Meudon (France), May 16th, 2024

Vallourec, a world leader in premium tubular

solutions, announces today its results for the first quarter 2024.

The Board of Directors of Vallourec SA, meeting on May 15th 2024,

approved the Group's first quarter 2024 Consolidated Financial

Statements.

First Quarter 2024 Results

- Cash generation capability

of New Vallourec on display with sixth straight quarter of

deleveraging

- International OCTG pricing

remains strong due to robust demand pipeline across multiple

geographic regions

- Market demand remains

stable in the US; industry inventories have

normalized

- Expect to reduce net debt

further in the second quarter

- Target initiation of

capital returns to shareholders in 2025 at the

latesta

HIGHLIGHTS

First Quarter 2024 Results

- Effects of New Vallourec plan and

Value over Volume strategy on display:

- Tubes EBITDA margin of 23.6% up

277bps sequentially and 135bps year-over-year

- Tubes EBITDA per tonne of €751

increased sequentially and year over year despite lower US

pricing

- Group EBITDA of €235 million down

16% sequentially and 27% year over year

- Tubes EBITDA of €220 million down

12% sequentially and 21% year over year due to reductions in US

pricing and lower volumes, largely driven by the closure of

Germany

- Mine & Forest EBITDA of €30

million down 29% sequentially and 37% year over year due to lower

sales volumes and lower non-cash forest revaluation effects

- Adjusted free cash flow €172

million; total cash generation €102 million

- Deleveraging ahead of plan: net

debt declined sequentially and more than halved year over year from

€1,000 million in Q1 2023 to €485 million in Q1 2024

Second Quarter 2024

Outlookb

- Group EBITDA is expected to

moderately decline versus Q1 due to US Tubes market dynamics:

- For the Tubes segment, increased

volumes and EBITDA in our international portfolio are expected to

be more than offset by lower prices and volumes in the US

- Mine & Forest EBITDA is

expected to move closer to the €100 million annualized

run-rate

- Net debt is expected to decline

further versus the Q1 2024 level

Full Year 2024

Outlooka

- Group EBITDA margin expected to

remain strong through 2024 due to robust international Tubes

pricing in backlog and further operational improvement

- Net debt is expected to decline

meaningfully versus the Q1 2024 level

Philippe Guillemot, Chairman of the

Board of Directors and Chief Executive Officer,

declared:

“Our first quarter results confirm the merits of

the New Vallourec plan and our Value over Volume strategy.

Following the closure of our German rolling mills at the end of

2023, our Tubes profitability per tonne and EBITDA margin took

meaningful steps higher despite lower volumes in the first quarter.

We also continue to deliver on our goal to decrease our net debt,

which we reduced again by €85 million sequentially and €515 million

year over year.

“The international OCTG market remains strong.

We see a robust pipeline of new order opportunities across the

Middle East, Africa and North Sea, and accordingly, market prices

remain favorable. In the US, a reset in market expectations has

caused some further incremental pricing pressure. That said, market

demand remains stable and inventories have normalized. We remain

disciplined in executing our Value over Volume strategy both in the

US and globally.

“We are seeing clear opportunities to deliver

differentiated value to our customers via our premium product

offering. In the Middle East, our customers are increasingly

focusing on developing their gas resources, for which they demand

premium connections. Continued momentum in deepwater exploration

and development campaigns is leading to strong demand for our

high-end products in mission-critical offshore applications.

Finally, in North America, operators’ desire to drill ever-longer

laterals in their horizontal wells is driving strong demand for our

high-torque connections.

“On March 12th, we announced that ArcelorMittal

had reached an agreement to purchase Apollo’s stake in Vallourec.

The deal is expected to close in the second half of 2024, following

the completion of various regulatory approvals. We are delighted to

welcome ArcelorMittal as a reference shareholder and look forward

to finding ways to enhance value with this industrial partner.

“In April, we successfully executed our holistic

balance sheet refinancing. This marked a major step towards our

objective of making Vallourec crisis-proof. Through these

transactions, we have extended our debt and liquidity facility

maturities, increased our available liquidity, and reduced our debt

service costs. We now benefit from greater visibility and financial

flexibility for the years to come. Alongside this transaction, our

significant progress in reshaping Vallourec has been recognized by

all three of the major ratings agencies. S&P has upgraded our

rating for the fourth time since we announced the New Vallourec

plan, which now stands at BB+, Outlook stable. We are also

delighted to welcome the addition of Moody’s and Fitch, which rate

Vallourec Ba2, Outlook positive and BB+, Outlook positive,

respectively.

