The Agfa-Gevaert Group in 2023: Group EBITDA increases by 52%,

powered by its growth engines - regulated information

Regulated information – March 13, 2024 - 7:45 a.m.

CET The

Agfa-Gevaert Group in 2023: Group EBITDA increases by 52%, powered

by its growth engines

- HealthCare IT:

- Strong improvement in profitability

- Continued investments in innovative solutions

- Digital Print & Chemicals:

- Growing ZIRFON business started to contribute to

profitability

- Profitable growth for Digital Print in spite of subdued

equipment investment climate

- Film activities under pressure from macro-economic conditions

and currency impact

- Radiology Solutions:

- Direct Radiography: Improved profitability in a soft

market

- Medical film: Continuing impact from new centralized

procurement practices in China and macro-economic and geopolitical

conditions

- Adjusted EBITDA at 76 million Euro: significant

year-over-year improvement driven by growth engines and stringent

cost management

- Significant improvement in working capital from 32% to

27%

Mortsel (Belgium), March 13, 2024 – Agfa-Gevaert today

commented on its results in 2023. “In 2023 all our growth

engines performed very well, powering the profitability of the

Group. We have made strong progress in all of them, with the launch

of our HealthCare IT cloud and web streaming activities, our

strategic partnership with EFI and an unprecedented number of

innovative product introductions, including our SpeedSet

single-pass packaging printer. Furthermore, our ZIRFON membrane

business grew exponentially and started to contribute to our

profitability in the course of 2023. This validates the

repositioning of the Group in these future-oriented activities,”

said Pascal Juéry, President and CEO of the Agfa-Gevaert Group.

|

in million euro |

FY 2023 |

FY 2022re-presented |

% change (excl. FX effects) |

Q4 2023 |

Q4 2022re-presented |

% change (excl. FX effects) |

|

REVENUE |

|

|

|

|

|

|

|

HealthCare IT |

249 |

244 |

2.2% (4.9%) |

70 |

70 |

-0.8% (2.6%) |

|

Digital Print & Chemicals |

409 |

372 |

9.8% (12.0%) |

109 |

99 |

10.1% (12.7%) |

|

Radiology Solutions |

425 |

461 |

-7.9% (-4.5%) |

116 |

130 |

-11.0% (-7.7%) |

|

Contractor Operations and Services – former Offset |

68 |

68 |

-0.3% (-0.1%) |

18 |

16 |

13.2% (13.6%) |

|

GROUP |

1,150 |

1,145 |

0.5% (3.2%) |

313 |

316 |

-0.9% (2.1%) |

|

ADJUSTED EBITDA (*) |

|

|

|

|

|

|

|

HealthCare IT |

31.2 |

26.9 |

16.0% |

15.5 |

11.1 |

39.4% |

|

Digital Print & Chemicals |

18.6 |

3.4 |

443.4% |

5.1 |

(4.9) |

|

|

Radiology Solutions |

37.5 |

47.0 |

-20.2% |

14.0 |

18.7 |

-25.4% |

|

Contractor Operations and Services – former Offset |

2.6 |

(8.4) |

|

1.2 |

(1.2) |

|

|

Unallocated |

(14.4) |

(18.6) |

|

(4.0) |

(4.9) |

|

|

GROUP |

76 |

50 |

52.0% |

32 |

18 |

75.9% |

(*) before

restructuring and non-recurring items

Agfa-Gevaert Group

|

in million euro |

FY 2023 |

FY 2022re-presented |

% change(excl. FX effects) |

Q4 2023 |

Q4 2022re-presented |

% change (excl. FX effects) |

|

Revenue |

1,150 |

1,145 |

0.5% (3.2%) |

313 |

316 |

-0.9% (2.1%) |

|

Gross profit (*) |

359 |

346 |

3.7% |

100 |

95 |

6.3% |

|

% of revenue |

31.2% |

30.2% |

|

32.0% |

29.9% |

|

|

Adjusted EBITDA (*) |

76 |

50 |

52.0% |

32 |

18 |

75.9% |

|

% of revenue |

6.6% |

4.3% |

|

10.2% |

5.8% |

|

|

Adjusted EBIT (*) |

31 |

(1) |

|

21 |

5 |

282.2% |

|

% of revenue |

2.7% |

-0.1% |

|

6.6% |

1.7% |

|

|

Net result |

(101) |

(223) |

|

(5) |

(186) |

|

|

Profit from continuing operations |

(51) |

(186) |

|

(3) |

(126) |

|

|

Profit from discontinued operations |

(49) |

(37) |

|

(3) |

(60) |

|

(*) before

restructuring and non-recurring items

Full year

- Excluding currency effects, the Agfa-Gevaert Group’s revenue

increased by 3.2%, driven by growth engines HealthCare IT, Digital

Printing Solutions and ZIRFON membranes for green hydrogen

production. In 2023, the growth engines more than compensated for

the decline of the traditional film activities, which were under

pressure from challenging economic conditions (including adverse

currency effects and the weakening economy in China) and

geopolitical circumstances.

