Azerion publishes interim Q3 2023 results

Platform growth and improved efficiency driving

profitability growth of +48% YoY

Highlights of Q3 2023

- Net revenue of approximately € 108.5 million,

up +2.8% from approximately € 105.5 million

Q3 2022 mainly driven by Platform growth, particularly in

advertising revenue from Direct sales, and the integration of

previous acquisitions.

- Adjusted EBITDA of approximately € 18.3

million, up +48% from approximately € 12.4 million

in Q3 2022 due to improved margins due to increased Platform

revenue and contribution from Direct sales, continued integration

of previous acquisitions and ongoing cost optimisation.

- Platform segment Adjusted EBITDA of

approximately € 13.5 million, an increase of +88%

compared to €7.2 million in Q3 2022, reflecting improved

margins due to increased Platform revenue and contribution from

Direct sales, continued integration of previous acquisitions and

ongoing cost optimisation.

- On track to deliver expected annualized cost savings of

at least € 20 million, excluding any effects from foreign

exchange. The expected savings are compared to the January 2023

baseline.

- Completed the sale of the social card games

portfolio for an initial cash consideration of € 81.3 million,

subject to customary adjustments, with an earnout based on the

performance of the acquired business that could take the total

consideration up to a maximum of € 150 million.

- Signed 58 new publishers to expand Azerion’s

supply footprint across Europe and Americas and 3 new

Direct Demand Side Platforms creating new revenue

opportunities for our publisher partners.

- In October, completed the refinancing of the

Company’s outstanding € 200 million bonds with a new issuance of

senior secured callable floating rate bonds for a nominal amount of

€ 165 million.

- In October, completed the acquisition of Hawk,

a demand side advertising technology platform that provides

advertisers and agencies with easy access to large audiences in

growth formats such as digital out of home, audio and connected TV

through a single, multi-channel buying platform.

Highlights YTD Q3 2023

- Net revenue of approximately € 343.2 million YTD Q3 2023, up

+13% from approximately € 303.8 million YTD Q3

2022 mainly driven by Platform growth, particularly in advertising

revenue from Direct sales, and the integration of previous

acquisitions.

- Adjusted EBITDA of approximately € 45.5 million YTD Q3 2023, up

+52% from approximately € 30.0 million YTD Q3 2022

reflecting improved margins due to increased Platform revenue and

contribution from Direct sales, continued integration of previous

acquisitions and ongoing cost optimisation.

Selected KPIs

Financial results - Azerion Group N.V. - Q3 2023

in millions of €

|

|

Q3 2023 |

Q3 2022 |

|

|

|

|

Net revenue |

Operating profit /

(loss)1) |

Adjusted EBITDA |

Net revenue |

Operating profit / (loss) |

Adjusted EBITDA |

Net revenue growth |

Adjusted EBITDA growth |

|

Group |

108.5 |

77.3 |

18.3 |

105.5 |

0.2 |

12.4 |

2.8% |

47.6% |

|

Platform |

90.8 |

4.0 |

13.5 |

84.2 |

(0.4) |

7.2 |

7.8% |

87.5% |

|

Premium Games |

17.7 |

73.3 |

4.8 |

21.3 |

1.7 |

5.2 |

(16.9)% |

(7.7)% |

|

of which social card games portfolio |

6.7 |

74.7 |

2.1 |

9.3 |

3.2 |

3.7 |

|

|

|

Other |

- |

- |

- |

- |

(1.1) |

- |

|

|

1) The operating profit of the Group, Premium Games and social

card games portfolio includes the net gain from the sale of the

social card games portfolio for € 72.6 million.

Financial results - Azerion Group N.V. - YTD 2023

in millions of €

|

|

YTD 2023 |

YTD 2022 |

|

|

|

|

Net revenue |

Operating profit /

(loss)1) |

Adjusted EBITDA |

Net revenue |

Operating profit / (loss) |

Adjusted EBITDA |

Net revenue growth |

Adjusted EBITDA growth |

|

Group |

343.2 |

66.7 |

45.5 |

303.8 |

(147.8) |

30.0 |

13.0% |

51.7% |

|

Platform |

279.7 |

(7.6) |

30.4 |

238.8 |

(14.8) |

17.1 |

17.1% |

77.8% |

|

Premium Games |

63.5 |

74.3 |

15.1 |

65.0 |

1.1 |

12.9 |

(2.3)% |

17.1% |

|

of which social card games portfolio |

28.3 |

80.6 |

9.7 |

26.9 |

7.6 |

9.1 |

|

|

|

Other |

- |

- |

- |

- |

(134.1) |

- |

|

|

1) The operating profit of the Group, Premium Games and social

card games portfolio includes the net gain from the sale of the

social card games portfolio for € 72.6 million.

Message from the CEO

"We are pleased with the relative resilience of our business

model to the market conditions during Q3 and in particular the

growth in our Platform revenue and increased contribution from our

Direct sales teams. We continue to see the benefits of our ongoing

consolidation and integration projects reflected in our improving

Adjusted EBITDA margins. The recent acquisition of Hawk will help

us to integrate and consolidate even further, while expanding our

services in channels such as audio, digital out of home, drive to

store and connected TV.

For the full year 2023, we continue to expect Adjusted EBITDA to

be at least € 75 million, with Net Revenue for the year now

expected to be around € 520 million, reflecting recent market

conditions.

Having focused on integration and cost optimisation for the

first three quarters of the year, the market conditions are

presenting increasingly attractive opportunities to further grow

our business through partnerships and strategic

investments.’’

- Umut Akpinar

Financial overview

Net revenue

Net revenue for the quarter amounted to € 108.5 million compared

to € 105.5 million in Q3 2022, an increase of approximately 2.8%.