“We are now notably ahead of schedule on our

plan to reach zero net debt by year-end 2025 at the latest. As

such, we anticipate that we will initiate our return of capital to

shareholders in 2025 at the latest.c”

Key Quarterly Data

|

in € million, unless noted |

Q1 2024 |

Q4 2023 |

Q1 2023 |

QoQ chg. |

YoY chg. |

|

Tubes volume sold (k tonnes) |

292 |

382 |

431 |

(90) |

(139) |

|

Iron ore volume sold (m tonnes) |

1.4 |

1.7 |

1.5 |

(0.4) |

(0.1) |

|

Group revenues |

990 |

1,276 |

1,338 |

(286) |

(348) |

|

Group EBITDA |

235 |

280 |

320 |

(45) |

(85) |

|

(as a % of revenue) |

23.7% |

22.0% |

23.9% |

1.8 pp |

(0.2) pp |

|

Operating income (loss) |

174 |

198 |

257 |

(25) |

(84) |

|

Net income, Group share |

105 |

105 |

156 |

0 |

(51) |

|

Adj. free cash flow |

172 |

275 |

194 |

(103) |

(22) |

|

Total cash generation |

102 |

149 |

151 |

(47) |

(49) |

|

Net debt |

485 |

570 |

1,000 |

(85) |

(515) |

CONSOLIDATED RESULTS

ANALYSIS

In Q1 2024, Vallourec recorded revenues

of €990 million, down (26%) year over year, which was also (26%) at

constant exchange rates. The decrease in Group revenues

reflects:

- (32%) volume decrease mainly driven

by the closure of the European rolling mills and decreased

shipments in Oil & Gas Tubes in North America

- 7% price/mix effect

- (1%) Mine and Forest effect

- 0.1% currency effect

In Q1 2024, EBITDA amounted to €235

million, or 23.7% of revenues, compared to €320 million

(23.9% of revenues) in Q1 2023. The decrease was

largely driven by lower average selling prices in Tubes in North

America, offset by improved Tubes results outside of North

America.

In Q1 2024, operating income was €174

million, compared to €257 million in Q1 2023.

Financial income (loss) was negative at

(€20) million, compared to (€46)

million in Q1 2023. Net interest expense in Q1 2024 was (€15)

million compared to (€26) million in Q1 2023.

Income tax amounted to (€46)

million compared to (€53) million in Q1 2023.

This resulted in positive net income,

Group share, of €105 million, compared to €156 million in

Q1 2023.

Earnings per diluted share was

€0.43, versus €0.66 in Q1 2023, reflecting the above

changes in net income as well as an increase in potentially

dilutive shares largely related to the Company’s outstanding

warrants, which are accounted for using the treasury share

method.

RESULTS ANALYSIS BY SEGMENT

Tubes: In Q1 2024, Tubes revenues were

down 26% year over year due to a 32%

reduction in shipments, offset by a 9% increase in average selling

price. This decrease in shipments was largely attributable to the

closure of Vallourec’s German rolling operations as a result of the

New Vallourec plan and decreased shipments in North America.

Tubes EBITDA decreased from €279 million in Q1 2023 to €220

million Q1 2024 due to decreases in profitability in North

America offset by improvements in the rest of the world.

Mine & Forest: In Q1 2024, iron ore

production sold was 1.4 million tonnes, decreasing by 9%

year over year. In Q1 2024, Mine & Forest EBITDA

reached €30 million, versus €48 million in Q1 2023,

largely reflecting lower sales volumes, lower forest revaluation

effects and higher costs.

CASH FLOW AND FINANCIAL

POSITION

Cash Flow Analysis

In Q1 2024, adjusted operating cash flow

was €235 million versus €299 million in Q1 2023. The

decrease was attributable to lower EBITDA, offset by reduced

financial cash out.

Adjusted free cash flow was €172

million, versus €194 million in Q1 2023. Lower adjusted

operating cash flow was partially offset by a smaller working

capital build versus the prior year period.

Total cash generation in Q1 2024 was

€102 million, versus €151 million in Q1 2023. The decrease

was attributable to lower adjusted free cash flow as well as higher

restructuring charges and non-recurring items.

Net Debt and Liquidity

As of March 31, 2024,

net debt stood at €485 million, a significant decrease compared to

€1,000 million on March 31, 2023. Gross debt amounted to

€1,551 million including €43 million of fair value adjustment under

IFRS 9. Long-term debt amounted to €1,352 million and short-term

debt totaled €199 million.

