U.S. Dollar Firms On Strong ADP Data

January 05 2023 - 5:09AM

RTTF2

The U.S. dollar was higher against its major counterparts in the

New York session on Thursday, as the nation's private sector

employment rose much more than expected in December, supporting

expectations for further interest rate hikes from the Federal

Reserve in the future.

Data from the payroll processor ADP showed that private sector

employment jumped by 235,000 jobs in December after surging by an

upwardly revised 182,000 jobs in November.

Economists had expected employment to jump by about 150,000 jobs

compared to the addition of 127,000 jobs originally reported for

the previous month.

Investors digested minutes from the Fed's December meeting

showing that policymakers supported keeping interest rates higher

for longer for some time in the future.

Fed officials cautioned against loosening policy too soon, the

minutes indicated, and dashed hopes for rate cuts later this

year.

The greenback was up against the euro and the franc, at 1.0547

and 0.9345, respectively. The currency is seen finding resistance

around 1.03 against the euro and 0.96 against the franc.

The USD/JPY pair reached a 1-week high of 133.76. The greenback

is likely to test resistance around the 135.00 area.

The greenback appreciated against the pound, hitting a 2-day

high of 1.1911. The greenback may locate resistance around the 1.16

level.

The greenback rebounded to 1.3548 against the loonie, off its

early more than a 4-week low of 1.3470. Against the aussie, it

edged up to 0.6766. The next likely resistance for the greenback is

seen around 1.37 against the loonie and 0.66 against the

aussie.

The greenback gained ground against the kiwi and touched a 2-day

high of 0.6230. Should the greenback strengthens further, 0.61 is

found as its resistance level.

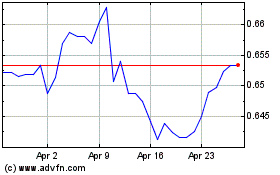

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Aug 2024 to Sep 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Sep 2023 to Sep 2024