Nexity 2022 half-year results: Resilient first half results

Paris

– France, 27 July 2022, 17h45 CEST

Resilient first half

resultsCautious management of development

activitiesStrong growth of

ServicesAnnual

objectives specified

Cautious management of

residential development:

commercial launches postponed

-

Recovery in permits granted, but commercial launches postponed to

manage the consequences of inflation and protect margins

-

Anticipation of a 17% market decline in 2022 (estimated at ~130,000

units vs. 157,000 in 2021)

-

Nexity's robustness: 7,639 reservations in the first half (-9% in

volume, -5% in value)

Financial performance: resilience in

development activities, strong

growth in services, indebtedness

under control

-

Revenue of €1,964 million, with service activities up by 9%

-

Current operating profit of €110m, i.e. a half-year margin of 5.6%,

not representative of annual performance

-

Solid financial structure: net debt of €878m, i.e. 2.3x EBITDA,

highest point of annual debt

2022 targets specified to

better reflect the uncertainty of

the macro-economic environment

-

Confirmation of over 14% market share in 2022, in a new home market

now expected to decline

-

Maintain a high operating margin around 8% based on revenue at

least equal to 2021

Nexity is

well-prepared to

address the

tremendous needs of the sustainable

city

-

Closing of the acquisition of the Angelotti Group, a leading

residential developer in Occitanie (south of France), expected at

year-end

-

Investor Day on 28 September: accelerating Nexity's integrated real

estate operator model for sustainable cities

H1 2022

KEY FIGURES1

|

BUSINESS ACTIVITY |

FINANCIAL RESULTS |

|

|

H1 2022 |

Change |

(€m) |

H1 2022 |

H1 2021 |

22 vs 21 |

|

New home reservations in

France |

|

vs. H1 2021 |

Revenue |

1,964 |

2,063 |

-5% |

|

Volume |

7,639 units |

-9% |

Operating profit |

110 |

133 |

-17% |

|

Value |

€1,756m |

-5% |

Operating margin (% of revenue) |

5.6% |

6.4% |

-80 bps |

|

Commercial real estate |

|

|

Net profit – Group share |

54 |

75 |

-27% |

|

Order intake |

€92m |

|

|

|

|

|

|

|

|

|

(€m) |

Jun-22 |

Dec-21 |

|

|

Development outlook |

|

vs. Dec-21 |

Net

debt2 |

878 |

598 |

|

|

Backlog |

€6.5bn |

-1% |

x EBITDA after leases (12 month) |

2,3x |

1,5x |

|

1 Data on a like-for-like basis

i.e without businesses sold in H1 2021: Century 21 consolidated

until 31 March and Ægide-Domitys consolidated until 30 June 2021

figures have been restated following the IFRS-IC decision of March

2021 on the costs of software used in Saas mode 2 Net debt before

leases.

VÉRONIQUE BÉDAGUE, CHIEF EXECUTIVE

OFFICER, COMMENTED:

« The geopolitical and macroeconomic uncertainty

leads us to manage our operations with greater caution. To cope

with inflationary pressures, we are more selective in launching

operations and take the time to work on optimising our products in

terms of both cost and selling price. Finally, once the launch has

been decided, we capitalise on our diversified offer and our

multi-channel marketing capability to ensure optimal time to

market. This is how we protect our margins and contain our debt.

This tight control of our supply for sale enables us to adapt to

changes in demand, which remains strong, both from individuals and

institutionals, despite macro-prudential measures aimed at reducing

the credit availability to individuals and the rise in interest

rates. Nexity's performance demonstrates the strength of its

business model, capitalising in particular on its position as

France's leading developer and on the very strong growth in the

results of its service activities. The volume of our business

potential, the strength of our backlog, the solidity of our balance

sheet and the quality and commitment of our teams, give us

confidence that we will be able to weather this period of

uncertainty as well as possible, and we will be able to meet the

immense needs in the French housing market. We have also just

strengthened our positions in Occitania region (South of France) by

acquiring a majority stake in Angelotti and remain in motion to

participate in the future consolidation of the sector and better

respond to the challenges of sustainable

cities. »RESIDENTIAL REAL

ESTATE

Business activityThe supply

shortage, observed for several years on the French market, persists

despite a recent recovery in the delivery of building permits for

collective housing. The acceleration of the inflationary context

recorded in the second quarter lengthens the operations’ set-up

time, delays the start of their marketing, thus constraining the

supply for sale. The new home market in France is therefore

affected despite a still sustained demand, both from individuals

and institutional investors. According to the FPI (Fédération des

Promoteurs Immobiliers), new home sales fell by around 20% in the

first quarter which should continue for the rest of the year.

Against this backdrop, Nexity's business

activity held up well in the first half of the year, with 7,639

reservations (-9% in volume compared with H1 2021, -5% in value to

€1.8 billion), with its customer base still balanced between retail

sales (63% of reservations in the first half of the year) and bulk

sales (37%). Sales prices per square metre in supply constrained

areas (A and B1), which account for around 80% of reservations

during the period, remain on an upward trend, in line with the

first quarter (+3.7% vs H1 2021).

As expected, Nexity saw during the first half a

recovery in building permits (+19% vs H1 2021), but is keen to

secure its margins in a more difficult environment. Therefore,

these new permits did not allow to increase the supply for sale as

anticipated at the beginning of the year, mainly given the

negotiation time required to integrate the inflationary trend in

construction costs and validate the selling price. As a result,

housing launches fell by 12% over the period. The supply for sale

therefore remains low (7,199 units against 7,655 on 31 December

2021) and does not meet demand. This supply is low-risk (no stock

of completed homes, and more than 70% of the supply not launched)

and the time-to-market remains very fast (4.5 months vs. 4.4 months

at 31 December 2021).

|

New scope (€m) |

H1 2022 |

H1 2021 |

2022/2021change |

|

Revenue |

1,377 |

1,398 |

- 2% |

|

Current operating profit |

65 |

81 |

- 20% |

|

Margin (as a % of revenue) |

4.7% |

5.8% |

-110 bps |

|

|

30/06/22 |

31/12/21 |

|

|

Working capital

requirement (WCR) |

1,152 |

1,029 |

|

Financial results Revenue was

slightly down in the first half of 2022, reflecting the lower level

of new operations starts during the period. The margin rate is

down, affected by the cautious management of operations leading to

a lower coverage of fixed costs due to operations delay and higher

costs related to projects’ exits. Working capital requirement

amounted €1.2 billion. Working capital for new homes in France

represented 18% of the backlog, in line with historical levels.

OutlookGiven the tougher

housing environment observed in the second quarter, Nexity now

expects the market to decline by 17% in 2022 (~130,000 units vs.

157,000 units in 2021). Nexity is maintaining its target of over

14% market share, with an acceleration in bulk sales expected in

the second half of the year. The contribution to 2022 earnings from

the acquisition of the Angelotti Group announced in June 2022

should be small, in the event of a year-end closing. The Group

remains confident in its ability to contain the pressure on

construction costs for ongoing operations. Expectations of rising

real estate mortgage rates lead us to increase our vigilance

regarding the relevance of new production in relation to market

conditions.