The increase in Net Revenue year on year came from growth in the

Platform segment of approximately € 6.6 million, particularly in

advertising revenue from Direct sales and the integration of

previous acquisitions, offset by a reduction in Net Revenue in

Premium Games between the same periods of approximately € 3.6

million, largely due to the completed sale of the social card games

portfolio during Q3 2023.

Net revenue YTD Q3 2023 amounted to € 343.2 million compared to

€ 303.8 million in YTD Q3 2022, an increase of approximately 13.0%,

mainly due to growth in the Platform segment between the same

periods of approximately € 41 million, particularly in advertising

revenue from Direct sales and the integration of previous

acquisitions.

Earnings

The operating profit for the quarter amounted to € 77.3 million,

compared to a profit of € 0.2 million in Q3 2022 mainly explained

by gain on the sale of the social card games portfolio completed on

28 August 2023 of € 72.6 million.

Adjusted EBITDA was € 18.3 million for the quarter compared

to € 12.4 million in Q3 2022, an increase of approximately 47.6%

due to increased Net revenue from the Platform segment at higher

margins driven by increased contribution to advertising revenue

from Direct sales, continued integration of previous acquisitions

and ongoing cost optimisation, and notwithstanding the loss of

earnings due to the sale of the social card games portfolio

completed on and as from 28 August 2023.

The operating profit YTD Q3 2023 amounted to € 66.7 million,

compared to a loss of € 147.8 million YTD Q3 2022 mainly explained

by the gain on the sale of the social card games portfolio

completed on 28 August 2023 of €72.6 million and the €144.8 million

of De-SPAC related expenses incurred in 2022, but not present in

2023.

Adjusted EBITDA was € 45.5 million YTD Q3 2023 compared to €

30.0 million YTD Q3 2022, an increase of approximately 51.7%, due

to increased revenue from Platform business at higher margins

coupled with efficiencies from cost optimisation and the

integration and consolidation of previously acquired

businesses.

Cash flow

Cash flow from operating activities in Q3 2023 was an outflow of

approximately € (15.8) million, mainly due to movements in net

working capital, reflecting a decrease in trade and other payables

of € (18.0) million and increase in trade and other receivables of

€ (5.1) million. Cash flow from investing activities for the period

was an inflow of € 46.9 million, mainly due to the net proceeds

from the sale of the social card game portfolio € 66.0 million,

offset in part by payments for intangibles of € (7.6) million and

deferred payments and earn-outs relating to past acquisitions of €

(8.1) million. Cash flow from financing activities in the period

amounted to an outflow of € (4.0) million, mainly relating to early

cancellation and payments relating to lease liabilities.

Cash flow from operating activities in YTD Q3 2023 was an inflow

of € 18.9 million, mainly due to movements in net working capital,

reflecting a decrease in trade and other receivables of € 18.6

million and a decrease in trade and other payables of € (10.2)

million. Cash flow from investing activities was an inflow of € 9.3

million, mainly due to € 66.0 million of proceeds from the sale of

the social card games portfolio offset in part by payments for

intangibles of € (19.6) million and deferred payments and earn-outs

relating to past acquisitions of € (33.1) million. Cash flow from

financing activities totalled an outflow of € (10.0) million,

mainly relating to repayment of external borrowings, early

cancellation of and payments relating to lease liabilities.

Capex

Azerion capitalizes development costs related to internal

development of assets, a core activity to support innovation in its

platform. These costs primarily relate to developers’ time devoted

to the development of games, platforms, and other new features. In

Q3 2023 Azerion capitalized € 3.9 million, equivalent to 16.1%

(2022: 16.9%) of gross personnel costs excluding restructuring

provision expense. For YTD Q3 2023 Azerion capitalized € 14.1

million, equivalent to 17.5% (2022: 16.6%) of gross personnel costs

excluding restructuring provision expense.

Financial position and financing

Net interest bearing debt*) amounted to € 152.3 million as of 30

September 2023, mainly comprising the outstanding bond loan with a

nominal value of € 200 million (part of a total € 300 million

framework), which became a current borrowing as at April 2023 and

lease liabilities with a balance of € 14.7 million less the cash

and cash equivalents position of € 69.2 million.

*) As defined in the Terms & Conditions of the Senior

Secured Callable Floating Rate Bonds ISIN: NO0013017657. Please

also refer to the Definitions section and the notes of this Interim

Report for more information.

Platform Segment

Our Platform segment includes our digital advertising

activities, e-commerce, the operation and distribution of casual

games and Fanzone. It generates Net revenue mainly by displaying

digital advertisements in both game and general content, as well as

selling and distributing AAA games through our e-commerce channels.

Advertisers are serviced through two models: i) Direct sales, which

involve a direct engagement between Azerion’s commercial teams and

advertisers or their agencies in the placement of digital

advertisements, and ii) Automated auction sales in which

advertising inventory is purchased through real-time auctions.

Platform is also integrated with parts of our Premium Games

segment, leveraging inter-segment synergies.

Platform – Selected Financial KPIs

Financial results - Platform

in millions of €

|

|

Q3 |

Q3 |

YTD |

YTD |

|

|

2023 |

2022 |

2023 |

2022 |

|

Net revenue |

90.8 |

84.2 |

279.7 |

238.8 |

|

Operating profit / (loss) |

4.0 |

(0.4) |

(7.6) |

(14.8) |

|

Adjusted EBITDA |

13.5 |

7.2 |

30.4 |

17.1 |

|

Net revenue growth % |

7.8% |

|

17.1% |

|

|

Adjusted EBITDA growth % |

87.5% |

|

77.8% |

|

|

Adjusted EBITDA margin % |

14.9% |

8.6% |

10.9% |

7.2% |

Net revenue of € 90.8 million in Q3 2023, compared to € 84.2

million in Q3 2022, an increase of 7.8%, driven by increased

contribution from Direct sales, integration of past acquisitions

and global sales teams, combined with the roll out of new ad

formats on the Platform. In Q3 2023, Azerion’s Direct sales teams

contributed approximately 65% of Platform advertising Net revenue,

with the balance provided by automated auction sales, as compared

to approximately 55% in Q3 2022.