- Based on the strong performances of the HealthCare IT and

Digital Print & Chemicals divisions, the Group’s gross profit

margin improved to 31.2%, in spite of adverse effects including

cost inflation, adverse currency effects, manufacturing

inefficiencies and the weakness in the industrial film

markets.

- Adjusted EBITDA improved strongly from 50 million euro in 2022

to 76 million euro (6.6% of revenue).

- Restructuring and non-recurring items resulted in a charge of

39 million euro versus 138 million euro in 2022, which was heavily

impacted by transformation efforts and impairments in Radiology

Solutions.

- The net finance costs amounted to 26 million euro.

- Income tax expenses decreased to 16 million euro versus 29

million euro in 2022.

- The Agfa-Gevaert Group posted a net loss of 101 million euro,

largely driven by the loss related to the Offset Solutions

transaction.

Fourth quarter

- In Q4, the Group’s EBITDA performance continued to improve

thanks to the growth engines HealthCare IT, Digital Printing

Solutions and Green Hydrogen Solutions.

Financial position and cash flow

- Net financial debt (including IFRS 16) improved from 33 million

euro in Q3 2023 to 6 million euro in Q4 2023.

- Trade working capital (CONOPS excluded) significantly improved

from 32% of turnover at the end of Q4 2022 to 27% in Q4 2023. In

absolute numbers, trade working capital evolved from 342 million

euro at the end of Q4 2022 to 296 million euro.

- In 2023, the Group generated a free cash flow of minus 48

million euro. In the fourth quarter, a positive free cash flow of

33 million euro was recorded.

OutlookIn 2024, the Agfa-Gevaert Group expects

a continuation of the trends seen in the previous year, with

continued growth for the growth engines and further profitability

improvements. As usual, due to seasonality reasons, a slower start

of 2024 is expected, followed by a stronger second half, supported

by the impact of the materialization of postponed

projects.

2024 outlook per division:

- HealthCare IT: A continued progress in profitability is

expected, although strong investments in cloud technology are

planned.

- Digital Print & Chemicals: The division expects significant

top line and profitability growth, driven by Digital Print

Solutions and Green Hydrogen Solutions.

- Radiology Solutions: The medical film business will continue to

be under pressure. The progress in Direct Radiography is expected

to continue.

HealthCare IT

|

in million euro |

FY 2023 |

FY 2022re-presented |

% change(excl. FX effects) |

Q4 2023 |

Q4 2022re-presented |

% change(excl. FX effects) |

|

Revenue |

249 |

244 |

2.2% (4.9%) |

70 |

70 |

-0.8% (2.6%) |

|

Adjusted EBITDA (*) |

31.2 |

26.9 |

16.0% |

15.5 |

11.1 |

39.4% |

|

% of revenue |

12.5% |

11.0% |

|

22.2% |

15.8% |

|

|

Adjusted EBIT (*) |

24.1 |

19.6 |

23.1% |

13.7 |

9.3 |

46.7% |

|

% of revenue |

9.7% |

8.0% |

|

19.7% |

13.3% |

|

(*) before restructuring and non-recurring items

Full year

- Continued investments in innovative solutions:

- Launch of Enterprise Imaging Cloud at RSNA 2023, offering

healthcare providers a solution that is secure, scalable, and

accessible, as well as easy to maintain and use – at a predictable

cost. First significant Cloud contract signed in North

America.

- Introduction of Streaming Client in Enterprise Imaging at RSNA

2023, making images available in near real time, empowering all

members of the care team to collaborate seamlessly.

- Acceleration of innovation efforts:

- To focus on cloud, web streaming and reporting, workflow

orchestration, and scalability.

- This specific effort – expected to amount to 10 million euro in

2024-2025 – will be capitalized and will come on top of the current

R&D expenditure.

- Significant improvement in customer satisfaction – customers

are committed to long-term and turned promoters.

- Innovation and outstanding customer services acknowledged by

market observers and industry influencers:

- Best in KLAS for Enterprise Imaging for Radiology solution in

the PACS Middle East/Africa category for the second consecutive

year.

- Enterprise Imaging XERO Viewer ranked #1 Best in KLAS in the

Universal Viewer category for 2024.

- Throughout the year, HealthCare IT’s order book remained at a

healthy level. The division recorded a 1.8% growth in the 12 months

rolling order intake starting from 122 million euro the year before

to 125 million euro. In both periods, about 15% of total order

intake is related to managed services.

- Excluding currency effects, the division’s top line increased

by 4.9% versus 2022.

- Based on a strong second half of the year, HealthCare IT’s

gross profit margin improved from 45.2% in 2022 to 46.5%. The

improvement was mainly due to overall growth and the increased

portion of own IP in the sales mix. The adjusted EBITDA margin

increased from 11.0% in 2022 to 12.5%, supported by operational

efficiency.

Fourth quarter

- Excluding currency effects, HealthCare IT’s revenue increased

by 2.6% versus the fourth quarter of 2022.

- The gross profit margin improved strongly from 45.1% of revenue

in 2022 to an all-time high 51.4%.

