U.S. Dollar Weakens Amid Expectations For Less Aggressive Fed

January 09 2023 - 5:43AM

RTTF2

The U.S. dollar lost ground against its major counterparts in

the European session on Monday, as investors bet on a slower pace

of policy tightening by the Federal Reserve in the wake of a lower

than expected wage growth in December.

Slower than expected wage growth prompted traders to scale back

bets on interest rate increases anticipated for 2023.

Fed fund futures are now pricing in a 78 percent chance of a 25

basis point rate hike at the next meeting.

Investors await Fed Chairman Jerome Powell's speech at a central

banking conference in Sweden due on Tuesday.

All eyes are on U.S. inflation data due on Thursday. Economists

expect inflation to slow to 6.5 percent in December, from 7.1

percent in November.

The greenback fell to a 5-day low of 131.31 against the yen and

a 10-month low of 0.9188 against the franc, off its early highs of

132.66 and 0.9292, respectively. The greenback is seen finding

support around 117.00 against the yen and 0.88 against the

franc.

The greenback dropped to near a 4-week low of 1.0732 against the

euro and near a 3-week low of 1.2188 against the pound, reversing

from its early highs of 1.2079 and 1.2079, respectively. The

greenback is likely to face support around 1.11 against the euro

and 1.23 against the pound.

The greenback depreciated to a 1-1/2-month low of 1.3357 against

the loonie, more than 4-month low of 0.6947 against the aussie and

near a 4-week low of 0.6412 against the kiwi, after rising to

1.3444, 0.6874 and 0.6328, respectively in early deals. The

greenback is poised to challenge support around 1.29 against the

loonie, 0.72 against the aussie and 0.66 against the kiwi.

U.S. consumer credit for November will be featured in the New

York session.

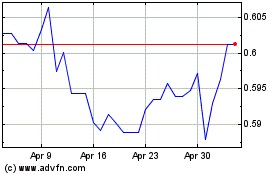

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

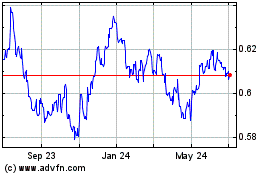

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024