The FINEOS Platform Winter Release Delivers Group, Voluntary and Absence Management Enhancements Essential to Insurers, Employers, and Employees

March 24 2022 - 9:15AM

Business Wire

FINEOS product updates fortify sales and services efficiencies,

enable new product speed to market, and enhance multiple customer

experiences

The FINEOS Corporation (ASX:FCL), the leading core platform for

life, accident and health insurance globally, released a set of

product updates within the cloud-native FINEOS Platform that

provide expanded capabilities across Group, Voluntary, and Absence

Management products. The updates fulfil needs throughout the full

customer spectrum across insurers, employers, and employees to

support sales and service effectiveness, new product speed to

market, and an enriched customer experience.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220324005534/en/

To gain deeper insights into the FINEOS Platform Winter

Release, join the live product management panel discussion:

The FINEOS Platform: Purpose-Built for

Innovation and Growth on April 14, 2022 at 11:30 am

ET.

"This release marks another significant step forward in how the

FINEOS Platform serves all parts of the Group, Voluntary, and

Absence value chain. We are solving more problems for our customers

and doing so in uniquely seamless ways,” said Eoin Kirwan, Chief

Product Officer, FINEOS.

The FINEOS Platform Group, Voluntary, and Absence Management

Enhancements Include:

Sales and Underwriting Effectiveness

- Integrated Experience Rating: NextGen functionality for the

underwriting and actuarial teams to drive profitability across

their book of business. Via an embedded user experience, an

underwriter can leverage prior claims experience to provide the

best appropriate rate for the customer while providing leading risk

management principles for the insurer. The experience rate is

blended with the manual rate based upon insurer rules and

preferences.

- Enhanced Group Underwriting provides one view of the

employer at time of quote: Integrated pricing flexibility and

enhanced underwriting processes provides real time adjustment to

changing market needs. Whole case underwriting enables optimized

product bundles based on the employer’s total need and drives

greater enrollment participation.

- LIMRA LDEx API Enhancements: Enhanced LIMRA LDEx APIs

include absence management connectivity and data management.

New Product Speed to Market

- Voluntary Benefits Product Enhancements for Policy, Billing,

and Claims: Enhanced claims integration and automation

capabilities for accident, critical illness, and hospital indemnity

enables insurers to leverage integrated eligibility and enrollment

data for member elections to drive voluntary product claim

acceleration and auto adjudication.

- Additional Member Management and Bill Processing: This

release provides extended support for the variety of administrative

models across group insurance and worksite for member

management.

- Billing Enhancements: Enhanced list bill processing

supports the increased consumer centric product and services

required by the market with additional billing support for insured

Paid Family and Medical Leave (PFML) policies.

Customer Experience

- Robust Employer Dashboard and Reporting Portal and APIs:

Real-time data dashboards enable employers to view workforce leave

information and review data in graphical views, filter the data by

leave reason, groups, and dates. Reports can be exported in Excel

or PDF formats to gain insight into individual case details.

- Intermittent Leave Process Improvement: This release

reduces friction associated with intermittent leave, including

surfacing the right level of information and automation, low-touch,

and no-touch options, such as over-frequency tolerance rule.

- Paid Leave Integration: Enriched integration and

automation between paid leave, unpaid leave, disability, and

voluntary benefits that pertain to an employee’s single leave

reason, reduces duplicate work and errors, and providing a single

source of truth across the value chain for all elements of an

employee’s leave claim.

“As the only purpose-built, cloud-native core insurance solution

for the life, accident and health market, the FINEOS Platform

remains ahead of the curve in meeting the technical and operational

needs of insurers,” said Michael Kelly, CEO, FINEOS. “Deployable as

an end-to-end core solution, or as components to enable incremental

transformation efforts, the FINEOS Platform has something for the

entire Employee Benefits value chain including better support for

the sales/service process, the customer experience and the ability

to deal with a broad range of products and services such as absence

management,” added Kelly.

About FINEOS Corporation FINEOS is a leading provider of

core systems for life, accident and health insurers globally with 7

of the 10 largest employee benefits insurers in the US as well as 6

of the largest life insurers in Australia. With employees and

offices throughout the world, FINEOS continues to scale rapidly,

working with innovative, progressive insurers in North America,

Europe, and Asia Pacific.

The FINEOS Platform is the only purpose-built, end-to-end SaaS

insurance solution for the life, accident and health market. The

FINEOS AdminSuite delivers industry leading capabilities across

core administration including absence management, billing, claims,

payments, policy administration, provider management and new

business and underwriting; all of which are configurable to operate

independently or as one suite. The machine learning enabled FINEOS

Engage solution enables robust people first digital engagement

pathways and the FINEOS Insight solution provides predictive

analytics and reporting across the business.

For more information, visit www.FINEOS.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220324005534/en/

Victoria Jamison Sr Marketing Manager FINEOS Corporation + 353 1

639 9700 victoria.jamison@fineos.com

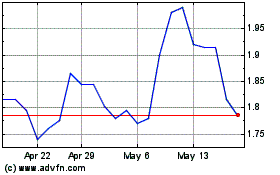

FINEOS (ASX:FCL)

Historical Stock Chart

From Nov 2024 to Dec 2024

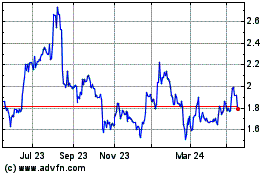

FINEOS (ASX:FCL)

Historical Stock Chart

From Dec 2023 to Dec 2024