- Adjusted EBITDA strongly improved quarter-over-quarter,

reaching 22.2% of revenue in the fourth quarter.

Digital Print & Chemicals

|

in million euro |

FY 2023 |

FY 2022re-presented |

% change(excl. FX effects) |

Q4 2023 |

Q4 2022re-presented |

% change(excl. FX effects) |

|

Revenue |

409 |

372 |

9.8% (12.0%) |

109 |

99 |

10.1% (12.7%) |

|

Adjusted EBITDA (*) |

18.6 |

3.4 |

443.4% |

5.1 |

(4.9) |

|

|

% of revenue |

4.6% |

0.9% |

|

4.7% |

-4.9% |

|

|

Adjusted EBIT (*) |

2.6 |

(9.3) |

|

1.0 |

(8.5) |

|

|

% of revenue |

0.6% |

-2.5% |

|

1.0% |

-8.5% |

|

(*) before restructuring and non-recurring items

Full yearDigital Printing Solutions

- Inks grew with 14% driven by higher sales across all segments

as well as by the ongoing program to convert former Inca customers

to Agfa’s ink sets.

- Global strategic partnership between Agfa and EFI announced

early 2024. Agfa will integrate EFI’s roll-to-roll system into its

offerings, while EFI will incorporate Agfa’s high-end hybrid inkjet

printers into its suite of solutions.

- Major product launches expected in 2024, including:

- The revolutionary water-based SpeedSet 1060 packaging printer,

which will be the fastest printer in its category. First contract

with beta customer signed in UK – second one coming soon.

- Next-Generation Hybrid Anapurna H3200 Inkjet Printer (launch at

FESPA)

- New mid-range printer (launch at FESPA)

- 5m roll-to-roll machine (launch at FESPA)

Green Hydrogen Solutions

- For over 100 customers in 30 countries, ZIRFON is rapidly

becoming the preferred choice.

- Successful industrial ramp-up of ZIRFON production

capacity.

- Establishment of new industrial-scale ZIRFON production plant

in Mortsel, Belgium:

- All environmental permits obtained.

- 11 million euro grant from the EU Innovation Fund.

- Entry into operation foreseen for October 2025.

- Representing 20 gigawatt per year of alkaline water

electrolysis.

- Renewed collaboration agreement with VITO, a global research

and service center, to pioneer a new generation of gas separator

membranes for alkaline water electrolyzers.

- More than 80% of 2024 volumes already committed to by

customers.

Division performance

- Growth driven by growth engines Digital Printing Solutions and

Green Hydrogen Solutions and general price increase actions.

- The weakness in the electronics industry impacted volumes of

the ORGACON conductive materials and the products for the

production of printed circuit boards.

- The profitable growth of the Digital Printing Solutions and

ZIRFON growth engines, as well as general price increase actions

and cost improvements led to a significant improvement in the

division’s performance.

- The division was able to restore its gross profit margin from

24.9% of revenue in 2022 to 27.1%. The division’s recurring EBITDA

margin improved strongly to 4.6% in 2023, versus 0.9% in the

previous year.

Fourth quarter

- In the fourth quarter, the division’s revenue increase was

driven by the strong performances of the Digital Printing business

and the ZIRFON range. In Digital Printing, equipment sales

recovered following a subdued third quarter.

- The division’s gross profit margin improved strongly from 18.6%

in the fourth quarter of 2022 to 25.8%.

Radiology Solutions

|

in million euro |

FY 2023 |

FY 2022re-presented |

% change(excl. FX effects) |

Q4 2023 |

Q4 2022re-presented |

% change(excl. FX effects) |

|

Revenue |

425 |

461 |

-7.9% (-4.5%) |

116 |

130 |

-11.0% (-7.7%) |

|

Adjusted EBITDA (*) |

37.5 |

47.0 |

-20.2% |

14.0 |

18.7 |

-25.4% |

|

% of revenue |

8.8% |

10.2% |

|

12.1% |

14.4% |

|

|

Adjusted EBIT (*) |

18.8 |

22.4 |

-16.2% |

9.1 |

12.7 |

-27.9% |

|

% of revenue |

4.4% |

4.9% |

|

7.9% |

9.7% |

|

(*) before restructuring and non-recurring items

Full year

- In China, the medical film business was impacted by the gradual

implementation of new centralized procurement practices.

Furthermore, the current geopolitical situation had an adverse

effect on cost levels. In most regions, adverse currency effects

impacted the business’ top line and profitability, which was partly

offset by successful price actions.

- Agfa continues to manage the market driven top line decline of

the Computed Radiography business, maintaining healthy profit

margins.

- Profitability of the Direct Radiography business (DR) strongly

improved following the streamlining and repositioning of the

business. The business remains extremely dynamic in emerging

markets, while in Europe and North-America, certain customer groups

are postponing their investment plans.

- Introduction of artificial intelligence solutions that support

automated pathologies detection, thus becoming the leader in

operationalizing embedded AI at point of care:

- SmartXR: AI for X-ray equipment operation assistance.

