CNOVA N.V. First Quarter 2017 Activity

April 13 2017 - 1:40AM

CNOVA

N.V.

First Quarter 2017 Activity

Amsterdam - April 13, 2017, 07:45

CEST - Cnova N.V. (Euronext Paris: CNV; ISIN: NL0010949392)

("Cnova" or the "Company") today announced unaudited gross

merchandise value (GMV), net sales and other operating data for the

quarter ended March 31, 2017.

-

Gross merchandise volume

(GMV): €770 million (+8% like-for-like[1])

-

Including an impact of -2.0 pts from TV category

(shift to DTT[2] in

2016)

-

Marketplace share at 32.0% (+267 bp)

-

+10% of GMV growth over the last eight

weeks[3]

-

Net sales: €472 million (+4%

like-for-like)

-

Strong traffic growth: 234

million visits (+11%)

-

Cdiscount ranks 2nd best among

French retailers in number of social networks'

interactions[5]

-

Active customers: 8.3 million

(+10%)

-

Number of items sold: 12.5

million (+12%)

Emmanuel Grenier, Cnova CEO, commented:

"Cdiscount's

volume of activity has been and continues to run at a double-digit

rate over the last two months after a disappointing start to the

year. Our customer loyalty program, Cdiscount à volonté, continues

to double in size and is driving growth of repeat business. The

quality of our marketplace vendors has steadily increased and is

accompanied by an improving profitability profile. While the

mobile share of traffic closes in on 60%, we are seeing

double-digit growth in traffic, orders and number of active

customers. And our high margin home furnishings and appliances

product categories now account for half of net sales.

Looking forward,

we have our eyes firmly fixed on increasing the flow of traffic to

our site and further monetizing that flow through the offering of

expanded product categories with existing and new services. Beyond

our multi-media, mobile telephone and cloud storage offers, we are

planning on introducing a variety of home and financial services in

the 2nd quarter. We

have expanded the total floor space we currently have in France and

expect to continue to do so in order to: one, increase inventory

diversity and size; two, better accommodate the success of our

marketplace fulfillment offer; and three, continue to bring our

products closer to our clients in our pursuit of 24/7 overnight

delivery.

In a highly

competitive French market, Cdiscount's longstanding leading

positions in terms of pricing, customer financing and quick

delivery are proving to be key competitive advantages that continue

to attract new customers."

[1] Like-for-like: includes

adjustments related to i) the sale or closure in 2016 of the

specialty sites Comptoir des Parfums, Comptoir Santé and

MonCornerDéco, ii) the voluntary pullback of B2B sales initiated in

the 3rd quarter

of 2016 and iii) the additional day (February 29) in 2016.

[2] DTT:

Digital Terrestrial Television, known as TNT in France.

[3] Commercial

trend over the last eight weeks up to April 11, based on placed B2C

GMV.

[4] Average

unique monthly visitors on desktop site in January and February

2017, based on Médiamétrie studies.

[5] According

to Sprinklr survey published in February 2017, based on the number

of like, share and comments on social networks

1st Quarter 2017

Highlights

Gross merchandise

volume (GMV) totaled €770 million, an increase of 7.7% versus

2016 on a like-for-like (l-f-l) basis (please see Footnote 1 page

1). On a reported basis, GMV rose 5.2% compared to 2016. After a

slow start in January, order volume progressed throughout the

quarter, reaching a run rate of +12% in March. This trend has

continued in early April with a placed B2C merchandise volume

growth of 10% over the last eight weeks to April 11.

Excluding TV products, which

benefited from the mandatory shift to Digital Terrestrial

Television (DTT or TNT) in the 1st quarter

2016, GMV increased by 9.7% on a yearly basis.

This progression is explained

by:

-

Growing traffic: increase

of 11.4% year-on-year (y-o-y), driven by a growing mobile share: +633 basis points to 57% in the quarter.

Mobile visits rose by 25%, and the mobile conversion rate increased

by more than 20 basis points on a yearly basis. Average unique

monthly desktop visitors increased by 8.0% y-o-y in January and

February 2017 up to 12.2 million, making Cdiscount.com the most

dynamic website among the five main e-retailers in France,

according to Médiamétrie. This enables Cdiscount to consolidate its

#2 position in unique monthly visitors. This same metric for mobile

unique monthly visitors stands at 6.5 million over the same

period;

-

Solid increase in orders

and number of items sold: y-o-y increases of

13.6% and 11.7%, respectively;

-

Expanding marketplace share

of total GMV: increase to 32.0% (+267 basis points y-o-y) due to:

i) good performance of home, personal goods such as toys and video

games, and hi-tech categories, ii) increase in the number of

marketplace product offerings by 38% y-o-y, iii) continuous

improvement in the quality of marketplace vendors in terms of

customer service levels, aided by the development of Cdiscount

fulfillment services to vendors - the share of marketplace GMV

fulfilled by Cdiscount rose from 5% in March 2016 to 10% in March

2017;

-

Growing number of active

customers: y-o-y increase of 10.4% to 8.3 million at the end of

the quarter. Membership of Cdiscount à volonté

(CDAV), Cdiscount's loyalty program whose members purchase at a

higher frequency than non-CDAV customers, increased by 116%

compared to March 2016.

