Regulatory News:

Clasquin (Paris:ALCLA):

INITIATED BY THE COMPANY

SAS SHIPPING AGENCIES SERVICES SÀRL (« SAS

»)

PRESENTED BY

SOCIETE GENERALE

BANK PRESENTING THE OFFER AND ACTING AS

GUARANTOR

Offer

Price : €142,03 per Clasquin share

Duration

of the Offer : 25 trading days

The timetable for the public

tender offer (the “Offer”) will be determined by the Autorité des

Marchés Financiers (the “AMF”) in accordance with the provisions of

its General Regulation.

AMF

This press release relating to the filing

of a proposed public tender offer for the shares of Clasquin with

the AMF on October 14, 2024 (the "Press Release") was

prepared and published by SAS pursuant to Article 231-16 of the

General Regulation of the AMF.

The Offer and the draft offer document

(the “Draft Offer Document”) remain subject to review by the

AMF.

IMPORTANT NOTICE

In accordance with the provisions of

Article L. 433-4 II of the French Monetary and Financial Code and

Articles 237-1 et seq. of the General Regulation of the AMF, in the

event that, at the closing of the Offer, the number of Clasquin

shares not tendered in the Offer by the minority shareholders (with

the exception of treasury shares held by Clasquin and unavailable

free shares subject to a liquidity mechanism) does not represent

more than 10% of the share capital and voting rights of Clasquin,

SAS intends to file a request with the AMF to carry out, at the

latest within ten (10) trading days following the closing of the

Offer, or as the case may be, at the latest within three (3) months

following the closing of the Reopened Offer (as defined below), a

squeeze-out procedure for the said shares (other than the treasury

shares held by Clasquin and the free shares subject to a liquidity

mechanism) to be transferred to SAS, in return for a unitary

compensation equal to the Offer price per share.

The Press Release should be read together

with all other documents published in connection with the Offer. In

particular, in accordance with Article 231-28 of the General

Regulation of the AMF, a description of the legal, financial and

accounting characteristics of SAS will be made available to the

public no later than the day preceding the opening of the Offer. A

press release will be issued to inform the public of the manner in

which this information will be made available.

The Draft Offer Document is available on the website of the AMF

(www.amf-france.org) et on the website of CLASQUIN

(www.clasquin.com) and may be obtained free of charge from Société

Générale, GLBA/IBD/ECM/SEG 75886 Paris Cedex 18.

1. OVERVIEW OF THE OFFER

Pursuant to Title III of Book II and more specifically Articles

232-1 et seq. of the General Regulation of the AMF, SAS Shipping

Agencies Services Sàrl, a limited liability company (société à

responsabilité limitée) incorporated under Luxembourg law,

registered with the Luxembourg Trade and Companies Registry under

number B113456, having its registered office at 11B, Boulevard

Joseph II, Luxembourg (L-1840) ("SAS" or the

"Offeror") irrevocably offers to all the shareholders of

Clasquin, a public limited company (société anonyme), with a share

capital of 4,658,536 euros, registered with the Lyon Trade and

Companies Registry under number 959 503 087, having its registered

office at 235 Cours Lafayette, Immeuble le Rhône Alpes, 69451 Lyon

Cedex, France ("Clasquin" or the "Company", and

together with its directly or indirectly owned subsidiaries, the

"Group"), to acquire in cash all their shares in the Company

(the "Shares") by way of a public tender offer, the terms of

which are described below.

The Offer price is 142.03 euros per Share (the "Offer

Price"). The Offer Price is identical to the price paid in cash

by the Offeror in the context of the Acquisition (as defined

hereinafter).

The Shares are admitted to trading on Euronext Growth in Paris

("Euronext Growth") under ISIN code FR0004152882, mnemonic

"ALCLA".

The Offer follows the Acquisition by SAS, on October 9, 2024, of

42.06% of the Company's share capital (the terms and conditions of

which are described in Section 1.1.2 of the Draft Offer

Document).

As of the date of the Draft Offer Document, SAS holds 979,800

shares representing 979,800 voting rights, i.e. 42.06% of the

Company's share capital and 38.97% of its theoretical voting

rights1 , based on a total of 2,329,268 shares and 2,514,363

theoretical voting rights in the Company within the meaning of

Article 223-11 of the AMF's General Regulation.

In accordance with the provisions of Article 231-6 of the AMF's

General Regulation, the Offer relates to all Shares not held

directly by the Offeror, whether outstanding or to be issued, with

the exception of :

- Shares held in treasury by the Company,

i.e., to the knowledge of the Offeror at the date of the Draft

Offer Document, 1,542 Shares, and

- of the Unavailable Free Shares (as this

term is defined in Section 2.3 (Situation of the beneficiaries of

Free Shares) of the Draft Offer Document), i.e., to the knowledge

of the Offeror at the date of the Draft Offer Document, 11,186

Shares,

i.e., to the knowledge of the Offeror at the

date of the Draft Offer Document, 12,728 Shares excluded;

i.e., to the knowledge of the Offeror at the date of the Draft

Offer Document, a maximum total number of Shares targeted by the

Offer equal to 1,336,740 Shares, representing 57.39% of the

Company's share capital and 60.53% of its theoretical voting

rights.