As of March

31, 2024, the liquidity position was very strong

at €1,714 million, with cash amounting to €1,066 million,

availability on our revolving credit facility (RCF) of €462

million, and availability on an asset-backed lending facility (ABL)

of €186 million (d).

COMPLETION OF BALANCE SHEET

REFINANCING

In April 2024, we executed a significant and

holistic balance sheet refinancing that has substantially extended

our debt maturities and reduced our financial costs. The key

elements of this operation include:

- Entry into a new

5-year €550 million multi-currency revolving credit facility (RCF)

with a substantially diversified, global banking group

- Entry into an

upsized and extended 5-year $350 million asset-backed lending

facility (ABL) in the United States

- Issuance of 8-year

$820 million 7.5% senior notes and entry into a cross-currency swap

to hedge Vallourec’s currency exposure on its new senior notes with

a euro-effective interest rate of approximately 5.8%

- Redemption of the

full €1,023 million of previously outstanding 8.5% Senior Notes due

2026

- Repayment of

approximately €68 million of the €262 million PGE (prêts garantis

par l’Etat) during the transaction and repayment of the remaining

amount by December 31, 2024.

The successful completion of this refinancing

further strengthens Vallourec's financial position and sustainably

improves its cash flow generation. Accordingly, the Group will

benefit from both greater visibility and financial flexibility over

the coming years. Vallourec estimates that this process will

generate a recurring net economic benefit in a range of €30 to €35

million per year.

Furthermore, Vallourec now maintains credit

ratings with all three of the major ratings agencies. Vallourec’s

issuer rating with S&P, has been upgraded for the fourth time

since we announced the New Vallourec plan and now stands at BB+,

Outlook stable. We furthermore welcome the addition of Moody’s and

Fitch, which rate Vallourec Ba2, Outlook positive and BB+, Outlook

positive, respectively.

SECOND QUARTER AND FULL YEAR 2024

OUTLOOKE

In the second quarter of 2024, based on

our assumptions and current market conditions, Vallourec

expects:

- Group EBITDA to moderately decline

versus Q1 due to US Tubes market dynamics:

- For the Tubes segment, increased

volumes and EBITDA in our international portfolio will be more than

offset by lower prices and volumes in the US

- Iron ore production sold will be

slightly higher sequentially with Mine & Forest EBITDA moving

closer to the €100 million annualized run-rate

- Net debt to decline further versus

the Q1 2024 level

For the full year 2024, based on our

assumptions and current market conditions, Vallourec

expects:

- Group EBITDA margin to remain

strong through 2024, driven by:

- Continued strong performance in

Tubes, due to robust international Tubes pricing in backlog and

further operational improvement

- Iron ore production sold of

approximately 6 million tonnes

- Total cash generation to be

positive

- Net debt to decline meaningfully

versus the Q1 2024 level

Information and Forward-Looking Statements

This press release

includes forward-looking statements. These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms as “believe”, “expect”,

“anticipate”, “may”, “assume”, “plan”, “intend”, “will”, “should”,

“estimate”, “risk” and or, in each case, their negative, or other

variations or comparable terminology. These forward-looking

statements include all matters that are not historical facts and

include statements regarding the Company’s intentions, beliefs or

current expectations concerning, among other things, Vallourec’s

results of operations, financial condition, liquidity, prospects,

growth, strategies and the industries in which they operate.

Readers are cautioned that forward-looking statements are not

guarantees of future performance and that Vallourec’s or any of its

affiliates’ actual results of operations, financial condition and

liquidity, and the development of the industries in which they

operate may differ materially from those made in or suggested by

the forward-looking statements contained in this presentation. In

addition, even if Vallourec’s or any of its affiliates’ results of

operations, financial condition and liquidity, and the development

of the industries in which they operate are consistent with the

forward-looking statements contained in this presentation, those

results or developments may not be indicative of results or

developments in subsequent periods. By their nature,

forward-looking statements involve risks and uncertainties because

they relate to events and depend on circumstances that may or may

not occur in the future. These risks include those developed or

identified in the public documents filed by Vallourec with the

French Financial Markets Authority (Autorité des marches

financiers, or “AMF”), including those listed in the “Risk Factors”

section of the Universal Registration Document filed with the AMF

on March 14, 2024, under filing number n° D. 24-0113. Accordingly,

readers of this document are cautioned against relying on these

forward-looking statements. These forward-looking statements are

made as of the date of this document. Vallourec disclaims any

intention or obligation to complete, update or revise these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable laws

and regulations. This press release does not constitute any offer

to purchase or exchange, nor any solicitation of an offer to sell

or exchange securities of Vallourec. or further information, please

refer to the website https://www.vallourec.com/en .

