TIDM0A28 TIDMJE.

RNS Number : 4941Z

Prosus NV

10 January 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

THAT JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

PROSUS N.V.

(formerly named Myriad International Holdings N.V)

Incorporated in the Netherlands

Legal Entity Identifier: 635400Z5LQ5F9OLVT688

ISIN: NL0013654783

Euronext Amsterdam and JSE Share code: PRX

("Prosus")

LAPSE OF THE OFFER

for

JUST EAT PLC

by

PROSUS N.V.

through its wholly-owned indirect subsidiary MIH Food Delivery

Holdings B.V.

On 19 December 2019, Prosus N.V. (Prosus) announced the final

increased offer by its wholly-owned indirect subsidiary MIH Food

Delivery Holdings B.V. (MIH) to acquire the entire issued and to be

issued share capital of Just Eat plc (Just Eat) (the Final

Increased Offer).

As at 1.00 p.m. (London time) on 10 January 2020 (being the

closing date of the Final Increased Offer), Prosus had received

valid acceptances of the Final Increased Offer in respect of

158,037 Just Eat Shares, representing approximately 0.02 per cent.

of the issued share capital of Just Eat. MIH does not own any Just

Eat Shares. As such, the Acceptance Condition has not been

satisfied and the Final Increased Offer has now lapsed.

As the Final Increased Offer has lapsed, it is no longer open to

acceptances and any accepting Just Eat Shareholders cease to be

bound by their acceptances.

Bob van Dijk, CEO of Prosus, commented: "We would like to thank

the Just Eat board and management team for their constructive

engagement throughout the process. As stated in our Original Offer

and subsequently, we consider Just Eat an attractive business

though one which will require significant investment. We have been

clear throughout that we would remain disciplined in how we

allocate our capital and the price that we would offer.

We have an outstanding track record of executing M&A at the

right price for our shareholders and of generating strong returns.

Just Eat is not an acquisition we wanted to make at any cost and

while we have significant financial capacity, we believe that our

final offer of 800 pence per share was appropriate in light of the

investment required and preserved our ability to create value for

our shareholders.

Our core operating segments are growing fast with significant

runway ahead of them. We will continue to identify and pursue

opportunities that will be both additive to our current strategy

and generate high levels of return for our shareholders."

In respect of Just Eat Shares held in certificated form, the

Form of Acceptance, Second Form of Acceptance and/or Third Form of

Acceptance (as applicable), share certificate(s) and/or other

document(s) of title will be returned by post (or by such other

method as may be approved by the Panel) within 14 days of the Final

Increased Offer lapsing to the person or agent whose name and

address outside the Restricted Jurisdictions is set out in the

relevant box on the relevant Form of Acceptance or, if none is set

out, to the first-named or sole holder of his registered address

outside the Restricted Jurisdictions. No such documents will be

sent to an address in any Restricted Jurisdiction.

In respect of Just Eat Shares held in uncertificated form,

Computershare, the Receiving Agent, will, immediately (or within

such longer period as the Panel may permit, not exceeding 14 days

after the lapsing of the Final Increased Offer), give instructions

to Euroclear to transfer all Just Eat Shares held in escrow

balances and in relation to which it is the escrow agent for the

purposes of the Final Increased Offer to the original available

balances of the Just Eat Shareholders concerned.

Capitalised terms in this announcement, unless otherwise

defined, have the same meanings as set out in the Final Increased

Offer Document (including words or expressions defined in the Final

Increased Offer Document by reference to the Offer Document).

Enquiries:

Investor Enquiries +1 347 210 4305

Eoin Ryan, Head of Investor Relations

Media Enquiries +44 207 251 3801

Sarah Ryan, International Media Relations

Finsbury (PR adviser to Prosus)

J.P. Morgan Cazenove (Financial adviser

to Prosus and MIH) +44 20 7742 4000

Charles Harman

Barry Weir

Bill Hutchings

James Robinson

Chris Wood

Morgan Stanley & Co International plc (Financial

adviser to Prosus and MIH)

Mark Rawlinson

Gergely Voros

Enrique Perez-Hernandez

Laurence Hopkins

Ben Grindley +44 207 425 8000

Finsbury (PR adviser to Prosus) +44 207 251 3801

Rollo Head

Guy Lamming

Allen & Overy LLP is retained as legal adviser to Prosus and

MIH.

JSE sponsor: Investec Bank Limited

10 January 2020

Amsterdam, the Netherlands

Important notice related to financial advisers

J.P. Morgan Securities plc, which conducts its UK investment

banking business as J.P. Morgan Cazenove (J.P. Morgan Cazenove) and

which is authorised by the PRA and regulated by the FCA and the PRA

in the United Kingdom, is acting as financial adviser exclusively

for Prosus and MIH and no one else in connection with the Final

Increased Offer and will not regard any other person as its client

in relation to the Final Increased Offer and shall not be

responsible to anyone other than Prosus or MIH for providing the

protections afforded to clients of J.P. Morgan Cazenove, or for

providing advice in relation to the Final Increased Offer or any

matter referred to in this announcement. Neither J.P. Morgan

Cazenove nor any of its affiliates owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, in delict, under statute or

otherwise) to any person who is not a client of J.P. Morgan

Cazenove in connection with this announcement, any statement

contained herein, the Final Increased Offer or otherwise.

Morgan Stanley & Co. International plc (Morgan Stanley),

which is authorised by the PRA and regulated by the FCA and the PRA

in the United Kingdom, is acting as financial adviser exclusively

for Prosus and MIH and no one else in connection with the matters

set out in this Increased Offer. In connection with such matters,

Morgan Stanley, its affiliates and their respective directors,

officers, employees and agents will not regard any other person as

their client, nor will they be responsible to any other person for

providing the protections afforded to their clients or for

providing advice in connection with the contents of this Final

Increased Offer or any other matter referred to herein.

Further information

This announcement is provided for information purposes only. It

is not intended to and does not constitute or form part of, an

offer, invitation, inducement or the solicitation of an offer to

purchase, otherwise acquire, subscribe for, exchange, sell or

otherwise dispose of or exercise rights in respect of any

securities, or the solicitation of any vote or approval of an offer

to buy securities in any jurisdiction, pursuant to the Final

Increased Offer or otherwise nor shall there be any sale, issuance

or transfer of any securities pursuant to the Final Increased Offer

in any jurisdiction in contravention of any applicable laws.

This announcement has been prepared for the purpose of complying

with English law and the City Code, the Market Abuse Regulation and

the Disclosure Guidance and Transparency Rules and the information

disclosed may not be the same as that which would have been

disclosed if this announcement had been prepared in accordance with

the laws of jurisdictions outside England and Wales and/or the

Netherlands.

Rounding

Certain figures included in this announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables may vary slightly

and figures shown as totals in certain tables may not be an

arithmetic aggregation of the figures that precede them.

Time

Unless otherwise indicated, all references to time in this

announcement are to London time.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

OLAURVSRRUUAAAR

(END) Dow Jones Newswires

January 10, 2020 10:45 ET (15:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

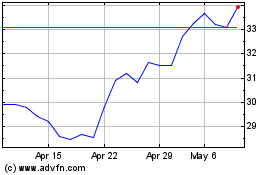

Prosus NV (EU:PRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

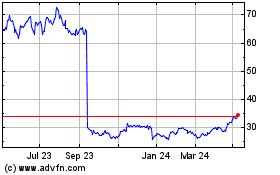

Prosus NV (EU:PRX)

Historical Stock Chart

From Nov 2023 to Nov 2024