Net revenue of € 279.7 million for YTD Q3 2023 , compared to €

238.8 million YTD Q3 2022, an increase of 17.1%, similarly driven

by increased contribution from Direct sales, integration and

consolidation of past acquisitions and global sales teams, combined

with the roll out of new ad formats on the Platform.

Adjusted EBITDA of € 13.5 million in Q3 2023, compared to € 7.2

million in Q3 2022, an increase of 88% due to growth in higher

margin Direct sales, improved spend on higher-impact ads in

channels such as audio, connected TV and digital out of home,

increased monetisation of exclusive partnerships and owned and

operated content, together with ongoing consolidation and

integration of previously acquired businesses and cost

optimisation.

Adjusted EBITDA of € 30.4 million for YTD Q3 2023, compared to €

17.1 million for YTD Q3 2022, an increase of more than 78%, mainly

as a result of higher margin sales mix and ongoing consolidation

and integration of previously acquired businesses and cost

optimisation.

Selected business initiatives in Q3 2023

include:

- Successfully consolidated previous acquisitions in the US to

create Azerion US.

- Azerion Fanzone progressing well with 4 new club partners added

in Q3, taking Fanzone’s total club partnerships to 21.

- Launched ’Join the Planet,’ an initiative promoting

environmental awareness through gaming and VR experiences through

collaboration with Verse Estate.

- Partnership with Dag en Nacht Media on programmatic

advertising.

- Collaboration with Flashtalking by Mediaocean to bring dynamic

creative to high-impact, video and gaming formats.

- Azerion JAPAC, Lifesight, and New Balance collaborate on

innovative in-game advertising campaign.

Advertising - Selected Operational KPIs

Advertising - Operational KPIs

|

|

Q3 2022 |

Q4 2022 |

Q1 2023 |

Q2 2023 |

Q3 2023 |

|

Avg. Digital Ads Sold per Month (bn) |

9.6 |

10.7 |

12.2 |

13.0 |

12.2 |

|

Advertising auction platform (bn) |

4.3 |

5.4 |

5.1 |

6.1 |

5.4 |

|

Publisher monetisation services (bn) |

5.3 |

5.3 |

7.1 |

6.9 |

6.8 |

|

Avg. Gross Revenue per Million Processed Ad Requests from

advertising auction platform (€) |

23.9 |

32.8 |

30.0 |

36.3 |

30.4 |

|

Previous reported figures (€) |

11.2 |

16.7 |

11.2 |

15.5 |

13.4 |

|

Additional formats (€) |

12.7 |

16.1 |

18.8 |

20.8 |

17.0 |

The Average Digital Ads Sold per Month (bn)

increased to 12.2 billion from 9.6 billion in Q3 2022, reflecting

the growth of the Platform business through increased ad format

offerings and the integration of previous acquisitions. As of Q1

2023 the reported number of average digital ads sold per month

include the following previous acquisitions: Adplay, Adverline,

Monolith, Hybrid Theory, MMedia, Takerate, Targetspot and

Vlyby.

The Average Gross Revenue per Million Processed Ad

Requests was € 30.4 in Q3 2023, compared to € 23.9 in Q3

2022, demonstrating our ability to grow and manage the advertising

auction platform efficiently and profitably whilst providing an

attractive proposition for advertisers and publishers. New ad

formats integrated into the platform have also contributed to

higher margins.

Previously reported figures of Average Gross Revenue per Million

Processed Ad Requests (€) were of advertising auction platform

Improve Digital. Additional ad formats: Headerlift, Pubgalaxy,

Sublime, Inskin, Strossle, Keymobile, Delta Projects, Admoove and

Quantum have been included from Q1 2022, Infinia was included in

figures as of Q3 2022 and Madvertise as of Q3 2022. Additional new

ad formats have been included as of Q1 2023, these include Adplay,

Adverline, Monolith, Hybrid Theory, MMedia, Takerate, Targetspot

and Vlyby. In Q4 2022, the Average gross revenue per million ad

requests was revised to exclude ad requests that are rejected

before entering our advertising auction platform.

Premium Games Segment

Up until 28 August 2023, the Premium Games segment included

social card and casino games, as well as metaverse games. Azerion

completed the sale of its social card games portfolio to Playtika

Holding Corp. on 28 August 2023 and its contribution to the Premium

Games segment ceased at that date. The segment generates revenue

mainly by offering users the ability to make in-game purchases for

extra features and virtual goods to enhance their gameplay

experience. This segment aims to stimulate social interaction among

players and build communities, offering an extended value

proposition to advertisers and generating cross-selling

opportunities with the Platform segment.

Premium Games – Selected Financial KPIs

Financial results - Premium Games

in millions of €

|

|

Q3 |

Q3 |

YTD |

YTD |

|

|

2023 |

2022 |

2023 |

2022 |

|

Net revenue |

17.7 |

21.3 |

63.5 |

65.0 |

|

of which social card games portfolio |

6.7 |

9.3 |

28.3 |

26.9 |

|

Operating profit / (loss)1) |

73.3 |

1.7 |

74.3 |

1.1 |

|

of which social card games portfolio1) |

74.7 |

3.2 |

80.6 |

7.6 |

|

Adjusted EBITDA |

4.8 |

5.2 |

15.1 |

12.9 |

|

of which social card games portfolio |

2.1 |

3.7 |

9.7 |

9.1 |

|

Net revenue growth % |

(16.9)% |

|

(2.3)% |

|

|

Adjusted EBITDA growth % |

(7.7)% |

|

17.1% |

|

|

Adjusted EBITDA margin % |

27.1% |

24.4% |

23.8% |

19.8% |

1) The operating profit of Premium Games and social card games

portfolio includes the net gain from the sale of the social card

games portfolio for € 72.6 million.