Presentation of Q1 2024 Results

Conference call / audio webcast on May 16th at

9:30 am CET

- To listen to the audio webcast:

https://channel.royalcast.com/landingpage/vallourec-en/20240516_1/

- To participate in the conference

call, please dial (password: “Vallourec”):

-

+44 (0) 33 0551 0200 (UK)

-

+33 (0) 1 7037 7166 (France)

- +1 786 697 3501 (USA)

- Audio webcast replay and slides

will be available at:

https://www.vallourec.com/en/investors

About Vallourec

Vallourec is a world

leader in premium tubular solutions for the energy markets and for

demanding industrial applications such as oil & gas wells in

harsh environments, new generation power plants, challenging

architectural projects, and high-performance mechanical equipment.

Vallourec’s pioneering spirit and cutting edge R&D open new

technological frontiers. With close to 15,000 dedicated and

passionate employees in more than 20 countries, Vallourec works

hand-in-hand with its customers to offer more than just tubes:

Vallourec delivers innovative, safe, competitive and smart tubular

solutions, to make every project possible.

Listed on Euronext in

Paris (ISIN code: FR0013506730, Ticker VK), Vallourec is part of

the CAC Mid 60, SBF 120 and Next 150 indices and is eligible for

Deferred Settlement Service.

In the United States,

Vallourec has established a sponsored Level 1 American Depositary

Receipt (ADR) program (ISIN code: US92023R4074, Ticker: VLOWY).

Parity between ADR and a Vallourec ordinary share has been set at

5:1.

Financial Calendar

|

May 23rd

2024July 26th

2024November

15th 2024 |

Annual General MeetingRelease of Second Quarter and Half Year 2024

ResultsRelease of Third Quarter and Nine Month 2024 results |

For further information, please contact:

|

Investor relations Connor LynaghTel: +1 (713)

409-7842connor.lynagh@vallourec.com |

Press relations Héloïse Rothenbühler Tel: +33 (0)1

41 03 77

50 heloise.rothenbuhler@vallourec.com |

|

Individual shareholdersToll Free Number (from

France): 0 805 65 10 10 actionnaires@vallourec.com |

|

APPENDICES

The Group’s reporting currency is the euro. All

amounts are expressed in millions of euros, unless otherwise

specified. Certain numerical figures contained in this document,

including financial information and certain operating data, have

been subject to rounding adjustments.

Documents accompanying this

release:

- Tubes Sales Volume

- Mine Sales Volume

- Foreign Exchange Rates

- Tubes Revenues by Geographic

Region

- Tubes Revenues by Market

- Segment Key Performance Indicators

(KPIs)

- Summary Consolidated Income

Statement

- Summary Consolidated Balance

Sheet

- Key Cash Flow Metrics

- Summary Consolidated Statement of

Cash Flows (IFRS)