The Offeror has offered to enter into a liquidity agreement with

the beneficiaries of Unavailable Free Shares, under certain

conditions, as described in Section 1.3.2 of the Draft Offer

Document.

With the exception of the Free Shares allocated by the Company

(as described in Section 2.3 of the Draft Offer Document), as at

the date of the Draft Offer Document and to the best of the

Offeror's knowledge, there are no equity securities or other

financial instruments or rights giving immediate or future access

to the Company's share capital or voting rights other than the

Shares.

The Offer is voluntary and will be carried out in accordance

with the normal procedure, in accordance with the provisions of

Articles 232-1 et seq. of the AMF's General Regulation.

The Offer is subject to the lapse threshold referred to in

Article 231-9, I of the AMF’s General Regulation, as described in

Section 2.5 of the Draft Offer Document. It is not subject to any

regulatory condition.

If the required conditions are met, the Offer will be followed

by a squeeze-out procedure in accordance with Articles L. 433-4, II

of the French Monetary and Financial Code and 237-1 et seq. of the

AMF General Regulation. In this event, the Shares (other than

treasury Shares and Unavailable Free Shares subject to the

liquidity mechanism) which have not been tendered to the Offer, or,

as the case may be, to the Reopened Offer (as this term is defined

in Section 2.10 of the Draft Offer Document), will be transferred

to the Offeror in consideration for a cash compensation equal to

the Offer Price, i.e. 142.03 euros per Share.

In accordance with the provisions of Article 231-13 of the AMF's

General Regulation, Société Générale, which guarantees the content

and irrevocable nature of the commitments made by the Offeror in

connection with the Offer, has filed the draft Offer with the AMF

on behalf of the Offeror (the "Presenting Bank").

1.2 Background of the Offer

1.2.1 Presentation of the

Offeror

The Offeror is a limited liability company incorporated under

the laws of Luxembourg and is a wholly-owned subsidiary of MSC

Mediterranean Shipping Company SA, a world leader in shipping and

logistics, headquartered in Geneva, Switzerland ("MSC" and

the "MSC Group").

The MSC Group offers versatile international transport solutions

covering air, land and sea transport. The MSC Group has a modern

fleet of more than 825 container ships and, over the years, has

diversified into cruise line and passenger ferry services, as well

as first-class logistics infrastructures and port terminals.

1.2.2 Background of the Offer

On November 30, 2023, the Offeror submitted a non-binding offer

(the "NBO") to Mr. Yves REVOL and the company OLYMP OMNIUM

LYONNAIS DE MANAGEMENT ET DE PARTICIPATIONS, a simplified joint

stock company (société par actions simplifiée) incorporated under

French law, having its registered office at 70 Chemin de la

Sauvegarde, 69130 Ecully and registered with the Lyon Trade and

Companies Registry under number 380 163 394 ("OLYMP") to

enter into exclusive negotiations for the sale of 42% of the share

capital of Clasquin.

This exclusivity was granted by Mr Yves REVOL and OLYMP when the

NBO was countersigned on December 4, 2023. In this context, Mr.

Yves REVOL and OLYMP provided the Offeror with a certain amount of

information concerning Clasquin, in particular as part of a "due

diligence" procedure in accordance with the AMF recommendations on

data room procedures set out in the Guide de l'information

permanente et de la gestion de l'information privilégiée (Position

- Recommendation DOC-2016-08).

On March 21, 2024, the Offeror, Mr. Yves REVOL, Mrs. Evelyne

REVOL and OLYMP (together the "Sellers"2) entered into a put

option agreement for the benefit of the Sellers, under which the

Offeror undertook to acquire all 979.800 Shares held by the

Sellers, representing 42.06% of Clasquin's share capital, at a

price of 142.03 euros per share (the "Acquisition"), subject

to the Sellers exercising their put option agreement, following

consultation with the relevant Group employee representative

bodies.

The Company then initiated information and consultation

procedures with the relevant employee representative bodies on

March 25 and 28, 2024 respectively, which issued a favorable

opinion.

On March 28, 2024, following the exercise by the Sellers of the

promise to purchase, the Sellers and the Offeror entered into a

share purchase agreement for the acquisition by SAS of 42.06% of

the share capital of Clasquin, for a price of 142.03 euros per

Share (the "Share Purchase Agreement").

The Acquisition was subject to obtaining the authorization of

the Minister of the Economy in respect of the control of foreign

investments in France, in accordance with the provisions of Article

L. 151-3 of the French Monetary and Financial Code, as well as to

obtaining authorizations from the merger control authorities in

Morocco, Tunisia and Vietnam, and the authorization of the European

Commission. The conditions precedent stipulated in the Share

Purchase Agreement relating to the obtaining of these prior

authorizations having been satisfied, the Offeror completed the

Acquisition on October 9, 2024.

The completion of the Acquisition was the subject of a press

release from the Company and a press release from SAS, published on

October 9, 2024, in which the filing of the present Offer at a

price of 142.03 euros per Share was announced.

