PRESS RELEASE: NACON: Strong increase in profitability in 1st half

November 30 2020 - 12:00PM

PRESS RELEASE: NACON: Strong increase in profitability in 1st half

Nacon

Press release

Lesquin, 30 November 2020, 18:00 hrs

Strong increase in profitability in

1st half:

·Current Operating Profit : 15.7

M€ (+47.3%) i.e. 18.2% of

sales

·Net Result: 9.6 M€

(+46.7%)

Outlook: New Upward revision of FY

2020/21 sales: 160-170 M€

NACON (ISIN FR0013482791) today releases its

audited consolidated results for the first half of fiscal year

2020/21 (from April 1 to September 30) as approved by its Board of

directors on 30 November 2020.

|

Consolidated in M€ - IFRS |

09/2020 |

09/2019 (3) |

Change |

|

Sales |

86.6 |

63.7 |

+35.9% |

|

Gross margin (1) In % of Sales

EBITDA (2) In % of

Sales |

45.352.3%

30.435.1% |

39.261.5%

23.537.0% |

+15.5%

+29.2% |

|

Current operating income EBITA

In % of Sales Non recurrent items

(including Bonus Shares) |

15.718.2%

(1.8) |

10.716.8%

(1.0) |

+47.3% |

|

Operating result In % of

Sales |

13.916.1% |

9.715.2% |

+43.3% |

|

Financial result Including currency gain (loss) |

(0.8) |

(0.5) |

|

|

Earnings before tax

In % of Sales |

13.115.2% |

9.314.5% |

+41.8% |

|

Tax |

(3.6) |

(2.7) |

|

|

Net result for the period In % of

Sales |

9.611.1% |

6.510.2% |

+46.7%

|

|

|

|

|

|

(1)

Gross Margin = Sales - Cost of goods sold;

(2)

EBITDA = Current Operating Income before depreciation and

amortization of tangible and intangible

assets (3)

The partial asset contribution of the Gaming

business to Nacon by Bigben Interactive was carried out with an

accounting effect as of October 1, 2019. Assets and liabilities

contributed were recognized at their carrying amount. In order to

ensure the comparability of financial statements, comparative data

is taken from the "combined financial statements", which take into

account financial flows as well as income statement and balance

sheet items related to the Gaming business prepared from the

accounting books of Bigben Interactive and its Gaming subsidiaries.

These financial flows include acquisitions of studios from the date

of acquisition.

Current Operating Income rate in line

with the 18% annual target.

In the first half of FY 2020/21 (1 April to 30

September 2020), Nacon posted 86.8 M€ sales, up 35.9% when compared

with the first half of the previous financial year. Half-year

business was boosted by the momentum of Gaming accessories, in

particular RIGTM premium headsets and official controllers for

PlayStation®4 consoles and by strong growth in sales of the games

back catalogue.

Against this backdrop of significant sales

growth, the reduction in external expenses and the controlled

increase in personnel costs enabled Nacon to generate a 47.3%

increase in Current Operating Income (COI) to 15.7 M€. It now

represents 18.2% of sales, in line with the announced target for

the full financial year 2020/21.

Net result for the period was 9.6 M€ after

taking into account 1.8 M€ expenses related to bonus share plans,

0.8 M€ net financial expenses and 3.6 M€ income tax,

Positive free cashflow of 8.2 M€ for the

first half of the year.

At 30 September 2020, operating cashflow rose

sharply to 34.1 M€, enabling the Group to self-finance all the

CAPEX (25.9 M€) and to generate a 8.2 M€ free cashflow.

Notwithstanding a 5 M€ increase in capital

expenditure and bank loan repayments, net cash after deduction of

65.3 M€ financial debt, amounted to 50.7 M€ at 30 September 2020,

compared with 42.8 M€ at end-March 2020.

Outlook : FY 2020/21 sales revised

upward

Nacon anticipates an ongoing sales momentum in

the 2nd half of FY 2020/2021 (from 1 October 2020 to 31 March 2021)

thanks to :

- favourable markets now benefiting from two generations of

consoles (Current Gen PS®4 / XB1 and Next Gen PS®5 / Xbox Series

X|S) on which Nacon will simultaneously develop almost all of its

future productions;

- the growth in digital sales and the release of Next Gen

versions of WRC® 9, Tennis World Tour® 2, and Hunting Simulator® 2,

as well as the launch of five new games (Warhammer: Chaosbane®,

Monster Truck Championship, Blood Bowl 3, Handball 21, Werewolf:

the Apocalypse® - Earthblood, Rogue Lords);

- the order book for headsets placed by American retailers for

the Christmas season,

- the release of the Revolution X and Pro Compact controller

range for the new Microsoft console and a special MG-X Series range

for cloud gaming.

Banking on these favourable trends, Nacon

announces a further upward revision of its FY 2020/2021 sales

target now ranging between 160 M€ and 170 M€ (vs. 129.4 M€ at 31

March 2020), while confirming a 18% COI rate for this financial

year. Nacon also reiterates its financial targets for FY 2022/23

with sales between 180 M€ and 200 M€ and a COI rate exceeding

20%.

Next publication:

Q3 2020/21 sales: 25 January

2021, Press release after close of the Paris stock exchange

|

ABOUT NACON

|

|

2019-20 ANNUAL SALES129.4 M€

HEADCOUNTOver 550 employees

INTERNATIONAL16 subsidiaries and a distribution

network across 100

countrieshttps://corporate.nacongaming.com/ |

NACON is a company of the BIGBEN Group founded in 2019 to

optimize its know-how through strong synergies in the video game

market. By bringing together its 9 development studios, the

publishing of AA video games, the design and distribution of

premium gaming devices, NACON focuses 30 years of expertise at the

service of players. This new unified business unit strengthens

NACON's position in the market, enables it to innovate by creating

new unique competitive advantages. Company listed on

Euronext Paris, compartment B ISIN : FR0013482791 ;

Reuters : NACON.PA ; Bloomberg : NACON:FP

PRESS CONTACTCap Value – Gilles Broquelet

gbroquelet@capvalue.fr - +33 1 80 81 50 01 |

- CP_NACON_RS_2020_21_def ENG

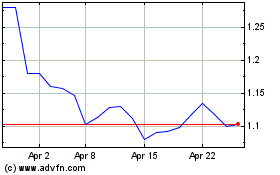

Nacon (EU:NACON)

Historical Stock Chart

From Oct 2024 to Nov 2024

Nacon (EU:NACON)

Historical Stock Chart

From Nov 2023 to Nov 2024