- Indebtedness

- Liquidity

- Reconciliation of New Cash

Metrics

- Definitions of Non-GAAP Financial

Data

Tubes Sales Volume

|

in thousands of tonnes |

2024 |

2023 |

YoY chg. |

|

Q1 |

292 |

431 |

(32%) |

|

Q2 |

- |

396 |

- |

|

Q3 |

- |

343 |

- |

|

Q4 |

- |

382 |

- |

|

Total |

292 |

1,552 |

- |

Mine Sales Volume

|

in millions of tonnes |

2024 |

2023 |

YoY chg. |

|

Q1 |

1.4 |

1.5 |

(9%) |

|

Q2 |

- |

1.9 |

- |

|

Q3 |

- |

1.8 |

- |

|

Q4 |

- |

1.7 |

- |

|

Total |

1.4 |

6.9 |

- |

Foreign Exchange Rates

|

Average exchange rate |

Q1 2024 |

Q4 2023 |

Q1 2023 |

|

EUR / USD |

1.09 |

1.08 |

1.07 |

|

EUR / BRL |

5.38 |

5.40 |

5.58 |

|

USD / BRL |

4.95 |

4.99 |

5.19 |

Quarterly Tubes Revenues by Geographic

Region

|

in € million |

Q1 2024 |

Q4 2023 |

Q1 2023 |

QoQ% chg. |

YoY% chg. |

|

North America |

450 |

548 |

658 |

(18%) |

(32%) |

|

South America |

153 |

230 |

189 |

(33%) |

(19%) |

|

Middle East |

162 |

212 |

112 |

(24%) |

45% |

|

Europe |

51 |

57 |

152 |

(11%) |

(67%) |

|

Asia |

68 |

89 |

54 |

(23%) |

26% |

|

Rest of World |

48 |

61 |

92 |

(20%) |

(48%) |

|

Total Tubes |

932 |

1,196 |

1,258 |

(22%) |

(26%) |

Quarterly Tubes Revenues by Market

|

in € million |

Q1 2024 |

Q4 2023 |

Q1 2023 |

QoQ% chg. |

YoY% chg. |

YoY % chg. at Const. FX |

|

Oil & Gas and Petrochemicals |

762 |

1,017 |

1,021 |

(25%) |

(25%) |

(25%) |

|

Industry |

119 |

112 |

214 |

6% |

(44%) |

(46%) |

|

Other |

51 |

67 |

23 |

(24%) |

125% |

133% |

|

Total Tubes |

932 |

1,196 |

1,258 |

(22%) |

(26%) |

(26%) |

Quarterly Segment KPIs

| |

|

Q1 2024 |

Q4 2023 |

Q1 2023 |

QoQ chg. |

YoY chg. |

|

Tubes |

Volume sold* |

292 |

382 |

431 |

(23%) |

(32%) |

|

Revenue (€m) |

932 |

1,196 |

1,258 |

(22%) |

(26%) |

|

Average Selling Price (€) |

3,189 |

3,130 |

2,919 |

2% |

9% |

|

EBITDA (€m) |

220 |

249 |

279 |

(12%) |

(21%) |

|

Capex (€m) |

46 |

33 |

45 |

38% |

3% |

|

Mine & Forest |

Volume sold* |

1.4 |

1.7 |

1.5 |

(21%) |

(9%) |

|

Revenue (€m) |

80 |

101 |

93 |

(21%) |

(14%) |

|

EBITDA (€m) |

30 |

43 |

48 |

(29%) |

(37%) |

|

Capex (€m) |

9 |

7 |

7 |

18% |

14% |

|

H&O |

Revenue (€m) |

45 |

53 |

46 |

(15%) |

(3%) |

|

EBITDA (€m) |

(13) |

(12) |

(5) |

10% |

nm |

|

Int. |

Revenue (€m) |

(67) |

(73) |

(59) |

(9%) |

13% |

|

EBITDA (€m) |

(2) |

1 |

(3) |

nm |

nm |

|

Total |

Revenue (€m) |

990 |

1,276 |

1,338 |

(22%) |

(26%) |

|

EBITDA (€m) |

235 |

280 |

320 |

(16%) |

(27%) |

|

Capex (€m) |

56 |

42 |

53 |

31% |

5% |

|

* Volume sold in thousand tonnes for Tubes and in million tonnes

for Mine |

|

|

|

H&O = Holding & Other, Int. = Intersegment

Transactions |

|

|

|

|

nm = not meaningful |

|

|

|

|

|

Quarterly Summary Consolidated Income

Statement

|

€ million, unless noted |

Q1 2024 |

Q4 2023 |

Q1 2023 |

QoQ chg. |

YoY chg. |

|

Revenues |

990 |

1,276 |

1,338 |

(286) |

(348) |

|

Cost of sales |

(669) |

(886) |

(926) |

216 |

257 |

|

Industrial margin |

321 |

390 |

412 |

(70) |

(91) |

|

(as a % of revenue) |

32.4% |

30.6% |

30.8% |

1.8 pp |

1.6 pp |

|

Selling, general and administrative expenses |

(87) |

(86) |

(79) |

(1) |

(8) |

|

(as a % of revenue) |

(8.8%) |

(6.7%) |

(5.9%) |

(2.1) pp |

(2.9) pp |

|

Other |

1 |

(24) |

(13) |

25 |

14 |

|

EBITDA |

235 |

280 |

320 |

(45) |

(85) |

|

(as a % of revenue) |

23.7% |

22.0% |

23.9% |

1.8 pp |

(0.2) pp |

|

Depreciation of industrial assets |

(45) |

(40) |

(40) |

(5) |

(5) |

|

Amortization and other depreciation |

(8) |

(10) |

(10) |

2 |

2 |

|

Impairment of assets |