Premium Games

Net revenue of € 17.7 million in Q3 2023, as compared to € 21.3

million in Q3 2022, a decrease of (16.9)%, mainly due to the

revenue loss in September resulting from the sale of our social

card games portfolio. The Net revenue of the remaining Premium

Games titles across our social casino and metaverse portfolios was

€ 11.0 million in Q3 2023, as compared to € 12.0 million in Q3

2022, a decrease of (8.3)% mainly driven by lower revenue in our

metaverse environments.

Net revenue of € 63.5 million for YTD Q3 2023, as compared to €

65.0 million for YTD Q3 2022, a decrease of (2.3)% predominantly

due to the loss of revenue in September from the sale of our social

card games portfolio. The Net revenue for YTD Q3 2023 of the

remaining Premium Games titles across our social casino and

metaverse portfolios was € 35.2 million, as compared to € 38.1

million for YTD Q3 2022, a decrease of (7.6)% mainly driven by

lower revenue in our metaverse environments.

Adjusted EBITDA of € 4.8 million in Q3 2023, as compared to €

5.2 million in Q3 2022, a decrease of (7.7)%, mainly due to the

contribution lost in September from the sale of the social card

games portfolio. The Adjusted EBITDA of the remaining Premium Games

titles across our social casino and metaverse portfolios was € 2.7

million in Q3 2023, as compared to € 1.5 million in Q3 2022, an

increase of approximately 80% mainly driven by improved performance

in the social casino portfolio and cost optimisation across the

segment.

Adjusted EBITDA of € 15.1 million for YTD Q3 2023, as compared

to € 12.9 million for YTD Q3 2022, an increase of 17.1% mainly due

to improved performance in both the social cards and social casino

portfolios and cost optimisation across the segment, more than

offsetting the contribution lost in September from the sale of our

social card games portfolio. The Adjusted EBITDA for YTD Q3 2023 of

the remaining Premium Games titles across our social casino and

metaverse portfolios was € 5.4 million, as compared to € 3.8

million for YTD Q3 2022, an increase of approximately 42% mainly

driven by improved performance in the social casino portfolio and

cost optimisation across the segment.

Premium Games – Selected Operational KPIs

Premium Games - Operational KPIs

|

|

Q3 2022 |

Q4 2022 |

Q1 2023 |

Q2 2023 |

Q3 2023 |

|

Avg. Time in Game per Day (min) |

80 |

79 |

84 |

84 |

79 |

|

Avg. DAUs (thousands) |

556 |

559 |

601 |

558 |

454 |

|

Avg. ARPDAU (€) |

0.42 |

0.45 |

0.42 |

0.42 |

0.44 |

- The Average Time in Game per Day (min)

remained relatively flat in Q3 2023 as compared to Q3 2022 at 79

minutes per day.

- The Average Daily Active Users (DAUs)

decreased by (18)% in Q3 2023 as compared to Q3 2022, mainly due to

the loss of active players in September from the sale of the social

card games portfolio.

- The Average Revenue per Daily Active User

(ARPDAU) increased by almost 5% in Q3 2023 as compared to

Q3 2022, mainly due to a stable loyal user base spending more in

game.

Selected operational KPIs include the results from the social

card games portfolio for July and up until the completion of the

sale on 28 August 2023 only.

Outlook

Adjusted EBITDA for full year 2023 is still expected to be at

least € 75 million, supported in particular by continued progress

in the integration of previous acquisitions and ongoing cost

optimisation.

Net Revenue for full year 2023 is now expected to be around €

520 million, up from € 452.6 million FY 2022, as compared to

previous expectations of around € 540 million. The reduction in Net

Revenue expectations for the full year reflects recent market

conditions leading to lower anticipated growth in automated auction

sales than originally envisaged for H2 2023.

Having focused on integration and cost optimisation for the

first three quarters of the year, the market conditions are

presenting increasingly attractive opportunities to further grow

our business through partnerships and strategic investments.

As a result, the previously communicated medium term guidance is

retained: expected annual Net revenue growth of around 15% and

annual Adjusted EBITDA margins expected to be in the range of 14%

to 16%.

Other information

Interest Bearing Debt

Interest Bearing Debt

in millions of €

|

|

30 September 2023 |

31 December 2022 |

|

Total non-current indebtedness |

13.4 |

215.8 |

|

Total current indebtedness |

208.1 |

12.8 |

|

Total financial indebtedness |

221.5 |

228.6 |

|

Deduct Zero interest bearing loans |

- |

(0.1) |

|

Interest Bearing Debt |

221.5 |

228.5 |

|

Less: Cash and cash equivalents |

(69.2) |

(50.9) |

|

Net Interest Bearing Debt (Bond terms) |

152.3 |

177.6 |

References to bond terms in the table above refer to the terms

as defined in the Senior Secured Callable Floating Rate Bonds ISIN:

NO0013017657

Reconciliation of net income to Adjusted

EBITDA

Reconciliation of net income to Adjusted EBITDA - Q3

in millions of €

|

|

Q3 |

|

|

2023 |

2022 |

|

|

Azerion Group |

Premium Games |

Platform |

Other |

Azerion Group |

Premium Games |

Platform |

Other |

|

Profit / (loss) for the period |

54.4 |

|

|

|

(5.2) |

|

|

|

|

Income Tax expense |

18.1 |

|

|

|

1.1 |

|

|

|

|

Profit / (loss) before tax |

72.5 |

|

|

|

(4.1) |

|

|

|

|

Net finance costs |

4.8 |

|

|

|

4.3 |

|

|

|

|

Operating profit / (loss) |

77.3 |

73.3 |

4.0 |

- |

0.2 |

1.7 |

(0.4) |

(1.1) |

|

Depreciation & Amortization |

11.3 |

3.0 |

8.2 |

0.1 |

9.6 |

2.9 |

6.5 |

0.2 |

|

De-SPAC related expenses |

- |

- |

- |

- |

0.1 |

0.1 |

- |

- |

|

Other1) |

(72.6) |

(72.7) |

0.1 |

- |

0.8 |

0.1 |

- |

0.7 |

|

Acquisition expenses |

2.8 |

1.2 |

1.7 |

(0.1) |

1.6 |

0.2 |

1.2 |

0.2 |

|

Restructuring |

(0.5) |

- |

(0.5) |

- |

0.1 |

0.2 |

(0.1) |

- |

|

Adjusted EBITDA |

18.3 |

4.8 |

13.5 |

- |

12.4 |

5.2 |

7.2 |

- |

1) Other mainly includes the net gain from the sale of the

social card games portfolio for € 72.6 million.

Reconciliation of net income to Adjusted EBITDA - YTD

in millions of €

|

|

YTD |

|

|

2023 |

2022 |

|

|

Azerion Group |

Premium Games |

Platform |

Other |

Azerion Group |

Premium Games |

Platform |

Other |

|

Profit / (loss) for the period |

32.3 |

|

|

|

(150.0) |

|

|

|

|

Income Tax expense |

21.4 |

|

|

|

2.4 |

|

|

|

|

Profit / (loss) before tax |

53.7 |

|

|

|

(147.6) |

|

|

|

|

Net finance costs |

13.0 |

|

|

|

(0.2) |

|

|

|

|

Operating profit / (loss) |

66.7 |

74.3 |

(7.6) |

- |

(147.8) |

1.1 |

(14.8) |

(134.1) |

|

Depreciation & Amortization |

32.5 |

9.6 |

22.9 |

- |

26.3 |

8.6 |

17.7 |

- |

|

De-SPAC related expenses |

- |

- |

- |

- |

144.8 |

2.4 |

9.4 |

133.0 |

|

Other1) |

(71.1) |

(71.7) |

0.6 |

- |

1.1 |

0.4 |

(0.2) |

0.9 |

|

Acquisition expenses |

10.5 |

1.2 |

9.3 |

- |

4.2 |

0.2 |

3.8 |

0.2 |

|

Restructuring |

6.9 |

1.7 |

5.2 |

- |

1.4 |

0.2 |

1.2 |

- |

|

Adjusted EBITDA |

45.5 |

15.1 |

30.4 |

- |

30.0 |

12.9 |

17.1 |

- |

1) Other mainly includes the net gain from the sale of the

social card games portfolio for € 72.6 million.

Operating expenses

Breakdown of Operating expenses

in millions of €

|

|

Q3 |

YTD |

|

2023 |

2022 |

2023 |

2022 |

|

Personnel costs |

(19.8) |

(20.2) |

(73.6) |

(83.3) |

|

Includes: |

|

|

|

|

|

Restructuring related expenses |

0.5 |

(0.1) |

(6.9) |

(1.4) |

|

Azerion Founder Warrants, reported as share-based payment

expense |

- |

- |

- |

(9.9) |

|

De-SPAC early exercised share-based payment expense |

- |

- |

- |

(10.3) |

|

Other expenses |

(4.9) |

(7.9) |

(28.6) |

(150.0) |

|

Includes: |

|

|

|

|

|

De-SPAC transaction related expenses |

|

|

|

(121.4) |

|

Operating expenses |

(24.7) |

(28.1) |

(102.2) |

(233.3) |

|

Of which: |

|

|

|

|

|

Platform |

(19.2) |

(21.4) |

(81.3) |

(76.9) |

|

Premium Games |

(5.9) |

(6.5) |

(21.2) |

(23.1) |

Restructuring

In relation to ongoing consolidation and integration,

restructuring charges across the next two quarters are expected in

total to be in the range of approximately € 2 million to € 3

million. These costs impact the reported operating profit / loss,

but are removed from Adjusted EBITDA.

Bond Refinancing

On 8 April 2021 Azerion issued senior secured callable fixed

rate bonds for a total of € 200 million, within a total framework

amount of € 300 million (ISIN: SE0015837794). The maturity date of

the bonds was 28 April 2024 and the bonds carried a fixed interest

rate of 7.25% per annum. On 31 October 2023, Azerion announced that

these bonds had been fully redeemed at a redemption price of

100.725% of the nominal amount of the bonds. The total redemption

amount was € 204.7 million, comprising € 200 million of nominal

amount of the bonds plus call premium of € 1.45 million and accrued

but unpaid interest. After roll-overs from these bonds to newly

issued bonds (see below), the balance outstanding for redemption

was settled through a combination of net proceeds of this new bond

issue of € 76.2 million and cash from Azerion of € 45.1

million.

On 14 September 2023, Azerion announced that it had successfully

placed € 165 million of senior secured floating rate bonds, within

a total framework amount of € 300 million to qualified

institutional investors internationally (ISIN: NO0013017657). The

new bond issuance was a post Q3 2023 event that was completed at

the end of October 2023. The newly issued bonds have a 3-year

tenor, will carry a floating rate coupon of 3 months EURIBOR plus

6.75 per cent per annum and were issued at 98.5 per cent of par.

The net proceeds of this bond issue, in combination with cash from

Azerion, have been used to fully redeem the bonds issued on 8 April

2021 (ISIN: SE0015837794), as mentioned above.

Sale of social card games portfolio

Playtika Holding Corp and Azerion announced on 1 August 2023

that they had entered into a definitive agreement for Playtika to

acquire from Azerion its social card games portfolio.

