TIDMSPA

RNS Number : 5022A

1Spatial Plc

30 September 2020

30 September 2020

1Spatial plc (AIM: SPA)

("1Spatial", the "Group" or the "Company")

Interim Results for the six-month period ended 31 July 2020

Robust performance, delivering revenue growth and positive

operating cash flow

1Spatial, a global leader in providing Location Master Data

Management (LMDM) software and solutions, is pleased to announce

interims results for the year six months ended 31 July 2020.

Financial Highlights

-- Solid progress against a backdrop of Covid-19, with Group

revenues up 8% to GBP11.7m (H1 2020: GBP10.9m), including full

six-month contribution from Geomap-Imagis

-- Solutions revenues up 21% to GBP10.1m (H1 2020: GBP8.3m)

-- Adjusted EBITDA steady at GBP1.7m (H1 2020: GBP1.7m)

-- Positive operating cashflow of GBP1.7m (H1 2020: outflow GBP1.9m)

-- Net cash position of GBP3.4m at 31 July 2020 (31 January

2020: GBP3.9m) following the payment of GBP0.6m deferred

consideration for the acquisition of Geomap-Imagis

GBPm Half-year Half-year

to to

31 July 31 July % change

20 19

Revenue 11.7 10.9 8%

Gross profit 6.1 5.7 6%

Adjusted EBITDA * 1.7 1.7 1%

Operating loss (0.8) (0.6) 23%

Loss after tax (0.7) (0.6) 16%

Operating cash inflow/(outflow) 1.7 (1.9) n/a

* Adjusted for strategic, integration, other irregular items and

share-based payments

Operational Highlights

-- US$2.6m 5-year contract with the US State of Michigan

-- Further wins across all geographic markets, including the

Environment Agency and Greater London National Underground Asset

Register in the UK

-- Expansion contracts with existing customers, including Google and Northern Gas Networks

-- Migrations from Elyx to Esri platform commenced in France with seven projects now underway

-- Launched 1Data Gateway, the first 1Spatial cloud-based offering

-- Some delay to customer decision making due to Covid-19, but

overall the business remained resilient

Current trading and Outlook

-- Trading in H2 has begun in line with management's

expectations, including winning new contract with the US Geological

Survey

-- We are seeing an increased number of sales opportunities,

both from our direct sales activities and via partners

-- While decision-making may continue to be protracted in the

short-term, the breadth of our opportunity, combined with the

quality of our offering and people, mean we are increasingly

confident with regards to the long-term future of 1Spatial

-- The Board has reinstated full year guidance, expecting H2

revenues to be at a similar level to H1

Commenting on the results, 1Spatial CEO, Claire Milverton,

said:

"We continued to make progress with our strategy in the first

half of the year, delivering a robust trading performance against

the backdrop of Covid-19, expanding our existing customer

relationships, winning new strategic accounts and continuing to

enhance the capabilities of our Location Master Data Management

offering. We are pleased to present these results, where we have

delivered positive free cash flow in the first six months,

demonstrating the Group's strengthening financial position.

"We have entered the second half of the year with an increased

order book of contracted revenues, providing us with a good level

of revenue visibility. T he breadth of our opportunity combined

with the quality of our offering and people, mean we are

increasingly confident with regards to the long-term future of

1Spatial."

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No.596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

The Company will host an analyst presentation at 11am today and

for those wishing to register, please email

1spatial@almapr.co.uk

For further information, please contact:

1Spatial plc 01223 420 414

Claire Milverton / Andrew Fabian

Liberum (Nomad and Broker) 020 3100 2000

Neil Patel / Cameron Duncan/ Ed Phillips /

Miquela Bezuidenhoudt

Alma PR 020 3405 0205

Caroline Forde / Justine James / Harriet Jackson 1spatial@almapr.co.uk

About 1Spatial plc

1Spatial plc is a global leader in providing Location Master

Data Management (LMDM) software and solutions, primarily to the

Government, Utilities and Transport sectors. Our global clients

include national mapping and land management agencies, utility

companies, transportation organisations, government and defence

departments.

Today - as location data from smartphones, the Internet of

Things and great lakes of commercial Big Data increasingly drive

commercial decision-making - our technology drives efficiency and

provides organisations with confidence in the data they use.

We unlock the value of location data by bringing together our

people, innovative solutions, industry knowledge and our extensive

customer base. We are striving to make the world more sustainable,

safer and smarter for the future. We believe the answers to

achieving these goals are held in data. Our 1Spatial Location

Master Data Management (LMDM) platform incorporating our 1Integrate

rules engine delivers powerful data solutions and focused business

applications on-premise, on-mobile and in the cloud. This ensures

data is current, complete, and consistent through the use of

automated processes and always based on the highest quality

information available.

1Spatial plc is AIM-listed, headquartered in Cambridge, UK, with

operations in the UK, Ireland, USA, France, Belgium, Tunisia and

Australia.

For more information visit www.1spatial.com

Half-year review

We have continued to progress our strategy in the first half of

the year, delivering a robust trading performance against the

backdrop of Covid-19, expanding our existing customer

relationships, winning exciting new strategic accounts and

continuing to enhance the capabilities of our Location Master Data

Management offering.

We delivered positive free cash flow in the first six months,

demonstrating the Group's strengthening financial position and

providing us with the increased flexibility as we implement our

growth strategy.

