shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision of this Agreement shall be prohibited by or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this Agreement.

Section 8. Governing Law. This Agreement shall be governed by, and construed in accordance with, the law of the State of New York, without application of any choice of law provisions that would require the application of the law of another jurisdiction.

Section 9. Jurisdiction; etc.

(a)EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY AND UNCONDITIONALLY SUBMITS, FOR ITSELF AND ITS PROPERTY, TO THE EXCLUSIVE JURISDICTION OF ANY NEW YORK STATE COURT LOCATED IN NEW YORK COUNTY OR FEDERAL COURT OF THE UNITED STATES SITTING IN NEW YORK COUNTY, AND ANY APPELLATE COURT FROM ANY THEREOF, IN ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT, OR FOR RECOGNITION OR ENFORCEMENT OF ANY JUDGMENT, AND EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY AND UNCONDITIONALLY AGREES THAT ALL CLAIMS IN RESPECT OF ANY SUCH ACTION OR PROCEEDING MAY BE HEARD AND DETERMINED IN ANY SUCH NEW YORK STATE COURT OR, TO THE FULLEST EXTENT PERMITTED BY LAW, IN SUCH FEDERAL COURT. EACH OF THE PARTIES HERETO AGREES THAT A FINAL JUDGMENT IN ANY SUCH ACTION OR PROCEEDING SHALL BE CONCLUSIVE AND MAY BE ENFORCED IN OTHER JURISDICTIONS BY SUIT ON THE JUDGMENT OR IN ANY OTHER MANNER PROVIDED BY LAW. NOTHING IN THIS AGREEMENT SHALL AFFECT ANY RIGHT THAT ANY SECURED PARTY MAY OTHERWISE HAVE TO BRING ANY ACTION OR PROCEEDING RELATING TO THIS AGREEMENT IN THE COURTS OF ANY JURISDICTION.

(b)Each of the Parties hereto irrevocably and unconditionally waives, to the fullest extent it may legally and effectively do so, any objection that it may now or hereafter have to the laying of venue of any suit, action or proceeding arising out of or relating to this Agreement in any New York State or Federal court. Each of the parties hereto hereby irrevocably waives, to the fullest extent permitted by law, the defense of an inconvenient forum to the maintenance of such action or proceeding in any such court.

Section 10. Waiver of Jury Trial. EACH PARTY HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVES TO THE FULLEST EXTENT PERMITTED BY LAW ANY RIGHTS IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION BASED HEREON, OR ARISING OUT OF, UNDER, OR IN CONNECTION WITH, THIS AGREEMENT, OR ANY COURSE OF CONDUCT, COURSE OF DEALING, STATEMENTS (WHETHER ORAL OR WRITTEN) OR ACTIONS OF THE PARTIES IN CONNECTION HEREWITH. EACH PARTY ACKNOWLEDGES AND AGREES THAT IT HAS RECEIVED FULL AND SUFFICIENT CONSIDERATION FOR THIS PROVISION (AND EACH OTHER PROVISION OF THIS AGREEMENT) AND THAT THIS PROVISION IS A MATERIAL INDUCEMENT FOR EACH PARTY ENTERING INTO THIS AGREEMENT.

[signature pages follow]

3

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed and delivered as of the day and year first above written.

|

|

|

PARTIES: |

|

|

|

5E ADVANCED MATERIALS, INC., |

|

|

|

By: /s/ Paul Weibel____________________________ |

|

Title: Chief Financial Officer |

|

|

|

|

|

BEP SPECIAL SITUATIONS IV LLC |

|

|

|

By: /s/ Jonathan Siegler_________________________ |

|

Title: Managing Director |

|

|

|

|

|

ALTER DOMUS (US) LLC |

|

|

|

By: /s/ Pinju Chiu______________________________ |

|

Title: Associate Counsel |

|

|

|

|

|

ASCEND GLOBAL INVESTMENT FUND SPC - STRATEGIC SP |

|

|

|

By: /s/ Mulyadi Tjandra_________________________ |

|

Title: Director |

|

|

|

|

|

MAYFAIR VENTURES PTE LTD. |

|

|

|

By: /s/ Chow Woei Horng_______________________ |

|

Title: Director |

|

|

Signature Page to Standstill Agreement

Exhibit 99.1

PRESS RELEASE

November 9th 2023

5E ADVANCED MATERIALS SIGNS STANDSTILL AGREEMENT WITH LENDER

Agreement with convertible note holder provides an opportunity to strengthen balance sheet and further discussions for equity commitments to facilitate next phase for 5E

HESPERIA, CA., November 9, 2023 (GLOBE NEWSWIRE) – 5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) (“5E” or the “Company”), a boron and lithium company with U.S. government Critical Infrastructure designation for its 5E Boron Americas (Fort Cady) Complex, today announced that it has taken proactive steps in advancing discussions with its lender and several parties to achieve a funding solution to position for next phase of 5E operations. To facilitate this, Company has entered a standstill agreement.

