UPDATE: Alumina Ltd Returns To Profit, Demand Set To Grow 12%

February 09 2011 - 6:34PM

Dow Jones News

The world's largest seller of alumina roared back to profit in

2010, with Alumina Ltd. (AWC.AU) turning 2009's US$26 million loss

into a US$35 million net profit as the commodity started to loosen

its tether to the price of aluminum.

Chief Executive John Bevan said the market for the commodity is

set to grow 12% over the coming year. "The global alumina market is

entering a growth phase due in part to the rising demand for

alumina from independent, non-integrated smelters, including many

in China," he said.

Sale prices for the company's alumina rose 28% on the previous

year, but a stronger Australian dollar cut into profits, the

company said.

Australia accounts for 60% of global production from the Alcoa

World Alumina & Chemicals joint venture, majority-owned by

U.S.-based Alcoa Inc. (AA) and in which Alumina has a 40%

stake.

In the year to Dec. 31, the joint venture produced 15.2 million

tons of alumina, with quarterly production in the fourth quarter

hitting a record.

The company paid a final dividend of 4 U.S. cents per share,

with a total for the year of 6 cents including the company's

half-year dividend, compared to 1.8 cents in 2009.

Alumina Ltd. received US$234 million in dividends from AWAC over

the course of the year.

Alumina is a chemically refined commodity produced from bauxite

ore, which is then further refined in smelters to produce aluminum

metal. The commodity has traditionally been priced at around

12%-15% of benchmark aluminum prices, but at half-year results last

year Bevan said the company had started moving its contracts to

independent pricing.

The move, which would see alumina priced off a markets-based

index instead, should be complete once all long-term contracts had

been revised around 2015.

Similar pricing changes have seen booming prices for iron ore

and coking coal over the past year, as the commodities have

responded more closely to fluctuations in supply and demand.

The price of aluminum has also been on the rise over the past

year following its trough in the wake of the global financial

crisis, with three-month futures on the London Metal Exchange

hitting a post-crisis intraday high of $2,575.25 a metric ton

Wednesday.

Alumina's current spot price of $390/ton is 15.1% of that price,

and the company said its realised sale prices in 2010 rose 28% on

the previous year.

AWAC is the largest supplier of alumina to independent smelters,

although major miners such as United Co. Rusal PLC (0486.HK), Rio

Tinto PLC (RIO), and Aluminum Corp. of China Ltd. (ACH), or

Chinalco, produce large volumes of the material for their own

smelters.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

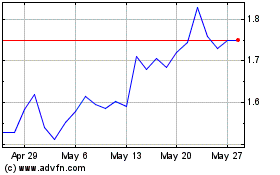

Alumina (ASX:AWC)

Historical Stock Chart

From Dec 2024 to Jan 2025

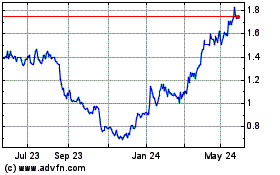

Alumina (ASX:AWC)

Historical Stock Chart

From Jan 2024 to Jan 2025