Australia Liberalizes Ownership Of Media -- WSJ

September 15 2017 - 3:02AM

Dow Jones News

By Rob Taylor

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 15, 2017).

CANBERRA, Australia -- Australia's media sector is poised for a

wave of mergers after legislators agreed to the most sweeping

shake-up of ownership controls in decades, hoping to help

struggling outlets compete with digital rivals like Alphabet Inc.'s

Google and Netflix Inc.

Key independent Nick Xenophon, whose NXT Party wields bargaining

power in the Senate, struck a deal with the conservative government

to pass the reforms in return for funding to help smaller

publishers and newsrooms employ more journalists.

Sen. Xenophon said the negotiations to shake up laws put in

place three decades ago were "the most difficult and protracted and

robust" he had undertaken. "The significance of this agreement

should not be underestimated," he said. The legislation passed 31

to 27.

Australia's traditional media outlets, including The Wall Street

Journal publisher News Corp., have been hard hit in recent years by

falling advertising revenue as audiences embrace digital platforms.

Newspaper circulation has declined sharply as well.

The reforms, opposed by the opposition Labor Party, will abolish

a 75% audience "reach rule" that had prevented free-to-air

television networks like Nine Entertainment Co., Seven West Media

Ltd. and the Ten Network Holdings Ltd.-- recently in plans to be

acquired by U.S. television behemoth CBS Corp.--from buying

regional affiliates that could access more than three quarters of

the population.

They also removed a two-out-of-three rule that prevented large

media companies from controlling free-to-air TV stations,

newspapers and radio stations in the same market.

The reforms could give fresh impetus to a counterbid by News

Corp. Co-Chairman Lachlan Murdoch and Australian media entrepreneur

Bruce Gordon to CBS Corp's $201 million Australian dollars ($160.4

million) buyout of Ten Network Holdings, with both opposing the

proposed deal in the Australian courts.

As part of the deal, Treasurer Scott Morrison agreed to ask the

Australian Competition and Consumer Commission to conduct an

inquiry into the impact of Facebook and Google on the traditional

media industry, adding to a slew of inquiries by lawmakers into the

tax affairs of both internet giants.

Media companies who unanimously supported the reforms argued

existing controls were no longer relevant against new digital

streaming platforms like Netflix, Google and Apple, as well as

global media firms like the New York Times, BuzzFeed and the

Guardian who have set up newsrooms in Australia.

News of an impending deal to end months of protracted political

wrangling saw media stocks rise Thursday, including Southern Cross

Media Group Ltd., Fairfax Media, Seven West Media and Nine

Entertainment. Speculation has swirled that Fairfax and Nine could

be first off merger blocks after passage of the reforms.

Write to Rob Taylor at rob.taylor@wsj.com

(END) Dow Jones Newswires

September 15, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

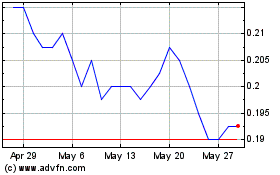

Seven West Media (ASX:SWM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Seven West Media (ASX:SWM)

Historical Stock Chart

From Dec 2023 to Dec 2024