COMMERCIAL REAL

ESTATE

Business activityIn a market

context at the bottom of the cycle and still wait-and-see, Nexity

recorded, as expected, a low level of order intake in the first

half of the year (92 million euros at the end of June). This amount

includes 66 million euros in order intake in the regions (+41%

compared to H1 2021) where Nexity continues to strengthen its

presence.

|

New scope (€m) |

H1 2022 |

H1 2021 |

2022/2021change |

|

Revenue |

161 |

280 |

- 43% |

|

Current operating profit |

21 |

44 |

- 53% |

|

Margin (as a % of revenue) |

13.0% |

15.8% |

-280 bps |

|

|

30/06/22 |

31/12/21 |

|

|

Working capital

requirement (WCR) |

64 |

24 |

|

Financial resultsH1 2021 basis

of comparison is high, as it included the contribution of the order

intake for the Reiwa building in Saint-Ouen, which contributed €124

million to revenue and €16 million to operating profit. The

half-year results for 2022 are logically down due to this

significant base effect. Restated for this item, revenue is up 3%.

The margin rate for the first half of 2022 remains higher than the

normative level of the business. The level of WCR remains low and

takes into account the rate of customer advances collection during

the construction period.

OutlookThe outlook for

Commercial real estate business remains unchanged. Given the

wait-and-see attitude of companies, order intake should reach a low

point in 2022. The backlog consumption should lead to achieve a

consolidated revenue of around €400 million in 2022.

SERVICES

|

New scope (€m) |

H1 2022 |

H1 2021 |

2022/2021change |

|

Revenue |

421 |

385 |

9% |

|

o/w Property Management |

188 |

186 |

1% |

|

o/w Serviced Properties |

102 |

70 |

45% |

|

o/w Distribution |

132 |

130 |

2% |

|

Current operating profit |

36 |

26 |

39% |

|

Margin (as a % of revenue) |

8.5% |

6.7% |

+180 bps |

|

|

30/06/22 |

31/12/21 |

|

|

Working capital

requirement (WCR) |

52 |

75 |

|

Services revenue amounted 421

million in the first half of 2022, up 9% compared to H1 2021,

mainly driven by serviced properties activities, particularly

coworking (Morning), which saw its revenue double in H1 2022,

driven by the increase in the occupancy rate over the period (+11

points) and the 30% increase in the number of managed spaces (9

openings during H1 representing 19,000 sqm). Student residencies

(Studea) had also a strong performance with a3 points increase in

occupancy rate at 96% compared to 93% at end-December 2021.

Current operating

profit rose by 39% to €36 million. The operating

margin rate increased by 180 basis points to 8.5%.

OutlookIn the second half of

the year, the Services activities should benefit from the continued

good momentum of profitable growth recorded in the first half of

the year.

CONSOLIDATED

RESULTS – OPERATIONAL

REPORTING

Reported H1 2021 net profit amounted to €281

million and included non-recurring items relating to the disposal

of Ægide-Domitys and Century 21 (€206 million). Restated on a

like-for-like basis, H1 2021 net profit amounted to €75

million.

| |

|

H1 2021

restated* |

|

H1 2022 |

|

2022/2021changeLike-for-like basis |

|

in € million |

|

Reported |

Disposed activities and non-recurring

items |

Like-for-like basis |

|

|

|

|

| Consolidated

revenue |

|

2,275 |

211 |

2,063 |

|

1,964 |

|

-5% |

|

Operating profit |

|

359 |

226 |

133 |

|

110 |

|

-17% |

| As a % of

revenue |

|

|

|

6.4% |

|

5.6% |

|

|

| Net financial

income/(expense) |

|

(44) |

(13) |

(31) |

|

(26) |

|

-18% |

| Income tax |

|

(31) |

(7) |

(24) |

|

(24) |

|

|

| Share of

profit/(loss) from equity-accounted investments |

|

(1) |

|

(1) |

|

(1) |

|

|

| Net

profit |

|

283 |

206 |

77 |

|

59 |

|

-23% |

| Non-controlling

interests |

|

(2) |

|

(2) |

|

(5) |

|

|

|

Net profit attributable to equity holders of the parent

company |

|

281 |

206 |

75 |

|

54 |

|

-27% |

|

(in euros) |

|

|

|

|

|

|

|

|

|

Net earnings per share |

|

€5.07 |

|

€1.35 |

|

€0.98 |

|

|

*2021 figures have been restated following the

IFRS-IC decision of March 2021 on the costs of software used in

Saas mode

REVENUE

Reported revenue amounted to

€1,964

million, down 5% compared to H1 2021 on a

like-for-like basis. H1 2021 reported revenue included revenue from

disposed activities in 2021 (Century21 and Ægide-Domitys) and

amounted to €2,275 million. Restated for the base effect of the

Reiwa Commercial real estate order taken in the first half of 2021,

revenue rose by 1%.

|

in € million |

|

H1 2022 |

H1 2021 |

|

2022/2021change |

|

Development |

|

1,538 |

1,678 |

|

- 8% |

| Residential Real

Estate Development |

|

1,377 |

1,398 |

|

- 2% |

| Commercial Real

Estate Development |

|

161 |

280 |

|

- 43% |

|

Services |

|

421 |

385 |

|

+ 9% |

| Property

Management |

|

188 |

186 |

|

+ 1% |

| Serviced

properties |

|

102 |

70 |

|

+ 45% |

|

Distribution |

|

132 |

130 |

|

+ 2% |

| Other

Activities |

|

5 |

1 |

|

ns |

|

Revenue new scope |

|

1,964 |

2,063 |

|

- 5% |

| Revenue from

disposed activities (1) |

|

|

211 |

|

|

|

Revenue |

|

1,964 |

2,275 |

|

- 14% |

(1) Disposed activities were consolidated until 31 March 2021

for Century 21 and until 30 June 2021 for Ægide-Domitys.

Under IFRS, reported revenue

was €1,800 million. It excludes revenue from joint ventures in

application of IFRS 11, which requires their recognition by equity

accounting of proportionally integrated joint ventures in

operational reporting. Reported revenue in H1 2021 (€2,099

millions) is not comparable as it included the revenue of the

disposed activities in 2021 (Century21 and Ægide-Domitys).

As a reminder, revenue generated by the

development businesses from VEFA off-plan sales and CPI development

contracts is recognised using the percentage-of-completion method,

i.e. on the basis of notarised sales and pro-rated to reflect the

progress of all inventoriable costs.

OPERATING PROFIT

Current operating

profit amounted

to €110

million and the current operating margin reached

5.6% of revenue, at a level not representative of annual

performance. Half of the decline in the margin rate (-80 bps) is

due to the base effect from the Reiwa Commercial real estate order

taken in H1 2O21.

| |

|

H1 2022 |

|

H1 2021* |

|

|

in € million |

|

Operating profit |

Marginrate |

|

Operating profit |

Marginrate |

|

|

Development |

|

86 |

5.6% |

|

125 |

7.4% |

|

| Residential Real

Estate Development |

|

65 |

4.7% |

|

81 |

5.8% |

|

| Commercial Real

Estate Development |

|

21 |

13.0% |

|

44 |

15.8% |

|

|

Services |

|

36 |

8.5% |

|

26 |

6.7% |

|

| Other

Activities |

|

(11) |

ns |

|

(18) |

ns |

|

|

Current operating profit new scope |

|

110 |

5.6% |

|

133 |

6.4% |

|

*2021 figures have been restated following the

IFRS IC decision of March 2021 on the costs of software used in

Saas mode

OTHER INCOME STATEMENT

ITEMS

Financial expense amounted to

-€26 million in H1 2022 and improved by €5 million compared to 30

June 2021 on a like-for-like basis. The increase in interest

expenses on leases (€2 million vs. H1 2021) following the growth in

coworking activities is largely offset by the decrease in the cost

of financial debt for €7 million. The average cost of

financing is down to 1.8% from 2.1% at end 2021. Given its

mainly fixed-rate debt structure, the Group has little exposure to

an increase in interest rates on the 2022 financial result.