Our Location Master Data Management solutions business delivered

revenue growth of 21% overall, benefitting from a full six-month

contribution from Geomap-Imagis and continued uptake of our data

management solutions and business applications.

We enter the second half of the year with an increased order

book of contracted future revenue and a growing sales pipeline.

While sales cycles continue to be protracted, our expanded business

provides us with a strong platform to capitalise on the growing

demand for usable location-based data in our target industries and

geographic markets. Given the Board's confidence in the business,

we have reinstated full year guidance.

Delivering our strategy

We help customers make better business decisions and move

forward to a smarter world by unlocking the value of location data.

We are building our highly scalable business on three pillars:

Innovation, Customer Relationships and Smart Partnerships.

1. Innovation

Innovation lies at the heart of 1Spatial. Our technology

development hubs in the UK (Cambridge) and France (Paris) have been

at the forefront of continually adapting to provide innovative

solutions to manage location data for over 50 years. We help

organisations build strong spatial data infrastructures, leading to

better business decisions. We do this using our automated,

rules-based approach to data validation, integration and

enhancement. We have continued our development work in the period

across the three areas of our Location Master Data Management

offering.

Data Management Solutions - 1Integrate and 1Data Gateway

The landscape within the public sector is increasingly dominated

by the need to establish higher levels of geospatial data integrity

and assurance. The Geospatial Commission published its 5-year

national Geospatial Strategy, the "Power of Place", in May 2020,

advocating greater exploitation of geospatial data. The rise of

Digital Twins has also reinforced the need for greater trust in

data and the revived motivation for developing an Information

Management Framework. These developments place greater importance

on the capabilities of 1Spatial's core Location Master Data

Management technology and products, like 1Integrate, which has

helped us secure key wins.

Development work in the period included the addition of 3D

capability to the 1Integrate rules engine, with early pre-beta

releases enabling pre-sales and marketing engagements with

customers, providing the ability for increased engagement with

national mapping agencies and the Building Information Modelling

(BIM)/construction sector.

We launched 1Data Gateway in March 2020, supporting the cloud

platform. This product enables customers to validate data

throughout the data supply chain and was a key component of State

of Michigan win in the US.

We launched an internal training programme within our Tunisian

operation in the period, upskilling the team in the Location Master

Data Management products, starting with 1Integrate. This will

expand our capacity and speed to implement rules for projects

within our data digitisation business.

Business Applications

The Group continues to review and develop its portfolio of

Business Applications and is prioritising investment based on

repeatable solutions driven by market needs.

We continue to invest in the 1Water solution, built on the Esri

technology platform, including use of the new Utility Network

Model. This brings together the expertise of 1Spatial's water

network management and Esri's platform. It is being rolled out in

incremental releases in H2 2021 and beyond.

We continue to develop our Traffic Management Plan Automation

(TMPA) Business Application, which uses the 1Integrate rules engine

to automate the complex manual process of designing traffic control

layouts following the traffic management rulebook.

Other innovations at an earlier stage include ecology survey and

machine learning capabilities for water leakage detection.

Cloud platform

Product and technology evolution continue to underpin the cloud

platform. Architectural changes such as the 1Data Gateway portal

and docker containerised deployments have been completed or are

underway. Additional capabilities such as remote data access

services will continue to be added through H2 2021. This will

result in a scalable cloud deployment to underpin TMPA and other

solutions, as well as SaaS product delivery for those

components.

2. Customer Relationships

We want to be our customers' strategic partner and trusted

advisor in Location Master Data Management in our chosen industries

and geographies.

Land

We continued to secure new customers across our geographies and

markets. In the UK, the Environment Agency selected 1Spatial to

develop their new Digital Asset Data and Information system for

developing digital twins of key assets. We secured the second phase

of the Greater London National Underground Asset Register project,

and Laing Murphy JV invested in 1Data Gateway as they roll out

their HS2 supply chain data quality process.

In France, new wins include a 4-year framework agreement with

Seine Grand Lac, which manages flood prevention in the City of

Paris, a contract with Etablissement Public Foncier d'Ile de

France, who manage the public properties in the Paris Region and

several local authorities. In the US, the Michael Baker

partnership, underpinned by 1Integrate, continues to win business,

with 10 new clients added to date in the year. We also secured a

new 1integrate licence sale to Farm Credit Services.

Expand

We continued to expand sales to existing customers in the

period, with continued investment in 1Spatial products and services

demonstrating clients' trust in our people and technology.

In the UK, 1Spatial delivered two new enterprise mobile

applications across Northern Gas Networks for field reporting of

emergency incidents and asset maintenance. RPA (Land Management

System) and DAERA (FARMAP) have both extended their service

management and software contracts with 1Spatial, as well as

continued software upgrades at PRAI in Ireland and Ordnance Survey

Ireland. Our expertise in building practical business solutions is

becoming more deeply integrated at OSGB as we help develop their

new generation of open source products under the PSMA.

In France, seven existing customers have commenced migration

from the Group's legacy platform, to the Esri platform, paving the

way for future expansion. The Group secured four expansion

contracts in the French utility and government sectors. We also

extended a key support and maintenance contract for a European

national cadastre agency for four years with a total contract value

of EUR1.3m.