The sale was completed on 28 August 2023, for an initial cash

consideration of € 81.3 million, subject to customary adjustments,

with an earnout based on the performance of the acquired business

that could take the total consideration up to a maximum of € 150

million. At completion Azerion received net proceeds of

approximately € 66 million and approximately 15 months after the

completion date Azerion will receive the remaining proceeds

relating to the performance based earnout and other contractual

terms, subject to the terms of the asset purchase agreement.

The earnout consideration is based on the Adjusted EBITDA

results, as defined in the asset purchase agreement, of the social

card games portfolio for the period running from 1 October 2023

until 30 September 2024 (the “Earnout Period”), and calculated by

multiplying the incremental Adjusted EBITDA of the social card

games portfolio above the "Baseline" (as defined below) by a

multiple of between 6 and 7 (both inclusive); the specific multiple

to be applied is contingent upon the revenue growth of the social

card games portfolio achieved during the Earnout Period. The

"Baseline" is defined as the last twelve months Adjusted EBITDA on

a carve-out basis of approximately € 13.5 million.

The gain on sale before income tax that includes the received

proceeds at completion, an estimate of the remaining proceeds,

derecognized fixed assets and related transaction costs, amounted

to € 72.6 million.

Condensed consolidated statement of profit or loss and other

comprehensive income

Condensed consolidated statement of profit or loss and other

comprehensive income

in millions of €

|

|

Q3 |

YTD |

|

|

2023 |

2022 |

2023 |

2022 |

|

Net revenue |

108.5 |

105.5 |

343.2 |

303.8 |

|

Costs of services and materials |

(67.7) |

(67.0) |

(214.4) |

(190.6) |

|

Personnel costs |

(19.8) |

(20.2) |

(73.6) |

(83.3) |

|

Depreciation |

(2.0) |

(1.7) |

(5.9) |

(4.9) |

|

Amortization |

(9.3) |

(7.9) |

(26.6) |

(21.4) |

|

Other gains and losses |

72.5 |

(0.6) |

72.6 |

(1.4) |

|

Other expenses |

(4.9) |

(7.9) |

(28.6) |

(150.0) |

|

Operating profit / (loss) |

77.3 |

0.2 |

66.7 |

(147.8) |

|

|

|

|

|

|

|

Finance income |

2.1 |

1.0 |

7.5 |

17.2 |

|

Finance costs |

(6.9) |

(5.3) |

(20.5) |

(17.0) |

|

Net Finance costs |

(4.8) |

(4.3) |

(13.0) |

0.2 |

|

|

|

|

|

|

|

Profit / (loss) before tax |

72.5 |

(4.1) |

53.7 |

(147.6) |

|

|

|

|

|

|

|

Income tax expense |

(18.1) |

(1.1) |

(21.4) |

(2.4) |

|

Profit / (loss) for the period |

54.4 |

(5.2) |

32.3 |

(150.0) |

|

Attributable to: |

|

|

|

|

|

Owners of the company |

54.1 |

(5.1) |

31.6 |

(149.8) |

|

Non-controlling interest |

0.3 |

(0.1) |

0.7 |

(0.2) |

|

|

|

|

|

|

|

Exchange difference on translation of foreign operations |

(0.3) |

- |

(0.3) |

(1.3) |

|

Total other comprehensive income |

(0.3) |

- |

(0.3) |

(1.3) |

|

|

|

|

|

|

|

Total comprehensive income/(loss) |

54.1 |

(5.2) |

32.0 |

(151.3) |

|

Attributable to: |

|

|

|

|

|

Owners of the company |

56.5 |

(5.1) |

31.3 |

(150.4) |

|

Non-controlling interest |

(2.4) |

(0.1) |

0.7 |

(0.9) |

|

|

|

|

|

|

|

Loss per share for losses attributable to the ordinary equity

holders of the company: |

|

|

|

|

|

Basic profit/(loss) per share (in €) |

|

|

0.26 |

(1.33) |

|

Diluted profit/(loss) per share (in €) |

|

|

0.20 |

(1.33) |

Condensed consolidated statement of financial position

Condensed consolidated statement of financial position

in millions of €

|

|

30 September 2023 |

31 December 2022 |

|

Assets |

|

|

|

Non-current assets |

428.6 |

429.3 |

|

Goodwill |

169.0 |

184.2 |

|

Intangible assets |

168.8 |

186.2 |

|

Property, plant and equipment |

17.7 |

20.5 |

|

Non-current financial assets |

71.8 |

36.8 |

|

Deferred tax asset |

1.2 |

1.5 |

|

Investment in joint venture and associate |

0.1 |

0.1 |

|

|

|

|

|

Current assets |

201.8 |

209.2 |

|

Trade and other receivables |

132.0 |

157.3 |

|

Current tax assets |

0.6 |

1.0 |

|

Cash and cash equivalents |

69.2 |

50.9 |

|

Total assets |

630.4 |

638.5 |

|

|

|

|

|

Equity |

|

|

|

Share capital |

1.2 |

1.2 |

|

Share premium |

141.0 |

130.8 |

|

Treasury shares |

(0.8) |

0.0 |

|

Legal reserve |

27.5 |

25.2 |

|

Share based payment reserve |

12.7 |

13.7 |

|

Currency translation reserve |

(1.7) |

(1.3) |

|

Other equity instruments |

15.0 |

29.0 |

|

Retained earnings |

(77.3) |

(104.8) |

|

Shareholders’ equity |

117.6 |

93.8 |

|

Non-controlling interest |

4.6 |

2.4 |

|

Total equity |

122.2 |

96.2 |

|

|

|

|

|

Liabilities |

|

|

|

Non-current liabilities |

60.7 |

257.7 |

|

Borrowings |

2.9 |

201.5 |

|

Lease liabilities |

10.5 |

14.3 |

|

Provisions |

1.4 |

1.6 |

|

Deferred tax liability |

34.3 |

25.3 |