On June 5, 2024, the Board of Directors of Clasquin, acting on

the recommendation of an ad hoc committee made up of a majority of

independent directors, appointed Accuracy, represented by Mr. Henri

Philippe, as independent expert, to prepare a report on the

financial terms of the Offer and to present its conclusions in the

form of a fairness opinion ("Accuracy" or the

"Independent Expert"). The appointment of the Independent

Expert was announced in a press release issued by the Company on

June 17, 2024.

On October 10, 2024, the Company consulted the relevant employee

representative bodies on the Offeror's proposed filing of the

Offer, which issued a favorable opinion on the same day.

On October 14, 2024, following receipt of the fairness opinion

issued by the Independent Expert, and after consultation with the

relevant employee representative bodies, the Company's Board of

Directors issued a reasoned opinion (avis motivé) in accordance

with Article 231-19 of the AMF's General Regulation, stating in its

conclusion that the Offer is in the interests of the Company, its

shareholders and its employees.

As the Offeror has not acquired, directly or indirectly, any of

the Company's shares during the twelve months preceding the

completion of the Acquisition, the Offeror holds, following the

completion of the Acquisition, 979,800 Shares of the Company, to

which are attached 979,800 voting rights, representing 42.06% of

the share capital and 38.97% of the theoretical voting rights of

the Company.

1.2.3 Shareholding structure of the

Company’s share capital and voting rights

To the knowledge of the Offeror, and according to the

information provided by the Company at the date of the Draft Offer

Document, the Company's share capital amounts to 4,658,536 euros,

divided into 2,329,268 Shares with a par value of 2 euros each. The

number of theoretical voting rights is 2,514,363.

a) Shareholding

structure of the Company’s share capital and voting rights prior to

the Acquisition

To the knowledge of the Offeror, the shareholding structure of

the Company’s share capital and voting rights prior to the

Acquisition was as follows:

Shareholder

Number of shares

% of capital

Number of theoretical voting

rights

% of theoretical voting

rights

OLYMP

872 556

37,46%

1 729 347

50,49%

Mr. Yves Revol

53 477

2,30%

106 954

3,12%

Yves Revol Foundation

53 581

2,30%

53 581

1,56%

Mrs Evelyne Revol

186

0,01%

372

0,01%

Total Sellers

979 800

42,06%

1 890 254

55,19%

Ariane Participations and Famille

Morin

158 701

6,81%

290 054

8,47%

Employees / Corporate officers

(in registered form)

91 575

3,93%

135 089

3,94%

FCPE Clasquin

129 728

5,57%

129 728

3,79%

Free Float

967 922

41,55%

978 150

28,56%

Treasury shares

1 542

0,07%

1 542

0,05%

Total

2 329 268

100%

3 424 817

100%

b) Shareholding

structure of the Company’s share capital and voting rights

post-Acquisition

To the knowledge of the Offeror, as of the date of the Draft

Offer Document, the structure of the Company’s share capital and

voting rights is as follows after completion of the

Acquisition:

Shareholder

Number of shares

% of capital

Number of theoretical voting

rights

% of theoretical voting

rights

SAS Shipping Agencies Services

Sàrl

979 800

42,06%

979 800

38,97%

Ariane Participations and Famille

Morin

158 701

6,81%

290 054

11,54%

Employees / Corporate officers

(in registered form)

91 575

3,93%

135 089

5,37%

FCPE Clasquin3

129 728

5,57%

129 728

5,16%

Floating

967 922

41,55%

978 150

38,90%

Treasury shares

1 542

0,07%

1 542

0,06%

Total4

2 329 268

100%

2 514 363

100%

1.2.4 Declarations of crossing of

thresholds and of intentions

In accordance with Article 10 of the Company's Articles of

Association and Article L. 233-7, III of the French Commercial

Code, SAS has declared to the Company that it has exceeded,

directly and individually, the thresholds of 2.5%, 5%, 7.5%, 10%,

12.5%, 15%, 17.5%, 20%, 22.5%, 25%, 27.5%, 30%, 32.5%, 35%, 37.5%

and 40% of the Company's share capital and 2.5%, 5%, 7.5%, 10%,

12.5%, 15%, 17.5%, 20%, 22.5%, 25%, 27.5%, 30%, 32.5%, 35% and

37.5% of its voting rights.

1.2.5 Acquisition of Shares by the Offeror

over the last 12 months

With the exception of the Acquisition, the Offeror has not

acquired any Shares or securities giving access to the Company's

share capital over the past twelve months, it being further

specified that SAS did not hold any Shares, directly or indirectly,

alone or in concert, prior to the Acquisition.

1.2.6 Regulatory, administrative and

antitrust approvals

The Offer is not subject to any regulatory approval. However,

the Acquisition required the authorization of the Minister of the

Economy with respect to the control of foreign investment in

France, in accordance with the provisions of Article L. 151-3 of

the French Monetary and Financial Code, as well as authorizations

from the merger control authorities in Morocco, Tunisia and

Vietnam, and the authorization of the European Commission.

1.2.7 Reasons for the Offer

Headquartered in Lyon, the Group is the only French

multinational mid-sized company (ETI) specializing in freight

forwarding and overseas logistics, with activities in freight

forwarding, logistics and customs. The Group handles a large number

of import-export flows thanks to its strong international presence,

with operations in six European countries, almost all Asian

countries, the Americas and, more recently, sub-Saharan Africa and

the Maghreb.