- ScanXR: AI for clinicians assistance.

- Throughout the year, Agfa implemented actions to increase the

business’ agility and to better adapt it to the current market

conditions (right-sizing of the organization, relocations, cost

control actions, price increases, net working capital

actions).

- Mainly due to the issues in the medical film business, the

division’s gross profit margin decreased slightly from 32.2% of

revenue in 2022 to 31.4%. Although costs are well under control and

profitability of the Direct Radiography business improved

considerably versus 2022, the division’s adjusted EBITDA margin

decreased from 10.2% of revenue to 8.8%.

- Effective March 13, 2024, Jeroen Spruyt assumes the position of

President of the Radiology Solutions Division. He will also

continue to lead the DR business unit.

- Fourth quarter

- The top line and margin decline was mainly due to the before

mentioned issues in the medical film business.

- Profitability of the DR business improved strongly versus the

fourth quarter of 2022.

Contractor Operations and Services – former

Offset

|

in million euro |

FY 2023 |

FY 2022re-presented |

% change(excl. FX effects) |

Q4 2023 |

Q4 2022re-presented |

% change(excl. FX effects) |

|

Revenue |

68 |

68 |

-0.3% (-0.1%) |

18 |

16 |

13.2% (13.6%) |

|

Adjusted EBITDA (*) |

2.6 |

(8.4) |

|

1.2 |

(1.2) |

|

|

% of revenue |

3.9% |

-12.4% |

|

6.5% |

-7.2% |

|

|

Adjusted EBIT (*) |

(0.4) |

(13.8) |

|

0.4 |

(2.5) |

|

|

% of revenue |

-0.5% |

-20.3% |

|

2.4% |

-15.4% |

|

(*) before restructuring and non-recurring items

- Early April, the Agfa-Gevaert Group completed the sale of its

Offset Solutions division to Aurelius Group. The new division

contains results related to supply and manufacturing agreements

that the Agfa-Gevaert Group signed with its former division, now

rebranded as ECO3.

- The comparative period 2022 has been re-presented accordingly.

As per IFRS 5 rules, stranded costs related to Offset Solutions

have been treated differently in 2023 vs 2022. In 2022, stranded

costs are reported under CONOPS. In 2023, these are absorbed by the

three business divisions.

Reporting post Offset SolutionsThe recent sale

of the Offset Solutions division (now rebranded to ECO3) influences

the way the Agfa-Gevaert Group reports its results. The numbers

from sales to EBITDA present the Agfa-Gevaert Group with Offset

Solutions excluded, but with a new division called ‘Contractor

Operations and Services – former Offset’ or ‘CONOPS’. CONOPS

represents the supply of film and chemicals as well as a set of

support services delivered by Agfa to the external party ECO3. The

turnover represents the supply agreements, with corresponding COGS

charges. The income related to the support services will be

accounted for as Other Income, while the costs related to those

support services are re-presented in the different SG&A lines.

The comparative period 2022 has been re-presented accordingly. As

per IFRS 5, stranded costs related to Offset Solutions have been

treated differently in 2023 vs 2022. In 2022, stranded costs are

reported under CONOPS. In 2023, these are absorbed by the three

business divisions.

End of messageManagement Certification of Financial

Statements and Quarterly ReportThis statement is made in

order to comply with new European transparency regulation enforced

by the Belgian Royal Decree of November 14, 2007 and in effect as

of 2008."The Board of Directors and the Executive Committee of

Agfa-Gevaert NV, represented by Mr. Frank Aranzana, Chairman of the

Board of Directors, Mr. Pascal Juéry, President and CEO, and Mr.

Dirk De Man, CFO, jointly certify that, to the best of their

knowledge, the consolidated financial statements included in the

report and based on the relevant accounting standards, fairly

present in all material respects the financial condition and

results of Agfa-Gevaert NV, including its consolidated

subsidiaries. Based on our knowledge, the report includes all

information that is required to be included in such document and

does not omit to state all necessary material

facts.”Statement of riskThis statement is made in

order to comply with new European transparency regulation enforced

by the Belgian Royal Decree of November 14, 2007 and in effect as

of 2008."As with any company, Agfa is continually confronted with –

but not exclusively – a number of market and competition risks or

more specific risks related to the cost of raw materials, product

liability, environmental matters, proprietary technology or

litigation." Key risk management data is provided in the annual

report available on www.agfa.com.