|

Other non-current liability |

11.6 |

15.0 |

|

|

|

|

|

Current liabilities |

447.5 |

284.6 |

|

Borrowings |

203.9 |

7.9 |

|

Provisions |

1.9 |

0.9 |

|

Trade payables 1) |

92.2 |

111.9 |

|

Accrued liabilities1) |

92.9 |

103.7 |

|

Current tax liabilities |

16.3 |

5.4 |

|

Lease liabilities |

4.2 |

4.9 |

|

Other current liabilities1) |

36.1 |

49.9 |

|

Total liabilities |

508.2 |

542.3 |

|

Total equity and liabilities |

630.4 |

638.5 |

1) Trade, other payables and accrued liabilities have been

reclassified to Trade payables, Accrued liabilities and Other

current liabilities to better reflect the reporting by nature

Condensed consolidated statement of cash flow

Condensed consolidated statement of cash flow

in millions of €

|

|

2023 |

2022 |

2023 |

2022 |

|

|

Q3 |

Q3 |

YTD |

YTD |

|

Operating profit / (loss) |

77.3 |

0.2 |

66.7 |

(147.8) |

|

|

|

|

|

|

|

Adjustments for: |

|

|

|

|

|

Depreciation and amortisation |

11.2 |

9.6 |

32.5 |

26.4 |

|

Movements in provisions per profit and loss |

1.3 |

0.3 |

7.9 |

1.8 |

|

Gain on sale of social card game portfolio |

(72.6) |

- |

(72.6) |

- |

|

Share-based payments expense |

0.1 |

0.5 |

0.7 |

22.9 |

|

De-SPAC related expenses |

- |

0.1 |

- |

14.6 |

|

De-SPAC listing expense |

- |

- |

- |

107.1 |

|

Other non-cash items |

(2.9) |

(2.2) |

(2.9) |

(0.1) |

|

|

|

|

|

|

|

Changes in working capital items: |

|

|

|

|

|

(Increase)/Decrease in trade and other receivables |

(5.1) |

(10.1) |

18.6 |

(1.6) |

|

Increase (decrease) in trade payables and other payables |

(18.0) |

20.7 |

(10.2) |

16.3 |

|

|

|

|

|

|

|

Utilization of provisions |

(1.6) |

(0.9) |

(6.8) |

(1.6) |

|

Interest paid |

(5.1) |

(4.6) |

(14.0) |

(14.0) |

|

Income tax paid |

(0.4) |

(0.7) |

(1.0) |

(1.2) |

|

Net cash provided by (used for) operating activities |

(15.8) |

12.9 |

18.9 |

22.8 |

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

Net proceeds from sale of business |

66.0 |

- |

66.0 |

- |

|

Payments for property, plant and equipment |

(0.8) |

(0.5) |

(1.4) |

(1.4) |

|

Payments for intangibles |

(7.6) |

(4.5) |

(19.6) |

(14.2) |

|

Net cash outflow on acquisition of subsidiaries |

(8.1) |

(6.2) |

(33.1) |

(45.4) |

|

Net cash outflow on acquisition of securities and equity

investments |

(2.6) |

- |

(2.6) |

- |

|

Net cash provided by (used for) investing activities |

46.9 |

(11.2) |

9.3 |

(61.0) |

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

Proceeds from external borrowings |

0.4 |

- |

0.5 |

- |

|

Repayment of external borrowings |

(0.8) |

1.2 |

(3.6) |

(2.0) |

|

De-SPAC related expenses |

- |

(0.2) |

- |

(33.4) |

|

Payment of principal portion of lease liabilities |

(1.7) |

(2.1) |

(5.0) |

(5.2) |

|

Early cancellation of lease liability |

(1.5) |

- |

(1.5) |

- |

|

Dividends paid to shareholders of non-controlling interests |

(0.4) |

- |

(0.4) |

- |

|

Proceeds from De-SPAC transaction |

- |

- |

- |

404.1 |

|

Settlement of De-SPAC transaction |

- |

- |

- |

(310.9) |

|

Net cash provided by (used for) financing activities |

(4.0) |

(1.1) |

(10.0) |

52.6 |

|

|

|

|

|

|

|

Net increase in cash and cash equivalents |

27.1 |

0.6 |

18.2 |

14.4 |

|

Effect of changes in exchange rates on cash and cash

equivalents |

(0.1) |

(0.2) |

0.1 |

(0.5) |

|

Cash and cash equivalents at the beginning of the period |

42.2 |

48.8 |

50.9 |

35.3 |

|

Cash and cash equivalents at the end of the period |

69.2 |

49.2 |

69.2 |

49.2 |

Definitions

Adjusted EBITDA represents operating Profit /

(Loss) excluding depreciation, amortization, impairment of

non-current assets, restructuring and acquisition related expenses

and other items at management discretion.

Adjusted EBITDA Margin represents Adjusted

EBITDA as a percentage of Net revenue

Average gross revenue per million processed ad requests

from the advertising auction platform is calculated by

dividing gross advertising revenue by a million advertisement

requests running through advertising auction platform Improve

Digital. Not all advertisement requests are processed and become

eligible to be fulfilled as an advertisement sold, therefore this

metric measures the efficiency and overall profitability of the

digital advertising auction platform, demonstrating that the

revenue generated by the advertisements that are sold also

remunerate and more than cover the costs of all the advertisement

requests.

Average time in game per day measures how many

minutes per day, on average, the players of Premium Games spend in

the games. This demonstrated their engagement with the games, which

generates more opportunities to grow the ARPDAU.

Average DAUs represents average daily

active users, which is the number of distinct users per day

averaged across the relevant period.

