Euro Sinks As ECB Chief Draghi Hints At Further Easing

January 21 2016 - 4:51AM

RTTF2

The euro re-entered the negative territory in European trading

on Thursday, after the European Central Bank chief Mario Draghi

hinted that the bank would "review and possibly reconsider" its

monetary policy stance at its next meeting in early March, as

downside risks to inflation had intensified amid global market

turmoil and plunging commodity prices.

In his customary press conference at Frankfurt, Draghi signaled

that euro area inflation dynamics continue to be weaker than

expected, as downside risks had risen further amid heightened

uncertainty about emerging market economies' growth prospects,

volatility in financial and commodity markets, and geopolitical

risks.

"It is therefore necessary to review and possibly reconsider our

monetary policy stance at our next meeting in early March, when the

new staff macroeconomic projections become available which will

also cover the year 2018," he told.

His comments came after the ECB left its interest rates

unchanged. The main refinancing rate was maintained at a record low

of 0.05 percent, the deposit rate was kept at a record low of -0.30

percent and the marginal lending rate was retained at 0.30

percent.

The euro showed mixed performance in the Asian session. While

the currency declined against the greenback and the pound, it held

steady against the franc and the yen.

The euro resumed its early decline against the greenback,

touching a 2-week low of 1.0778. This is down by 0.96 percent from

Wednesday's closing value of 1.0883. The euro-greenback pair is

likely to find support around the 1.06 region.

The single currency slipped to a 2-day low of 0.7640 against the

pound and more than a 9-month low of 126.16 against the yen,

reversing from its prior highs of 0.7742 and 127.87, respectively.

Continuation of the euro's downtrend may lead it to support levels

of around 0.75 against the pound and 124.00 against the yen.

Pulling away from an early high of 1.0973 against the Swiss

franc, the euro edged down to 1.0918. Further weakness may take the

euro to a support around the 1.08 mark.

Figures from the Swiss National Bank showed that Switzerland's

money supply growth slowed in December, after improving in the

previous two months.

M3, the broad measure of money supply, rose at a slower pace of

1.6 percent year-over-year in December, following a 2.1 percent

spike in November. In October, the rate of increase was 1.4

percent.

The euro weakened to a 2-day low of 1.6722 against the kiwi,

6-day low of 1.5554 against the aussie and an 8-day low of 1.5522

against the loonie, after having advanced to 1.7010, 1.5881 and

1.5876, respectively in early deals. The euro is seen finding

support around 1.65 against the kiwi, 1.54 against the aussie and

1.53 against the loonie.

Looking ahead, weekly U.S. crude oil inventories data and

Eurozone consumer confidence index for January are due to be

released shortly.

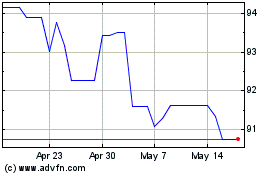

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Oct 2024 to Nov 2024

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Nov 2023 to Nov 2024