Confirmation Information – press release Agfa-Gevaert

NVThe statutory auditor, KPMG Bedrijfsrevisoren –

Réviseurs d’Entreprises, represented by F. Poesen, has confirmed

that the audit procedures, which have been substantially completed,

have not revealed any material misstatement in the accounting

information included in the Company’s annual announcement.Berchem,

March 13, 2024KPMG Bedrijfsrevisoren / Réviseurs

d’EntreprisesRepresented byF. Poesen, Partner

Contact:Viviane DictusDirector

Corporate CommunicationSeptestraat 272640 Mortsel - BelgiumT +32

(0) 3 444 71 24E viviane.dictus@agfa.com

The full press release and financial information is also

available on the company's website:

www.agfa.com.Consolidated Statement of Profit or Loss (in

million euro)

Consolidated figures following IFRS accounting

policies.

|

Continued operations |

2023 |

2022re-presented 1 |

Q4 2023unaudited |

Q4 2022re-presented 1 |

|

Revenue |

1,150 |

1,145 |

313 |

316 |

|

Cost of sales |

(792) |

(800) |

(214) |

(223) |

|

Gross profit |

359 |

345 |

100 |

93 |

|

Selling expenses |

(170) |

(181) |

(43) |

(48) |

|

Administrative expenses |

(140) |

(168) |

(36) |

(47) |

|

R&D expenses |

(73) |

(82) |

(17) |

(23) |

|

Net impairment loss on trade and other receivables, including

contract assets |

1 |

(1) |

1 |

- |

|

Other operating income |

53 |

64 |

15 |

15 |

|

Other operating expenses |

(38) |

(117) |

(12) |

(92) |

|

Results from operating activities |

(8) |

(139) |

7 |

(101) |

|

Interest income (expense) - net |

3 |

- |

2 |

- |

|

Interest income |

15 |

4 |

6 |

2 |

|

Interest expense |

(12) |

(4) |

(4) |

(1) |

|

Other finance income (expense) - net |

(29) |

(18) |

(9) |

(5) |

|

Other finance income |

2 |

6 |

- |

1 |

|

Other finance expense |

(31) |

(24) |

(9) |

(6) |

|

Net finance costs |

(26) |

(18) |

(7) |

(5) |

|

Share of profit of associates, net of tax |

(1) |

(1) |

(1) |

(1) |

|

Profit (loss) before income taxes |

(35) |

(157) |

(1) |

(106) |

|

Income tax expenses |

(16) |

(29) |

(2) |

(20) |

|

Profit (loss) from continued operations |

(51) |

(186) |

(3) |

(126) |

|

Profit (loss) from discontinued operations, net of

tax |

(49) |

(37) |

(3) |

(60) |

|

Profit (loss) for the period |

(101) |

(223) |

(5) |

(186) |

|

Profit (loss) attributable to: |

|

|

|

|

|

Owners of the Company |

(102) |

(221) |

(5) |

(182) |

|

Non-controlling interests |

1 |

(2) |

- |

(4) |

|

|

|

|

|

|

|

Results from operating activities |

(8) |

(139) |

7 |

(101) |

|

Restructuring and non-recurring items |

(39) |

(138) |

(13) |

(106) |

|

Adjusted EBIT |

31 |

(1) |

21 |

5 |

|

|

|

|

|

|

|

Earnings per Share Group – continued operations (euro) |

(0.33) |

(1.19) |

(0.02) |

(0.81) |

|

Earnings per Share Group – discontinued operations (euro) |

(0.33) |

(0.22) |

(0.02) |

(0.36) |

|

Earnings per Share Group – total (euro) |

(0.66) |

(1.41) |

(0.03) |

(1.18) |

1) Compliant with IFRS 5.33, the Company has presented in its

Consolidated Statement of Profit or Loss and Comprehensive Income,

a single amount comprising the total of the post-tax profit (loss)

of discontinued operations and the post-tax profit (loss) on the

disposal of net assets constituting the discontinued operations.

The Group has sold its Offset Solutions business in April, 2023.

Comparative information has been re-presented.

Consolidated Statement of Comprehensive Income for the

year ending December 2022 / December 2023 (in million

euro) Consolidated figures following IFRS

accounting policies.

|

|

2023 |

2022 re-presented 1 |

|

Profit / (loss) for the period |

(101) |

(223) |

|

Profit / (loss) for the period from continuing

operations |

(51) |

(186) |

|

Profit / (loss) for the period from discontinuing

operations |

(49) |

(37) |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

(12) |

7 |

|

Exchange differences on translation of foreign operations |

(10) |

7 |

|

Release of exchange differences of discontinued operations to

profit or loss |

(2) |

- |

|

Cash flow hedges: |

4 |

- |

|

Effective portion of changes in fair value of cash flow hedges |

2 |

(5) |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

2 |

5 |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

- |

|

Income taxes |

- |

- |

|

Items that will not be reclassified subsequently to profit

or loss: |

(13) |

123 |

|

Equity investments at fair value through OCI – change in fair

value |

(1) |

(2) |

|

Remeasurements of the net defined benefit liability |

(15) |

148 |

|

Income tax on remeasurements of the net defined benefit

liability |

3 |

(23) |

|

Total Other Comprehensive Income for the period, net of

tax |

(21) |

130 |

|

Total other comprehensive income for the period from

continuing operations |

(15) |

102 |

|

Total other comprehensive income for the period from

discontinuing operations |

(6) |

28 |

|

|

|

|

|

Total Comprehensive Income for the period, net of tax

attributable to |

(123) |

(93) |

|

Owners of the Company |

(125) |

(91) |

|

Non-controlling interests |

2 |

(2) |

|

Total comprehensive income for the period from continuing

operations attributable to: |

(66) |

(85) |

|

Owners of the Company (continuing operations) |

(66) |

(85) |

|

Non-controlling interests (continuing operations) |

- |

- |

|

Total comprehensive income for the period from

discontinuing operations attributable to: |

(56) |

(8) |

|

Owners of the Company (discontinuing operations) |

(58) |

(6) |

|

Non-controlling interests (discontinuing operations) |

2 |

(2) |

1) Compliant with IFRS 5.33, the Company has presented in its

Consolidated Statement of Profit or Loss and Comprehensive Income,

a single amount comprizing the total of the post-tax profit (loss)

of discontinued operations and the post-tax profit (loss) on the

disposal of net assets constituting the discontinued operations.

