Telstra Acquires Digicel Pacific in Partnership With Australian Government -- 2nd Update

October 24 2021 - 6:57PM

Dow Jones News

By Stuart Condie

SYDNEY--Telstra Corp. Ltd. agreed to acquire mobile networks in

six Pacific nations in a US$1.6 billion deal largely funded by the

Australian government, which foreign policy experts have said

wanted to block China from buying the assets.

Australia's largest mobile communications provider on Monday

said government-owned Export Finance Australia would provide

US$1.33 billion toward the deal. Telstra said it would contribute

the remaining US$270 million and own 100% of Digicel Pacific's

ordinary equity.

Australia's Department of Foreign Affairs and Trade said the

funding commitment was part of the government's so-called Pacific

Step Up initiative, which it said aims to develop secure and

reliable infrastructure in the region. The EFA will help to manage

financial and other risks associated with the acquisition, it

added.

"Telstra's acquisition sends an important signal about the

company's potential and about wider business confidence in the

future of the Pacific region," the department said.

Telstra Chief Executive Andrew Penn said Digicel Pacific, which

operates in Papua New Guinea, Fiji, Nauru, Samoa, Tonga and

Vanuatu, is a commercially attractive asset and critical to

telecommunications in the region.

"It is consistent with the Australian government's interest in

encouraging quality investment in the Pacific, the financial

arrangements make it very attractive for Telstra, and it

strengthens our relationships with the Australian Government and

the Pacific region," Mr. Penn said.

Analysts have suggested the acquisition could improve Telstra's

standing with the government ahead of the expected privatization of

Australia's National Broadband Network. Telstra and other providers

currently lease access to the network, the creation of which has

been an earnings headwind for providers over recent years.

The move is the latest by the Australian government seeking to

limit Chinese influence in the region, particularly in the

telecommunications sector. Australia has banned Chinese telecoms

firm Huawei Technologies Co. from involvement in its 5G mobile

network.

In 2018, Australia said it would build an undersea high-speed

internet cable to the Solomon Islands, shutting out Huawei from the

project. And more recently, Australia began reviewing on security

grounds a Chinese company's lease of the port in the northern

Australian city of Darwin.

If China acquired the Pacific mobile networks, it could monitor

Australian communications to and from the region and use its

control of the assets as leverage, John Lee, a senior fellow at the

United States Studies Centre at the University of Sydney, said in

July.

Mr. Penn said Digicel Pacific would sit within a new

international subsidiary when the deal completes within

three-to-six months. Telstra had already planned the creation of

the unit to hold assets including subsea cables, while its other

subsidiaries hold its fixed-line infrastructure, its mobile

infrastructure, and its customer-facing operations.

Mr. Penn said the transaction exceeded all Telstra's acquisition

criteria by being earnings-per-share accretive, being more

accretive than a share buyback, and boasting a

return-on-invested-capital higher than its

weighted-average-cost-of-capital. The purchase of Digicel Pacific,

a subsidiary of privately owned Digicel Group Holdings Ltd.,

enhances Telstra's outlook, Mr. Penn added.

Digicel Group said Digicel Pacific had democratized mobile

communications by making services available to more than 10 million

people. It said the brand would remain in all markets and the

current management team would remain with the company.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

October 24, 2021 18:42 ET (22:42 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

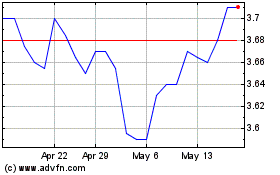

Telstra (ASX:TLS)

Historical Stock Chart

From Feb 2025 to Mar 2025

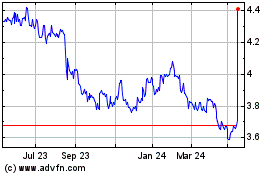

Telstra (ASX:TLS)

Historical Stock Chart

From Mar 2024 to Mar 2025