Canadian Dollar Slides On Economic Worries

August 01 2024 - 10:41AM

RTTF2

The Canadian dollar dropped against its most major counterparts

in the New York session on Thursday, as weaker-than-expected

manufacturing data pointed to a slowdown in the economy.

The ISM manufacturing PMI declined to 46.8 in July from 48.5 in

June. Economists had expected the index to inch up to 48.8

percent.

U.S. jobless claims climbed to an 11-month high last week,

reinforcing the view that labor market is softening.

Traders await key monthly U.S. jobs data due on Friday, which

could offer additional clues on the rate outlook.

Employment is expected to increase by 175,000 jobs in July after

surging by 206,000 jobs in June, while the unemployment rate is

expected to remain unchanged at 4.1 percent.

The loonie fell to more than a 9-month low of 1.3870 against the

greenback. The loonie is seen finding support around the 1.41

level.

The loonie eased to 1.4965 against the euro, from an early more

than 2-week high of 1.4895. The currency is poised to challenge

support around the 1.52 level.

The loonie retreated to 107.91 against the yen. This may be

compared to an early nearly 7-month low of 107.55. The currency may

locate support around the 104.00 level.

In contrast, the loonie recovered against the aussie and was

trading at 0.9017. The currency is likely to locate resistance

around the 0.88 level.

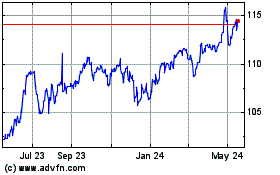

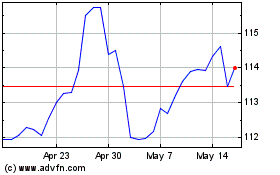

CAD vs Yen (FX:CADJPY)

Forex Chart

From Oct 2024 to Nov 2024

CAD vs Yen (FX:CADJPY)

Forex Chart

From Nov 2023 to Nov 2024