Cdiscount has continued to

strongly develop its presence on social

networks. Its "fan base" on Facebook has

significantly increased between end March 2016 and end March 2017,

from 1.2 million to 1.4 million members. According to Sprinklr

(survey published in February 2017), Cdiscount ranks second among

62 French retail players in terms of number of interactions on

social networks (like, share, comment).

Net sales

totaled €472 million in the 1st quarter

2017, up 4.0% on a l-f-l basis compared to the same period in 2016

(+1.4% on a reported basis). Home furnishings and household

appliances accounted for 50% of direct sales, while hi-tech items

(AV and smartphones) and IT goods represented 36% of direct sales.

Marketplace commissions increased by 23% y-o-y.

Customer and

Marketplace offer and service enhancements during the

1st quarter 2017

centered on improvement of existing and development of new services

and growth of assortment, including:

-

The opening of a new 12,000 sqm distribution

center in the middle of France (Orléans) with a planned

2nd quarter 2017

expansion to at least 40,000 sqm,

-

Further upgrade of logistics enhancements: new

warehouse management IT system (Manhattan) allows for shortened

delivery times and increased order processing capacity,

-

Launch of inventory expansion program and

accompanying state-of-the-art logistics network, focusing on home

furnishing and interior, appliances, gardening and tools product

categories, to meet growing client demand,

-

Ramp-up of improved marketplace quality with

increased profitability:

-

Marketplace vendors meeting higher quality

standards put in place in 2016,

-

Launch of premium marketplace offer

(advantageous visibility, access to additional consumer financing

options, data analysis, etc.),

-

New marketplace vendor services under

development to further enhance profitability: access to new

financial services, enhanced fulfillment packages, etc.

-

Planned 2nd quarter

launch of new home and financial services.

First Quarter 2017

Activity

| Cnova N.V. |

First

Quarter(1) |

Change |

| 2017 |

2016 |

Reported(1) |

L-F-L(2) |

| GMV(3)

(€ millions) |

770.4 |

732.4 |

+5.2% |

+7.7% |

| Marketplace

share |

32.0% |

29.3% |

+267 bp |

|

| Net sales (€ millions) |

472.0 |

465.3 |

+1.4% |

+4.0% |

| Traffic (visits in

millions) |

233.8 |

209.9 |

+11.4% |

|

| Mobile

share |

56.9% |

50.6% |

+633 bp |

|

| Active customers(4)

(millions) |

8.3 |

7.5 |

+10.4% |

|

| Number of items sold (millions) |

12.5 |

11.2 |

+11.7% |

|

| Orders(5)

(millions) |

6.5 |

5.7 |

+13.6% |

|

-

All figures are unaudited and

have been adjusted as of January 1, 2015, to reflect i) the merger

of Cnova Brazil into Via Varejo on October 31, 2016, ii) the sale

or closure of Cdiscount's international sites, and iii) the sale of

the specialty site MonShowroom. These activities are reported as

discontinued.

-

Like-for-like: includes

adjustments related to i) the sale or closure in 2016 of the

specialty sites Comptoir des Parfums, Comptoir Santé and

MonCornerDéco, ii) the voluntary pullback of B2B sales initiated in

the 3rd quarter of

2016 and iii) the additional day (February 29) in 2016.

-

Gross Merchandise Volume (GMV)

is defined as product sales + other revenues + marketplace business

volumes (calculated based on approved and sent orders) including

taxes.

-

Active customers at the end of

March having purchased at least once through cdiscount.com during

the previous 12 months.

-

Total placed orders before

cancellation due to fraud detection and/or customer

non-payment.

***

About Cnova

N.V.

Cnova N.V., one of the leading

e-Commerce companies in France, serves 8.3 million active customers

via its state-of-the-art website, Cdiscount. Cnova N.V.'s product

offering of more than 22 million items provides its clients with a

wide variety of very competitively priced goods, several fast and

customer-convenient delivery options as well as practical payment

solutions. Cnova N.V. is part of Groupe Casino, a global

diversified retailer. Cnova N.V.'s news releases are available at

www.cnova.com. Information available on, or accessible through, the

sites referenced above is not part of this press release.

This press release contains

regulated information (gereglementeerde informatie) within the

meaning of the Dutch Financial Supervision Act (Wet op het

financieel toezicht) which must be made publicly available pursuant

to Dutch and French law. This press release is intended for

information purposes only.

***

Cnova Investor Relations Contact:

investor@cnova.com

Tel: +31 20 795 06 71 |

Media contact:

directiondelacommunication@cnovagroup.com

Tel: +31 20 795 06 76 |

PR Sales release 1Q17

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Cnova N.V. via Globenewswire

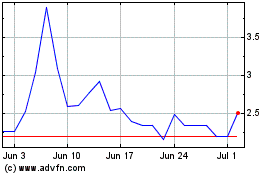

Cnova NV (EU:CNV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cnova NV (EU:CNV)

Historical Stock Chart

From Jul 2023 to Jul 2024