3 |

153 |

– |

(150) |

3 |

|

Asset disposals, restructuring costs and non-recurring items |

(11) |

(185) |

(13) |

174 |

2 |

|

Operating income (loss) |

174 |

198 |

257 |

(25) |

(84) |

|

Financial income (loss) |

(20) |

26 |

(46) |

(46) |

26 |

|

Pre-tax income (loss) |

154 |

224 |

211 |

(70) |

(57) |

|

Income tax |

(46) |

(102) |

(53) |

55 |

7 |

|

Share in net income (loss) of equity affiliates |

1 |

(0) |

(1) |

1 |

2 |

|

Net income |

108 |

122 |

157 |

(14) |

(49) |

|

Attributable to non-controlling interests |

3 |

17 |

1 |

(13) |

2 |

|

Net income, Group share |

105 |

105 |

156 |

0 |

(51) |

|

|

|

|

|

|

|

|

Basic earnings per share (€) |

0.46 |

0.46 |

0.67 |

0.00 |

(0.22) |

|

Diluted earnings per share (€) |

0.43 |

0.44 |

0.66 |

(0.01) |

(0.23) |

|

|

|

|

|

|

|

|

Basic shares outstanding (millions) |

230 |

229 |

232 |

0 |

(2) |

|

Diluted shares outstanding (millions) |

244 |

240 |

237 |

4 |

7 |

Summary Consolidated Balance

Sheet

|

In € million |

|

|

|

|

|

|

Assets |

31-Mar-24 |

31-Dec-23 |

Liabilities |

31-Mar-24 |

31-Dec-23 |

|

|

|

|

Equity - Group share |

2,307 |

2,157 |

|

Net intangible assets |

40 |

42 |

Non-controlling interests |

71 |

67 |

|

Goodwill |

40 |

40 |

Total equity |

2,378 |

2,224 |

|

Net property, plant and equipment |

1,974 |

1,980 |

Bank loans and other borrowings (A) |

1,352 |

1,348 |

|

Biological assets |

66 |

70 |

Lease debt |

37 |

40 |

|

Equity affiliates |

17 |

16 |

Employee benefit commitments |

91 |

102 |

|

Other non-current assets |

171 |

159 |

Deferred taxes |

83 |

83 |

|

Deferred taxes |

208 |

209 |

Provisions and other long-term liabilities |

323 |

317 |

|

Total non-current assets |

2,516 |

2,516 |

Total non-current liabilities |

1,885 |

1,890 |

|

Inventories |

1,319 |

1,242 |

Provisions |

185 |

249 |

|

Trade and other receivables |

697 |

756 |

Overdraft & other short-term borrowings (B) |

199 |

122 |

|

Derivatives - assets |

18 |

47 |

Lease debt |

16 |

17 |

|

Other current assets |

263 |

251 |

Trade payables |

832 |

763 |

|

Cash and cash equivalents (C) |

1,066 |

900 |

Derivatives - liabilities |

71 |

79 |

|

Other current liabilities |

314 |

369 |

|

Total current assets |

3,364 |

3,196 |

Total current liabilities |

1,617 |

1,599 |

|

Assets held for sale and discontinued

operations |

1 |

1 |

Liabilities held for sale and discontinued operations |

– |

– |

|

Total assets |

5,881 |

5,713 |

Total equity and liabilities |

5,881 |

5,713 |

|

|

|

|

|

|

|

|

Net financial debt (A+B-C) |

485 |

570 |

Net income (loss), Group share |

105 |

496 |

Quarterly Key Cash Flow

Metrics

|

In € million |

Q1 2024 |

Q4 2023 |

Q1 2023 |

QoQ chg. |

YoY chg. |

|

EBITDA |

235 |

280 |

320 |

(45) |

(85) |

|

Non-cash items in EBITDA |

10 |

(1) |

13 |

11 |

(3) |

|

Financial cash out |

5 |

(1) |

(18) |

6 |

23 |

|

Tax payments |

(15) |

(52) |

(16) |

37 |

1 |

|

Adjusted operating cash flow |

235 |

226 |

299 |

9 |

(64) |

|

Change in working capital |

(7) |

92 |

(52) |

(99) |

45 |

|

Gross capital expenditure |

(56) |

(43) |

(53) |

(13) |

(3) |

|

Adjusted free cash flow |

172 |

275 |

194 |

(103) |

(22) |

|

Restructuring charges & non-recurring items |

(67) |

(193) |

(47) |

126 |

(20) |

|

Asset disposals & other cash items |

(3) |

67 |

4 |

(70) |

(7) |

|

Total cash generation |

102 |

149 |

151 |

(47) |

(49) |

|

Non-cash adjustments to net debt |

(17) |

22 |

(21) |

(39) |

4 |

|

(Increase) decrease in net debt |

85 |

171 |

130 |

(86) |

(45) |

Summary Consolidated Statement of Cash

Flows (IFRS)