Since its takeover by Yves Revol in 1982, the Group showed very

strong growth, with consolidated sales of over 562 million euros in

the year ended December 31, 2023. Clasquin shares have been listed

on Euronext Growth since 2006.

The Offeror also intends to integrate Clasquin and its

subsidiaries into the MSC Group, while continuing to operate its

businesses with its teams and under the Group's brands (CLASQUIN,

TIMAR, LCI-CLASQUIN, CVL, EXACIEL, ART SHIPPING INTERNATIONAL and

TRANSPORTS PETIT in particular).

Combining the activities of the Offeror and the Company would

enable Clasquin to accelerate its growth, by offering more

innovative solutions based on the various branches of the MSC Group

(maritime, air, rail, road, barge, warehousing).

The MSC Group would benefit from the Group's international

network, enabling it to offer global solutions to its customers,

particularly in Africa, India and the Middle East.

1.3 Intentions of the Offeror for the next twelve

months

1.3.1 Industrial, commercial and financial

strategy

The Offeror intends, with the support of the Company's current

management, to pursue the main strategic orientations implemented

by the Company, and does not intend to modify the Company's

operating model, other than in the normal course of business.

The Offeror supports the Company's growth strategy, based on

expansion in Europe, the Middle East, Asia, North America and, more

recently, Africa, which it intends to accelerate by offering more

innovative solutions based on the MSC Group's various divisions

(sea, air, rail, road, barge, warehousing).

1.3.2 Intentions regarding

employment

The Offer is in line with the Company's continuity in operation

and growth. As such, the Offer is not expected to have any

particular impact on the Company's headcount or its salary and

human resources management policies.

1.3.3 Composition of the Company's

governing and management bodies

Until October 9, 2024, the Company's Board of Directors

comprised eight members:

- Yves Revol, Chairman,

- Hugues Morin, Chief Executive Officer,

- Laurence Ilhe, Deputy Chief Executive Officer,

- Doctor Ma Fan, independent,

- Claude Revel, independent and Chairman of the CSR

Committee,

- Laurent Fiard, independent,

- Olymp SAS (represented by Jean-Christophe Revol), and

- Philippe Lons, Deputy Chie Executive Officer,

Since October 9, 2024, and in order to reflect the Company's new

shareholding structure resulting from the Acquisition, Mr Yves

Revol and OLYMP have resigned from their respective mandates; the

Company's Board of Directors now comprised the following eight

members:

- Nicolas Sartini, Chairman,

- Hugues Favard,

- Hugues Morin, Chief Executive Officer,

- Laurence Ilhe, Deputy Chief Executive Officer,

- Doctor Ma Fan, independent,

- Claude Revel, independent and Chairman of the CSR

Committee,

- Laurent Fiard, independent, and

- Philippe Lons, Deputy Chief Executive Officer.

In the event of the implementation of a squeeze-out procedure,

it is planned to convert the Company into a simplified joint stock

company.

1.3.4 Benefits of the Offer for the

Company and its shareholders

The Offeror offers the shareholders of the Company who tender

their Shares to the Offer the opportunity to obtain immediate

liquidity for all of their Shares at a price per Share of 142.03

euros.

The Offer Price reflects a premium of 14.22% over the

volume-weighted average price 60 trading days prior to the

announcement of the Offer, and of 59.94% to the last closing price

prior to the announcement of the entry into exclusive negotiations

between Mr. Yves REVOL and OLYMP, on the one hand, and SAS, on the

other, dated December 4, 2023 and 70.42% over the volume-weighted

average prices 60 trading days prior to the announcement of the

intention to file the Offer.

The elements used to assess the Offer Price, including the

premium levels offered as part of the Offer, are presented in

Section 3 (Elements used to assess the Offer Price) of the Draft

Offer Document.

1.3.5 Synergies - Economic

benefits

The operational and financial synergies resulting from the

Transaction will be generated through the integration of Clasquin

into the MSC Group, which will enable Clasquin to offer its current

and future customers new and unique transport solutions based on

the various assets of the MSC Group.

1.3.6 Merger

At the date of the Draft Offer Document, the Offeror does not

intend to merge with the Company.

1.3.7 Intentions regarding the

implementation of a squeeze-out and a delisting of the Company

following the Offer

Should the conditions set out in Article L. 433-4, II of the

French Monetary and Financial Code and Articles 237-1 et seq. of

the AMF's General Regulation are met at the closing of the Offer,

SAS intends to require the AMF, within ten (10) trading days of the

publication of the result of the Offer or, as the case may be,

within three (3) months of the closing of the Reopened Offer, to

implement a squeeze-out procedure for the Shares not tendered to

the Offer.

The implementation of the squeeze-out will result in the

delisting of the Company's Shares from Euronext Growth.

In the event that the Offeror is not in a position to proceed

with a squeeze-out at the end of the Offer or the Reopened Offer,

the Offeror reserves the right to file, in accordance with

applicable regulations, a public offer followed, if necessary, by a

squeeze-out for the Shares that it does not hold directly or

indirectly, alone or in concert, at that date. In this context, the

Offeror reserves the right to increase its shareholding in the

Company after the closing of the Offer and before the filing of a

new offer, in compliance with applicable regulations.