Average ARPDAU represents Average Revenue per

Daily Active User, which is revenue per period divided by days in

the period divided by average daily active users in that period and

represents average per user in-game purchases for the period.

Financial Indebtedness represents as defined in

the terms and conditions of the Senior Secured Callable Floating

Rate Bonds ISIN: NO0013017657 any indebtedness in respect of:

- monies borrowed or raised. including Market Loans;

- the amount of any liability in respect of any Finance

Leases;

- receivables sold or discounted (other than any receivables to

the extent they are sold on a non-recourse basis);

- any amount raised under any other transaction (including any

forward sale or purchase agreement) having the commercial effect of

a borrowing;

- any derivative transaction entered into in connection with

protection against or benefit from fluctuation in any rate or price

(and, when calculating the value of any derivative transaction,

only the mark to market value shall be taken into account, provided

that if any actual amount is due as a result of a termination or a

close-out, such amount shall be used instead);

- any counter indemnity obligation in respect of a guarantee,

indemnity, bond, standby or documentary letter of credit or any

other instrument issued by a bank or financial institution;

and

- (without double counting) any guarantee or other assurance

against financial loss in respect of a type referred to in the

above paragraphs (1)-(6).

Net Interest Bearing Debt as defined in the

terms and conditions of the Senior Secured Callable Floating Rate

Bonds ISIN: NO0013017657 means the aggregate interest bearing

Financial Indebtedness less cash and cash equivalents (including

any cash from a Subsequent Bond Issue standing to the credit on the

Proceeds Account or another escrow arrangement for the benefit of

the Bondholders) of the Group in accordance with the Accounting

Principles (for the avoidance of doubt, excluding any Bonds owned

by the Issuer, guarantees, bank guarantees, Subordinated Loans, any

claims subordinated pursuant to a subordination agreement on terms

and conditions satisfactory to the Agent and interest bearing

Financial Indebtedness borrowed from any Group Company) as such

terms are defined in the terms and conditions of the Senior Secured

Callable Floating Rate Bonds ISIN: NO0013017657.

Operating expenses are defined as the aggregate

of personnel costs and other expenses as reported in the statement

of Other comprehensive income. More details on the cost by nature

reporting can be found in the published annual financial statements

of 2022.

Disclaimer and Cautionary Statements

This communication contains information that qualifies as inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation.

This communication may include forward-looking statements. All

statements other than statements of historical facts are, or may be

deemed to be, forward-looking statements. Forward-looking

statements include, among other things, statements concerning the

potential exposure of Azerion to market risks and statements

expressing management’s expectations, beliefs, estimates,

forecasts, projections and assumptions. Words and expressions such

as aims, ambition, anticipates, believes, could, estimates,

expects, goals, intends, may, milestones, objectives, outlook,

plans, projects, risks, schedules, seeks, should, target, will or

other similar words or expressions are typically used to identify

forward-looking statements. Forward-looking statements are

statements of future expectations that are based on management’s

current expectations and assumptions and involve known and unknown

risks, uncertainties and other factors that are difficult to

predict and that could cause the actual results, performance or

events to differ materially from future results expressed or

implied by such forward-looking statements contained in this

communication. Readers should not place undue reliance on

forward-looking statements.

Any forward-looking statements reflect Azerion’s current views

and assumptions based on information currently available to

Azerion’s management. Forward-looking statements speak only as of

the date they are made and Azerion does not assume any obligation

to update or revise such statements as a result of new information,

future events or other information, except as required by law.

The interim financial results of Azerion Group N.V. as included

in this communication are required to be disclosed pursuant to the

terms and conditions of the Senior Secured Callable Floating Rate

Bonds ISIN: NO0013017657.

This report has not been reviewed or audited by Azerion’s

external auditor.

Certain financial data included in this communication consist of

alternative performance measures (“non-IFRS financial measures”),

including Adjusted EBITDA. The non-IFRS financial measures, along

with comparable IFRS measures, are used by Azerion’s management to

evaluate the business performance and are useful to investors. They

may not be comparable to similarly titled measures as presented by

other companies, nor should they be considered as an alternative to

the historical financial results or other indicators of Azerion

Group N.V.’s cash flow based on IFRS. Even though the non-IFRS

financial measures are used by management to assess Azerion Group

N.V.’s financial position, financial results and liquidity and

these types of measures are commonly used by investors, they have

important limitations as analytical tools, and the recipients

should not consider them in isolation or as a substitute for

analysis of Azerion Group N.V.’s financial position or results of

operations as reported under IFRS.

For all definitions and reconciliations of non-IFRS financial

measures please also refer to www.azerion.com/investors.

This report may contain forward-looking non-IFRS financial

measures. The Company is unable to provide a reconciliation of

these forward-looking non-IFRS financial measures to the most

comparable IFRS financial measures because certain information

needed to reconcile those non-IFRS financial measures to the most

comparable IFRS financial measures is dependent on future events

some of which are outside the control of Azerion. Moreover,

estimating such IFRS financial measures with the required precision

necessary to provide a meaningful reconciliation is extremely

difficult and could not be accomplished without unreasonable

effort. Non-IFRS financial measures in respect of future periods

which cannot be reconciled to the most comparable IFRS financial

measure are calculated in a manner which is consistent with the

accounting policies applied in Azerion Group N.V.’s consolidated

financial statements.

This communication does not constitute an offer to sell, or a

solicitation of an offer to buy, any securities or any other

financial instruments.

Contact

Investor Relations: ir@azerion.comMedia relations:

press@azerion.com

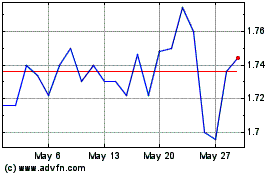

Azerion Group NV (EU:AZRN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Azerion Group NV (EU:AZRN)

Historical Stock Chart

From Feb 2024 to Feb 2025