Australian Dollar Falls On Weak Retail Sales Data

April 29 2024 - 10:30PM

RTTF2

The Australian dollar weakened against other major currencies in

the Asian session on Tuesday, after data showed that the

Australia's retail sales fell lower-than-expected in March.

Data from the Australian Bureau of Statistics showed that the

total value of retail sales in Australia was down a seasonally

adjusted 0.4 percent on month in March, coming in at A$35.663

billion. That missed forecasts for an increase of 0.2 percent

following the 0.3 percent gain in February.

On a yearly basis, retail sales rose 0.8 percent.

In other economic news, data from the Reserve Bank of Australia

showed that the private sector credit in Australia was up 0.3

percent on month in March, missing forecasts for 0.4 percent and

down from 0.5 percent in February.

On a yearly basis, credit gained 5.1 percent.

Data from Caixin showed that the manufacturing sector in China

continued to expand in April, and at a faster pace, with a

manufacturing PMI score of 51.4. That's up from 51.1 and it moved

further above the boom-or-bust line of 50 that separates expansion

from contraction.

Crude oil prices settled lower amid worries about growth and

outlook for oil demand and the rising possibility of the Federal

Reserve delaying interest rate cuts. West Texas Intermediate Crude

oil futures for June ended down by $1.22 or 1.45 percent at $82.63

a barrel.

Traders cautiously look ahead to the U.S. Fed's monetary policy

announcement on Wednesday after the central bank's preferred

inflation gauge largely met expectations.

The Fed is widely expected to leave interest rates unchanged,

but the accompanying statement and Fed Chair Jerome Powell's

post-meeting press conference may shed additional light on the

outlook for interest rates.

Recent economic data has tamped down expectations of a near-term

rate cut, with the central bank now seen as likely to leave rates

unchanged until at least September.

The Australian dollar traded higher against its major rivals on

Monday amid risk appetite.

In the Asian trading now, the Australian dollar weakened against

other major currencies in the Asian session on Tuesday.

The Australian dollar fell to 4-day lows of 0.6523 against the

U.S. dollar, 1.6403 against the euro and 1.0973 against the NZ

dollar, from yesterday's closing quotes of 0.6561, 1.6332 and

1.0989, respectively. If the aussie extends its downtrend, it is

likely to find support around 0.63 against the greenback, 1.67

against the euro and 1.07 against the kiwi.

Against the yen and the Canadian dollar, the aussie slipped to

102.22 and 0.8930 from Monday's closing quotes of 102.56 and

0.8966, respectively. The aussie may test support near 98.00

against the yen and 0.88 against the loonie.

The other antipodean currency or the New Zealand dollar, also

fell against its most major currencies in the Asian session.

The NZ dollar fell to 4-day lows of 0.5933 against the U.S.

dollar and 1.8034 against the euro, from yesterday's closing quotes

of 0.5970 and 1.7948, respectively. If the kiwi extends its

downtrend, it is likely to find support around 0.57 against the

greenback and 1.82 against the euro.

Against the yen, the kiwi edged down to 92.98 from Monday's

closing value of 93.34. The kiwi may test support near the 91.00

region.

Looking ahead, Germany unemployment data for April and flash GDP

data for the first quarter, the Bank of England's mortgage

approvals data for March and Eurozone flash GDP for the first

quarter and inflation data for April are due to be released in the

European session.

In the New York session, Canada GDP data for April, U.S.

employment cost index for the first quarter, Redbook report, house

price index for February, U.S. Chicago PMI for April, U.S. CB

consumer confidence for April and U.S. Dallas Fed services index

for April are slated for release.

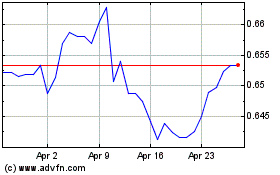

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Nov 2024 to Dec 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Dec 2023 to Dec 2024