Bitcoin Plummets To $59,000, On-Chain Data Reveals Why

August 28 2024 - 4:30PM

NEWSBTC

Bitcoin has observed a plunge to the $59,000 level during the past

day. Here’s what could be behind it, according to on-chain data.

Bitcoin Exchange Inflow Spiked Just Before The Crash In a new post

on X, CryptoQuant Head of Research Julio Moreno discussed the

latest trend in Bitcoin Exchange Inflow. Exchange

Inflow is an on-chain metric that tracks the total amount of

assets being transferred into the wallets of centralized

exchanges. Investors deposit many coins on these platforms when

this indicator’s value is high. One of the main reasons holders may

transfer to exchanges is for selling-related purposes so this trend

can have bearish consequences for BTC’s value. Related Reading:

Litecoin Sees Sudden Exodus Of Retail Investors: Why This Can Be

Bullish On the other hand, the low metric implies holders aren’t

moving that many coins from self-custody into exchanges, which,

depending on whether outflows are also occurring, can potentially

be bullish for the cryptocurrency. Now, here is the chart shared by

Moreno that shows the trend in the Bitcoin Exchange Inflow over the

past few days: As displayed in the graph at the top, the Bitcoin

Exchange Inflow saw some notable spikes in the lead-up to the

latest price plunge. The version of the indicator in the chart is

specifically for the spot platforms, so selling was likely the goal

of the investors making these deposits. The CryptoQuant head has

also attached the data for another metric: the Spent Output Value

Bands version of the Exchange Inflow, under the chart for the

Exchange Inflow. This indicator shows how the Exchange Inflow

breaks down according to the transactions’ size. In the graph,

Moreno has specifically highlighted the 1,000 to 10,000 BTC value

band, corresponding to addresses carrying between 1,000 and 10,000

tokens in their balance. Investors of this scale are popularly

known as the whales and are considered among the market’s most

influential entities. As the chart shows, the Exchange Inflow for

these large Bitcoin holders also spiked alongside the spikes in the

general metric, implying that the whales contributed to some of the

deposits. Related Reading: Solana, Ethereum Attract Traders Amid

Bitcoin Open Interest Plunge Given the timing of the inflows made

by these humongous investors, it’s probable that this selling was

partially responsible for the bearish price action the

cryptocurrency witnessed during the past day. As such, the

indicator could be worth monitoring shortly, as more large deposits

could suggest that the Bitcoin sellers aren’t done yet. BTC Price

At the time of writing, Bitcoin is floating around $59,900, down

almost 4% over the last 24 hours. Featured image from Dall-E,

CryptoQuant.com, chart from TradingView.com

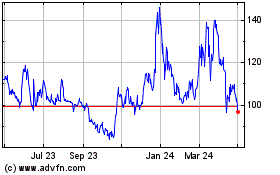

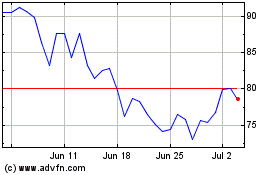

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024