|

In € million |

Q1 2024 |

Q1 2023 |

YoY chg. |

|

Consolidated net income (loss) |

108 |

157 |

(49) |

|

Net additions to depreciation, amortization and provisions |

0 |

32 |

(32) |

|

Unrealized gains and losses on changes in fair value |

13 |

7 |

6 |

|

Capital gains and losses on disposals |

(7) |

(2) |

(5) |

|

Share in income (loss) of equity-accounted companies |

(1) |

1 |

(1) |

|

Other cash flows from operating activities |

(0) |

– |

(0) |

|

Cash flow from (used in) operating activities after cost of

net debt and taxes |

114 |

195 |

(81) |

|

Cost of net debt |

15 |

26 |

(11) |

|

Tax expense (including deferred taxes) |

46 |

53 |

(7) |

|

Cash flow from (used in) operating activities before costs

of net debt and taxes |

175 |

274 |

(99) |

|

Interest paid |

(7) |

(10) |

3 |

|

Tax paid |

(15) |

(16) |

1 |

|

Interest received |

10 |

2 |

8 |

|

Other cash flow on financial income |

5 |

– |

5 |

|

Cash flow from (used in) operating activities |

168 |

250 |

(82) |

|

Change in operating working capital in the statement of cash

flows |

(7) |

(52) |

45 |

|

Net cash flow from (used in) operating activies

(A) |

161 |

198 |

(37) |

|

Acquisitions of property, plant and equipment and intangible

assets |

(56) |

(53) |

(3) |

|

Disposals of property, plant and equipment and intangible

assets |

12 |

10 |

2 |

|

Impact of acquisitions (changes in consolidation scope) |

(0) |

(0) |

0 |

|

Impact of disposals (changes in consolidation scope) |

– |

– |

– |

|

Other cash flow from investing activities |

0 |

0 |

0 |

|

Net cash flow from (used in) investing activities

(B) |

(44) |

(43) |

(0) |

|

Increase or decrease in equity attributable to owners |

– |

2 |

(2) |

|

Dividends paid to non-controlling interests |

(1) |

(2) |

2 |

|

Proceeds from new borrowings |

63 |

195 |

(132) |

|

Repayment of borrowings |

(5) |

(0) |

(4) |

|

Repayment of lease liabilities |

(6) |

(6) |

0 |

|

Other cash flow used in financing activities |

(9) |

1 |

(10) |

|

Net cash flow from (used in) financing activites

(C) |

44 |

190 |

(146) |

|

Impact of changes in exchange rates

(D) |

6 |

(1) |

8 |

|

Impact of reclassification to assets held for sale and

discontinued operations (E) |

– |

– |

– |

|

Change in net cash

(A+B+C+D+E) |

167 |

343 |

(176) |

|

Opening net cash |

898 |

547 |

|

|

Closing net cash |

1,065 |

889 |

|

Indebtedness

|

In € million |

31-Mar-24 |

31-Dec-23 |

|

8.500% Bonds due 2026 |

1,098 |

1,105 |

|

1.837% PGE due 2027 |

231 |

229 |

|

ACC ACE (a) |

117 |

94 |

|

Other |

106 |

42 |

|

Total gross financial indebtedness |

1,551 |

1,470 |

|

Cash and cash equivalents |

1,066 |

900 |

|

Total net financial indebtedness |

485 |

570 |

(a) Refers to ACC (Advances on

Foreign Exchange Contract) and ACE (Advances on Export Shipment

Documents) program in BrazilLiquidity

|

In € million |

31-Mar-24 |

31-Dec-23 |

|

Cash and cash equivalents |

1,066 |

900 |

|

Available RCF |

462 |

462 |

|

Available ABL (a) |

186 |

177 |

|

Total liquidity |

1,714 |

1,539 |

(a) This $210m committed ABL is

subject to a borrowing base calculation based on eligible accounts

receivable and inventories, among other items. The borrowing base

is currently approximately $201m. Availability is shown net of

approximately $9m of letters of credit and other items.

DEFINITIONS OF NON-GAAP FINANCIAL

DATA

Adjusted free cash flow is

defined as adjusted operating cash flow +/- change in operating

working capital and gross capital expenditures. It corresponds to

net cash used in operating activities less restructuring and

non-recurring items +/- gross capital expenditure.