Tax expense (including the

Cotisation sur la Valeur Ajoutée des Entreprises, CVAE) on a

like-for-like basis was stable at - €24 million. The

current effective tax rate (excluding CVAE) was 27% at end-June

2022 in line with the normative fiscal rate.

Net profit Group's

share on a like-for-like basis during H1 2022 was €54

million (compared to €75 million at 30 June 2021).

CASH FLOW AND

BALANCE SHEET ITEMS

Cash flow from operating activities

after lease payments but before interest and tax expenses

was €125 million at end-June 2022, comparable to the contribution

in the first half of 2021.

Operating working capital (excluding

tax) rose by €196 million, which is comparable to the

usual increase in the first half of the year, still marked by

expenditure flows on construction sites, which exceeds the inflows

for the period. The change in WCR in H1 2021, which amounted to

€355 million, took into account €238 million related to the

consumption of advances paid for Commercial real estate on 2020

orders (mainly the Eco-campus in La Garenne Colombes).

Nexity’s free cash-flow was a

net outflow of €136 million at end-June 2022 compared to a net

outflow of €95 million at 30 June 2021 restated for the effect of

the consumption of customer advances. This reflects a controlled

increase in working capital in H1 2022.

|

in € million |

|

H1 2022 |

H1 2021* |

| Cash

flow from operating activities before interest and tax

expenses |

|

188 |

233 |

| Repayment of

lease liabilities |

|

(63) |

(117) |

| Cash

flow from operating activities after lease payments but before

interest and tax expenses |

|

125 |

116 |

| Change in

operating working capital |

|

(196) |

(355) |

| Interest and tax

paid |

|

(36) |

(71) |

| Net cash

from/(used in) operating

activities |

|

(107) |

(310) |

| Net cash

from/(used in) operating investments |

|

(29) |

(23) |

| Free

cash-flow |

|

(136) |

(333) |

| Net cash

from/(used in) financial investments |

|

(7) |

185 |

| Dividends paid

by Nexity SA |

|

(138) |

(111) |

| Net cash

from/(used in) financing activities, excluding dividends |

|

22 |

(165) |

|

Change in cash and cash equivalents |

|

(259) |

(423) |

*2021 figures have been restated following the

IFRS-IC decision of March 2021 on the costs of software used in

Saas mode

Net cash

from/(used in) financial

investments totalled €7 million in H1 2022. It mainly

included in H1 2021, the disposal of 100% of Century 21 and 45% of

Ægide.

Net cash flow

from/(used in) financing

activities totalled only €22 million as there were no

repayments during the period. In H1 2021, they included the

repayment at maturity of a bond.

WORKING CAPITAL REQUIREMENT

|

in € million |

|

30 June

2022 |

31 December

2021 |

2022/2021change |

|

Development |

|

1,215 |

1,053 |

162 |

| Residential Real

Estate Development |

|

1,152 |

1,029 |

123 |

| Commercial Real

Estate Development |

|

64 |

24 |

39 |

|

Services |

|

52 |

75 |

(23) |

| Other

Activities |

|

46 |

(7) |

52 |

| Total

WCR excluding tax |

|

1,313 |

1,121 |

192 |

| Corporate income

tax |

|

5 |

(2) |

7 |

|

Working capital requirement (WCR) |

|

1,318 |

1,119 |

199 |

At

30 June 2022,

WCR excluding tax increased by €192 million

compared to end-December 2021, driven by Residential real estate

(+€123 million).

Land commitments considered as Landbank totalled

around €250 million at 30 June 2022 (compared to around €280

million at 31 December 2021).

|

BALANCE SHEET AND FINANCIAL

STRUCTURE |

The Group’s net debt before lease liabilities

amounted to €878 million at end-June 2022, up €280 million compared

to end-2021. This increase came in particular from the dividend

payment in the first half of the year (€138 million) and the

increase in working capital requirement (€192 million).

The level at end-June represents the highest

point in annual indebtedness.

Leverage ratio was 2.3x EBITDA at 30 June 2022,

well below the bank covenant thresholds (3.5x).

The Group has a solid financial situation as of

30 June 2022, with a total cash position of €914 million, to which

are added €600 million of confirmed and undrawn credit lines.

Gross debt is mainly fixed rate (56%), reducing

the Group's exposure to rising interest rates.

|

in € million |

|

30 June

2022 |

31 December

2021 |

2022/2021 change |

| Bond issues and

others |

|

999 |

994 |

5 |

| Bank debt and

commercial papers |

|

793 |

768 |

26 |

| Net cash and

cash equivalents |

|

(914) |

(1,163) |

249 |

|

Net financial debt before lease liabilities |

|

878 |

598 |

280 |

At 30 June 2022, the average debt

maturity was high at 2.6 years (compared to 3.1 years at

end-2021) with an average cost of debt down to

1.8% compared to 2.1% in 2021 given the refinancing policy pursued

in 2021.

Lease liabilities rose during

H1 2022 by €51 million, to reach €677 million, reflecting the

growth in the number of managed coworking office spaces. Net debt

including lease liabilities amounted to €1,554 million at 30 June

2022, compared to €1,224 million at 31 December 2021.

2022

OUTLOOK

2022 targets specified

1 to better

reflect the uncertainty of the

macro-economic environment

-

Confirmation of over 14% market share in 2022, in a new home market

now expected to decline

-

Maintain a high operating margin around 8% based on revenue at

least equal to 2021

Nexity will continue to closely monitor the

current economic, social and health situation.

ACQUISITION

OF A MAJORITY STAKE IN THE ANGELOTTI GROUP

As the regional leader in residential

development and urban planning in Occitania region (South of

France), this acquisition is a major step forward for Nexity. Fully

in line with the Group's strategic ambition, this transaction will

strengthen Nexity's urban planning offer, a business that has been

in place for a long time and that transforms territories to serve

our local authority clients. It will also enable Nexity to

strengthen its market share in residential development in Occitania

and PACA regions, two regions with strong growth prospects, by

relying on reputable and well-established local partners. In 2021,

the Angelotti group totalled revenue of €150 million (+20% compared

to 2020) and has a pipeline of projects representing around 6 years

of activity.

***

FINANCIAL CALENDAR & PRACTICAL

INFORMATIONS

Investor Day (only with

invitation) Wednesday

28 September 2022Q3 2022 business activity and

revenue Wednesday

26 October 2022 (after market close)

A conference call will be held

today in French with a simultaneous translation into English

at 6.30 p.m. (Paris Time), available on the

website https://nexity.group/en/ in the Finance section and with

the following numbers:

|

|

+33 (0) 1 70 37 71 66 |

- Calling from elsewhere in

Europe

|

+44 (0) 33 0551 0200 |

- Calling from the United States

|

+1 212 999 6659 |

Code: Nexity en

The presentation accompanying this conference

will be available on the Group’s website from 6:15 p.m. (Paris

Time) and may be viewed at the following address: Nexity H1 2022

webcast

The conference call will be available on replay

at https://nexity.group/en/finance from the following day.