1.3.8 The Company's dividend

policy

The Company's dividend distribution policy will continue to be

determined by its corporate bodies, based on the distributive

capacity, financial situation and financial needs of the Company

and its subsidiaries.

1.4 Agreements that may have a significant impact on the

assessment or outcome of the Offer

At the date of the Draft Offer Document, the agreements likely

to have a significant impact on the assessment of the Offer or its

outcome, namely the Share Purchase Agreement, the Liquidity

Agreements, the Undertakings to Tend Shares to the Offer, the

agreements for the sale of shares in companies of the Group, the

amendments to the minority shareholders' agreements and agreements

on the remuneration of certain executives, are described in

Sections 1.3.1, 1.3.2, 1.3.3, 1.3.4 and 1.3.5 of the Draft Offer

Document.

2. CHARACTERISTICS OF THE OFFER

2.1 Terms of Offer

Pursuant to Article 231-13 of the AMF's General Regulation,

Société Générale, acting on behalf of the Offeror as presenting

institution, filed with the AMF on October 14, 2024 the draft Offer

in the form of a public tender offer for all the Shares other than

the Shares currently held by the Offeror.

As part of the Offer, which will be carried out in accordance

with the normal procedure governed by Articles 232-1 et seq. of the

AMF's General Regulation, the Offeror irrevocably undertakes to

acquire from the Company's shareholders, for a period of 25 trading

days, all the Shares tendered to the Offer at the Offer Price, i.e.

142.03 euros per Share.

Société Générale, as guaranteeing bank, guarantees the content

and irrevocable nature of the commitments made by the Offeror as

part of the Offer, in accordance with the provisions of Article

231-13 of the AMF's General Regulation.

2.2 Number and nature of the Shares targeted in the

Offer

As of the date of the Draft Offer Document, the Offeror holds

979,800 Shares, representing 42.06% of the Company's share capital

and 38.97% of the Company's theoretical voting rights on the basis

of a total number of 2,329,268 Shares representing 2,514,363

theoretical voting rights of the Company within the meaning of

Article 223-11 of the AMF's General Regulation.

The Offer targets all outstanding Shares not held directly by

the Offeror, i.e. a maximum of 1,349,468 Shares, excluding the

following Shares:

9. Shares held in treasury by the Company,

i.e., to the knowledge of the Offeror at the date of the Draft

Offer Document, 1,542 Shares, and 10. the Unavailable Free Shares

(as this term is defined in Section 2.3 of the Draft Offer

Document), i.e., to the knowledge of the Offeror at the date of

filing of the Draft Offer Document, 11,186 Shares,

i.e., to the knowledge of the Offeror at the date of filing of

the Draft Offer Document, a maximum total number of Shares targeted

by the Offer equal to 1,336,740, representing 57.39% of the share

capital and 60.53% of the theoretical voting rights of the

Company.

With the exception of the Free Shares allocated by the Company,

as of the date of the Draft Offer Document and to the knowledge of

the Offeror, there are no equity securities or other financial

instruments or rights that could give access, immediately or in the

future, to the Company's share capital or voting rights.

2.3 Beneficiaries of free shares

To the knowledge of the Offeror and at the date of the Draft

Offer Document, the Company has set up three free share plans (the

"Free Shares"), the main features of which are described in

Section 2.3 of the Draft Offer Document.

The Unavailable Free Shares will be covered by the liquidity

mechanism described in Section 1.3.2 of the Draft Offer Document,

subject to the signature of a Liquidity Agreement by the

Beneficiaries.

2.4 Situation of Shares held via a corporate mutual

fund

The Shares held by the Company's FCPE "Clasquin Performances"

(the fonds commun de placement d’entreprise – the "Clasquin

FCPE") are targeted by the Offer.

To the knowledge of the Offeror, at the date of the Draft Offer

Document, the Clasquin FCPE, which operates within the framework of

the Company's employee savings plans, holds 129,728 Shares.5

On October 9, 2024, the Supervisory Board of FCPE Clasquin

decided to tender the Shares held by FCPE Clasquin to the

Offer.

2.5 Lapse threshold

Pursuant to the provisions of Article 231-9, I of the AMF's

General Regulation, the Offer will lapse if, at the closing date,

the Offeror, acting alone or in concert within the meaning of

Article L. 233-10 of the French Commercial Code, does not hold a

number of shares representing a fraction of the Company's share

capital or voting rights in excess of 50%, i.e. a minimum of

1,164,635 Shares or 1,257,182 voting rights (this threshold being

hereinafter referred to as the "Lapse Threshold" (seuil de

caducité)). The Lapse Threshold is determined in accordance with

the rules set out in Article 234-1 of the AMF's General

Regulation.

It will not be known whether the Lapse Threshold has been

reached until the AMF publishes a notice of the result of the

Offer, which will take place after the closing of the Offer.

If the Lapse Threshold is not reached, the Offer will not be

successful and the Shares tendered to the Offer will be returned to

their holders following the publication of the final notice of

result informing of the lapse of the Offer, without any interest,

indemnity or other payment of any nature whatsoever being due to

the said holders.