Adjusted operating cash flow is

defined as EBITDA adjusted for non-cash benefits and expenses,

financial cash out and tax payments.

Asset disposals and other cash

items includes cash inflows from asset sales as well as

other investing and financing cash flows.

Change in working capital

refers to the change in the operating working capital

requirement.

Data at constant exchange

rates: The data presented “at constant exchange rates” is

calculated by eliminating the translation effect into euros for the

revenue of the Group’s entities whose functional currency is not

the euro. The translation effect is eliminated by applying Year N-1

exchange rates to Year N revenue of the contemplated entities.

EBITDA: Earnings Before

Interest, Taxes, Depreciation and Amortization is calculated by

taking operating income (loss) before depreciation and

amortization, and excluding certain operating revenues and expenses

that are unusual in nature or occur rarely, such as:

- impairment of goodwill and

non-current assets as determined within the scope of impairment

tests carried out in accordance with IAS 36;

- significant restructuring expenses,

particularly resulting from headcount reorganization measures, in

respect of major events or decisions;

- capital gains or losses on

disposals;

- income and expenses resulting from

major litigation, significant roll-outs or capital transactions

(e.g., costs of integrating a new activity).

Financial cash out includes

interest payments on financial and lease debt, interest income and

other financial costs.

Free cash flow, as previously

defined, may continue to be derived as follows: total cash

generation - asset disposals & other cash items. This is also

defined as EBITDA adjusted for changes in provisions, less interest

and tax payments, changes in working capital, less gross capital

expenditures, and less restructuring/other cash outflows.

Gross capital expenditure:

gross capital expenditure is defined as the sum of cash outflows

for acquisitions of property, plant and equipment and intangible

assets and cash outflows for acquisitions of biological assets.

(Increase) decrease in net debt

(alternatively, “change in net debt”) is defined as total cash

generation +/- non-cash adjustments to net debt.

Industrial margin: The

industrial margin is defined as the difference between revenue and

cost of sales (i.e. after allocation of industrial variable costs

and industrial fixed costs), before depreciation.

Lease debt is defined as the

present value of unavoidable future lease payments.

Net debt: Consolidated net debt

(or “net financial debt”) is defined as bank loans and other

borrowings plus overdrafts and other short-term borrowings minus

cash and cash equivalents. Net debt excludes lease debt.

Net working capital requirement

is defined as working capital requirement net of provisions for

inventories and trade receivables; net working capital requirement

days are computed on an annualized quarterly sales basis.

Non-cash adjustments to net

debt includes non-cash foreign exchange impacts on debt

balances, IFRS-defined fair value adjustments on debt balances, and

other non-cash items.

Non-cash items in EBITDA

includes provisions and other non-cash items in EBITDA.

Operating working capital

requirement includes working capital requirement as well

as other receivables and payables.

Restructuring charges and non-recurring

items consists primarily of the cash costs of executing

the New Vallourec plan, including severance costs and other

facility closure costs.

Total cash generation is

defined as adjusted free cash flow +/- restructuring charges and

non-recurring items and asset disposals & other cash items. It

corresponds to net cash used in operating activities +/- gross

capital expenditure and asset disposals & other cash items.

Working capital requirement is

defined as trade receivables plus inventories minus trade payables

(excluding provisions).

a Vallourec’s dividend policy would in any event

be conditional upon the Board’s decision taking into account

Vallourec’s results, its financial position including the

deleveraging target and the potential restrictions applicable to

the payment of dividends. Dividends and share repurchases would

also be subject to shareholders’ approval.b In all cases, total

cash generation and net debt guidance excludes the potential

positive impact of major asset sales. See further details regarding

the second quarter and full year 2024 outlook at the end of this

press release.c Vallourec’s dividend policy would in any event be

conditional upon the Board’s decision taking into account

Vallourec’s results, its financial position including the

deleveraging target and the potential restrictions applicable to

the payment of dividends. Dividends and share repurchases would

also be subject to shareholders’ approvald As of March 31, 2024,

the borrowing base for this facility was approximately $201

million, and $9 million in letters of credit and other commitments

were issued. e In all cases, total cash generation and net debt

guidance excludes the potential positive impact of major asset

sales.

- Vallourec Q1 2024 Press Release

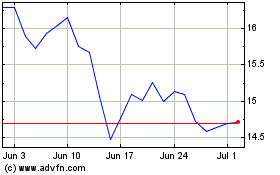

Vallourec (EU:VK)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vallourec (EU:VK)

Historical Stock Chart

From Jan 2024 to Jan 2025