James Hardie Downgrades Its Annual Earnings Guidance

August 15 2022 - 6:12PM

Dow Jones News

By David Winning

SYDNEY--James Hardie Industries PLC downgraded its annual

earnings guidance, partly to reflect inflationary pressures that

are affecting its building product businesses around the world.

James Hardie said it now expects adjusted net income of between

US$730 million and US$780 million in the 12 months through March,

2023. That is lower than prior guidance of US$740 million-US$820

million, but would still represent growth on US$620.7 million

achieved in the 2022 fiscal year.

"Our primary reasons for adjusting guidance downward are:

continued inflationary pressures globally, our lowered expectations

regarding Europe segment Ebit, the impact of a strengthening U.S.

dollar on the translation of our APAC and Europe earnings and

housing market uncertainty," said Jason Miele, James Hardie's chief

financial officer.

The revised guidance was provided to investors alongside its

first-quarter performance, which was headlined by 15% growth in

adjusted net income to US$154.3 million. Quarterly net profit

totalled US$163.1 million, up 34% on year.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

August 15, 2022 17:57 ET (21:57 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

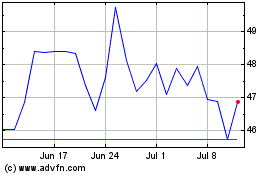

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Nov 2024 to Dec 2024

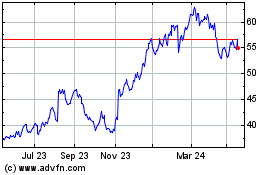

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2023 to Dec 2024