Amcor CEO Expects US, European Antitrust Approval On Alcan Buy

October 22 2009 - 12:23AM

Dow Jones News

Amcor Ltd. (AMC.AU) Chief Executive Ken MacKenzie said Thursday

he expects U.S. and European trade regulators to approve its A$2.44

billion acquisition of parts of Rio Tinto Ltd.'s (RTP) Alcan

packaging business.

MacKenzie told reporters after the company's annual general

meeting in Melbourne that he expects the deal, announced in August,

to close by Jan. 1 pending regulatory approval.

Initial feedback from regulators should come in the next six

weeks, he said.

The company currently has net debt of A$3.4 billion or debt

gearing at 43%, up from A$2.6 billion at June 30 and gearing of

46%.

With targeted gearing of 50%, MacKenzie said Amcor has

sufficient headroom for further acquisitions.

Within two years of the close of the Alcan deal, Amcor

anticipates strong cash flow, which may allow for further capital

management, including reinvestment in the business, debt reduction

or return to shareholders.

-By Andrew Harrison, Dow Jones Newswires;

61-3-9292-2095; andrew.harrison@dowjones.com

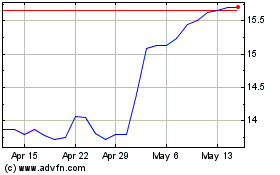

Amcor (ASX:AMC)

Historical Stock Chart

From Sep 2024 to Oct 2024

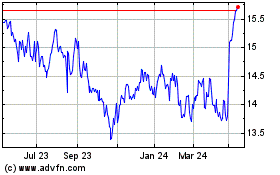

Amcor (ASX:AMC)

Historical Stock Chart

From Oct 2023 to Oct 2024