The French version of the 2022 interim financial

report is filed today with the Autorité des Marchés Financiers

(AMF) and is available on the Group’s website.

Avertissement:

The information, assumptions and estimates that the Company could

reasonably use to determine its targets are subject to change or

modification, notably due to economic, financial and competitive

uncertainties. Furthermore, it is possible that some of the risks

described in Section 2 of the Universal Registration Document filed

with the AMF under number D.22-0248 on 6 April 2022, could have an

impact on the Group’s operations and the Company’s ability to

achieve its targets. Accordingly, the Company cannot give any

assurance as to whether it will achieve its stated targets and

makes no commitment or undertaking to update or otherwise revise

this information.

Contact:Domitille Vielle – Head

of Investor relations / +33 (0)6 03 86 05 02 –

investorrelations@nexity.fr

ANNEX :

OPERATIONAL REPORTING

Quarterly reservations – Residential

Real Estate

| |

|

2022 |

|

2021 |

|

2020 |

|

Number of units |

|

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

| New homes

(France) |

|

4,149 |

3,490 |

|

7,658 |

4,092 |

4,843 |

3,508 |

|

7,299 |

3,848 |

5,402 |

3,450 |

|

Subdivisions |

|

423 |

337 |

|

772 |

367 |

439 |

338 |

|

660 |

244 |

297 |

360 |

|

International |

|

100 |

133 |

|

216 |

247 |

404 |

249 |

|

503 |

193 |

74 |

165 |

|

Total new scope |

|

4,672 |

3,960 |

|

8,646 |

4,706 |

5,686 |

4,095 |

|

8,462 |

4,285 |

5,773 |

3,975 |

|

Reservations carried out directly by Ægide |

|

|

|

|

|

|

348 |

389 |

|

143 |

336 |

392 |

207 |

|

Total (in number of units) |

|

4,672 |

3,960 |

|

8,646 |

4,706 |

6,034 |

4,484 |

|

8,605 |

4,621 |

6,165 |

4,182 |

| |

|

2022 |

|

2021 |

|

2020 |

|

|

Value, in €m incl. VAT |

|

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

|

| New homes

(France) |

|

992 |

764 |

|

1,447 |

845 |

1,056 |

792 |

|

1,534 |

855 |

1,141 |

750 |

|

|

Subdivisions |

|

37 |

27 |

|

55 |

33 |

42 |

29 |

|

57 |

19 |

25 |

30 |

|

|

International |

|

2 |

18 |

|

31 |

48 |

72 |

41 |

|

91 |

29 |

11 |

26 |

|

|

Total new scope |

|

1,032 |

808 |

|

1,533 |

927 |

1,170 |

862 |

|

1,682 |

903 |

1,177 |

806 |

|

|

Reservations carried out directly by Ægide |

|

|

|

|

|

|

85 |

90 |

|

32 |

70 |

90 |

41 |

|

|

Total (in €m incl. VAT) |

|

1,032 |

808 |

|

1,533 |

927 |

1,255 |

952 |

|

1,713 |

974 |

1,267 |

847 |

|

Breakdown of new home reservations in France by

client

|

In number of units, new scope |

H1 2022 |

H1 2021 |

H1 2022/H1 2021 change |

| Homebuyers |

1,513 |

20% |

1,778 |

21% |

-15% |

|

o/w: - First time buyers |

1,317 |

17% |

1,514 |

18% |

-13% |

|

- Other home buyers |

195 |

3% |

264 |

3% |

-26% |

| Individual

investors |

3,335 |

44% |

3,686 |

44% |

-10% |

| Professional

landlords |

2,791 |

37% |

2,887 |

35% |

-3% |

|

O/w : - Institutional investors |

727 |

10% |

936 |

11% |

-22% |

|

- Social housing operators |

2,064 |

27% |

1,951 |

23% |

6% |

|

Total |

7,639 |

100% |

8,351 |

100% |

-9% |

Services

|

|

|

June 2022 |

|

December

2021 |

|

Change |

|

|

|

Property Management |

|

|

|

|

|

|

|

|

| Portfolio of

managed housing |

|

|

|

|

|

|

|

|

| - Condominium

management |

|

675,000 |

|

672,000 |

|

+ 0.4% |

|

|

| - Rental

management |

|

158,000 |

|

155,000 |

|

+ 1.9% |

|

|

|

Commercial real estate |

|

|

|

|

|

|

|

|

| - Assets under

management (in millions of sq.m) |

|

20.2 |

|

20.4 |

|

- 1% |

|

|

|

Serviced properties |

|

|

|

|

|

|

|

|

|

Student residences |

|

|

|

|

|

|

|

|

| - Number of

residences in operation |

|

129 |

|

129 |

|

0 |

|

|

| - Rolling

12-month occupancy rate |

|

96% |

|

93% |

|

+ 3 pts |

|

|

|

Shared office space |

|

|

|

|

|

|

|

|

| - Managed areas

(in sq.m) |

|

76,000 |

|

57,000 |

|

+ 19.000 |

|

|

| - Rolling

12-month occupancy rate |

|

85% |

|

74% |

|

+ 11 pts |

|

|

|

Distribution |

|

June 2022 |

|

June 2021 |

|

Change |

|

|

| - Total

reservations |

|

2,425 |

|

2,731 |

|

- 11% |

|

|

|

- Reservations on behalf of third parties |

|

1,497 |

|

1,770 |

|

- 15% |

|

|

| |

|

|

|

|

|

|

|

|

Quarterly figures -

Revenue

| |

2022 |

|

2021 |

|

2020 |

|

in € million |

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

|

Development |

839 |

699 |

|

1,279 |

815 |

827 |

851 |

|

1,747 |

703 |

680 |

524 |

| Residential Real

Estate development |

750 |

626 |

|

1,146 |

735 |

742 |

655 |

|

1,216 |

642 |

434 |

467 |

| Commmercial Real

Estate development |

89 |

72 |

|

133 |

79 |

85 |

195 |

|

530 |

61 |

247 |

57 |

|

Services |

226 |

195 |

|

270 |

198 |

209 |

176 |

|

237 |

198 |

161 |

171 |

| Property

management |

149 |

141 |

|

141 |

140 |

129 |

126 |

|

129 |

133 |

114 |

126 |

|

Distribution |

77 |

54 |

|

129 |

58 |

80 |

50 |

|

108 |

65 |

47 |

45 |

|

Other activities |

4 |

1 |

|

|

|

|

1 |

|

|

|

|

|

|

Revenue - New scope |

1,069 |

895 |

|

1,549 |

1,013 |

1,036 |

1,027 |

|

1,983 |

901 |

842 |

695 |

|

Revenue from

disposed

activities* |

|

|

|

|

|

107 |

104 |