2.6 Terms and conditions of the Offer

In accordance with Articles 231-13 and 231-18 of the AMF's

General Regulation, the Offer and the Draft Offer Document were

filed with the AMF on October 14, 2024. On the same day, the AMF

will publish a notice of filing on its website

(www.amf-france.org).

In accordance with Article 231-16 of the AMF's General

Regulation, the draft offer document, as filed with the AMF, is

made available to the public free of charge at the registered

office of the Presenting Bank and is published on the AMF website

(www.amf-france.org).

This Press Release containing the main elements of the Draft

Offer Document and specifying the terms and conditions of its

availability will be issued on October 14, 2024.

This Offer and the Draft Offer Document remain subject to review

by the AMF.

The AMF will publish on its website a clearance decision of the

Offer (déclaration de conformité), after having verified that the

proposed Offer complies with the applicable legal and regulatory

provisions. Pursuant to the provisions of Article 231-23 of the

AMF's General Regulation, this clearance decision will serve as the

approval (visa) of the offer document of the Offeror.

In accordance with Article 231-27 of the AMF's General

Regulation, the offer document thus approved by the AMF will be

made available to the public free of charge at the registered

office of the Presenting Bank, no later than the day before the

opening of the Offer. This document will also be available on the

AMF website (www.amf-france.org).

In accordance with Article 231-28 of the AMF's General

Regulation, the document containing other information on the legal,

financial and accounting characteristics of the Offeror will be

made available to the public free of charge at the registered

office of the Presenting Bank, no later than the day before the

opening of the Offer. This document will also be available on the

AMF website (www.amf-france.org).

In accordance with Articles 231-27 and 231-28 of the AMF's

General Regulation, press releases specifying the terms and

conditions under which the Offeror will make these documents

available will be published no later than the day before the

opening of the Offer on the Company's website

(www.clasquin.com).

Prior to the opening of the Offer, the AMF will publish a notice

of opening and timetable, and Euronext Paris will publish a notice

announcing the terms and conditions of the Offer and its

timetable.

2.7 Procedure for tendering Shares to the Offer

The Shares tendered to the Offer (including, as the case may be,

to the Reopened Offer) must be freely negotiable and free from any

lien, pledge, collateral or other security interest or restriction

of any kind on the free transfer of their ownership. The Offeror

reserves the right to reject, at its sole discretion, any Shares

tendered to the Offer which do not comply with this condition.

The Offer and all related agreements are subject to French law.

Any dispute or litigation, regardless of the subject matter or

basis, relating to this Offer will be brought before the competent

courts.

The Offer will be carried out in accordance with the normal

procedure pursuant to Articles 232-1 et seq. of the AMF's General

Regulation and will be open for a period of twenty-five (25)

trading days.

Shareholders of the Company who wish to tender their Shares to

the Offer must, in time for their order to be executed, submit a

tender order for their Shares to their financial intermediary.

Shareholders can contact their financial intermediaries to find out

about the terms and conditions of tender and the deadlines for

participating in the Offer.

Pursuant to Article 232-2 of the AMF's General Regulation,

orders to tender Shares to the Offer may be revoked at any time up

to and including the closing date of the Offer. After this date,

orders to tender Shares to the Offer will become irrevocable.

2.8 Centralization of the orders to tender Shares

Orders to tender Shares to the Offer will be centralized by

Euronext Paris.

On the date indicated in the Euronext Paris notice, each

financial intermediary and the institution holding the registered

accounts of the Company's Shares must transfer to Euronext Paris

the Shares for which they have received an order to tender to the

Offer.

After Euronext Paris has received all orders to tender to the

Offer under the conditions described above, Euronext Paris will

centralize all such orders and determine the result of the

Offer.

No interest will be paid by the Offeror for the period between

the date on which the Shares are tendered to the Offer and the

settlement date of the Offer. This settlement date will be

indicated in the notice of result to be published by Euronext

Paris. Settlement will take place after the centralization

operations.

2.9 Publication of the results and settlement of the

Offer

In accordance with the provisions of Article 232-3 of its

General Regulation, the AMF will announce the final result of the

Offer no later than nine (9) trading days after the closing of the

Offer. If the AMF determines that the Offer is successful, Euronext

Paris will indicate in a notice the date and terms of delivery of

the Shares and payment of the Offer price.

On the settlement date of the Offer, the Offeror will credit

Euronext Paris with the funds corresponding to the settlement of

the Offer. On this date, the Company Shares tendered to the Offer

and all rights attached thereto will be transferred to the Offeror.

Euronext Paris will make the cash payment to the intermediaries on

behalf of their clients who have tendered their Shares to the Offer

on the settlement date of the Offer.

If necessary, all the operations described above will be

repeated in an identical sequence and under conditions, in

particular with regard to timing, which will be specified in a

notice published by Euronext Paris in connection with the Reopened

Offer.

