Coinbase Premium Index Reaches Two-Year Low At -0.23%: Impact On Bitcoin Price Unveiled

January 03 2025 - 10:30PM

NEWSBTC

In a promising development, the Bitcoin price is inching closer to

the coveted $100,000 mark as it trades above $98,000 for the first

time since late December. Crypto analyst Ali Martinez has

highlighted several critical metrics that could signal further

bullish momentum for the leading cryptocurrency as the market

begins to recover. Bitcoin Price Surges Amid Coinbase Premium Index

Low One of the significant indicators discussed by Martinez is the

Coinbase Premium Index, which recently hit -0.23%, its lowest point

in two years. This index measures the price difference between

Bitcoin on Coinbase and other exchanges. A negative premium

suggests that US-based investors may be less willing to pay a

premium for Bitcoin, but the current rebound could indicate a shift

toward growing institutional interest in the asset. Related

Reading: Prepare For A Solana Sell-Off: How Grayscale’s 2025

Unlocks Could Shake The Market Martinez also noted that the recent

uptick in the Bitcoin price comes amid a notable withdrawal trend,

with over 48,000 BTC—valued at more than $4.5 billion—pulled from

exchanges in the past week. This trend indicates a bullish

sentiment among investors, despite a brief price correction that

occurred late last year. Despite these positive signals, Martinez

cautions that Bitcoin is at a crucial juncture. He emphasized the

importance of sustaining a close above the 50-day moving average

(MA), currently just above $96,000. A failure to maintain

this level could lead to a potential downward correction.

Conversely, a sustained close above the 50-day MA could signal the

end of the recent correction and confirm a more robust bullish

trend. Strong Upward Move Expected After Wave Three Breakout In

addition to Martinez’s insights, the Elliot Wave Academy has

provided a technical analysis of the recent Bitcoin price

movements, suggesting that the cryptocurrency is currently in the

fourth wave of a larger bullish cycle. The academy’s analysis

indicates that after a powerful breakout from a price channel,

Bitcoin has successfully surpassed the ideal level of wave three,

which may signal a strong upward move. The fourth wave, according

to their analysis, is characterized by a sideways pattern following

the sharp rise of wave three. The potential correction zones

for this wave have been identified, and should these levels be

breached, the next upward wave could target a Bitcoin price range

between $117,475.70 and $138,058.37. These figures represent major

bullish targets that could attract further investment and drive

Bitcoin’s price higher. Related Reading: Dogecoin Recovery In

Sight: Strong Support Hints At Bullish 2025 All around, as the

Bitcoin price continues its upward trajectory, the combination of

significant withdrawals from exchanges, a low Coinbase Premium

Index, and positive Elliott Wave analysis paints a compelling

picture for the cryptocurrency’s future. However, investors

should remain vigilant, keeping an eye on critical price levels

that could determine the market’s next move. At the time of

writing, the market’s leading crypto is trading at $98,320.

Featured image from DALL-E, chart from TradingView.com

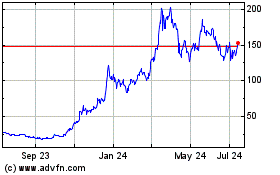

Solana (COIN:SOLUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025