|

134 |

120 |

88 |

92 |

|

Revenue |

1,069 |

895 |

|

1,549 |

1,013 |

1,143 |

1,132 |

|

2,118 |

1,021 |

929 |

787 |

* Disposed activities are consolidated until 31 Mars 2021 for

Century 21 and until 30 June 2021 for Ægide-Domitys

Backlog

| |

2022 |

|

2021 |

|

2020 |

|

In € million, excluding VAT |

H1 |

Q1 |

|

FY |

9M |

H1 |

Q1 |

|

FY |

9M |

H1 |

Q1 |

| Residential Real

Estate development |

5,541 |

5,551 |

|

5,565 |

5,610 |

5,504 |

5,399 |

|

5,509 |

5,100 |

4,986 |

4,522 |

| Commercial Real

Estate development |

906 |

935 |

|

974 |

1,013 |

1,059 |

1,138 |

|

1,032 |

321 |

373 |

398 |

|

Total Backlog |

6,447 |

6,485 |

|

6,538 |

6,622 |

6,563 |

6,536 |

|

6,541 |

5,421 |

5,359 |

4,920 |

| Restatement of

operations carried out directly by Ægide |

|

|

|

|

|

|

242 |

|

280 |

298 |

300 |

274 |

|

Total Backlog new scope |

6,447 |

6,485 |

|

6,538 |

6,622 |

6,563 |

6,778 |

|

6,820 |

5,719 |

5,659 |

5,194 |

Half-year

figuresReservations

– Residential Real

Estate

| |

|

2022 |

|

2021 |

|

2020 |

|

Number of units |

|

H1 |

|

FY |

H2 |

H1 |

|

FY |

H2 |

H1 |

| New homes

(France) |

|

7,639 |

|

20,101 |

11,750 |

8,351 |

|

19,999 |

11,147 |

8,852 |

|

Subdivisions |

|

760 |

|

1,916 |

1,139 |

777 |

|

1,561 |

904 |

657 |

|

International |

|

233 |

|

1,116 |

463 |

653 |

|

935 |

696 |

239 |

|

Total new scope |

|

8,632 |

|

23,133 |

13,352 |

9,781 |

|

22,495 |

12,747 |

9,748 |

|

Reservations carried out directly by Ægide |

|

- |

|

737 |

- |

737 |

|

1,078 |

479 |

599 |

|

Total (in number of units) |

|

8,632 |

|

23,870 |

13,352 |

10,518 |

|

23,573 |

13,226 |

10,347 |

| |

|

2022 |

|

2021 |

|

2020 |

|

Value, in €m incl. VAT |

|

H1 |

|

FY |

H2 |

H1 |

|

FY |

H2 |

H1 |

| New homes

(France) |

|

1,756 |

|

4,140 |

2,292 |

1,848 |

|

4,281 |

2,389 |

1,892 |

|

Subdivisions |

|

64 |

|

159 |

88 |

71 |

|

131 |

76 |

55 |

|

International |

|

20 |

|

192 |

79 |

113 |

|

156 |

120 |

36 |

|

Total new scope |

|

1,840 |

|

4,491 |

2,459 |

2,032 |

|

4,568 |

2,585 |

1,983 |

|

Reservations carried out directly by Ægide |

|

|

|

175 |

- |

175 |

|

233 |

102 |

131 |

|

Total (in €m incl. VAT) |

|

1,840 |

|

4,666 |

2,459 |

2,207 |

|

4,802 |

2,687 |

2,115 |

Revenue

| |

|

2022 |

|

2021 |

|

2020 |

|

in € million |

|

H1 |

|

FY |

H2 |

H1 |

|

FY |

H2 |

H1 |

|

Development |

|

1,538 |

|

3,771 |

2,094 |

1,678 |

|

3,654 |

2,449 |

1,204 |

| Residential Real

Estate development |

|

1,377 |

|

3,279 |

1,882 |

1,398 |

|

2,759 |

1,858 |

901 |

| Commmercial Real

Estate development |

|

161 |

|

492 |

212 |

280 |

|

895 |

592 |

303 |

|

Services |

|

421 |

|

853 |

468 |

385 |

|

767 |

435 |

333 |

| Property

management |

|

289 |

|

537 |

281 |

256 |

|

503 |

263 |

240 |

|

Distribution |

|

132 |

|

316 |

186 |

130 |

|

265 |

172 |

92 |

|

Other activities |

|

5 |

|

1 |

|

1 |

|

|

|

|

|

Revenue - New scope |

|

1,964 |

|

4,625 |

2,562 |

2,063 |

|

4,421 |

2,884 |

1,537 |

|

Revenue from

disposed

activities* |

|

|

|

211 |

|

211 |

|

434 |

254 |

179 |

|

Revenue |

|

1,964 |

|

4,836 |

2,562 |

2,275 |

|

4,855 |

3,139 |

1,716 |

* Disposed activities are consolidated until 31 Mars 2021 for

Century 21 and until 30 June 2021 for Ægide-Domitys

Current operating profit

| |

|

2022 |

|

2021* |

|

2020* |

|

In € million |

|

H1 |

|

FY |

H2 |

H1 |

|

FY |

H2 |

H1 |

|

Development |

|

86 |

|

330 |

205 |

125 |

|

275 |

213 |

61 |

| Residential Real

Estate development |

|

65 |

|

271 |

191 |

81 |

|

203 |

195 |

8 |

| Commmercial Real

Estate development |

|

21 |

|

59 |

15 |

44 |

|

72 |

19 |

54 |

|

Services |

|

36 |

|

74 |

48 |

26 |

|

41 |

27 |

14 |

| Property

management |

|

23 |

|

37 |

23 |

14 |

|

20 |

12 |

8 |

|

Distribution |

|

13 |

|

37 |

25 |

12 |

|

21 |

15 |

6 |

|

Other activities |

|

(11) |

|

(33) |

(16) |

(18) |

|

(35) |

(26) |

(9) |

|

Current operating profit - New

scope |

|

110 |

|

371 |

238 |

133 |

|

281 |

215 |

66 |

|

Non-current operating

profit |

|

|

|

157 |

116 |

41 |

|

(2) |

14 |

(16) |

|

Operating profit |

|

110 |

|

528 |

353 |

174 |

|

279 |

228 |

50 |

*2020 and 2021 figures have been restated

following the IFRS-IC decision of March 2021 on the costs of

software used in Saas mode Consolidated income statement

- 30 June

2022

|

In € million |

|

30/06/2022IFRS |

|

Restatementof

jointventures |

30/06/2022Operationalreporting |

|

30/06/2021Restated*Operationalreporting New

scope before non-recurring items |

|

Revenue |

|

1,800.2 |

|

163,5 |

1,963.7 |

|

2,063.5 |

| Operating

expenses |

|

(1,623.6) |

|

(1,772.0) |

(1,772.0) |

|

(1,853.4) |

| Dividends

received from equity-accounted investments |

|

2.2 |

|

(2.2) |

- |

|

- |

|

EBITDA |

|

178.8 |

|

12.9 |

191.7 |

|

210.1 |

| Lease

payments |

|

(63.5) |

|

- |

(63.5) |

|

(60.8) |

|

EBITDA after lease payments |

|

115.3 |

|

12.9 |

128.2 |

|

149.3 |

| Restatement of

lease payments |

|

63.5 |

|

- |

63.5 |

|

60.8 |

| Depreciation of

right-of-use assets |

|

(63.0) |

|

0.0 |

(63.0) |

|

(59.3) |

| Depreciation.