The Group has sold its Offset Solutions business in April, 2023.

Comparative information has been re-presented.Consolidated

Statement of Comprehensive Income for the quarter ending December

2022 / December 2023 (in million euro)

Consolidated figures following IFRS accounting policies.

|

|

Q4 2023unaudited |

Q4 2022 re-presented1 |

|

Profit / (loss) for the period |

(5) |

(186) |

|

Profit / (loss) for the period from continuing

operations |

(3) |

(126) |

|

Profit / (loss) for the period from discontinuing

operations |

(3) |

(60) |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

(12) |

(42) |

|

Exchange differences on translation of foreign operations |

(12) |

(42) |

|

Release of exchange differences of discontinued operations to

profit or loss |

- |

- |

|

Cash flow hedges: |

2 |

4 |

|

Effective portion of changes in fair value of cash flow hedges |

2 |

2 |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

- |

2 |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

- |

|

Income taxes |

- |

- |

|

Items that will not be reclassified subsequently to profit

or loss: |

(12) |

9 |

|

Equity investments at fair value through OCI – change in fair

value |

- |

- |

|

Remeasurements of the net defined benefit liability |

(15) |

19 |

|

Income tax on remeasurements of the net defined benefit

liability |

3 |

(10) |

|

Total Other Comprehensive Income for the period, net of

tax |

(22) |

(30) |

|

Total other comprehensive income for the period from

continuing operations |

(17) |

(32) |

|

Total other comprehensive income for the period from

discontinuing operations |

(5) |

2 |

|

|

|

|

|

Total Comprehensive Income for the period, net of tax

attributable to |

(28) |

(216) |

|

Owners of the Company |

(28) |

(209) |

|

Non-controlling interests |

- |

(7) |

|

Total comprehensive income for the period from continuing

operations attributable to: |

(19) |

(158) |

|

Owners of the Company (continuing operations) |

(19) |

(158) |

|

Non-controlling interests (continuing operations) |

- |

- |

|

Total comprehensive income for the period from

discontinuing operations attributable to: |

(8) |

(58) |

|

Owners of the Company (discontinuing operations) |

(8) |

(51) |

|

Non-controlling interests (discontinuing operations) |

- |

(7) |

1) Compliant with IFRS 5.33, the Company has presented in its

Consolidated Statement of Profit or Loss and Comprehensive Income,

a single amount comprizing the total of the post-tax profit (loss)

of discontinued operations and the post-tax profit (loss) on the

disposal of net assets constituting the discontinued operations.

The Group has sold its Offset Solutions business in April, 2023.

Comparative information has been re-presented.

Consolidated Statement of Financial Position (in million

euro)

Consolidated figures following IFRS accounting

policies.

