Japanese Yen Rallies On BoJ Pivot Hopes

December 07 2023 - 5:09AM

RTTF2

The Japanese yen climbed against its major counterparts in the

European session on Thursday, as comments from Bank of Japan

governor Kazuo Ueda boosted hopes that the central will end its

negative interest-rate policy soon.

Speaking to the Parliament, Ueda said the BoJ has several

options to pull interest rates from negative territory. These

include continuing to target the interest rate it applies to cash

reserves kept at the bank by financial institutions or reverting to

a policy directing the overnight call rate.

"We have not made a decision yet on which interest rate to

target once we end our negative interest rate policy," Ueda

said.

Preliminary data from the Cabinet Office showed that Japan's

leading index declined for the second straight month in

October.

The leading index, which measures future economic activity, fell

to a 3-month low of 108.7 in October from 109.3 in the previous

month.

The yen firmed to 1-1/2-month highs of 181.88 against the pound

and 165.29 against the franc, off its early lows of 184.98 and

168.42, respectively. The currency is seen finding resistance

around 172.00 against the pound and 144.00 against the franc.

The yen advanced to a multi-month high of 144.54 against the

greenback and more than a 2-month high of 155.74 against the euro,

from its early lows of 147.31 and 158.58, respectively. The

currency may find resistance around 139.00 against the greenback

and 150.00 against the euro.

The yen climbed to a multi-month high of 106.36 against the

loonie, 1-1/2-month high of 94.97 against the aussie and a

multi-week high of 88.90 against the kiwi, reversing from its early

lows of 108.36, 96.49 and 90.47, respectively. The currency is

poised to find resistance around 104.00 against the loonie, 92.00

against the aussie and 86.00 against the kiwi.

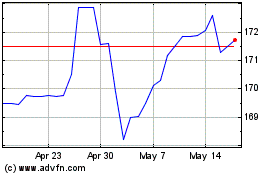

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jun 2024 to Jul 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jul 2023 to Jul 2024