2.10 Reopening of the Offer

In accordance with the provisions of Article 232-4 of the AMF's

General Regulation, if the Offer is successful, it will be

automatically reopened within ten (10) trading days of the

publication of the final result of the Offer, under identical terms

to those of the Offer. In such a case, the AMF will publish the

timetable for the reopening of the Offer, which will last at least

ten (10) trading days (the "Reopened Offer").

If the Offer is reopened, the procedure for tendering and

centralizing Shares in the Reopened Offer will be identical to

those applicable to the Offer described in Sections 2.7 and 2.8 of

the Draft Offer Document, it being specified, however, that orders

to tender Shares in the Reopened Offer will be irrevocable.

However, the Offeror reserves the right, should it decide to

implement a squeeze-out directly at the end of the Offer in

accordance with the conditions set out in Articles 237-1 et seq. of

the AMF's General Regulation, to request the AMF to implement such

a squeeze-out within ten trading days of the publication of the

notice of result of the Offer. In this case, the Offer would not be

reopened.

The Reopened Offer and all related contracts are governed by

French law. Any dispute or litigation, regardless of the subject

matter or basis, relating to the Offer shall be brought before the

competent courts.

2.11 Interventions on or off the market during the

Offer

With effect from the beginning of the Offer period, the Offeror

reserves the right to acquire Shares, on or off-market, in

accordance with the provisions of Articles 231-38 and 231-39 of the

AMF's General Regulation.

These acquisitions will be made at a price of 142.03 euros per

Share, which corresponds to the Offer Price, without placing the

Offeror in the position of having to file a draft Offer, i.e.

within the limit of 184,834 Shares.

2.12 Indicative timetable of the Offer

Prior to the opening of the Offer, the AMF will publish a notice

of opening and timetable, and Euronext Paris will publish a notice

announcing the terms and opening of the Offer.

An indicative timetable for the Offer is set out below:

Date

Main steps of the

Offer

October 14, 2024

- Filing of the draft Offer and the Draft

Offer Document with the AMF.

- Draft Offer Document made available to

the public and posted on the AMF website (www.amf-france.org).

- Publication of a press release

announcing the filing and availability of the Draf Offer

Document.

- Filing of the Company's draft response

document (projet de note en réponse), including the reasoned and

favorable opinion of the Company's Board of Directors and the

Independent Expert's report.

- Company's draft response document made

available to the public and posted on the Company's website

(www.clasquin.com) and on the AMF website (www.amf-france.org).

- Publication of a press release

announcing the filing and availability of the Company’s draft

response document.

November 5, 2024

- Publication of its clearance decision on

the Offer by the AMF, which serves as the clearance of the

Offeror’s Offer document and of the Company’s response

document.

- Offer document having received the AMF’s

clearance made available to the public and published on the AMF

website (www.amf-france.org).

- Information on the legal, financial and

accounting characteristics of the Offeror made available to the

public and posted on the AMF website (www.amf-france.org).

- Publication by the Offeror of a press

release announcing the availability of the Offer document having

received the AMF’s clearance and of the information on the legal,

financial and accounting characteristics of the Offeror.

- Draft response document having received

the AMF’s clearance made available to the public and posted on the

Company's website (www.clasquin.com) and on the AMF website

(www.amf-france.org).

- Information on the Company's legal,

financial and accounting characteristics made available to the

public and posted on the Company's website (www.clasquin.com) and

on the AMF website (www.amf-france.org).

- Publication by the Company of a press

release announcing the availability of the draft response document

having received the AMF’s clearance and of the information on the

Company's legal, financial and accounting characteristics.

November 6, 2024

- Opening of the Offer.

December 10, 2024

- Closing of the Offer.

December 13, 2024

- Publication by the AMF of the notice of

result of the Offer.

December 18, 2024

- If the Offer is successful,

settlement-delivery of the Offer.

January 2, 2025

- Reopening of the Offer for 10 trading

days in the event of a positive outcome.

January 15, 2025

- Closing of the reopened Offer.

January 20, 2025

- Publication by the AMF of the notice of

result of the reopened Offer.

January 23, 2025

- Settlement-delivery of the reopened

Offer.

As soon as possible after January

23, 2025

- Implementation of the squeeze-out

procedure and delisting of the Shares from Euronext Growth, if the

conditions are met.

2.13 Possibility to withdraw the Offer

In accordance with the provisions of Article 232-11 of the AMF's

General Regulation, the Offeror may withdraw its Offer within a

period of five (5) trading days following publication of the

timetable for a competing offer or improved offer. The Offeror will

inform the AMF of its decision to withdraw its Offer, which will be

published.

2.14 Costs and financing of the Offer

2.14.1 Costs of the Offer

The aggregate amount of all external fees, costs and expenses

incurred by the Offeror in connection with the Offer only,

including in particular fees and other expenses of external

financial, legal and accounting advisors as well as experts and

other consultants, and advertising and communication expenses, is

estimated at approximately nine hundred and ninety-seven thousand

euros (€997,000) (excluding taxes).

2.14.2 Financing of the Offer

In the event that all Shares targeted by the Offer are tendered

to the Offer, the total amount of the cash consideration to be paid

by the Offeror to the shareholders of the Company who have tendered

their Shares under the Offer would amount to a maximum of

€189,857,182.20 (excluding fees and commissions).

This amount will be financed by the Offeror by its own

funds.