The highlight in the US was the significant contract secured

with the State of Michigan to deliver the second phase of their

Geographic Framework. This is a five-year contract with an expected

total contract value of at least $2.6m. We have continued to win

new work with Google Inc., the Federal Highways and US Census, and

expansion wins with LA County, Ventura County and the State of

Minnesota.

3. Smart Partnerships

We use smart partnerships to extend our market reach, providing

additional scale to our capabilities. We target three types of

partners: major technology consultancies, software platform

providers, and adjacent industry specialists.

A new partnership agreement with global engineering firm Black

& Veatch has led to early success in the UK with potential to

expand this technology collaboration overseas. Our strong

partnership with E sri France is generating increasing interest in

the local authority and utility market and our Michael Baker

relationship in the US continues to bring new customers. We

continue to work on new partnership opportunities in all geographic

markets.

Covid-19

Coronavirus (Covid-19) continues to have an unprecedented impact

globally and our business continuity plans remain robust. Most

sites continue to work on a remote basis, providing outstanding

support to our customers, with some beginning a phased return to

the office.

We have seen some lengthening of sales cycles across all

territories but continue to see new opportunities entering our

pipeline. As described in the update provided at the time of the

AGM, our French business saw the greatest impact, with the

suspension of local government contracting activity impacting both

licence and service revenue generation. However, the suspension has

now been lifted.

We chose to maintain all of our skilled workforce during the

Covid-19 period, receiving no support under the UK Government job

retention scheme, although, we did utilise financial support in

some overseas territories, where there was a greater impact.

As flagged in our Final Results announced on 11 June 2020, we

increased our funding from corporate lenders in H1 2021 by GBP1.8m

to provide extra resources as we entered a period of uncertainty.

We have controlled expenditure tightly through the deferment of

some discretionary spending. If we were to see a slow-down in our

customer win rate and activities, we would take appropriate action.

However, our extensive customer base, healthy levels of recurring

revenue and growing contracted order book provide us with

confidence in the resilience of the business.

Current Trading & Outlook

We have entered the second half of the year with an increased

order book of contracted revenues, providing us with a good level

of revenue visibility. Trading in the second half of the year has

begun in line with management's expectations, including new

contract wins, such as with the US Geological Survey, and we expect

H2 revenues to be at a similar level to H1 . We are seeing an

increased number of sales opportunities, both from our direct sales

activities and via partners, and both the breadth and size of

opportunity continues to increase. While decision-making may

continue to be protracted in the short-term due to Covid-19, the

breadth of our opportunity combined with the quality of our

offering and people, mean we are increasingly confident with

regards to the long-term future of 1Spatial.

Claire Milverton

Chief Executive Officer

Financial performance

Summary

The Group delivered a robust financial performance in the first

half of the year, growing revenues, maintaining adjusted EBITDA

profit levels and, importantly, generating positive cash flow.

Although the business reported an overall loss before tax (which

was impacted by a number of non-cash charges), with the positive

free cash flow and increased order book of committed revenue, the

Board believes the business is in a much stronger financial

position than in the prior period.

Revenue

Group revenue increased by 8% to GBP11.7m compared to GBP10.9m

in H1 2020. Whilst this included the full six months of the

acquisition of Geomap-Imagis (GI), compared to 3 months in the

prior year, it was a solid result against the backdrop of the

Covid-19 pandemic. The core Solutions revenue stream (now around

86% of Group revenues) increased by 21% year on year, as the

business focuses on developing and selling repeatable software

solutions under a SaaS model.

Core revenue growth

H1 2021 H1 2020 % change

Solutions 6.63 6.39 4%

GI acquisition 3.47 1.94 79%

-------- -------- ---------

Total solutions 10.10 8.33 21%

GIS 1.63 2.53 (36%)

-------- -------- ---------

Total revenue 11.73 10.86 8%

-------- -------- ---------

In the prior period, we had only three months' benefit of the GI

acquisition in Europe and the table below shows the change in

Solutions revenue on a like for like basis (i.e. including only Q2

revenue in H1 2021 for the acquisition). Whilst there was a revenue

drop compared to the prior period, mainly due to Covid-19-related

project delays following the postponement of the French local

elections, the overall profitability of the acquisition was

maintained at a similar level.

Core revenue growth - on

like for like basis

H1 2021 H1 2020 % change

Solutions 6.63 6.39 4%

GI acquisition (Q2) 1.75 1.94 (10%)

-------- -------- ---------

Total Solutions 8.38 8.33 1%

-------- -------- ---------

The business is transitioning towards selling term subscription

licences rather than perpetual licences, and the level of revenue

from perpetual licences is expected to continue to decrease as a

percentage of revenue. Non-core Geographic Information Systems

("GIS") revenue decreased as expected, (although the decline was

also impacted by project delays due to Covid-19) to GBP1.6m from

GBP2.5m, and now accounts for only c. 14% of Group revenues.

As part of this transition, recurring revenue increased by 15%

compared to H1 2020 and is now 44% of total revenues, up from 42%

in the comparative period.

Revenue by type

H1 2021 H1 2020 % change

Recurring revenue* 5.19 4.52 15%

Services 5.52 4.95 12%

Perpetual licences 1.02 1.39 (27%)

-------- -------- ---------

Total revenue 11.73 10.86 8%

-------- -------- ---------

Percentage of recurring

revenue 44% 42%

* Recurring revenue comprises term licences and support and

maintenance revenue.