amortisation and impairment of non-current assets |

|

(16.6) |

|

(0.0) |

(16.6) |

|

(15.6) |

| Net change in

provisions |

|

4.0 |

|

0.2 |

4.1 |

|

4.1 |

| Share-based

payments |

|

(6.1) |

|

- |

(6.1) |

|

(6.3) |

| Dividends

received from equity-accounted investments |

|

(2.2) |

|

(0.0) |

|

|

- |

|

Current operating profit |

|

94.9 |

|

15.2 |

110.1 |

|

133.0 |

| Capital gains on

disposal |

|

- |

|

- |

- |

|

- |

|

Operating profit |

|

94.9 |

|

15.2 |

110.1 |

|

133.0 |

| Share of net

profit from equity-accounted investments |

|

9.8 |

|

(9.8) |

|

|

- |

|

Operating profit after share of net profit from equity-accounted

investments |

|

104.7 |

|

5.4 |

110.1 |

|

133.0 |

| Cost of net

financial debt |

|

(14.1) |

|

(1.2) |

(15.3) |

|

(22.8) |

| Other financial

income/(expenses) |

|

(2.0) |

|

(0.3) |

(2.2) |

|

(2.4) |

| Interest expense

on lease liabilities |

|

(8.1) |

|

- |

(8.1) |

|

(5.9) |

|

Net financial income/(expense) |

|

(24.2) |

|

(1.4) |

(25.6) |

|

(31.1) |

|

Pre-tax recurring profit |

|

80.5 |

|

4.0 |

84.5 |

|

101.9 |

| Income tax |

|

(20.5) |

|

(4.0) |

(24.4) |

|

(24.2) |

| Share of

profit/(loss) from other equity-accounted investments |

|

(1.0) |

|

- |

(1.0) |

|

(0.9) |

|

Consolidated net profit |

|

59.0 |

|

0.0 |

59.0 |

|

76.7 |

|

Attributable to non-controlling interests |

|

4.9 |

|

- |

4.9 |

|

1.9 |

| |

|

|

|

|

|

|

- |

|

Attributable to equity holders of the parent

company |

|

54.2 |

|

0.0 |

54.2 |

|

74.8 |

| (in euros) |

|

|

|

|

|

|

|

|

Net earnings per share |

|

0.98 |

|

|

0.98 |

|

1.35 |

*2021 figures have been restated following the

IFRS-IC decision of March 2021 on the costs of software used in

Saas mode

Simplified consolidated balance-sheet

- 30 June

2022

|

ASSETS(in € million) |

|

30/06/2022IFRS |

|

Restatementof

jointventures |

|

30/06/2022Operationalreporting |

|

31/12/2021Operationalreporting |

|

Goodwills |

|

1,358.2 |

|

- |

|

1,358.2 |

|

1,356.5 |

| Other

non-current assets |

|

873.8 |

|

0.2 |

|

874.1 |

|

817.7 |

|

Equity-accounted investments |

|

126.8 |

|

(65.3) |

|

61.5 |

|

62.5 |

|

Total non-current assets |

|

2,358.8 |

|

(65.1) |

|

2,293.7 |

|

2,236.7 |

|

Net WCR |

|

1,150.2 |

|

168.2 |

|

1,318.4 |

|

1,118.9 |

|

Total Assets |

|

3,509.0 |

|

103.1 |

|

3,612.1 |

|

3,355.6 |

| |

|

|

|

|

|

|

|

|

|

Liabilities and equity(in € million) |

|

30/06/2022IFRS |

|

Restatementof

jointventures |

|

30/06/2022Operationalreporting |

|

31/12/2021Operationalreporting |

|

Share capital and reserves |

|

1,794.4 |

|

(0.0) |

|

1,794.4 |

|

1,603.6 |

|

Net profit for the period |

|

54.2 |

|

0.0 |

|

54.2 |

|

324.9 |

|

Equity attributable to equity holders of the parent company |

|

1,848.6 |

|

(0.0) |

|

1,848.6 |

|

1,928.6 |

|

Non-controlling interests |

|

24.9 |

|

0.0 |

|

24.9 |

|

19.6 |

|

Total equity |

|

1,873.5 |

|

(0.0) |

|

1,873.5 |

|

1,948.2 |

|

Net debt |

|

1,463.4 |

|

91.0 |

|

1,554.5 |

|

1,223.8 |

|

Provisions |

|

99.0 |

|

1.7 |

|

100.6 |

|

104.2 |

|

Net deferred tax |

|

73.1 |

|

10.4 |

|

83.5 |

|

79.5 |

|

Total Liabilities and equity |

|

3,509.0 |

|

103.1 |

|

3,612.1 |

|

3,355.6 |

Net debt -

30 June 2022

|

(in € million) |

30/06/2022IFRS |

Restatementof

jointventures |

30/06/2022Operationalreporting |

|

31/12/2021Operationalreporting |

| Bond issues

(incl. accrued interest and arrangement fees) |

809.7 |

- |

809.7 |

|

806.3 |

| Loans and

borrowings |

904.1 |

78.2 |

982.3 |

|

955.3 |

|

Loans and borrowings |

1,713.8 |

78.2 |

1,792.0 |

|

1,761.6 |

|

|

|

|

|

|

|

|

Other financial receivables and payables |

(163.3) |

157.5 |

(5.8) |

|

4.7 |

| |

|

|

|

|

|

| Cash and cash

equivalents |

(782.9) |

(164.8) |

(947.7) |

|

(1,204.2) |

|

Bank overdraft facilities |

19.0 |

20.2 |

39.2 |

|

36.2 |

|

Net cash and cash equivalents |

(763.9) |

(144.6) |

(908.5) |

|

(1,168.0) |

|

|

|

|

|

|

|

|

Total net financial debt before lease

liabilities |

786.5 |

91.0 |

877.6 |

|

598.3 |

|

|

|

|

|

|

|

|

Lease liabilities |

676.9 |

- |

676.9 |

|

625.5 |

|

|

|

|

|

|

|

|

Total net debt |

1,463.4 |

91.0 |

1,554.5 |

|

1,223.8 |

Simplified statement of cash flows -

30 June 2022

|

(in € million) |

30/06/2022IFRS(6-month

period) |

Restatementof

jointventures |

30/06/2022Operationalreporting |

|

30/06/2021Operationalreporting

Restated * |

|

Consolidated net profit |

59.0 |

- |

59.0 |

|

283.0 |

| Elimination of

non-cash income and expenses |

72.1 |

9.6 |

81.7 |

|

(123.5) |

|

Cash flow from operating activities after interest and tax

expenses |

131.1 |

9.6 |

140.8 |

|

159.5 |

| Elimination of

net interest expense/(income) |

22.2 |

1.2 |

23.4 |

|

41.4 |

| Elimination of

tax expense, including deferred tax |

20.2 |

4.0 |

24.2 |

|

31.0 |

|

Cash flow from operating activities before interest and tax

expenses |

173.5 |

14.8 |

188.3 |

|

231.9 |

| Repayment of

lease liabilities |

(63.5) |

- |

(63.5) |

|

(116.7) |

|

Cash flow from operating activities after lease payments but before

interestand tax expenses |

110.1 |

14.8 |

124.8 |

|

115.2 |

| Change in

operating working capital |

(200.3) |

4.4 |

(195.9) |

|

(355.2) |

| Dividends

received from equity-accounted investments |

2.2 |

(2.2) |

- |

- |

|

| Interest

paid |

(7.7) |

(1.1) |

(8.8) |

|

(15.5) |

| Tax paid |

(26.2) |

(1.3) |

(27.6) |

|

(50.9) |

|

Net cash from/(used in)

operating activities |

(122.0) |

14.6 |

(107.4) |

|

(306.4) |

| Net cash

from/(used in) net operating investments |

(28.9) |

- |

(28.9) |

|

(22.2) |

|

Free cash flow |

(151.0) |

14.6 |

(136.4) |

|

(328.6) |

| Acquisitions of

subsidiaries and other changes in scope |

(2.8) |

(0.0) |

(2.9) |

|

208.1 |

| Other net

financial investments |

(3.7) |

(0.1) |

(3.8) |

|

(27.4) |

|

Net cash from/(used in)

