How 4DOT is making DeFi Accessible to Crypto Investors

March 03 2022 - 1:01AM

NEWSBTC

While the exponential growth of decentralized finance is evident

from the increased awareness and utility, the industry still

remains complex to navigate for new users. However, with the

growing progress and growth, a new concept of decentralized finance

has evolved as DeFi 3.0. DeFi 3.0 is a modular approach to

decentralized finance in harmony with Web 3.0 with an aim to

improve user participation using simplification. DeFi 3.0 is an

initiative taken by several projects to promote a community-centric

approach where the investors and traders benefit the most. With the

right approach and deployment, DeFi 3.0 has the potential to

blossom into one of the most progressive aspects of the crypto

industry. Moreover, DeFi 3.0 is solving several pain points of DeFi

2.0 that investors and users faced in various instances. The

Drawbacks of DeFi 2.0 While DeFi 2.0 paved the way for the

innovative DeFi 3.0, it witnessed several instances where the

investors were scammed out of billions of dollars. One of the

biggest cases that came to light was with Wonderland. The top

executive of Wonderland, Michael Patryn proposed the DeFi protocol

that offers yields of 83,000% which unfortunately did not fall

through Wonderland investors were promised unbelievable APYs by

showcasing a treasury balance of $675 Million. However, the TIME

token price plummeted significantly from the high of $10,000 to a

low of $335 in November last year. This price downfall caused the

investors to lose significant investments. Luckily, DeFi 3.0 is

solving these pain points of the previous gen DeFi and projects

like 4dot using its products such as Cross-Chain Farming and D3

Protocol. 4DOT – DeFi 3.0 Made Easy 4DOT is a decentralized finance

ecosystem that offers innovative and easily accessible DeFi 3.0

solutions. The project has designed a set of DeFi 3.0 products that

empower the ecosystem and its vision of bringing awareness to the

masses. 4DOT has designed a buy, hold, earn model where anyone can

participate despite their experience level. The buy, hold, earn

model is paired with a dynamic treasury via taxes and generates

profit across different chains. Moreover, all 4DOT product smart

contracts are fully audited, and the liquidity is locked prior to

launch until 2024. 4DOT ensures that any protocol deployed on the

ecosystem is audited and secured using fundamental and on-chain

analysis. 4DOT ecosystem consists of these four products: Cross

Chain Farming ($CCF) $CCF is a DeFi 3.0 Farming-as-a-Service

protocol that helps users to receive reflections and dividends via

a protocol-managed yield farming treasury. D3 Protocol D3 Protocol

is a DeFi 3.0 index, where users can stake and earn from an

auto-investing, auto-compounding treasury of yield-bearing DeFi 3.0

assets. The stakers of the protocols will receive reflections and

$BUSD dividends. Moreover, 4DOT will be launching a DeFi 3.0

Launchpad (4DOT Launchpad) and a DeFi 3.0 low-risk yield farming

strategy (Hera Capital) soon to expand its suite of products. Apart

from these robust DeFi 3.0 products, 4dot will also introduce a

liquidity lock, a Hashex Audit, excellent farming profits and a

transparent team. 4DOT is a complete DeFi 3.0 ecosystem with robust

products and an innovative approach, which will help the project

disrupt the decentralized finance industry.

Harmony (COIN:ONEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

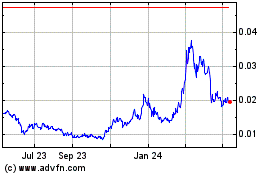

Harmony (COIN:ONEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Harmony (Cryptocurrency): 0 recent articles

More Harmony News Articles