Buckle Up: Here Is Why Bitcoin Might Just Be Gearing Up For a 200% Surge

July 02 2024 - 10:00PM

NEWSBTC

Amid the current Bitcoin market performance suggesting signs of a

rebound, prominent crypto analyst Wise Advice has

highlighted a critical indicator in Bitcoin’s trading pattern.

Bollinger Bands Signal 200% Bitcoin Surge According to the analyst,

the Bitcoin weekly Bollinger Band, a statistical chart

characterizing the prices and volatility over time, has shrunk to

its second-lowest width in six years. Traditionally, such

contraction has been a precursor to substantial price movements.

Related Reading: Market Analysts Eye July for Potential Big Wins in

Bitcoin and Ethereum — Here’s Why Wise advice disclosed that

historically, a similar constriction was observed before Bitcoin

surged 200% from a base of $24,000 to a high peak within five

months. This indicator is particularly noteworthy as it suggests

that market volatility is about to increase, potentially leading to

a significant price rise. For context, Bollinger Bands are a set of

trend indicators derived from a moving average and an upper and

lower band, each set at a standard deviation from the moving

average. This tool helps traders to assess how high or low the

current price is relative to previous trades. A narrowing of these

bands typically indicates a reduction in volatility. A sharp

increase or decrease often follows it in price, as the market

prepares to make a substantial move. Bitcoin Holders, Read this 🚨

The #Bitcoin weekly Bollinger band is now at its 2nd lowest level

in 6 years. The last time it was this low, #BTC was trading at

$24K, and it pumped 200% in just 5 months

pic.twitter.com/jnud3pCjAr — Wise Advice (@wiseadvicesumit) July 1,

2024 Recent Market Activity and Bullish Outlook Despite a promising

setup, Bitcoin has recently struggled to maintain its upward

momentum. Over the past week, while there has been a modest 3%

recovery, the price has faced resistance, peaking at $63,790 before

dipping to around $62,563. This recent price action occurs amid

broader market anticipation of a favorable July. Market analysts,

including the team at QCP Capital, reference historical data

showing Bitcoin’s tendency to rebound in July with an average

return of 9.6%, especially after weak performances in June. This

pattern of a strong July following a weak June is supported by

additional market commentary. They are not alone in their optimism;

other market analysts like Ali have also noted similar recovery

patterns in past post-June slumps, hinting at a strong comeback in

July. Supporting the bullish sentiment are the substantial inflows

into US spot Bitcoin ETFs. This Monday, these funds recorded daily

net inflows totaling $129.45 million, marking the fifth consecutive

day of positive flows and the most substantial intake since early

June. Related Reading: Bitcoin Begins Month With A Rebound As

Metaplanet’s BTC Investment Tops $10 Million Leading the inflows

were Fidelity’s FBTC and Bitwise’s BITB, with significant

contributions, suggesting that institutional interest remains

strong despite the market’s recent fluctuations. Featured image

created with DALL-E, Chart from TradingView

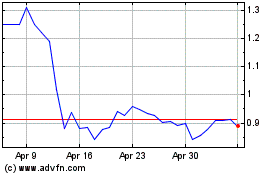

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024