investing activities |

(6.5) |

(0.1) |

(6.7) |

|

180.7 |

| Dividends paid

to equity holders of the parent company |

(138.1) |

- |

(138.1) |

|

(110.6) |

| Other payments

to/(from) minority shareholders |

0.2 |

- |

0.2 |

|

(6.3) |

| Net

disposal/(acquisition) of treasury shares |

(1.5) |

|

(1.5) |

|

2.0 |

| Change in

financial receivables and payables (net) |

18.3 |

4.5 |

22.8 |

|

(160.8) |

|

Net cash from/(used in)

financing activities |

(121.2) |

4.5 |

(116.6) |

|

(275.8) |

| Impact of

changes in foreign currency exchange rates |

0.2 |

- |

0.2 |

|

0.4 |

|

Change in cash and cash equivalents |

(278.5) |

19.0 |

(259.4) |

|

(423.3) |

*2021 figures have been restated following the

IFRS-IC decision of March 2021 on the costs of software used in

Saas mode

Capital employed

|

In € million |

|

|

|

|

30 June 2022 |

| |

|

Totalexcl. right-of-use

assets |

Totalincl. right-of-use

assets |

|

Non-currentassets |

|

Right-of-useassets |

|

WCR |

|

Goodwill |

| Development |

|

1,274 |

1,322 |

|

59 |

|

48 |

|

1,215 |

|

- |

| Services |

|

163 |

715 |

|

111 |

|

552 |

|

52 |

|

- |

| Other Activities

and not attributable |

|

1,466 |

1,492 |

|

56 |

|

26 |

|

51 |

|

1,358 |

|

Group capital employed |

|

2,903 |

3,529 |

|

226 |

|

626 |

|

1,318 |

|

1,358 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

|

|

|

|

31 December

2021 |

| |

|

Totalexcl. right-of-use

assets |

Totalincl. right-of-use

assets |

|

Non-currentassets |

|

Right-of-useassets |

|

WCR |

|

Goodwill |

| Development |

|

1,086 |

1,135 |

|

33 |

|

49 |

|

1,053 |

|

|

| Services |

|

179 |

678 |

|

104 |

|

499 |

|

75 |

|

|

| Other Activities

and not attributable |

|

1,430 |

1,463 |

|

82 |

|

33 |

|

(9) |

|

1,356 |

|

Group capital employed |

|

2,694 |

3,276 |

|

219 |

|

582 |

|

1,119 |

|

1,356 |

| |

|

|

|

|

|

|

|

|

|

|

|

ANNEX: IFRS

Consolidated income statement -

30 June 2022

|

In € million |

|

30/06/2022IFRS |

|

30/06/2021IFRS

Restated* |

|

Revenue |

|

1,800.2 |

|

2,099.0 |

| Operating

expenses |

|

(1,623.6) |

|

(1,867.1) |

| Dividends

received from equity-accounted investments |

|

2.2 |

|

2.5 |

|

EBITDA |

|

178.8 |

|

234.4 |

| Lease

payments |

|

(63.5) |

|

(116.7) |

|

EBITDA after lease payments |

|

115.3 |

|

117.7 |

| Restatement of

lease payments |

|

63.5 |

|

116.7 |

| Depreciation of

right-of-use assets |

|

(63.0) |

|

(59.4) |

| Depreciation.