In August 2022, 5E secured a $60 million private placement of senior secured notes convertible into common stock of the Company from U.S. based institutional investment manager, Bluescape Energy Partners. Under the terms of the private placement, 5E was to maintain a minimum cash balance of $10 million (“Cash Covenant”). Today, 5E announced its fiscal first quarter 2024 financial results and a cash balance of $11.8 million. With respect to its ongoing financing and commercial initiatives, the Company required a time extension to achieve an appropriate funding solution.

As part of its plan to restructure its convertible note and strengthen its balance sheet, the Company has entered into a standstill agreement with BEP Special Situations IV, LLC (“Lender”), its primary lender and the holder of the Company’s senior secured convertible notes.

The standstill agreement will provide 5E with a time extension to advance discussions with several parties to achieve a successful funding resolution for its next phase of growth as it works judiciously to finalize its permit obligations. Under the standstill agreement, the agreement allows the Company to go below its current cash covenant until December 1, 2023.

The Company is committed to protecting the interests of its stakeholders and is working diligently to negotiate and deliver a capital structure to better position the Company to commence operations. In connection with these efforts, the Company has retained Province to advise in achieving a successful restructure of its debt. Province has extensive experience and a proven track record of advising companies and boards through restructuring of debt instruments.

“A successful restructure of our convertible notes, combined with an approval from the EPA certifying compliance with all permit conditions and the granting of authorization to commence operations to extract boron and lithium, will enable us to advance operations and growth ahead,” said Susan Brennan, Chief Executive Officer of 5E Advanced Materials. “The standstill agreement provides the time and opportunity to achieve a successful outcome.”

About 5E Advanced Materials, Inc.

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) is focused on becoming a vertically integrated global leader and supplier of boron specialty and advanced materials, complemented by lithium co-product production. The Company’s mission is to become a supplier of these critical materials to industries addressing global decarbonization, food and domestic security. Boron and lithium products will target applications in the fields of electric transportation, clean energy infrastructure, such as solar and wind power, fertilizers, and domestic security. The business strategy and objectives are to develop capabilities ranging from upstream extraction and product sales of boric acid, lithium carbonate and potentially other co-products, to downstream boron advanced material processing and development. The business is based on our large domestic boron and lithium resource, which is located in Southern California and designated as Critical Infrastructure by the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency.

Forward Looking Statements and Disclosures

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this press release regarding our business strategy, plans, goal, and objectives are forward-looking statements. When used in this press release, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “estimate,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on 5E’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady project, including our ability to timely and successfully complete our Small Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; our ability to timely and successfully implement a recapitalization plan; and other risks. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. No representation or warranty (express or implied) is made as to, and no reliance should be place on, any information, including projections, estimates, targets, and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions, or misstatements contained herein. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as to the date of this press release.

For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s Form 10-K filed on August 30, 2023. Additional risks are also disclosed by 5E in its filings with the U.S. Securities and Exchange Commission throughout the year, including its Form 10-K, Form 10-Qs and Form 8-Ks, as well as in its filings under the Australian Securities Exchange. Any forward-looking statements are given only as of the date hereof. Except as required by law, 5E expressly disclaims any obligation to update or revise any such forward-looking statements. Additionally, 5E undertakes no obligation to comment on third party analyses or statements regarding 5E’s actual or expected financial or operating results or its securities.

For further information contact:

|

|

|

Davis Snyder or Joseph Caminiti Alpha IR Group FEAM@alpha-ir.com Ph: +1 (312) 445-2870 |

J.T. Starzecki Chief Marketing Officer jstarzecki@5eadvancedmaterials.com Ph: +1 (612) 719-5076 |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

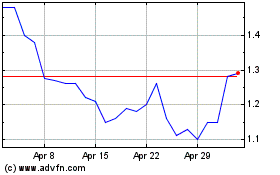

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Apr 2024 to May 2024

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From May 2023 to May 2024