Commonwealth Bank Profit Hit by Compensation Costs -- Update

August 06 2019 - 8:13PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Commonwealth Bank of Australia's (CBA.AU)

annual profit was squeezed by margin pressure and the rising cost

of compensating customers for past failings, though it flagged

signs of stability in the housing market.

The bank, Australia's largest by market value and the country's

biggest mortgage lender, recorded an 8.1% drop in net profit for

the financial year as customer remediation costs swelled by about 1

billion Australian dollars (US$675.8 million). It also struggled

with a dip in income as lending and deposit volume growth was

offset by compensation, the removal and reduction in certain

customer fees, and a rise in compliance and wages costs.

Still, Commonwealth Bank held its dividend steady and said it

had neutralized the discount on its dividend reinvestment plan and

would consider options for returning capital to shareholders after

the sale of assets further bolstered its balance sheet.

"We're making very good progress on becoming a simpler and

better bank, both simplifying our portfolio as well as the way we

operate and serve our customers," said Matt Comyn, the former head

of retail banking who took over as chief executive in April

2018.

Net profit fell to A$8.57 billion in the 12 months through June

from A$9.33 billion the year before. It was the second year running

that Commonwealth Bank's profit has declined.

After years of benefiting from low levels of soured loans and

dominant positions in a booming mortgage market, the nation's

biggest banks have struggled with headwinds to revenue growth from

a retreat in property prices and customer compensation and

compliance costs. Regulatory and political scrutiny has also

increased following last year's damming government-ordered probe of

misconduct in the financial industry, which revealed a number of

cases including widespread charging of fees for financial advice

that wasn't delivered.

Commonwealth Bank, which has a market value of about A$141

billion, said the cost of its ongoing remediation program had now

climbed to almost A$2.2 billion as it spend more on refunding fees

charged to wealth and banking customers.

Cash earnings, a measure followed by analysts that strips out

items including currency hedging volatility and losses or gains on

asset sales, fell by 4.7% to A$8.49 billion on ongoing operations,

missing expectations.

However, the bank maintained its dividend for the second half of

the year at A$2.31 a share, for an unchanged full-year payout of

A$4.31.

Commonwealth Bank last week completed the A$4.2 billion sale of

its global asset-management business, Colonial First State, and it

is awaiting final regulatory approval for the A$688 million exit

from its stake in China's BoComm Life Insurance. That gave it the

flexibility to consider capital-management options, including a

possible off-market share buyback, it said.

Commonwealth Bank, viewed by analysts as a bellwether for the

industry due to its scale, said the recent escalation of the trade

dispute between the U.S. and China was a clear risk to global

growth assumptions, but more positively there were signs of a

recovery in Australia's housing market. Prices in Sydney and

Melbourne have risen for the last two months, the first rebound

since mid-2017, and there has been a pick-up in housing credit

growth, Mr. Comyn said.

The bank logged home and business lending growth of 4% for the

year, though competition and customers switching from higher-margin

mortgage options saw its net interest margin, a profit measure

based on the difference between the rate at which a bank borrows

and lends, contract slightly over the financial year. Operating

expenses also rose by 2.5% for the year with the remediation

program, wage inflation and information technology spending.

Commonwealth Bank's annual loan-impairment expense was 11%

higher at A$1.2 billion, but it said credit quality remained sound.

Customers falling behind on personal loans remained elevated, with

pockets of stress in Western Sydney and Melbourne, though there was

a modest improvement in customers falling behind on home-loan

payments, it said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 06, 2019 19:58 ET (23:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

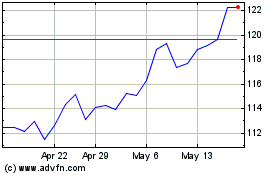

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Jan 2025 to Feb 2025

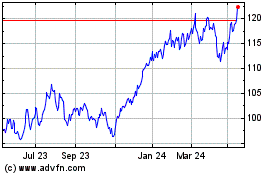

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Feb 2024 to Feb 2025