Revenue in the European business was lower on a like for like

basis due to both the reduction in the GIS revenue (all within

Europe) and also the lower solutions revenue from the GI

acquisition, although overall revenues in Europe grew by 14%,

benefitting from three additional months of acquired revenues.

Revenue increased in all other regions compared to H1 2020, and in

the US, which represents 10% of Group revenue, the growth was 12%

compared to the prior year.

Regional revenue

H1 2021 H1 2020 % change

UK/Ireland 4.34 4.28 1%

Europe 5.09 4.48 14%

US 1.16 1.04 12%

Australia 1.14 1.06 8%

-------- -------- ---------

Total revenue 11.73 10.86 8%

-------- -------- ---------

Committed revenue

The levels of both contracted revenue and revenue expected from

recurring support contracts increased compared to last year. This

increased level of visibility allows the Board to plan future

investment with confidence.

Gross profit margin

The gross margin was down slightly year on year to 52% from 53%

and this is mainly attributable to lower levels of new licences due

to the impact of Covid-19 delaying some decisions and a lower level

of utilisation realised on services. Offsetting this in the cost of

sales, the Group received GBP0.3m of grants from overseas

governments as part of business support schemes in relation to

Covid-19. Going forward, the management team are focused on driving

improvements to the gross margin levels.

Adjusted EBITDA

The adjusted EBITDA was at a similar level to the prior year at

GBP1.7m with a margin of 14.2%. Whilst lower than H1 2020, the

EBITDA margin was marginally ahead of FY 2020 of 13.8%. Cost

management has been an important focus during H1 2021 and expenses

are constantly reviewed to ensure the level is appropriate for the

structure of the business. Administrative expenses increased over

the comparable period mainly because of the additional three months

of the acquired business.

The Board is focused on improving the Group's profitability and

cash generation going forward whilst balancing the needs for

further investment in sales infrastructure (for example, in the US

region), marketing initiatives (such as the new website launch) and

product development (improvements to existing and new repeatable

solutions) to grow the business.

Operating loss and loss before tax

The Group recorded an operating loss of GBP0.8m compared to

GBP0.6m in the prior period being impacted by increases in non-cash

items such as amortisation of acquired intangibles. This resulted

in the Group's loss before tax increasing to GBP0.7m from GBP0.6m

for the comparable period.

Taxation

The net tax credit for the period was GBP0.1m (H1 2020:

GBP40k).

Balance sheet

The Group's net assets reduced to GBP15.3m from GBP15.5m at 31

January 2020 (and GBP16.6m at 31 July 2019). The reduction was

mainly due to the overall loss after tax offset by currency gains

in reserves.

Cash flow

Operating cash flow improved significantly to an inflow of

GBP1.7m in H1 2021 compared to an outflow of GBP1.9m in H1 2020.

Indeed, the focus on cash flow has also resulted in free cash flow

being GBP0.5m positive even after irregular one-off items, as shown

in the table below:

H1 FY 2020 H1 2020

Free cash flow 2021

GBP'000 GBP'000 GBP'000

-------- -------- --------

Cash generated from/(used in) operations

before strategic, integration and other

irregular items 1,773 1,861 (1,275)

Net interest (72) (144) (62)

Net tax (70) 313 149

Expenditure on product development and

intellectual property capitalised (965) (2,188) (874)

Purchase of property, plant and equipment (102) (132) (70)

-------- -------- --------

Free cash flow before strategic, integration

and other irregular items 564 (290) (2,132)

Cashflow on strategic, integration and

other irregular items (29) (1,289) (652)

-------- -------- --------

Free cash flow 535 (1,579) (2,784)

-------- -------- --------

Within investing activities, the deferred consideration of

EUR0.7m (GBP0.6m) on the acquisition of Geomap Imagis, was paid as

planned in H1 2021. The level of R&D increased slightly to

GBP1.0m from GBP0.9m in H1 2020; the level of R&D for the full

year is expected to be at a similar level to last year.

The business took advantage of available bank loans offered on

reasonable commercial terms as part of the Covid-19 support

initiatives in Europe and this has boosted the Group's gross cash

position to GBP6.6m. With a net cash position of GBP3.4m at 31 July

2020 and positive operating cash flow, the business is in a much

stronger financial position than in the prior period and this gives

the Board the confidence to continue to invest in its

three-pillared strategy for growth.

Andrew Fabian

Interim CFO

Condensed consolidated statement of comprehensive income

Six months ended 31 July 2020

Unaudited Audited Unaudited

Six months Six months

ended Year ended ended

31 July 31 January 31 July

2020 2020 2019

Continuing operations Note GBP'000 GBP'000 GBP'000

-------------------------------------------- ----- ----------- ------------ -----------

Revenue 11,726 23,385 10,861

Cost of sales (net of government

grants of GBP346,000 (H1 2020: nil)) (5,655) (11,123) (5,138)

-------------------------------------------- ----- ----------- ------------ -----------

Gross profit 6,071 12,262 5,723

Administrative expenses (6,861) (13,800) (6,363)

-------------------------------------------- ----- ----------- ------------ -----------

(790) (1,538) (640)

-------------------------------------------- ----- ----------- ------------ -----------

Adjusted* EBITDA 1,666 3,226 1,655

Less: depreciation (97) (152) (48)