2.15 Reimbursement of brokerage fees

Except as set out below, no costs will be reimbursed and no

commissions will be paid by the Offeror to any Shareholder

tendering Shares or to any intermediary or person soliciting the

tender of Shares to the Offer.

In connection with the Offer, the Offeror will bear the

brokerage fees and related VAT paid by the holders of Shares

tendered to the Offer (including the Reopened Offer, where

applicable), up to a maximum of 0.2% (excluding taxes) of the

amount of the Shares tendered to the Offer, with a maximum of 50

euros (including taxes) per transaction. Shareholders will not be

reimbursed for any negotiation fees in the event of the Offer not

being successful for any reason whatsoever.

Euronext Paris will pay directly to the financial intermediaries

the amounts due in respect of the reimbursement of the

above-mentioned expenses as from the settlement-delivery date of

the Offer or the Reopened Offer, as the case may be.

2.16 Offer restrictions outside of France

The Offer has not been the subject of any application for

registration or approval by any financial market regulatory

authority other than the AMF, and no measures will be taken in this

respect.

The Offer is therefore made to shareholders of the Company

located in France and outside of France, provided that the local

law to which they are subject allows them to take part in the Offer

without requiring that the Offeror complete additional

formalities.

Publication of the present Press Release, the Draft Offer

Document, the Offer, the acceptance of the Offer and the delivery

of the Shares may, in certain jurisdictions, be subject to specific

regulations or restrictions. Accordingly, the Offer is not directed

at persons subject to such restrictions, either directly or

indirectly, and must not be accepted from any jurisdiction where

the Offer is subject to restrictions.

Neither the Press Release nor any other document relating to the

Offer constitutes an offer to sell or acquire financial instruments

or a solicitation of such an offer in any jurisdiction in which

such an offer or solicitation would be unlawful, could not validly

be made, or would require the publication of a prospectus or the

completion of any other formality under local financial law.

Holders of Shares located outside of France may only participate in

the Offer to the extent that such participation is permitted under

the local law to which they are subject.

Accordingly, persons in possession of the Press Release or the

Draft Offer Document are required to inform themselves about any

local restrictions that may apply and to comply with such

restrictions. Failure to comply with these restrictions may

constitute a violation of applicable securities laws and

regulations.

The Offeror shall not be liable for any breach by any person of

any applicable legal or regulatory restrictions.

2.17 Tax treatment of the Offer

The tax regime applicable to the Offer is described in Section

2.17 of the Draft Offer Document.

3. ASSESSMENT OF THE OFFER PRICE

The table below summarizes the factors used to assess the Offer

Price.

Valuation methods

Value per Clasquin share (€)

Premium implied (%)

Unaffected share price

Closing price on December 4,

2023

88.8

59.9%

VWAP 1 month to December 4,

2023

80.5

76.4%

VWAP 3 months to December 4,

2023

83.5

70.1%

VWAP 6 months to December 4,

2023

82.1

73.1%

VWAP 12 months to December 4,

2023

72.7

95.3%

Financial analysts' price

target unaffected

Financial analysts' average

target price

94.0

51.1%

Discounted cash flows

Central case

119.3

19.0%

Top of the range

127.5

11.4%

Bottom of the range

112.2

26.6%

Method

presented for illustrative purposes

Historical stock market

multiples

EV/EBITDA (next 12 months) :

Historical average 5 years Clasquin 8.5x

89.6

58.6%

Warning

This Press Release has been prepared for

information purposes only. It does not constitute an offer to the

public and is not intended for distribution in jurisdictions other

than France. The distribution of this Press Release, the Offer and

its acceptance may be subject to specific regulations or

restrictions in certain jurisdictions. The Offer is not addressed

to persons subject to such restrictions, either directly or

indirectly, and is not likely to be accepted from any jurisdiction

where the Offer would be subject to such restrictions.

Consequently, persons in possession of the Communiqué are required

to inform themselves about any local restrictions that may apply

and to comply with them.

SAS declines all responsibility for any

violation of these restrictions by any person.

This document is an unofficial English-language

translation of the French-language Press Release published by the

Offeror and relating to the filing of the draft tender offer

document. In the event of any discrepancies between this unofficial

English-language Press Release and the official French-language

Press Release, the latter shall prevail.

1 Calculated in accordance with Article 223-11 of the AMF’s

General Regulation. 2 On October 1, 2024, Yves Revol donated 53,581

shares to the Yves Revol Foundation endowment fund governed by law

no. 2008-776 of August 4, 2008. 3 Number of shares held on

September 27, 2024, the date of the last known Clasquin FCPE

inventory. 4 The number of theoretical voting rights on October 10,

2024 communicated by the Company is 2,514,363. 5 Number of shares

held on September 27, 2024, the date of the last known Clasquin

FCPE inventory.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241014620898/en/

Clasquin

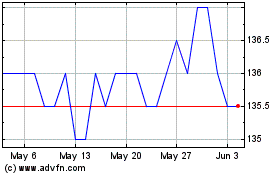

Clasquin (EU:ALCLA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Clasquin (EU:ALCLA)

Historical Stock Chart

From Dec 2023 to Dec 2024