| |

31/12/2023 |

31/12/2022 |

|

Non-current assets |

576 |

602 |

| Goodwill |

215 |

218 |

| Intangible

assets |

24 |

29 |

| Property, plant

and equipment |

115 |

107 |

| Right-of-use

assets |

39 |

45 |

| Investments in

associates |

1 |

1 |

| Other financial

assets |

4 |

5 |

| Assets related to

post-employment benefits |

29 |

18 |

| Trade

receivables |

2 |

9 |

| Receivables under

finance leases |

69 |

72 |

| Other assets |

4 |

8 |

| Deferred tax

assets |

74 |

91 |

| Current

assets |

792 |

1,153 |

| Inventories |

289 |

487 |

| Trade

receivables |

175 |

291 |

| Contract

assets |

83 |

94 |

| Current income

tax assets |

51 |

56 |

| Other tax

receivables |

20 |

28 |

| Other financial

assets |

- |

1 |

| Receivables under

finance lease |

31 |

31 |

| Other

receivables |

48 |

6 |

| Other current

assets |

13 |

17 |

| Derivative

financial instruments |

2 |

3 |

| Cash and cash

equivalents |

77 |

138 |

| Non-current

assets held for sale |

2 |

2 |

|

TOTAL ASSETS |

1,368 |

1,756 |

|

|

31/12/2023 |

31/12/2022 |

| Total

equity |

396 |

561 |

| Equity

attributable to owners of the Company |

395 |

520 |

| Share

capital |

187 |

187 |

| Share

premium |

210 |

210 |

| Retained

earnings |

945 |

1,042 |

| Other

reserves |

- |

(3) |

| Translation

reserve |

(22) |

(9) |

| Post-employment

benefits: remeasurements of the net defined benefit liability |

(926) |

(908) |

|

Non-controlling interests |

1 |

41 |

|

Non-current liabilities |

584 |

610 |

| Liabilities for

post-employment and long-term termination benefit plans |

486 |

536 |

| Other employee

benefits |

5 |

9 |

| Loans and

borrowings |

69 |

41 |

| Provisions |

7 |

14 |

| Deferred tax

liabilities |

9 |

9 |

| Trade

payables |

3 |

- |

| Other non-current

liabilities |

4 |

- |

| Current

liabilities |

388 |

585 |

| Loans and

borrowings |

14 |

25 |

| Provisions |

13 |

36 |

| Trade

payables |

132 |

249 |

| Contract

liabilities |

97 |

109 |

| Current income

tax liabilities |

23 |

29 |

| Other tax

liabilities |

24 |

32 |

| Other

payables |

9 |

6 |

| Employee

benefits |

73 |

95 |

| Other current

liabilities |

1 |

- |

| Derivative

financial instruments |

- |

2 |

| TOTAL

EQUITY AND LIABILITIES |

1,368 |

1,756 |

Consolidated Statement of Cash Flows (in million

euro) Consolidated figures following IFRS accounting

policies.