Less: depreciation on right of use

asset (559) (878) (458)

Less: amortisation and impairment

of intangible assets 7 (1,500) (2,169) (974)

Less: share-based payments (175) (398) (222)

Less: strategic, integration and

other irregular items 6 (125) (1,167) (593)

-------------------------------------------- ----- ----------- ------------ -----------

Operating loss (790) (1,538) (640)

Finance income 13 40 36

Finance cost (85) (235) (62)

-------------------------------------------- ----- ----------- ------------ -----------

Net finance cost (72) (195) (26)

Loss before tax (862) (1,733) (666)

Income tax credit 135 248 40

-------------------------------------------- ----- ----------- ------------ -----------

Loss for the period (727) (1,485) (626)

Other comprehensive income

Items that may subsequently be reclassified

to profit or loss:

Actuarial gains arising on defined benefit - 40 -

pension, net of tax

Exchange differences on translating

foreign operations 381 (120) 358

Other comprehensive income/(loss)

for the period, net of tax 381 (80) 358

============================================ ===== =========== ============ ===========

Total comprehensive loss for the

period (346) (1,565) (268)

============================================ ===== =========== ============ ===========

* Adjusted for strategic, integration and other irregular items

(note 6) and share-based payments.

Loss per ordinary share from continuing operations attributable

to the owners of the parent during the year (expressed in pence

per ordinary share):

Basic loss per share 4 (0.65) (1.37) (0.60)

Diluted loss per share 4 (0.65) (1.37) (0.60)

Condensed consolidated statement of financial position

As at 31 July 2020

Unaudited Audited Unaudited

As at As at As at

31 July 31 January 31 July

2020 2020 2019

-------------------------------------- ----- ---------- ------------ ----------

Note GBP'000 GBP'000 GBP'000

-------------------------------------- ----- ---------- ------------ ----------

Assets

Non-current assets

Intangible assets including goodwill 7 15,590 15,560 16,331

Property, plant and equipment 415 374 442

Right-of-use assets 3,265 3,272 3,365

Total non-current assets 19,270 19,206 20,138

-------------------------------------- ----- ---------- ------------ ----------

Current assets

Trade and other receivables 8 8,951 9,930 9,431

Current income tax receivable 308 233 156

Cash and cash equivalents 10 6,569 5,108 4,001

-------------------------------------- ----- ---------- ------------ ----------

Total current assets 15,828 15,271 13,588

-------------------------------------- ----- ---------- ------------ ----------

Total assets 35,098 34,477 33,726

-------------------------------------- ----- ---------- ------------ ----------

Liabilities

Current liabilities

Bank borrowings 10 (1,267) (135) (732)

Lease liabilities (985) (957) (931)

Trade and other payables 9 (10,861) (11,439) (9,641)

Deferred consideration 12 - (599) (613)

Provisions - - (81)

Total current liabilities (13,113) (13,130) (11,998)

-------------------------------------- ----- ---------- ------------ ----------

Non-current liabilities

Bank borrowings 10 (1,869) (1,086) -

Lease liabilities (2,330) (2,340) (2,432)

Deferred consideration 12 (398) (370) (380)

Defined benefit pension obligation (1,567) (1,417) (1,504)

Deferred tax (537) (679) (836)

Total non-current liabilities (6,701) (5,892) (5,152)

-------------------------------------- ----- ---------- ------------ ----------

Total liabilities (19,814) (19,022) (17,150)

Net assets 15,284 15,455 16,576

====================================== ===== ========== ============ ==========

Share capital and reserves

Share capital 11 20,150 20,150 20,150

Share premium account 30,479 30,479 30,479

Own shares held (303) (303) (303)

Equity-settled employee benefits

reserve 3,507 3,332 3,156

Merger reserve 16,465 16,465 16,465

Reverse acquisition reserve (11,584) (11,584) (11,584)

Currency translation reserve 565 184 662

Accumulated losses (43,518) (42,791) (41,972)

Purchase of non-controlling interest

reserves (477) (477) (477)

-------------------------------------- ----- ---------- ------------ ----------

Equity attributable to shareholders

of the parent company 15,284 15,455 16,576

-------------------------------------- ----- ---------- ------------ ----------

Total equity 15,284 15,455 16,576

====================================== ===== ========== ============ ==========

Condensed

consolidated

statement

of changes in

equity

Period ended

31 July 2020

Purchase

Equity-settled of

Share Own employee Reverse Currency non-controlling

Share premium shares benefits Merger acquisition translation interest Accumulated Total

GBP'000 capital account held reserve reserve reserve reserve reserve losses equity

Balance at 1

February 2019 18,971 28,661 (303) 2,934 16,030 (11,584) 304 (477) (41,346) 13,190

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Comprehensive

loss

Loss for the

year - - - - - - - - (1,485) (1,485)

Other

comprehensive

(loss)/income

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Actuarial

gains arising

on

defined

benefit

pension - - - - - - - - 40 40

Exchange

differences

on

translating

foreign

operations - - - - - - (120) - - (120)

