Is Too Late To Accumulate Bitcoin? What This Indicator Says

October 24 2024 - 9:00PM

NEWSBTC

Here’s what the historical pattern of an on-chain indicator

suggests regarding whether the time to accumulate Bitcoin is over

or not. Bitcoin 150-Day MA aSOPR Currently Has A Value Of 1.01 As

pointed out by an analyst in a CryptoQuant Quicktake post, the

150-day moving average (MA) of the Bitcoin aSOPR has a value of

just 1.01 right now. The “Adjusted Spent Output Profit Ratio”

(aSOPR) here refers to an indicator that basically tells us about

whether the BTC investors are selling their coins at a profit or

loss. This metric works by going through the on-chain history of

all tokens being sold/transferred to see what price they were

transacted at prior to this. When this price for any coin is less

than the current price at which they are now being sold, then that

particular token’s sale could be assumed to be leading to profit

realization. Related Reading: Analytics Firm Reveals Why Dogecoin

& Apecoin Hit Tops Similarly, coins of the opposite type could

be considered to be adding to the loss realization. The aSOPR

combines such profits and losses being realized across the network,

and calculates their ratio. The “adjusted” in this metric’s name

comes from the fact that it filters out transactions of coins that

were moved inside an hour of their last transaction. Transfers like

these are generally of no consequence to the wider market, so it

makes sense to take them out of the data. Now, here is a chart that

shows the trend in the 150-day MA of the Bitcoin aSOPR over the

last few years: As displayed in the above graph, the 150-day MA

Bitcoin aSOPR has consistently remained above the 1 mark this year,

which implies the investors as a whole have been realizing more

profits than losses. Earlier in the year, the indicator had grown

to a high of 1.04 as the investors had taken the profits of the

rally. As the consolidation of the cryptocurrency has dragged on,

though, the metric has declined, with its value now sitting at

1.01. In the chart, the quant has highlighted two zones that have

historically been significant for the aSOPR. The first is the

region under 0.98, where bottoms have historically occurred. At

levels this low, the investors are participating in notable loss

realization. Resolute hands pick up the coins from these

capitulators, thus helping the price reach a point of turnaround.

Related Reading: Bitcoin Profitability Index Hits 202%: Is This

Enough For A Top? The other zone is the one above 1.08, where tops

have formed in the past as a result of the aggressive profit-taking

from the whales. So far, the current cycle hasn’t seen the Bitcoin

aSOPR visit this territory. “Based on previous trends, accumulating

Bitcoin until aSOPR reaches 1.04 could be a solid strategy for

long-term gains,” says the analyst. “Timing the market by observing

whale behavior may prove fruitful.” BTC Price Bitcoin had plunged

to the $65,000 level yesterday, but the coin has already made

recovery as its price is now floating around $67,100. Featured

image from Dall-E, CryptoQuant.com, chart from TradingView.com

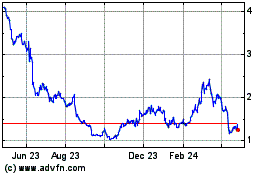

ApeCoin (COIN:APEUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

ApeCoin (COIN:APEUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025