amortisation and impairment of non-current assets |

|

(16.6) |

|

(16.0) |

| Net change in

provisions |

|

4.0 |

|

4.9 |

| Share-based

payments |

|

(6.1) |

|

(6.6) |

| Dividends

received from equity-accounted investments |

|

(2.2) |

|

(2.5) |

|

Current operating profit |

|

94.9 |

|

154.8 |

| Capital gains on

disposal |

|

- |

|

184.7 |

|

Operating profit |

|

94.9 |

|

339.5 |

| Share of net

profit from equity-accounted investments |

|

9.8 |

|

13.3 |

|

Operating profit after share of net profit from equity-accounted

investments |

|

104.7 |

|

352.8 |

| Cost of net

financial debt |

|

(14.1) |

|

(24.2) |

| Other financial

income/(expenses) |

|

(2.0) |

|

(2.0) |

| Interest expense

on lease liabilities |

|

(8.1) |

|

(16.3) |

|

Net financial income/(expense) |

|

(24.2) |

|

(42.5) |

|

Pre-tax recurring profit |

|

80.5 |

|

310.3 |

| Income tax |

|

(20.5) |

|

(26.4) |

| Share of

profit/(loss) from other equity-accounted investments |

|

(1.0) |

|

(0.9) |

|

Consolidated net profit |

|

59.0 |

|

283.0 |

|

Attributable to non-controlling interests |

|

4.9 |

|

2.1 |

| |

|

|

|

|

|

Attributable to equity holders of the parent

company |

|

54.2 |

|

280.9 |

| (in euros) |

|

|

|

|

|

Net earnings per share |

|

0.98 |

|

5.07 |

*2021 figures have been restated following the

IFRS-IC decision of March 2021 on the costs of software used in

Saas mode

Simplified consolidated balance-sheet

- 30 June

2022

|

ASSETS(in € million) |

|

30/06/2022IFRS |

|

31/12/2021IFRS |

|

Goodwills |

|

1,358.2 |

|

1,356.5 |

| Other

non-current assets |

|

873.8 |

|

817.6 |

| Equity-accounted

investments |

|

126.8 |

|

124.9 |

|

Total non-current assets |

|

2,358.8 |

|

2,299.0 |

| Net WCR |

|

1,150.2 |

|

943.8 |

|

Total Assets |

|

3,509.0 |

|

3,242.8 |

| |

|

|

|

|

|

Liabilities and equity(in € million) |

|

30/06/2022IFRS |

|

31/12/2021IFRS |

|

Share capital and reserves |

|

1,794.4 |

|

1,603.6 |

|

Net profit for the period |

|

54.2 |

|

324.9 |

|

Equity attributable to equity holders of the parent company |

|

1,848.6 |

|

1,603.6 |

|

Non-controlling interests |

|

24.9 |

|

19.6 |

|

Total equity |

|

1,873.5 |

|

1,948.2 |

| Net debt |

|

1,463.4 |

|

1,122.1 |

| Provisions |

|

99.0 |

|

102.4 |

|

Net deferred tax |

|

73.1 |

|

70.2 |

|

Total Liabilities and equity |

|

3,509.0 |

|

3,242.8 |

Consolidated net debt

- 30 June

2022

|

(in € million) |

|

30/06/2022IFRS |

|

31/12/2021IFRS |

| Bond issues

(incl. accrued interest and arrangement fees) |

|

809.7 |

|

806.3 |

| Loans and

borrowings |

|

904.1 |

|

865.7 |

|

Loans and borrowings |

|

1,713.8 |

|

1,672.0 |

|

|

|

|

|

|

|

Other financial receivables and payables |

|

(163.3) |

|

(133.0) |

| |

|

|

|

|

| Cash and cash

equivalents |

|

(782.9) |

|

(1,061.6) |

|

Bank overdraft facilities |

|

19.0 |

|

19.2 |

|

Net cash and cash equivalents |

|

(763.9) |

|

(1,042.4) |

|

|

|

|

|

|

|

Total net financial debt before lease

liabilities |

|

786.5 |

|

496.6 |

|

|

|

|

|

|

|

Lease liabilities |

|

676.9 |

|

625.5 |

|

|

|

|

|

|

|

Total net debt |

|

1,463.4 |

|

1,122.1 |

Simplified statement of cash flows

- 30 June

2022

|

(in € million) |

30/06/2022IFRS |

|

30/06/2021IFRS

Restated* |

|

Consolidated net profit |

59.0 |

|

283.0 |

| Elimination of

non-cash income and expenses |

72.1 |

|

(136.8) |

|

Cash flow from operating activities after interest and tax

expenses |

131.1 |

|

146.2 |

| Elimination of

net interest expense/(income) |

22.2 |

|

40.5 |

| Elimination of

tax expense, including deferred tax |

20.2 |

|

26.0 |

|

Cash flow from operating activities before interest and tax

expenses |

173.5 |

|

212.7 |

| Repayment of

lease liabilities |

(63.5) |

|

(116.7) |

|

Cash flow from operating activities after lease payments but before

interestand tax expenses |

110.1 |

|

96.0 |

| Change in

operating working capital |

(200.3) |

|

(333.1) |

| Dividends

received from equity-accounted investments |

2.2 |

|

2.5 |

| Interest

paid |

(7.7) |

|

(14.7) |

| Tax paid |

(26.2) |

|

(45.3) |

|

Net cash from/(used in)

operating activities |

(122.0) |

|

(294.7) |

| Net cash

from/(used in) net operating investments |

(28.9) |

|

(22.2) |

|

Free cash flow |

(151.0) |

|

(316.8) |

| Acquisitions of

subsidiaries and other changes in scope |

(2.8) |

|

208.2 |

|

Other net financial investments |

(3.7) |

|

(23.5) |

| Net cash

from/(used in) investing

activities |

(6.5) |

|

184.7 |

| Dividends paid

to equity holders of the parent company |

(138.1) |

|

(110.6) |

| Other payments

to/(from) minority shareholders |

0.2 |

|

(6.3) |

| Net

disposal/(acquisition) of treasury shares |

(1.5) |

|

2.0 |

|

Change in financial receivables and payables (net) |

18.3 |

|

(176.8) |

| Net cash

from/(used in) financing

activities |

(121.2) |

|

(291.8) |

|

Impact of changes in foreign currency exchange rates |

0.2 |

|

0.3 |

|

Change in cash and cash equivalents |

(278.5) |

|

(423.5) |

*2021 figures have been restated following the

IFRS-IC decision of March 2021 on the costs of software used in

Saas mode

GLOSSARY

Business potential: The total

volume of potential business at any given moment, expressed as a

number of units and/or revenue excluding VAT, within future

projects in Residential Real Estate Development (New homes,

Subdivisions and International) as well as Commercial Real Estate

Development, validated by the Group’s Committee, in all structuring

phases, including the projects of the Group’s urban regeneration

business (Villes & Projets); this business potential includes

the Group’s current supply for sale, its future supply (project

phases not yet marketed on purchased land, and projects not yet

launched associated with land secured through options)

Current operating profit:

Includes all operating profit items with the exception of items

resulting from unusual, abnormal and infrequently occurring

transactions. In particular, impairment of goodwill is not included

in current operating profit

Development backlog (or order

book): The Group’s already secured future revenue, expressed in

euros, for its real estate development businesses (Residential Real

Estate Development and Commercial Real Estate Development). The

backlog includes reservations for which notarial deeds of sale have

not yet been signed and the portion of revenue remaining to be

generated on units for which notarial deeds of sale have already

been signed (portion remaining to be built)

EBITDA: Defined by Nexity as

equal to current operating profit before depreciation, amortization

and impairment of non-current assets, net changes in provisions,

share-based payment expenses and the transfer from inventory of

borrowing costs directly attributable to property developments,

plus dividends received from equity-accounted investees whose

operations are an extension of the Group’s business. Depreciation

and amortization include right-of-use assets calculated in

accordance with IFRS 16, together with the impact of neutralising

internal margins on disposal of an asset by development companies,

followed by take-up of a lease by a Group company.

EBITDA after lease payments:

EBITDA net of expenses recorded for lease payments that are

restated to reflect the application of IFRS 16 Leases

Free cash flow: Cash generated

by operating activities after taking into account tax paid,

financial expenses, repayment of lease liabilities, changes in WCR,

dividends received from companies accounted for under the equity

method and net investments in operating assets

Joint ventures: Entities over

whose activities the Group has joint control, established by

contractual agreement. Most joint ventures are property

developments (Residential Real Estate Development and Commercial

Real Estate Development) undertaken with another developer

(co-developments)

Land bank: The amount

corresponding to acquired land development rights for projects in

France carried out before obtaining a building permit or, in some

cases, planning permissions

Net profit before non-recurring

items: Group share of net profit restated for

non-recurring items such as change in fair value adjustments in

respect of the ORNANE bond issue and items included in non-current

operating profit (disposal of significant operations, any goodwill

impairment losses, remeasurement of equity-accounted investments

following the assumption of control)

New scope: Scope of

consolidation excluding the contribution of disposed activities

(Century 21 and Ægide-Domitys) and capital gains. Disposed

activities have been consolidated until 31 March 2021 for Century

21 and until 30 June 2021 for Ægide-Domitys.

Order intake:

Development for Commercial Real Estate: The total

of selling prices excluding VAT as stated in definitive agreements

for Commercial Real Estate Development projects, expressed in euros

for a given period (notarial deeds of sale or development

contracts).

Operational reporting:

According to IFRS but with joint ventures proportionately

consolidated. This presentation is used by management as it better

reflects the economic reality of the Group’s business

activities

Pipeline: sum of backlog and

business potential; could be expressed in months or years of

activity (as the backlog and the business potential) based on the

last 12 months revenue.

Property Management: Management

of residential properties (rentals, brokerage), common areas of

apartment buildings (as managing agent on behalf of condominium

owners), commercial properties, and services provided to users.

Reservations by value: (or

expected revenue from reservations) – Residential Real Estate: The

net total of selling prices including VAT as stated in reservation

agreements for development projects, expressed in euros for a given

period, after deducting all reservations cancelled during the

period.

Revenue: revenue generated by

the development businesses from VEFA off-plan sales and CPI

development contracts is recognised using the

percentage-of-completion method, i.e. on the basis of notarised

sales and pro-rated to reflect the progress of all inventoriable

costs.

Serviced properties: the

Group’s business activities in the management and operation of

student residences as well as flexible workspaces.

Time-to-market: supply for sale

compared to reservations for the last 12 months, expressed in

months, for new home reservations segment in France

1 Objectives for the full year 2022 communicated

last February: a market share of over 14% in a new home market

expected to slightly grow (c.150,000 units) and a current operating

profit of at least €380 million, enabling the operating margin to

be maintained at around 8%.

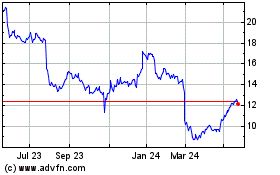

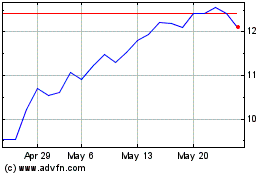

Nexity (EU:NXI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nexity (EU:NXI)

Historical Stock Chart

From Jul 2023 to Jul 2024