Total other

comprehensive

(loss)/income - - - - - - (120) - 40 80

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Total

comprehensive

(loss)/income - - - - - - (120) - (1,445) (1,565)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Transactions

with owners

recognised

directly in

equity

Issue of share

capital, net

of share

issue costs 1,179 1,818 - - 435 - - - - 3,432

Recognition of

share-based

payments - - - 398 - - - - - 398

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

1,179 1,818 - 398 435 - - - - 3,830

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Balance at

31 January

2020

(Audited) 20,150 30,479 (303) 3,332 16,465 (11,584) 184 (477) (42,791) 15,455

=============== ======== ======== ======= =============== ======== ============ ============ ================ ============ ========

Comprehensive

loss

Loss for the

period - - - - - - - - (727) (727)

Other

comprehensive

income

Exchange

differences

on

translating

foreign

operations - - - - - - 381 - - 381

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Total other

comprehensive

income - - - - - - 381 - - 381

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Total

comprehensive

income/(loss) - - - - - - 381 - (727) (346)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Transactions

with owners

recognised

directly in

equity

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Issue of share - - - - - - - - - -

capital

Recognition of

share-based

payments - - - 175 - - - - - 175

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

- - - 175 - - 381 - (727) (171)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Balance at

31 July 2020

(Unaudited) 20,150 30,479 (303) 3,507 16,465 (11,584) 565 (477) (43,518) 15,284

=============== ======== ======== ======= =============== ======== ============ ============ ================ ============ ========

Purchase

Equity-settled of

Share Own employee Reverse Currency non-controlling

Share premium shares benefits Merger acquisition translation interest Accumulated Total

GBP'000 capital account held reserve reserve reserve reserve reserve losses equity

Balance at 1

February 2019 18,971 28,661 (303) 2,934 16,030 (11,584) 304 (477) (41,346) 13,190

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Comprehensive

loss

Loss for the

period - - - - - - - - (626) (626)

Other

comprehensive

income

Exchange

differences

on

translating

foreign

operations - - - - - - 358 - - 358

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Total other

comprehensive

income - - - - - - 358 - - 358

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Total

comprehensive

income/(loss) - - - - - - 358 - (626) (268)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Transactions

with owners

recognised

directly in

equity

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Issue of share

capital 1,179 1,818 - - 435 - - - - 3,432

Recognition of

share-based

payments - - - 222 - - - - - 222

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

1,179 1,818 - 222 435 - - - - 3,654

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Balance at 31

July 2019

(Unaudited) 20,150 30,479 (303) 3,156 16,465 (11,584) 662 (477) (41,972) 16,576

=============== ======== ======== ======= =============== ======== ============ ============ ================= ============ ========

Condensed consolidated statement of cash flows

Period ended 31 July 2020

Unaudited Audited Unaudited

31 July 31 January 31 July

2020 2020 2019

Note GBP'000 GBP'000 GBP'000

---------------------------------------- ------ ---------- ----------- ----------

Cash flows from operating activities

Cash generated from/(used in)

operations a) 1,744 572 (1,927)

Interest received 13 40 -

Interest paid (85) (184) (62)

Tax (paid)/received (70) 313 149

Net cash from/(used) in operating

activities 1,602 741 (1,840)

------------------------------------------------ ---------- ----------- ----------

Cash flows from investing activities

Acquisition of subsidiaries (net

of cash acquired) (585) (2,151) (2,151)

Purchase of property, plant and

equipment (102) (132) (70)

Expenditure on product development

and intellectual property capitalised (965) (2,188) (874)

Net cash used in investing activities (1,652) (4,471) (3,095)

------------------------------------------------ ---------- ----------- ----------

Cash flows from financing activities

New borrowings 1,832 672 -

Repayment of borrowings (6) (133) -

Repayment of obligations under

leases (598) (792) (431)

Net proceeds of share issue - 2,805 2,915

Net cash generated from financing

activities 1,228 2,552 2,484

------------------------------------------------ ---------- ----------- ----------

Net increase/(decrease) in cash

and cash equivalents 1,178 (1,178) (2,451)

Cash and cash equivalents at start

of period 5,108 6,358 6,358

Effects of foreign exchange on

cash and cash equivalents 283 (72) 94

Cash and cash equivalents at end

of period 6,569 5,108 4,001

------------------------------------------------ ---------- ----------- ----------

Notes to the condensed consolidated statement of cash flows

a) Cash used in operations

Unaudited Audited Unaudited

As at 31 As at

As at January 31 July

31 July 2020 2020 2019

GBP'000 GBP'000 GBP'000

------------------------------------------------- ----------------- ---------- -----------

Loss before tax (862) (1,733) (666)

Adjustments for:

Net finance cost 72 144 62

Depreciation 656 1,030 506

Amortisation and impairment 1,500 2,169 974

Share-based payment charge 175 398 222

Decrease/(Increase) in trade and

other receivables 1,392 (2,377) (1,366)

(Decrease)/Increase in trade and

other payables (1,177) 702 (1,498)

Increase in provisions - - 38

Increase in defined benefit pension

obligation 46 72 -

Net foreign exchange movement (58) 167 (199)

Cash from/(used) in operations 1,744 572 (1,927)

------------------------------------------------- ----------------- ---------- -----------

Reconciliation of cash generated before

and after impact of strategic, integration

and other irregular items Unaudited Audited Unaudited

As at As at As at

31 July 31 January 31 July

2020 2020 2019

Cash generated from/(used in) operations

before strategic, integration and other

irregular items 1,773 1,861 (1,275)

Cashflow on strategic, integration and

other irregular items (29) (1,289) (652)