|

|

2023 |

2022 |

Q4 2023unaudited |

Q4 2022 |

|

Profit (loss) for the period |

(101) |

(223) |

(5) |

(186) |

|

Income taxes |

21 |

42 |

3 |

30 |

|

Share of (profit)/loss of associates, net of tax |

1 |

1 |

1 |

1 |

|

Net finance costs |

26 |

19 |

7 |

5 |

|

Operating result |

(53) |

(160) |

6 |

(150) |

|

|

|

|

|

|

|

Depreciation & amortization |

26 |

35 |

7 |

9 |

|

Depreciation & amortization on right-of-use assets |

19 |

28 |

5 |

7 |

|

Impairment losses on goodwill |

- |

70 |

- |

70 |

|

Impairment losses on intangibles and PP&E |

3 |

29 |

2 |

29 |

|

Impairment losses on right-of-use assets |

5 |

15 |

(1) |

15 |

|

|

|

|

|

|

|

Exchange results and changes in fair value of derivates |

(1) |

10 |

(2) |

(3) |

|

Recycling of hedge reserve |

2 |

5 |

- |

2 |

|

Government grants and subsidies |

(5) |

(5) |

(1) |

(2) |

|

(Gains)/Losses on the sale of intangibles and PP&E |

- |

(1) |

- |

- |

|

Result on the disposal of discontinued operations |

42 |

- |

(4) |

- |

|

Expenses for defined benefit plans & long-term termination

benefits |

24 |

35 |

3 |

7 |

|

Accrued expenses for personnel commitments |

60 |

70 |

14 |

19 |

|

Write-downs/reversal of write-downs on inventories |

13 |

12 |

3 |

4 |

|

Impairments/reversal of impairments on receivables |

(1) |

1 |

(1) |

- |

|

Additions/reversals of provisions |

1 |

23 |

(1) |

17 |

|

|

|

|

|

|

|

Operating cash flow before changes in working

capital |

134 |

166 |

29 |

24 |

|

|

|

|

|

|

|

Change in inventories |

23 |

(65) |

43 |

57 |

|

Change in trade receivables |

(22) |

25 |

(20) |

(4) |

|

Change in contract assets |

10 |

(14) |

8 |

(6) |

|

Change in trade working capital assets |

11 |

(55) |

31 |

47 |

|

Change in trade payables |

(10) |

(7) |

26 |

2 |

|

Change in contract liabilities |

5 |

(8) |

(2) |

(16) |

|

Changes in trade working capital liabilities |

(5) |

(15) |

25 |

(13) |

|

Changes in trade working capital |

6 |

(69) |

56 |

33 |

|

|

2023 |

2022 |

Q4 2023unaudited |

Q4 2022 |

|

Cash out for employee benefits |

(133) |

(149) |

(35) |

(37) |

|

Cash out for provisions |

(22) |

(27) |

(2) |

(10) |

|

Changes in lease portfolio |

2 |

(2) |

(9) |

(12) |

|

Changes in other working capital |

(15) |

4 |

7 |

19 |

|

Cash settled operating derivatives |

- |

(9) |

- |

(3) |

|

|

|

|

|

|

|

Cash from / (used in) operating activities |

(28) |

(86) |

46 |

15 |

|

|

|

|

|

|

|

Income taxes paid |

(2) |

(15) |

(3) |

(11) |

|

Net cash from / (used in) operating

activities |

(30) |

(100) |

43 |

4 |

|

of which related to discontinued operations |

(12) |

- |

- |

(3) |

|

|

|

|

|

|

|

Capital expenditure |

(34) |

(33) |

(12) |

(9) |

|

Proceeds from sale of intangible assets & PP&E |

3 |

2 |

1 |

- |

|

Acquisition of subsidiaries, net of cash acquired |

3 |

(48) |

- |

- |

|

Disposal of discontinued operations, net of cash disposed of |

(4) |

(5) |

1 |

- |

|

Investment in associates |

(1) |

(1) |

- |

(1) |

|

Interests received |

16 |

7 |

6 |

3 |

|

|

|

|

|

|

|

Net cash from / (used in) investing

activities |

(16) |

(76) |

(5) |

(8) |

|

of which related to discontinued operations |

(5) |

(10) |

- |

(3) |

|

|

|

|

|

|

|

Interests paid |

(13) |

(5) |

(4) |

(2) |

|

Dividends paid to non-controlling interests |

(9) |

(11) |

- |

(5) |

|

Purchase of treasury shares |

- |

(21) |

- |

- |

|

Proceeds from borrowings |

40 |

3 |

- |

- |

|

Repayment of borrowings |

- |

(4) |

- |

(2) |

|

Payment of finance leases |

(23) |

(30) |

(6) |

(7) |

|

Proceeds / (payment) of derivatives |

(3) |

(9) |

1 |

(4) |

|

Other financing income / (costs) received/paid |

(2) |

1 |

(1) |

(1) |

|

|

|

|

|

|

|

Net cash from / (used in) financing

activities |

(10) |

(77) |

(10) |

(21) |

|

of which related to discontinued operations |

(11) |

(20) |

- |

(7) |

|

|

|

|

|

|

|

Net increase / (decrease) in cash & cash

equivalents |

(57) |

(253) |

28 |

(26) |

|

|

|

|

|

|

|

Cash & cash equivalents at the start of the

period |

138 |

398 |

53 |

178 |

|

Net increase / (decrease) in cash & cash equivalents |

(57) |

(253) |

28 |

(26) |

|

Effect of exchange rate fluctuations on cash held |

(4) |

(7) |

(5) |

(14) |

|

Cash & cash equivalents at the end of the

period |

77 |

138 |

77 |

138 |

The Group has elected to present a statement of cash flows that

includes all cash flows, including both continuing and

discontinuing operations.Consolidated Statement of changes

in Equity (in million euro) Consolidated figures following

IFRS accounting policies.

|

in million euro |

Share capital |

Share premium |

Retained earnings |

Reserve for own shares |

Revaluation reserve |

Hedging reserve |

Remeasurement of the net defined benefit

liability |

Translation reserve |

TOTAL |

NON-CONTROLLING INTERESTS |

TOTAL EQUITY |

|

Balance at January 1, 2022 |

187 |

210 |

1,284 |

- |

2 |

(2) |

(1,033) |

(15) |

632 |

54 |

685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(221) |

- |

- |

- |

- |

- |

(221) |

(2) |

(223) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

(2) |

- |

125 |

7 |

130 |

- |

130 |

|

Total comprehensive income for the period |

- |

- |

(221) |

- |

(2) |

- |

125 |

7 |

(91) |

(2) |

(93) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(10) |

(10) |

|

Purchase of own shares |

- |

- |

- |

(21) |

- |

- |

- |

- |

(21) |

- |

(21) |

|

Cancellation of own shares |

- |

- |

(21) |

21 |

- |

- |

- |

- |

- |

- |

- |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

(21) |

- |

- |

- |

- |

- |

(21) |

(10) |

(31) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2022 |

187 |

210 |

1,042 |

- |

(1) |

(2) |

(908) |

(9) |

520 |

41 |

561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2023 |

187 |

210 |

1,042 |

- |

(1) |

(2) |

(908) |

(9) |

520 |

41 |

561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(102) |

- |

- |

- |

- |

- |

(102) |

1 |

(101) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

(1) |

4 |

(12) |

(13) |

(23) |

1 |

(22) |

|

Total comprehensive income for the period |

- |

- |

(102) |

- |

(1) |

4 |

(12) |

(13) |

(125) |

2 |

(123) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(9) |

(9) |

|

Transfer of amounts recognized in OCI to retained earnings

following loss of control |

- |

- |

6 |

- |

- |

- |

(6) |

- |

- |

- |

- |

|

Derecognition of NCI following loss of control |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(33) |

(33) |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

6 |

- |

- |

- |

(6) |

- |

- |

(42) |

(42) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2023 |

187 |

210 |

945 |

- |

(1) |

1 |

(926) |

(22) |

395 |

1 |

396 |

- Press release in pdf

- Statements in pdf

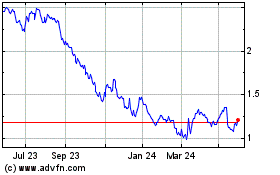

AGFA Gevaert NV (EU:AGFB)

Historical Stock Chart

From Nov 2024 to Dec 2024

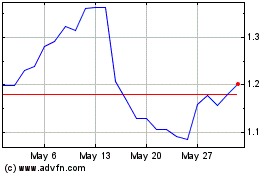

AGFA Gevaert NV (EU:AGFB)

Historical Stock Chart

From Dec 2023 to Dec 2024