--------------------------------------------- ---------- ------------ ----------

Cash generated from/(used in) operations

after strategic, integration and other

irregular items 1,744 572 (1,927)

--------------------------------------------- ---------- ------------ ----------

b) Reconciliation of net cash flow to movement in net funds

Unaudited Audited Unaudited

As at 31 As at

As at January 31 July

31 July 2020 2020 2019

GBP'000 GBP'000 GBP'000

------------------------------------------------- ----------------- ---------- -----------

Increase/(Decrease) in cash in the

period 1,178 (1,178) (2,451)

------------------------------------------------- ----------------- ---------- -----------

Changes resulting from cash flows 1,178 (1,178) (2,451)

Net cash inflow in respect of new

borrowings (1,832) (672) -

Changes in net funds due to borrowings

acquired - (731) (732)

Net cash inflow in respect of borrowings

repaid 6 133 -

Effect of foreign exchange 194 (23) 94

------------------------------------------------- ----------------- ---------- -----------

Change in net funds (454) (2,471) (3,089)

Net funds at beginning of period 3,887 6,358 6,358

-------------------------------------------------

Net funds at end of period 3,433 3,887 3,269

------------------------------------------------- ----------------- ---------- -----------

Analysis of net funds

Cash and cash equivalents classified

as:

Current assets 6,569 5,108 4,001

Bank and other loans (3,136) (1,221) (732)

Net funds at end of period 3,433 3,887 3,269

------------------------------------------------- ----------------- ---------- -----------

Notes to the Interim Financial Statements

1. Principal activity

1Spatial plc is a public limited company which is listed on the

AIM London Stock Exchange and is incorporated and domiciled in the

UK. The address of the registered office is Tennyson House,

Cambridge Business Park, Cowley Road, Cambridge, CB4 0WZ. The

registered number of the Company is 5429800.

The principal activity of the Group is the development and sale

of software along with related consultancy and support.

2. Basis of preparation

This condensed consolidated interim financial report for the

half-year reporting period ended 31 July 2020 has been prepared in

accordance with Accounting Standard IAS 34 Interim Financial

Reporting. The interim report does not include all the notes of the

type normally included in an annual financial report. Accordingly,

this report is to be read in conjunction with the annual report for

the year ended 31 January 2020 and any public announcements made by

1Spatial Plc during the interim reporting period.

The financial information for the six months ended 31 July 2020

and 31 July 2019 is neither audited nor reviewed and does not

constitute statutory financial statements within the meaning of

section 434(3) of the Companies Act 2006 for 1Spatial plc or for

any of the entities comprising the 1Spatial Group. Statutory

financial statements for the preceding financial year ended 31

January 2020 were filed with the Registrar and included an

unqualified auditors' report.

After making enquiries, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, they continue to adopt the going concern basis in

preparing the half-yearly condensed consolidated financial

statements.

3. Taxation

The tax credit on the result for the six months ended 31 July

2020 is based on the estimated tax rates in the jurisdictions in

which the Group operates, for the year ending 31 January 2021.

4. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period plus

the deferred shares to be issued in March 2023 in relation to the

Geomap-Imagis acquisition completed in May 2019 (see note 12).

Unaudited Audited Unaudited

As at As at 31 As at

31 July January 31 July

2020 2020 2019

GBP'000 GBP'000 GBP'000

Loss attributable to equity holders

of the Parent (727) (1,485) (626)

------------------------------------- ---------- --------- ----------

Number Number Number

000s 000s 000s

------------------------------------- ---------- --------- ----------

Basic weighted average number of

ordinary shares 112,114 108,438 104,332

------------------------------------- ---------- --------- ----------

Diluted weighted average number

of ordinary shares 113,469 110,181 106,179

------------------------------------- ---------- --------- ----------

Unaudited Audited Unaudited

As at As at As at

31 July 31 January 31 July

2020 2020 2019

Pence Pence pence

---------------------------------- ---------- ------------ ----------

Basic and diluted loss per share (0.65) (1.37) (0.60)

---------------------------------- ---------- ------------ ----------

Basic loss per share and diluted loss per share are the same

because the options are anti-dilutive. Therefore, they have been

excluded from the calculation of diluted weighted average number of

ordinary shares.

5. Dividends

No dividend is proposed for the six months ended 31 July 2020

(31 January 2020: nil; 31 July 2019: nil).

6. Strategic, integration and other irregular items

In accordance with the Group's policy for strategic, integration

and other irregular items, the following charges were included in

this category for the period:

Six months Six months

ended Year ended ended

31 July 31 January 31 July

2020 2020 2019

GBP'000 GBP'000 GBP'000

--------------------------------------- ----------- ------------ -----------

Costs associated with the acquisition

and integration of the Geomap-Imagis

Group 125 1,167 593

Total 125 1,167 593

--------------------------------------- ----------- ------------ -----------

7 . Intangible assets including goodwill

Customers

and related Development Website Intellectual

Goodwill Brands contracts Software costs costs property Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 February

2020 17,291 452 4,579 6,487 16,932 30 66 45,837

Additions - - - - 962 - 3 965

Effect of foreign

exchange 351 16 251 258 471 - - 1,347

----------------------

At 31 July 2020 17,642 468 4,830 6,745 18,365 30 69 48,149

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Accumulated

impairment

and amortisation

At 1 February

2020 11,363 204 3,113 4,185 11,374 30 8 30,277

Amortisation - 23 297 221 957 - 2 1,500

Effect of foreign

exchange 249 1 154 94 284 - - 782

At 31 July 2020 11,612 228 3,564 4,500 12,615 30 10 32,559

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Net book amount

at

31 July 2020 6,030 240 1,266 2,245 5,750 - 59 15,590

====================== ========= ======== ============= ========= ============ ======== ============= ========

Customers

and related Development Website Intellectual

Goodwill Brands contracts Software costs costs property Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 February 2019 16,161 232 2,843 4,421 15,012 30 66 38,765

Arising on

acquisition 1,338 226 1,847 2,164 - - - 5,575

Additions - - - - 2,188 - - 2,188

Effect of foreign

exchange (208) (6) (111) (98) (268) - - (691)

----------------------

At 31 January 2020 17,291 452 4,579 6,487 16,932 30 66 45,837

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Accumulated

impairment

and amortisation

At 1 February 2019 11,533 165 2,754 3,850 10,232 30 7 28,571

Amortisation - 40 433 385 1,197 - 3 2,058

Impairment - - - - 111 - - 111

Effect of foreign

exchange (170) (1) (74) (50) (166) - (2) (463)

At 31 January 2020 11,363 204 3,113 4,185 11,374 30 8 30,277

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Net book amount

at

31 January 2020 5,928 248 1,466 2,302 5,558 - 58 15,560

====================== ========= ======== ============= ========= ============ ======== ============= ========

8. Trade and other receivables

As at As at As at

31 July 31 January 31 July

2020 2020 2019

Current GBP'000 GBP'000 GBP'000

----------------------------------------- --------- ------------ ---------

Trade receivables 3,462 5,012 4,634

Less: provision for impairment of trade

receivables (44) (68) -

----------------------------------------- --------- ------------ ---------

3,418 4,944 4,634

Other taxes and social security - - 168

Other receivables 1,445 1,431 1,739

Prepayments and accrued income 4,088 3,555 2,890

----------------------------------------- --------- ------------ ---------

8,951 9,930 9,431

----------------------------------------- --------- ------------ ---------

9. Trade and other payables

As at As at As at

31 July 31 January 31 July

2020 2020 2019

Current GBP'000 GBP'000 GBP'000

------------------------------------ --------- ------------ ---------

Trade payables 1,587 2,143 2,295

Other taxation and social security 2,829 2,477 2,571

Other payables 693 996 498

Accrued liabilities 1,137 905 455

Deferred income 4,615 4,918 3,822

------------------------------------ --------- ------------ ---------

10,861 11,439 9,641

------------------------------------ --------- ------------ ---------

10. Cash and borrowings

As at As at As at

31 July 31 January 31 July

2020 2020 2019

Analysis of net funds GBP'000 GBP'000 GBP'000

Cash and cash equivalents classified

as:

Current assets 6,569 5,108 4,001

Bank and other loans (3,136) (1,221) (732)

Net funds at end of period 3,433 3,887 3,269

-------------------------------------- --------- ------------ ---------

During the period new loans of GBP1.83m were arranged to

strengthen the Group's financial position.

11. Share capital

As at As at As at

31 July 31 January 31 July

2020 2020 2019

GBP'000 GBP'000 GBP'000

---------------------------------------------- --------- ------------ ---------

Allotted, called up and fully paid

110,805,795 (Jan 2020: 110,805,795) ordinary

shares of 10p each 11,082 11,082 11,082

226,699,878 (Jan 2020: 226,699,878) deferred

shares of 4p each 9,068 9,068 9,068

---------------------------------------------- --------- ------------ ---------

20,150 20,150 20,150

---------------------------------------------- --------- ------------ ---------

There are 110,805,795 ordinary shares of 10p in issue, of which

a total of 319,635 ordinary shares are held in treasury. Therefore,

the total number of ordinary shares with voting rights is

110,486,160.

The deferred shares of 4p each do not carry voting rights or a

right to receive a dividend. Accordingly, the deferred shares will

have no economic value.

12. Business combinations

In May 2019, the Company entered into two share purchase

agreements to acquire the entire issued share capital of

Geomap-Imagis Participations ("Geomap-Imagis") for a total

consideration of EUR7.0m. The transaction was completed in the last

financial year. In H1 2021, deferred consideration of EUR0.7m

(GBP0.6m) was paid as planned. The remaining balance of EUR0.4m of

the consideration to be satisfied by the issue of shares will be

satisfied on 30 March 2023. Further details of this business

combination were disclosed in note 18 of the Group's annual

financial statements for the year ended 31 January 2020.

The business is now largely integrated from an operational

perspective although there is some rationalisation of internal

systems in order to improve operational efficiencies being

implemented that are expected to be completed during H2 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZGZLNLGGGZM

(END) Dow Jones Newswires

September 30, 2020 02:00 ET (06:00 GMT)

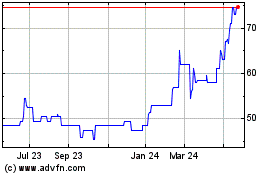

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

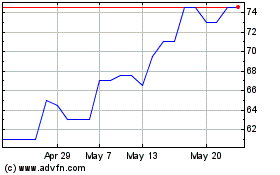

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025